This transformation is different from the internet of the 1990s, driven by financial regulars and AI, more likely to give birth to open protocols rather than monopolistic platforms, marking an accelerated shift in technological paradigms.

Written by: Oliver, Mars Finance

We are at a moment of division in the crypto world. On one hand, there is an unprecedented institutional frenzy: Wall Street giants like BlackRock and Fidelity are embracing Bitcoin in ways never seen before, with their spot ETF products attracting hundreds of billions of dollars in traditional capital like a siphon; sovereign wealth funds and national pensions are also quietly incorporating crypto assets into their vast investment portfolios. This wave makes the narrative of "cryptocurrency becoming mainstream" sound incredibly real.

But on the other hand, for the general public, the crypto world seems more distant than ever. Apart from the dramatic price fluctuations and stories of a few speculators, it has almost no presence in daily life. The once-boisterous NFT market has fallen silent, and the Web3 games that were once highly anticipated have failed to "break the circle." This huge temperature difference constitutes a core contradiction: on one side is a feast for financial elites, while on the other is the mainstream world watching from the sidelines. How should we understand this disconnect?

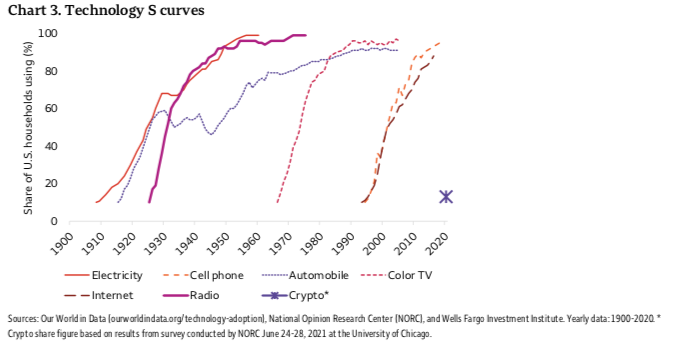

It is against this backdrop that senior executives at Visa, including CEO Alfred F. Kelly Jr., have made a profound judgment on multiple occasions: cryptocurrencies are at a stage similar to "early 1990s e-commerce," where, although not fully understood by the public, the underlying technology and ecosystem are rapidly maturing, about to welcome a "super inflection point" in the adoption curve. Research from institutions like Wells Fargo provides data support for this metaphor. Reports show that the user adoption curve for cryptocurrencies is astonishingly similar to that of the early 1990s internet. Even though the internet was born in 1983, by 1995, less than 1% of the global population was using it. This figure is strikingly similar to today's proportion of cryptocurrency users. History shows that disruptive technologies must go through a long, slow, and confusing ramp-up period before they explode.

However, this seemingly perfect analogy may obscure a deeper truth. History does not simply repeat itself. Today’s crypto world is being completely rewritten by two variables that were unimaginable back then—the entry of financial "regulars" and the rise of artificial intelligence (AI). This is not just a replay of history, but an accelerated and distinctly different evolution.

Old World Giants, New World Pioneers

The e-commerce revolution of the 1990s was a typical "disruptor" game. Back then, Amazon, eBay, and PayPal emerged from the fringes of the mainstream business world as "new nobles," challenging traditional giants like Walmart and Citibank with entirely new rules. It was an era for garage entrepreneurs and venture capitalists, where the main storyline was "disruption" and "replacement."

Today, however, the story of cryptocurrency presents a starkly different narrative. The most notable pioneers are no longer just hoodie-wearing crypto punks, but also the well-suited financial "regulars" from Wall Street and Silicon Valley. They are not trying to destroy the old world but are attempting to "transport" the entire old world onto a new technological foundation. This "inside-out" transformation will be vividly demonstrated in 2025.

Larry Fink, CEO of BlackRock, is seeing his prophecy of "asset tokenization" accelerate into reality. Following the success of Bitcoin's spot ETF in 2024, BlackRock partnered with Securitize to launch its first tokenized fund—BUIDL—on Ethereum, turning shares of traditional money market funds into tokens that can circulate on the blockchain 24/7. Meanwhile, the number of companies treating crypto assets as strategic reserves (known as DATCOs) has surged, with the total amount of crypto assets held on their balance sheets historically surpassing $100 billion.

A more critical variable comes from the shift in the U.S. government's attitude. The previously ambiguous and sometimes hostile regulatory environment saw a decisive turning point in 2025. The U.S. government not only became a significant holder of Bitcoin (through law enforcement seizing nearly 200,000 Bitcoins) but, more importantly, began to establish clear "rules of the game" for the industry. The GENIUS Act, signed in July, is the first comprehensive federal regulatory framework for stablecoins in the U.S., providing a compliance path for this market worth over $250 billion. Following that, an executive order allowing $9 trillion in U.S. retirement funds to invest in cryptocurrencies and other alternative assets opened a massive influx of incremental capital into the market. This top-down recognition fundamentally changed the risk-reward calculations for institutional entry and solidified the foundation of this transformation.

AI: A "New Species" Seeking Native Economic Soil

If the entry of financial giants has paved a highway from the crypto world to the real world, then the explosion of artificial intelligence has brought the first true "natives" to this new land.

The internet of 1995 addressed the connection issues between "people" and "information," and "people" and "goods." The essence of e-commerce is to digitize and online-enable the commercial activities of human society. The next era we are entering will be about how "AI" collaborates economically with "AI." As a new productive force, AI is creating digital content, code, designs, and even scientific discoveries at an unprecedented speed. The value created by AI urgently needs a matching, native economic system.

Cryptographic technology was born precisely for this purpose. Imagine a scenario: an AI design program autonomously creates a unique piece of art. It can mint this work into an NFT (non-fungible token) through a smart contract, thereby obtaining unique, verifiable ownership. Subsequently, another AI marketing program can discover this NFT and autonomously decide to pay a small cryptocurrency fee to promote it on social media. If an AI purchasing agent from a clothing brand is interested in this design, it can directly interact with the smart contract holding the NFT, automatically pay the licensing fee, and obtain permission to produce 1,000 T-shirts. The entire process requires no human intervention, with the creation, confirmation, circulation, and distribution of value completed instantaneously on-chain.

This is not science fiction. Ethereum founder Vitalik has pointed out that the combination of AI and crypto can solve each other's core problems: AI needs trustworthy rules and asset ownership, while the crypto world needs a "user" that can act autonomously. This symbiotic relationship is giving rise to entirely new application scenarios. For example, decentralized computing networks (like Akash Network) allow AI developers to rent global idle GPU computing power using cryptocurrency; on-chain AI models attempt to build more transparent and censorship-resistant intelligent systems through token economics.

The scale and speed of these AI-native economic activities may far exceed the total of human commercial activities. What it needs is a globally unified, low-friction, programmable value settlement layer. This is the core value of cryptographic technology and the grand vision that the internet of the 1990s could not reach.

Are We Looking for the Next "Amazon" or "TCP/IP"?

In the face of such changes, investors and builders often ask: who will be the "Amazon" or "Google" of the crypto world?

This question itself may be limited by historical experience. Amazon's success is built on the platform economic model of Web 2.0—a centralized company that attracts massive users by providing excellent services, ultimately forming a winner-takes-all network effect. However, the spiritual core of the crypto world lies in "protocols" rather than "platforms." Its goal is to create public infrastructure that is open, neutral, and permissionless, like TCP/IP (the underlying communication protocol of the internet).

Therefore, the future winners may not be a closed commercial empire but an open ecosystem or a widely adopted underlying standard. What we might see is a Layer 2 network (like Arbitrum or Optimism) becoming the actual carrying layer for the vast majority of applications due to its excellent performance and developer ecosystem; or a cross-chain communication protocol (like LayerZero or Axelar) becoming the "value router" connecting all blockchains; or a decentralized identity (DID) standard becoming the unified passport for all users entering the digital world.

The victors at this "protocol" layer will have business models that are entirely different from Amazon's. They will not profit by charging high platform fees but will capture the value of the entire ecosystem's growth through their native tokens. They are more like public utilities such as city roads and water supply systems, rather than a monopolistic supermarket.

Of course, this does not mean that the application layer has no opportunities. Great companies will still emerge on top of these open protocols. But the key to their success will no longer be building closed moats but rather how to better utilize these open protocols to create unique value for users.

Finally, returning to that quote: if you are willing to see the judgment of Visa's CEO as a signal rather than a resolution, then the more important question is "how do we turn the signal into practice." For enterprises, this is a comprehensive project from strategic alignment and compliance preparation to product implementation; for individual and institutional investors, it is about distinguishing between long-term perspectives and short-term fluctuations, neither blindly following nor passively avoiding, and seeking those on-chain use cases that can generate value in the real economy.

History has given us two things: one is a mirror, allowing us to see possible trajectories; the other is lessons, reminding us that the ultimate winners are often not the fastest speculators but the infrastructures and platforms that establish lasting, real demand and can transcend cycles. Today's crypto is simultaneously writing two parts of a script—the lively market short story and the slowly forming infrastructure epic. If what Visa says is true, the next decade will be a key decade for the latter to accelerate into the mainstream.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。