Hyperliquid is a Layer 1 blockchain optimized for high-frequency trading and DeFi applications.

Author: Nick Sawinyh

Translation: ShenChao TechFlow

Hyperliquid Chain is a high-performance Layer 1 (L1) blockchain that has rapidly emerged in recent years as a powerful engine in the decentralized finance (DeFi) space.

It aims to provide the speed and efficiency of centralized exchanges while maintaining the transparency and decentralization of blockchain technology, redefining on-chain trading and financial applications.

Its flagship decentralized exchange (DEX) focuses on perpetual contract trading, and with the recent launch of HyperEVM, it has attracted a vibrant ecosystem that spans from DeFi protocols to meme token issuance platforms and AI-driven applications.

In this detailed blog post, we will delve into the Hyperliquid ecosystem, highlighting key projects and analyzing the unique features, potential, and challenges faced by this chain.

What is Hyperliquid?

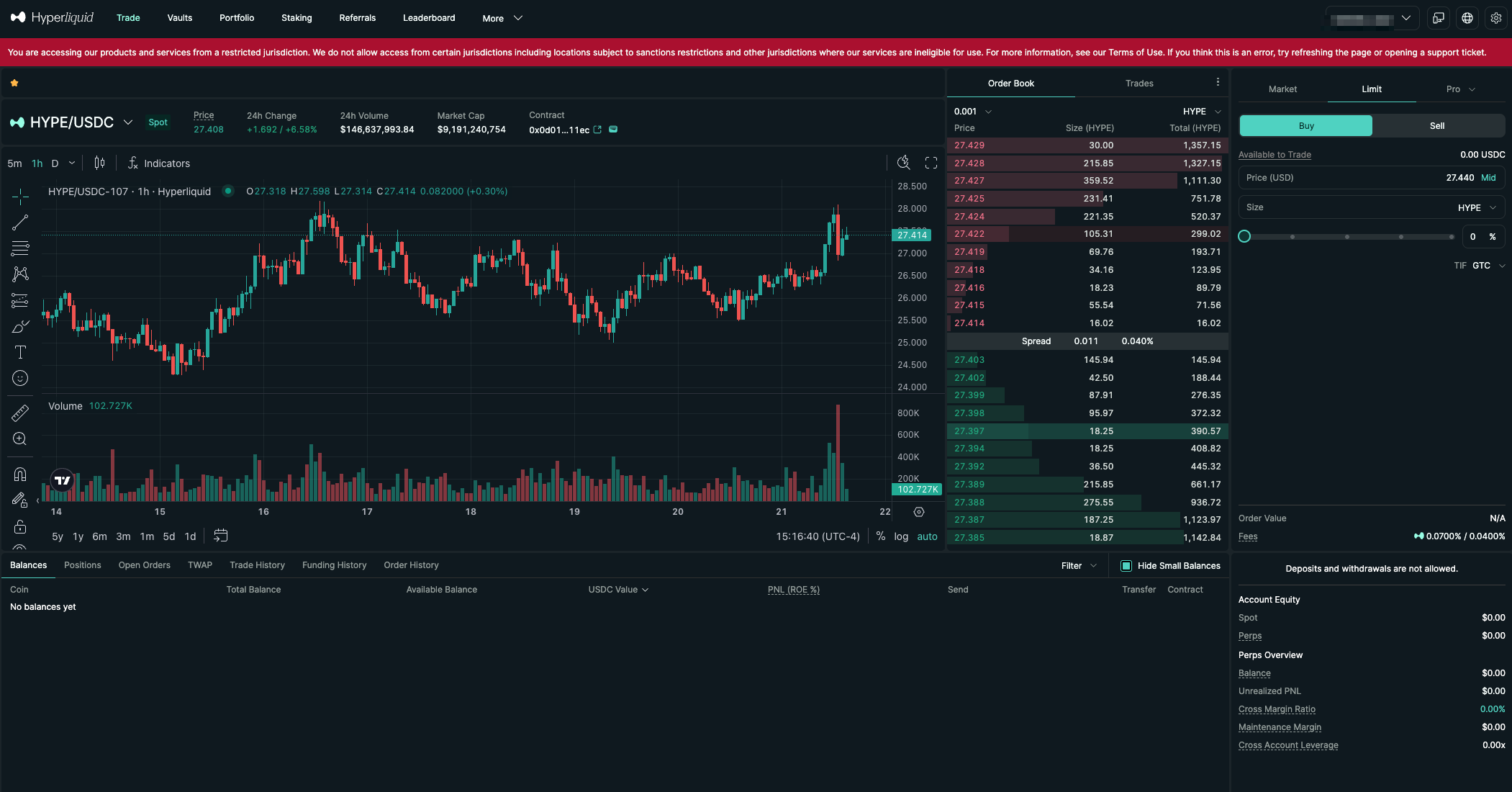

Hyperliquid is a Layer 1 blockchain optimized for high-frequency trading and DeFi applications. Since its launch in 2023, it has operated on a custom consensus algorithm called HyperBFT, derived from the HotStuff protocol, which achieves sub-second block finality and supports a throughput of up to 200,000 orders per second. Unlike many decentralized exchanges that rely on automated market makers (AMMs), Hyperliquid employs a fully on-chain central limit order book (CLOB) model, providing deep liquidity, low slippage, and a trading experience comparable to centralized exchanges like Binance.

The native token of the Hyperliquid chain, $HYPE, is the core driving force of its ecosystem, serving as a utility token for paying transaction fees, staking, and governance functions. In November 2024, Hyperliquid conducted an unprecedented airdrop event, distributing 310 million $HYPE tokens worth over $1.2 billion to early users, accounting for 31% of the total supply. This community-centric strategy, combined with its self-funding model (refusing venture capital support), has propelled Hyperliquid's rapid growth. By early 2025, its cumulative trading volume had approached $1 trillion.

The Hyperliquid ecosystem is further enhanced by its HyperEVM, an Ethereum Virtual Machine (EVM) execution layer integrated into the L1 blockchain. Launched on February 18, 2025, HyperEVM allows developers to deploy Ethereum-compatible smart contracts while leveraging Hyperliquid's high-speed consensus mechanism and native financial infrastructure. This makes Hyperliquid a powerful platform for building advanced DeFi applications, asset tokenization tools, and innovative trading tools.

Core Features of Hyperliquid Chain

Before diving into its ecosystem projects, let's first understand the core features that make Hyperliquid attractive to developers and users:

High Performance: The HyperBFT consensus mechanism achieves block confirmation times of less than 1 second (with a median latency of only 0.2 seconds), supporting over 200,000 transactions per second, with future scalability to over 1 million orders per second.

On-Chain Order Book: Unlike decentralized exchanges based on automated market makers (AMMs), Hyperliquid's centralized limit order book (CLOB) ensures efficient price discovery, transparency, and support for advanced order types, including perpetual contracts with leverage up to 50x.

HyperEVM: As an EVM execution layer protected by HyperBFT, HyperEVM supports Ethereum-compatible smart contracts that can directly interact with Hyperliquid's native order book and liquidity.

HIP-1 and HIP-2 Standards

HIP-1: Allows projects to link their native tokens to Hyperliquid's on-chain spot order book, lowering the barrier for token issuance.

HIP-2: Provides automated liquidity for new tokens, addressing liquidity shortages and ensuring smooth trading.

Zero Gas Fees: Hyperliquid eliminates gas fees for transactions, with standard limit order fees capped at 0.01% and taker fees around 0.035%, making it highly cost-effective for high-frequency traders.

Community-First Model: Hyperliquid allocates 76.2% of $HYPE to the community and has not introduced any venture capital support, reflecting a commitment to user participation and fairness.

Vaults: Users can deposit funds into vaults for copy trading, market making, or liquidation strategies, sharing profits and losses (P&L) with vault operators.

These powerful features provide developers with an innovative ground for various projects, from lending protocols to meme token issuance platforms, all seamlessly integrated into Hyperliquid's high-performance infrastructure.

Hyperliquid Ecosystem: Key Project Analysis

The Hyperliquid ecosystem is rapidly expanding, covering areas such as DeFi, gaming, NFTs, artificial intelligence, and meme tokens. Below, based on recent developments and community activities, we categorize and interpret some of the most representative projects from a functional perspective.

DeFi Protocols

Hyperdrive

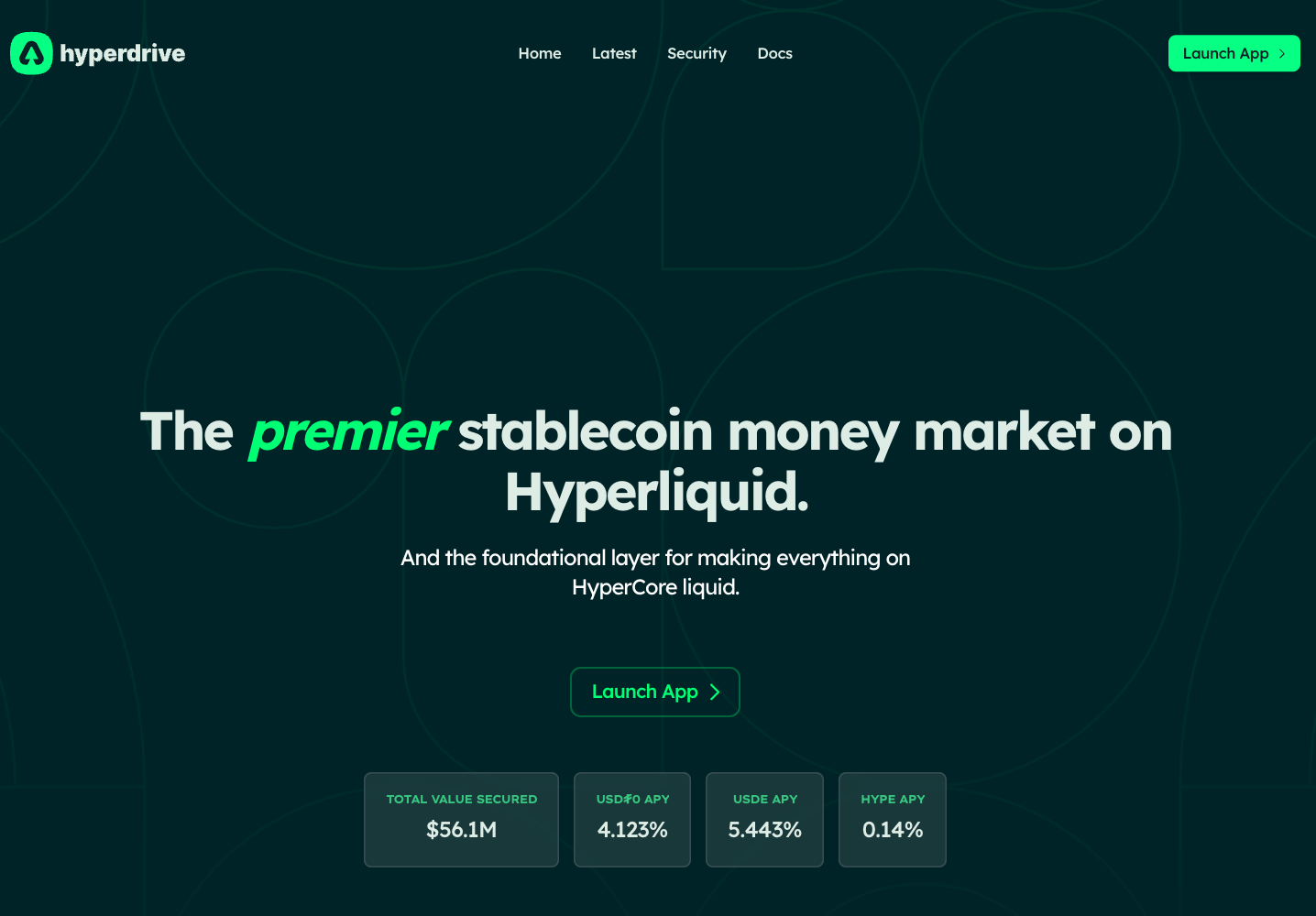

Overview: Hyperdrive is a one-stop DeFi hub on Hyperliquid, offering a spot lending market, liquid staking of $HYPE, and advanced yield strategies. By integrating multiple financial services into a single platform, Hyperdrive aims to simplify users' DeFi interaction experience.

Core Features:

Provides a spot lending market for assets.

Supports liquid staking of $HYPE, allowing users to earn rewards while maintaining liquidity.

Yield optimization strategies to help users maximize returns.

Impact: Hyperdrive enhances capital efficiency within the Hyperliquid ecosystem, attracting users seeking passive income and leveraged trading opportunities.

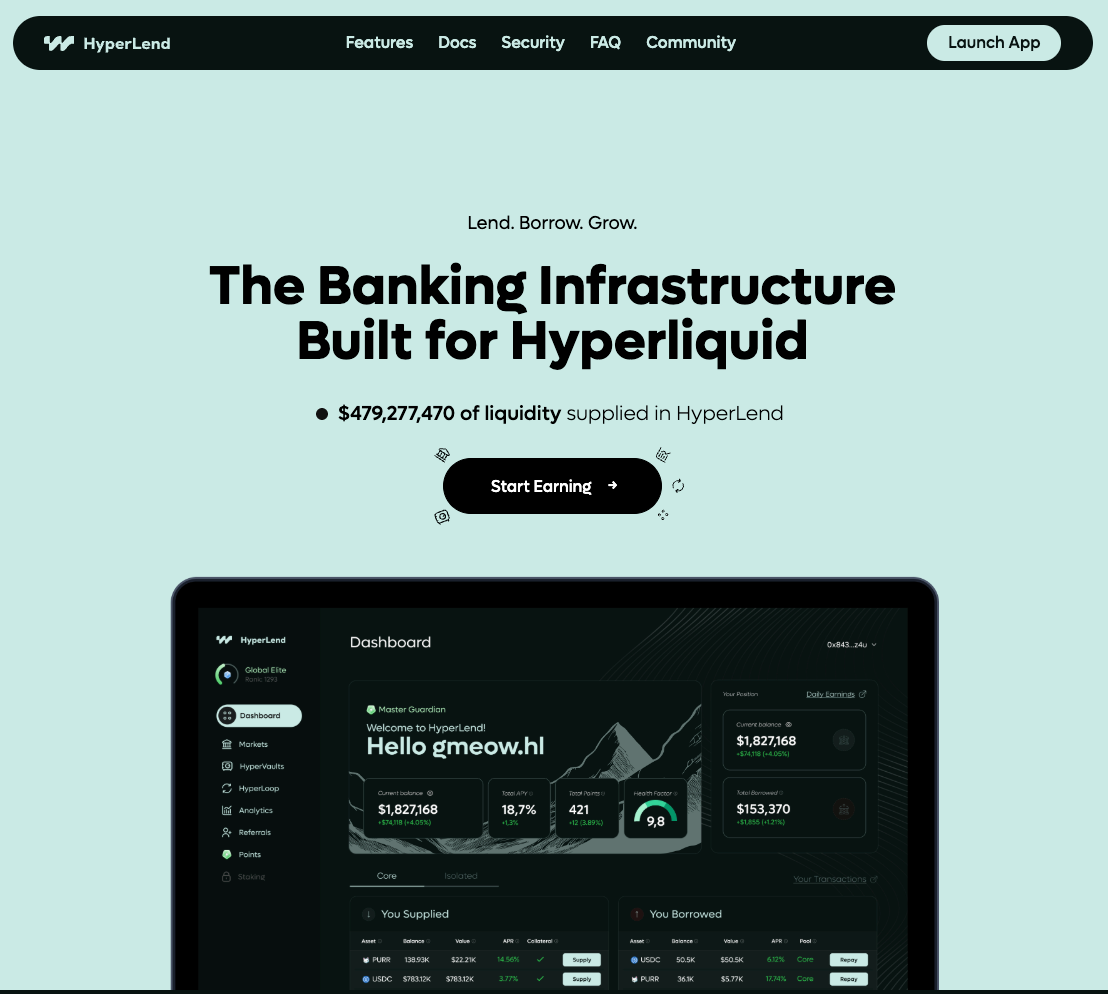

Hyperlend

Overview: Hyperlend is a decentralized lending protocol based on Hyperliquid's HyperEVM, similar to Aave. It supports using $HLP (Hyperliquid Points) vaults as collateral, unlocking leveraged yield opportunities for users.

Core Features:

Supports lending functions for native and EVM-compatible assets.

Integrated with $HLP vaults, supporting collateralized lending.

Plans to expand support for cross-chain assets.

Impact: As the first native lending protocol, Hyperlend further strengthens Hyperliquid's DeFi ecosystem by providing essential financial infrastructure.

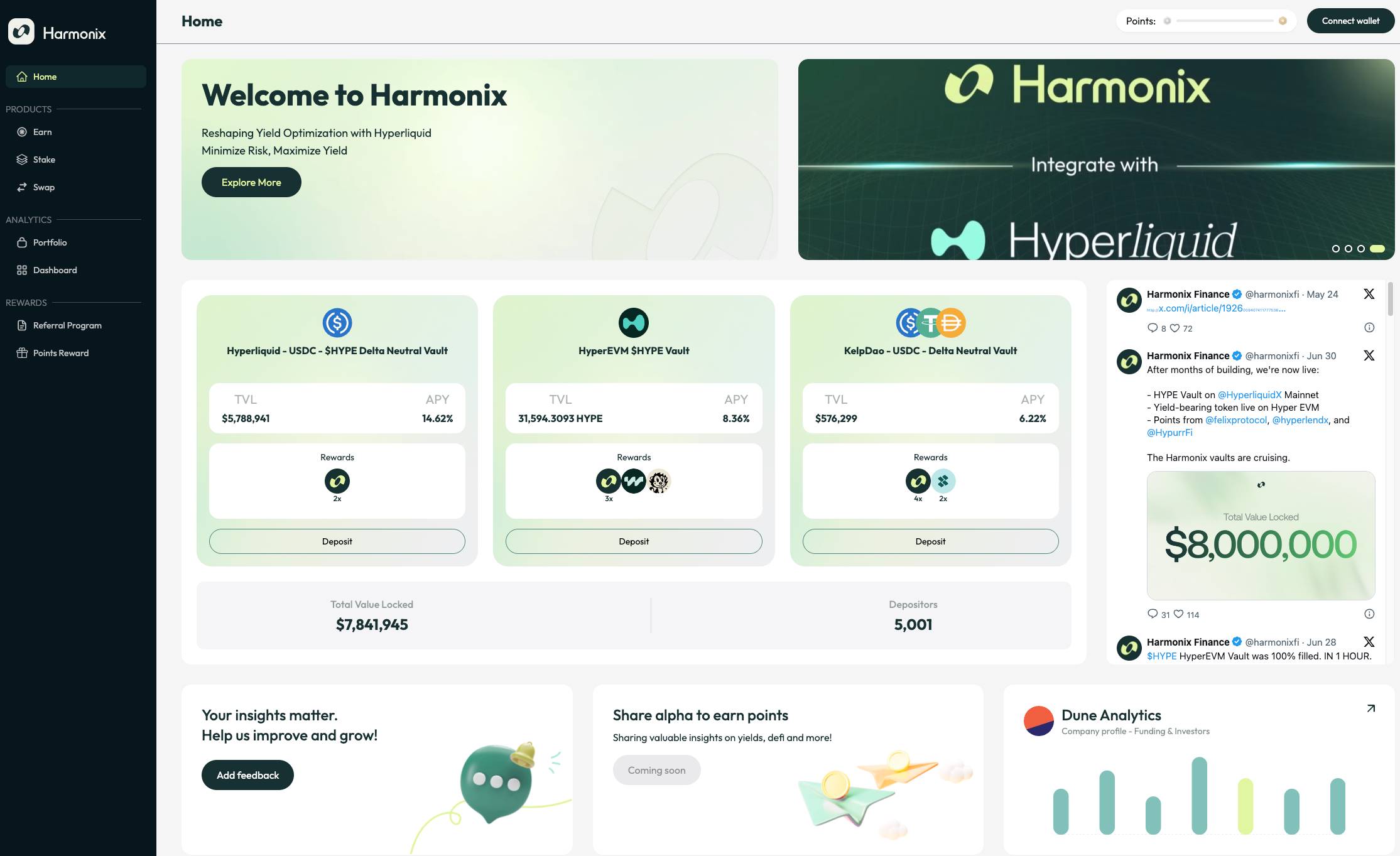

HarmonixFi

Overview: HarmonixFi is a vault-based protocol where users can earn $HYPE and future airdrop points by depositing assets. The protocol focuses on yield farming and community-driven incentive mechanisms.

Core Features:

Earn $HYPE and points through vault deposits.

Integrated with Hyperliquid's testnet to attract early users.

Community governance for protocol upgrades.

Impact: HarmonixFi incentivizes user participation through reward mechanisms while promoting overall ecosystem activity.

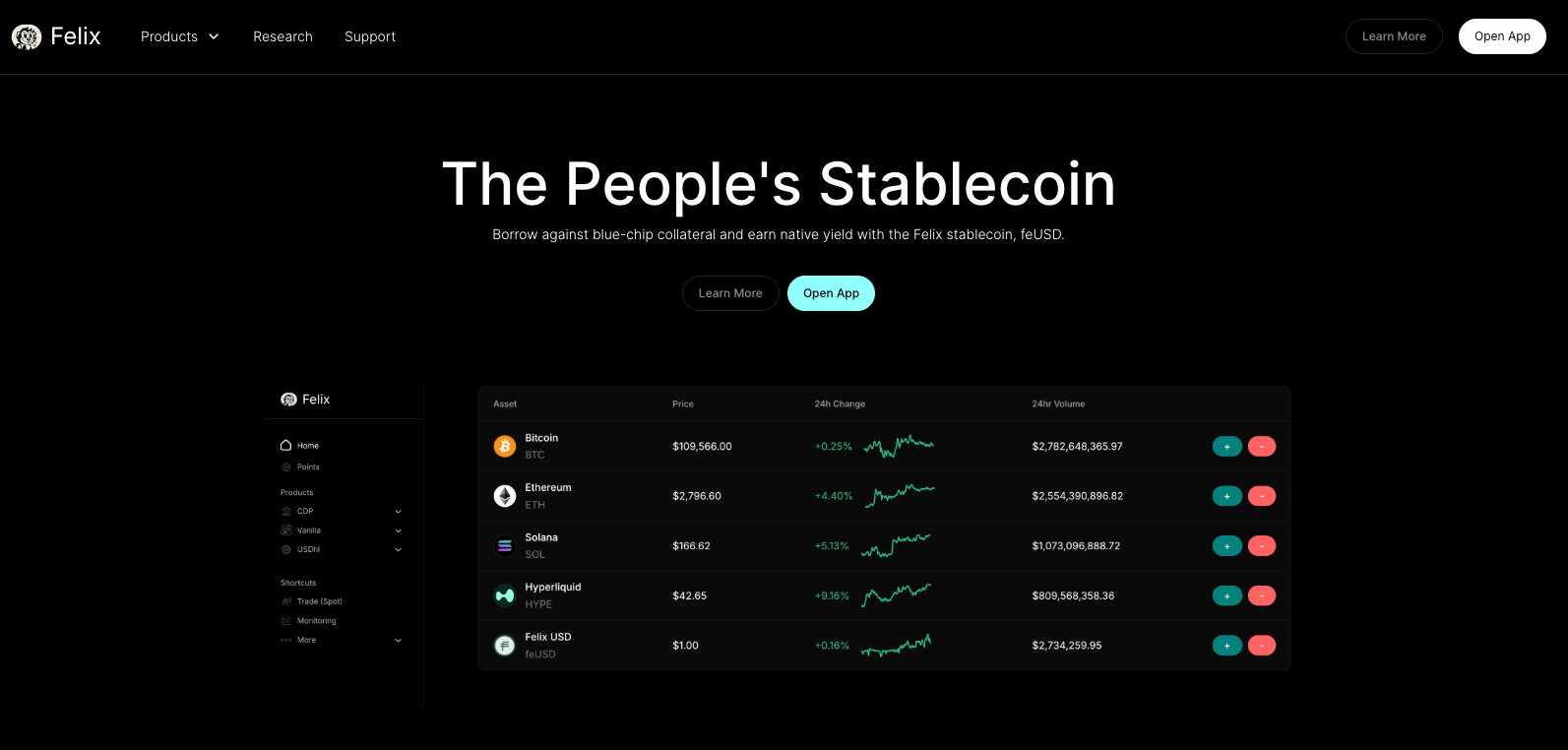

feUSD

Overview: feUSD is a native CDP stablecoin launched by the Felix protocol, allowing users to mint a stablecoin pegged to the US dollar by depositing $HYPE, $PURR, and other assets. Its goal is to provide price stability for trading and DeFi applications.

Core Features:

Minting through collateralization with ecosystem tokens.

Integrated with Hyperliquid's trading infrastructure.

Planned for use in lending and staking protocols.

Impact: Stablecoins like feUSD can significantly enhance Hyperliquid's DeFi ecosystem by providing stable trading pairs and reducing volatility risks.

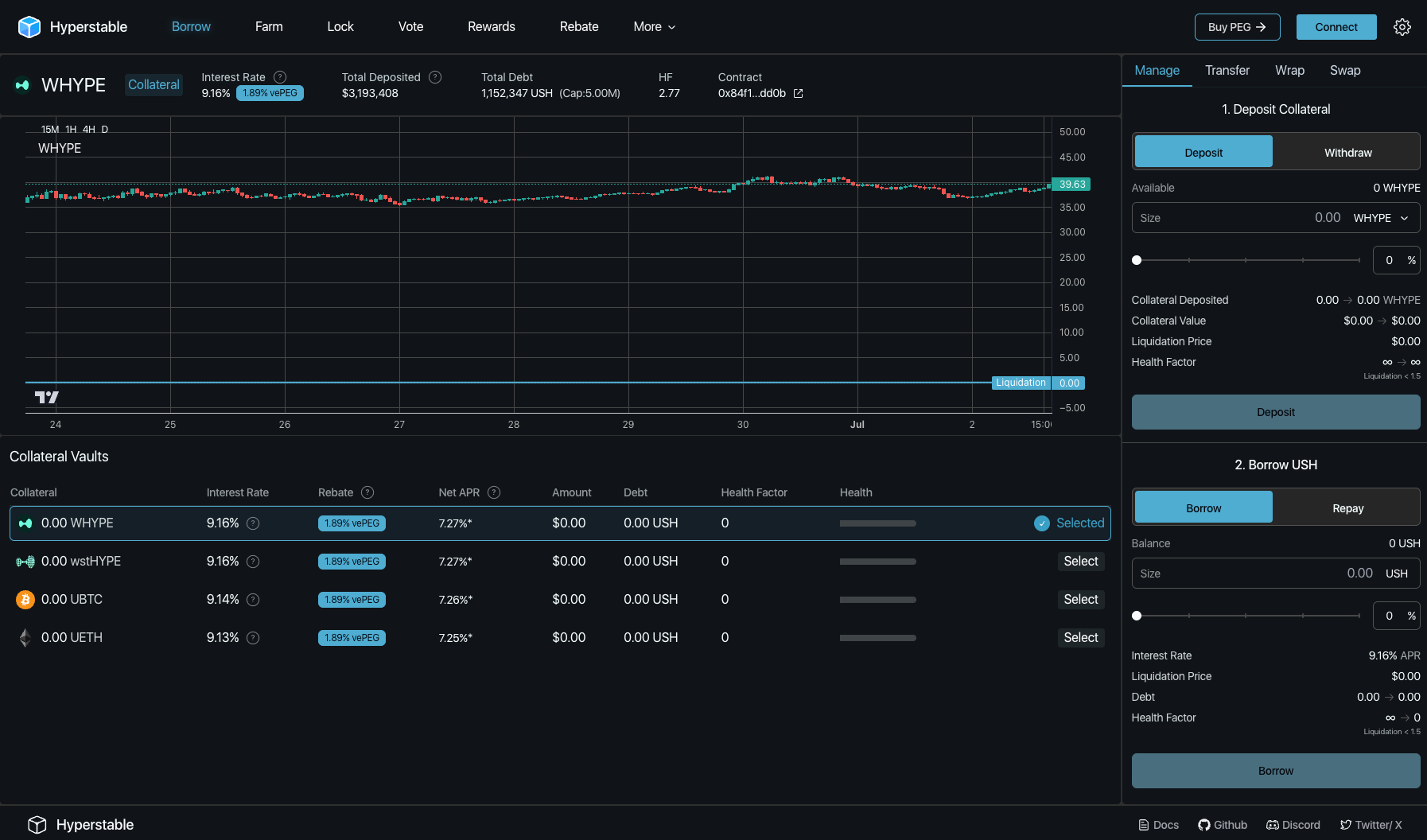

Hyperstable

Overview: Hyperstable is a decentralized stablecoin protocol based on HyperEVM, supported by crypto assets and over-collateralization, aimed at maintaining its USH stablecoin pegged to 1 USD. Launched in 2024, it employs a dual-token system, including USH and PEG governance tokens. Users can mint USH by depositing supported collateral (such as $HYPE) into non-custodial vaults. Hyperstable drives growth through a Borrowing Rebate Program and Referral Bonus, regularly distributing PEG tokens to offset interest costs. Liquidity providers can earn PEG by staking on AMMs like Curve, while vePEG holders can lock tokens to earn 100% of the protocol's revenue (paid in USH) and vote on token releases. Currently, Hyperstable has a total locked value (TVL) of $2.53 million, a 24-hour trading volume of $822,900, and has been audited by companies such as 0x52 and Pashov Audit Group. Its innovative voting-locked token economic model and high yield opportunities (stable pool annual yield of 20-50%) make it an attractive DeFi platform.

Impact: Hyperstable's stablecoin and governance model enhance Hyperliquid's DeFi ecosystem, providing price stability and attractive yields for borrowers, liquidity providers, and token holders.

KittenSwap

Overview: KittenSwap is a decentralized exchange (DEX) based on HyperEVM, launched in December 2024, designed as a fork of Velodrome. It utilizes an innovative ve(3,3) token economic model that combines the efficiency of automated market makers (AMMs) with governance and reward systems, aiming to align the interests of liquidity providers, token holders, and protocol developers.

Impact: KittenSwap's ve(3,3) model and community-driven incentives (including point programs and NFT integration) make it a cornerstone of the Hyperliquid DeFi ecosystem, driving user participation and liquidity supply.

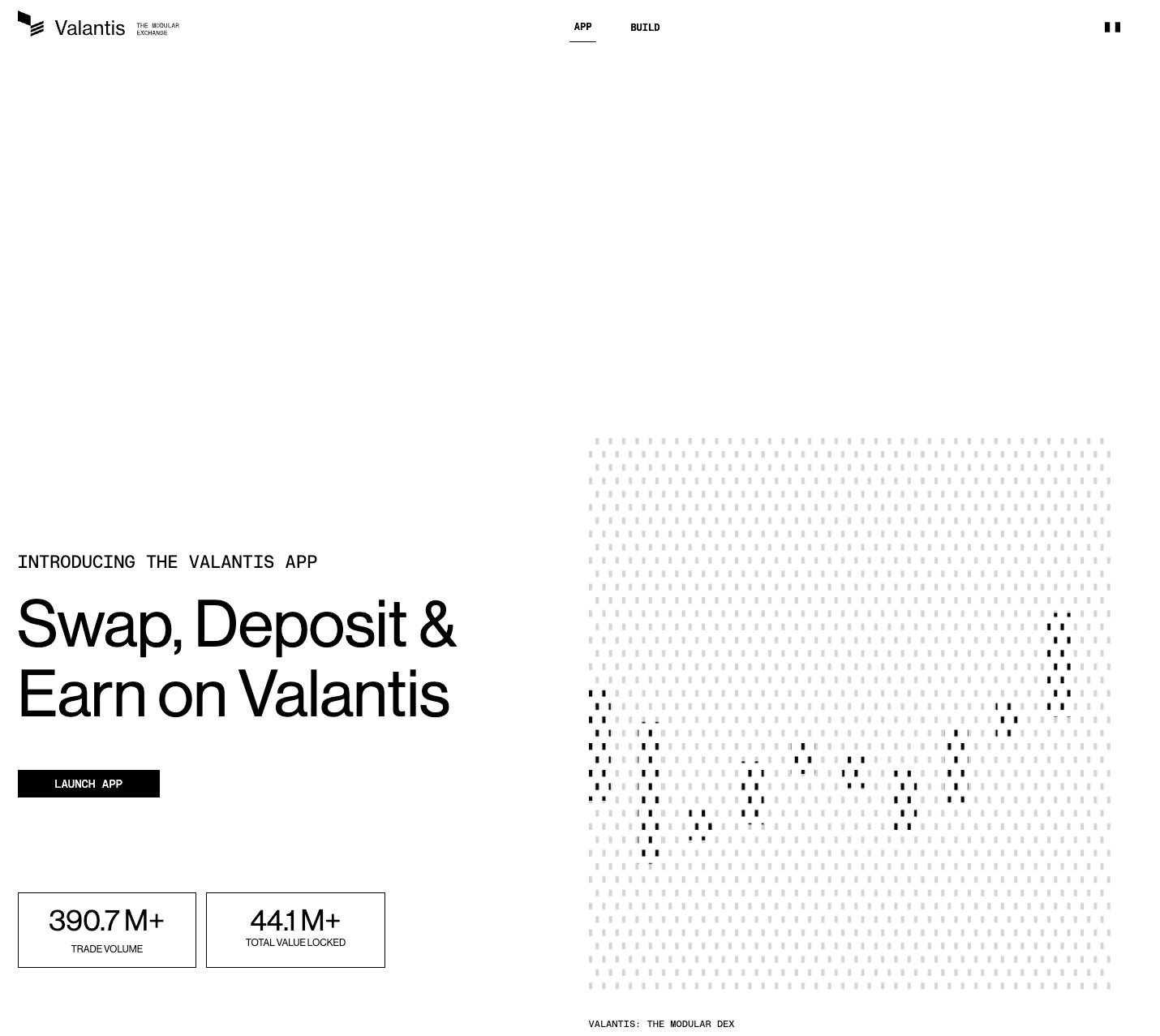

Valantis

Overview: Valantis is a modular decentralized exchange (DEX) protocol launched by Valantis Labs on HyperEVM in 2023, aimed at providing developers with the ability to create customized, composable DEXs. Its Sovereign Pools and Core Pools use reusable modules to handle pricing logic, fee calculations, oracle services, and liquidity management, alleviating liquidity fragmentation through shared external vaults. Valantis supports rebasing tokens (such as liquid staking tokens LSTs), with its HOT-AMM pool achieving over $50 million in trading volume and $5 million in liquidity. Currently, Valantis has a total locked value (TVL) of $44.21 million on Hyperliquid and offers various yield opportunities, including swap fees, lending, staking, and double HypurrFi point rewards for $HYPE deposits. Valantis secured $7.5 million in funding from investors like Triton Capital and Anthony Sassano, making it an essential part of Hyperliquid's DeFi infrastructure, supporting developers in building innovative DEXs with higher security and capital efficiency.

Impact: Valantis's modular framework and support for advanced DeFi features make it an important liquidity hub, driving developer adoption and trader participation.

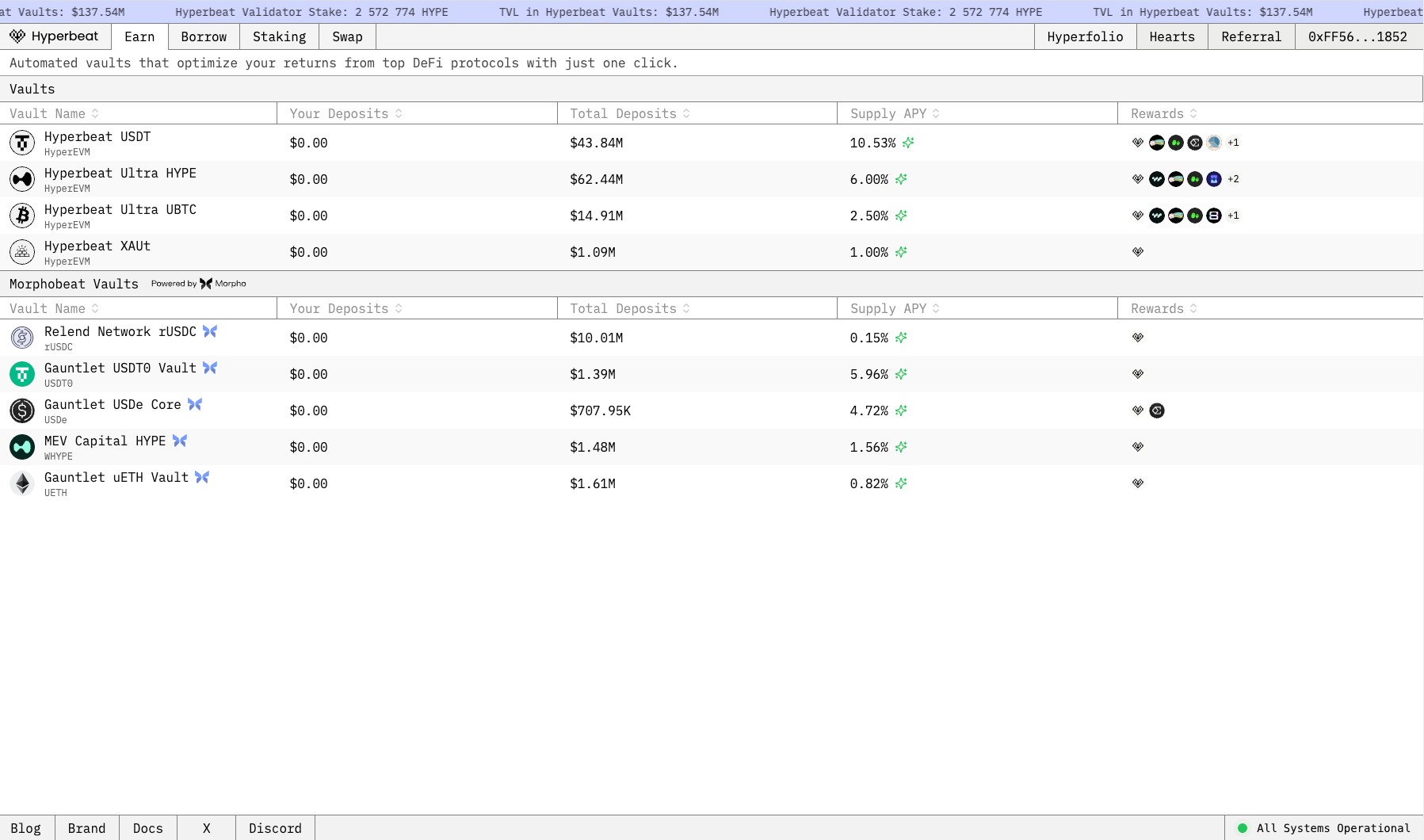

Hyperbeat

Overview: Hyperbeat is a decentralized lending protocol based on Hyperliquid's HyperEVM, launched in early 2025, aimed at enhancing capital efficiency for traders and liquidity providers. Users can lend assets (such as $HYPE, $KITTEN, and stablecoins) through Hyperbeat to earn interest or borrow against collateral to participate in Hyperliquid's spot and perpetual futures markets. Hyperbeat is deeply integrated with Hyperliquid's native order book, enabling seamless interaction between lending pools and trading activities. The protocol employs dynamic interest rates based on market demand and supports over-collateralized loans to ensure stability. With a user-friendly interface and low-latency trading, Hyperbeat attracted significant attention in its first month, achieving a total locked value (TVL) of $20 million. Its point-based reward system incentivizes early users, with plans to launch a native token to further align community interests.

Impact: Hyperbeat strengthens Hyperliquid's DeFi ecosystem by providing critical lending infrastructure, offering leveraged trading and yield opportunities to a broad user base.

Trading and Analysis Tools

Pvp.trade

Overview: Pvp.trade is a Telegram-based trading bot that supports spot and perpetual futures trading on Hyperliquid. It integrates social and competitive trading features, allowing users to accumulate points based on trading volume for future $PVP token airdrops.

Core Features:

Leverage and spot trading via Telegram.

Social trading features to view group members' positions.

Volume-based point accumulation for $PVP token airdrops.

Impact: Pvp.trade attracts widespread attention through its gamified trading experience and airdrop potential, raising $200,000 in an auction for its $PVP.

Insilico Terminal

Overview: Insilico Terminal is a trading tool that utilizes artificial intelligence (AI) to provide advanced market analysis and trading signals for Hyperliquid users (also supporting multiple centralized exchanges, including Binance, Coinbase Pro, Bybit, OKX, and Bitmex).

Core Features:

AI-based market predictions and trading strategies.

Real-time analysis of spot and derivatives markets.

Deep integration with Hyperliquid's order book.

Impact: Insilico enhances trading efficiency, attracting professional traders seeking data-driven insights.

Katoshi AI

Overview: Katoshi AI is an AI-based trading platform capable of automatically executing strategies and providing predictive analysis for the Hyperliquid market.

Core Features:

Automated trading bots for perpetual contracts and spot markets.

Predictive models for price trends.

User-friendly interface aimed at retail traders.

Impact: Katoshi AI democratizes advanced trading tools, enabling more users to easily participate in Hyperliquid's markets.

Meme Token and NFT Platforms

HypurrFun

Hypio

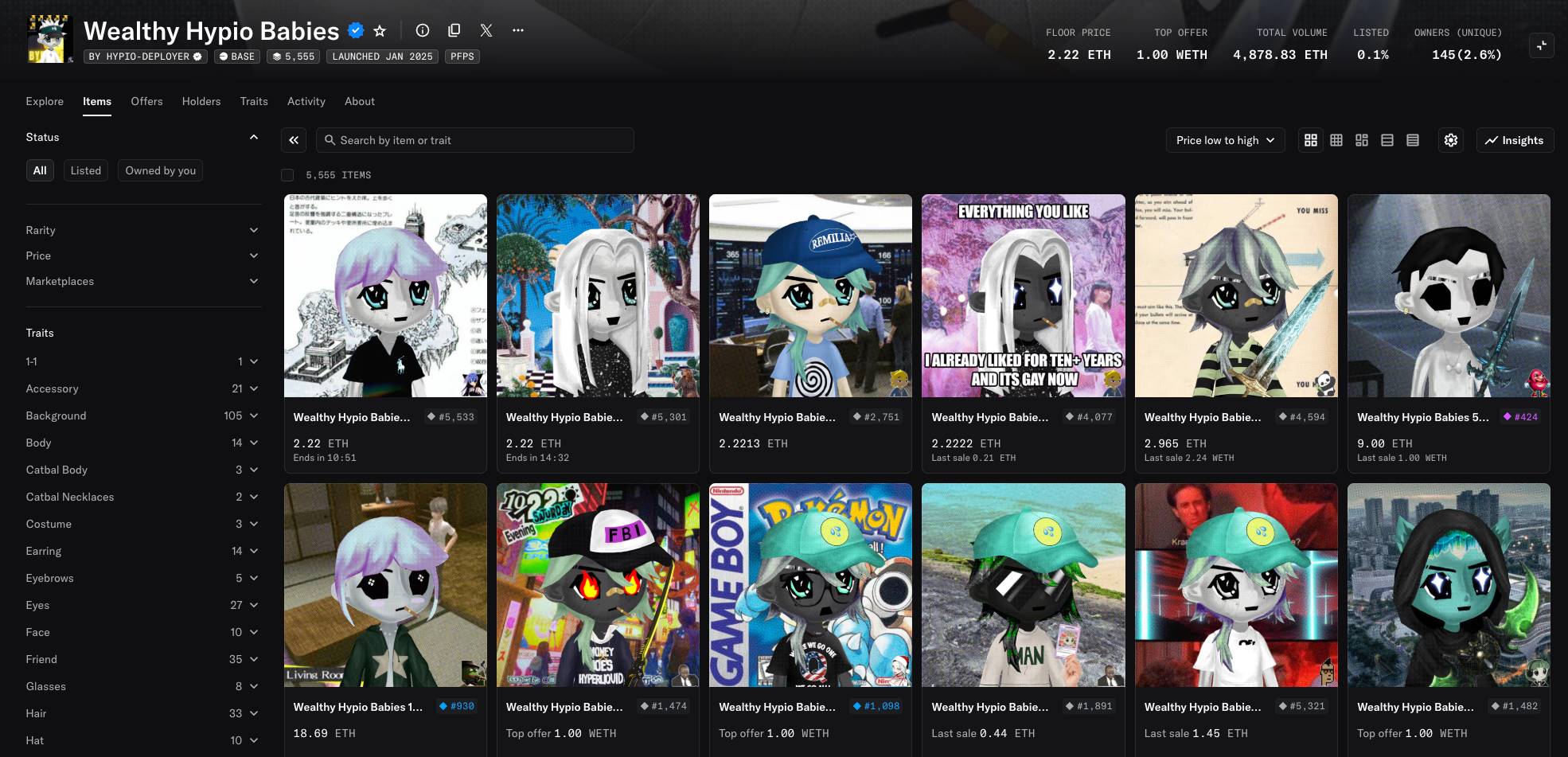

Overview: Hypio is a popular NFT series within the Hyperliquid ecosystem, launched in January 2025, aimed at combining NFTs with DeFi and gaming scenarios.

Core Features:

Unique NFT assets with practical use in the Hyperliquid ecosystem.

Plans for integration with gaming and staking protocols.

Community-driven design and governance at its core.

Impact: Hypio adds a creative dimension to Hyperliquid, attracting NFT enthusiasts and collectors.

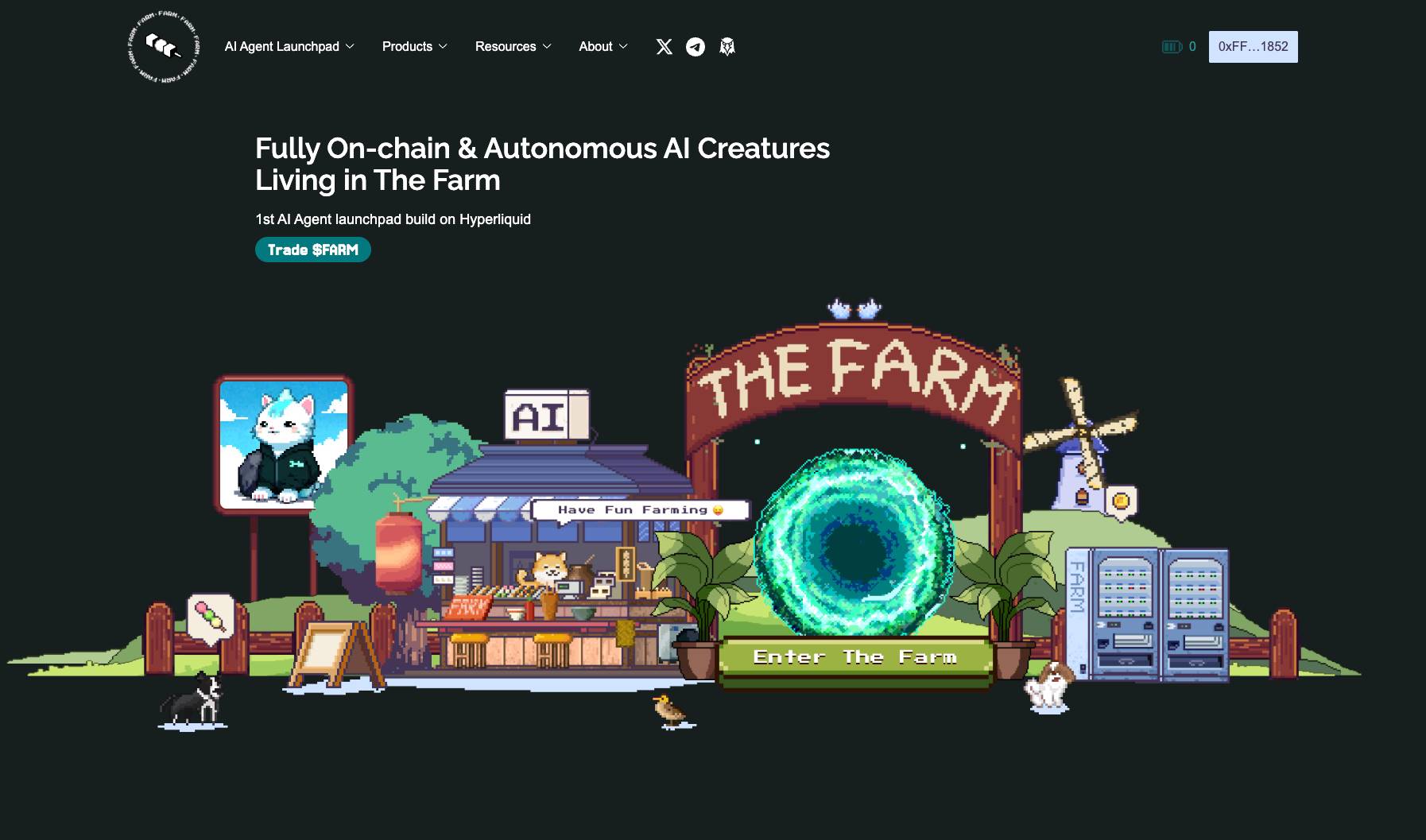

TheFarm.fun

Overview: TheFarm.fun is a pioneering AI-driven gaming platform on Hyperliquid, launched in 2024. It combines generative AI and blockchain technology to create a unique on-chain creature generation system. Users can mint pixelated NFT creatures from real animal photos using a proprietary GenAI model. The foundation of the ecosystem consists of the top 50 creatures known as "The Ancestors." The platform has confirmed an upcoming $FARM token airdrop, allocating 5% of the total supply to reward creators and voters, with 50% going to "The Ancestors," 30% to other minted creatures, and 20% to voters who choose "The Ancestors." The roadmap for TheFarm.fun includes simulation gameplay and combat/esports features, aiming to build a comprehensive gaming ecosystem. With strong community engagement and innovative AI integration, the platform quickly gained attention, offering a new experience that combines creativity and gamification.

Impact: The AI-driven NFT creation and planned gaming features of TheFarm.fun position it as a leader in Hyperliquid's gaming ecosystem, attracting creators and players seeking innovative blockchain experiences.

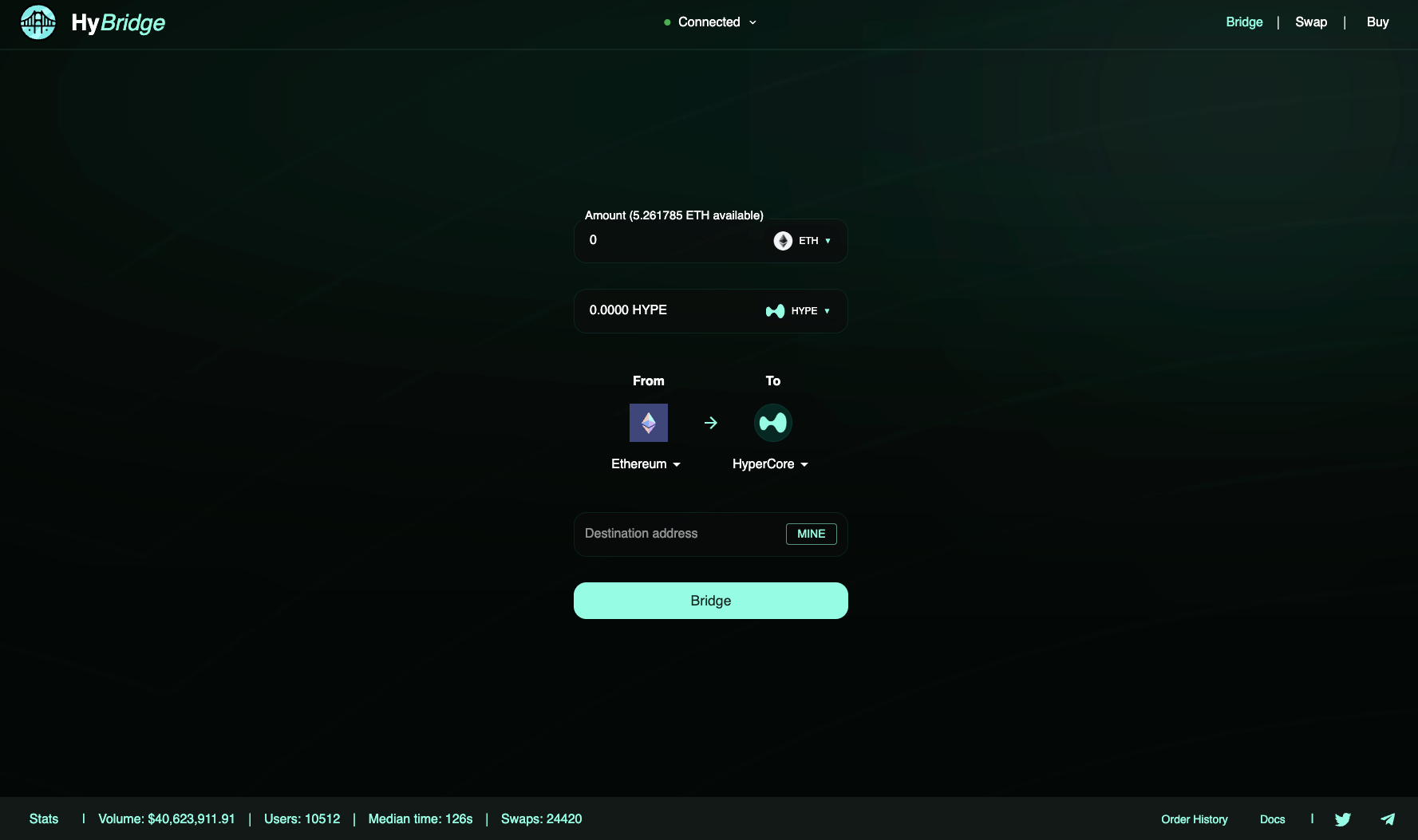

HyBridge

Overview: HyBridge is a community-developed cross-chain bridging protocol that supports asset transfers from seven blockchains (such as Ethereum, Solana, Arbitrum) to Hyperliquid, processing millions of transactions daily.

Core Features:

Supports cross-chain transfers of USDC, USDT, $HYPE, and ecosystem tokens.

Low fees and high throughput.

Can be directly converted to Hyperliquid native assets.

Impact: HyBridge simplifies the onboarding process for users, allowing users from multiple chains to easily access the Hyperliquid ecosystem.

Hyperunit

Overview: Hyperunit is a tokenized layer that supports the native BTC and ETH spot markets on Hyperliquid. It captures 50% of trading fees and plans to launch significant token issuance.

Core Features:

Provides tokenization services for major assets in spot trading.

Fee distribution through a revenue-sharing model.

Deep integration with Hyperliquid's order book.

Impact: Hyperunit enhances the attractiveness of Hyperliquid's spot markets, drawing attention from institutional and retail traders.

Goldsky

Overview: Goldsky is a data indexing platform designed to provide real-time analytics services for Hyperliquid's blockchain and DeFi applications.

Core Features:

High-speed data indexing for trading and smart contracts.

Developer-friendly API for building analytical tools.

Supports HyperEVM-based decentralized applications (dApps).

Impact: Goldsky provides developers with robust data infrastructure, facilitating rapid growth of the ecosystem.

Gaming and Entertainment

Playmoon

Overview: Playmoon is an emerging gaming platform on Hyperliquid, launched in 2025, focusing on providing competitive and social gaming experiences combined with blockchain technology. Users can access the platform through its login portal (playmoon.xyz/login). Playmoon emphasizes user-driven challenges and tokenized rewards, allowing players to earn assets through gameplay.

Although still in its early stages, the platform plans to leverage Hyperliquid's high-throughput infrastructure to support fast-paced on-chain gaming mechanics. Playmoon's social media promotion (including a Facebook page with 56 likes) uses the slogan "Défiez l’intouchable" (Challenge the Untouchable), hinting at a possible focus on competitive leaderboards or tournaments. Future plans include integration with Hyperliquid's spot market for trading in-game assets and expanding game content.

Impact: Playmoon's competitive gaming model and blockchain integration add a dynamic entertainment layer to Hyperliquid, attracting gamers and crypto enthusiasts.

MON Protocol

Overview: MON Protocol is a blockchain-based gaming and intellectual property (IP) distribution platform integrated with Hyperliquid, aimed at managing and distributing IP ecosystems through tokenization.

Launched in 2024, the protocol allows developers to create and monetize gaming assets, having over 100 collaborative projects and distributing $20 million in token rewards to $MON token holders.

The Launchpools feature of MON Protocol allows $MON holders to stake tokens to earn partner tokens, while its community presale event sold 62,092,000 $MON tokens at $0.099 each (representing 6.21% of the total supply), generating significant interest.

Additionally, MON Protocol supports earning $MON through NFT staking, utilizing on-chain incentive mechanisms to promote user acquisition and community governance.

By integrating with Hyperliquid's HyperEVM, the protocol enables seamless asset trading and DeFi interactions, establishing its significant position in the gaming ecosystem.

Impact: MON Protocol's focus on IP management and tokenized gaming rewards enhances the synergy between gaming and DeFi within Hyperliquid, attracting developers and players to its expansive ecosystem.

Sovrun

Overview: Sovrun (formerly BreederDAO) is a gaming asset platform and the first Layer 2 solution on Hyperliquid. The platform focuses on tokenizing gaming assets and is supported by a16z and Delphi.

Core Features:

Provides tokenized gaming assets for trading and staking.

Layer 2 scalability, supporting high-throughput gaming dApps.

Listed on Hyperliquid's spot exchange.

Impact: Sovrun builds a bridge between gaming and DeFi, expanding the application scenarios of Hyperliquid.

Ecosystem Dynamics and Trends

Token Auctions and Community Participation

Hyperliquid's HIP-1 token auction has become a hallmark event in its ecosystem, with project teams needing to pay between $300,000 to $1 million (in USDC) to bid for listing on the spot exchange. These auctions reflect the high demand for Hyperliquid's liquidity and trading infrastructure. Notable cases include $GOD ($1 million) and $PVP ($200,000), showcasing the fierce competition for token codes.

The community-driven HypurrCollective brings together ecosystem projects and supports developers, while HypurCo operates one of the largest validator nodes by staking 30 million $HYPE (valued at $600 million). This community-centric approach, combined with airdrop incentives (such as $HYPE and $PVP), significantly enhances user participation.

The Role of HyperEVM

HyperEVM was launched in February 2025 and marks a significant turning point in ecosystem development, enabling developers to build decentralized applications (dApps) based on smart contracts. Projects like Hyperlend, Hyperdrive, and SOVRN leverage the composability of HyperEVM, integrating deeply with Hyperliquid's native order book and liquidity. This shift has attracted the attention of mainstream DeFi protocols, such as Ethena Labs, which is exploring integration to reduce reliance on centralized exchanges.

Meme Token Craze

Meme tokens (such as $PIP, $JEFF, and $PURR, the latter being Hyperliquid's mascot) have rapidly gained popularity, driven by the convenient launch platform of HypurrFun. Although early auctions primarily focused on meme tokens, recent trends indicate that the ecosystem is shifting towards utility-driven projects (such as $SOLV and $SWELL), suggesting that the ecosystem is maturing.

Challenges and Risks

Despite Hyperliquid's rapid growth, it still faces multiple challenges:

Ecosystem Richness: The current ecosystem lacks a complete DeFi closed loop, with use cases mainly limited to trading, lending, and staking. Expanding to more use cases (such as options and structured products) is crucial.

Security Risks: Hyperliquid has faced scrutiny over potential vulnerabilities, including state-sponsored hacking attacks (such as the Lazarus Group) and risks of reentrancy attacks or oracle manipulation. Regular audits (such as Zellic's review of cross-chain bridges and staking logic) are key to ensuring security.

Liquidity Risks: New tokens often face low liquidity issues; although HIP-2 has alleviated some of this, maintaining deep liquidity for trading pairs remains a challenge.

Compliance Risks: As global regulations tighten, Hyperliquid must find a balance between innovation and compliance to avoid legal hurdles.

Stablecoin Integration: The lack of a native stablecoin (other than feUSD) may hinder the widespread adoption of DeFi. A robust stablecoin could enhance trading stability and attract institutional users.

Addressing these challenges requires ongoing innovation, community governance, and support from strategic partnerships.

Future Potential and Outlook

Hyperliquid's development roadmap focuses on ecosystem expansion, with plans including:

Launching more DeFi derivatives (such as options and leveraged products).

Attracting third-party developers through open protocols and incentives.

Integrating native assets (such as BTC, ETH, and SOL) for spot trading.

Optimizing HyperEVM with enhanced smart contract capabilities.

Industry experts (such as Ryan Watkins from Syncracy Capital) predict that Hyperliquid is poised to become the highest fee-generating blockchain in 2025, thanks to its comprehensive business model and increasing trading volume (currently averaging $500 million in daily spot trading). The platform's ability to combine spot, derivatives, and blockchain space through HyperEVM positions it as a DeFi superchain.

Upcoming native stablecoins, potential cross-chain integrations, and increasing developer activity (such as Insilico Terminal and Katoshi AI) all signal a bright future. As Hyperliquid matures, it may compete with established L1 blockchains like Ethereum and Solana in the DeFi and trading sectors.

How to Participate

Trade on Hyperliquid DEX: Connect your wallet by visiting app.hyperliquid.xyz and bridge USDC or USDT from Arbitrum to participate in perpetual contracts or spot market trading.

Participate in Airdrop Events: Earn points for future token distribution rewards by participating in projects like Pvp.trade, HarmonixFi, or HypurrFun.

Build on HyperEVM: Developers can deploy smart contracts using Ethereum-compatible tools and utilize HyperEVM's documentation and API for development.

Stake $HYPE: Stake $HYPE through liquidity staking protocols like Hyperdrive to earn rewards and support network security.

Explore the Hyperliquid Ecosystem: HypurrCollective provides a comprehensive Hyperliquid public ecosystem database.

Join the Community: Follow @HyperliquidX, @hypurr_co, and HypurrCollective on X for the latest updates, or participate in governance by voting with $HYPE.

Conclusion

The Hyperliquid Chain ecosystem is a vibrant and rapidly evolving space that combines high-performance trading with innovative DeFi and entertainment applications. Projects like Hyperlend, Pvp.trade, and HypurrFun showcase the chain's versatility, while the launch of HyperEVM brings a new wave of development for smart contract-based dApps. With its community-centric model, zero gas fees, and unparalleled throughput, Hyperliquid is poised to lead the next generation of on-chain finance.

However, challenges such as ecosystem richness, security, and compliance still need to be addressed to sustain growth. As Hyperliquid continues to innovate and attract developers, it has the potential to redefine decentralized trading and become a cornerstone of the DeFi ecosystem. Whether you are a trader, developer, or crypto enthusiast, now is the perfect time to explore the vibrant Hyperliquid ecosystem and join this revolution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。