10 sets of core data tell you about Ethereum's enduring dominance.

Source: Bankless

Translation and Compilation: BitpushNews

Ethereum has now completed a decade. After ten years of continuous block production on the mainnet, on-chain data for 2025 shows that its activity is still experiencing explosive growth!

Although alternative public chains and Ethereum's own Layer 2 networks have indeed diverted some user activity, Ethereum remains the heartbeat of the crypto economy—leading the industry in developer momentum, censorship resistance, and numerous key on-chain metrics.

So, what does this pioneer of smart contracts look like after ten years of development? The following 10 sets of core data illustrate Ethereum's enduring dominance.

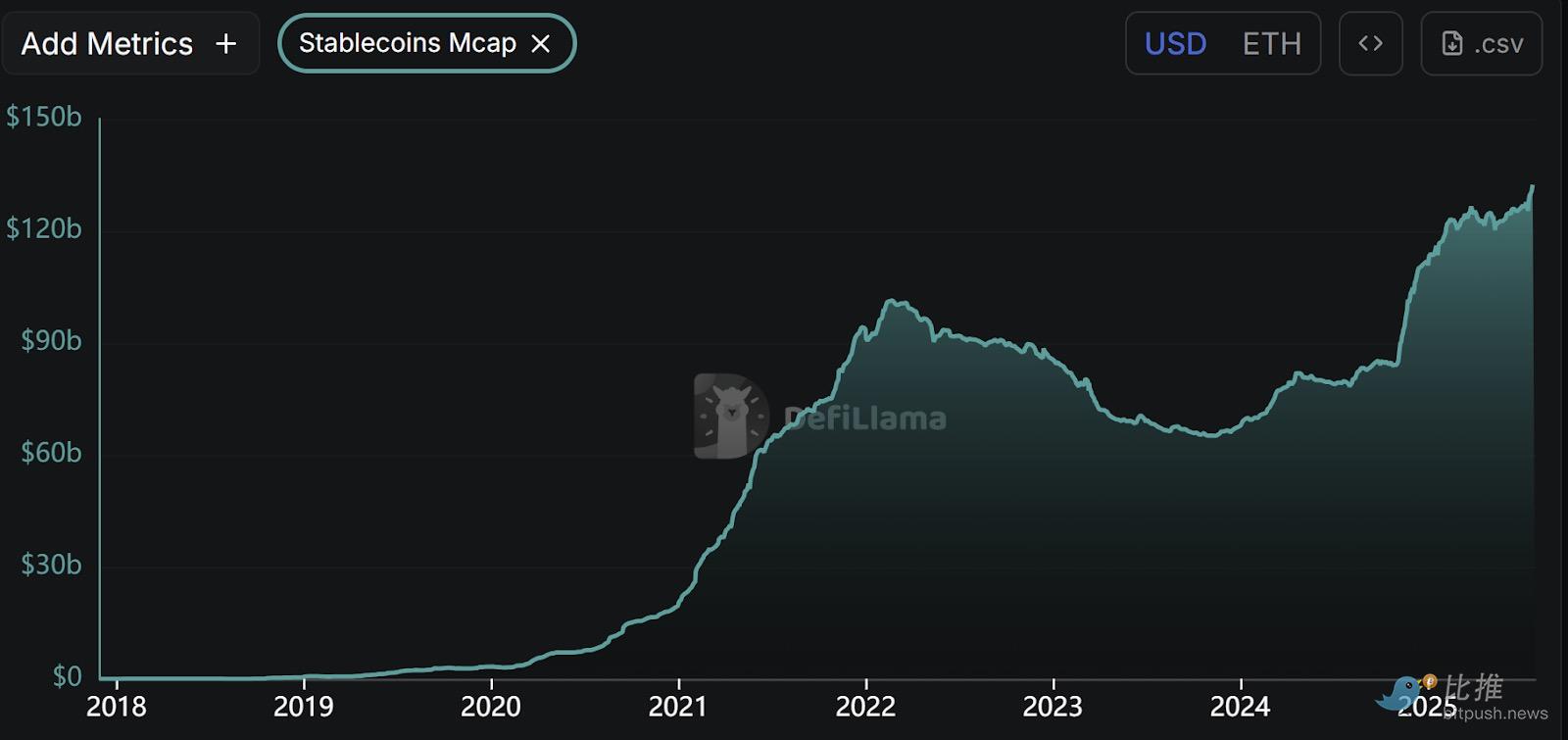

1. Stablecoin Supply

Tether launched a USD-pegged stablecoin in 2015 in collaboration with the crypto exchange Bitfinex, and since these tokens began their on-chain migration in 2017, the supply of stablecoins on the Ethereum network has been expanding at an astonishing rate.

Aside from a brief decline during the worst of the last crypto bear market, the on-chain stablecoin supply on the Ethereum network has historically maintained a trend of "only increasing," surpassing the $100 billion mark by the end of 2024, with no signs of slowing down in recent months.

Currently, there are dozens of issuers of USD-pegged tokens, including traditional financial giants like PayPal and JPMorgan. Meanwhile, the recently passed "GENIUS Act" in the U.S. is clearing the way for institutional adoption, and this sector is gaining attention as an alternative medium for everyday payments.

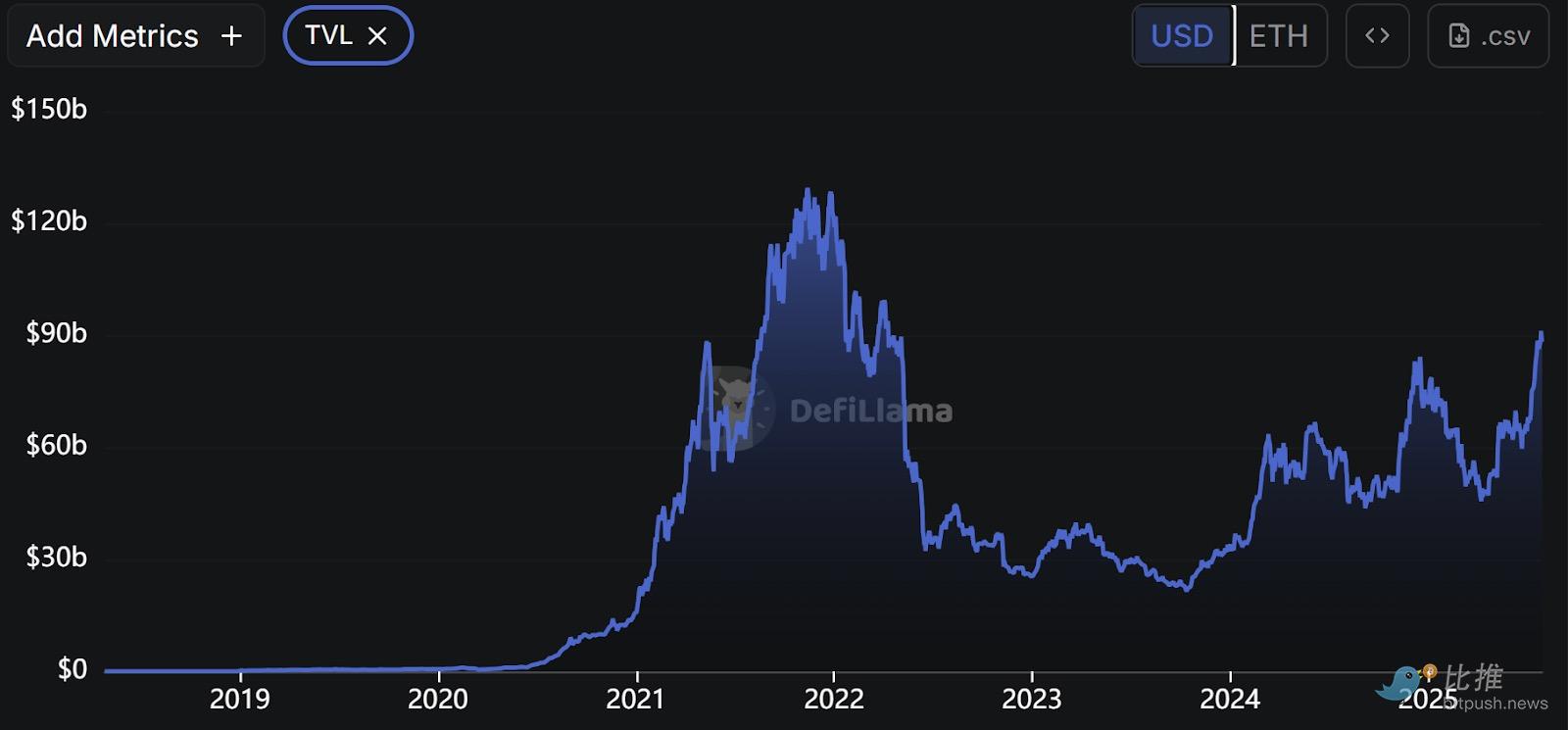

2. Total Value Locked (TVL)

Ethereum is the original smart contract platform. Despite multiple competing L1 chains and their integrated L2 networks diverting some of Ethereum's locked value, the chain still ranks among the leading blockchains in terms of total value locked (TVL).

The TVL stored in on-chain smart contracts and their related applications is the lifeblood of every crypto network: it represents the value that users trust and deposit into the on-chain financial system.

Although Ethereum's TVL suffered a blow during the last bear market as cryptocurrency prices plummeted and users withdrew or migrated to competing chains, this data has been experiencing explosive growth since April of this year, reaching a new cycle high of over $88 billion and actively pursuing a new all-time high.

Source: DeFiLlama

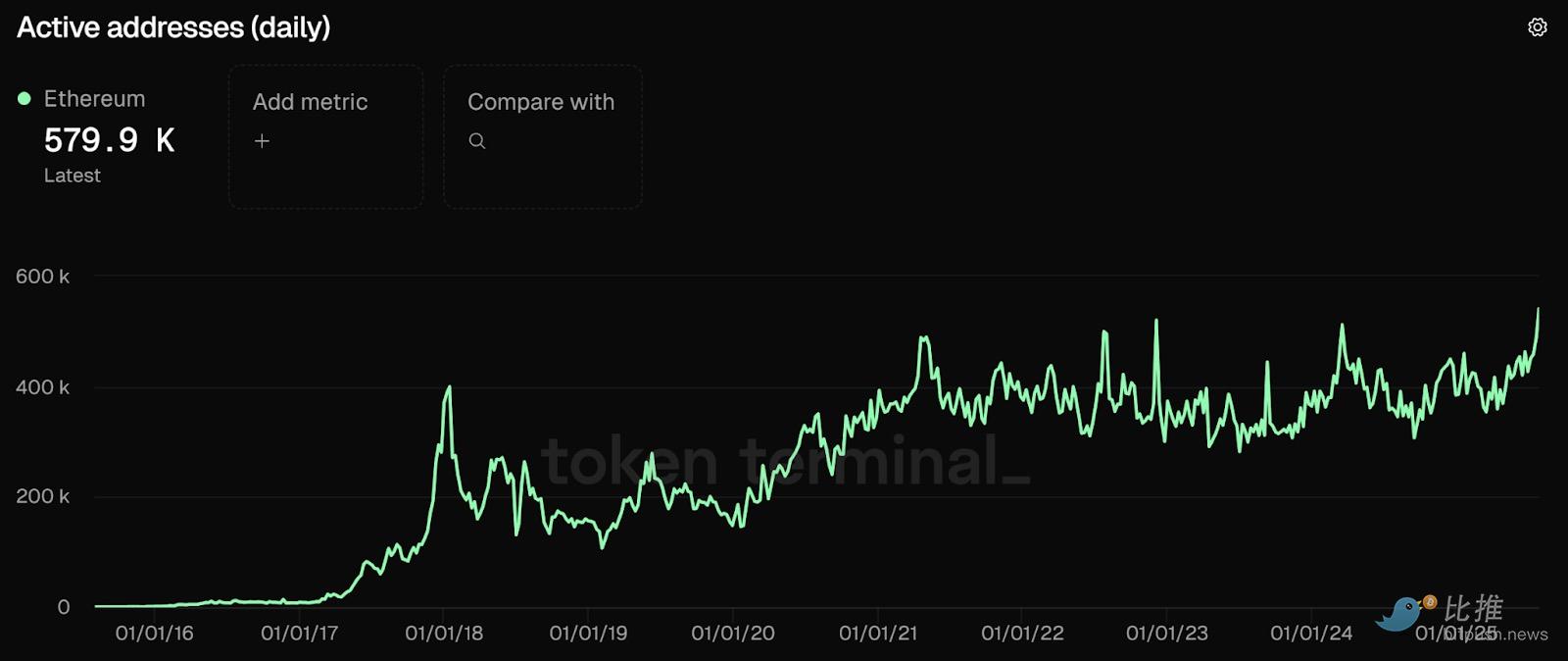

3. Active Users

Even as casual Ethereum ecosystem user activity has migrated to L2, it has not slowed the growth of daily active users on Ethereum, which recently reached a historic high of 580,000 unique addresses.

During the last bear market, the number of daily active addresses remained stable and has continued to rise throughout 2025, with more and more users turning to Ethereum L1 for the unique attributes offered by the world-leading on-chain financial ecosystem.

When including active addresses on Ethereum L2s, this growth is even more remarkable; Coinbase's Base L2 alone has 1.3 million active addresses daily. Additionally, leading L2s like Arbitrum, Celo, Ink, and World Chain have added another 1.2 million addresses.

Source: Token Terminal

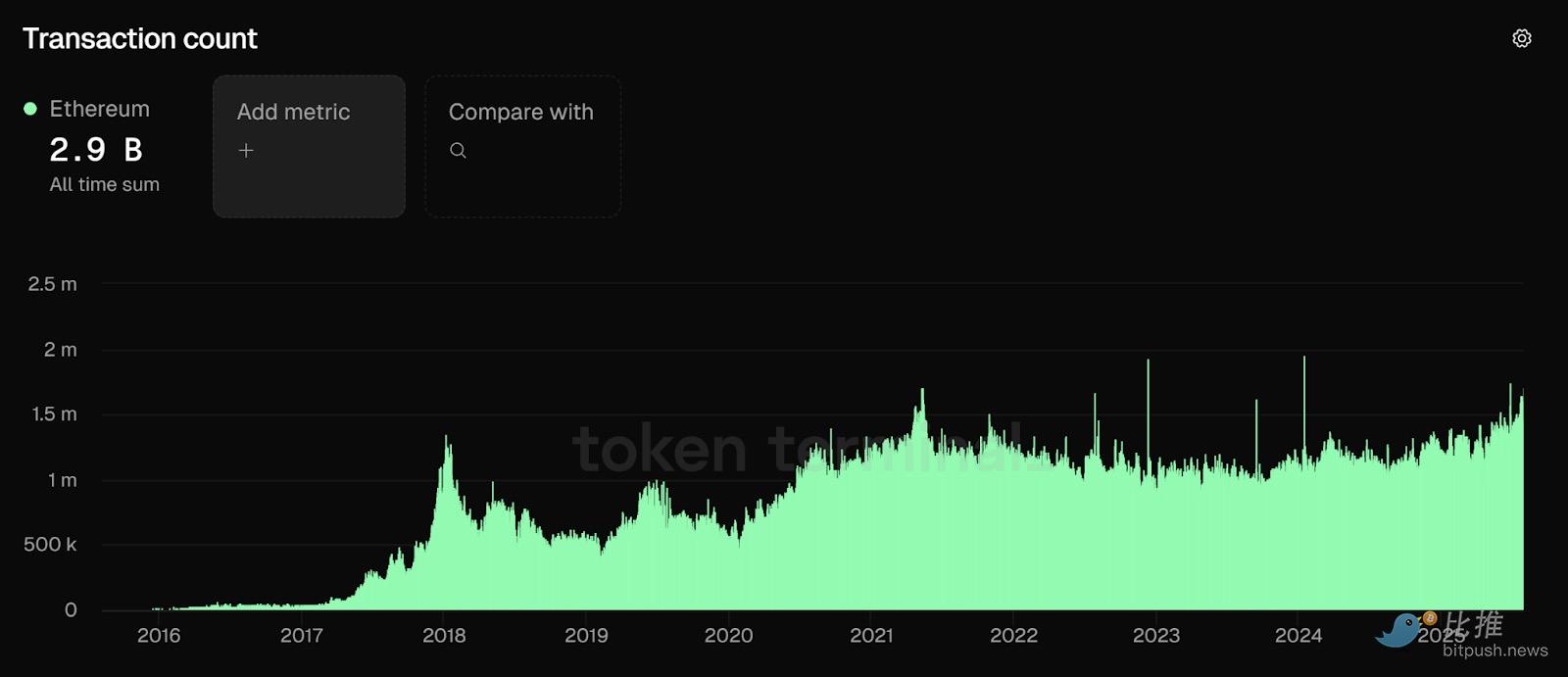

4. Daily Transaction Volume

With the increase in active users on Ethereum L1, the number of transactions has also grown. Since October 2023, daily transaction volume has steadily risen, maintaining a floor of over 1.7 million transactions at the time of writing.

Although this metric can spike dramatically during periods of speculative activity, Ethereum's daily transaction volume has historically shown a trend of "only increasing," with a cumulative total of 2.9 billion transactions since the network's inception.

When accounting for the numerous L2s on Ethereum, this statistic becomes even more optimistic. Including leading L2s, the daily activity in the Ethereum ecosystem far exceeds 500 million transactions.

Source: Token Terminal

5. Institutional Adoption

Ethereum has long been the blockchain favored by on-chain enthusiasts, and in 2025, this crypto network broke out of its niche positioning to become a well-known smart contract platform favored by institutional players.

Former President Donald Trump chose the Ethereum network as the home for his "World Freedom Financial Project" in 2024, joining this trend early. Banking giant JPMorgan deployed a deposit token on the Base chain in June of this year, establishing Ethereum L1 as the dominant platform for real-world assets (RWA), controlling nearly $7 billion in value and holding a 54% market share in this sector.

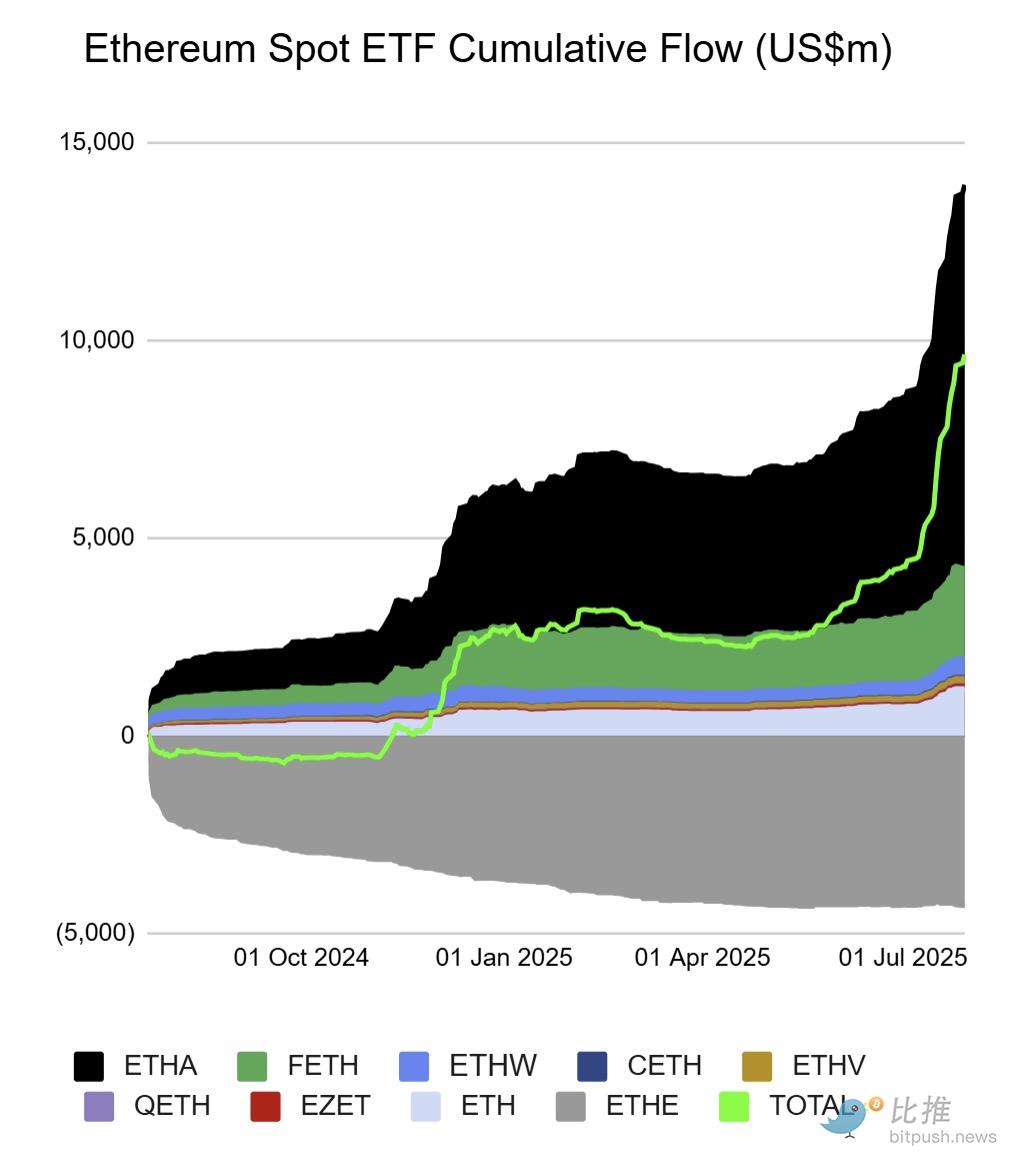

In recent months, Ethereum treasury companies—led by Consensys' Joe Lubin and Wall Street's Tom Lee—have outperformed Bitcoin competitors at significant prices. Similarly, the inflow of Ethereum ETFs has surged in recent weeks, attracting hundreds of millions of dollars daily, indicating that the Ethereum craze is sweeping the retail market.

Source: Farside

6. Censorship Resistance

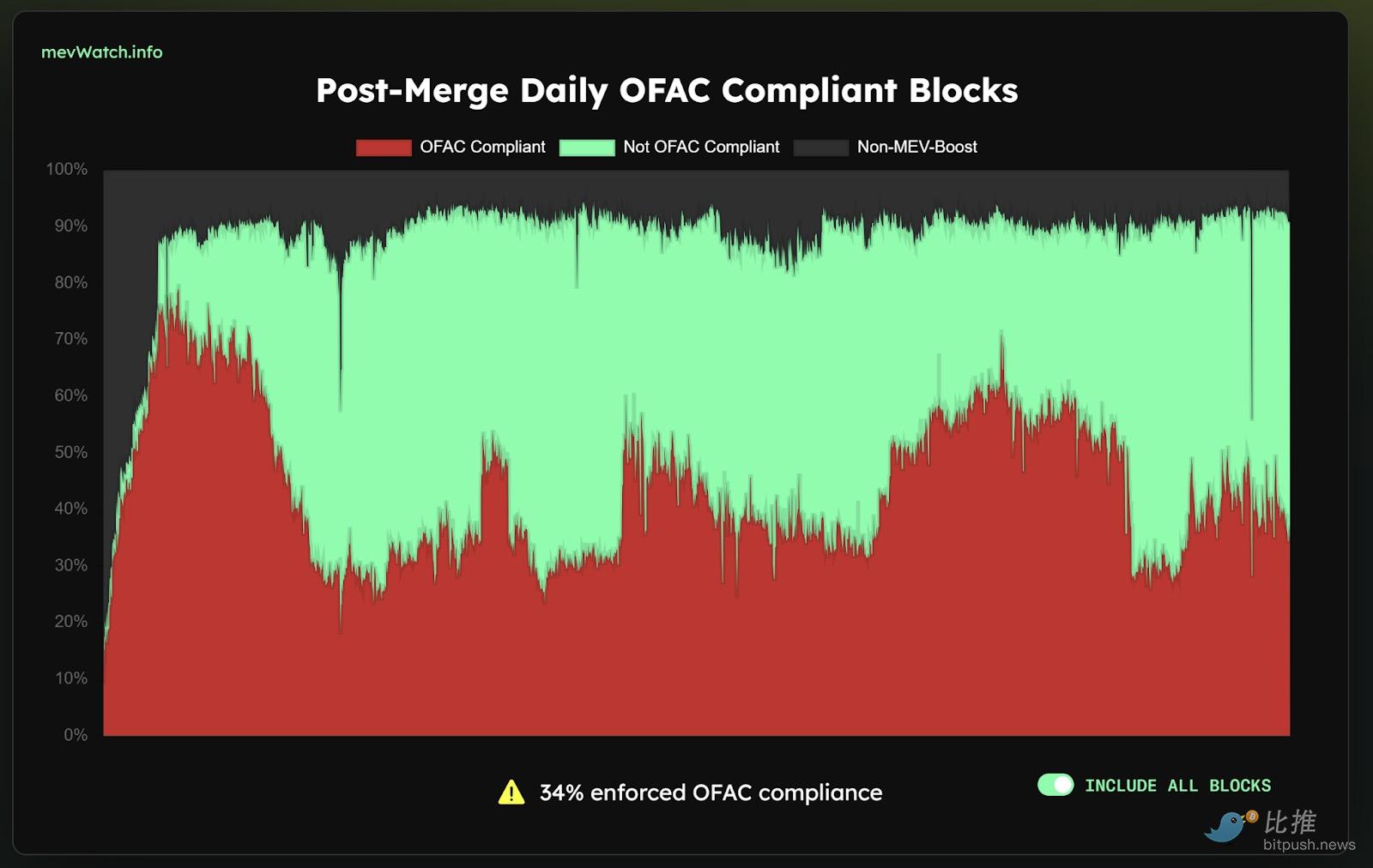

Ethereum L1 prides itself on its censorship resistance, providing an open financial system by allowing anyone to broadcast transactions without worrying that their operational capabilities will be compromised by a single actor or nation-state.

Unlike other crypto networks that frequently roll back chains to prevent funds from falling into the hands of bad actors, Ethereum's culture is characterized by its blind trust in code, ensuring that all transactions are final, regardless of the consequences.

These values extend to block building, with most block builders choosing to process all transactions, regardless of whether addresses or smart contracts have been flagged as malicious by nation-state actors.

Since Donald Trump's presidency, compliance with the U.S. Office of Foreign Assets Control (OFAC) sanctions list has significantly decreased in 2025, and major block builders have committed to processing all transactions, regardless of their source.

Additionally, leading Ethereum developers remain committed to adopting "inclusion lists," which will force all validators and block builders to include transactions solely based on fees.

Source: MEV Watch

7. Active Developers

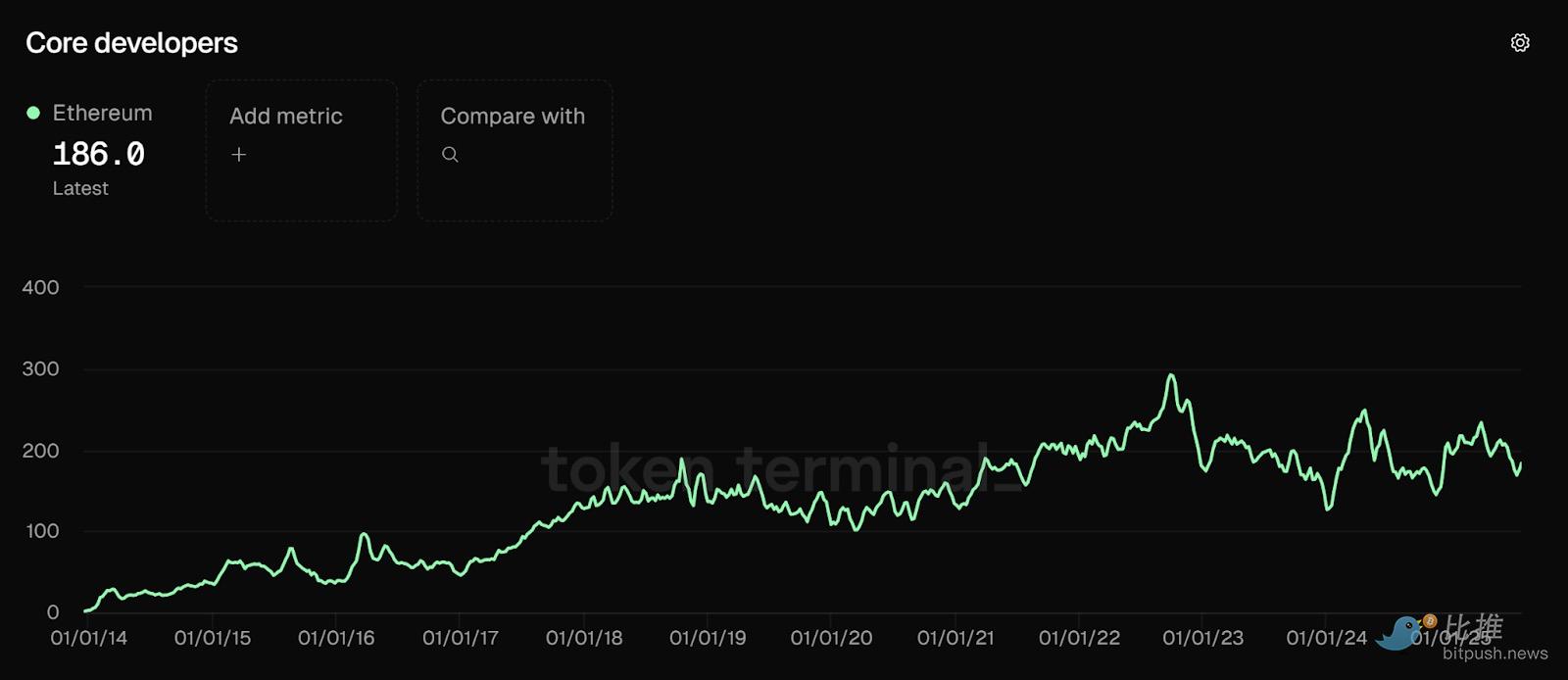

The status of the Ethereum core developer community—the number of different GitHub users who have submitted code to its public repository at least once in the past 30 days—remains strong!

Although the number of active developers is below the peak of the last bull market cycle, the number of core active developers on Ethereum (with 186 independent contributors) still exceeds that of all other crypto projects.

Ethereum's EVM (Ethereum Virtual Machine) has become the default standard for blockchain development, with its applications enjoying broad compatibility across mainstream chains.

Source: Token Terminal

8. Economic Security

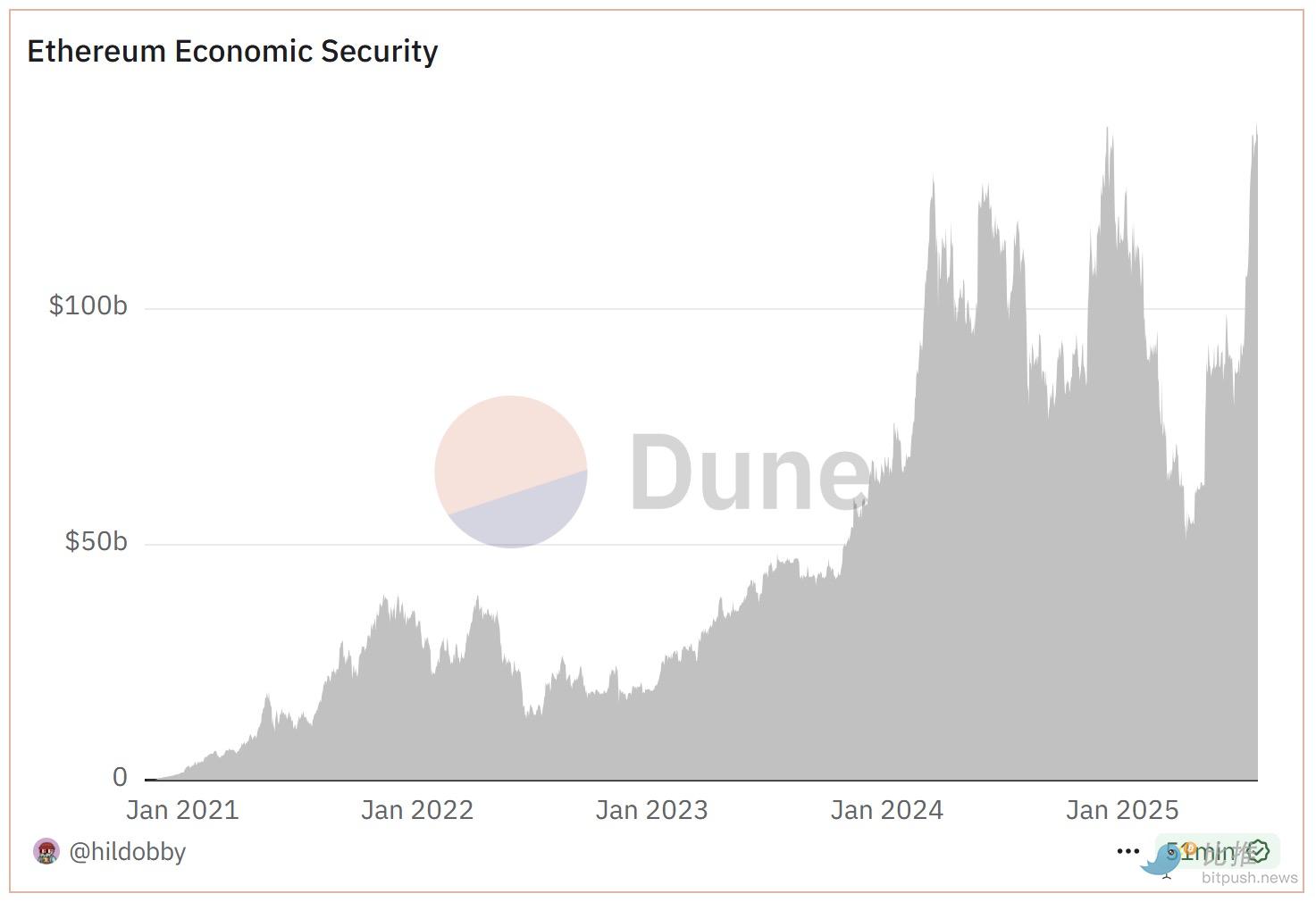

Aside from a few very brief interruptions (the longest occurring from November 2024 to February 2025), the amount of staked ETH has been steadily increasing since the "Beacon Chain" staking was first enabled in November 2020.

Combined with the explosive price trends of ETH, the ongoing upward trend in ETH staking has brought Ethereum's "economic security"—the value of ETH staked by validators to protect the network—to a historic high of $140 billion.

As Ethereum's economic security grows, various users can trade with greater peace of mind, knowing that their assets are increasingly protected from potential malicious actors who might manipulate the blockchain ledger.

Source: Dune Analytics

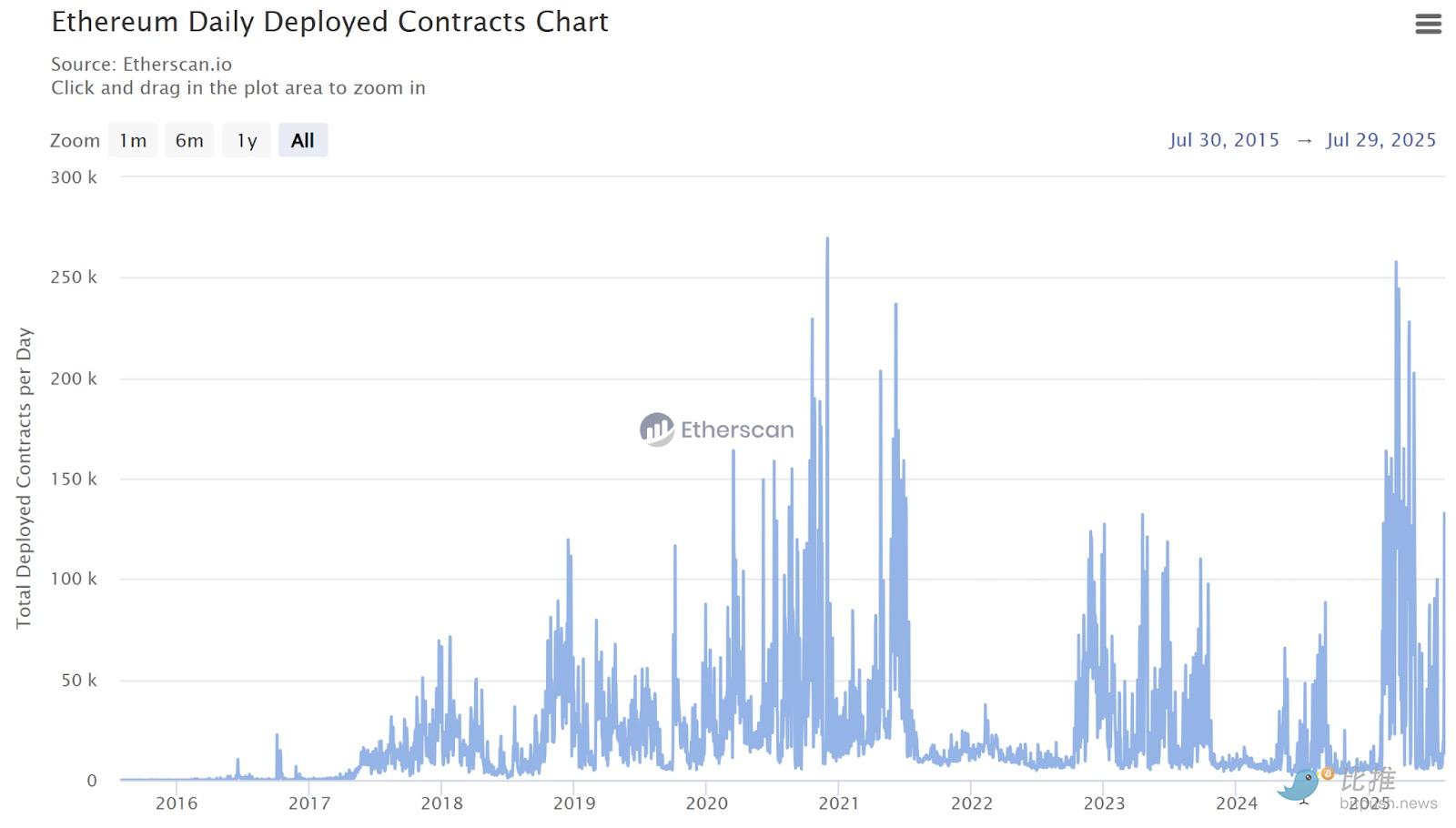

9. Contract Deployment Volume

The existence of a blockchain is to serve user transactions, and the volume of contract deployments provides insight into the evolving scope of on-chain activity.

These contracts can range from simple token deployments to complex applications, but each new contract represents a potential new behavior or use case for users. In this way, contract deployments can serve as a signal of on-chain innovation and practical growth.

Although the volume of Ethereum contract deployments slowed at the end of 2024 and the beginning of 2025, there has been a fierce development surge in recent months, with daily new contract deployments exceeding 200,000 on multiple occasions this year. Despite developers shifting to L2s, Ethereum L1 remains a vibrant hub of activity.

Source: Etherscan

10. ETH Price

Arguably the most watched success metric for any crypto project is the price of its native token. Although Ethereum has struggled for years in competition with other alternative cryptocurrencies, since May 2025, the token has rebounded strongly, appreciating 75% against Bitcoin.

Ethereum has become one of the best-performing crypto assets in recent months, with enthusiasm from both crypto natives and institutional investors for ETH nearly doubling its industry dominance.

Although Ethereum is still 10% away from its all-time high, based on recent price performance, this target could be achieved within days. If viewed on a logarithmic chart, breaking this level could bring it just a step away from $10,000…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。