Subquid is a decentralized data infrastructure platform that provides data retrieval and processing services for Web3 and AI applications.

Written by: 1912212.eth, Foresight News

On July 2, Heidelberger Beteiligungsholding AG, a publicly listed company on the Frankfurt Stock Exchange in Germany, announced that it has begun strategically accumulating SQD tokens and will soon be renamed SQD.AI Strategies AG. The SQD token acquisition initiated by Heidelberger Beteiligungsholding AG includes both over-the-counter (OTC) transactions and market purchases. The company plans to raise up to 50 million euros in the 2025 fiscal year to purchase, hold, and stake SQD tokens.

As a result of this news, SQD has seen a nearly 20% increase in the past 24 hours, currently priced at $0.178, with a market capitalization exceeding $100 million.

Germany's First Publicly Listed Company Focused on Crypto Assets

Heidelberger Beteiligungsholding AG is headquartered in Heidelberg, Germany, and has long focused on investing in and managing publicly listed securities, including traditional financial assets such as bonds and stocks. This investment company, listed on the Frankfurt Stock Exchange, provides comprehensive financial services for businesses and investors, including investment planning, market research and analysis, investor relations, and stock issuance.

In recent years, with the rise of crypto assets, Heidelberger Beteiligungsholding AG has clearly transformed into Germany's first publicly listed company focused on crypto asset reserves, with a core strategy centered on the long-term accumulation, holding, and staking of SQD tokens (Subquid tokens).

Notably, Heidelberger Beteiligungsholding AG's renaming to SQD.AI Strategies AG aims to convey a strategic commitment to the SQD project and its underlying AI and blockchain integration ecosystem. Currently, multiple global publicly listed companies are competing to create token reserves and modify their holding company names.

The company has initiated a plan to increase its holdings of SQD tokens through OTC transactions and market purchases, canceling its previously planned 700 million euro stock buyback program to reallocate capital to support the expansion of the SQD ecosystem. Additionally, the company announced that during the transformation period, it will temporarily reduce the dividend payout ratio to 10% of net profit, with plans to restore a payout level of 40%-50% by 2026, expecting earnings per share (EPS) to increase by over 20% and return on tangible equity (ROTE) to reach 19% by 2026.

SQD Network: Database Query Engine

Subquid is a decentralized data infrastructure platform designed to provide efficient and transparent data retrieval and processing services for Web3 and AI applications. Traditional blockchain data access relies on centralized remote procedure call (RPC) systems, which are not only inefficient but also pose risks of single points of failure and data monopolies. Subquid builds a decentralized data network to offer developers, blockchain projects, and AI applications faster and more reliable data access solutions.

The core advantages of the Subquid network lie in its high performance and scalability. According to official data, Subquid's query response speed is 10 times faster than traditional solutions, making it outstanding in processing large-scale on-chain data. The platform achieves rapid retrieval and analysis of blockchain data through a distributed node network and optimized data indexing technology, making it particularly suitable for scenarios requiring real-time data support, such as decentralized finance (DeFi), non-fungible token (NFT) markets, and AI-driven on-chain analytics.

In November 2021, the project completed a $3.8 million seed round of financing, followed by a public offering round on CoinList in January 2024, raising $6.28 million, during which 4% of the total supply of tokens was sold at a public offering price of $0.094 each.

The SQD token is the native asset of the Subquid network, used to pay for data query fees, incentivize node operators, and participate in network governance.

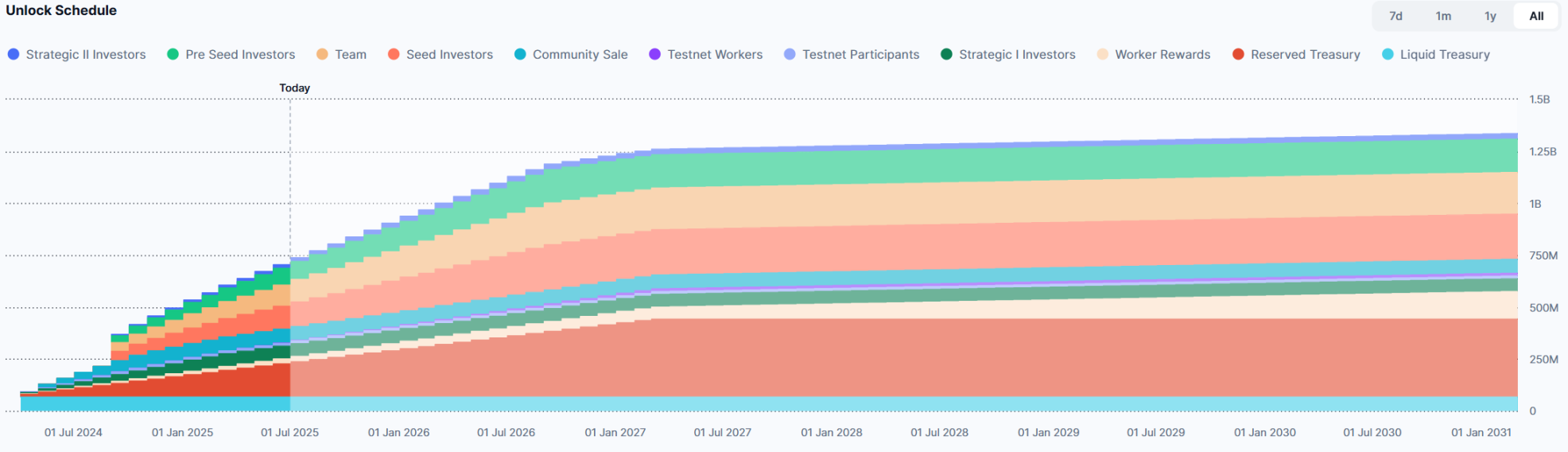

According to data from its official website, the token distribution is as follows: 15% for the team, 28.1% for the treasury, 5% for the liquidity treasury, 10% for node rewards, and 5% for community public offerings. Additionally, the share of VC investors accounts for 34.9%, including seed and strategic rounds.

Seizing the Opportunity of AI and Blockchain Integration?

Heidelberger Beteiligungsholding AG's strategic increase in SQD token holdings and its business direction adjustment centered around SQD are driven by multiple strategic considerations.

First, it is to align with market trends and position itself for future opportunities. Blockchain provides a decentralized and transparent data storage and transmission mechanism, while AI excels at extracting insights from vast amounts of data. The combination of the two can provide robust infrastructure support for Web3 applications, decentralized AI models, and the smart economy.

The Subquid decentralized data network supports on-chain AI applications. Heidelberger Beteiligungsholding AG clearly sees the strategic value of this trend. By increasing its holdings of SQD tokens and renaming itself SQD.AI Strategies AG, the company not only clarifies its positioning in the field of AI and blockchain integration but also provides shareholders with exposure to this high-growth market through direct ownership of SQD tokens. This transformation is similar to MicroStrategy's strategy of holding Bitcoin as a corporate asset reserve, marking a trend where crypto assets are increasingly viewed as strategic assets by traditional companies.

Secondly, it aims for long-term financial returns. From a financial perspective, Heidelberger Beteiligungsholding AG's SQD token accumulation plan is a high-risk, high-reward long-term investment. According to the company's disclosures, it expects to achieve significant financial gains through the expansion of the SQD ecosystem, including an increase of over 20% in EPS and a return on tangible equity of 19% by 2026. This expectation is based on the growth of the SQD network and the overall recovery of the crypto asset market.

Additionally, the staking mechanism of SQD tokens provides the company with an additional source of income. By participating in the staking of the Subquid network, the company can earn network rewards, further enhancing the appreciation potential of its assets. At the same time, the OTC trading and market purchase strategy for SQD tokens allows the company to accumulate tokens at a lower cost amid market fluctuations, laying the foundation for future value growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。