Key Points Summary:

- Currently, publicly listed companies hold approximately $7.6 billion in Ethereum (ETH) and plan to increase this figure to $30.4 billion by 2025—a growth rate of 300%.

- BitMine Immersion has purchased 833,137 ETH (approximately $2.9 billion) in just 35 days, aiming to hold 5% of the global ETH supply (about 6 million coins, valued at approximately $22 billion), with investors including Bill Miller and Cathie Wood.

- SharpLink Gaming holds 521,939 ETH (approximately $1.9 billion), and since shifting to an Ethereum reserve strategy, its stock price has surged by 400%, with plans to invest up to $5 billion in the future.

- BTCS owns 70,000 ETH ($275 million) and plans to further increase its holdings through $2 billion in financing; Bit Digital holds over 120,000 ETH ($430 million) after a $67 million capital increase, with both companies earning returns through staking.

- The Ether Machine (DYNX) will list with 400,000 ETH (approximately $1.6 billion), backed by Kraken and Pantera, offering over 5% staking returns and attracting significant institutional interest.

Ethereum Corporate Treasury Boom

An increasing number of publicly listed companies are beginning to view Ethereum (ETH) as a core reserve asset, similar to the former status of Bitcoin. Currently, large enterprises hold about $7.6 billion in ETH and plan to increase this to $30.4 billion—approximately three times the current amount.

This wave of accumulation follows a roughly 40% price increase in Ethereum over the past month, alongside a surge in institutional investments and opportunities to earn returns through staking. ETH is not only seen as a store of value but also as a source of ongoing income and participation in the expanding decentralized finance (DeFi) ecosystem.

Here’s an analysis of the ETH reserve strategies of major companies:

BitMine Immersion (BMNR)

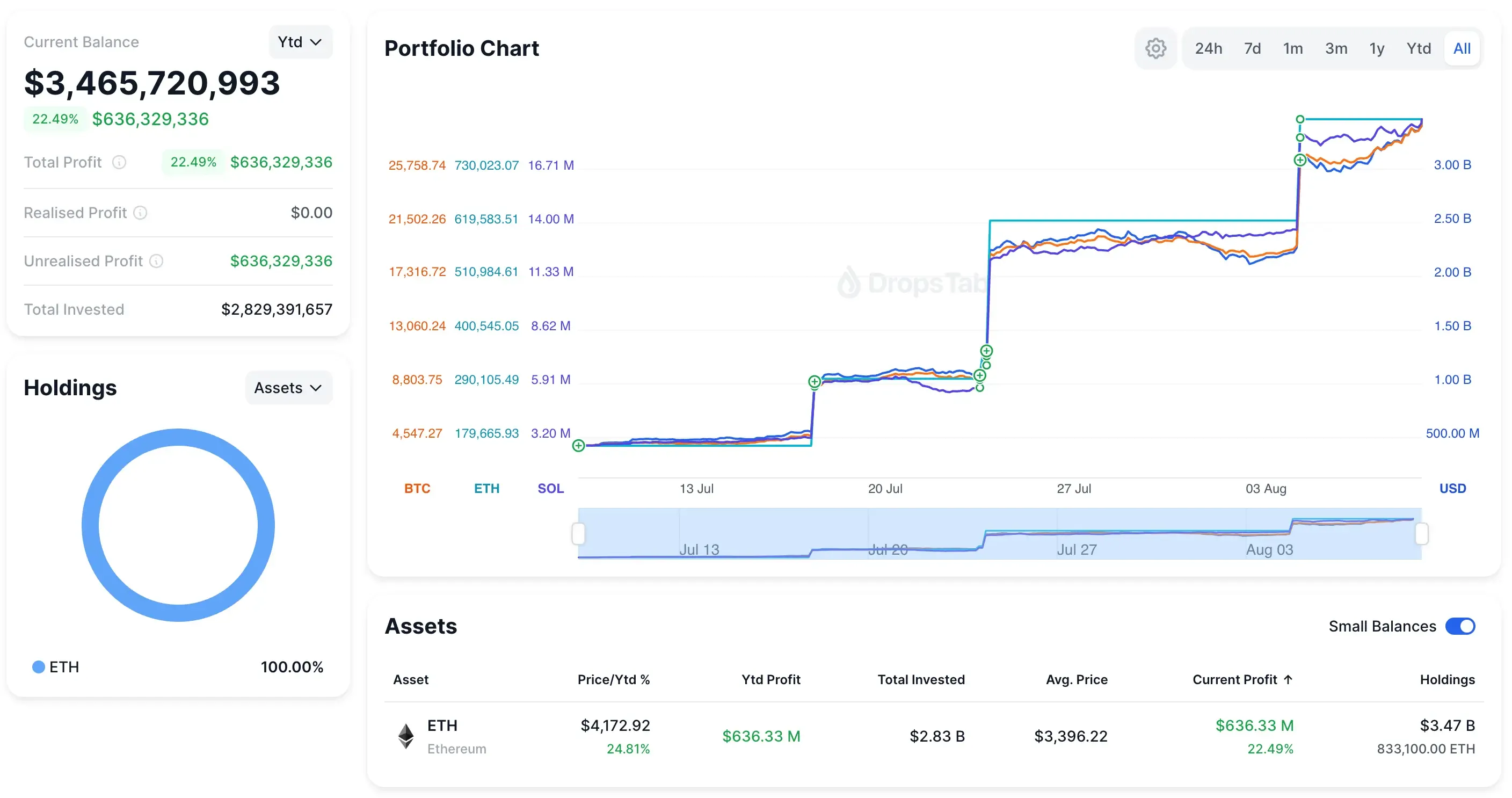

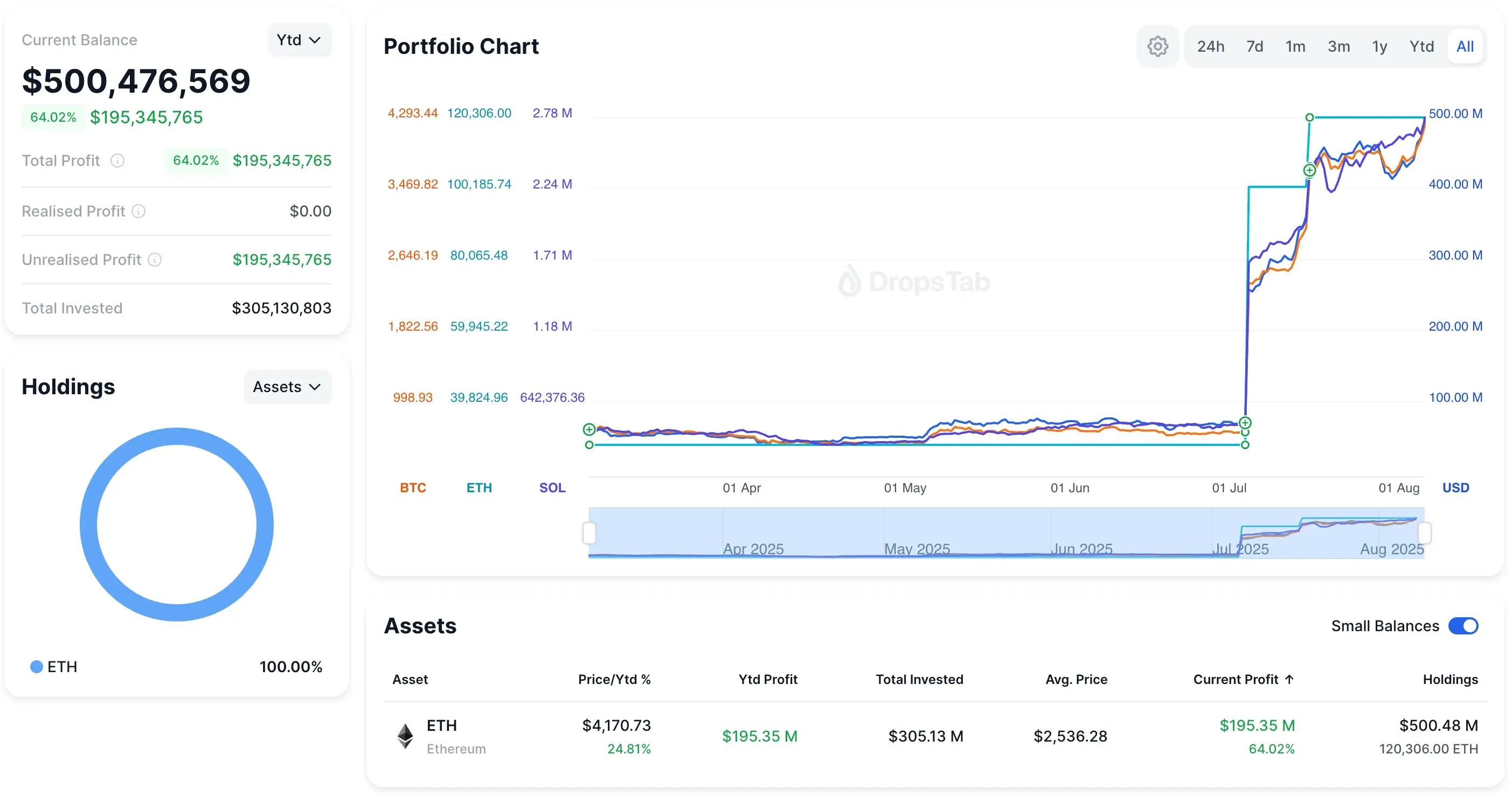

As of early August 2025, BitMine Immersion Technologies accumulated 833,137 ETH (valued at approximately $2.9 billion at about $3,492 per coin) in just 35 days after launching its Ethereum treasury program.

Goal: Hold 5% of Global ETH

The company refers to this plan as "5% Alchemy," aiming to hold approximately 6 million ETH, valued at about $22 billion. Supporters include Bill Miller III, Cathie Wood, Founders Fund, Pantera, Kraken, DCG, and Galaxy Digital.

Chairman Thomas "Tom" Lee stated that their buying speed has set a record for capital deployment.

BitMine's stock (NYSE: BMNR) has become one of the most actively traded securities in the U.S., and the company plans to use ETH for staking to generate stable returns. In short, BitMine aims to replicate MicroStrategy's strategy with Bitcoin—becoming one of the largest corporate holders of Ethereum and potentially influencing market trends.

Source: https://dropstab.com/p/bitmine-eth-strategy-portfolio-lipdgyz9ho

SharpLink Gaming (SBET)

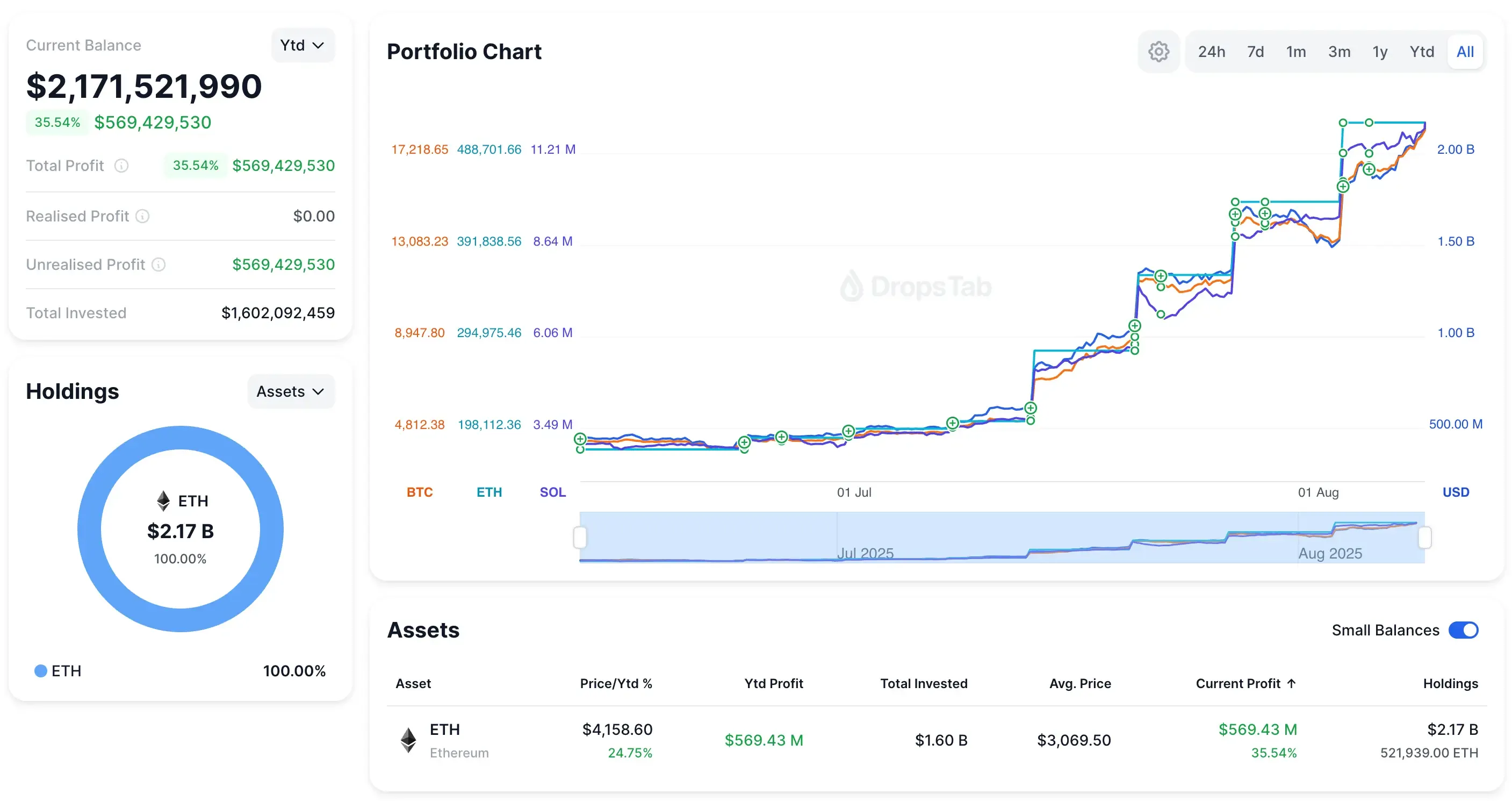

As of August 5, 2025, SharpLink Gaming Ltd. holds 521,939 ETH (approximately $1.9 billion). This includes 83,561 ETH (valued at $264 million) purchased in late July and 188,478 ETH (valued at $750 million) purchased in June, with an average cost of about $3,634 per coin.

$1.9 Billion in Ethereum + Stock Price Surge

Since shifting to an Ethereum reserve strategy in Q2 2025, SharpLink's stock price has skyrocketed over 420%. The company has transformed from a typical gaming/marketing firm to one closely tied to crypto assets, with each share corresponding to about 3.66 ETH, directly linking its stock price to Ethereum's price.

SharpLink plans to invest up to $5 billion in ETH in the future and continues to treat it as a core asset, potentially applying blockchain technology to its gaming business while benefiting from the rising price of ETH.

Source: https://dropstab.com/p/sharplink-gaming-eth-holding-u4ev63oess

BTCS Inc. (BTCS)

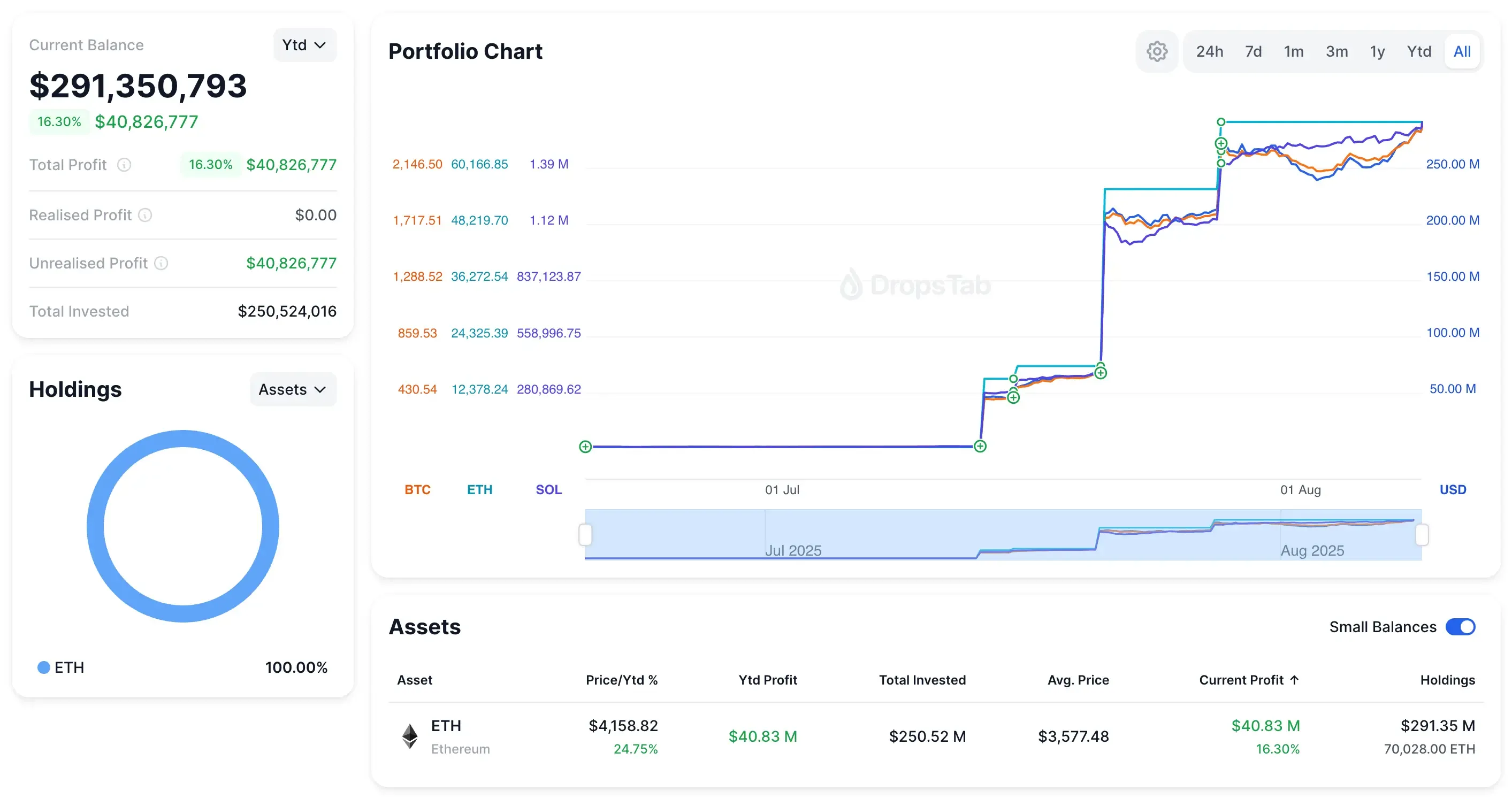

In 2025, BTCS Inc. shifted its strategic focus to Ethereum. As of late July, it holds 70,028 ETH (approximately $270–$275 million), up from 55,788 ETH (approximately $242 million) two weeks prior.

Ethereum Priority Strategy + $2 Billion Financing Plan

BTCS has applied to the SEC to raise up to $2 billion through stock issuance, primarily for purchasing ETH. Previously, the company raised about $207 million through stock issuance, convertible bonds, and DeFi lending, referring to it as a "DeFi/TradFi Fusion Flywheel."

BTCS not only holds ETH but also operates staking nodes (NodeOps) and block-building businesses (Builder+) to earn returns, achieving income growth beyond price appreciation. The stock price nearly doubled in 2025, and it is now among the top five publicly listed companies by ETH holdings.

Source: https://dropstab.com/p/btcs-inc-eth-portfolio-3zirq9utj5

The Ether Machine (DYNX/ETHM)

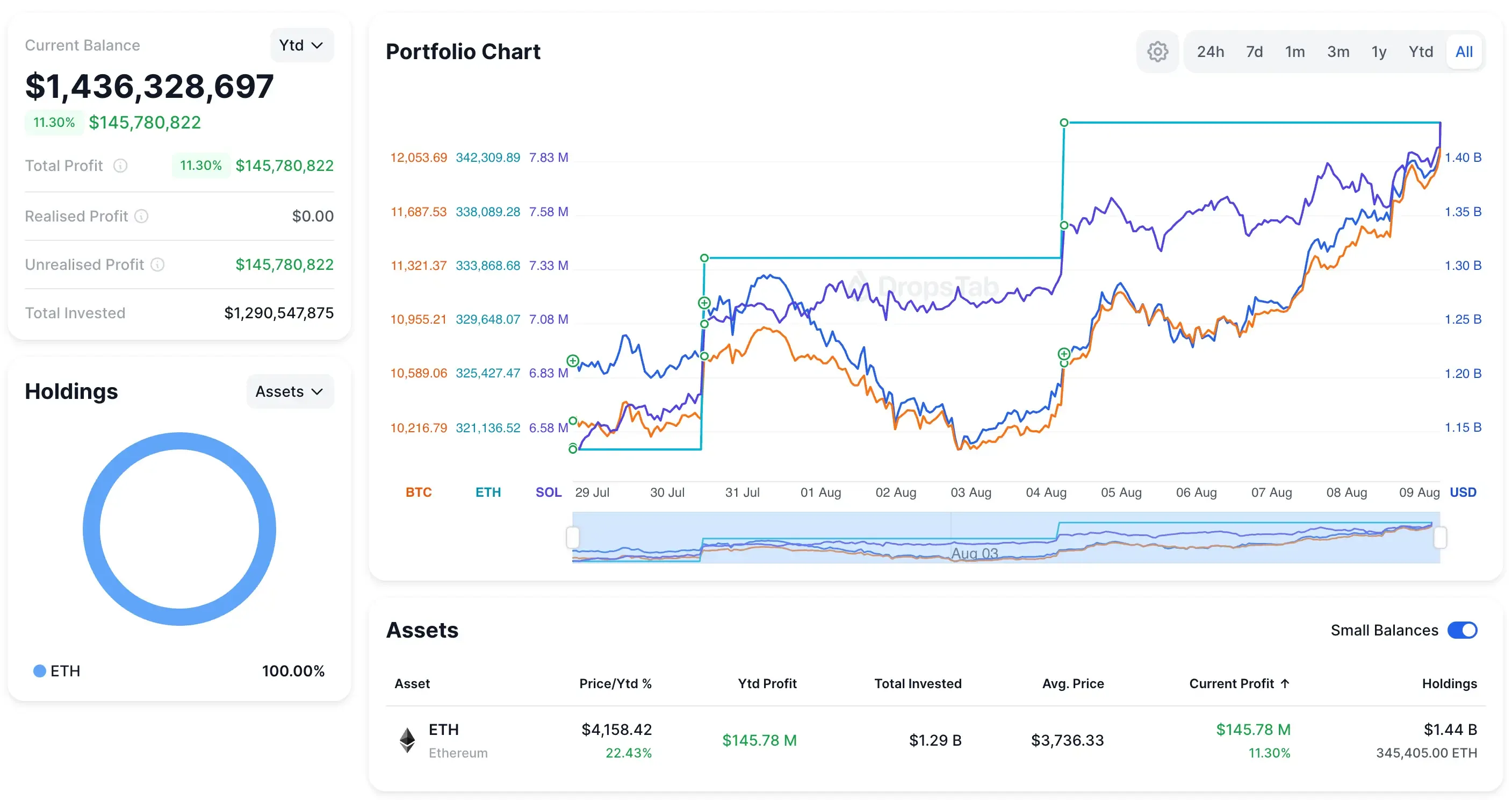

In Q4 2025, The Ether Machine will go public through a SPAC merger with Dynamix (NASDAQ: DYNX), initially holding 400,000 ETH (approximately $1.6 billion), making it one of the largest publicly listed holders of ETH.

SPAC Listing + Institutional Support

Investors backing the project include Blockchain.com, Kraken, and Pantera Capital, with $800 million reserved for further ETH purchases. The goal is to become the largest publicly listed company focused on Ethereum globally.

Incoming Chairman Andrew Keys believes that Ethereum's staking returns (around 5%) give it an advantage over Bitcoin, while also leading in the tokenization of real assets and stablecoins, with potential comparable to major internet platforms.

Source: https://dropstab.com/p/the-ether-machine-1u03i0q8ij

Bit Digital (BTBT)

In 2025, Bit Digital, Inc. ceased its Bitcoin mining operations and shifted to Ethereum staking and treasury management. In July, the company used $67.3 million in stock financing to purchase 19,683 ETH, increasing its total holdings to over 120,000 ETH (approximately $432 million).

From Bitcoin Miner to 120,000 ETH Holder

After the announcement, the stock price briefly rose 10% before retreating. Bit Digital has fully transformed into an Ethereum asset management company, earning returns through staking while benefiting from the appreciation of ETH.

Source: https://dropstab.com/p/bit-digital-eth-portfolio-jcv46zwc42

GameSquare (GAME)

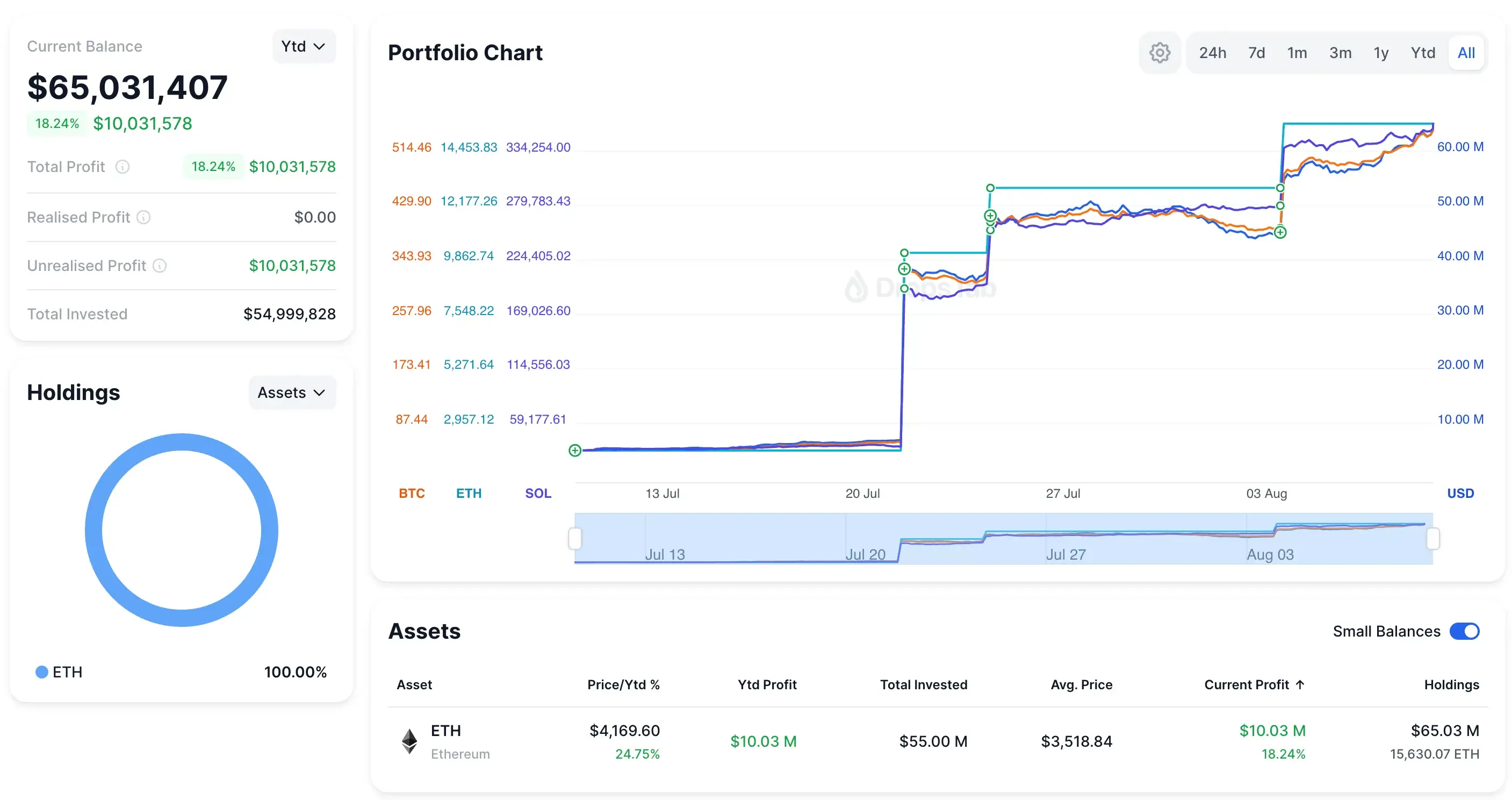

GameSquare Holdings, Inc. (NASDAQ: GAME) is a digital media and gaming company that began accumulating ETH reserves in 2025. As of August, it holds 15,630 ETH (approximately $60 million) and has reserved up to $250 million for future purchases.

Small-Scale ETH Yield Strategy

GameSquare is not merely holding ETH; it is investing in DeFi and staking strategies through Dialectic's on-chain platform, targeting an annualized return of 8%–14%, and using profits to repurchase $5 million in stock. CEO Justin Kenna stated that the goal is to make ETH a stable source of operational income.

Source: https://dropstab.com/p/gamesquare-holdings-eth-871kf2josl

Why are companies increasing their ETH holdings now?

In 2025, Ethereum has performed strongly, attracting more and more enterprises to enter the market. Over the past month, the price of ETH has risen by more than 40%, with $9.5 billion flowing into Ethereum funds and ETFs, surpassing Bitcoin's performance during the same period.

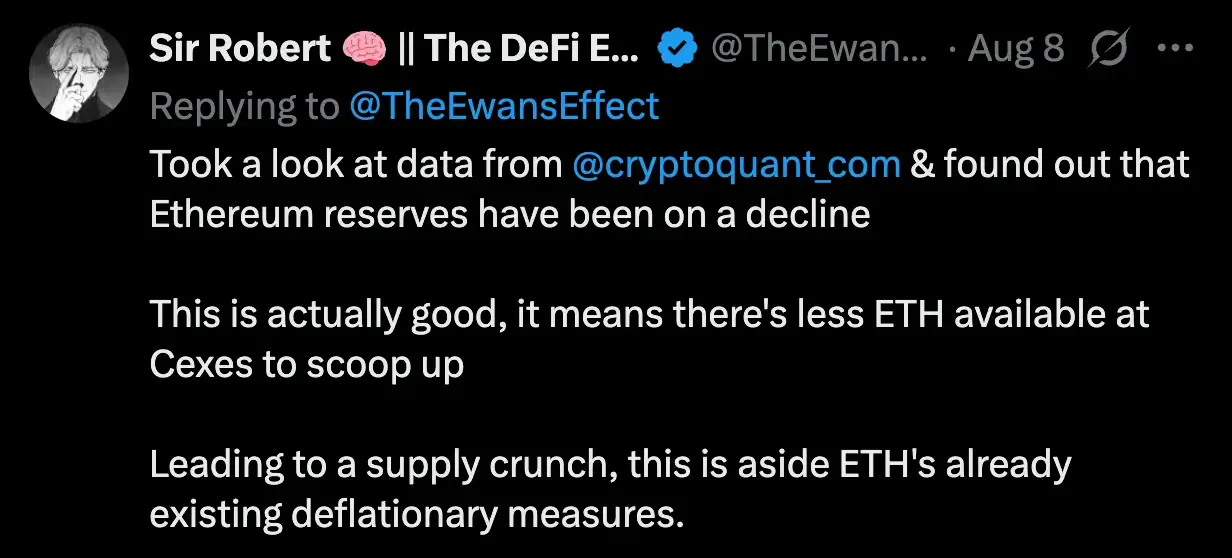

Ethereum has advantages that Bitcoin does not: through Proof of Stake (PoS), holders can earn an annualized return of 4%–6% through staking; ETH is also the core infrastructure for DeFi, stablecoins, and the tokenization of real assets, providing holders with opportunities to participate in major blockchain markets. On-chain data shows that the ETH reserves on exchanges are continuously declining.

Analyst @TheEwansEffect pointed out: "This is actually bullish because the decreasing ETH on centralized exchanges will lead to a supply contraction, and with the EIP-1559 burn mechanism, it further increases scarcity."

Source: https://x.com/TheEwansEffect/status/1953716746960969822

The Impact of the $30 Billion Corporate Ethereum Plans

Public companies plan to hold over $30 billion in ETH, indicating a significant shift in Wall Street's attitude towards crypto assets. If the targets are achieved, millions of ETH will be locked up long-term, reducing market circulation and exacerbating scarcity.

Similar to the early institutional entry into Bitcoin, multiple companies are allocating part of their treasury to Ethereum, which not only strengthens ETH's position as a reserve asset but also provides investors with a channel to indirectly hold ETH by buying shares of publicly listed companies (such as BitMine and SharpLink).

Although there are still risks related to price volatility, asset security, and regulation, the market has responded positively so far. Future success will depend on whether companies can safely earn staking returns and effectively manage capital. In 2025, Ethereum is becoming a major reserve asset for forward-looking public companies—whether to control supply, obtain staking returns, or prepare for potential ETF listings.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。