Author: BUBBLE

On August 8, 2025, CMB International, a subsidiary of China Merchants Bank, announced a collaboration with Singapore's digital exchange DigiFT and Solana public chain service provider OnChain to tokenize a US dollar money market fund recognized in both Hong Kong and Singapore, issuing the token CMBMINT on-chain. Notably, this marks the first instance of a tokenized fund across multiple jurisdictions, and the issuance led by a financial giant from Asia will serve as a good compliance model for future multi-regional cooperation in RWA.

By August 13, Solana officially released an announcement confirming that Solana would be the primary chain for the fund's tokenization, making it the first tokenized public fund product on the Solana public chain, with the market responding optimistically. In the past 24 hours, Solana's price rose by 15%, and within three hours of the announcement, Solana's price surged another 5%, breaking the $200 mark.

This article will interpret how the institutional network behind this collaboration operates, CMB International's blockchain layout and ambitions, and the investment content contained within the on-chain fund CMBMINT itself.

How was Solana's first on-chain fund realized?

The fund tokenization project brings together multiple forces from traditional finance and the blockchain sector. CMB International Asset Management provides high-quality fund assets and regulatory compliance assurance, DigiFT offers the on-chain issuance and trading platform, and OnChain is responsible for underlying technology deployment and public chain distribution support. The three parties worked together to achieve the on-chain issuance of a traditional money market fund.

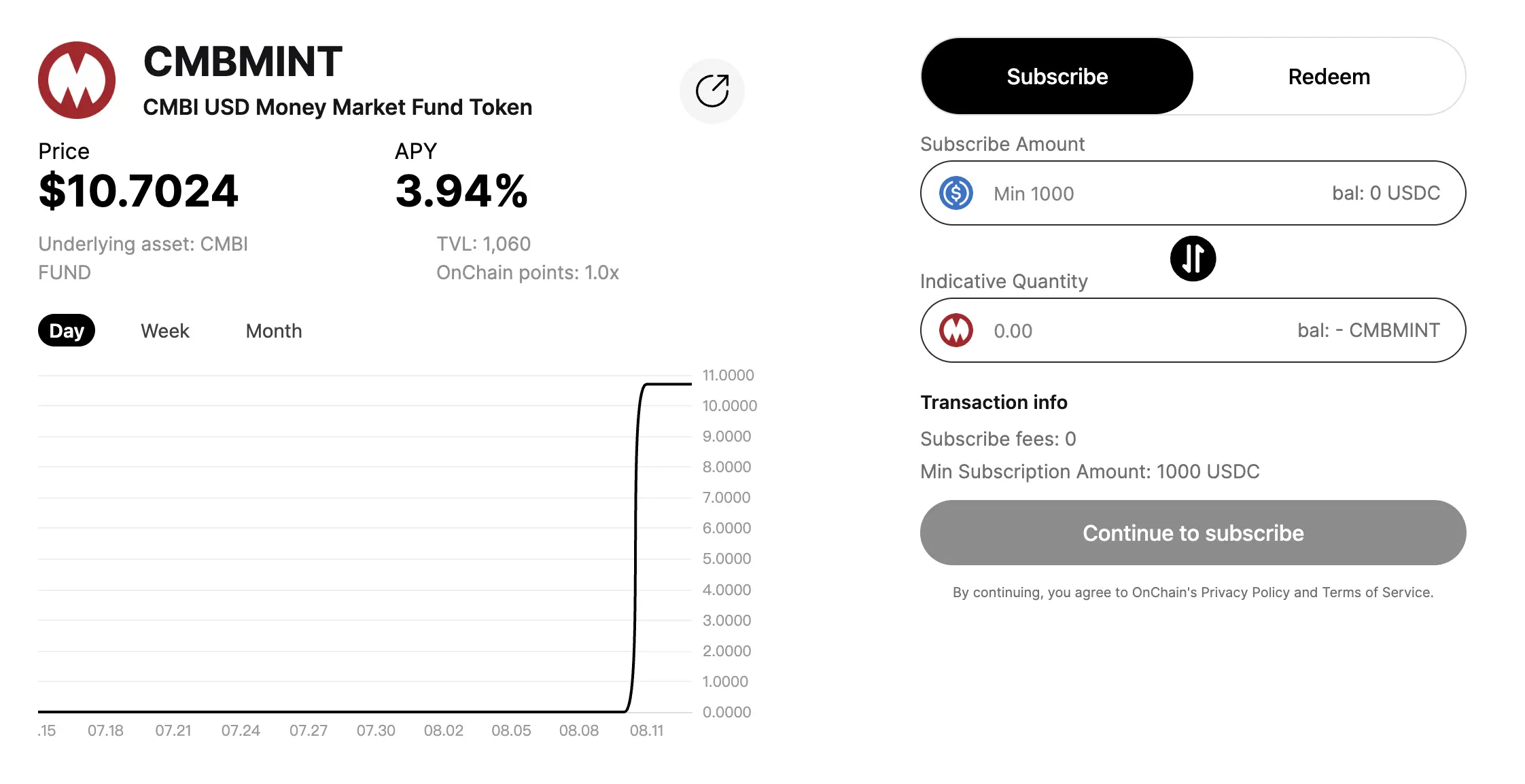

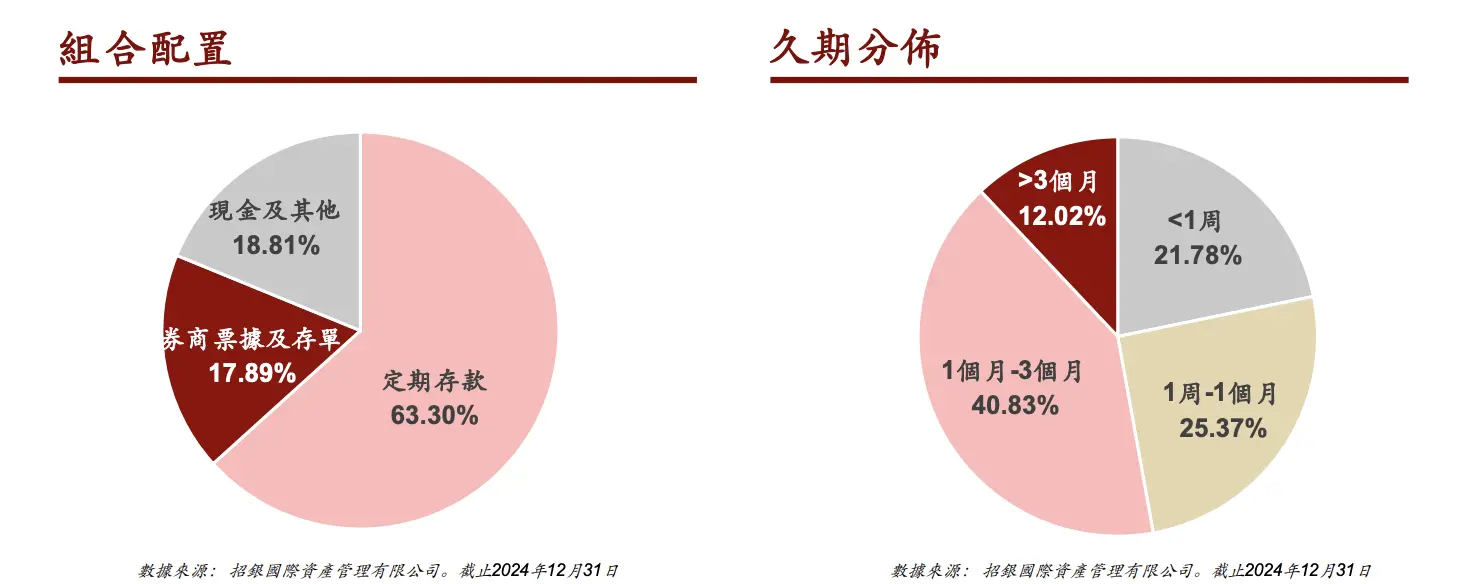

The tokenized asset is the CMB International US Dollar Money Market Fund (CMBMINT), a dollar-denominated money market fund established in February 2024, with 70% of the funds invested in low-volatility instruments such as short-term high-quality US dollar deposits, treasury bills, and commercial paper, and 30% invested in short-term deposits and high-quality money market instruments denominated in currencies other than the US dollar, overall pursuing capital preservation and stable returns.

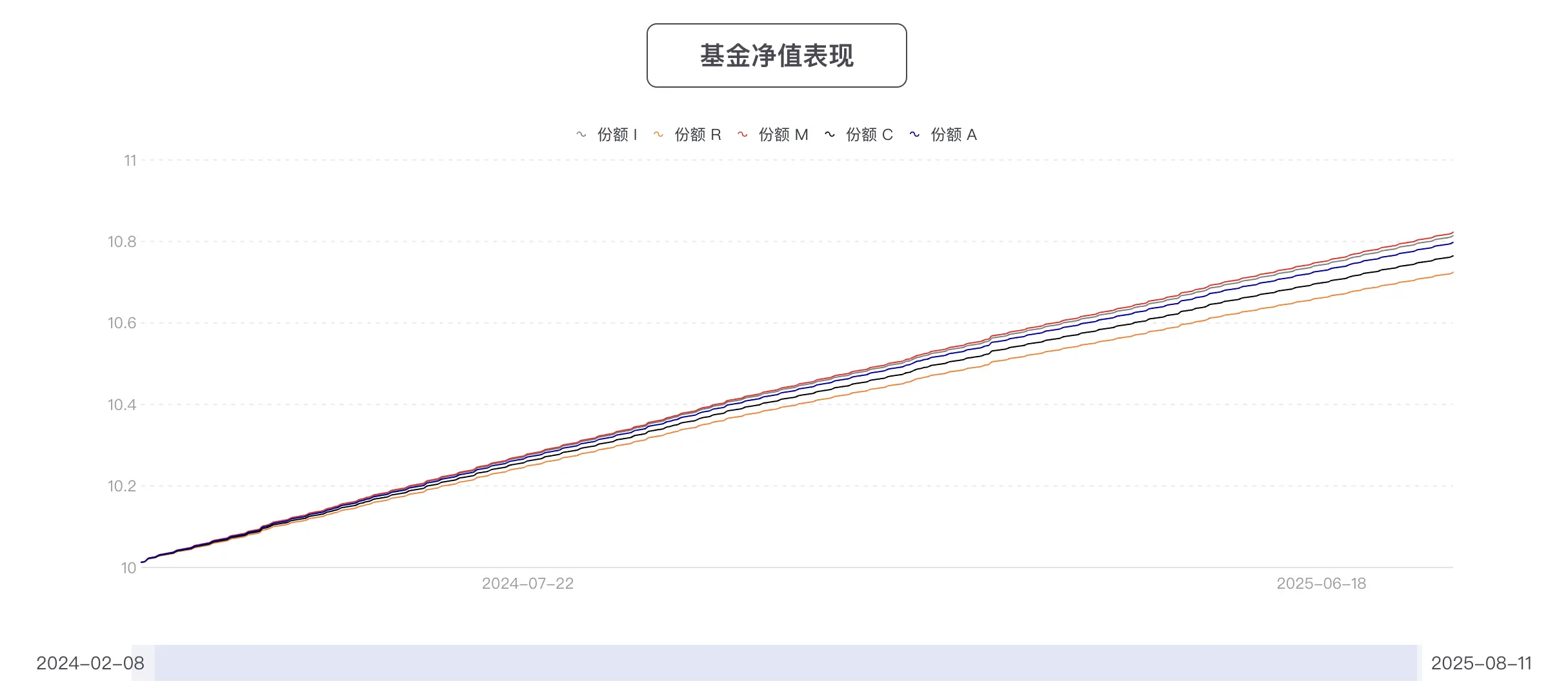

Since its establishment, the fund has performed excellently, ranking first among similar money market funds in the Asia-Pacific region as of July 31, 2025, according to Bloomberg. As it is a Hong Kong-Singapore mutual recognition fund, the fund is subject to regulation from both regions, with its investors classified as qualified professional investors. Therefore, the project is currently limited to recognized investors in Singapore subscribing to the fund tokens through the DigiFT platform to ensure participants meet local regulatory requirements (in the future, depending on the level of regulatory openness, it may expand to institutional clients in Hong Kong and other jurisdictions).

The annualized yield for each share remains above 4%, source: CMB official website

With the collaboration of DigiFT and OnChain, the money market fund completed the on-chain mapping and distribution of real assets. Specifically, DigiFT, as a licensed exchange, issued tokens linked to the fund's net asset value, with each token representing a certain share of the fund, and holders enjoying corresponding rights to the income. It is worth mentioning that this issuance pioneered the multi-chain deployment of public fund tokens; in addition to Solana, the CMBMINT token will subsequently be deployed on Ethereum, Arbitrum, and Plume Network.

OnChain embedded the entire tokenization process into its self-developed on-chain capital market infrastructure, providing comprehensive technical support. First, in terms of compliance architecture and asset tokenization security, OnChain introduced a "transfer hook" mechanism based on the Solana Token-2022 standard, ensuring that fund tokens can only be redeemed through contracts, eliminating private transfers and thus enhancing transaction compliance.

At the same time, it adopted a dual-standard architecture of SPL and Token-2022, ensuring compatibility with other on-chain assets while possessing flexible liquidity programming capabilities, and avoided traditional fund settlement delays through a real-time net asset value anchoring mechanism. Secondly, in the subscription and redemption phases, OnChain constructed a full-link security protection system, isolating core functions such as fund management, liquidity pools, and token minting into different PDA addresses to prevent single-point risks. A whitelist mechanism strictly limits key operators for critical operations, including fund company access and large transaction approvals. Real-time asset and permission scanning, bidirectional net asset value calculations, and net asset value update time limits are introduced throughout the full link to ensure price stability and account accuracy.

Finally, in liquidity management, OnChain designed a layered liquidity architecture, with an independent redemption pool (redeemcashpool) specifically to meet immediate redemption needs, avoiding liquidity runs; it also provides both instant and delayed redemption modes, intelligently allocating based on the liquidity status within the pool, and ensuring principal safety through a multi-account asset isolation mechanism even under extreme market conditions, thus achieving an almost T+0 fund arrival experience.

As the on-chain version of the Hong Kong-Singapore mutual recognition fund, CMBMINT adopts an innovative and robust model in its regulatory compliance architecture. The fund itself remains under the supervision of the Hong Kong Securities and Futures Commission and the Monetary Authority of Singapore (through the mutual recognition mechanism), while the issuance and trading of tokens occur on the platform of the licensed institution DigiFT in Singapore. This "dual regulatory" structure ensures that the underlying assets and trading environment are both in a legal and compliant state. Additionally, the smart contracts for the fund tokens have undergone rigorous security audits and introduced risk reserves and Proof of Reserve mechanisms to ensure the safety, transparency, and sufficiency of on-chain assets.

CMB International's Blockchain Layout

As a state-owned traditional financial institution, CMB International is among the early players to lay out the blockchain industry. It has built its blockchain network through investments, funds, and business collaborations. These early explorations not only earned it an industry advantage but also laid the foundation for subsequent innovations such as obtaining virtual asset licenses and launching on-chain funds. From underlying technology and public chain ecology to decentralized finance and virtual asset services, CMB International's blockchain journey is comprehensive and in-depth.

Investment in Underlying Technology (2017-2018)

CMB International's earliest involvement in the blockchain field can be traced back to late 2017. At that time, it participated in the Pre-A round financing of the Chinese blockchain technology startup "Cryptape." Cryptape was founded by former core Ethereum developer Xie Hanjian and focuses on the research and development of underlying blockchain technology, having developed the enterprise-level chain architecture CITA, which was open-sourced in July 2017. CITA pioneered a blockchain architecture combining "microservices + logical nodes," significantly enhancing the performance and scalability of blockchain networks.

Shortly thereafter, in July 2018, CMB International invested in the Chinese star public chain project Nervos Network. Nervos is a layered architecture public chain ecosystem dedicated to solving the scalability challenges of blockchain. Notably, CMB International not only provided funding but also facilitated collaboration between the invested projects and the China Merchants Bank system: for example, Nervos and the Cryptape team assisted China Merchants Bank in developing an open permissioned chain to meet the needs of financial services.

Ecosystem Fund and Diversified Expansion (2019-2022)

After initially mastering the underlying public chain, CMB International accelerated its investment pace in blockchain application ecosystems. Starting in 2019, its investment team delved into blockchain application directions such as payment clearing, tokenization, and identity verification, and discussed decentralized finance (DeFi) service solutions with institutions like the Nervos Foundation, nurturing broader cooperation opportunities.

In May 2021, CMB International, together with Nervos officials, launched a blockchain ecosystem fund called "InNervation" with a total of $50 million, planning to invest in blockchain startups with practical application prospects worldwide over three years. The fund focuses on DApps, DeFi protocols, NFT platforms, and Layer1/Layer2 infrastructure construction based on Nervos and related ecosystems, providing funding support ranging from $200,000 to $2 million for early-stage projects.

In addition to the public chain ecosystem, CMB International has also continued to pay attention to consortium chains and enterprise service fields. In July 2022, blockchain infrastructure provider "Rivtower" completed a Pre-B round financing of several tens of millions of RMB, with CMB International continuing to increase its investment as an existing shareholder. Rivtower was established by a domestic open-source consortium chain technology team and developed the world's first cloud-native blockchain framework CITA-Cloud, providing underlying technical support for the industrial internet and government-enterprise markets. CMB International's continuous follow-up investment in its A+ and Pre-B rounds indicates its long-term optimism about the underlying infrastructure track of blockchain and further consolidates its influence in the domestic consortium chain/Web3 infrastructure circle.

Exploration of Virtual Asset Services (2022-2025)

As blockchain and financial applications gradually merge, CMB International has begun to explore new fields that integrate digital assets and financial technology in recent years. Between 2022 and 2023, CMB International served multiple times as the exclusive placement agent for Hong Kong-listed company Arta TechFin (279.HK), assisting it in completing stock issuance and convertible bond issuance financing. Arta TechFin, founded by Zheng Zhigang, executive vice chairman of Hong Kong's New World Group, aims to connect Web2 and Web3 using new technologies like blockchain, providing high-end financial services that integrate virtual and traditional assets. Its products include the Arta Wallet, a wallet and custody platform using world-class security technology, and the Arta STO, a regulated digital securities issuance platform based on blockchain.

These forward-looking investments have also earned CMB International recognition from regulatory authorities. On July 14, 2025, CMB International Securities Limited officially received approval from the Hong Kong Securities and Futures Commission, becoming the first Chinese bank-affiliated brokerage in Hong Kong to obtain a virtual asset trading service license. This means that CMB International can legally provide trading services for qualified investors, including cryptocurrencies like Bitcoin and Ethereum, expanding its business scope from traditional stocks to the digital asset field.

Which Institutions Are Behind This "Century Cooperation" Between American Public Chains and Chinese Institutions?

The successful realization of this cross-border on-chain fund involves two key institutions, DigiFT and OnChain, one connecting CMB International through regulatory compliance, and the other focusing on public chain technology support to connect with public chains like Solana. Who are they?

DigiFT: Pioneer of On-Chain Compliant Exchanges

DigiFT is a fintech company established in 2021 in Singapore, dedicated to creating a compliant and decentralized parallel on-chain digital asset exchange. Its founder, Henry Zhang, has a senior banking background, which has made regulatory compliance a top priority for DigiFT from the very beginning.

Henry Zhang has nearly 13 years of experience as a senior executive in foreign banks in the Chinese-speaking region, source: LinkedIn

DigiFT is the world's first on-chain trading platform recognized by the Monetary Authority of Singapore as a Recognized Market Operator (RMO) and holding a Capital Markets Services (CMS) license. With this dual license, DigiFT can legally provide on-chain security token issuance and trading services to qualified investors. In terms of technological innovation, DigiFT was the first to launch a compliant on-chain automated market maker (AMM) mechanism, combining the efficiency of decentralized trading with traditional regulatory requirements. Additionally, the platform has issued some of the world's first tokenized US Treasury depositary receipts, demonstrating the feasibility of bringing real financial assets into the DeFi space.

In 2025, DigiFT further obtained a digital asset custody license from the Monetary Authority of Singapore, extending its business scope to compliant custody services and enhancing its end-to-end RWA solution capabilities. In the CMBMINT project, DigiFT plays the role of issuer and exchange: it issues tokens linked to the fund's net asset value and provides subscription, trading, and redemption channels to qualified investors through its platform.

In fact, prior to this collaboration, DigiFT had already completed multiple RWA tokenization partnerships. In February 2025, DigiFT partnered with Invesco to launch a $630 million tokenized private credit fund (iSNR), deployed on the Arbitrum chain, supporting USDC/USDT subscriptions and expanding to the Plume network. In March 2025, it launched two tokenized index funds tracking AI stocks (such as Apple and Tesla) and major crypto assets. DigiFT serves as the on-chain tokenization distribution partner for UBS, supporting products like uMINT (US dollar money market fund), and in August of this year, collaborated with KuCoin to use uMINT as collateral on the platform. Additionally, they have collaborated with institutions and projects such as HashKey Capital, FundBridge, Wellington Management, Libeara, Chainlink, IOST, WSPN, and GSR in varying degrees in the field of tokenizing physical assets.

It is precisely because DigiFT possesses mature compliance operation experience and innovative on-chain trading technology that CMB International can confidently entrust the management of fund token issuance and circulation to them. Traditional institutions are responsible for asset and compliance oversight, while innovative platforms handle technical implementation and market liquidity, allowing both to leverage their strengths.

OnChain: RWA Technology Driver

OnChain is a fintech company focused on the on-chain allocation of global assets, with core team members coming from both traditional finance and blockchain backgrounds, including founders of NASDAQ-listed companies, executives from trillion-dollar asset management firms, and former executives from top global exchanges. The core team graduated from prestigious institutions such as Peking University and Columbia University, and has held positions at Goldman Sachs, ByteDance, Tencent, and other organizations, possessing deep experience in blockchain, smart contracts, and digital asset management.

With the support of top institutions such as CMB International (CMBI), UBS, and Invesco, OnChain provides on-chain investment solutions covering money market funds, bond funds, and non-standard fixed income products, and plans to support global ETFs and mainstream stock market investments in the future, promoting the deep integration of traditional finance and on-chain ecosystems.

The Era of RWA for Major Institutions

An increasing number of institutions collaborating with on-chain projects reflects a trend: only when the forces of regulation, assets, and technology combine can RWA projects truly land and succeed. From a broader perspective, Asian financial institutions (Hong Kong's new policies, Singapore's sandbox) are building a stage for such cross-border blockchain innovations. In the future, as more traditional giants and blockchain innovation companies "connect the dots," we have reason to expect more cross-market and cross-technology collaborations, driving the maturation of real-world assets on-chain and bringing new possibilities for the globalization of financial markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。