How U.S. Economic Data to Shape Crypto Market Outlook Now

U.S. Economic Data to Shape Crypto Market This Week: Will It Spark a New Rally or Fresh Selloff?

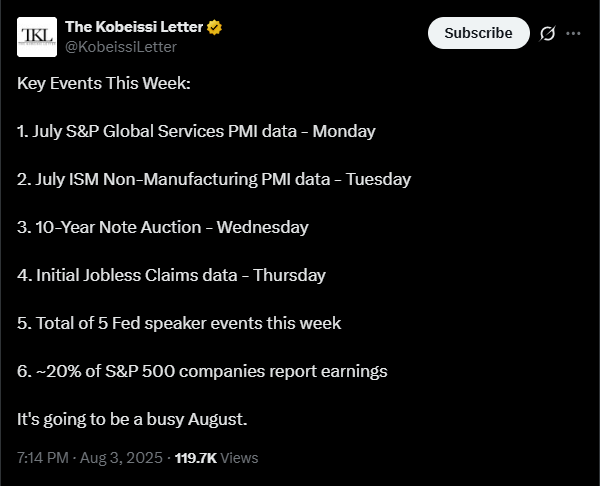

The first week of August begins with U.S. Economic Data to Shape Crypto Market including Bitcoin, Ethereum, and the broader dogotal assets. From key PMI reports to Fed speeches and treasury auctions, investors are eyeing multiple forces that could influence sector behavior.

Source: X

As the U.S. Economic Data to Shape Crypto Market starts showing up, traders and analysts both are considering the potential impact on Fed policy expectations. The s ector 's focus now shifts to whether the current Figures will support the virtual currency uplift or implying caution.

July Services PMI: Will Strong Figures Delay Rate Cuts?

The U.S. Services PMI for July is due today (Monday). In June, it was set at 55.9, highest in the following months. If July’s number holds above 55, it would show the continued economic strength, possibly giving the Federal Reserve more reasons to delay rate cuts.

Such a scenario may put pressure on the asset prices as risk assets generally prefer moderate rates. However, the figures came weaker than expected, it could bring back hopes of a Fed policy shift, giving Bitcoin and Ethereum a boost.

ISM Non‑Manufacturing PMI: Reversal Signal or Temporary Dip?

Scheduled for Tuesday, the ISM Non-Manufacturing PMI offers another key insight into the services sector. The forecast is currently laying at 52.5, a little down from June’s 52.9 which is the highest in three years.

While still above the 50-mark that signals expansion, if the decline continues, it may raise concerns about a slowing economy.

10‑Year Treasury Auction: Will Yields Shock the Platform?

Another eye-catching event in the U.S. Economic Data to Shape Crypto Market , the 10-Year Treasury Auction, is on Wednesday. Yields recently hovered around 4.362%. A sudden jump in yields could hint concerns about U.S. debt levels and increased government borrowing, typically a tension era for risk assets.

In contrast, if demand remains strong and yields drop or stay steady, it could ease sector anxiety, encouraging new buying activity.

Jobless Claims: Could Labor Platform Weakness Drive a Fed Pivot?

Thursday’s Jobless Claims will provide another overview of the labor sector situation. If jobless claims go up, especially after July's weak report , It could increase pressure on the Fed to cut interest rates.

Labor market degradation often strengthens the demands for rate cuts, which is traditionally bullish for Bitcoin and other virtual assets as lower interest rates reduce the opportunity cost of holding non-yielding assets.

Fed Speakers in Focus: Will Powell Drop a Dovish Hint?

Five Federal Reserve officials, including Chair Jerome Powell, are scheduled to speak this week which a part of U.S. Economic Data to Shape Crypto Market . With new tariff worries pushing inflation back, it is going to be exciting to watch how policymakers will balance to keep the economy strong.

A firm tone from Powell could pull down the crypto markets, while any soft shift or openness to easing may spark renewed optimism across virtual assets.

Earnings Season Continues: Risk Sentiment at Stake

Nearly 20% of S&P 500 companies will report earnings this week, including major tech and AI firms. Strong corporate results have so far supported equity markets and, by extension, digital assets.

However, disappointing earnings could lead to a broader risk-off environment. If tech giants deliver strong beats, sentiment may remain elevated, supporting continued upside of virtual money.

What to Watch: Can the Crypto Market Breakout or Breakdown?

This week’s U.S. Economic Data to Shape Crypto Market holds potentially. With PMI data, treasury auctions, Fed speeches, and earnings merging, traders are on alert for great-impacting factors.

At the time questions arise, will data confirm a slowing U.S. economy or surprise with unexpected resilience? Can Bitcoin and Ethereum regain strength on renewed rate-cut optimism?

The U.S. Economic Data to Shape Crypto Market theme highlights the increasingly tight correlation between macro events and digital asset performance. With potential for both rallies and retracements, market participants should brace for heightened volatility in the days ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。