SpaceX BTC Holding Proves Power of Long-Term Bitcoin Investment

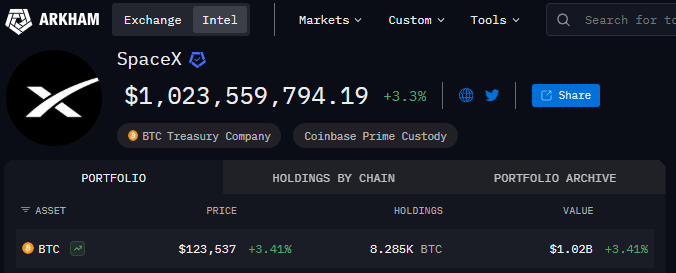

According to the data from Arkham Intelligence, Elon Musk’s SpaceX crossed the $1 billion mark. Currently, SpaceX BTC holding is totaling at 8,285, which in context of updated value sums up in a billion dollar structure.

Source: Arkham

The company first entered the market on December 31, 2020, when it made its initial purchase. The firm continued to add to its reserves until June 10, 2022, which was its last recorded Bitcoin purchase. Since then, it has not sold or bought any new coins.

So, why does the company choose to hold coins through market volatiles?

Long Term Investment Approach: Applying and Proved

This approach shows that many experts, including Robert Kiyosaki, Michael Saylor are not wrong when they state that the currency is the future of steady earnings.

Recently when Kiyosaki talked about how Bitcoin can make someone a millionaire simply by buy, hold and forget. SpaceX BTC holding has now provided a real-world example of this strategy in action. The only thing that is needed is strong conviction in the value and future of the currency.

Belief or Profit: Or Both

The company made its last purchase in June, 2022, when the Bit-coin was trading at around $30,000. At that time the 8,285 coins were valued at approx. $248 million. Today, that same amount is worth more than $1 billion, as current value is $123, 817, reflecting a 300% profit achieved solely by preserving.

If predictions of the digital asset to reach 150k by the end of the year become true, the firm will enjoy a 400% gain.

So, SpaceX BTC holding is designing a new pathway to building billions through staking? Or is it a chance for new organizations to enter the pace before a new surge?

Joining the Elite Club of Corporate Asset Billionaires

With SpaceX BTC holding now valued at $1 billion, it has joined the ranks of major corporate B-coin holders. Leading this group is MicroStrategy with 628,946 coins of worth ~$77 billion, followed by Marathon Digital Holdings (MARA) with 50,639 coins, and XXI 43,514 coins.

Elon Musk’s other company, Tesla, is also on the list, holding 11,506 b-coin valued at $1.42 billion. Together, Musk’s companies have established a significant presence among the world’s largest institutional Bitcoin investors.

Bitcoin’s Growing Circle of Global Admirers

The trend of securing virtual assets is no longer limited to any specific organizations. Thanks to Bitcoin’s significant growth, it has attracted a diverse range of admirers from different industries and regions. These include space firms like Blue Origin, public companies such as Block Inc. and Cango Inc., and even countries like the United States, El Salvador, and China, all making their mark in the Bitcoin space.

Conclusion: A Quiet but Powerful Statement

In the era where traders run after quick profits, SpaceX BTC holding’s $1B value speaks louder than any press release.

Whether SpaceX BTC holding is a calculated profit strategy or a hedging tool against volatility, Musk’s space organisation has secured its position in the history of corporate crypto adoption, and possibly set an example for others to join before a new big wave.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。