作者:Zz,ChainCatcher

编辑:TB,ChainCatcher

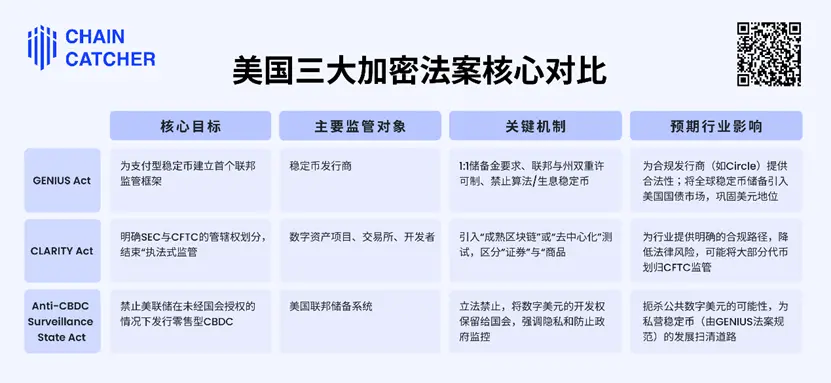

美国国会正在推进关键的加密监管立法。众议院开启"加密周",将对三项重要法案投票:《指导与建立美国稳定币国家创新法案》(GENIUS Act)、《数字资产市场清晰法案》(CLARITY Act)以及《反CBDC监视国家法案》。本文将详细梳理这三项法案如何为稳定币、数字资产交易及央行数字货币划定清晰的法律边界,及其对整个Web3生态的深远影响。

这三项法案将带来的改变:

- 从法律层面阻止美国发行央行数字货币,保护现有加密货币市场空间

- 避免政府数字货币对去中心化金融生态的竞争冲击

- 为私营部门数字资产留出更大发展空间

- 为美元稳定币提供明确的监管框架,降低合规成本

- 稳定币发行将更加规范化,提升用户信任度

- DeFi协议中的稳定币使用将获得更强法律保障

- 为其他数字资产交易提供清晰的市场规则

- 减少监管不确定性,降低项目合规风险

- 为数字资产创新提供更明确的法律边界

GENIUS法案:美元霸权的数字新衣

《GENIUS法案》将为稳定币市场带来全面规范,直接影响每个Web3用户的数字资产体验。

法案要求所有稳定币发行商必须获得联邦或州级许可,并以1:1比例持有美元现金、银行存款或短期美国国债作为储备。这意味着用户持有的每1枚稳定币背后,都有等值美元资产支撑,大幅提升资金安全性。

对用户而言,最重要的变化包括:算法稳定币将被明确禁止,给予两年过渡期,意味着类似Terra/Luna的项目将无法在美国运营。稳定币将无法向持有者支付利息,用户需要寻找其他DeFi协议获取收益。

该法案实际上是美国的金融战略布局。通过强制稳定币储备持有美元资产,预计到2028年全球2万亿美元稳定币市场中,将有1.6万亿美元流入美国短期国债,进一步巩固美元在数字世界的主导地位。

法案对行业格局影响深远。合规美国发行商如Circle将成为最大赢家,其CEO Jeremy Allaire多次表示支持,认为该法案能将稳定币正式纳入美国金融体系,成为企业资产负债表上的"现金等价物",从而打开机构采用大门。

相比之下,小型或不合规发行商将面临巨大合规成本和生存压力,市场可能出现进一步整合。外国发行商若想进入美国市场,也必须满足严格注册和监管要求。尽管法案在参议院获得两党广泛支持,但部分民主党人仍对其消费者保护和国家安全条款力度表示担忧。

CLARITY法案:划定SEC与CFTC的"楚河汉界"

美国加密行业长期受监管不确定性困扰。SEC和CFTC管辖权之争,以及SEC的"执法式监管"策略,让整个行业如履薄冰。SEC坚持用上世纪40年代的"Howey测试"判断数字代币属于证券,不仅扼杀创新,导致整个行业发展受阻,也引发SEC起诉Coinbase等法律战。《CLARITY法案》正是为了终结这场混乱。

法案核心创新在于引入"成熟区块链系统"概念。基本逻辑是:数字资产在初始融资阶段可能作为"投资合同资产"受SEC监管,但随着网络变得足够去中心化,就可转变为"数字商品",由CFTC负责监管。

判断区块链系统是否"成熟"的关键判断标准包括:没有任何实体持有超过20%代币,项目价值主要来源于实际使用而非投机炒作。这意味着真正去中心化的成熟项目将获得更宽松的监管环境。这实际上将"充分去中心化"理论正式写入法律。

根据法案,SEC主要负责数字资产初始发行环节和"成熟度"认证审核,同时保留反欺诈执法权。CFTC则获得对"数字商品"的独家管辖权,包括现货市场。CFTC将成为加密市场主要监管者,其监管风格通常比SEC更加务实和创新友好。这意味着Web3项目可能获得更多发展空间。

Web3项目将有明确的"毕业路径"——从证券监管过渡到商品监管,为长期发展提供法律确定性。用户交易成熟数字资产时,将面临更友好的监管环境,减少突然被认定为"未注册证券"的风险。

这一框架为行业带来前所未有的确定性。Coinbase、a16z等行业巨头纷纷表示支持,认为这正是行业发展所需的法律清晰度。对用户来说,这意味着参与DeFi、NFT等Web3应用时,将有更明确的合规指引和更稳定的监管预期。

反CBDC法案:一场关于"金融自由"的意识形态之战

《反CBDC监视国家法案》是三项法案中意识形态色彩最浓厚的一部。内容简单直接:禁止美联储在未经国会明确授权的情况下,发行面向零售的央行数字货币(CBDC)。

这意味着美国不会推出像中国数字人民币那样的官方数字货币。法案推动者担心CBDC可能成为"政府控制的可编程货币",让政府能够监控、审查甚至限制用户的每笔交易,这与Web3去中心化和隐私保护的核心理念直接冲突。

该法案实际上是在保护Web3生态系统免受政府直接竞争。如果美联储发行CBDC,可能会对比特币、以太坊以及各种DeFi协议构成重大威胁,因为用户可能更倾向于使用"官方"数字美元。

民主党人反对该法案,认为会削弱美国金融创新能力,但对web3而言,法案的通过意味着加密货币和DeFi协议将继续在相对自由的环境中发展,而不必担心来自官方数字货币的直接竞争。

法案的通过将确保数字美元的未来由私营部门主导——也就是通过《GENIUS法案》监管的稳定币来实现。这对Web3用户来说是双刃剑:一方面避免了政府直接控制,保持了去中心化特性;另一方面,稳定币仍需遵循严格监管,可能限制创新空间。

告别蛮荒,拥抱监管

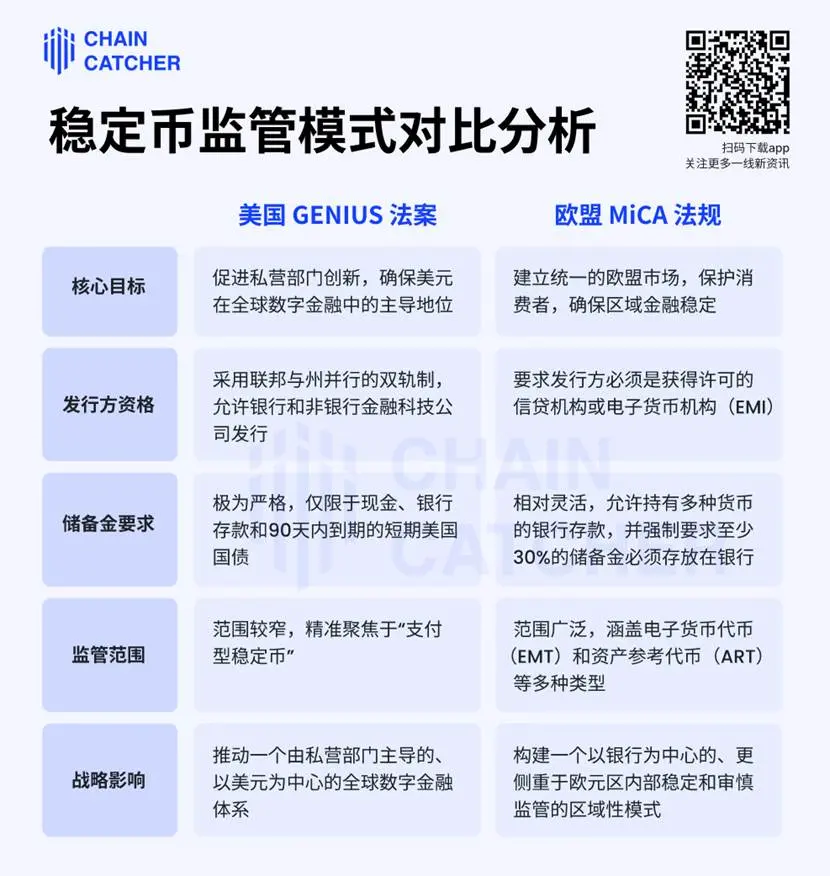

这一系列法案的快速推进,是美国政界、资本和加密行业多年博弈与合力的结果。面对欧盟MiCA法案和香港等地的积极布局,美国正试图通过一套组合拳,重新夺回数字金融领域的主导权。

众议院金融服务委员会在Patrick McHenry等关键人物推动下,成成功将加密政策从党派争议转向国家共识。法案在众议院获得大量民主党人支持,显示美国政界对Web3行业态度的根本转变。。

加密行业已从技术极客演变为强大的政治游说力量。以Coinbase为首的企业投入巨资支持亲加密的政治行动委员会,其CEO Brian Armstrong和倡导组织Stand With Crypto积极游说议员,成功将行业诉求包装成保护消费者和鼓励创新的议题。Circle则凭借合规形象,向立法者展示受监管的稳定币如何服务于美国金融利益。

同时,a16z等顶级风投机构和Coin Center、DeFi教育基金等智库组织,为法案提供理论基础和具体法律条文建议,深刻影响立法的最终形态。这标志着加密行业的政治运作已经"专业化",能够影响立法进程。

这一系列法案的通过,意味着新时代的开始。加密行业的"狂野西部"时代的逐渐落幕。作为获得法律确定性和市场合法性的代价,整个生态将被正式纳入现有金融监管框架。稳定币发行商将成为美国国债购买者,数字资产项目则必须在SEC和CFTC划定框架内运作。

这是一场重要的权衡:行业让渡部分创新自由度,换取在全球最大市场中的明确发展空间。美国则通过规范化管理,将Web3技术转化为巩固其金融主导地位的新工具。监管的"克拉里蒂时刻"已经到来,意味着更高的安全性,但也可能面临更少的创新选择和更高的合规成本。

推荐阅读:

七年恩怨悬顶:特朗普 “逼宫” 鲍威尔,离职风暴将带来什么?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。