Author: Frank, PANews

The cryptocurrency investment sector is undergoing a profound transformation. On one hand, traditional institutions are entering the market, bringing more capital and new strategies. On the other hand, native crypto investors are facing stronger competitors, with strategies like "holding altcoins," contract trading, and DeFi lending becoming increasingly challenging, raising the cognitive requirements for users.

The crypto market is becoming less friendly to novice users.

In the decision-making process of investment strategies, there is a classic dilemma known as the "impossible triangle" of profitability, safety, and liquidity. In past cycles, DeFi protocols often forced investors to make difficult trade-offs among these three: pursuing astonishing annual percentage yields (APY) often comes with significant risks from smart contracts and the potential for permanent loss of principal; while seeking absolute safety means funds can only sit idle in wallets, missing out on growth opportunities.

As a result, composite financial strategies are increasingly favored by investors. As a leading exchange, Binance's financial product types have always been at the forefront of the industry and is one of the most used platforms by crypto investors. However, the variety of financial products can often be overwhelming. This article provides a comprehensive overview of Binance's high-yield financial products, aiming to offer a new investment perspective.

Binance's high-yield financial products can be broadly divided into two categories. One category includes dollar stablecoin-related products represented by RWUSD and BFUSD, which have stable sources of income, such as RWA tokenized U.S. Treasury bonds or futures funding rates. The other category consists of structured products like discounted coin purchases and dual currency investments.

Products based on dollar stablecoins are relatively conservative, have low entry thresholds, and are capital-protected with stable yields. Structured products generally come with higher potential returns but also higher risks, requiring specific strategies.

"Discounted Coin Purchase": Making Institutional-Level Options Strategies Accessible to Retail Investors

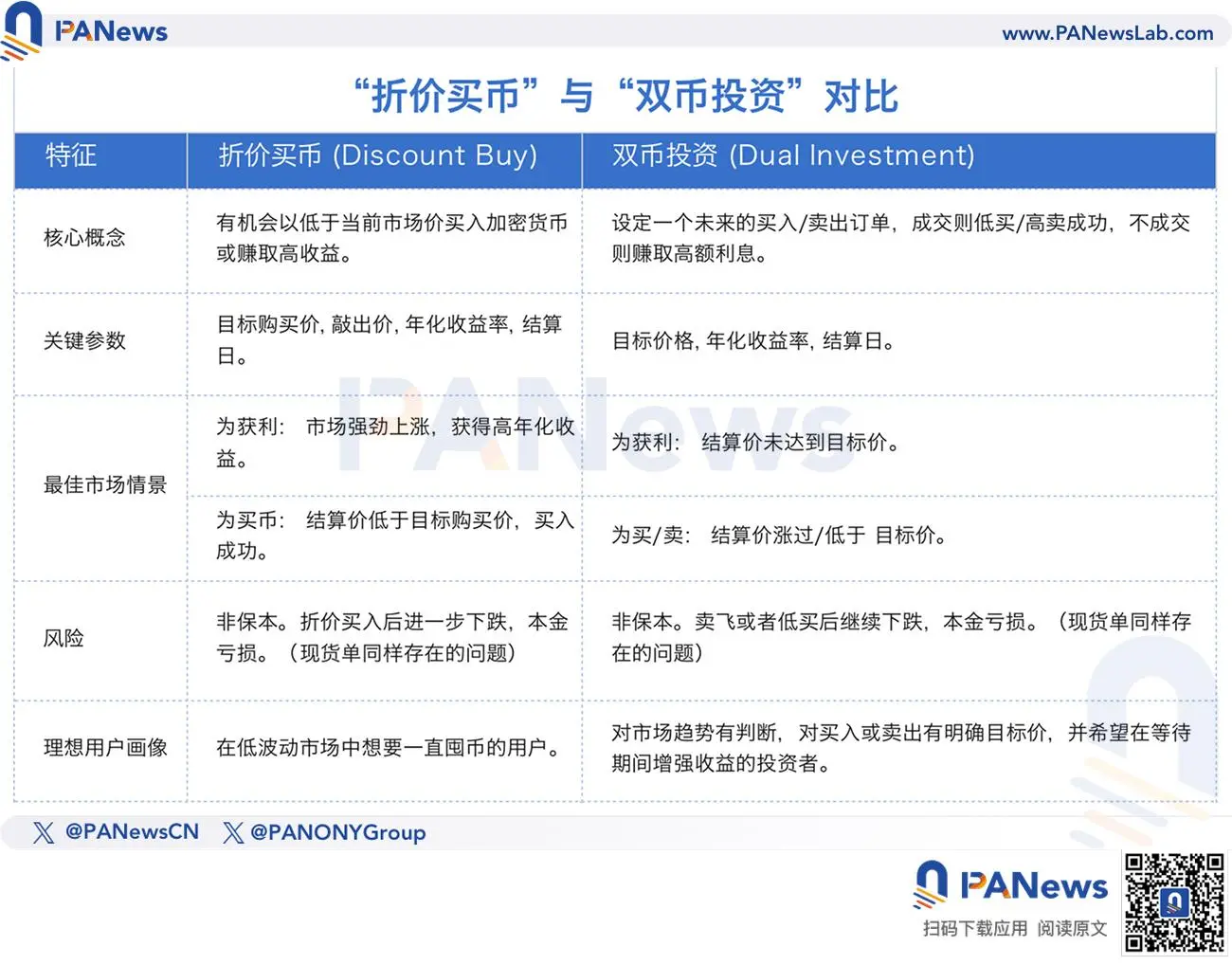

"Discounted Coin Purchase" is Binance's latest structured financial product, relying on options as its underlying asset, similar to the previously launched "Dual Currency Investment." These two are the "twin stars" among Binance's structured products.

For many investors, the current market conditions are perplexing: they want to build positions at lower costs during pullbacks but fear buying in too early. The newly launched "Discounted Coin Purchase" is designed to address this pain point.

The essence of "Discounted Coin Purchase" is a complex "exotic options" model. The main feature of this product is that users can accumulate coins (like BTC, ETH) at prices below the market rate or earn high annual yields. In traditional simple accumulation or low-price buying strategies, users often encounter the problem of setting the price too low, failing to successfully buy in. In this process, not only do they fail to build positions, but they also waste funds while waiting, incurring more opportunity costs.

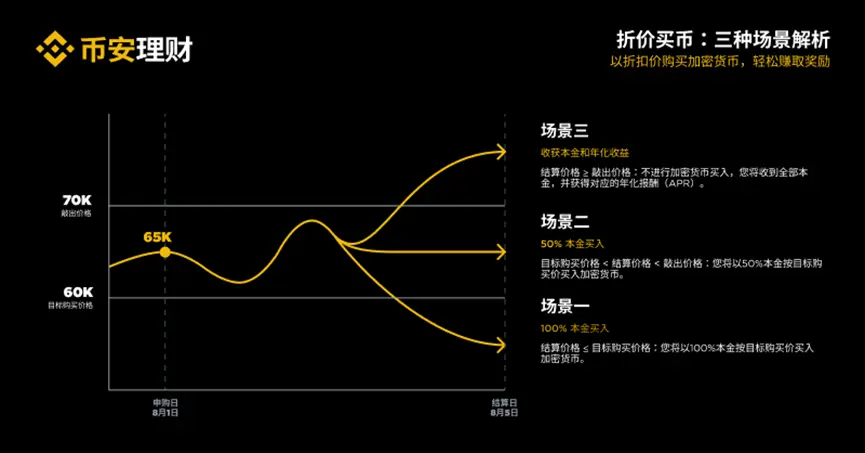

"Discounted Coin Purchase" perfectly solves this problem, allowing users to choose a target purchase price with corresponding APR and knock-out price. If the settlement price on the settlement day (the average price over half an hour on that day) is below the target purchase price, the user can successfully complete the position. If the settlement price is between the knock-out price and the target purchase price, the user will complete half of the position at the "target price," with the other half of the principal returned. If the price exceeds the knock-out price, although the coins are not purchased, the principal will be fully returned along with the previously agreed APR. This acts as a "missed opportunity protection," paying interest on the user's waiting opportunity cost.

The true value of "Discounted Coin Purchase" lies in helping users who wish to build positions in the future at prices lower than the current market price to automate their accumulation, or to ensure a certain financial return even if they fail to build positions (the current knock-out APR can reach 30%). Similar to "Discounted Coin Purchase," "Dual Currency Investment" is also based on options. Its core logic can be simply understood as: "Place a limit order for your future self; if the order is executed, you successfully buy low/sell high; if not executed, you can still earn extra interest during the waiting period."

Typical scenario: Suppose you plan to buy Bitcoin when the price pulls back to $60,000. If you place a direct spot limit order and it doesn't execute, your funds remain idle during this time. However, if you use the "low buy" feature of "Dual Currency Investment," setting $60,000 as the target price, even if it doesn't execute, your funds will continue to generate high interest.

"Dual Currency Investment" is more suitable for "planned traders" who have clear buy or sell points in the future. It transforms the waiting time cost into tangible returns. Users can choose the settlement date and APR based on their investment preferences, with many investors tending to choose a settlement date further away or a target price significantly different from the current price, aiming not for execution but for a more stable high yield. Many users also choose to continuously buy low and sell high within a range.

On August 14, "Dual Currency Investment" underwent a significant functional upgrade, adding daily settlement features for BTC and ETH, allowing users to choose working days within a 7-day period as the settlement time. It also introduced a customizable automatic reinvestment plan, supporting automatic reverse reinvestment, meaning that when the original purchase order reaches the target price, it can reinvest in the opposite direction of the original purchase order. These two upgrades further enhance capital utilization and strategy flexibility.

If "Dual Currency Investment" is a basic "spot limit order + interest," then "Discounted Coin Purchase" resembles a "smart bottom-buying robot" with buffers and multiple outcomes.

RWUSD: A Bridge Connecting Real-World Assets (RWA) and Retail Investors

If structured products are suitable for more professional crypto investors, then products based on dollar stablecoins are more suitable for users with low-risk preferences who wish to enhance asset utilization.

In 2025, RWA and stablecoins will undoubtedly be the hottest narratives of this cycle. Boston Consulting even predicts that the RWA market size will reach $16 trillion by 2030, and the stablecoin market size has already surpassed $2.6 trillion. However, when giants like BlackRock rush into the market, their high-threshold RWA and stablecoin products will keep the vast majority of retail investors at bay.

The RWUSD and BFUSD launched by Binance seem to serve as such a bridge.

RWUSD is essentially a capital-protected financial product supported by the yields of real-world assets like U.S. Treasury bonds. Although the official stance emphasizes that RWUSD is neither a stablecoin nor U.S. Treasury bonds themselves, its innovative significance lies in combining the native attributes of crypto with capital-protected financial management based on U.S. Treasury RWA. RWUSD has the following characteristics:

Breaks through RWA investment thresholds, with a minimum investment amount of 0.1 USD and a flexible redemption mechanism (a free quick redemption limit of 5,000 USD per person per day).

Aligns with the investment choices of low-risk preference investors; the approximate 4.2% reference annual yield, while not comparable to high-risk DeFi projects, offers a more reliable and stable option for risk-averse investors.

Compliant capital protection; compared to previous capital-protected financial products in the crypto space, RWUSD, relying on U.S. Treasury bonds or stablecoins, achieves a true capital protection design at the underlying logic level for the first time, which may attract a large number of institutions that are currently cautious about the crypto industry.

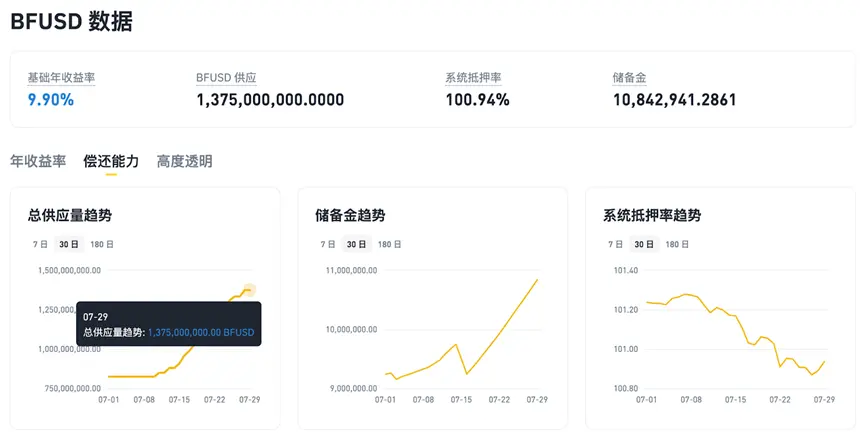

Unlike RWUSD, BFUSD, as a yield-generating financial product, targets another massive pool of idle funds—contract account margins. For many investors keen on participating in contract trading, margins are often funds that must remain idle, and typically, to ensure the safety of contract orders, the margin size is not insignificant.

BFUSD fills this gap, allowing users to earn returns directly while holding BFUSD, which can also be directly placed into contract margins, enabling a secondary utilization of stablecoins. Currently, BFUSD's annual yield can reach 9.9%, and its total value locked (TVL) has seen a significant increase, surpassing $1.3 billion as of July 29.

Overall, both RWUSD and BFUSD are capital-protected financial assets. While their annual yields are not high compared to DeFi, they significantly enhance capital utilization and provide higher security for capital safety. For individuals and institutions newly entering the crypto investment space, they are undoubtedly relatively safe choices.

BTC Staking: Activating Idle Capital, Capturing On-Chain Native Yields

In addition to the two types of financial products mentioned above, Binance also offers stable on-chain investment products. For example, "On-Chain Earnings," specifically BTC staking.

Unlike public chains like Ethereum that use proof-of-stake (PoS) mechanisms, allowing users to earn network security rewards by staking native tokens, Bitcoin, which uses proof-of-work (PoW), does not have "yield-generating" capabilities. This results in a massive amount of BTC being idle, unable to generate passive income for its holders. To address this issue, the BTCFi ecosystem has emerged, with one of its key innovations being liquid staking.

Binance collaborates with third parties like Solv Protocol to provide a value-added channel for traditional "non-yielding" assets like BTC. Users can stake BTC through their Binance accounts and earn SOLV token rewards based on their chosen lock-up period, with annual yields ranging from 0.6% to 1.6%. The product supports various lock-up periods and allows for early redemption at any time (though accumulated rewards will be forfeited). In this process, users can stake BTC with a single click on the Binance platform, capturing native yields from the BTCFi ecosystem without complex on-chain operations. For users, this allows them to capture on-chain innovation's native yields without leaving the familiar and trusted Binance environment.

In comparison, Binance's BTC staking has the following characteristics:

Assets are managed by Binance, ensuring the safety and reliability of funds;

No need to set up wallets or master DeFi knowledge; participation is possible using a Binance account;

Offers various staking periods and ample quotas to meet different users' yield and liquidity needs.

Returning to the initial topic, there is no perfect product in the market that can simultaneously satisfy high profitability, high safety, and high liquidity. However, a mature investor knows how to construct a diversified asset allocation portfolio to dynamically balance these three based on market conditions and personal needs.

By "productizing" and "one-clicking" complex financial strategies, Binance is lowering the threshold for ordinary users to participate in advanced investment games. This is not only a tool innovation but also a profound evolution of investment philosophy. An era that emphasizes strategy and allocation for all crypto investors has already arrived.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。