In-depth analysis of the bull and bear market scenarios for $PUMP.

Author: GLC

Translation: Deep Tide TechFlow

The upcoming token launch of Pump.fun may become one of the most anticipated events in the crypto space this year. Since 2024, this launch platform has been at the heart of the Memecoin craze, creating what can be considered the most successful and controversial retail traffic channel in the ecosystem.

Whether you love it or hate it, Pump.fun has proven its product-market fit.

Its permissionless token issuance platform has attracted thousands of users and creators through viral marketing and gamified user experience (UX), generating astonishing trading volumes. Although overall Memecoin activity has cooled down, Pump.fun still maintains a strong moat and continues to push forward with new initiatives like PumpSwap.

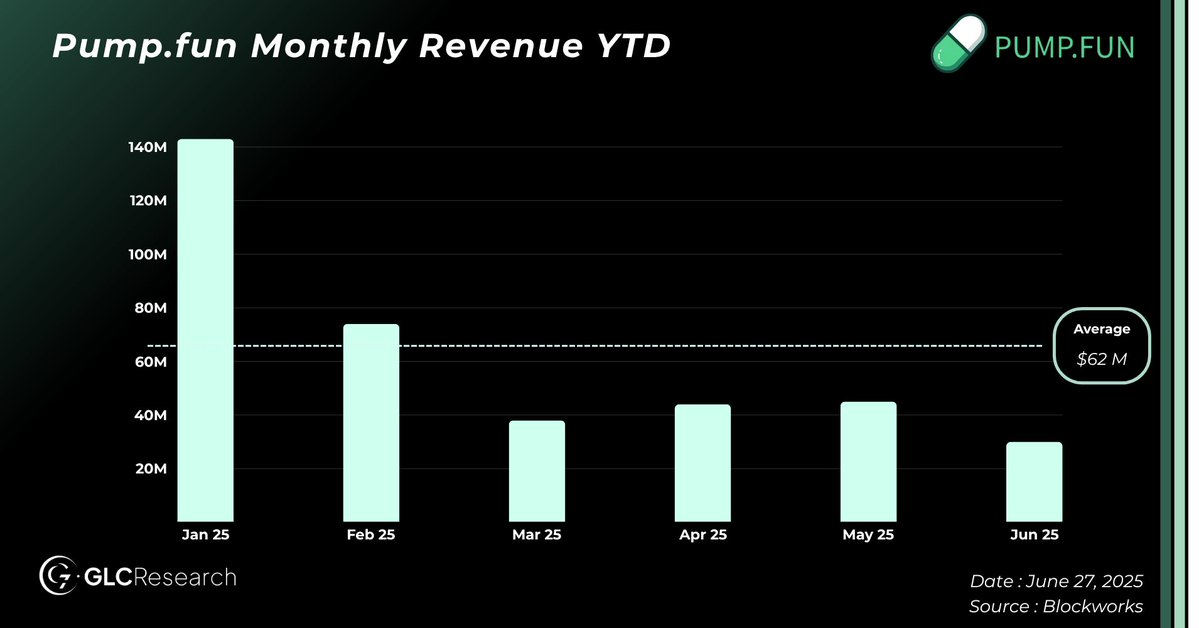

As of this year, Pump's monthly median revenue is approximately $45 million, making it not only one of the most widely used platforms in the crypto space but also one of the most profitable. With the upcoming launch of the $PUMP token, the protocol is at a critical turning point.

The key question is whether the team will view this moment as an opportunity to build a sustainable, investable asset or choose to aggressively extract value. Their past performance has raised some doubts, but opportunities still exist.

In any case, the risk and reward (R/R) seem asymmetrical.

Next, we will delve into the bull and bear market scenarios for $PUMP.

Agenda

Data and Performance: Revenue, trading volume, and user base

Team and Narrative Shift: Can they align with holders?

Valuation: Cash flow, revenue, and price-to-earnings (P/E) considerations

Growth Catalysts: Airdrops, acquisitions, and vertical expansion

Key Risks: Execution, competition, and market structure

Summary Thoughts

Key Metrics: More Resilient Than Expected

In January of this year, the Memecoin market was ignited by President Trump's launch of a personal token, marking the peak of activity across the industry. That month, Pump.fun generated an astonishing $140 million in revenue. However, shortly after, trading volumes in the Memecoin market began to plummet, and market sentiment turned sharply negative.

Talk of the "end of Memecoins" spread rapidly.

However, Pump.fun's performance has proven to be far more resilient than most expected.

Even in the context of an overall market downturn, Pump.fun has successfully retained a large and active user base. Currently, its daily active users are about 340,000, only slightly down from 400,000 in January. Of course, PumpSwap had not yet launched at that time, but the key point is that there are still a significant number of users engaging with Pump's products daily.

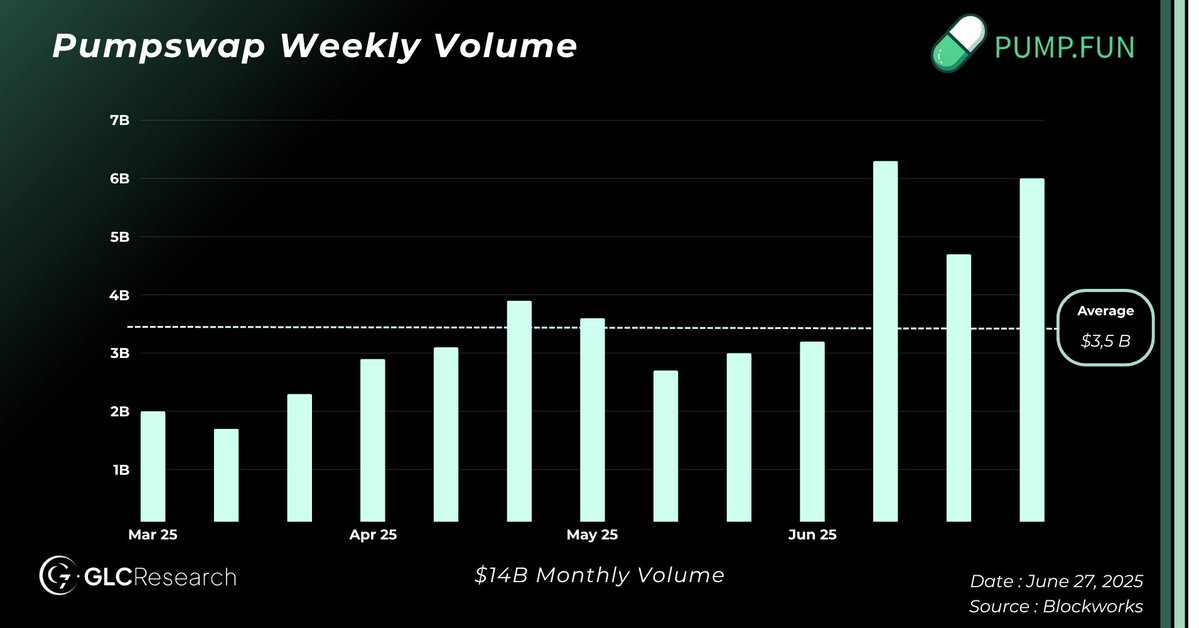

Since the beginning of the year, Pump.fun has averaged a monthly trading volume of about $14 billion through PumpSwap, with a total fee rate of 0.3% (of which 0.2% is allocated to liquidity providers, 0.05% to creators, and 0.05% to Pump).

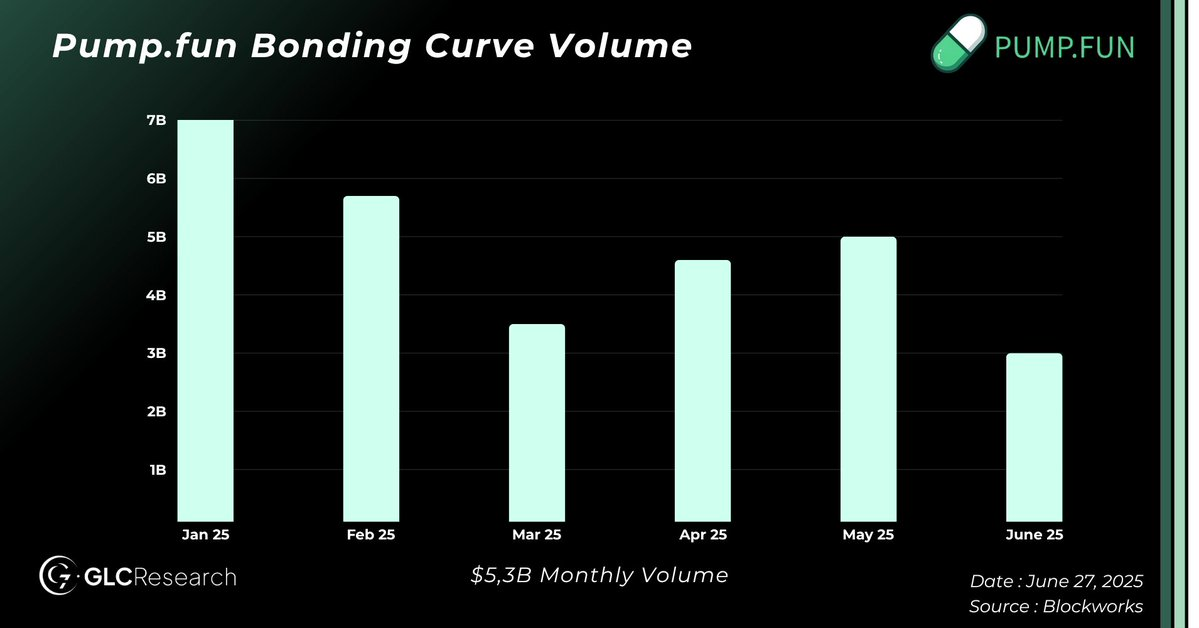

Its core Bonding Curve product has also maintained a monthly trading volume of about $5 billion, charging a 1% fee for both buying and selling.

This series of active data explains why the platform can consistently generate $45 million to $60 million in monthly revenue, with an annualized revenue of about $500 million. This makes $PUMP one of the highest revenue-generating tokens in the crypto space.

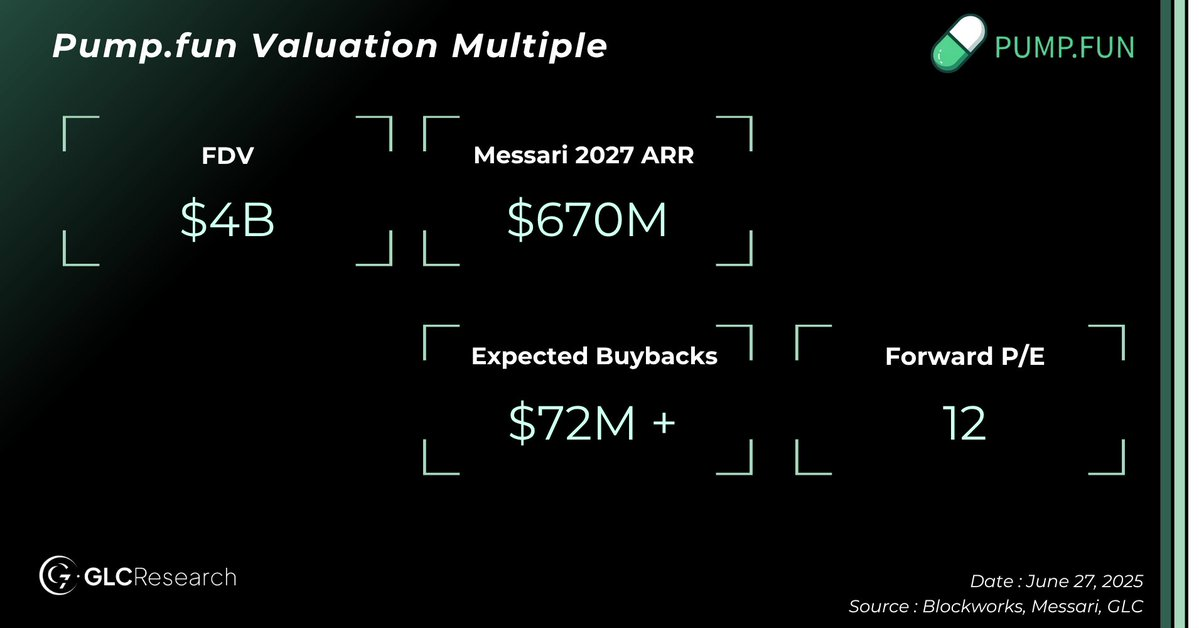

It is expected that $PUMP will launch its token issuance with a fully diluted valuation (FDV) of $4 billion, making it easy to understand why this is one of the most anticipated launches of the year.

We will delve deeper into its valuation mechanism later, but the core conclusion here is simple: even in a market downturn, $PUMP continues to "print money."

Team: Can They Shift the Narrative?

Pump.fun has created one of the most profitable products in the crypto space, but the team behind it has not garnered the same level of respect. Critics argue that they focus too much on value extraction without providing enough back to the community. Additionally, many view Memecoins as a drag on the crypto industry's reputation rather than a catalyst for growth.

Nevertheless, their success is not accidental. Speculation remains a core driving force in this industry, and Pump.fun is the first team to fully capture this demand through product-market fit.

Now, they have the opportunity to shift this narrative.

The upcoming $PUMP token issuance is a chance to align with holders. Reports suggest that a portion of the protocol's revenue may be used for buybacks, but the specific proportion has not been disclosed.

We do not expect a 100% revenue return like the Hyperliquid model. While this model can stimulate price performance in the short term, it can harm long-term sustainability. Pump is not an L1 (Layer 1 blockchain), and its growth requires capital support. A more realistic approach might be to allocate 50% of revenue for buybacks, similar to Raydium or Jupiter.

This proportion is competitive while also leaving room for reinvestment in new business lines, acquisitions, or ecosystem expansion. Pump.fun is a young company with real growth potential. We would prefer to see them set a target of around 10% in annual dividend payouts while using the remaining funds for long-term value compounding.

More important than the numbers is transparency. If the team wants to be taken seriously, they need to publicly disclose how funds are used, including operating costs, capital expenditures (Capex), reserve plans, and governance structures.

Raising $1 billion requires real accountability.

If they can achieve this, even moderate buybacks could be effective. But if they fall back into silent value extraction behaviors, the market reaction may not be favorable.

That said, even if they make mistakes, the downside risk seems limited. We will explore this further in the next section.

$PUMP Valuation Analysis

In this section, I will not provide a complete valuation framework as we typically do at GLC. The reason is simple: we are not experts in the Memecoin space, and any modeling attempts may carry a high degree of subjectivity.

That said, Messari's @defi_monk has proposed a fairly solid valuation framework, and I am comfortable with his assumptions. He is an excellent analyst and seems to take a more conservative rather than optimistic stance, which aligns well with how I assess such issues.

In his base case forecast, Monk expects Bonding Curve trading volumes to decline, but AMM (automated market maker) activity to increase, with annualized revenue potentially reaching about $670 million by 2027. These forecasts reflect the overall growth in on-chain trading volumes, potential increases in market share relative to Raydium, and the advantages of vertical integration.

In my view, this outlook is not only reasonable but also very realistic.

Of course, we cannot know the specific plans of the PUMP team. This is also one of the reasons why this is an asymmetric opportunity. If revenue does indeed reach this range, it is hard to say that $PUMP is overvalued at a $4 billion fully diluted valuation (FDV), especially with a price-to-earnings (P/E) ratio of about 12.

Admittedly, the long-term existence of Memecoins remains uncertain, but the fact is that they have lasted longer than many expected. Memecoins have strong community support, and if Bitcoin breaks its all-time high later this year, speculative activity will likely surge again, with $PUMP likely becoming one of the main beneficiaries.

In the past, the primary way to invest in Memecoins was through $SOL, but now $PUMP is gradually becoming a more direct and logical choice. If the market turns bullish, $PUMP could very well become a high-beta asset, quickly reflecting this trend.

Overall, given that the protocol is already generating about $500 million in annual revenue and holds $1 billion in cash reserves, purchasing $PUMP at a $4 billion valuation, with 75% of the token supply potentially allocated for community incentives or airdrops, seems like a choice with relatively limited downside risk.

Unless we unexpectedly enter a deep bear market with a collapse in on-chain trading volumes (a scenario I did not believe in back in February and still do not believe now), this opportunity is quite attractive to me.

Growth Catalysts: Airdrops and Acquisition Engine

$PUMP is seen as an asymmetric investment opportunity for several key reasons:

First, most participants in the crypto space now recognize that Hyperliquid's operational model is working—building products for the community, sharing profits with the community, and ultimately reaping rewards. Game theory strongly favors founding teams that follow the Hyperliquid model. Now, $PUMP is in the issuance phase, fully controlling its token supply, backed by a highly profitable company, holding $1 billion in cash reserves, and potentially having a large-scale airdrop plan, all of which undoubtedly equip it with all the elements for success.

More notably, the team has already generated hundreds of millions in revenue without issuing tokens. It is reasonable to speculate that most team members have earned far beyond expectations, and they now have all the resources to build $PUMP into a long-term successful asset.

While it is difficult to predict growth solely based on airdrop speculation, a more practical source of growth is the potential for vertical acquisitions. With its cash reserves and strong profitability, Pump.fun is fully capable of acquiring businesses that perfectly align with its model.

Jack Kubinec recently shared some insights in Blockworks' Lightspeed newsletter, where two of the acquisition targets he proposed particularly align with Pump's growth strategy:

- Telegram Trading Bots (e.g., BullX)

Telegram trading bots are widely used by active traders for sniping and copy trading. These bots generate revenue by taking a cut from trading volumes. According to Blockworks' estimates, Solana trading bots alone generate at least $500 million in annual revenue. Acquiring such bots would not only integrate well with Pump's core products but also add a significant new revenue stream.

- DEX Screener:

As Jack pointed out, another pain point for Pump regarding user retention is token discovery. Traders often rely on platforms like DEX Screener for real-time, data-rich analysis. DEX Screener also generates substantial revenue by charging Memecoin projects for enhanced visibility. According to DeFiLlama data, the platform earned over $100 million in revenue in just the past year. If Pump could acquire such a platform, it would help them better control the user experience and improve user retention.

These are just two examples of vertical integration that could strengthen Pump's market position, but the potential possibilities extend far beyond this. We believe Pump will actively utilize its raised funds and operational cash flow to acquire businesses that can expand its moat, drive diversification, and accelerate growth.

With strong fundamentals, deep cash reserves, and a clear path for vertical expansion, Pump is likely to evolve into a comprehensive acquisition engine to drive its next phase of growth.

Risks and Downsides

Clearly, Pump.fun faces some risks.

The first that comes to mind is competition. Everyone has seen how profitable Pump's business model is, so multiple teams are trying to capture market share, including Launchlabs, Believe App, Moonshot, and others. One of them may ultimately succeed in gaining market attention.

Another risk is regulatory pressure. Pump has already faced some issues, and it can be said that their current model does not fully align with regulatory expectations. Further scrutiny is entirely possible.

However, in my view, the biggest risk lies in the team's future operational choices. As mentioned earlier, to receive a positive evaluation for this issuance, the team needs to embrace transparency, maintain consistent reporting, and align appropriately with token holders. If they fall back into extractive behaviors or transfer value to insiders without clear communication, I believe the market will not respond favorably.

Currently, the market seems to expect the team to follow the Hyperliquid model, viewing the token as a long-term, community-aligned asset rather than a short-term extraction tool.

Even if the team fails to meet these expectations, I believe the downside risk may be limited to around -50%, assuming on-chain trading volumes remain stable. Of course, broader market changes could alter this.

That said, it is hard for me to believe that a company with $1 billion in cash and $500 million in annual revenue would remain below a $2 billion valuation for long.

Final Thoughts

Pump.fun stands at the intersection of crypto speculation and on-chain infrastructure. Although the narrative around Memecoins remains controversial, the platform has demonstrated clear product-market fit, becoming one of the most profitable and widely used applications in the space.

The upcoming $PUMP is a critical moment. Beyond being a highly anticipated event, it represents a broader test:

"Can the team transition from a closed, extractive model to a more transparent, aligned-with-token-holder-interests model focused on long-term sustainability?"

If they can, $PUMP has the potential to evolve into a more enduring asset within the ecosystem.

At the same time, long-term success may also depend on whether the team can diversify beyond the Memecoin space. Competing with more mature platforms like Jupiter to become a broader on-chain "super app" will require ongoing product development, deeper integrations, and strategic acquisitions. While this is fraught with uncertainty, the groundwork has already been laid.

This report specifically focuses on the asymmetric opportunity at the time of the $PUMP launch, based on current fundamentals and market expectations. Given its annual revenue of about $500 million, $1 billion in cash reserves, and flexible token supply mechanism, a fully diluted valuation (FDV) of $4 billion does not seem excessive, provided the team can execute a credible strategy aligned with investor interests. Additionally, as market demand for direct exposure to Memecoin infrastructure increases, $PUMP may command a higher valuation premium.

It should be noted that we typically do not focus on the Memecoin space and do not consider it our core area of expertise. However, from a financial perspective, if the team takes the right steps, the valuation of $PUMP at launch seems reasonable. Given its current cash flow and balance sheet strength, downside risk appears limited in the short term unless macro conditions or on-chain activity deteriorate significantly.

In short, $PUMP represents a high-risk, high-reward opportunity with some clear potential growth drivers, while short-term downside risk appears limited. Although we generally take a cautious approach to such areas, this indeed exemplifies a noteworthy asymmetric opportunity.

Disclosure Statement: The analyst of this research plans to purchase the asset at the time of the $PUMP launch.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。