Bitmine’s $24.5B Stock Sale Targets Bigger Ethereum Holdings

The corporate race to acquire Ethereum is heating up, and BitMine Immersion Technologies is stepping up its game. The company has just announced plans to sell up to $24.5 billion worth of stock, aiming to use the funds to buy more Ethereum as the token’s price edges closer to its all-time high.

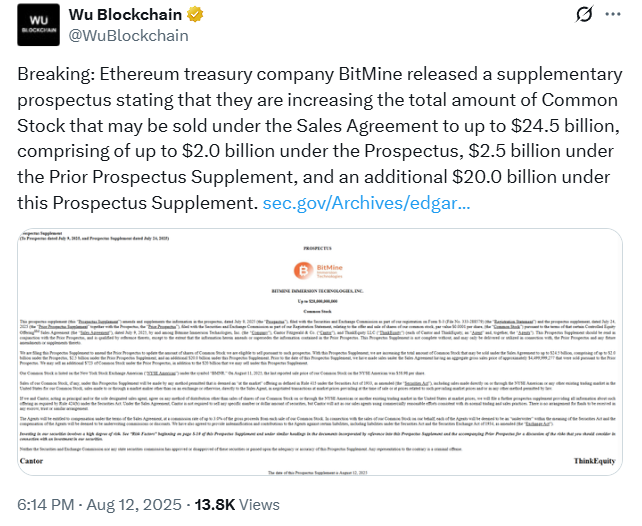

The action was disclosed in a supplemental prospectus that it submitted to the U.S. Securities and Exchange Commission (SEC) .

Source: X

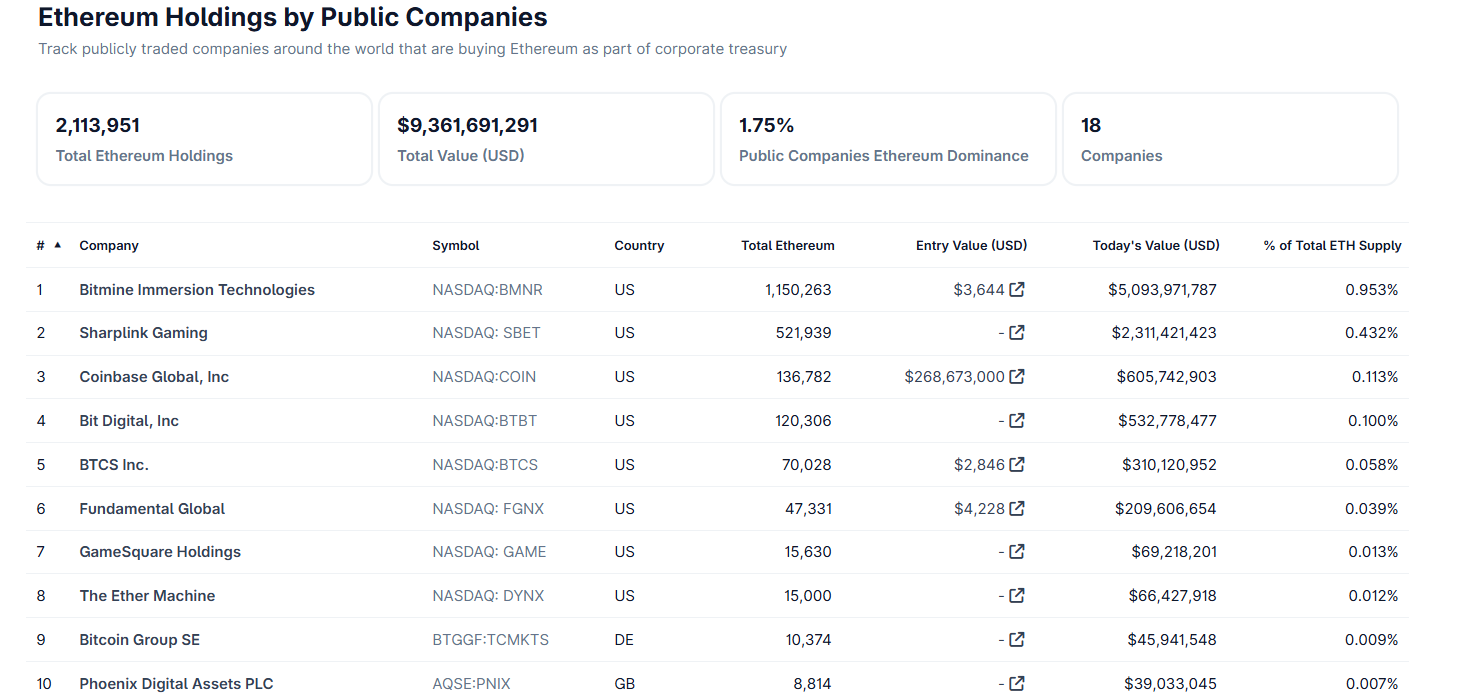

BitMine, itself one of the largest corporate ETH holders, indicates the increased stock sale will be executed on an at-the-market (ATM) offering, under which shares will be sold incrementally at prevailing market prices.

Source: CoinMarketCap

Why This Action?

The $24.5B authorization under the SEC filing is broken down as follows:

-

$2.0B from the initial July 9, 2025 prospectus

-

$2.5B from a July 24, 2025 supplement

-

$20.0B newly added in this latest filing

As stated in the prospectus, BitMine has already disposed of approximately $4.5 billion worth of shares under previous authorizations. Having only $723 remaining from the previous allotment, the new $20B addition considerably increases its ability to raise new capital.

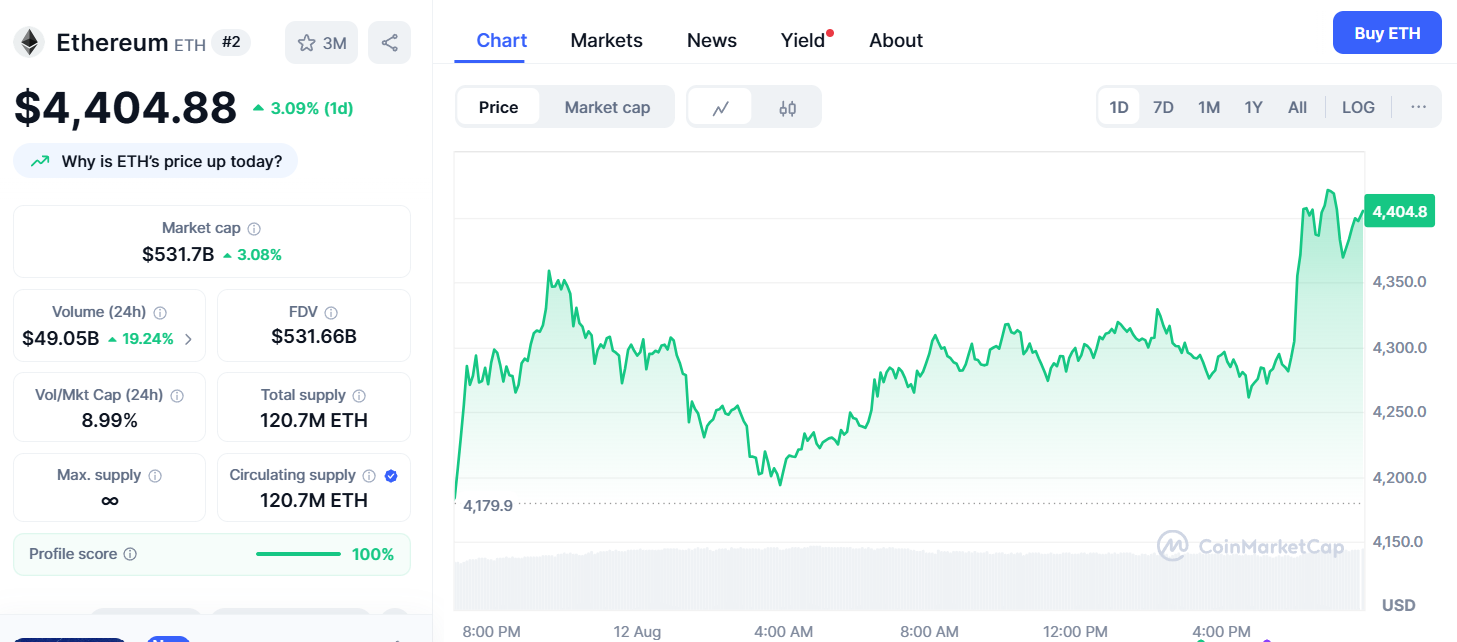

The analysts indicate this is a strategic move to increase BitMine's Ethereum holdings ahead of a possible breakout in price. ETH last traded at above $4,416, the company seems to be taking a bet on further upside.

Ethereum Market Response

Ethereum (ETH), one of the dominating cryptocurrencies, is currently trading at $4,404.88, marking a 3.09% increase over the last 24 hours. The cryptocurrency’s 24-hour trading volume is $49.05 billion, while its market capitalization stands at $531.7 billion.

Source: CoinMarketCap

Large-scale corporate purchases are considered by traders to be a buy signal, particularly when corporations invest billions of dollars in new money. The $4,500 level is now the short-term psychological target for ETH bulls .

BitMine's Stock Performance

BitMine's stock, which trades on the NYSE American under the symbol BMNR, had closed at $58.98 prior to the announcement (As mention in the prospectus) . Investors will be balancing the risk of dilution from this sizeable stock issuance against the long-term upside from the firm's increasing Ethereum position.

How will this affect the ETH Price?

If Bitmine proceeds with the big sale of stock and takes most of the proceeds to purchase Ethereum, it may inspire the substantial buying pressure within the market.

These kinds of massive company acquisitions may often lead to drive prices up in the short term, particularly when ETH is already close to a major resistance point like $4,500.

This action might instill bullish sentiment and draw additional institutional investment.

Final Thought

The whole crypto market changes rapidly, and major events like BitMine's move to increase its fundraising to $24.5 billion represent one of the biggest stock sale plans in corporate history related to crypto. These types of events play a crucial role in the crypto space and also lead to the question: What will happen next in the crypto market? The next few weeks will show whether this bold move pays off for BitMine’s finances and the wider Ethereum market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。