Author: Dong Jing, Wall Street Insights

All assets are going on-chain! The largest cryptocurrency exchange in the United States, Coinbase, is planning an ambitious strategic transformation.

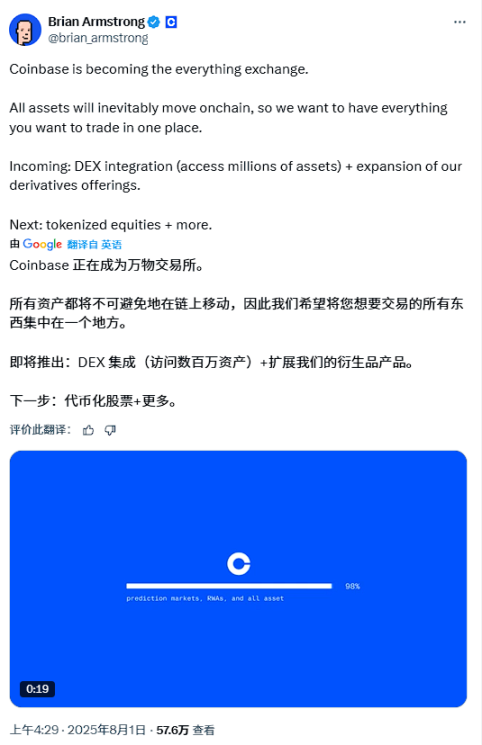

According to media reports, the company's CEO Brian Armstrong recently announced on social platform X that Coinbase will become a "Universal Exchange," planning to move all assets, including stocks, derivatives, and prediction markets, onto the blockchain for trading.

As Coinbase's Vice President of Product Max Branzburg stated, they are building an "exchange for everything," where all transactions will be completed on-chain. Analysts suggest that the core idea of this strategic transformation is to redefine the boundaries of digital asset trading.

Coinbase believes that the current policy environment creates favorable conditions for innovation and broader market adoption. Barclays analysts pointed out that although the timeline for new opportunities to translate into substantial revenue remains unclear, regulatory support is continuously improving.

"Universal Exchange" Strategic Layout

Coinbase CEO Brian Armstrong emphasized the long-term logic of this expansion on social platform X:

"Coinbase is becoming a Universal Exchange. All assets will inevitably move on-chain, so we want to have everything you want to trade in one place."

Coinbase Vice President of Product Max Branzburg clearly stated in an interview:

"We are building an exchange for everything. Everything you want to trade, one-stop shopping, all on-chain. We are putting all assets on-chain—stocks, prediction markets, and more. We are laying the foundation for a faster, more accessible, and more global economic system."

This new concept of a "Universal Exchange" will include tokenized physical assets, stocks, derivatives, prediction markets, and early-stage token sales. New products will be launched in the coming months, initially targeting U.S. users, followed by "gradual international promotion based on jurisdictional approval."

Branzburg specifically emphasized that tokenized stocks are the next key step, describing the $100 trillion traditional stock market as a great opportunity for on-chain transformation.

Reports indicate that Coinbase's expansion plans go beyond traditional cryptocurrency trading pairs, aiming to establish an alternative to traditional brokerage firms. The company plans to provide a unified platform for users to trade diversified assets, with all transactions settled and secured on-chain.

This expansion initiative puts Coinbase in more intense competition with Robinhood, Gemini, and Kraken. Notably, these competitors have recently opened tokenized stock products to users outside the United States.

Coinbase CEO Brian Armstrong has stated the goal: to make Coinbase a top financial services application within the next decade.

Improved Regulatory Environment Boosts Expansion

Recent changes in the regulatory environment encourage Coinbase to accelerate its diversification process. Analysts suggest that with stablecoin-related legislation providing clear guidelines and the improvement of the digital asset regulatory framework, the company believes the environment for innovation and broader adoption is increasingly favorable.

Barclays also noted that despite a 26% decline in revenue in the second quarter, Coinbase's latest shareholder letter describes these developments as growth catalysts. Meanwhile, revenue from stablecoin activities grew by 12%, partially offsetting weaker trading revenue. The company expects subscription and service revenue to steadily rise in the next quarter.

While retail and institutional investor trading is Coinbase's core business, the company is vigorously promoting consumer engagement through new services, fully leveraging the new supportive cryptocurrency policies introduced in the U.S.

Two weeks ago, the company launched the "Base App," aimed at creating a Western version of a WeChat-like super app.

Analysts believe this series of initiatives indicates that Coinbase is transforming from a purely cryptocurrency trading platform into a comprehensive financial services provider, attempting to redefine the boundaries of digital asset trading in the new regulatory environment.

Barclays analysts pointed out that while the timeline for these new opportunities to translate into meaningful revenue for Coinbase is still unclear, there is no doubt that the regulatory environment is becoming increasingly supportive.

Recommended Reading:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。