U.S. banking regulators have provided a new roadmap for traditional banks to enter the cryptocurrency asset space, indicating that banks planning to offer cryptocurrency custody services must consider the evolving nature of the crypto market and its underlying technology, and establish a governance framework that can adapt to the associated risks.

Written by: Bao Yilong

Source: Wall Street Insight

U.S. banking regulators have released a white paper on the holding of cryptocurrency by lending institutions, providing a new roadmap for traditional banks to enter the cryptocurrency asset space.

On July 14, media reports indicated that U.S. regulators released new guidelines to instruct banks on how to offer cryptocurrency custody services to customers without violating regulations. This move is seen as another significant development in how regulators are guiding traditional finance into the digital asset space since the "Trump 2.0 era."

According to reports, the Federal Reserve, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency jointly issued a statement, indicating that banks planning to provide cryptocurrency custody services must consider the evolving characteristics of the crypto market and its underlying technology, and establish a governance framework that can adapt to the associated risks.

The backdrop for this new guidance is that regulators withdrew previously issued risk guidelines related to the crypto industry in April of this year. At that time, the Federal Reserve also rescinded a directive from 2022 that required banks to report in advance before engaging in cryptocurrency activities.

Now, the cryptocurrency operations of these banks will be incorporated into the regular regulatory process for supervision. This move is interpreted by the market as a signal of regulatory "relaxation," granting banks greater autonomy in providing digital asset products and services to customers, marking a clear shift from the previously more cautious regulatory stance.

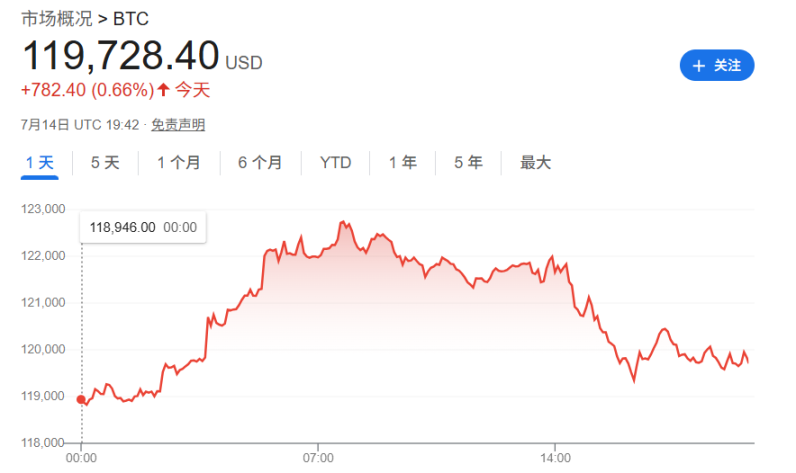

Wall Street Insight previously mentioned that market sentiment was buoyed by news that the U.S. Congress would welcome "Crypto Week" and review three key bills. Bitcoin briefly surpassed $123,000 during trading on Monday, setting a new historical record before quickly retreating below $120,000.

This dual benefit of regulation and legislation is reshaping market expectations for the cryptocurrency asset ecosystem. On one hand, industry participants believe that clear rules will bring long-term stability to the market.

On the other hand, some analysts warn that the current upward trend is highly dependent on the policy outlook, and any legislative setbacks could trigger a sharp market correction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。