Under the Bitcoin craze, four listed companies are taking a different approach by betting on Ethereum's capital reserves.

Written by: Christopher Rosa

Translated by: Saoirse, Foresight News

Michael Saylor's innovative strategy at MicroStrategy (stock code MSTR) has been groundbreaking. He significantly increased his Bitcoin holdings using financial instruments, sparking a trend among businesses. Since then, more than 50 companies have followed his Bitcoin-centric capital reserve strategy, and this number continues to rise. However, a group of visionary companies is now taking a different path: they are not only pursuing exposure to cryptocurrencies but are also focusing on a deep alignment with Ethereum's own economic engine.

In this report, we will focus on the first four U.S. listed companies that have established Ethereum reserves, analyzing their financing activities, assessing their "Ethereum concentration" (the amount of Ethereum held per share), and examining the market premium investors assign to these Ethereum-backed companies' capital reserves. In addition to the aforementioned metrics, we will explore the broader implications of this phenomenon on the health of the Ethereum network, the staking ecosystem, and DeFi infrastructure, emphasizing that these capital reserve strategies are not only reshaping corporate balance sheets but also injecting capital directly into the core areas of Ethereum's decentralized economy.

SharpLink Gaming (SBET)

Company Background

SharpLink Gaming Ltd. (NASDAQ: SBET) was founded in 2019 and is a technology company. It matches sports enthusiasts with timely sports betting and interactive gaming services through its proprietary platform, converting them into betting users. Additionally, the company develops free games and mobile applications and provides marketing services to sports media organizations, leagues, teams, and betting operators to deepen fan engagement. Moreover, SharpLink operates live fantasy sports and simulation games, with over 2 million users and an annual spending of nearly $40 million. The company has also obtained operating licenses in all U.S. states where fantasy sports and online betting are legally permitted.

Last month, SharpLink began accumulating Ethereum (ETH) on its balance sheet and financed these acquisitions through a combination of private equity investments (PIPEs) and at-the-market (ATM) offerings. The company's management team stated that this strategic shift stems from their strong confidence in Ethereum's future, believing that as a revenue-generating, programmable digital asset, it can allow the company to profit from staking and related opportunities. Despite adopting this novel financial strategy, SharpLink remains fully focused on its core gaming and interactive betting business, with the Ethereum capital reserve strategy serving as a supplement rather than a replacement for its core operations.

Financing and Ethereum Acquisition

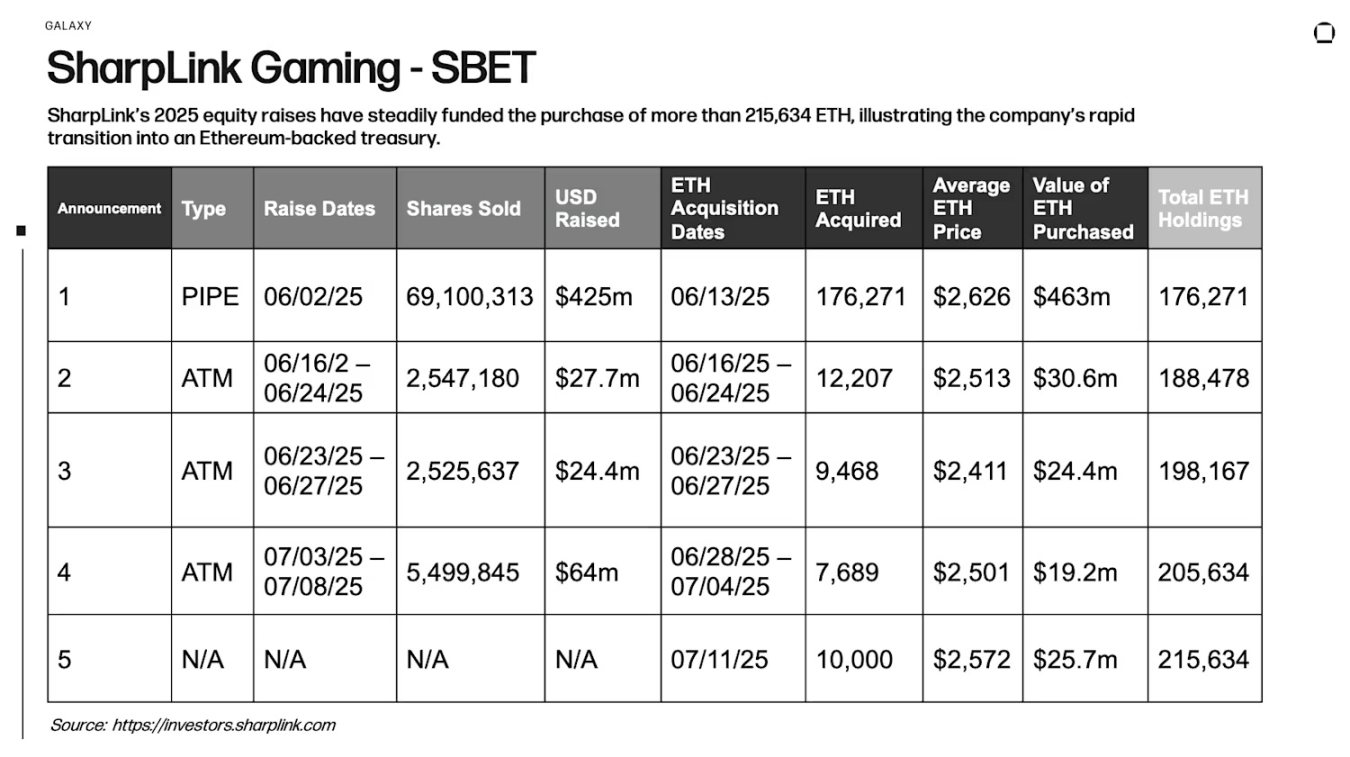

In 2025, SharpLink raised funds through equity financing, which have been steadily used to purchase over 215,634 Ethereum, indicating that the company is rapidly transforming into an Ethereum-backed capital reserve model.

Ethereum Deployment and Staking

SharpLink has staked all of its Ethereum reserves, earning a reward of 100 Ethereum from June 28 to July 4, and the total staking rewards have reached 322 Ethereum since the staking program began on June 2.

Key Points

SharpLink Gaming's strategic move into Ethereum has made it the listed company with the largest Ethereum reserves. Through multiple rounds of equity financing (including a large $425 million private equity investment and subsequent ATM offerings), the company has quickly accumulated the largest Ethereum holdings in the industry. Although this capital reserve strategy carries risks (including the impact of Ethereum price volatility), it also holds significant staking yield potential, highlighting the appeal of proof-of-stake digital assets as capital reserves. By staking 100% of its Ethereum reserves, SharpLink not only generates income but also directly contributes to the security and stability of the Ethereum network. This enriches the diversity of validator participation and fosters a synergy between corporate capital and protocol health.

BitMine Immersion Technologies (BMNR)

Company Background

BitMine Immersion Technologies Inc. (NYSE American: BMNR) is a blockchain infrastructure company based in Las Vegas, operating industrial-scale Bitcoin mining facilities, selling immersion cooling hardware, and providing hosting services for third-party mining equipment in regions with lower energy costs, such as Texas and Trinidad.

On June 30, the company raised approximately $250 million through a private placement of 55.6 million shares (priced at $4.50 per share) to expand its Ethereum reserves. As part of the transaction, Fundstrat co-founder Tom Lee was appointed as the chairman of BitMine's board, adding the guidance of a seasoned cryptocurrency strategist to the company's efforts to scale its Ethereum allocation.

Financing and Ethereum Acquisition

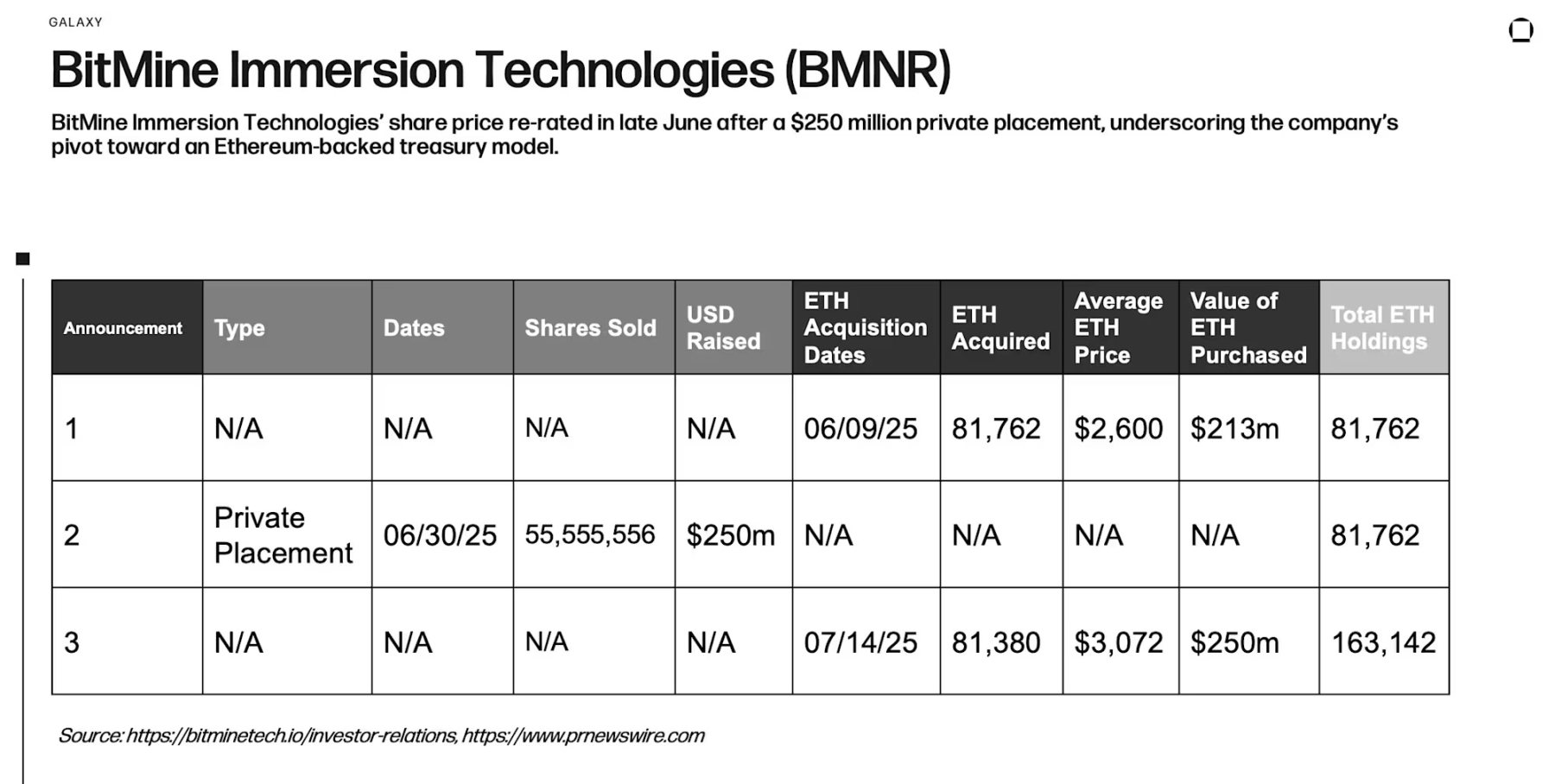

In late June, after completing the $250 million private placement, BitMine Immersion Technologies' stock was revalued, highlighting the company's shift towards an Ethereum-supported capital reserve model.

Ethereum Deployment and Staking

BitMine holds a substantial amount of Ethereum reserves, but as of the writing of this article, there is no public information confirming whether it has actively staked any portion of its reserves or deployed them on-chain in other ways.

Key Points

Through the $250 million financing, BitMine added approximately 81,380 Ethereum to its balance sheet, bringing its total holdings to over 163,000 Ethereum. To support this reserve accumulation, BitMine diluted its post-offering equity to over 56 million shares, an increase of about 13 times. Such a scale of dilution underscores that implementing a large-scale Ethereum reserve strategy requires substantial equity issuance support, reflecting the capital-intensive nature of accumulating Ethereum in the public market.

Bit Digital (BTBT)

Company Background

Bit Digital Inc. (NASDAQ: BTBT) is a digital asset platform based in New York, founded in 2015, initially operating industrial-scale Bitcoin mining facilities in the U.S., Canada, and Iceland.

In June 2025, the company completed a fully underwritten public offering, raising approximately $172 million; at the same time, it combined the proceeds from the sale of 280 Bitcoin with the offering funds to reinvest in Ethereum, accumulating approximately 100,603 Ethereum. Under the leadership of CEO and cryptocurrency veteran Sam Tabar, the company has transitioned to an Ethereum staking and capital reserve model.

Financing and Ethereum Acquisition

The chart traces Bit Digital's equity financing from June to July, the sale of 280 Bitcoin, and the reallocation of these funds to acquire over 100,000 Ethereum, highlighting the company's shift towards an Ethereum-centric capital reserve model.

Ethereum Deployment and Staking

As of March 31, Bit Digital held approximately 24,434 Ethereum, of which 21,568 were actively staked, with an average annual yield of 3.2% for Ethereum staking in 2024.

After the strategic adjustment, Bit Digital significantly expanded its Ethereum reserves through public offerings and the sale of Bitcoin, increasing its total holdings to 100,603 Ethereum. Although the company has not disclosed the specific staking amounts and expected yields post-transition, based on past operations, it will continue to focus on generating income through Ethereum staking.

Key Points

Bit Digital's transformation of its capital reserves is particularly noteworthy: it combines traditional public equity financing with the unconventional move of liquidating Bitcoin holdings to purchase Ethereum. This strategy sets Bit Digital apart among publicly listed cryptocurrency companies, demonstrating its strong confidence in Ethereum's revenue-generating capabilities. Compared to Bitcoin's passive role on the balance sheet, Ethereum's advantages are more pronounced.

GameSquare (GAME)

Company Background

GameSquare Holdings (NASDAQ: GAME) is a gaming media group based in Texas, owning brands such as FaZe Clan, Stream Hatchet, and GCN, focusing on creating creator-led marketing content for global advertisers targeting Gen Z gamers. In July, the company raised approximately $8 million through a follow-on equity offering and partnered with cryptocurrency company Dialectic to launch an Ethereum capital reserve plan, which could allocate up to $100 million in Ethereum, targeting a yield of 8% to 14%.

Financing and Ethereum Acquisition

The table outlines GameSquare's initial public equity financing, aimed at funding its Ethereum capital reserve strategy in collaboration with Dialectic.

Ethereum Deployment and Staking

As part of a broader digital asset reserve strategy, GameSquare has completed its first Ethereum purchase, acquiring $5 million worth of Ethereum. This move marks the company's official entry into the cryptocurrency reserve space, aiming to diversify its assets and support long-term innovation.

GameSquare's shift to an Ethereum capital reserve strategy represents a bold expansion beyond its core gaming media business. By collaborating with Dialectic and leveraging its Medici platform, GameSquare plans to invest funds in the DeFi space to achieve returns significantly higher than the standard Ethereum staking yield (typically 3% to 4%), targeting returns of 8% to 14%. If this strategy is successfully implemented, it will directly contribute to the stability and development of the entire Ethereum ecosystem by enhancing liquidity in key DeFi protocols and enriching the structure of validator participation. The active involvement of corporate capital will further solidify the foundations of DeFi infrastructure.

Ethereum Concentration (ETH Concentration)

The "Ethereum Concentration" metric was initially proposed by SharpLink Gaming, providing investors with a clear and comparable measure to assess the exposure of publicly listed companies building Ethereum reserves. This metric is centered on the "amount of Ethereum held per 1,000 diluted shares," taking into account all potential equity dilution factors such as warrants, stock options, and convertible instruments. The Ethereum holding data presented is either sourced from direct company disclosures or estimated based on their announced equity financing fully allocated to Ethereum. The diluted share count is derived from company filings, Bloomberg, SEC documents, and financial databases, ensuring consistency and accuracy of data across different companies. This metric offers investors an intuitive tool to evaluate relative Ethereum exposure levels on a per-share basis.

The table compares the "Ethereum Concentration" of publicly listed companies adopting Ethereum reserve strategies, indicating the amount of Ethereum held or planned to be held per 1,000 diluted shares.

Market Capitalization Premium and Book Value of Ethereum Reserves

A comparative analysis of the market capitalization premium of listed companies and the book value of their Ethereum holdings.

The above chart illustrates the relationship between each company's market capitalization and the book value of their Ethereum holdings (calculated as "total Ethereum held × $2,600 cost per coin"). A higher premium multiple indicates that investors value the company's strategic flexibility or future earnings far beyond the value of its underlying Ethereum assets. GameSquare (GAME) leads with a premium of approximately 13.8 times, highlighting the market's high optimism regarding its early Ethereum reserve building; BitMine (BMNR) has a premium of about 5 times following its latest $250 million financing; while Bit Digital (BTBT) and SharpLink (SBET) have relatively moderate premiums, reflecting more restrained market expectations. However, like all cryptocurrency reserve strategies, a significant decline in Ethereum's price could exacerbate downside risks associated with high premiums.

Comparison of Ethereum and Bitcoin Reserve Models

The rise of Ethereum reserves marks a significant strategic evolution for publicly listed companies focused on cryptocurrency business. The Bitcoin model primarily centers around "digital gold," emphasizing the passive preservation or appreciation of reserves; whereas Ethereum takes it a step further by creating active yields through staking and DeFi strategies, which adds extra appeal.

The four companies mentioned above have explicitly positioned Ethereum as a yield-generating reserve asset. SharpLink and BitMine have committed (or plan) to stake 100% of their Ethereum holdings to maximize the rewards from protocol-level staking; GameSquare, on the other hand, is pursuing risk-adjusted returns of 8%-14% through more complex DeFi strategies in collaboration with cryptocurrency company Dialectic, deepening this model. This preference for "yield-generating Ethereum" stands in stark contrast to Bitcoin's reserve "non-yielding passive model," indicating a shift in corporate capital management from solely relying on asset price appreciation to achieving balance sheet growth through active operations.

Unlike many Bitcoin reserve companies that heavily rely on convertible debt and leverage (see Galaxy's latest research report), the four leading Ethereum reserve companies—SharpLink, BitMine, Bit Digital, and GameSquare—are entirely financing their Ethereum reserves through equity issuance. This means they do not have to bear the pressures of debt maturity or interest payment obligations, and there is no default risk even in a downturn in the cryptocurrency market. The non-leveraged model significantly reduces systemic vulnerability, avoiding refinancing and equity dilution risks associated with deeply in-the-money convertible bonds.

The key point is that these Ethereum reserve strategies introduce a structural innovation: productive capital. By staking Ethereum, these companies not only earn the typical 3%-5% native yield from the protocol but also directly contribute to the security and stability of the Ethereum network. The higher the amount of Ethereum staked by corporate holders, the more stable and predictable the network validator ecosystem becomes, thereby forming a long-term synergy between corporate capital and the healthy development of the protocol.

In fact, as of July 9, the amount of Ethereum staked reached a historical peak (over 35 million, accounting for more than 30% of the total supply), and the rise of Ethereum reserve companies may be one of the key reasons driving this trend.

Taking GameSquare as an example, it plans to advance yield enhancement strategies through partners like Dialectic, investing its Ethereum reserves into lending, liquidity provision (market making), and re-staking, among other DeFi-native foundational businesses. This not only amplifies potential returns but also strengthens the ecological foundation of Ethereum's core protocol by enhancing liquidity and attracting institutional participation in decentralized markets.

Who Will Face the Greatest Equity Dilution Risk?

The image compares the impact of private equity investments (PIPE), at-the-market (ATM) offerings, and public stock offerings on equity dilution, highlighting which companies face the greatest short-term risks.

Investors need to carefully assess the behavior of equity financing that adds new shares to the market, especially in PIPE transactions, which can dilute existing shareholders' equity and exert pressure on stock prices. BitMine's large-scale PIPE issuance exposes it to significant dilution risk and stock price volatility in the short term; SharpLink's combination of PIPE and ATM financing will cause immediate dilution and ongoing incremental pressure. In contrast, Bit Digital and GameSquare employ more transparent traditional public offerings, making dilution situations clear and controllable, with relatively lower market risks.

Overall, companies choosing PIPE structures face higher initial market impact risks compared to ATM and traditional public offerings (especially during periods of market volatility). However, all these equity-centric financing strategies avoid the "high-leverage convertible bond" characteristics relied upon by Michael Saylor at MicroStrategy.

Conclusion

On the surface, the dramatic fluctuations of stocks related to Ethereum reserves may resemble the "speculative boom and bust cycles" common with meme coins, but the strategies employed by the first companies to establish Ethereum reserves are fundamentally different. These companies do not rely on hype or passive asset holding; instead, they position Ethereum as a "productive reserve asset," obtaining native yields through staking or, in some cases, investing in more complex DeFi strategies. This characteristic sharply contrasts with the pioneers of Bitcoin reserves, who follow a "passive digital gold" model and often finance their holdings through high-leverage convertible bonds. In contrast, the four Ethereum reserve companies—SharpLink, BitMine, Bit Digital, and GameSquare—support their strategy implementation through equity financing, thereby avoiding the structural vulnerabilities associated with debt repayment pressures and peaks in debt maturity.

Moreover, this capital is not idle. By staking Ethereum, companies directly contribute to the security of network validators and the stability of the protocol layer; companies like GameSquare, which plan to implement DeFi-native yield strategies, may also inject vitality into Ethereum infrastructure such as liquidity provision and lending markets.

Although challenges such as dilution risk, smart contract exposure, and price volatility remain, investors can use tools like dilution impact analysis and the premium-to-book value ratio to comprehensively assess downside risks and the upside potential driven by returns. Ultimately, this first batch of Ethereum reserve models demonstrates a more deeply engaged and productive capital operation. While it has given rise to a type of on-chain corporate reserve exposed to market volatility, this model still has the potential to inject momentum into the strengthening of the Ethereum ecosystem.

Disclosure: As of the date of this report, affiliated entities of Galaxy Digital are currently invested in BitMine and SharpLink Gaming.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。