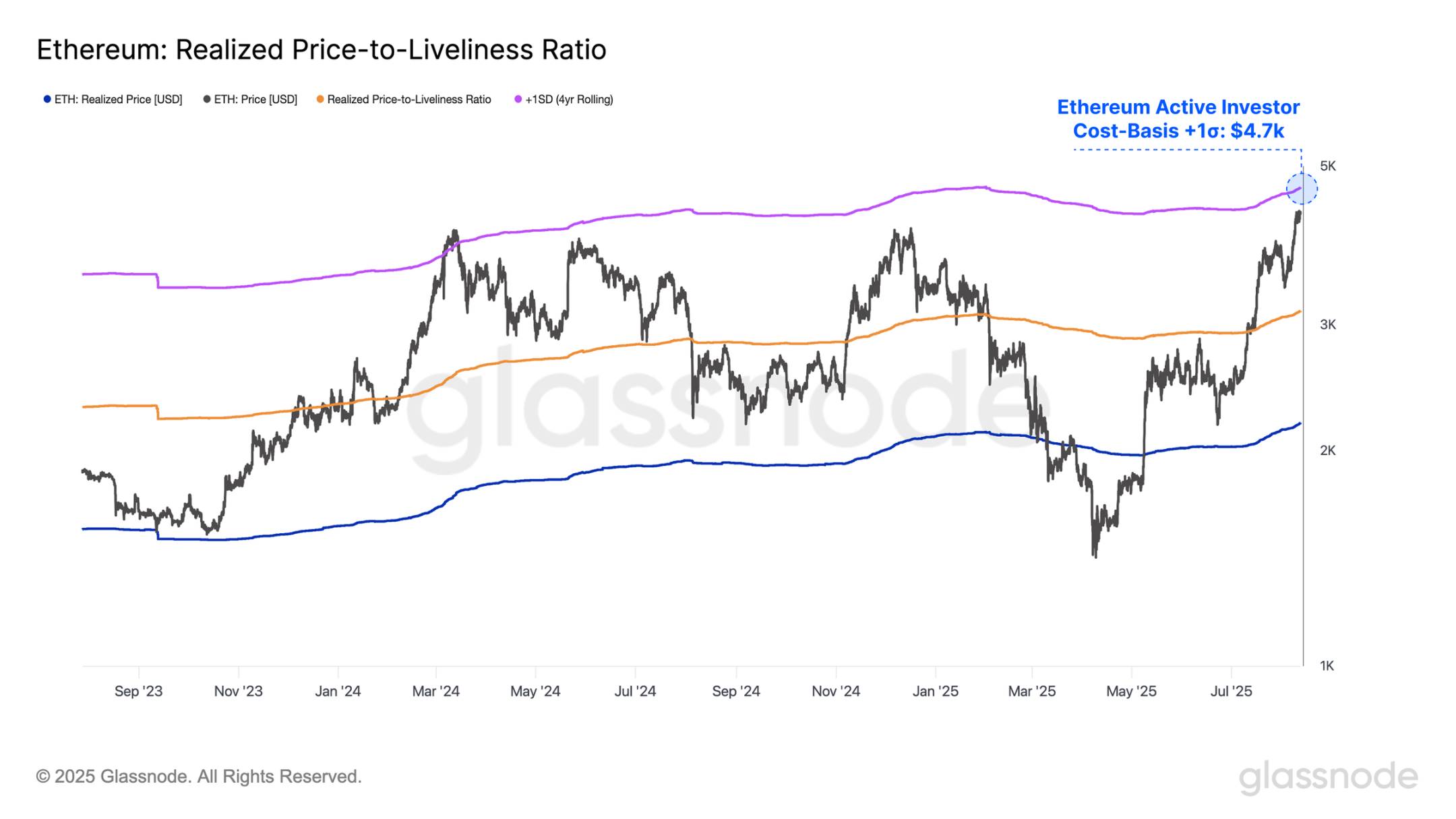

Ethereum is approaching its +1σ active realized price level of $4,700, a region that has historically triggered strong selling pressure.

Written by: UkuriaOC, CryptoVizArt, Glassnode

Compiled by: AididiaoJP, Foresight News

Ethereum's price continues to strengthen, moving towards historical highs, while Bitcoin consolidates below its peak. However, the surge in open contracts for mainstream altcoins, combined with unusually low volatility expectations for Bitcoin, lays the groundwork for increased volatility in the digital asset market.

Summary

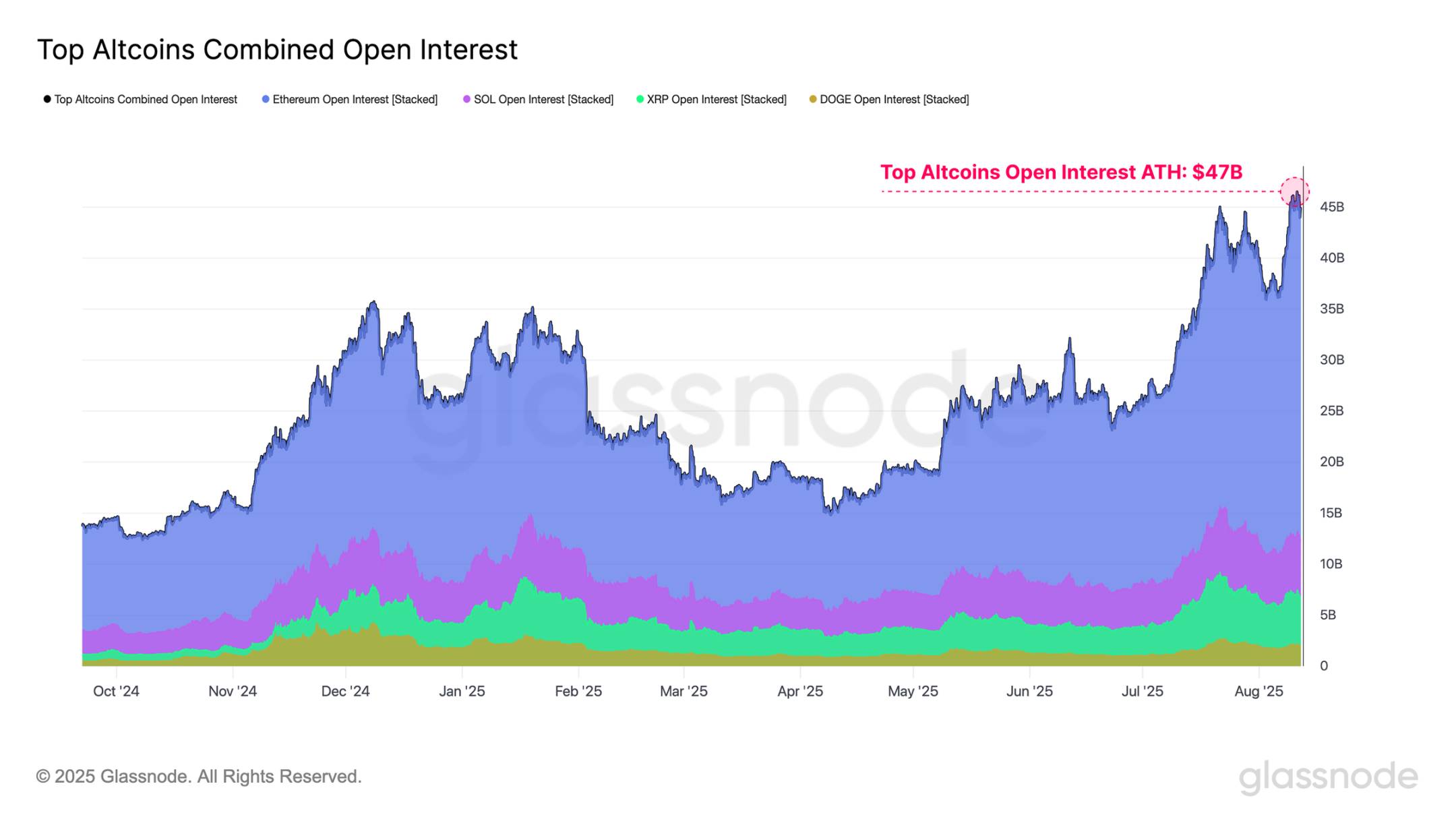

Ethereum's upward momentum continues to accelerate, with its price reaching $4,600, the highest level since December 2021, only about 5% lower than its previous all-time high. However, speculation around this leading altcoin is increasing, driving the total open contracts for mainstream altcoins to a record $47 billion. This accumulation of leverage creates a more volatile backdrop for the market, with price shocks increasingly having a reflexive impact.

Key on-chain indicators for Bitcoin show that its momentum remains strong. Short-term holders experienced significantly lower realized losses during the recent pullback to $112,000, and the vast majority of investors remain in profit.

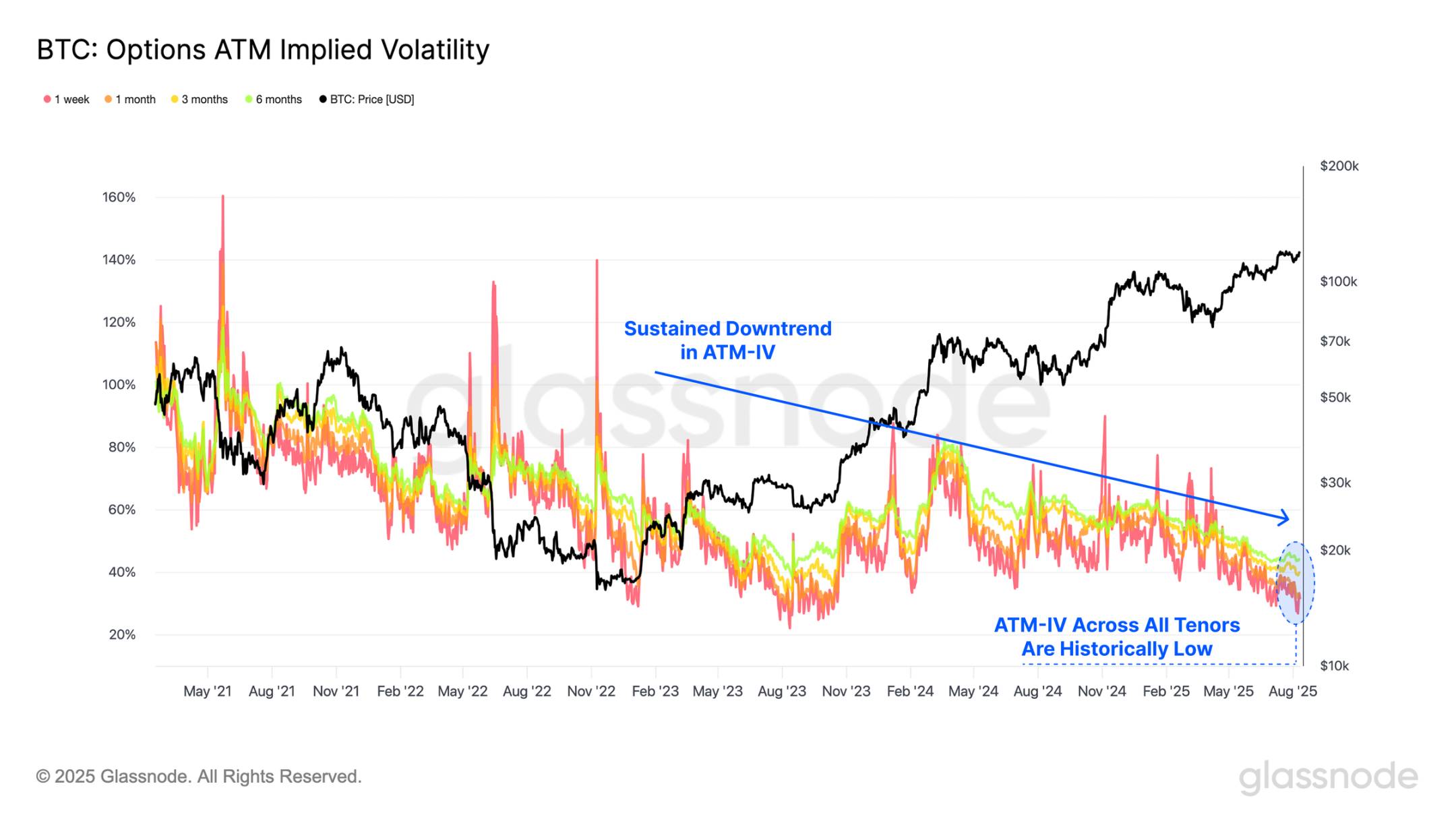

Options traders continue to bet on low volatility mechanisms, with at-the-money implied volatility (IV) across all maturities at multi-year lows. Historically, periods of unusually low implied volatility often precede sharp expansions in actual volatility, which can be seen as a contrarian signal.

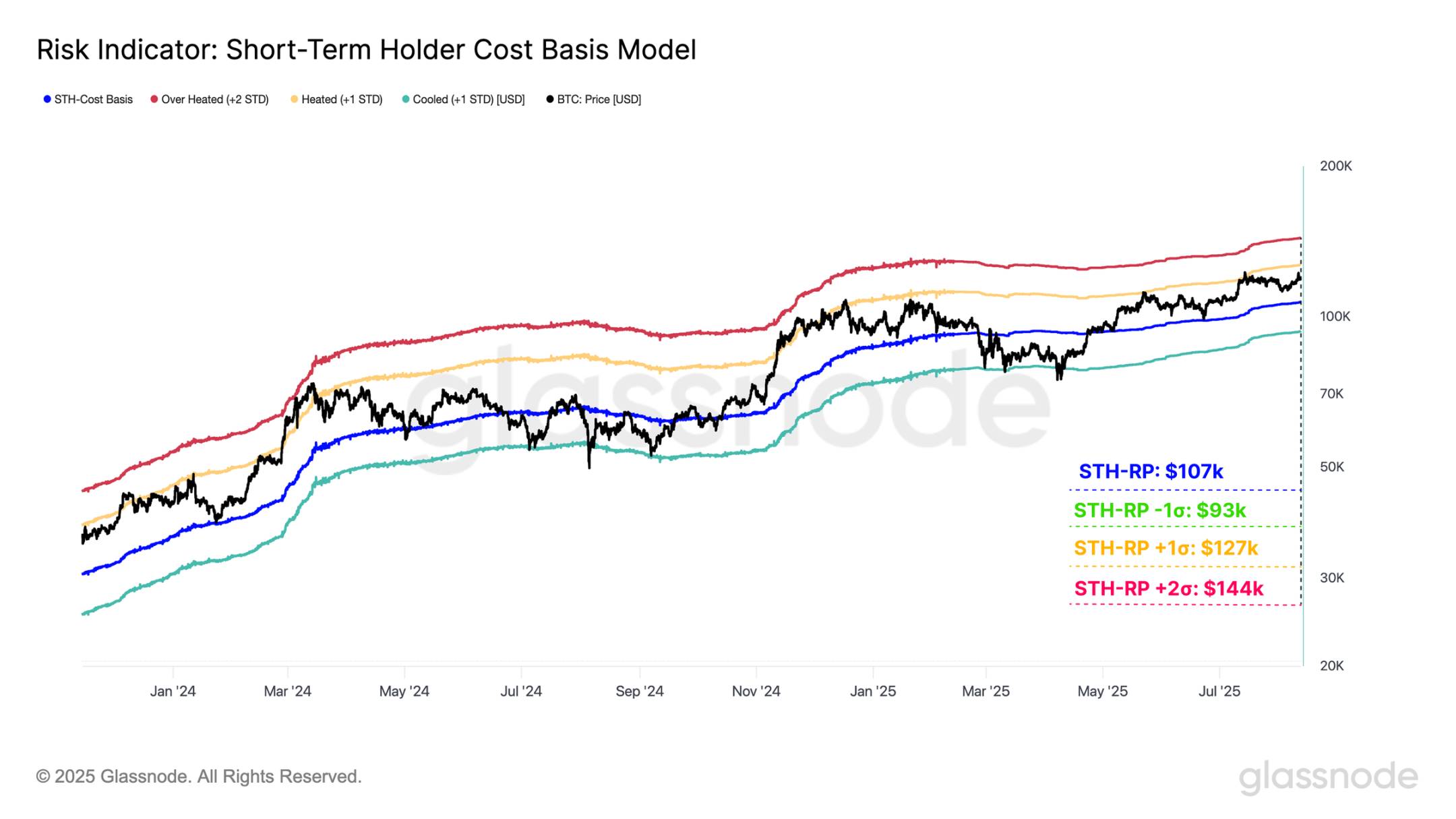

Ethereum is nearing its +1σ active realized price level of $4,700, a region that has historically triggered strong selling pressure. Meanwhile, Bitcoin is approaching its +1σ (one standard deviation, meaning the larger the σ, the more intense the price fluctuations) short-term holder cost basis of $127,000, a level that has consistently served as a periodic resistance. If Bitcoin can decisively break through this level, it may open the door for further price increases to the +2σ level of $144,000.

Note: The σ level helps traders identify historical price boundaries, with +1σ being a key short-term resistance level. A breakthrough could challenge higher standard deviation levels (such as +2σ), and prices reaching +2σ typically indicate an overheated market (such as excessive leverage by investors), necessitating caution regarding pullback risks. The same applies below.

Altcoin Rally

The rally in the digital asset market continues to accelerate, with Ethereum leading the way. Its price has climbed from $1,500 in April to $4,300, the highest level since December 2021, only about 5% lower than its all-time high of $4,800. Historically, Ethereum has been a barometer for the broader altcoin performance, and its recent strong performance is driving investors to speculate further along the risk curve.

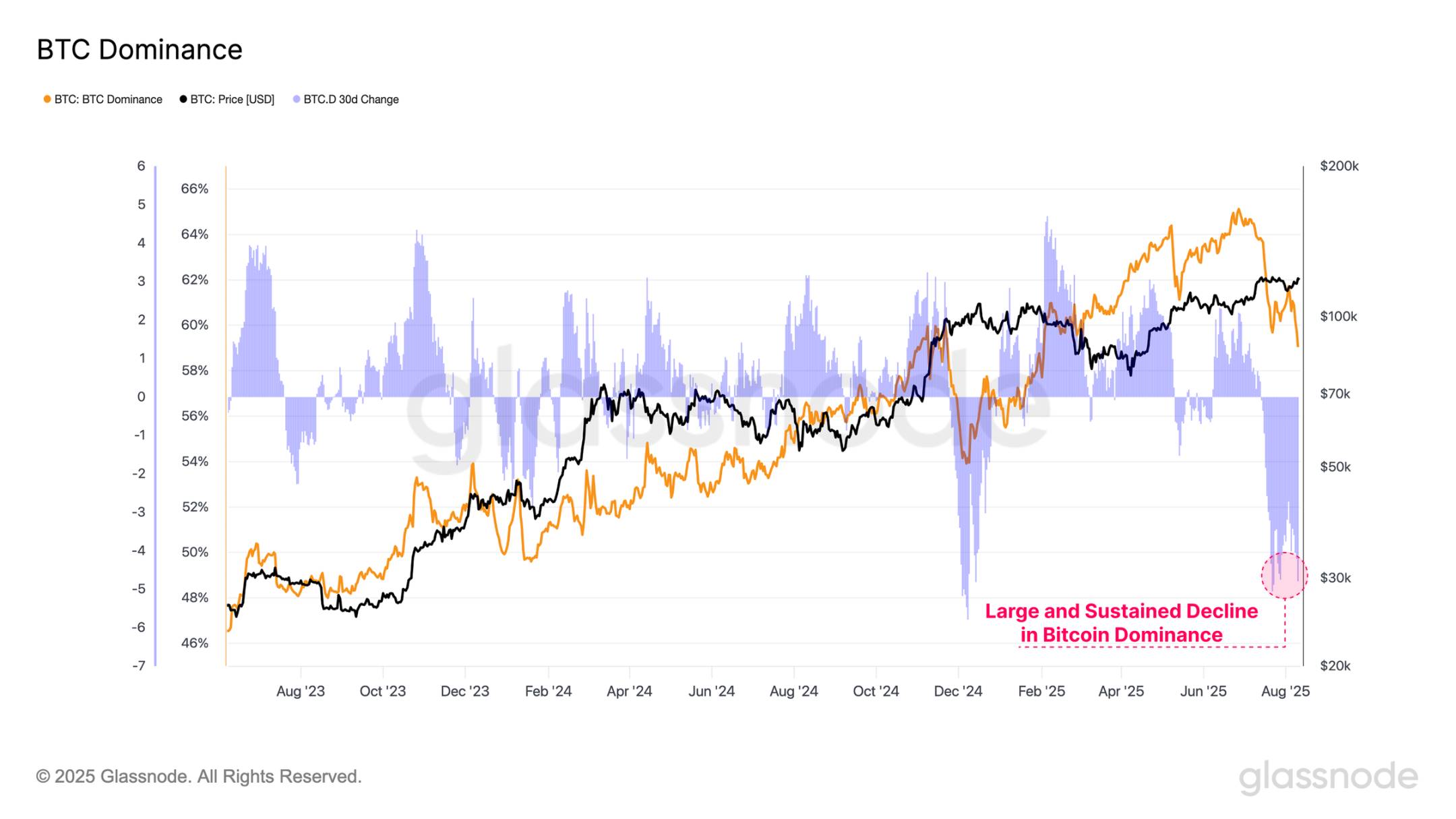

This rotation of funds is also reflected in Bitcoin's dominance metric, which measures Bitcoin's share of the total market capitalization of digital assets. Over the past two months, Bitcoin's dominance has dropped from 65% to 59%, highlighting that funds are flowing further into high-risk assets.

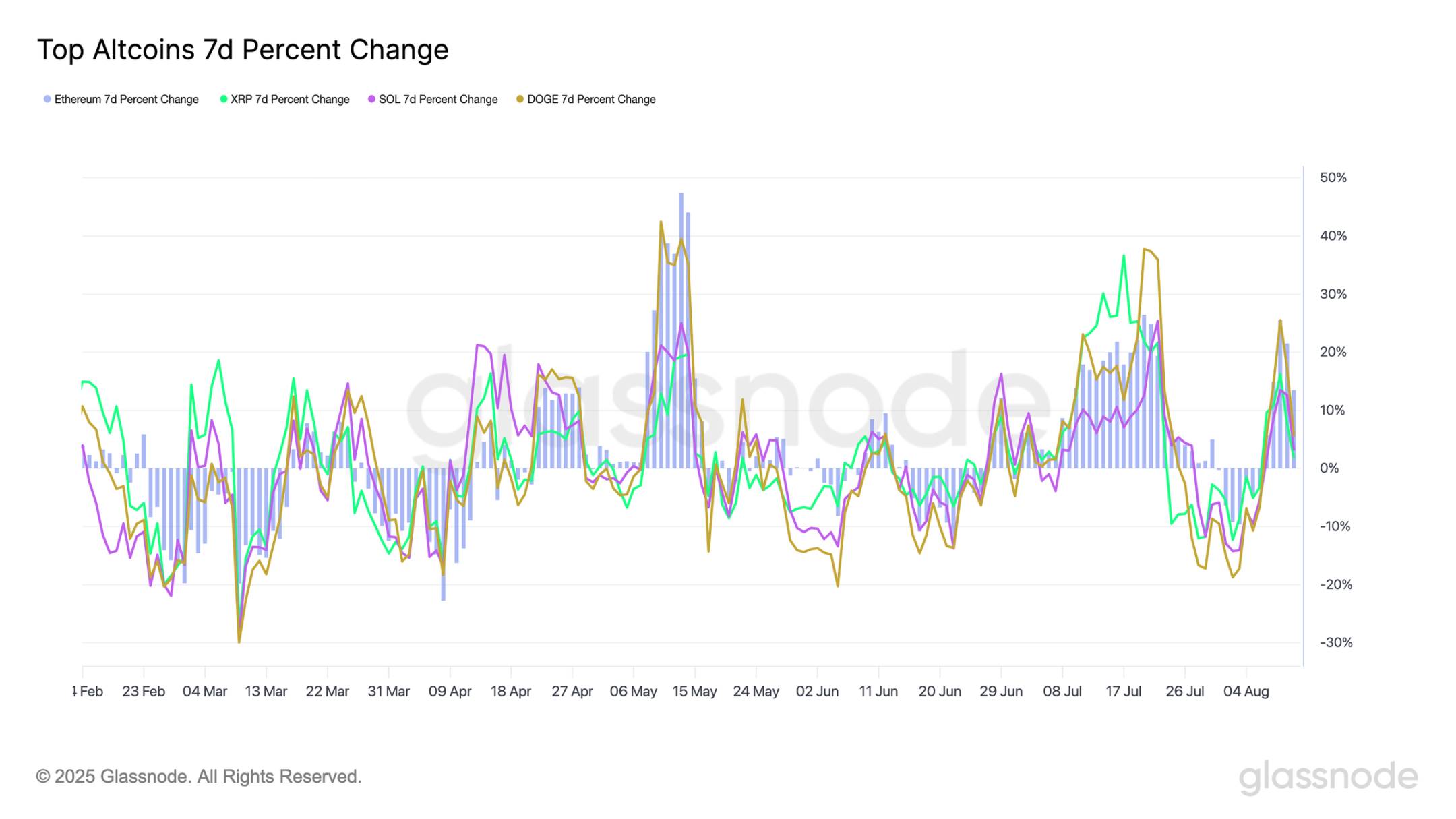

By observing the 7-day percentage changes of mainstream altcoins (Ethereum, XRP, Solana, and Dogecoin), we can see that during July and August, these assets exhibited strong gains multiple times:

Ethereum 7-day gain: +25.5%

XRP 7-day gain: +16.2%

Solana 7-day gain: +13.6%

Dogecoin 7-day gain: +25.5%

These gains indicate that as investor speculation intensifies, altcoins are experiencing a broad rally.

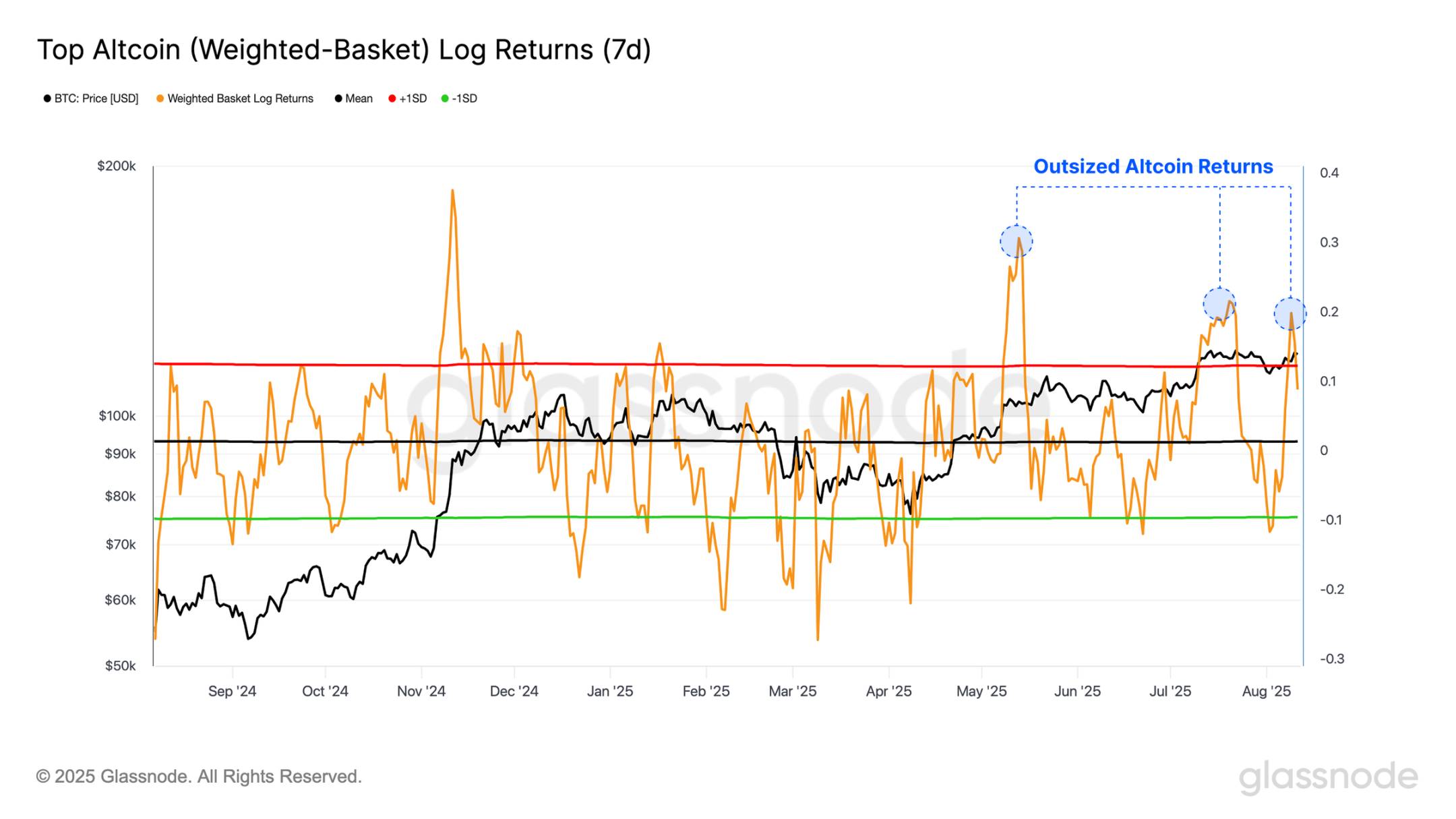

Another way to measure the performance of mainstream altcoins is to construct a market-cap-weighted basket of altcoins and assess its 7-day logarithmic return. This method naturally eliminates the impact of differences in asset sizes. By applying the ±1σ range, we can identify statistically significant periods of outperformance or underperformance. Over the past four months, this method has revealed three sustained periods of outperformance, highlighting the excess returns in the altcoin space.

The significant price fluctuations of mainstream altcoins have driven their total open contracts to a new high of $47 billion. These conditions indicate that leverage is accumulating in the market, making it more susceptible to sharp price fluctuations. High leverage can amplify both upward trends and exacerbate downward trends, creating a more reflexive and fragile market environment.

Turning Point

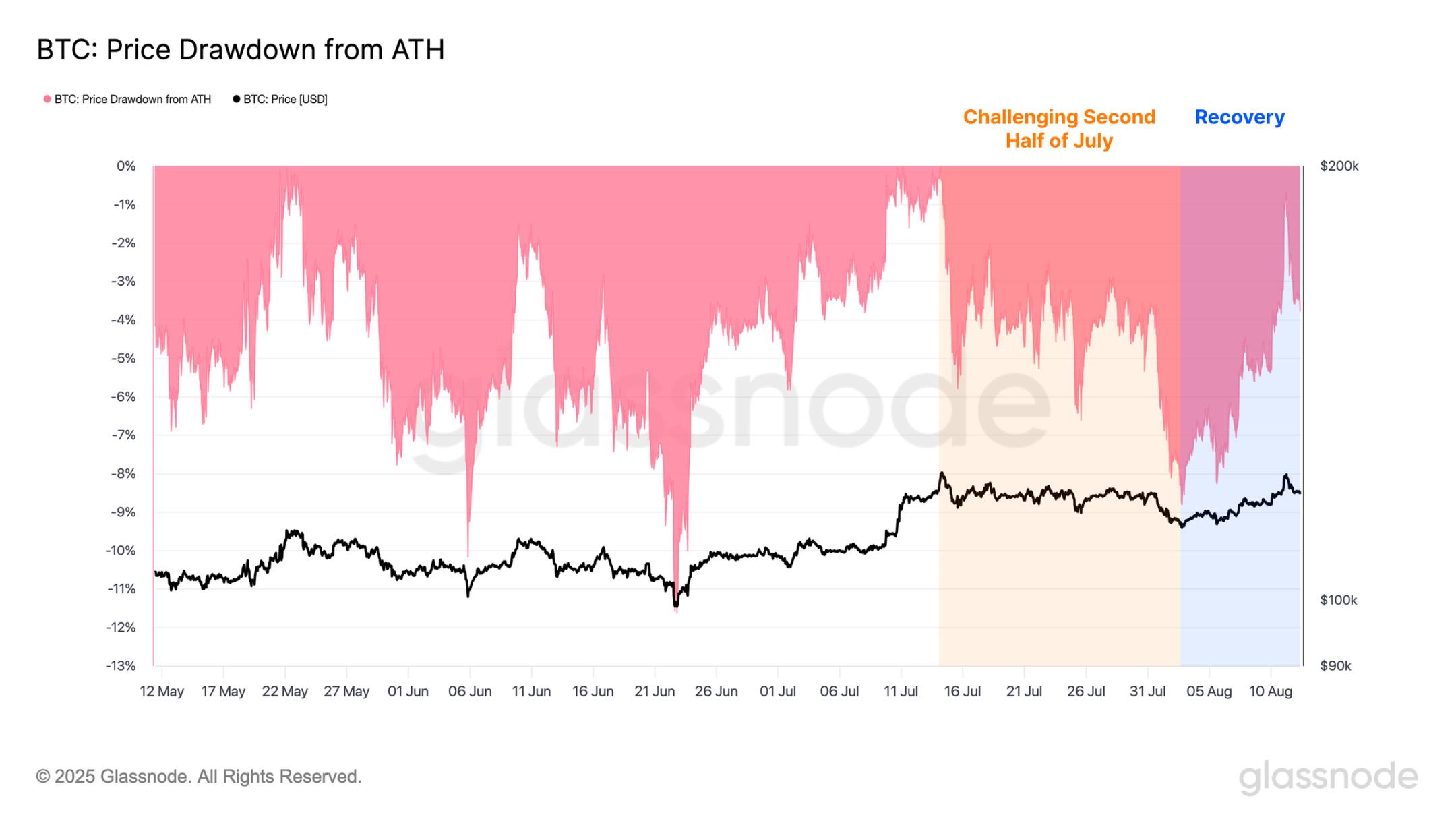

In contrast, Bitcoin has outperformed most altcoins throughout the cycle but faced challenges in the latter half of July, with its price dropping to $112,000, a decline of 9%, entering a low liquidity gap area. Since then, Bitcoin has rebounded strongly and is currently only 1% below its all-time high, indicating that the market is attempting to enter a new phase of price discovery.

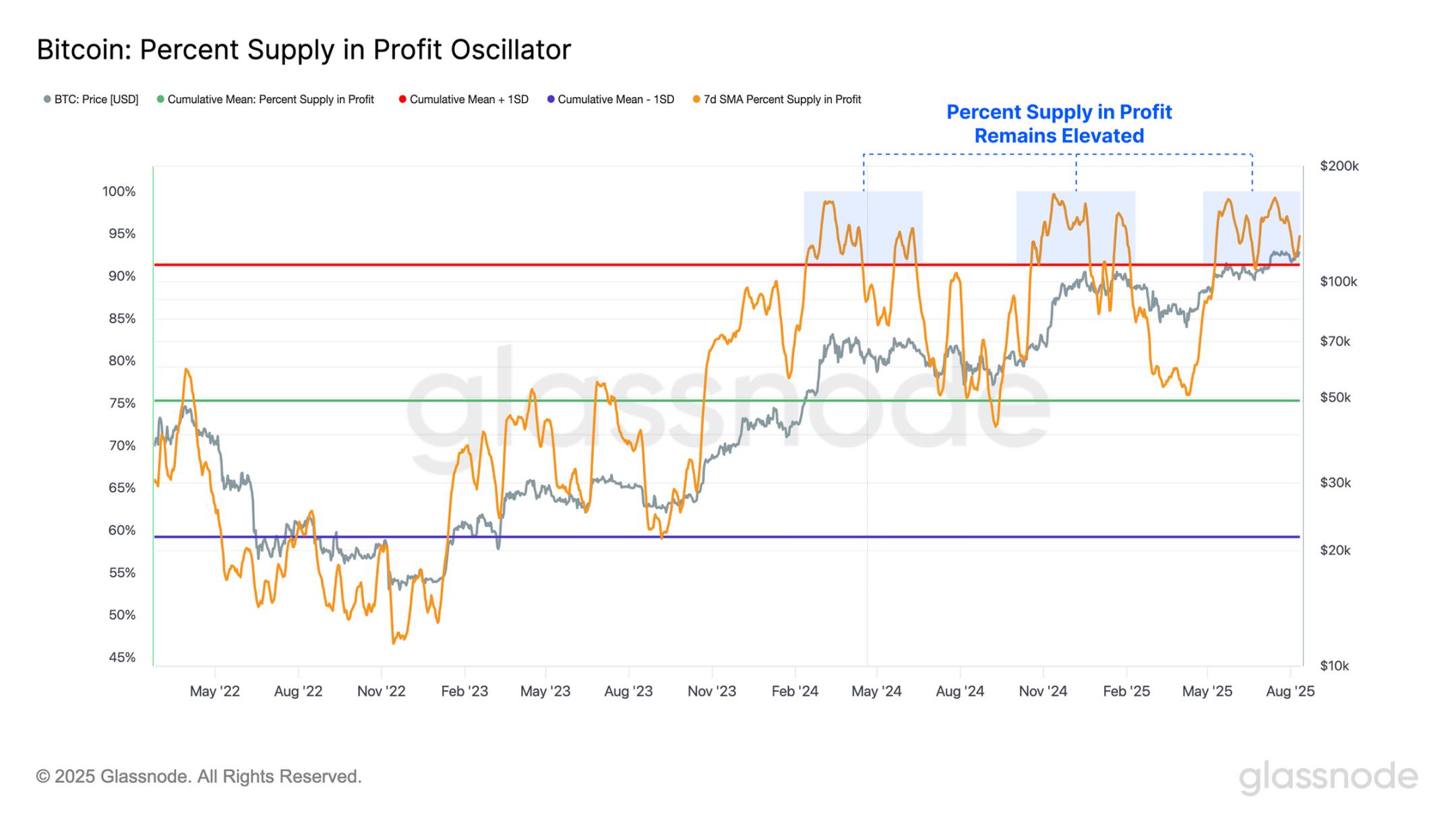

The recent upward momentum is supported by strong on-chain fundamentals. During the pullback, the proportion of circulating supply in profit has remained resilient, finding support at its +1σ level. This indicates that the vast majority of investors (95%) still hold unrealized profits.

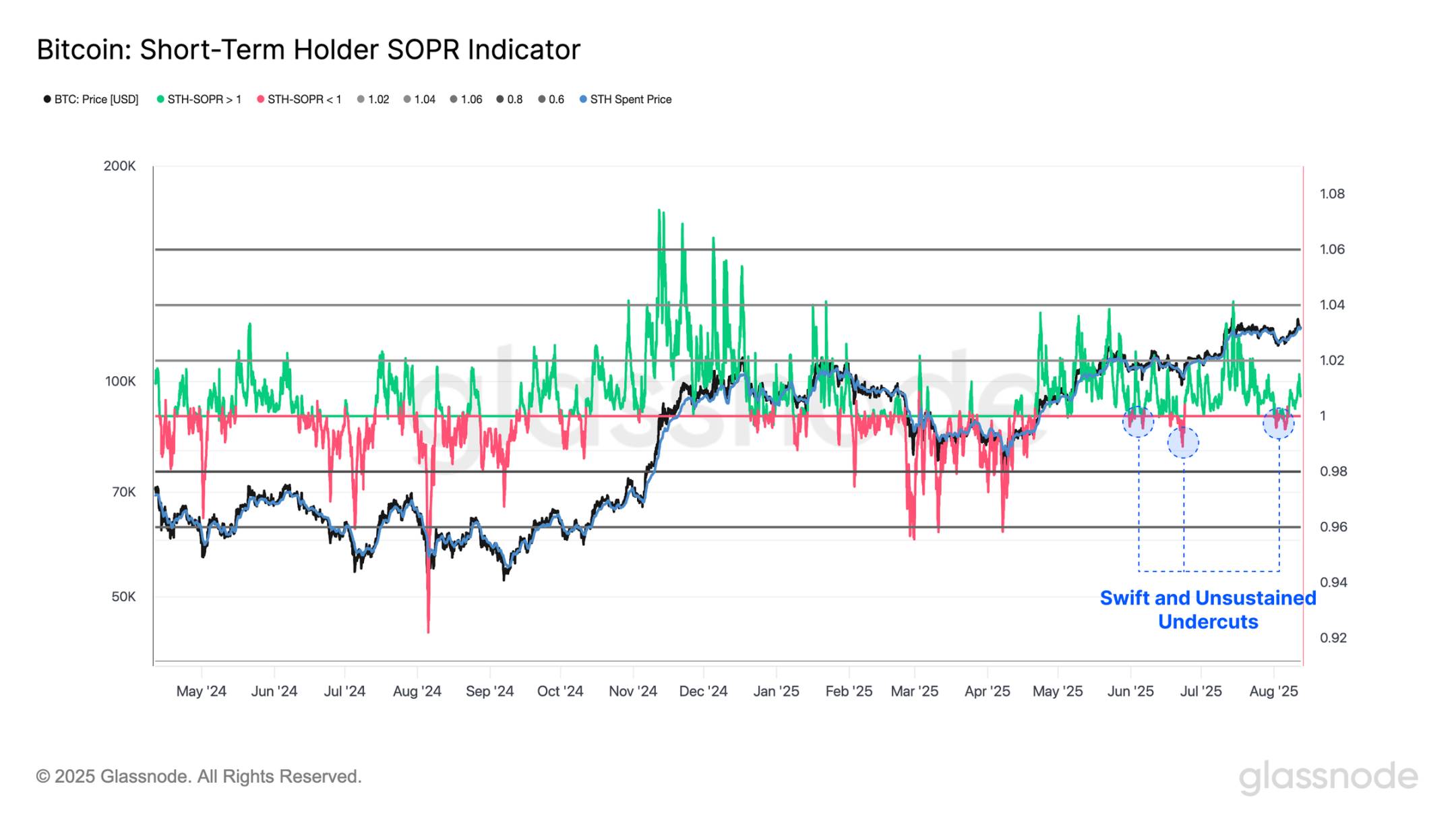

In the recent market downturn, the short-term holder spent output profit ratio (SOPR) has returned to the equilibrium level of 1.0, only briefly and slightly dipping below this level. This pattern suggests that new investors have been actively defending their cost basis, despite the sharp deterioration in market structure, with actual losses being relatively limited.

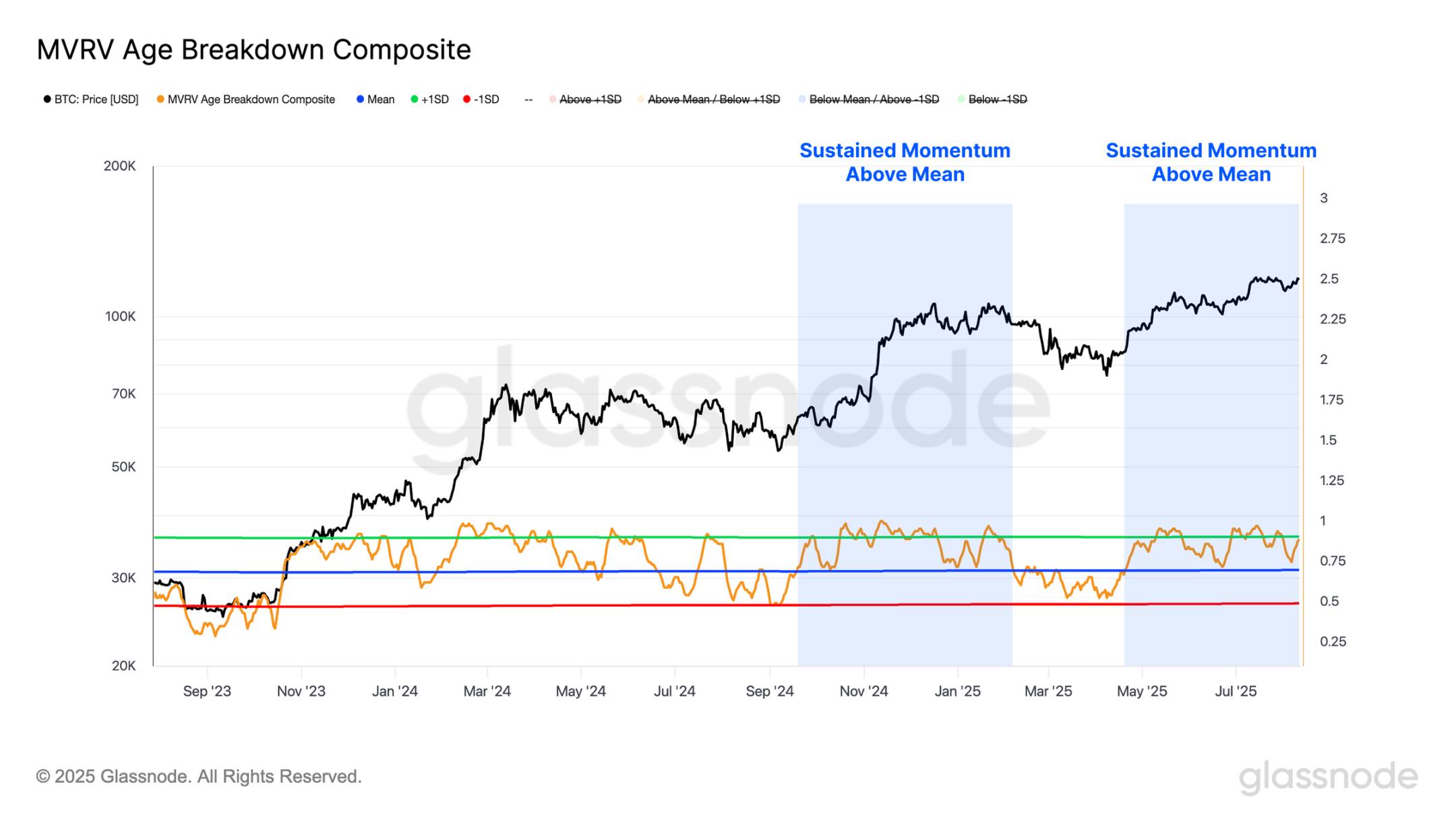

Additionally, we can use an equal-weighted portfolio to measure the average profit ratio of tokens held by investors of different ages. This provides an intuitive market momentum indicator by tracking when an increasing number of investors transition from unrealized profits to unrealized losses.

During the recent adjustment, this oscillation has remained above the mean and found strong support at this level, indicating that most investors remain profitable during the downturn. Combined with the marginal losses reflected in the short-term holder SOPR indicator, this suggests that selling pressure from market participants is minimal. The maintenance of this threshold marks an improvement in market conditions and provides a constructive backdrop for sustained upward momentum.

Implied Volatility Continues to Contract

Turning to the options market, at-the-money implied volatility (ATM IV) remains in a persistent downtrend, indicating that traders do not yet anticipate a shift to a high-volatility regime. Historically, this low volatility expectation often precedes sharp market fluctuations, making it a potential contrarian indicator.

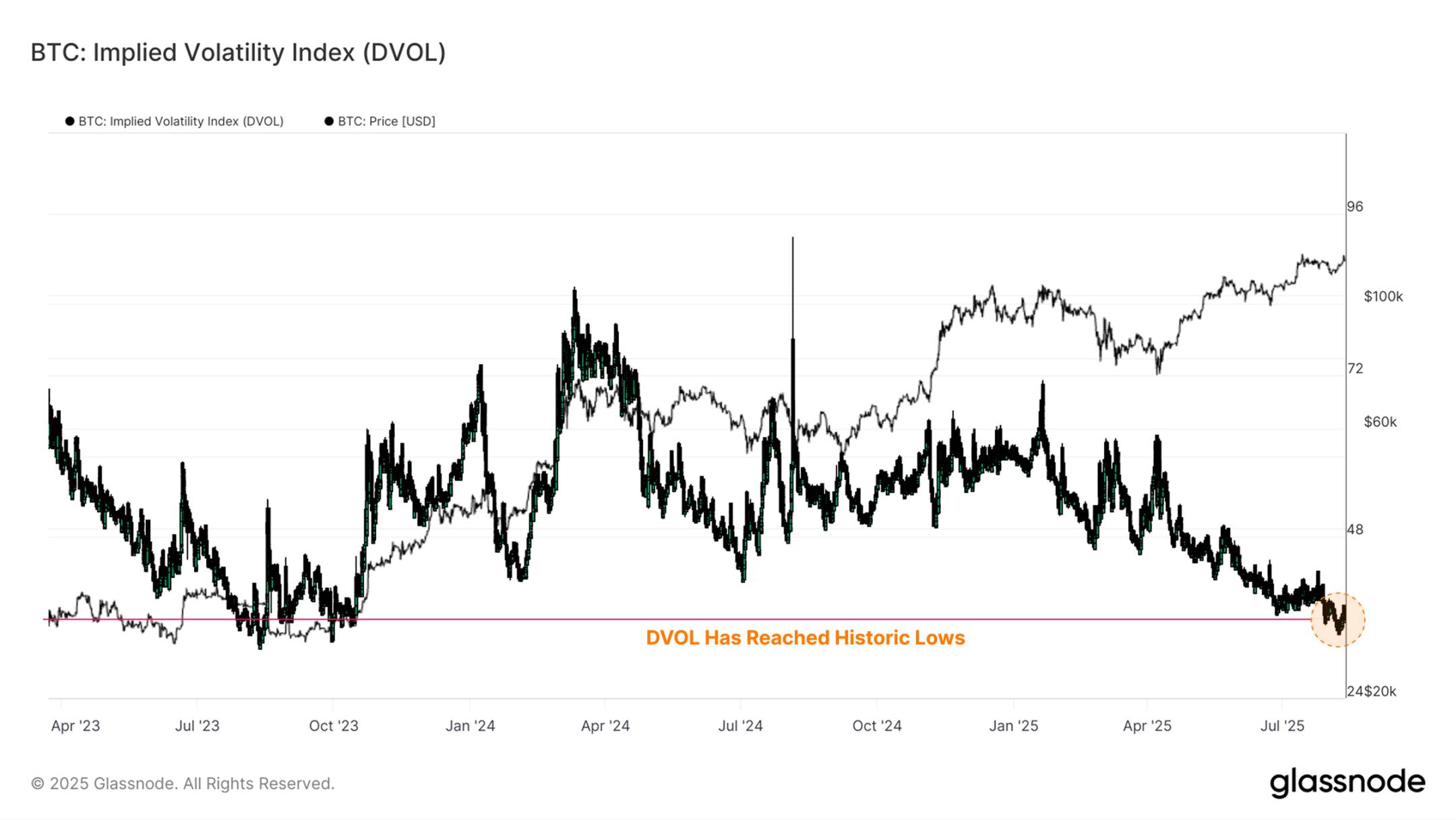

Furthermore, we can further validate the above observations through Deribit's DVOL index. This index is a 30-day implied volatility metric based on options data across all strike prices, not just at-the-money options. Similar to the VIX index in the stock market, it provides a broad perspective on market sentiment and expected price fluctuations, helping traders assess risk and identify periods of heightened speculation or uncertainty.

The current DVOL reading is at historical lows, with only 2.6% of trading days having values below the current level. This level typically reflects complacency in the market and a lack of demand for hedging against significant fluctuations. While this situation may persist, the market will be susceptible to sudden volatility if a catalyst occurs, as evidenced by the sharp and disorderly price fluctuations that occur when risks are rapidly repriced in past cycles.

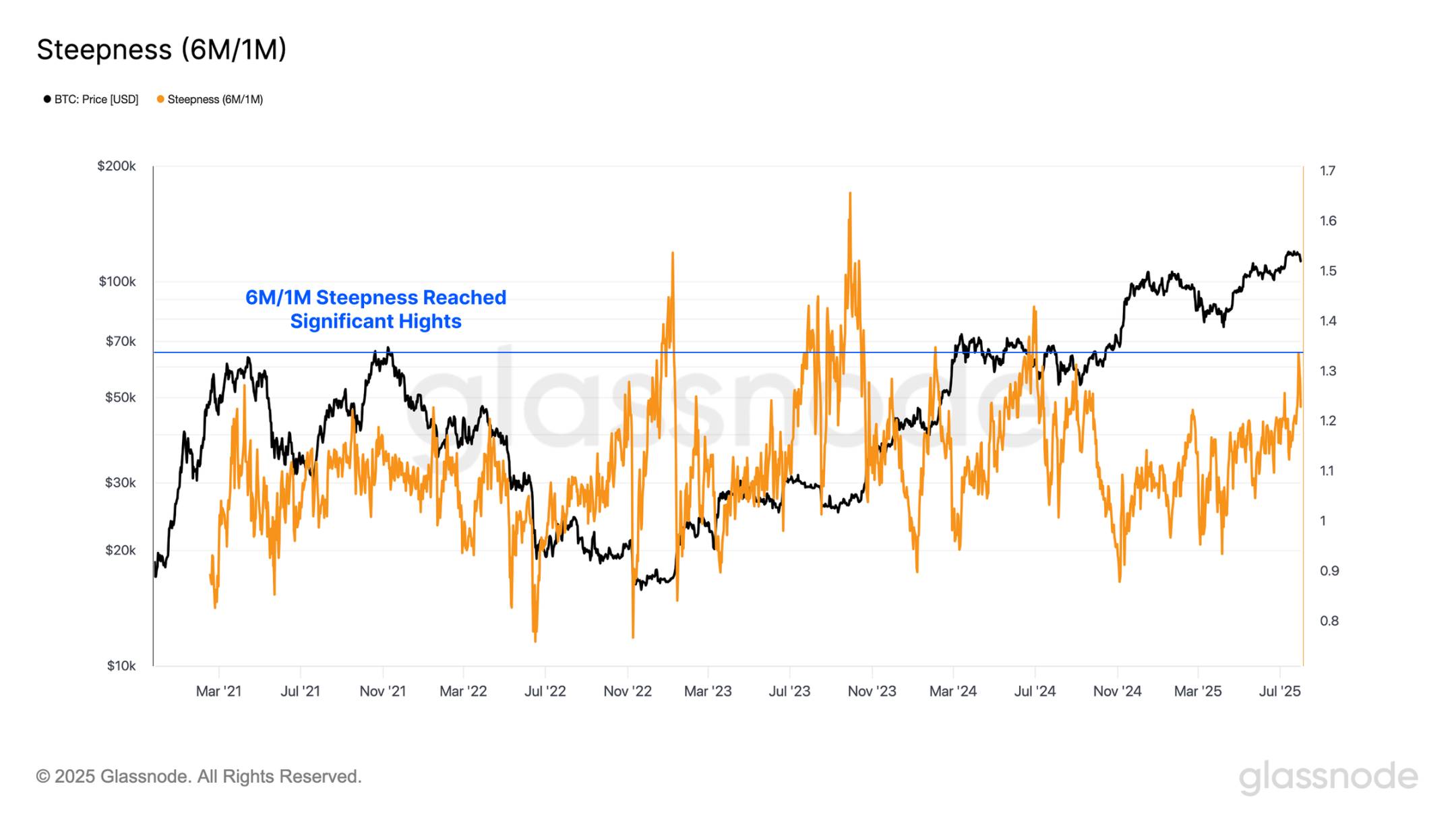

Additionally, we can track the 6-month/1-month implied volatility ratio to assess how market volatility expectations change over time. Changes in this ratio can reveal whether traders believe risks are concentrated in the near term or further out, helping to identify shifts in sentiment and the timing of market stress or exuberance.

Currently, the 6-month/1-month implied volatility ratio is high, with only 3.2% of trading days having readings above the current level. This indicates that options traders believe long-term uncertainty is significantly higher than short-term uncertainty, suggesting that volatility expectations for the next two quarters will rise sharply.

Market Navigation

To assess the potential upside targets of Ethereum's current rally, a useful reference point is its active realized price's +1 standard deviation level, which typically marks the beginning of selling pressure accumulation. Currently, this threshold is $4,700, which may represent an overheated area under current market conditions.

This level is historically significant, having served as a strong resistance during the rally in March 2024 and repeatedly acting as a resistance level during the 2020-2021 bull market cycle. In the past, when Ethereum has broken through this range, it has typically been accompanied by heightened investor sentiment and a fragile market structure.

Given these dynamics, the price point of $4,700 is a key resistance level that needs to be closely monitored. A decisive breakthrough could signal the market entering a more speculative phase, but if sentiment reverses, it could also increase the risk of a sharp pullback.

In contrast, for Bitcoin, we can assess the short-term holder (STH) cost basis, which represents the average purchase price of new market participants. Historically, this key price level marks the dividing line between local bull and bear markets. By applying standard deviation ranges, we can evaluate whether the market is overheated or oversold.

From the perspective of these pricing levels, $127,000 becomes a critical level to watch closely. If the price continues to rise, the market's reaction to this level will be crucial. Additionally, if Bitcoin decisively breaks through $127,000, it may target the $144,000 area, where the +2σ range coincides with a major resistance level, potentially triggering a sharp increase in selling pressure.

Summary and Conclusion

The market is currently in a sensitive phase of high speculation and low volatility, necessitating caution regarding short-term reversal risks. The current digital asset market exhibits polarization: Ethereum is surging towards historical highs, driving a broad rally in altcoins, but the surge in open contracts to $47 billion indicates accumulated leverage and rising market fragility; Bitcoin, on the other hand, is consolidating at high levels, with robust on-chain indicators, but the implied volatility in the options market has hit multi-year lows, signaling potential risks of sharp fluctuations.

The strong performance of the digital asset market continues, with Ethereum soaring to $4,600, the highest level since December 2021, currently only about 5% lower than its all-time high, while Bitcoin's momentum remains strongly supported by solid on-chain fundamentals.

The strong price performance of altcoins has driven a surge in open contracts for mainstream altcoins, totaling a record $47 billion, increasing the likelihood of significant price fluctuations. In contrast, the Bitcoin options market is still priced in a low-volatility environment, with implied volatility at multi-year lows, a setup that historically often precedes sudden expansions in actual volatility.

The two major cryptocurrencies are currently approaching historically significant resistance levels: Ethereum is at the +1σ level of its active realized price at $4,700, while Bitcoin is at the +1σ level of its short-term holder cost basis at $127,000. Price developments near these thresholds will be crucial in determining whether the market moves further towards higher cyclical targets or faces a sharp pullback driven by leverage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。