If you are looking for a simple and stable effective investment method, Bitget Launchpool is a good choice.

Author: OneshotBug

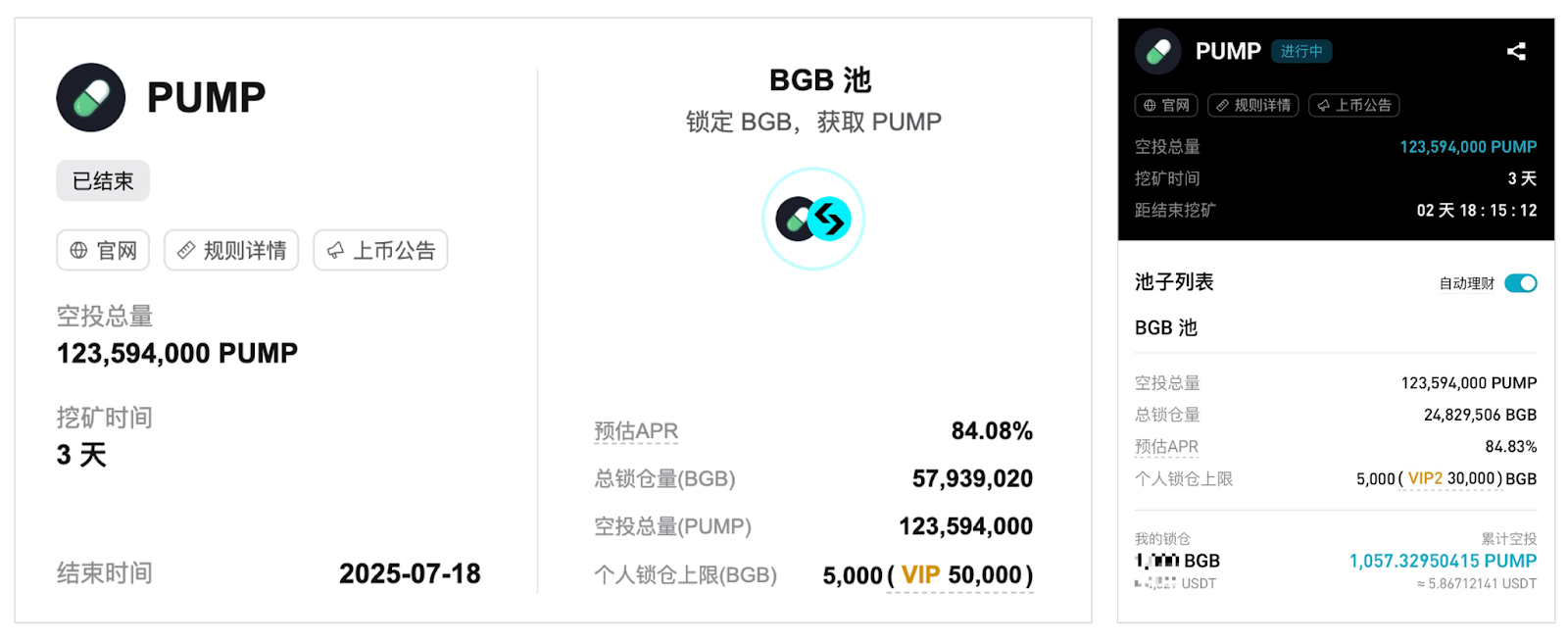

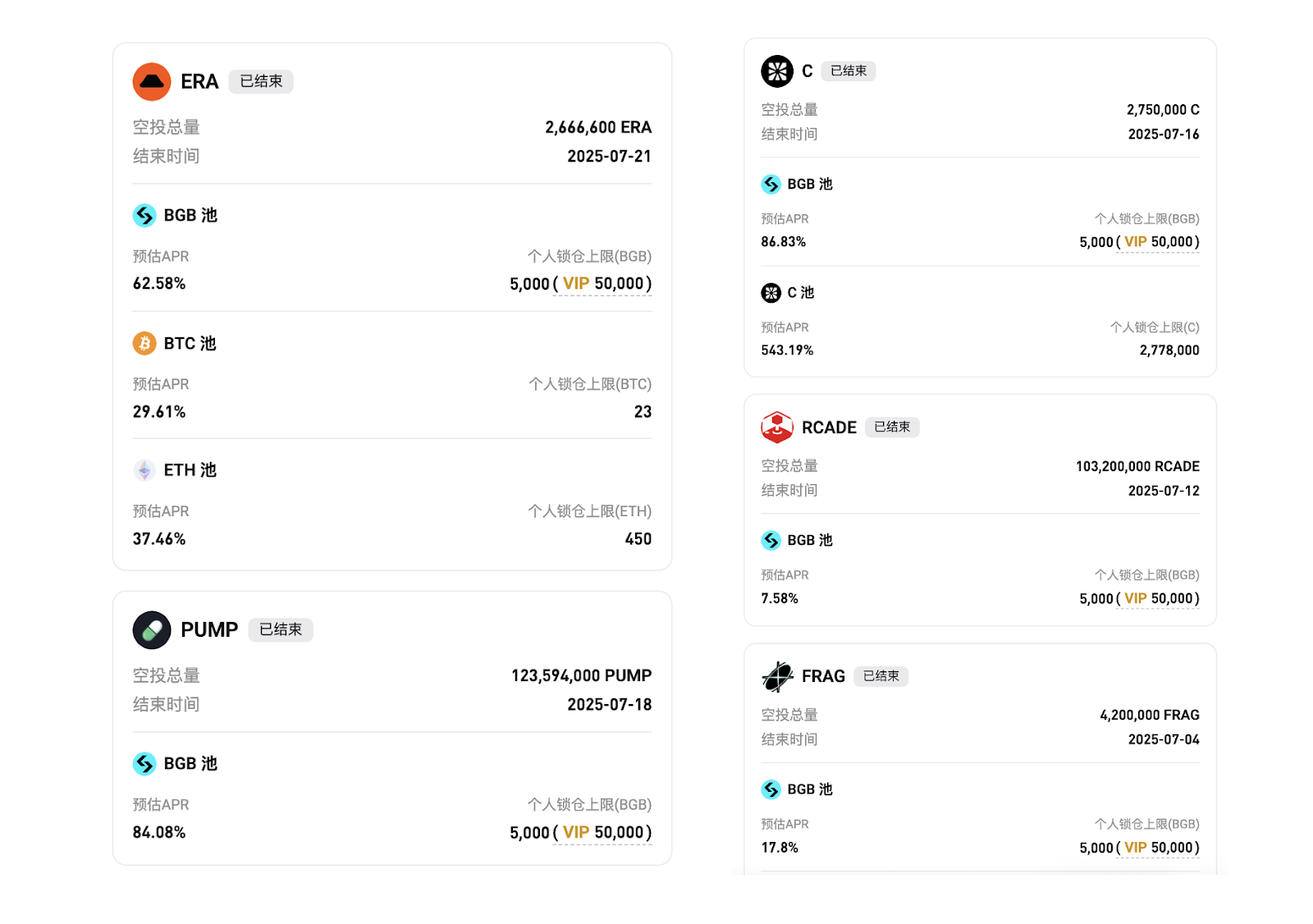

In the cryptocurrency market, while the opportunities for high returns in the short term are tempting, rational investors should focus more on stable returns and long-term appreciation. The significant increase in returns from Bitget Launchpool after launching major projects like ENA, SONIC, and ELX caught my interest. In July, it launched star projects like C, PUMP, and ERA, among which PUMP (Pump.fun) has generated a lot of buzz, and C (Chainbase) is listed on Binance.

After personally experiencing these recent activities, I no longer view Bitget Launchpool as a short-term speculative tool, but rather as a long-term investment channel that allows for "multiple gains from one investment" with continuous capital rotation. If you are looking for a simple and stable effective investment method, Bitget Launchpool is a good choice. The latest GAIA project is about to open for investment, confirmed to be listed on Binance Alpha, and it is likely to yield good returns, making it worth trying.

In the following article, I will share how to ensure stable returns from the same capital across consecutive Launchpool activities while effectively avoiding the high volatility risks of the market.

Bitget Launchpool Activity Review: From Participation to Returns

To better assess the potential of Bitget Launchpool, I participated in all recent activities, including C, PUMP, and ERA, and the returns from each project met expectations, gradually validating the platform's effectiveness in providing stable returns.

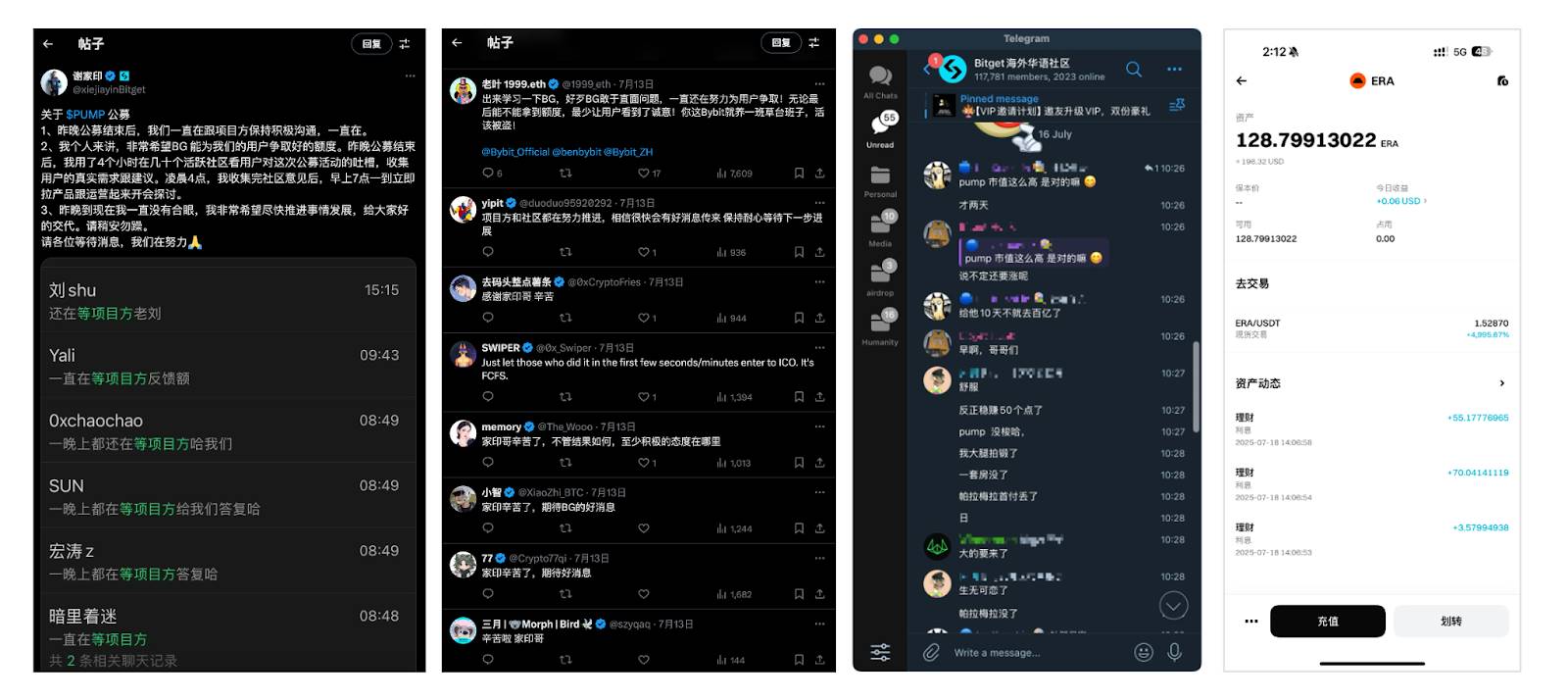

In terms of project returns, the PUMP project had a short-term APR that once reached 1,273.32%, and ERA's short-term APR peaked at 4,958.73%. According to shares from other users in Twitter and TG groups, many had satisfactory gains. For example, one investor earned 128 ERA (approximately 200U) within an hour during the ERA activity, ultimately yielding over 5000U. The community was filled with positive feedback, leading to a significant reputation boost.

Return Estimation: Assuming you invested 10,000U in early July to exchange for BGB to continuously participate in all activities, the final returns could reach approximately 1,460U, with an annualized return exceeding 175%. The composition of returns includes:

Directional gains from the increase in BGB itself: 1,220U

Hedged returns from Launchpool staking: 240U, with the hedging strategy serving as a source of risk-free returns.

These examples clearly demonstrate that Bitget Launchpool provides participants with continuous and stable returns through good market performance and activity arrangements. These returns not only meet expectations but also showcase the platform's strong resource allocation and robust return structure.

What Makes the Bitget Launchpool Model Unique?

Based on the current projects, gameplay, return rates, and public information of BG's Launchpool, here are its attractive features:

- Distribution Method: As Fair and Diverse as Possible

Many platforms often implement a "first-come, first-served" model, which, while logically fair, makes it difficult for many retail investors to obtain shares. Bitget Launchpool adopts a more diverse distribution method, primarily based on staking volume, allowing more users to secure shares, which has received very positive feedback from the community.

- Excellent Return Rates: Satisfactory Gains and Intensive Activity Arrangements

Many recent projects in Bitget Launchpool have yielded good returns, which is a significant reason for attracting investors. During market fluctuations, these activities can provide participants with stable and considerable returns, which is very positive for a wide range of retail investors.

- Platform Influence: Quality Projects and More Project Shares

From the quality of recent cooperative projects and the shares allocated to BG, BG's position as the fourth-largest and rapidly growing exchange has been recognized by project parties. For instance, in addition to the projects C, PUMP, and ERA launched in July, there were also strong background projects like ENA, SONIC, and ELX; in the PUMP project, BG successfully secured the highest allocation. This creates a positive cycle where the platform attracts project parties, and project parties can cooperate with the platform to provide users with more profit opportunities. By participating in these quality projects, users can enjoy higher returns and have greater trust in the platform. This is beneficial for project parties, BG, and users alike.

These combined advantages not only make Bitget Launchpool stand out in the market but also provide investors with a stable and efficient investment channel, making it a noteworthy opportunity for both beginners and seasoned investors.

Rolling Strategy: Seamless Transition Between Activities for Stable Returns

Bitget Launchpool now operates in my investment portfolio planning with a rolling strategy. Simply put, it involves converting the returns from each round of activities into BGB and then reinvesting it into the next round of activities, ensuring continuous capital flow and maximizing returns.

Core Idea

After participating in each Bitget Launchpool activity, I convert the token rewards into BGB instead of withdrawing them, and then continue to participate in the next round of activities. The benefit of this approach is that it avoids idle capital periods, ensuring continuous operation of funds and achieving compound growth. This strategy ensures that my returns from each activity are not idle and are continuously converted into more gains.

Specific Operational Process

The rolling operation is very simple and is not much different from regular investment operations. After each activity ends, I quickly liquidate the returns obtained and convert them into BGB. Then, based on the content of the next round of activities and the price trend of BGB, I decide how much BGB to invest. This process is efficient and continuous, with no need for extensive information monitoring; just a quick look at the activity page beforehand is sufficient. After each operation, I summarize the results, analyze the performance of returns, and adjust my strategy based on market changes to better optimize the next round of investments.

Strategy Advantages

The most significant advantage of the rolling strategy is that it avoids idle capital periods. Many platforms leave funds waiting for a long time after activities end, which is a loss for investors. Rolling enhances the continuity of investments, as returns are quickly reinvested after each activity ends, maximizing returns and effectively diversifying the risk of market fluctuations. Even if the prices of certain project tokens fluctuate, the funds remain in a steadily growing state.

This strategy theoretically applies to other similar staking or yield investment projects, but currently, many platforms have low frequencies of Launchpool activities and lack continuity, making BG seem like the only option at present.

My Changing Positioning of BGB: From Passive Holding to Active Operation

In my current investment strategy, BGB has gradually shifted from an initial "hold and wait for appreciation" to an active tool in my asset allocation.

Initially, my strategy for BGB was quite simple: hold and wait for appreciation. Especially after experiencing the market rise at the end of 2024, I was confident in the appreciation of BGB, continuously increasing my holdings and viewing it as a "passive asset." However, with the gradual development of Bitget Launchpool activities and BGB often being used as the main pool currency, BGB has become the core asset of my Launchpool rolling strategy.

In the composition of returns from Launchpool, the price increase of BGB itself is an important component of returns, so expectations for BGB's price are crucial. Considering last year's market, a high V/MC ratio, ongoing planned burnings, and the community feedback from Launchpool, I remain relatively optimistic about its price.

Risk Control and Sustainability: Rational Thinking Behind High Returns

Although Bitget Launchpool offers quite attractive high returns, as investors, we need to recognize the potential risks involved. No investment tool is without risk, and understanding and managing these risks is essential to ensure the sustainability of returns and avoid unnecessary losses.

1. Potential Risks

First, market volatility is one of the biggest risks. The volatility of the cryptocurrency market is unavoidable; even projects with considerable returns may experience price fluctuations due to market sentiment or macroeconomic changes. Tokens like BGB, which are LP pool tokens, have price growth as an important part of returns, but their prices can be influenced by overall market trends, which should not be overlooked. Therefore, as I mentioned earlier, it is still necessary to keep an eye on token prices. Being prepared for sudden fluctuations is a must for every investor.

Additionally, the risks associated with the projects themselves cannot be ignored. Although Bitget remains cautious in selecting projects, there is still a degree of uncertainty in the market. Some emerging projects may face technical challenges, operational instability, or low market acceptance, which could lead to the expected returns not being realized. Therefore, investors should remain vigilant and continuously assess the actual risks of the projects.

2. Response Strategy: Diversified Investment and Flexible Adjustments

To effectively manage these risks, diversified investment is one of the most common and effective strategies. While I advocate reinvesting all project returns into the next project, I do not invest all my principal each time; instead, I make certain diversified arrangements, such as temporarily converting a portion of BGB into USDT. I believe this can reduce the risk of individual projects and achieve a more balanced return.

Moreover, flexibly adjusting the investment portfolio is equally important. In the event of significant market fluctuations, I will adjust my investments based on the actual market conditions and the latest activities of the platform. For example, if the return rate of a certain project declines, I will quickly shift my funds to choose projects with greater return potential. By responding flexibly to market changes, I strive to keep my investments in an optimal state.

Conclusion: Continuously Optimizing Investment Strategies

In this article, I shared how to achieve stable long-term returns through Bitget Launchpool. Whether participating in high-return projects or using a rolling strategy to continuously invest funds into new activities, Bitget Launchpool demonstrates its unique advantages as a low-risk, high-return investment tool.

Moving forward, I will continue to focus on two key factors: first, the stability of APR in Bitget Launchpool. Although the current return rates are satisfactory, it remains to be seen whether the platform can maintain these high returns as the number of participating users increases. Second, the continuous introduction of quality projects. If Bitget can continue to bring in high-yield projects like ENA, C, and PUMP, and maintain excellent performance in subsequent projects like GAIA, its attractiveness and market position will further strengthen.

Through sharing my investment strategy, I hope to provide readers with some insights to help you find your own stable return path in a complex market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。