Despite still being in the accumulation phase, higher on-chain participation may increase Ethereum's liquidity and security while also amplifying its exposure to corporate funding risks.

Written by: Tanay Ved

Translated by: Saoirse, Foresight News

Key Points

Digital asset reserves focused on Ethereum are rapidly expanding, accumulating 2.2 million ETH (1.8% of total supply) in just two months, leading to a supply-demand imbalance.

These funds are adopting proactive on-chain strategies, planning to allocate capital through staking and DeFi configurations, supporting network security and liquidity while enhancing yields.

Although still in the accumulation phase, higher on-chain participation may increase Ethereum's liquidity and security while also amplifying its exposure to corporate funding risks.

The Rise of Digital Asset Reserves

Digital asset reserves (DATs), which are publicly traded companies holding cryptocurrencies like Bitcoin or Ethereum on their balance sheets, have become a new market entry channel. The launch of spot ETFs in 2024 has unleashed demand from investors who previously could not hold BTC and ETH through direct custody. Similarly, digital asset reserves provide investors with access to these assets and their ecosystems through publicly traded stocks, along with the strategic ability to raise and allocate capital.

We previously analyzed Michael Saylor's "Strategy Handbook," which raised funds through stock issuance and convertible bonds, accumulating over 628,000 Bitcoin (2.9% of total Bitcoin supply). Many companies worldwide are following suit, from Marathon Digital to Japan's Metaplanet, providing shareholders with an amplified or "leveraged" exposure to Bitcoin. This model is now expanding to other ecosystems, with numerous entities competing to increase their ETH holdings in corporate reserves.

While the goal of increasing shareholder exposure to the underlying assets remains unchanged, there is a fundamental difference between Ethereum reserves and Bitcoin reserves: the former can leverage Ethereum's staking and DeFi ecosystem. This creates the potential for enhanced returns through effective allocation of Ethereum's native yields and on-chain capital. In this article, we will analyze the dynamic impact of Ethereum reserves on Ethereum supply and explore the potential effects of these large institutions entering on-chain.

Supply Dynamics: The Race for 5% of Supply

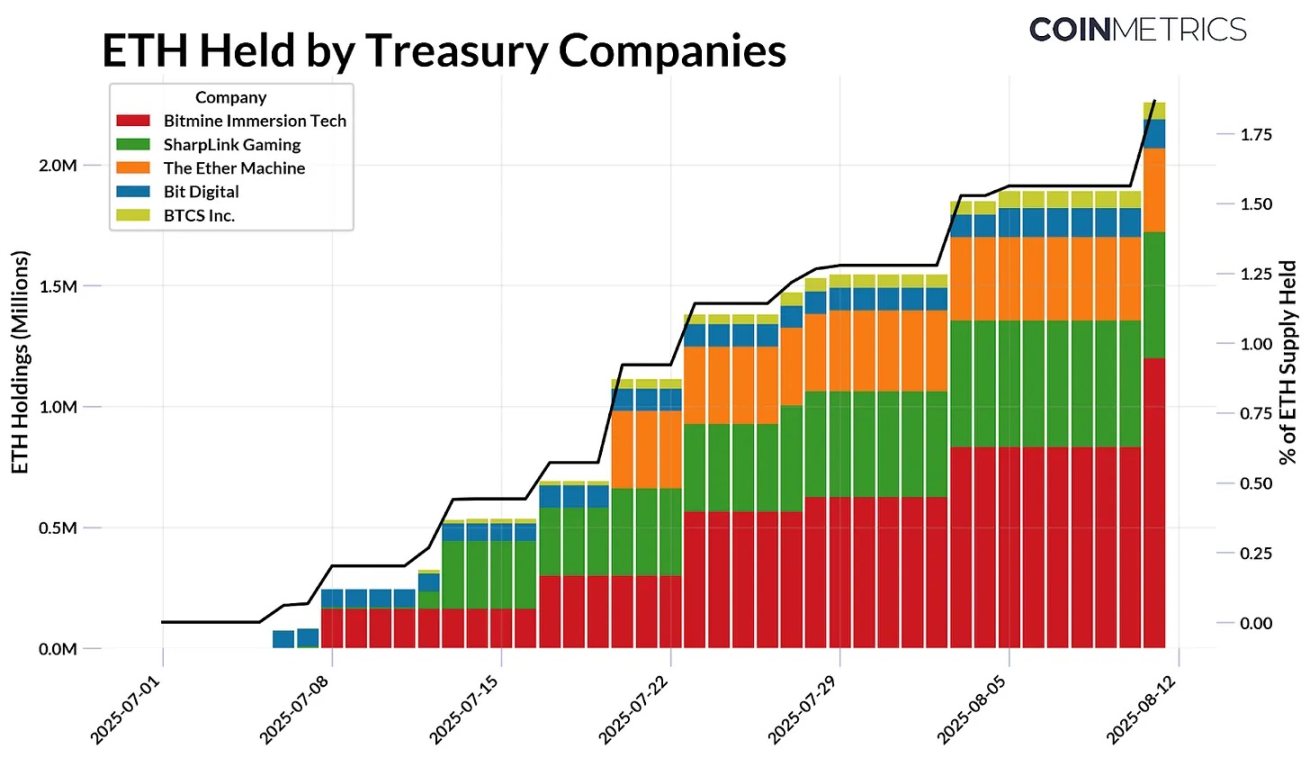

Since July of this year, Ethereum digital asset reserves have accumulated 2.2 million ETH, accounting for nearly 1.8% of the current total ETH supply. There are currently five major participants in this space, raising funds through equity financing methods such as public offerings or private investment in public equity (PIPE) to allocate capital and enhance the value of their holdings. As of August 11, the holdings of these entities are as follows:

Bitmine Immersion Technologies: 1.15 million ETH, valued at approximately $4.8 billion

SharpLink Gaming: 521,000 ETH, valued at approximately $2.2 billion

The Ether Machine: 345,000 ETH, valued at approximately $1.4 billion

Bit Digital: 120,000 ETH, valued at approximately $503 million

BTCS Inc.: 70,000 ETH, valued at approximately $293 million

Bitmine Immersion Technologies is currently the largest corporate holder of ETH, with holdings accounting for 0.95% of the total ETH supply, and is rapidly moving towards the goal of accumulating 5% of the circulating supply of ETH. As market conditions change, these companies are able to build reserves on favorable cost bases, intensifying the competition for a larger share of ETH.

Source: Coin Metrics Network Data Pro and public documents (as of August 11, 2025)

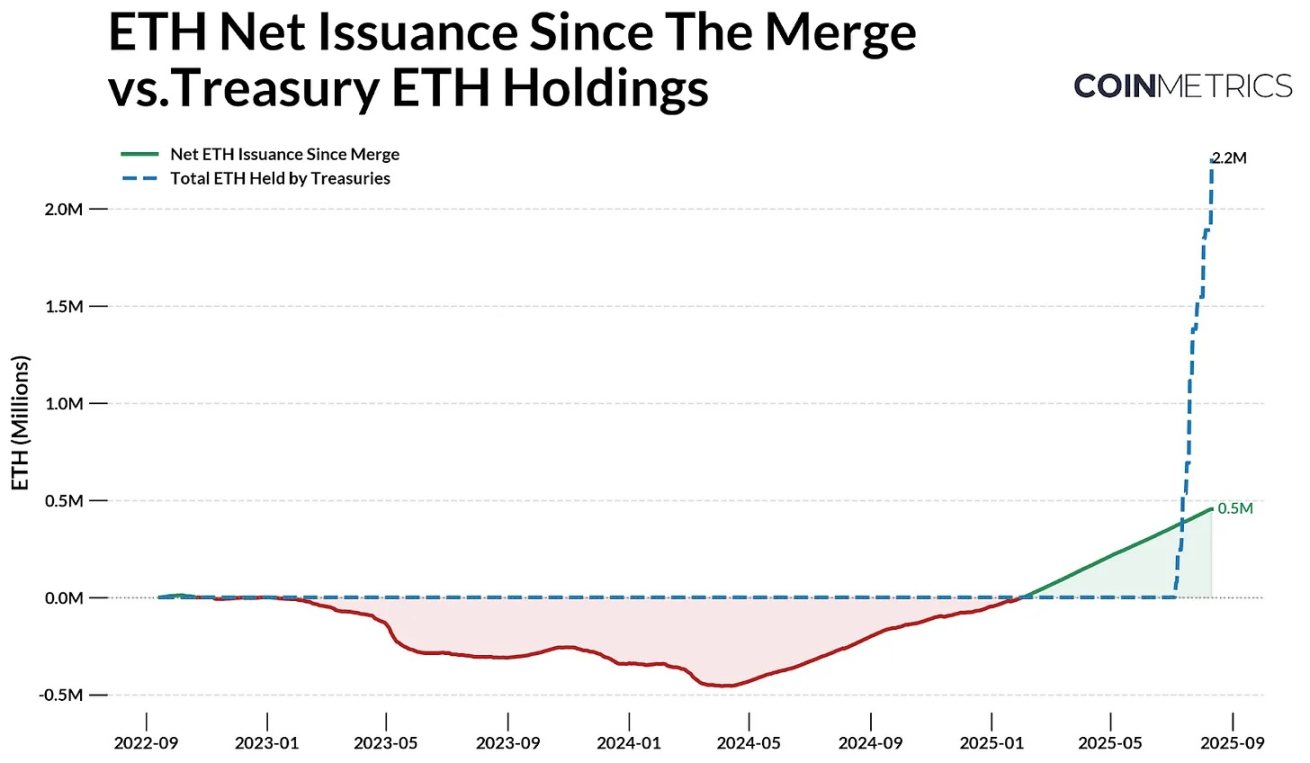

When combined with Ethereum's issuance dynamics, this trend becomes even more pronounced. Ethereum's supply is regulated by the PoS mechanism, with newly issued ETH allocated to validators while some transaction fees are burned, causing the net issuance to fluctuate between negative (deflationary) and positive (inflationary).

Since the "Merge" in September 2022, Ethereum has issued a total of 2.44 million ETH and burned 1.98 million ETH, resulting in a net increase of 454,300 ETH. Since July of this year, Ethereum treasury companies have cumulatively increased their holdings by 2.2 million ETH, far exceeding the net new issuance during the same period. Bitcoin's supply cap and halving mechanism directly reduce its new issuance, while Ethereum's supply is dynamic and currently in an inflationary state. Given that Ethereum's market cap is about 1/4.5 of Bitcoin's, the scale and speed of recent demand are even more noteworthy.

Source: Coin Metrics Network Data Pro and public documents

Considering that funds flowing into Ethereum ETFs have also been increasing in recent months, this supply-demand imbalance is even more pronounced. Overall, aside from the 29% ETH staked in the consensus layer and the 8.9% ETH held in other smart contracts, these instruments are continuously absorbing Ethereum's 107.2 million circulating supply (market available supply). Therefore, the ongoing accumulation of reserves and ETFs may amplify price sensitivity to new demand.

Ecosystem Impact: Staking, DeFi, and On-Chain Activity

Although most ETH treasuries are still in the accumulation phase, some of their funds may eventually enter on-chain. Unlike the relatively passive approach of Bitcoin treasuries, these companies plan to leverage Ethereum's staking and DeFi infrastructure to enhance risk-adjusted returns and effectively utilize their holdings. This shift is already underway: SharpLink Gaming is staking a significant portion of its holdings, BTCS Inc. is earning through Rocket Pool, and other companies like The Ether Machine and ETHZilla are preparing for more active on-chain management.

Source: Coin Metrics Network Data Pro

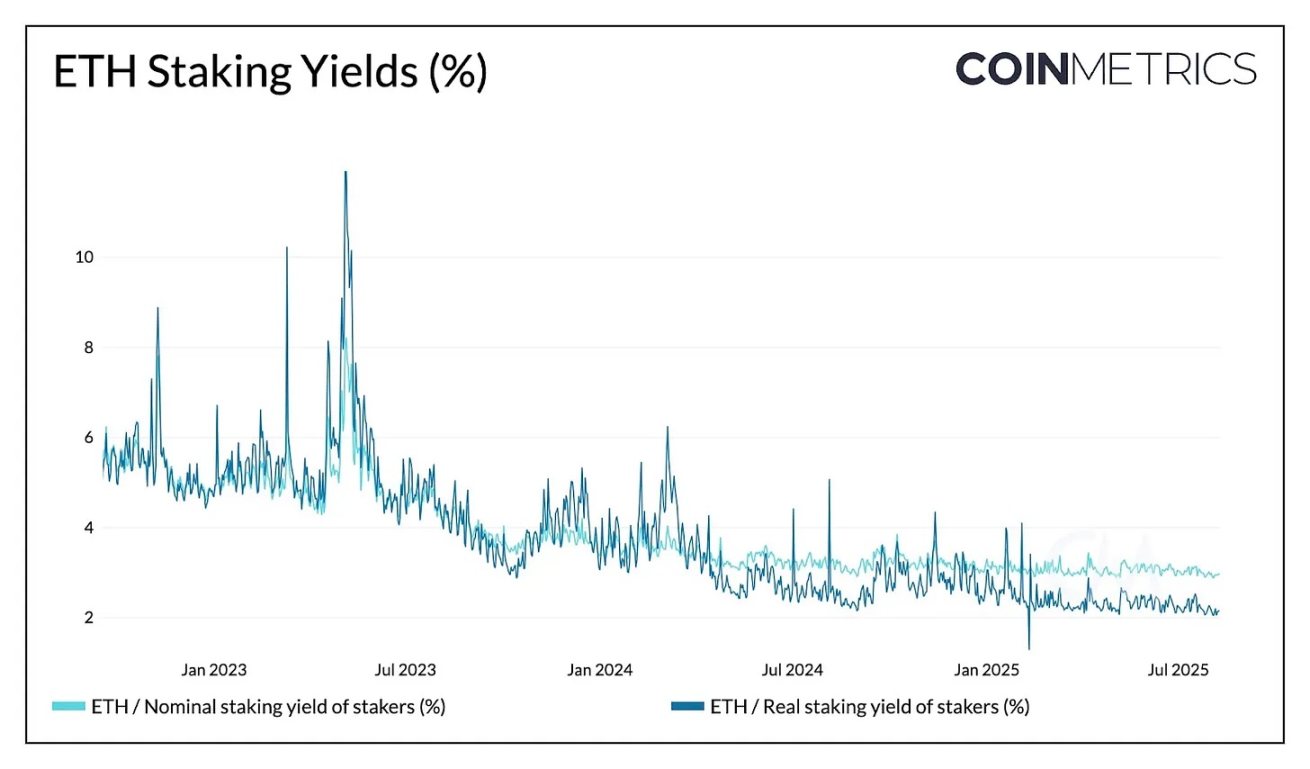

Currently, Ethereum can offer a nominal yield of 2.95% and a real (inflation-adjusted) yield of 2.15% by providing staking rewards for network security. This not only brings price appreciation to the underlying assets but also provides treasury companies with a stable income stream. For example, if 30% of the 2.2 million ETH currently held by treasury companies is staked at the current nominal yield of about 3%, with ETH priced at $4,000, it could generate approximately $79 million in annual income. Although a large influx of funds into staking may depress yields, the impact is relatively mild since Ethereum's reward rate gradually decreases as the total amount staked increases.

Corporate treasuries primarily participate in two ways: by running their own validator nodes or by utilizing liquid staking protocols. The U.S. SEC has clarified that liquid staking protocols are not considered securities, allowing companies to stake through third-party institutions like Lido, Coinbase, or RocketPool and receive "liquidity" token rewards in return.

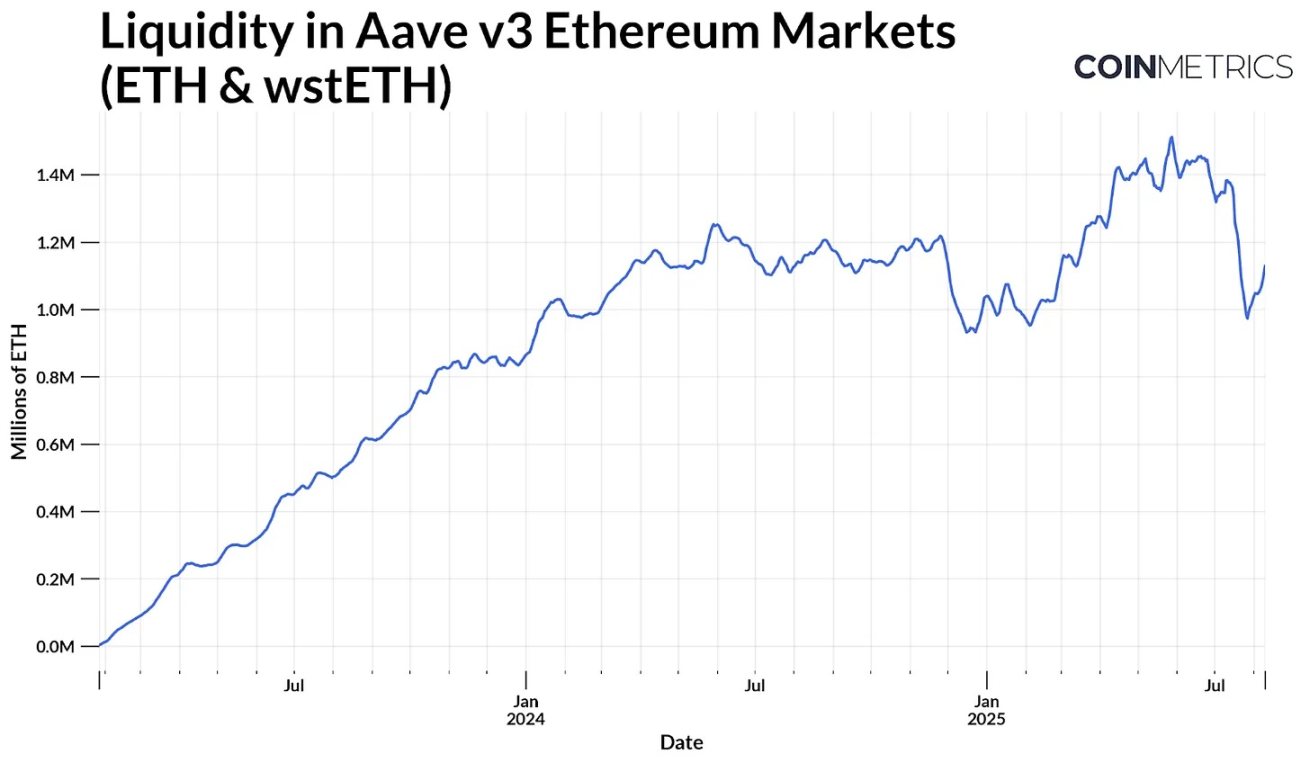

Source: Coin Metrics ATLAS

Despite the additional risks, tokens like Lido's stETH are widely used in DeFi for staking and lending, or to obtain additional yields in a capital-efficient manner based on the benchmark staking annual yield. For example, in Aave v3, ETH and liquid staking tokens like stETH constitute a large available liquidity pool (supply of assets available for lending). This liquidity pool has now grown to approximately 1.1 million ETH, and the addition of reserve funds may further expand the pool size, enhancing yields while increasing market liquidity.

Source: Coin Metrics Network Data Pro

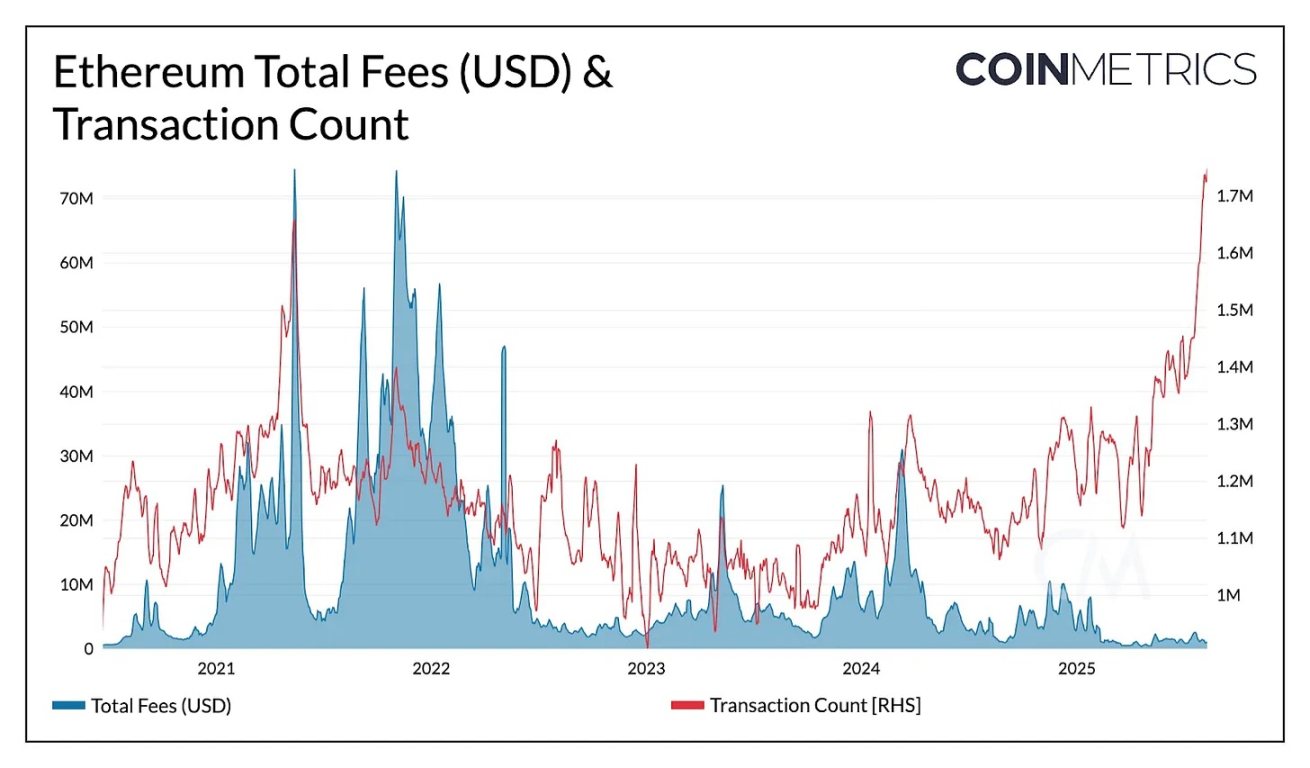

Although Ethereum's mainnet transaction volume has now surpassed historical records (1.7 to 1.9 million transactions per day), total fees remain at low levels for years due to recent gas limit increases and block capacity expansions that have alleviated network congestion and diverted some activity to L2. If treasury company funds enter on-chain on a large scale, high-value transactions on Ethereum L1 may drive growth in total demand for block space and fee revenue, potentially creating a positive feedback loop between reserve activity, liquidity, and on-chain usage.

Linking Corporate Treasury Performance to On-Chain Health

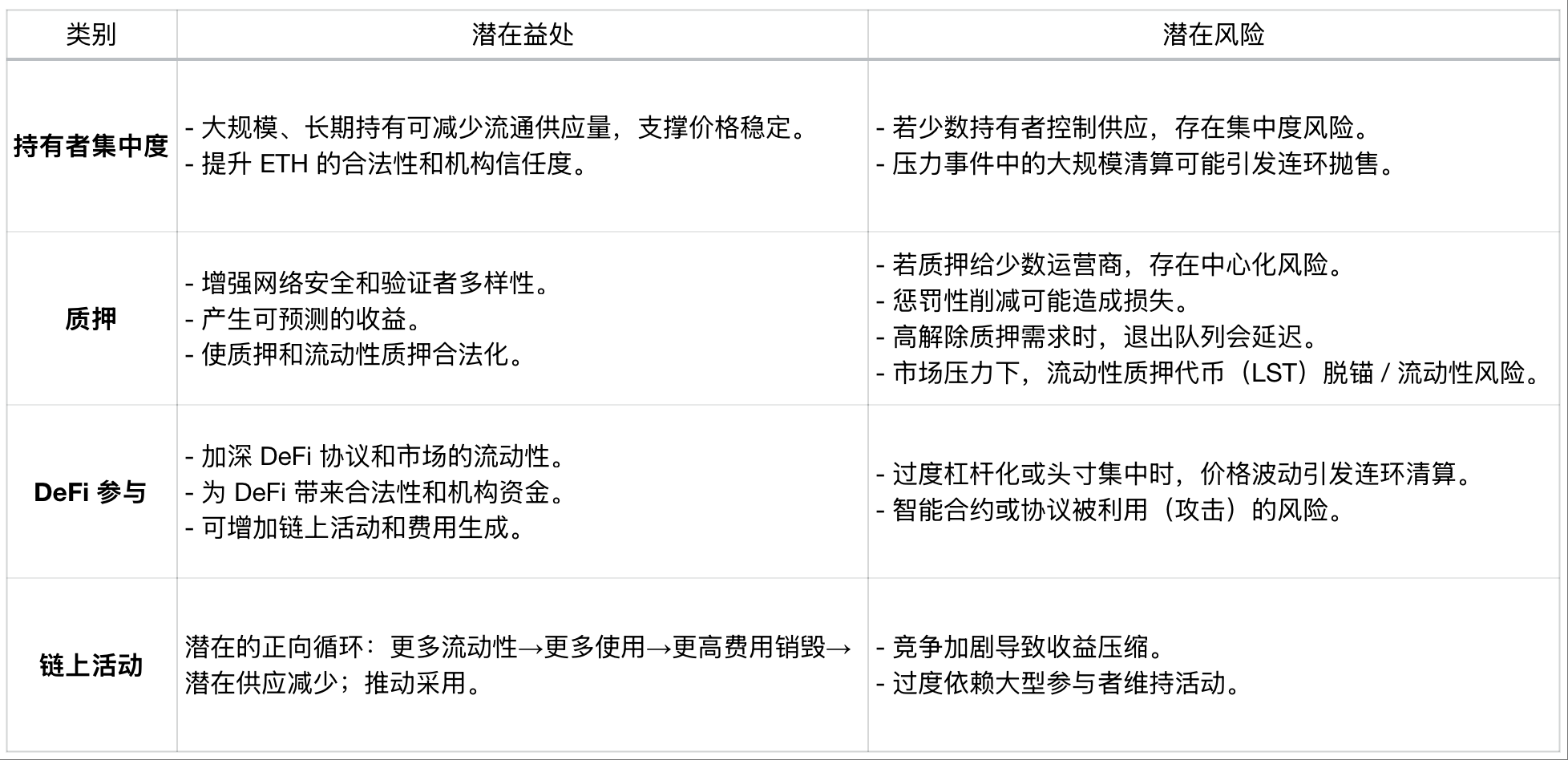

As publicly traded Ethereum treasury companies expand their on-chain presence, their financial performance increasingly impacts the long-term health of the Ethereum network, linking off-chain corporate performance to potential on-chain effects. Large-scale long-term holdings can reduce circulating supply, enhance recognition, and increase on-chain liquidity, but centralization, leverage, and operational risks mean that issues at the corporate level may transmit to the network.

Impact of Large ETH Reserves on On-Chain Activity

While these are considerations at the network level, corporate treasuries themselves are also influenced by market forces and investor sentiment. A strong balance sheet and sustained investor confidence can enable reserves to expand holdings and increase participation. Conversely, significant declines in the price of underlying assets, tightening liquidity, or excessive leverage may lead to ETH sell-offs or reduced on-chain activity.

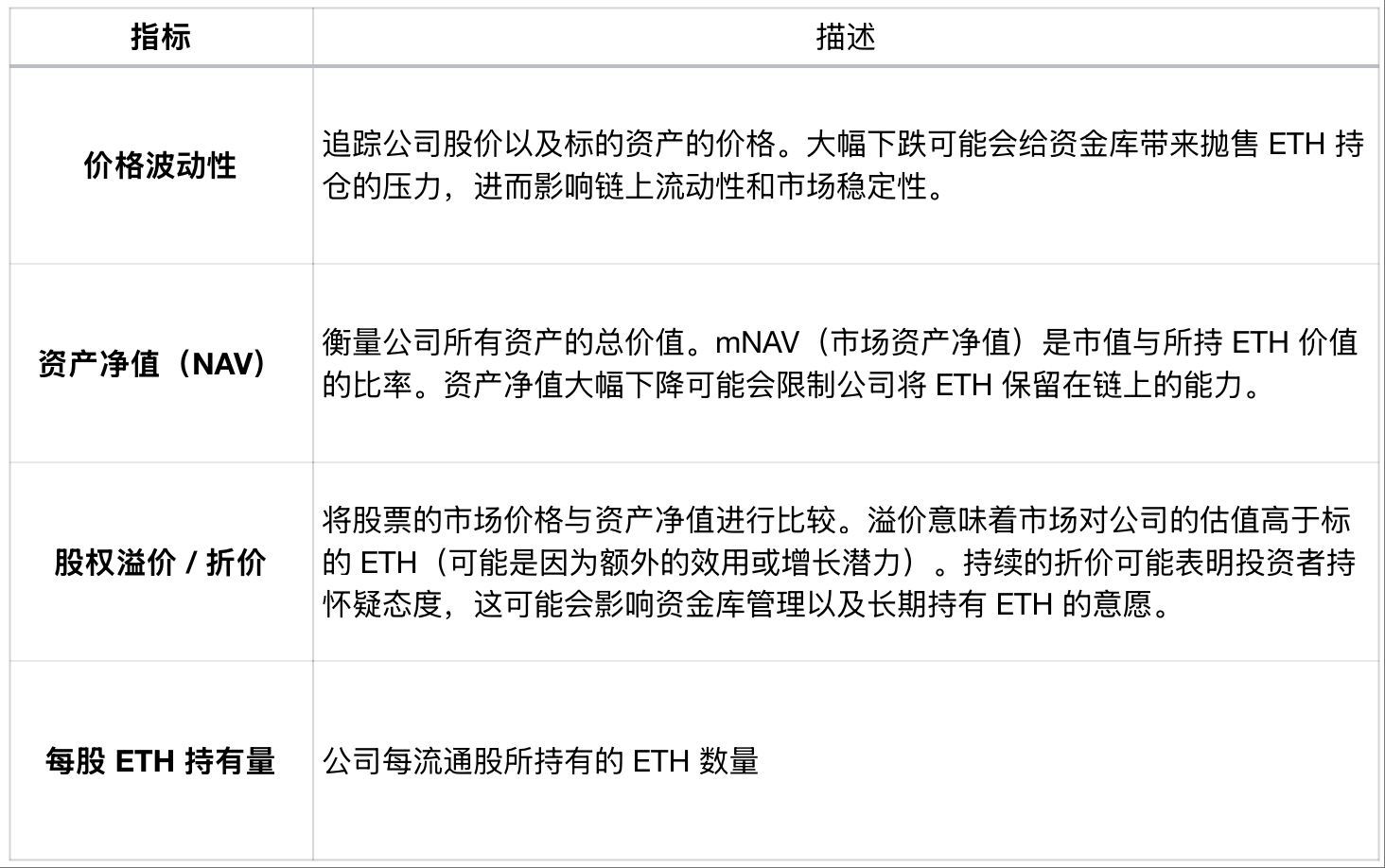

Metrics Related to Treasury Company Performance

Metrics Description

Price Volatility tracks the company's stock price and the price of the underlying asset. A significant decline may pressure the treasury to sell ETH holdings, thereby affecting on-chain liquidity and market stability. Net Asset Value (NAV) measures the total value of all company assets. mNAV (market NAV) is the ratio of market capitalization to the value of held ETH. A substantial decrease in NAV may limit the company's ability to keep ETH on-chain. Equity Premium/Discount compares the market price of the stock to the NAV. A premium indicates that the market values the company higher than the underlying ETH (possibly due to additional utility or growth potential). A persistent discount may suggest a skeptical attitude from investors, which could impact treasury management and the willingness to hold ETH long-term. ETH per Share indicates the amount of ETH held per circulating share.

By tracking the network-level impacts and the financial health of these companies, market participants can better predict how corporate treasury behavior may affect Ethereum's supply dynamics and overall network health.

Conclusion

The rapid rise of corporate Ethereum treasuries reflects the appeal of Ethereum as a reserve asset and source of on-chain yield. Its growing influence may enhance liquidity and activate network activity, but it also comes with risks related to leverage, financing, and capital management. As off-chain factors (such as stock performance and debt repayment) become increasingly linked to on-chain activity, these factors may quickly impact the on-chain environment. As these institutions scale, monitoring their balance sheet health and on-chain activities will be key to understanding their impact.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。