Strategy Bitcoin Push Expands as $2B IPO Fuels BTC Holdings

From software to Strategy Bitcoin Proxy

Strategy (formerly MicroStrategy) which was once known primarily as a business intelligence software firm has now transformed completely into a crypto corporate proxy. The company is under the leadership of its co-founder Michael Saylor who is very confident about BTC's and his predictions over it.

But recently, the firm created waves in the crypto industry when it aggressively increased its BTC Holdings and now plans to raise up to $2 billion. A recent post of Arkham shared on X, suggesting that MicroStrategy is on its way with Saylor and will buy all time high Bitcoin forever.

Source: X

The firm has set a $2 billion target and $500 million is the starting of it. Shared by Michael Saylor on his social media post. Strategy Bitcoin is launching $STRC, a new preferred stock, through an IPO for selected investors only.

Source: X.

Leveraging convertible notes to fuel Golden asset

To fund these purchases the firm is relying on convertible senior notes that is a financial tool that allows them to borrow money at lower interest rates while deferring stock dilution. This approach of the Strategy Bitcoin will take on debt without immediately affecting its shareholders.

The firm is betting big that asset's future gains will outweigh the cost of borrowing, effectively tying its balance sheet to the virtual currency’s long-term performance.

Could firm's $2B Bet Trigger an asset Supply Squeeze?

This strong move of the firm is a bold corporate financial decision that could influence the entire cryptocurrency ecosystem. A $2 billion investment into BTC could tighten supply and send signals to other institutions that BTC is becoming a serious reserve asset.

With only 21 million BTC ever to be mined if companies purchase it on a large scale then it may increase demand and create scarcity.

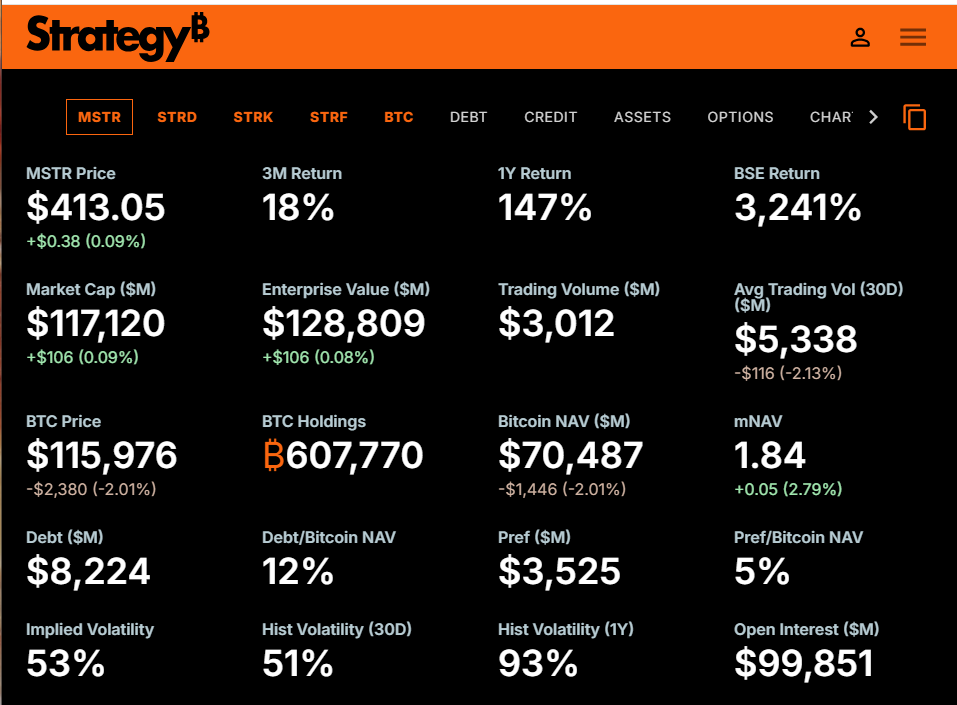

The company is currently having 607,770 BTC and not stopping itself in buying more which is trading at $115,976 (at the time of writing)

Source: MSTR

Risks loom large amid market volatility

However, the Strategy Bitcoin is not without risks; the BTC’s price swings could lead to substantial losses if the market turns bearish. The company is buying it to keep it as a reserve as confidence says it is the real gold and the future is Orange.

For which, critics argue that diverting billions toward Golden asset could distract the company from original business mission and potentially destabilize its long-term growth.

Conclusion

Strategy Bitcoin expanded $2billion offering marks a turning point in corporate crypto adoption. As traditional companies increasingly explore digital assets, MSTR stands out both a pioneer and a high-stake gambler.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。