"His ultimate vision is to transform Solana into a pillar of global finance, allowing information to spread as quickly as news."

Written by: Thejaswini M A

Translated by: Block unicorn

Introduction

Anatoly Yakovenko is angry.

It was 2017 when news broke that the Bitcoin conference would stop accepting Bitcoin payments because transaction fees had skyrocketed to $60-70 each.

The world's premier cryptocurrency event couldn't even use cryptocurrency.

So, he did what any frustrated engineer would do. He went to Café Soleil in San Francisco, ordered two coffees and a beer, and stayed up until 4 AM, pondering why Bitcoin was so slow.

In between sipping his second espresso and the last gulp of beer, Yakovenko suddenly had an epiphany, which he called his "aha moment." He suddenly thought of a way to encode the passage of time as a data structure.

He didn't know that this function had a name (verifiable delay function), so he couldn't Google it. He thought he had invented something entirely new.

In a sense, he did.

When Solana launched in 2020, it could process 65,000 transactions per second. Today, the blockchain Yakovenko built in his garage has a peak market value of over $50 billion.

The Growth Path of a Systems Thinker

Yakovenko's blockchain journey began with an early immigrant story. Born in Ukraine in 1981, he moved to the United States with his family in the early 1990s, joining the wave of Eastern European immigrants seeking opportunities in the American tech boom.

As a teenager, he became fascinated with the C language, captivated by the precision and power of low-level systems programming. "The possibility that writing a piece of code could solve a significant problem in the world was magical," he later recalled about his early programming days during the internet bubble.

At the University of Illinois at Urbana-Champaign, Yakovenko studied computer science and founded his first startup, Alescere, in the early 2000s, which was a VoIP system for small businesses. The company failed, but it provided him with valuable experience in real-time networking protocols.

In 2003, fresh from his startup experience, Yakovenko joined Qualcomm in San Diego. He started as a regular engineer but, over 13 years, tackled some of the company's most challenging technical problems.

He worked on various projects, from QChat's push-to-talk server to the BREW mobile operating system, eventually becoming a senior engineering manager. He also optimized communication between different processors. Yakovenko became an expert in "extending operating system services and protection domains to co-processors," essentially figuring out how to make different parts of a computer system work together without slowing each other down.

His patent portfolio from this period resembles a blueprint for his later blockchain work: "exposing host operating system services to co-processors" and "extending protection domains to co-processors." His work focused on minimizing overhead and improving coordination efficiency among distributed components.

"I started thinking about how we solved these scaling issues with wireless protocols at Qualcomm, which led me to explore this field deeply," he said.

The cellular tower technology he worked on used a method called time-division multiple access, coordinating multiple signals by precisely managing time. In 2017, after more than a decade at Qualcomm, Yakovenko began working on compression and distributed systems at Dropbox. But what truly changed everything was his side project.

He and Qualcomm's GPU lead, Stephen Ackrich, built hardware for deep learning and cryptocurrency mining to offset costs. This was originally about machine learning, not blockchain innovation.

But as Yakovenko observed their mining equipment coordinating with thousands of other computers, one question kept bothering him: why was proof of work so inefficient?

Bitcoin's transaction fees had soared to $60-70 each. This network, which was supposed to be peer-to-peer electronic cash, couldn't even handle basic payments. The Bitcoin conference further fueled his frustration.

That's when the moment at Café Soleil happened.

Proof of Historical Breakthrough

Imagine this: 10,000 people trying to agree on the timing of something, each shouting at each other, creating chaos.

That's essentially how Bitcoin operates. But the problems with Bitcoin go far beyond just noise.

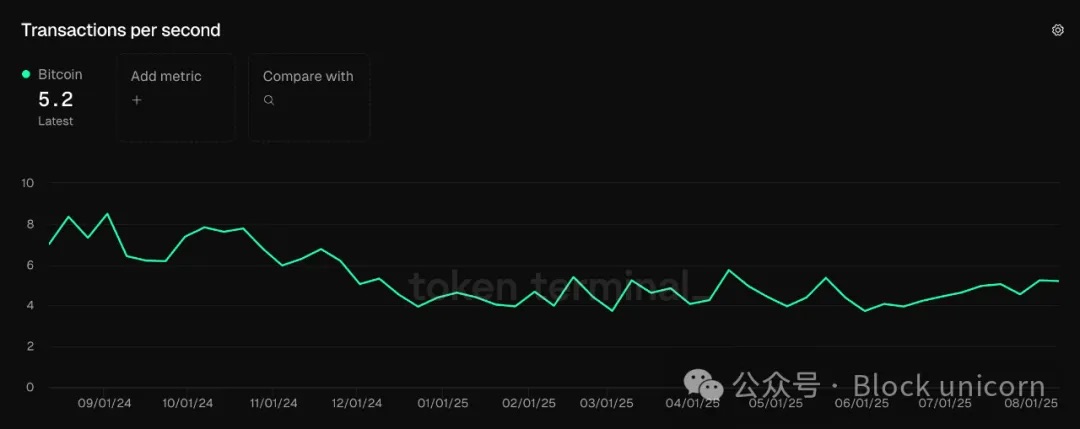

Bitcoin creates a new block every 10 minutes, a careful balance between security and speed. If it's too fast, the network could split into competing versions; if it's too slow, transactions take too long. This 10-minute cadence means Bitcoin can only process about 7 transactions per second.

In contrast, Visa processes about 24,000 transactions per second on average.

The real issue is that in a distributed system with thousands of computers globally, there is no central clock. Each computer's clock runs slightly differently. Network message transmission takes time. The order of events appears different depending on the observer's position.

Thousands of Bitcoin computers spend most of their time arguing over some basic questions: "Did this transaction happen before that one?" "When was this block created?" "Which version of the blockchain is correct?"

The more computers that join, the more intense the arguments become.

Yakovenko had an idea: what if there was no need to argue about time?

What if the blockchain had a built-in, tamper-proof clock? Each transaction would automatically receive a timestamp that everyone could independently verify.

No longer would thousands of computers need to constantly send messages to reach a consensus on time; they could simply look at the same tamper-proof clock to instantly know the order of events.

No more endless back-and-forth messages, just a cryptographic stopwatch keeping perfect time.

He called it "Proof of History."

Replacing debate with computation. No longer needing thousands of conversations about time, just looking at the clock. Simple and clear.

Building Solana

With this breakthrough, Yakovenko co-founded Solana Labs in 2018 with Greg Fitzgerald (another Qualcomm veteran) and Raj Gokal. The name comes from their experiences surfing at Solana Beach in California.

The co-founders would wake up in the morning to surf, bike to work, and code all day before heading back to the beach.

They built the project during the crypto winter of 2018-2019 when funding was scarce and enthusiasm waned. But Yakovenko saw this as an advantage. They could focus on engineering without facing hype and pressure.

"It was like the meteor that killed the dinosaurs. It really was a crypto winter; you saw many teams dissolve. We were always relatively conservative, never raising a lot of money, and we had about two years of runway, so we were always thinking, 'We have to get this right as quickly as possible and really focus on the key products we believe will make a difference,'" he recalled.

The team not only built Proof of History but also created a whole suite of innovations supporting high throughput:

Sealevel: A parallel smart contract runtime that allows the blockchain to run multiple transactions simultaneously by pre-declaring the accounts involved.

Turbine: A system inspired by BitTorrent that uses erasure coding and a random weighted tree to propagate transaction data across the network.

Gulf Stream: A transaction forwarding system without a memory pool that sends transactions to future leaders before block generation.

Cloudbreak: A horizontally scalable account storage system designed for high concurrent access.

Each innovation targets different bottlenecks. Together, they created something unprecedented: a blockchain that gets faster as it scales.

On March 16, 2020, the world was in chaos. The stock market crashed, countries locked down, and startups were failing. Yakovenko chose to launch Solana on that day. Within months, it proved to be a perfect timing, launching the fastest blockchain in the world.

By the end of 2020, Solana processed 8.3 billion transactions, created 54 million blocks, and attracted over 100 projects in DeFi, gaming, and Web3 integration. Validator nodes expanded to over 300 globally, which is impressive for a network that had been established for less than a year.

Developers began building applications that were impossible on slower blockchains. High-frequency trading systems, real-time games, and social media platforms became possible for the first time in blockchain history.

Disruption Years

Success brought new challenges. Solana's high throughput made it a target for adversarial traffic, exposing its systemic weaknesses.

September 14, 2021: A surge in transactions during the Grape IDO caused the network to fork, resulting in a 17-hour outage.

May 1, 2022: An NFT "blind minting" bot caused a consensus failure, taking the network offline for 7-8 hours.

May 31, 2022: An error in offline transaction processing led to a 4.5-hour outage.

October 1, 2022: A configuration error caused a 6-hour outage.

Critics pointed out that these events demonstrated that Solana sacrificed decentralization for speed. Its monolithic design meant that once something went wrong, the consequences were severe.

The team responded with systematic improvements: better deduplication handling, improved random number processing, fixing fork selection errors, and introducing the QUIC protocol to enhance network reliability.

In November 2022, Solana faced its biggest test—the collapse of FTX.

Sam Bankman-Fried was once one of Solana's most prominent supporters. When his exchange FTX collapsed, panic spread rapidly. Investors believed anything associated with FTX would fail, and Solana's token price plummeted as people rushed to sell.

The Solana community did not sit back and wait for others to solve the problem.

FTX controlled a popular trading platform called Serum, which many Solana users relied on. When FTX collapsed, this platform effectively became an "orphan," with no one knowing its fate.

Within hours, Solana's developers and community members sprang into action. They copied all of Serum's code and created a completely independent version, named OpenBook.

The technical term is "forking," which means creating a new version with the same functionality but without the ownership issues.

Throughout the crisis, Solana itself never stopped running.

Despite the price crash and panic, the blockchain continued processing transactions. No downtime. No technical failures.

Unlike traditional companies that might collapse due to a CEO's arrest, Solana's scale had surpassed any individual or company supporting it. The technology and community could survive independently.

Future Vision

At 44 years old, Yakovenko has achieved extraordinary accomplishments while maintaining a unique blend of engineering pragmatism and crypto idealism, a hallmark of successful blockchain founders.

He advocates for "reasonable rules," such as legislators trying to use the technology before regulating it.

Strangely, despite hoping for cryptocurrency-friendly policies, he opposed the government crypto reserve plan proposed by Trump. He believes it is too centralized, and this principled stance raises questions about his suitability for politics. He prefers to see innovation thrive naturally rather than allowing bureaucrats to control digital currency, even if those bureaucrats happen to favor his blockchain.

His ultimate vision is to transform Solana into a pillar of global finance, allowing information to spread as quickly as news.

Although Solana directly competes with Ethereum in the so-called "blockchain wars," Yakovenko rejects tribal thinking. He insists that different blockchains can coexist and complement each other rather than being a zero-sum game. This mature perspective is refreshing in the crypto industry, where people often predict that competing protocols will "go to zero" over minor technical differences.

Yakovenko built one of the world's most powerful distributed computers by leveraging an insight that, in hindsight, seems obvious but had not been cracked before—turning time itself into a blockchain data structure.

His personal net worth is estimated to be between $500 million and $800 million, and this financial success allows him to focus on building rather than wealth accumulation.

However, this recognition is beginning to manifest in the most significant form in the financial sector: other people's money. Currently, four publicly traded companies hold over $591 million worth of Solana tokens in their corporate treasuries, with Upexi leading the way, having accumulated 1.9 million SOL tokens in just four months. SOL Strategies has taken a more systematic dollar-cost averaging approach. Classover Holdings has announced plans to invest $500 million in Solana, while the U.S. strategic cryptocurrency reserve proposed by Trump lists Solana alongside Bitcoin and Ethereum as strategic assets. When publicly traded companies start treating your blockchain tokens like government bonds, you may have built something truly significant.

Institutional adoption indicates that Yakovenko's vision of Solana as a global financial infrastructure may not be far off. Asset management firms like Franklin Templeton and Fidelity are applying for Solana spot ETFs, and the logic behind companies choosing SOL as treasury reserves is the same as holding BTC or ETH: it serves as a store of value while potentially powering the future financial system.

If that frustrating night at Café Soleil truly led to a breakthrough that allows money to flow at the speed of light, corporate CFOs are starting to take notice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。