Dormant Bitcoin Whale Moves Entire $9.5B Stack After 14-Year Silence

Is the BTC Rally at Risk as Satoshi-Era Giant Moves $4.77 Billion?

Is one of the oldest Bitcoin Whale planning for a major sell-off that could revamp the whole crypto market? A Satoshi-era wallet , dormant for over 14 years, just transferred the second half of its massive hoard, fueling market-wide speculation and fear. As golden asset hit a fresh all-time high this week, OG movements are progressively pushing up price volatility.

Bitcoin Whale Moves Final 40K BTC-$4.77 Billion in One Go

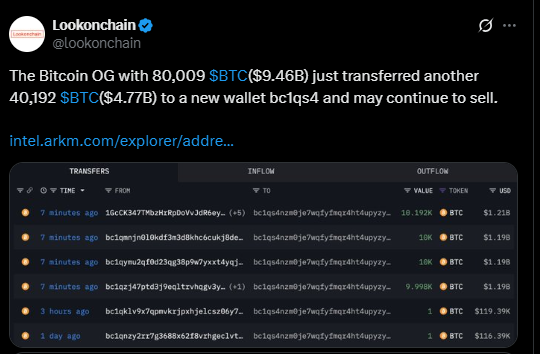

As reported by blockchain analysis platform Lookonchain, a legendary Bitcoin Whale that has been active since Satoshi Nakamoto times has recently moved 40,192 token worth about $4.77 billion to a new wallet. This is the second huge transfer from the same player in mere days.

Source: X

In recent days, the same address moved 40,009 coins to Galaxy Digital, an exclusive asset management firm. Galaxy Digital later sent 6,000 coins, around $706 million, to leading crypto exchanges Binance and Bybit, possibly getting ready for liquidity/sale.

Timeline: 14 Years of Dormancy Ends with Two Massive Transfers

This dormant wallet was first observed by Lookonchain on July 4, 2025, when it commenced the shift for the first time since 2011. Treasure was originally divided between eight wallets, with 20,000 token received in April 2011 at just $0.78 per coin, just before hidden pioneer Satoshi Nakamoto sent his final known message.

The remaining 60,009 BTC were shifted to six other wallets in May 2011, when the asset was priced at just $3.37. The total holding of over 80,000 BTC, now calculates more than $9.46 billion, had gone unaltered until this month.

Could a Sell-Off Be Imminent?

The back-to-back Bitcoin Whale transfers arrive at a critical juncture. On Monday, Bitcoin crossed $122,000 , hitting a new all-time high. However, the price quickly corrected, with CryptoQuant analyst Crazzyblockk opining that the dip was spurred by Bitcoin Whale taking profits.

With a whopping $4.77 billion value of coin newly shifted, market players are in alert mode. The worry? If even part of these funds landed on exchanges, it would put downward pressure on the price and trigger cascading liquidations.

Not Just One, Another Bitcoin Whale Awakens

Turning up the tension, another inactive Bitcoin Whale also woke up this week. After six years of stillness, this smaller Bitcoin Whale moved 1,042 BTC, valued at $123 million, to a fresh wallet, according to Nansen.

Lookonchain updates the BTC and was initially drawn from Braiins Mining and Xapo Bank, bought at nearly $8,746 per coin. The total investment of $9.12 million has now surged into a high nine- figure portfolio.

Who Still Holds the Most Coins?

In spite of these awakenings,major holders remain unmoved. Here are the biggest known holders:

-

Satoshi Nakamoto – ~1.096 million BTC (untouched to this day)

-

Winklevoss Twins – ~70,000 BTC

-

Tim Draper – ~30,000 (acquired from the U.S. Marshals auction)

-

Michael Saylor – ~17,732 (private, separate from MicroStrategy)

These enduring holders serve as a pillar of consistency in a market prone to fleeting volatility caused by OG activity.

What’s Next for Digital Asset?

The crypto market is currently keeping an eye on the blockchain like a hawk. If the recently relocated 40K BTC ends up on centralized exchanges, then it could be indicative of sell intent, potentially disrupting sentiment and triggering further price corrections. But if the currency gets stored in cold storage or is utilized for institutional custody, then the effect could be dampened.

Either way, this unusual Satoshi-era OG behavior is a sobering reminder of the quiet titans that remain hiding beneath the surface of the crypto sea.

Final Thoughts

While golden asset rewrites market records and crosses the $122K mark, long-dormant wallets are resurfacing to claim legacy fortune. But will these billion-dollar actions lead to a market unload or simply be a realignment for industrial security?

One thing is certain, the actions of early lovers or holders will continue to shape the narrative for modern investors.

Also read: Pudgy Penguins Price Crash After Whale Moves: What’s Next?免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。