Whale Borrows 5x Leverage on Aave Using $180M in ETH

A crypto whale has reportedly leveraged $180 million worth of Ethereum five times on the AAVE protocol.

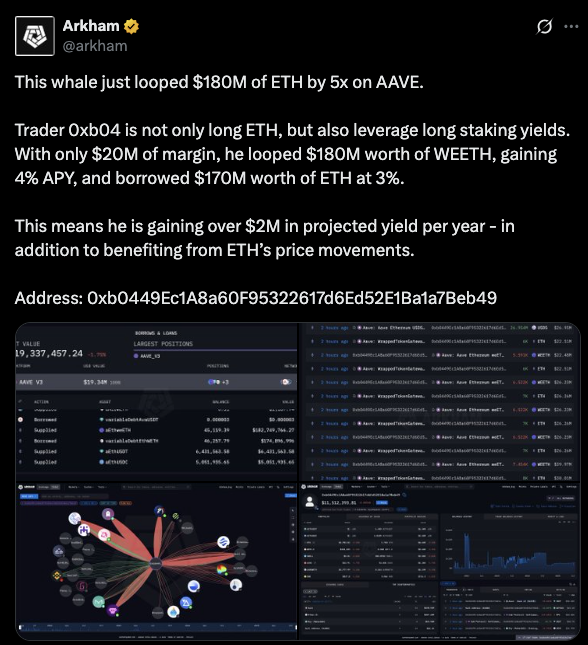

The trader, identified by the wallet address 0xb04, is deploying a high-risk, high-reward yield farming strategy. According to Arkham Intelligence, the trader began with just $20 million in capital. He then repeatedly looped it into $180 million worth of wrapped Ethereum (wETH) on AAVE.

ETH Whale Turns $20M Into $180M Loop

By doing so, the investor is not just long Ethereum but also capitalizing on staking yields. The position reportedly earns an annual yield of 4% from wETH deposits while borrowing \$170 million worth of Ethereum at an estimated 3% interest.

Source: Tweet

This structure allows the trader to potentially earn more than $2 million annually in passive yield alone. In addition, he gains exposure to ETH price increases, significantly amplifying his upside if the asset appreciates.

The aggressive yield strategy has caught the attention of on-chain analysts. Many are watching to see how this highly-leveraged Ethereum play unfolds in current market conditions.

ETH Price Dips Below Key Resistance Level

The ETH price experienced a notable decline on July 29, 2025, slipping by 1.84% to close at $3,757. This drop signals increasing bearish pressure after failing to sustain above the $3800 psychological level, which now acts as a key resistance zone.

On the daily chart, the price has created a lower high, which indicates that the price could make a bigger correction once a support is not reached. The short-term support stands at 3700 which has in the past mitigated negative momentum. Melting down under this region would lead to a subsequent route to additional losses.

The indicator of momentum reflects diminishing buying strength. The Relative Strength Index (RSI) is at 44, intact below the 50 mark of neutrality.

It indicates that bearish momentum is starting to pick up. However, as long as RSI does not rise above 50, there could be a lack or weakness of bulls in the short run.

In the meantime, the MACD indicator increases the alarming mood. The MACD crosses over the signal line, falling below the signal line, and the negative histogram is at -4.87. This bearish crossover further confirms a shift in momentum and possibly signals a deeper correction.

In the near future, the support level of $3,700 might be retested in case the sellers remain in control. In case bulls recapture the current levels of $3800 and turn them into support, then the potential targets would be set to $4000 and later at $4300.

Source: Tradingview

Nevertheless, the inability to maintain current levels can add to selling pressure that will pull down the price to the levels around the $3500 mark or those lower.

In conclusion, the leveraged ETH position by the whale is another example of the high-risk profile of the DeFi platform, whereas current market sentiment underlies general risk aversion among participants in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。