The feedback loop between Ethereum's utility and ETH value capture will be restored.

Author: David Hoffman

Translated by: Deep Tide TechFlow

Ethereum is Winning, but ETH Investors Are Still Losing

You may have noticed that my stance on ETH has become more moderate recently. The decline in ETH's relative valuation has led to a loss of investor confidence, and when ETH aspires to be the currency of the internet, investor confidence is key.

For years, the reasons behind ETH's underperformance have been a focal point of debate. Many of the issues affecting ETH's relative valuation are beyond its control—contributions from figures like Gary Gensler and Michael Saylor have played a role. (Gensler has since left, and ETH fund management companies have finally been established; some external issues will resolve themselves.)

Today, I want to focus on the challenges firmly in the hands of the Ethereum community, as many of the reasons Ethereum has lagged behind the market for over three years are determined by the community itself. We should concentrate on addressing these issues to revitalize potential ETH buyers.

The Value Capture Problem of ETH

Many of the challenges facing Ethereum can be distilled into a core theme: there is a broken value capture supply chain between Ethereum's utility and the value of ETH.

"I’m surprised… the usage of stablecoins on Ethereum, Solana, and Tron… doesn’t seem to create more value for the Layer1 token holders that these stablecoins rely on."

— Joe Weisenthal on The Chopping Block

In this episode, the CB team continues to discuss this Ethereum-specific issue, as SOL and TRX have reached all-time highs, while Ethereum's economic model, especially the Layer2 model, is particularly flawed compared to its competitors.

When it comes to stablecoins, concerns about the relationship between stablecoin supply and the value capture of their Layer1 tokens have been raised as early as the 2018-2019 bear market. Nic Carter published an article on Bankless in 2020 discussing this issue—Crypto Fiat: Mutualistic or Parasitic?

In short, stablecoin buyers and holders on Ethereum Layer1 do not bring any value to ETH beyond spending about $0.50 in gas fees to purchase these stablecoins. If they do the same on Layer2, even if they purchase stablecoins worth billions of dollars, the value capture of ETH would drop below $0.01.

The Narrative Momentum of Ethereum

Nevertheless, the adoption metrics for Ethereum are undoubtedly bullish.

The recently launched Robinhood Chain deploying tokenized stocks on Ethereum validates Ethereum's Layer2 roadmap and its position as a trusted neutral settlement layer for Wall Street assets. With Robinhood Chain, OG promises that blockchain technology will upgrade Wall Street's outdated financial system for tokenization and trading, and everything is coming to fruition.

This statement is just one of many bullish signals for the network:

The Ethereum ecosystem maintains a dominant share of 50% of stablecoin supply, and if you ignore the opaque Tron ecosystem, that figure rises to 75%.

The sensational IPO of CRCL particularly validates Ethereum, as Ethereum holds 66% of all USDC.

Coinbase, the most trusted and respected brand in the crypto industry, is building on Ethereum Layer2.

Ethereum boasts 100% uptime, prioritizing true decentralization without any counterparties resonating to meet Wall Street's demands and enhance its brand image against other competitors.

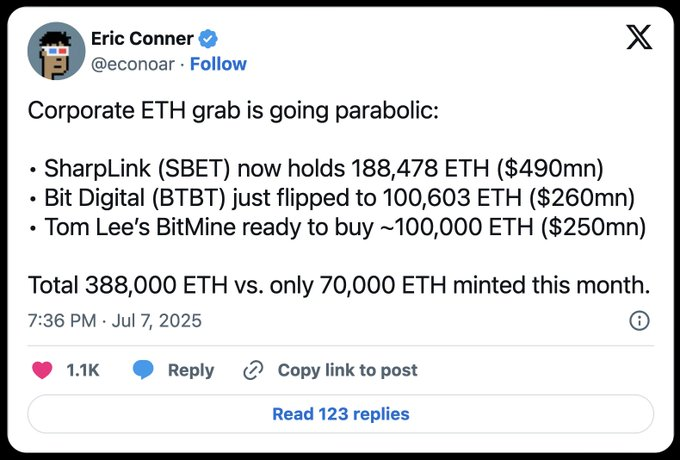

The economic influence of ETH fund companies is continuously increasing:

Original tweet link: Click here

If you want to promote bullish narratives for ETH and Ethereum, it is becoming increasingly easier to do so.

All the efforts made by Ethereum developers to maintain decentralization and trusted neutrality are paying off, and the adoption metrics in the world's capital gravity center—Wall Street—are incredible.

Expanding the ETH Narrative

Many people see the above adoption and success stories as opportunities.

Tom Lee's Bitmine fund management strategy is leveraging Ethereum's narrative advantage. The strategy is simple: incorporate ETH into the balance sheet and then pitch ETH to Wall Street. Ethereum itself has many narrative highlights; all ETH needs is a sufficiently vibrant person to excite Wall Street.

We are about to witness how undervalued ETH has been over the past four years. Is ETH's poor price performance a result of market irrationality? Or does its decline truly reflect deeper, more structural issues?

Tribalism and Social Scalability

Delving deeper into the above, you will gain a more profound understanding of two aspects of ETH.

On one hand, a network adopting a Layer2 model cuts off a link in the value capture supply chain of ETH. On the other hand, you see an incredible success story where it seems that Wall Street only needs a gentle push to send ETH to $10,000.

My view on this dichotomy is as follows:

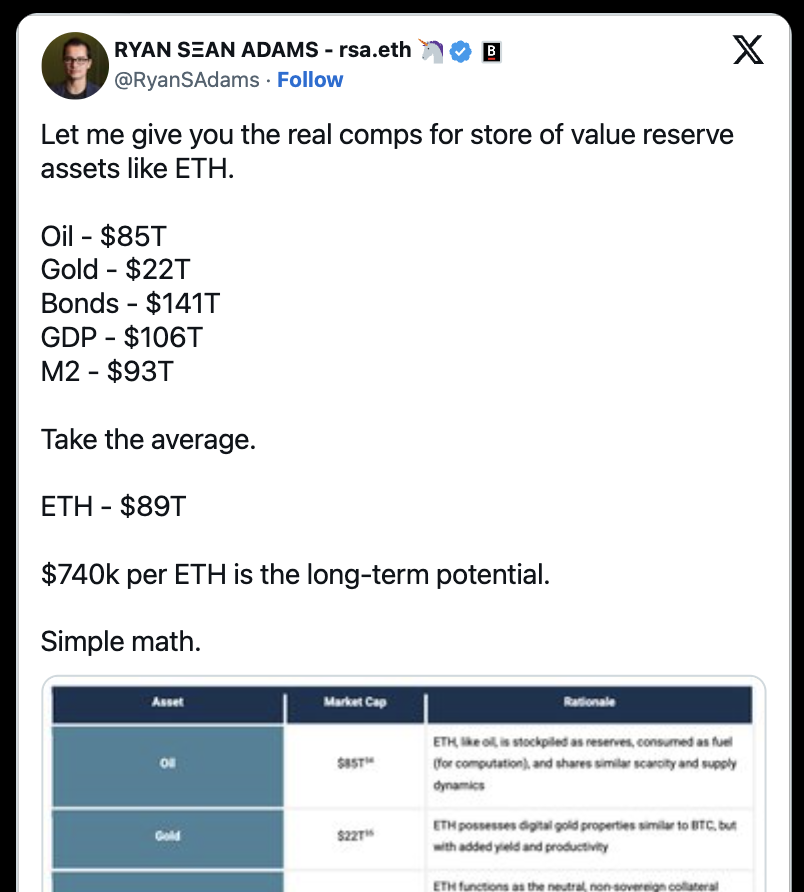

If you add narrative firepower to an unresolved value capture supply chain, you get tribalism, which is loved by insiders of the tribe but rejected by outsiders:

Original tweet link: Click here

Now, most people within Ethereum feel excited about Ryan's proposed price of $740,000 per ETH, while those outside Ethereum might see the same thing and think it is delusional (just read QT).

However, let’s imagine an alternative scenario where the superior value capture supply chain of ETH becomes a core part of the ETH narrative, just like in 2021. In this case, all Ethereum Layer2s are based on Native+Based Rollup, and Ethereum's block time is reduced to about 2 seconds (which is Ethereum's long-term goal).

In this world:

Rollups have synchronous composability, eliminating the need for network bridging. Lower Layer1 block times allow market makers to offer tighter spreads, leading to greater on-chain trading volume. Price execution power is significantly enhanced.

Ethereum's robust MEV infrastructure can ultimately be used to provide traders with optimal execution (on Memecoins, etc.), rather than the approximately 20% of yield they find elsewhere.

Cross-chain liquidity flows back to Layer1, while Native+Based Rollup can seamlessly tap into Layer1 liquidity, increasing trading volume.

Based+Native Rollup consumes 10 to 100 times less gas than current L2s while providing shared liquidity and composability, meaning all this activity on Rollups will actually consume a significant amount of ETH.

Tokenized assets on Rollups become accessible to other parts of the Ethereum ecosystem. Ethereum's position as a platform for issuing and trading tokenized assets will be further enhanced.

What I have outlined above is a future: the feedback loop between Ethereum's utility and ETH value capture will be restored.

Original tweet link: Click here

Breaking the Tribalism Narrative

In 2024, Bitcoin transitioned from an asset primarily promoted by its tribal community to one regarded as a "special snowflake" asset by the world's most powerful governments. Only Bitcoin has strategic reserves. No other asset possesses such reserves.

The fundamentals of Bitcoin (the 21 million cap) compel non-tribal investors to hold at least some Bitcoin.

Ethereum needs to do the same.

While Tom Lee and all other ETH fund companies are spreading the gospel of ETH to Wall Street, it would be even better if they could leverage a coherent value capture story.

The Ethereum community must quickly fix the feedback loop between Ethereum's utility and ETH value. We understand the necessary inputs. We also recognize the stakeholders, including many who have already participated in realizing this vision, as well as some who may need to be persuaded by other community members. We believe we can achieve this.

What are the stakes? It is a more effective Ethereum growth story that we can sell to the world—a story that can ultimately fulfill the ETH tribe's expectation for ETH to break the $10,000 barrier.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。