Author: 0xBrooker

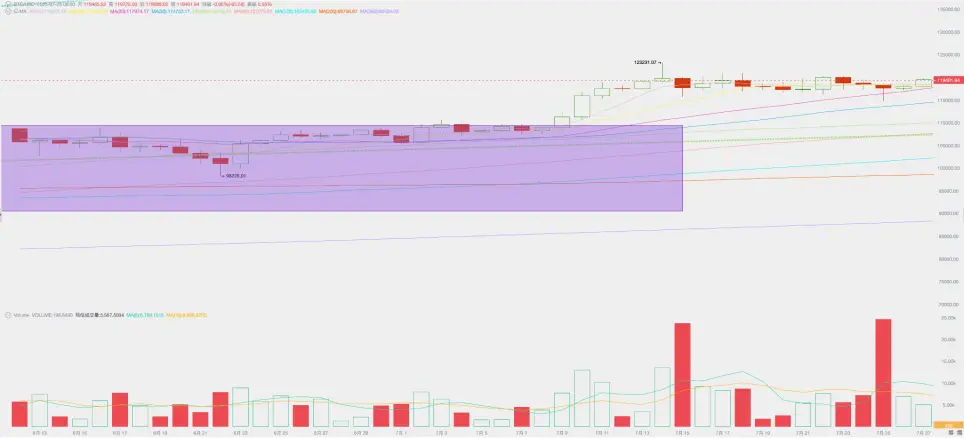

BTC Daily Chart

This week, BTC opened at $117,315.68 and closed at $117,312.70, up 1.84%, with a high of $120,300.00 and a low of $114,750.00, resulting in a volatility of 4.73% and a high trading volume.

The U.S. economic data released this week maintains expectations for a rate cut in September, but the probability of a rate cut is only 64.5%. Due to the deadline of the tariff war on August 1, long positions continue to sell at the key level of $120,000 to realize profits, while buying power from corporate purchases and BTC Spot ETFs absorbs the selling pressure, resulting in a robust buying and selling atmosphere.

As BTC consolidates at a high level, ETH, which surged 26.4% last week, slightly rose 3.07% during its consolidation, supporting expectations for an Altseason. Most small-cap Altcoins experienced declines, but quality projects remained strong, causing BTC's market share to slightly drop to 60%.

Excluding the expectations for a rate cut, the most impactful factor on the market— the reciprocal tariff war—also made further progress this week, with Japan and the EU signing a 15% tariff increase, overall in line with market expectations, leading to a rise in U.S. stocks.

Policies, Macroeconomic Finance, and Economic Data

Following last week's CPI data meeting expectations, the U.S. reported initial jobless claims of 217,000 this Thursday, lower than the expected 226,000 and the previous value of 221,000, once again demonstrating the resilience of the U.S. economy, while also temporarily reducing expectations for a rate cut in September.

On the same day, the preliminary value of the U.S. July S&P Global Manufacturing PMI was 49.5, below the expected 52.7 and the previous value of 52.9, providing slight positive support for a rate cut.

U.S. President Trump made a rare visit to the Federal Reserve to "hold them accountable," but faced a cold response from Chairman Powell. As divisions within the Federal Reserve regarding whether to cut rates have emerged, the upcoming interest rate meeting on July 31 has become more uncertain, but the market generally believes that the probability of a rate cut in July is very low and has already priced this in.

In terms of the reciprocal tariff war, this week saw clear progress in the third phase (signing).

The U.S. and Japan reached an agreement—Japan's exports to the U.S. will uniformly apply a 15% "reciprocal tariff" (significantly lower than the previously claimed 25%-35%), Japan will invest $500 billion in the U.S. over the next 10 years, and agree to further open up automobile and agricultural import quotas. The 15% tax rate, along with investments and U.S. product imports, was below market expectations, leading to a 4.1% surge in the Nikkei index this week.

The U.S. and EU reached an agreement—EU exports to the U.S. (including automobiles) will incur a 15% tariff, while U.S. exports to the EU will enjoy a 0% tariff. The EU committed to an additional $600 billion investment in the U.S., purchasing $750 billion worth of U.S. energy products (mainly liquefied natural gas), and procuring a large amount of U.S. military equipment.

On July 25, the White House updated the draft of the "Reciprocal Tariff Act," raising tariffs generally to 12%, while retaining an additional tax rate range of up to 70%, and announced that it would confirm the final tax rates with about 150 trading partners before August 1.

Although major trading countries such as China, Canada, and Mexico have not yet signed final agreements, the market generally believes that the tariff war is coming to an end, and its impact on the market has been overshadowed by economic and employment data, as well as expectations for rate cuts.

With the resilience of the U.S. economy and expectations for AI spending, most companies that have reported during the Q2 earnings season have exceeded expectations, which has also given funds confidence to continue buying at high levels. The three major U.S. stock indices performed steadily this week, with the Nasdaq, S&P 500, and Dow Jones recording increases of 1.02%, 1.46%, and 1.26%, respectively.

EMC Labs believes that the opening of a rate cut cycle, the impending end of the tariff war, and AI driving growth in U.S. corporate performance are psychological supports for U.S. stocks reaching new highs at high valuations. Similarly, any fluctuations and downward adjustments in these three expectations will also create downward pricing momentum for U.S. stocks and BTC. However, systemic risks in the market have been largely eliminated, and a new economic cycle is about to begin.

Crypto Market

This week, BTC fluctuated in the range of $115,000 to $120,000, with the 5-day and 10-day moving averages converging, and it briefly retraced to the 20-day moving average.

In previous reports, we pointed out that BTC had initiated the fourth wave of this cycle's upward trend, but after challenging $120,000, it returned to a consolidation pattern. The reason is that after a significant rise in early July, the buying momentum weakened due to the uncertainty of the tariff war on August 1, compounded by continued selling from long positions, leading to a pause in the upward trend.

The reduction in long positions is not necessarily all negative; whether on or off the market, we have noticed that funds are rapidly flowing into Altcoins led by ETH.

The crypto market is in a style transition period within the cycle, marked by a reversal in the ETH/BTC trading pair. Subsequently, BTC's rise will come more from corporate purchases and the inflow of funds from the BTC Spot ETF channel.

Fund Inflows and Selling

With the initiation of the fourth wave of the upward trend, long positions have once again started large-scale selling, with over 190,000 coins sold in the past three weeks, leading to a slowdown in inventory reduction on centralized exchanges.

In particular, the awakening and selling of ancient whales have created significant psychological pressure on the market. In the absence of sufficient buying power on the market, strong buying power from off-market sources has provided strong support for BTC prices.

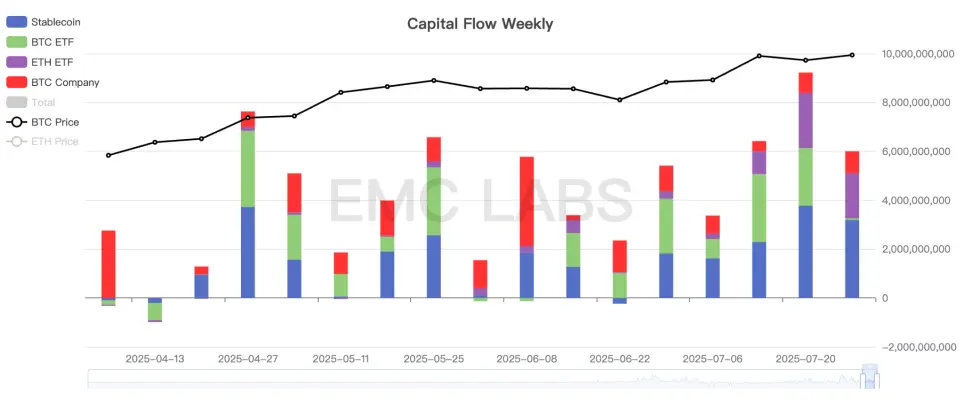

This week, the total inflow of funds into the market reached $6.002 billion, with stablecoin channels accounting for $3.192 billion, BTC Spot ETF channels $702 million, corporate purchases $898 million, and ETH Spot ETF channels $1.842 billion, once again surpassing the buying power of the BTC Spot ETF.

Two changes occurring off-market are that corporate purchases have become the main buying force, and there are signs that ETF channel funds are shifting from BTC to ETH. These two changes are worth close attention.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0.5, indicating an upward phase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。