撰文:Viktor

编译:Shaw 金色财经

一家比特币财库储备公司的目标是什么?是提高每股比特币的比例,即公司持有的比特币总量与公司完全稀释后的股份数量之间的比率。

微策略(Microstrategy)公司并非试图通过比特币交易来把握时机并获取美元收益,他们唯一的关注点在于通过以增值的方式在其资产负债表中增加比特币,从而提高每股比特币(BPS)的比例。

我们称其持有的比特币规模为「资产净值(NAV)」,称其市值与资产净值的比率即为「溢价市值(mNAV)」。如果一家公司的市值为 100 亿美元,其持有的比特币价值 50 亿美元,那么该公司的溢价市值为 2。(假设该公司股票供应量为 1 亿股,每股 100 美元,比特币价格为 10 万美元。这意味着该公司持有 5 万枚比特币,即每 1000 股对应的比特币数量为 50000/100000 = 0.5 枚。)

比特币储备公司提升其每股收益(BPS)的主要方式是通过「ATM」(市价发行)计划:发行新股,直接在市场上出售,并用所得收益购买更多的比特币。这就是我所说的储备公司可以利用的第一种途径。

第一部分:股票(ATM)

回到我的例子,这家市值 100 亿美元的公司可以发行价值 10 亿美元的新股,将其出售到市场,然后立即用所得现金购买价值 10 亿美元的比特币。假设股票和比特币的价格没有变动(这只是为了理解背后的数学原理),那么该公司的新市值为 110 亿美元,新资产净值为 60 亿美元。其资产净值溢价现在为 11/6 = 1.83,所以有所下降,但其每股比特币比率现在为 60000/110000 = 0.545,所以有所上升。然后我们可以定义一个「比特币收益率」,即每股收益的增长:0.0545/0.5 = 1.09,即 9% 的收益率。

该公司以「增值」的方式购入了更多的比特币:即便在股票数量有所稀释的情况下,这种稀释在每股收益方面仍是增值的,因为这一比率有所上升。

这种操作是比特币财库储备公司最常用的手段,只有当公司交易价格高于其资产净值时才能进行,即 mNAV 溢价高于 1 时。mNAV 溢价越高,这种 ATM 操作就越有利可图,从而产生更高的「比特币收益率」。

基本上,公司管理层是在以溢价向短期股票买家抛售股票,而他们获取的收益最终会惠及长期持股者。(但显然短期买家有可能成为长期持股者,所以如果认为从长期来看值得,那么理性地接受以较大溢价买入也是可以的)

公司市值与其资产负债表之间的这种「套利」理论上也可以反向操作:如果公司股价相对于其资产净值有大幅折价,那么管理层可以决定出售其资产负债表中的比特币来回购股票,这一操作也会提高每股比特币的数量。

在这两种情况下,管理层都在与那些要么以大幅溢价买入、要么以大幅折价卖出的短期股票交易者进行交易,这些操作所获收益会重新分配给长期股东,他们的每股账面价值得以提升,这意味着以比特币计价的所持股票的理论「底价」在上涨。

实际上,迄今为止对该公司最具吸引力的操作是,在溢价高于资产净值(mNAV)时出售股票,因为在 mNAV 贬值时出售则更为棘手:首先,如果规模足够大(在策略方面确实如此),这可能会对基础资产(比特币)的价格产生负面影响,从而导致潜在的「死亡螺旋」(即比特币和股票价格双双下跌)。其次,这会向市场传递负面信息,使公司看起来更弱,还会使其规模缩小。最后,这种操作可能涉及税收问题,从而降低其盈利能力。

因此,一家比特币储备公司主要会专注于以较高的每股资产净值出售股份,以增加每股收益并产生比特币收益。值得注意的一点是,鉴于股东购买比特币储备公司是为了其比特币收益,更高的比特币收益就证明了以更高的每股资产净值购买此类公司的合理性,而这也将使公司能够持续产生更高的比特币收益。较高的每股资产净值既是原因也是结果。

「这听起来不可持续,只有存在更傻的人愿意溢价购买,这种做法才能奏效!」没错,这大体上是对的,这就是为什么仅靠出售股票(ATM)来运作的比特币储备公司是个残缺的工具,任何有抱负的比特币储备公司还应当利用第二种手段来获取比特币收益:在股权之上使用债务。

第二部分:债务(杠杆)

企业使用债务的方式非常直接:如果您认为比特币将以一定的复合年增长率(GAGR)(即年化投资回报率)增长,那么您可以发行利率低于该复合年增长率的固定收益工具,并以比特币收益的形式「获取差额」。

我不会详述一家公司可能会使用哪些债务工具,但假设它能以每年 8% 的利率借款,并预计比特币每年的复合增长率超过 20%。那么,该公司可以借入美元,用所得款项购买比特币,从而获得 12% 的利差(20%-8%),然后通过更高的每股收益比率将收益回馈给股东。

显然,我知道人们极其害怕杠杆,往往认为在加密货币领域使用任何杠杆都会让你血本无归,但:1/ 我写了一整篇文章(即将更新)来介绍微策略(Microstrategy),表明他们的杠杆使用非常保守,爆仓的可能性极低;2/ 显然,适度使用杠杆是有可能跑赢比特币的,尤其是当你有债务期限的保护时。

一个简单的思维模型可以理解像微策略这样的公司所涉及的杠杆类型,即想象一个 1.2 倍杠杆的长期比特币多头头寸,只有在比特币价格连续三年低于理论上的「平仓价格」时才会被强制清算。

如果一家公司能够通过加杠杆的方式永久性地获得更多比特币,那么它将能够拥有一个表现优于比特币的储备,从而为股东提供比特币收益。长期股东可以将每股比特币价值比率视为其股票价格的理论底线,而且这个底线会以比特币计价的方式永久性上升。比特币储备公司本质上就是一种设计用来超越比特币表现的工具。这就是为什么有些人愿意以高于账面价值的价格长期持有这些公司的股票,而不会成为冤大头。

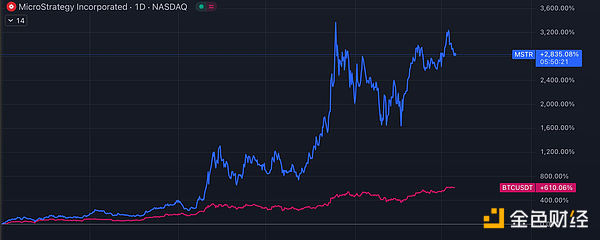

例如,在 2024 年,微策略(MSTR)为其股东创造了 75% 的比特币收益。这意味着,如果 2024 年初你的每股价格下限为 0.001 比特币,那么到年底就变成了 0.00175 比特币。如果你在 2024 年初以 1.75 倍的资产净值购买 MSTR,那么你支付的超过资产净值的全部 75% 的溢价在仅仅一年内就全部收回了。

由于市场预期一家公司未来能够为其股东提供的比特币收益,因此以高于账面价值的价格买入该公司股票完全合理,而「用 1 美元的比特币换 3 美元」的说法完全是无稽之谈。

全栈式加密储备公司的成长路径是什么?

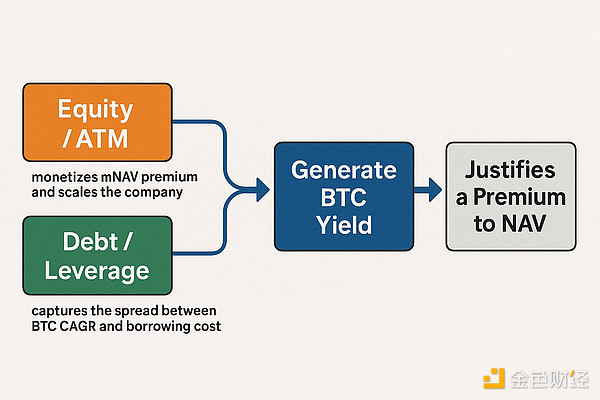

所以,回顾前两部分的内容,一家「全栈式比特币储备公司」应该有「两条腿」:第一条是股票,第二条是债务。通常,它们从股票开始,并利用 ATM 来启动飞轮。通过建立定期购买比特币的一贯记录,公司作为严格遵循 Michael Saylor 策略的比特币储备公司建立起信任,这促使投资者给予其较高的溢价,从而让公司能够获得不错的比特币收益。

使用 ATM 有助于扩大公司规模,一旦达到一定规模,他们就可以开始发行固定收益工具,这证明了他们可以再次「利用」的更高资产净值,从而进一步扩大规模,只要条件允许,就可以重复这一过程。

「那会持续多久呢?」嗯,只要比特币的复合年增长率显著高于他们债务的利息支付,我想这种状况还能持续很久……显然,决定这样一家公司能以多快的速度发展的主要因素在于其市值相对于资产净值的溢价有多大,而这由市场决定,取决于关注度、公司看起来有多可靠、首席执行官有多有魅力等等。

另一条普遍规则是,随着公司规模的扩大,mNAV(市场资产净值)理应逐渐降低,但这并不意味着溢价会在 1 时结束,中 / 长期的均衡 mNAV 完全有可能超过 1.5。这也不意味着在一家小公司溢价极高时买入就是糟糕的选择,因为如果该公司提供的比特币收益率足够高,这种做法也是可以被合理化的。正如我之前所写,每次 ATM 操作都会降低 mNAV 溢价,但这并不一定意味着在同一时期内你的表现逊于基础资产(比特币)。理论上,一家公司的 mNAV 可能从 5 倍降至 2 倍,而在此期间比特币和股票的价格都保持不变。

山寨币财库储备公司呢?

既然我已经讲了比特币财库储备公司的情况,那其他币种的储备公司又如何呢?嗯,它们基于的模式完全相同。但显然存在巨大差异,因为使用其他币种作为基础资产意味着使用的是一个实力弱得多的资产,而且「只涨不跌」的可能性也小得多。

这意味着使用固定收益部分要危险得多,大多数公司可能都不会选择这条道路。如果你的山寨币随着时间的推移逐渐跌回零值(大多数山寨币都是如此),那么以每年 8%(甚至 4%)的利率借入美元来购买山寨币显然是个糟糕的主意。

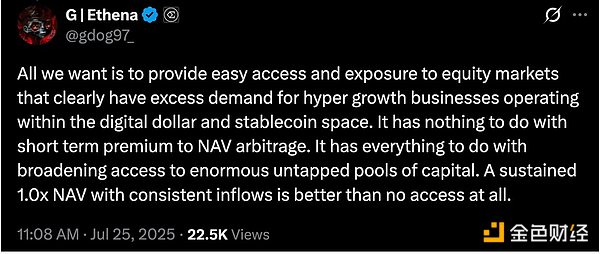

也许思考这些财库储备公司的最佳框架是 Guy Young(Ethena 创始人)在这里提出的框架:

山寨币储备公司只不过是一种工具,能让公开市场(及其庞大的规模)以不完美的方式接触到山寨币。这对股票买家来说是有利的,因为即便溢价购买底层资产也比根本买不到要好(如果他们看涨的话),而且对山寨币来说也是有利的,因为与仅依靠加密原生资金池相比,它带来了全新的资金流。

但与比特币储备公司相比,山寨币储备公司仍是残缺不全的工具,因为它们无法利用股权和债务这两条路径来产生比特币 / 加密货币收益。这意味着这些公司的市场资产净值更有可能趋向于 1,甚至可能折价交易。但比特币储备公司并非如此。

至于以太坊的储备公司,它们完全可以效仿 Michael Saylor 的策略,利用固定收益工具。如果你认为以太坊的长期复合年增长率与比特币相似,那么这确实是个好主意,但如果您对以太坊的未来没有那么坚定的信心,那么发行债务来购买以太坊的风险就大得多。

总结

1. 真正的「全栈」财库储备体系有两个方面

- 第一阶段:股票 /ATM 转化了 mNAV 溢价,是公司实现规模扩张的关键工具。

- 第二阶段:债务将比特币复合年增长率与借款成本之间的差额货币化。

2. mNAV 优质股溢价大于 1 可能非常合理:

如果比特币收益率(BPS 增长)≥支付的溢价,长期持有者仍会获利。

3. 山寨币财库储备是单一的,即残缺的工具:

如果没有债务杠杆,从长期来看,它们应该会向 1 倍的 mNAV(或更低)靠拢。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。