Original | Odaily Planet Daily (@OdailyChina)

Author | Golem (@web3golem)_

On November 28, YZi Labs (formerly Binance Labs) published a lengthy article stating that it would expand the board of directors of the publicly listed company CEA Industries, and elect several new directors. The language was filled with disappointment towards CEA Industries, stating, “Investing in BNC was based on optimism about the company's fundamentals and the DAT strategy centered around BNB, but since completing the $500 million PIPE financing this summer, BNC's stock price performance has clearly diverged from this logic, even though BNB's price has seen considerable increases during this period.”

This indicates that the expansion of the board is not merely an organizational adjustment, but is aimed at “rescue.” According to TradingView data, since BNC's stock price peaked at $68.76 on July 28, it has been on a downward trend, currently reported at $5.97, with a decline of 25.75% over the past six months, and more than a 91% drop from its peak, erasing all gains since the announcement of the BNB treasury's establishment.

The once-leading treasury has fallen to this state, causing significant losses for investors, and perhaps YZi Labs is beginning to regret the decision made in the summer of 2025.

Born with a golden key: BNB treasury leader

In the summer of 2025, the entire U.S. stock market was restless.

“U.S. stock markets are willing to pay over $2 for a $1 crypto asset,” Bloomberg columnist Matt Levine's assessment aptly described the frenzy for DAT in the U.S. stock market. According to CoinGecko statistics, by October 2025, there were 142 publicly listed DAT companies globally, with 76 established in 2025; DAT companies invested a total of $42.7 billion in 2025, with more than half occurring in the third quarter.

As DAT became a buzzword in the capital market, any crypto asset that did not have a DAT company treating it as a reserve felt out of place, like being well-dressed at a dance but not being invited. Thus, crypto companies began to openly and covertly promote the establishment of DAT public companies, packaging their tokens as reserve assets to “present” to the U.S. stock market, telling a story that capital favored, including BNB.

At the end of July 2025, the BNB treasury public company CEA Industries (NASDAQ: BNC) made a dazzling debut, announcing the completion of a $500 million private placement led by YZi Labs, and renamed itself “BNB Network Company,” officially implementing the BNB reserve plan, aiming to hold 1% of the total supply of BNB.

CEA Industries was the only BNB treasury company to receive official funding support from YZi Labs at that time, thus becoming a star in the stock market overnight, with its stock price soaring from $8.8 to $68.76 in a single day, an increase of over 680%.

During the peak of altcoin DAT, CZ had stated, “There are over 30 listed companies in the market wanting to establish BNB reserves, but I will only support one or two of them.” So, what was the reason CEA Industries was chosen?

The secret lies with David Namdar, the CEO of CEA Industries (now named BNB Network Company).

Before founding BNB Network Company, David Namdar had several career experiences. He worked in traditional finance at UBS Hong Kong and Millennium Management, and in 2014, he co-founded the crypto investment bank SolidX Partners. In 2017, David Namdar co-founded Galaxy Digital with Michael Novogratz and successfully listed it in Canada. After leaving Galaxy, he became an angel investor and provided consulting services for several DAT companies.

These career experiences equipped David Namdar with rich experience to establish BNB Network Company, and according to David Namdar during a live broadcast on August 26, he has known CZ for eight or nine years and they have a good personal relationship, although they have never worked together, they often communicate in social settings.

With extensive industry experience and the backing of being a “CZ confidant,” David Namdar naturally secured investment from YZi Labs and quickly grew into the leader of the BNB treasury.

However, while both parties were envisioning a bright future, they did not expect that the moment of alliance would be the last happy time for both.

mNAV drops to 0.68, YZi Labs personally “cleans up”

According to CEA Industries' official financial dashboard displayed, it currently holds 515,054 BNB, valued at over $460 million, with an average cost of $851.29, still below the current price of BNB. However, CEA Industries' mNAV is only 0.68. mNAV is the ratio of the market value of a DAT company to the value of its held cryptocurrencies; when mNAV is 1, it means the premium of the stock price relative to the crypto asset has disappeared, and it is trading at a discount.

Although many DAT public companies have seen their mNAV drop below 1 as the heat of DAT fades (Related reading: DAT's turning point? These 12 treasury companies represent mNAV has dropped below 1) , CEA Industries' situation cannot simply be attributed to the market.

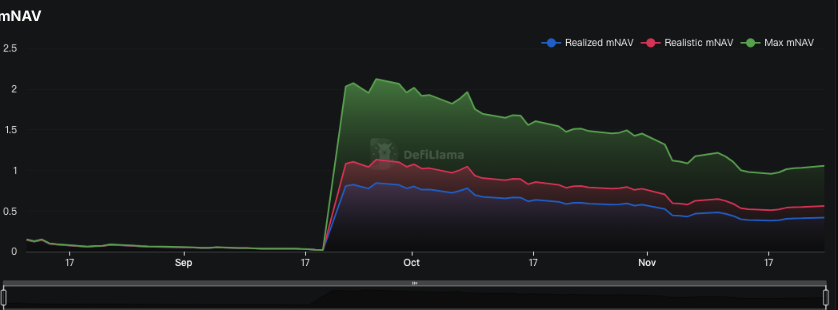

According to DeFiLlama data, CEA Industries' mNAV has been declining since the announcement of the BNB treasury plan, showing no signs of recovery.

The decline in mNAV often occurs alongside a drop in token prices—when crypto token prices fall, mNAV declines, which weakens the financing ability of DAT companies, exacerbates equity dilution, leading to a drop in stock prices, and thus enters a vicious cycle of continued mNAV decline.

However, the key point is that from August to October, BNB prices continued to rise, even reaching a new high of $1375.11, while CEA Industries' mNAV continued to decline during this period. Due to the lack of transparency at that time, no one knew the reason. (Odaily note: CEA Industries' official financial dashboard was launched on November 19.)

Comparing with other BNB treasury companies highlights CEA Industries' anomalies.

Nano Labs is a publicly listed company that has implemented the BNB reserve strategy. According to DeFiLlama data, it holds 128,000 BNB, less than a quarter of CEA Industries' BNB reserves, but Nano Labs' mNAV maintained above 1.5 from August to October.

With abnormal mNAV and stagnant stock prices, even the best allies in the past, YZi Labs could no longer hold back from coming out to “clean up” for them.

In the lengthy article published by YZi Labs, the issues existing in CEA Industries were not concealed at all. YZi Labs head Ella Zhang stated that the poor performance of BNC's stock price is mainly due to “weak strategic execution, insufficient communication with investors, and ineffective board oversight.” YZi Labs also pointed out specific issues with CEA Industries, including delays in submitting key SEC documents, failure to timely update digital asset treasury and NAV data, and confusion in external identity and strategic narrative.

Since YZi Labs' publication, CEA Industries' official account and CEO David Namdar have not made any public statements, leaving it unclear whether this can be interpreted as “one must admit mistakes and stand straight when being criticized.”

However, as the designated leader of the BNB treasury, YZi Labs clearly does not want to easily abandon CEA Industries. In the lengthy article, it stated that it would soon announce a specific list of board candidates, and whether David Namdar, as a “CZ confidant,” will be ousted during the transition of power and responsibilities will be closely followed by Odaily.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。