Key Points

● The total market capitalization of global cryptocurrencies is $3.51 trillion, up from $3.23 trillion last week, representing a 7.98% increase this week. As of the time of writing, the cumulative net inflow for Bitcoin spot ETFs in the U.S. is approximately $48.87 billion, with a net inflow of $2.22 billion this week; the cumulative net inflow for Ethereum spot ETFs in the U.S. is approximately $4.18 billion, with a net inflow of $283 million this week.

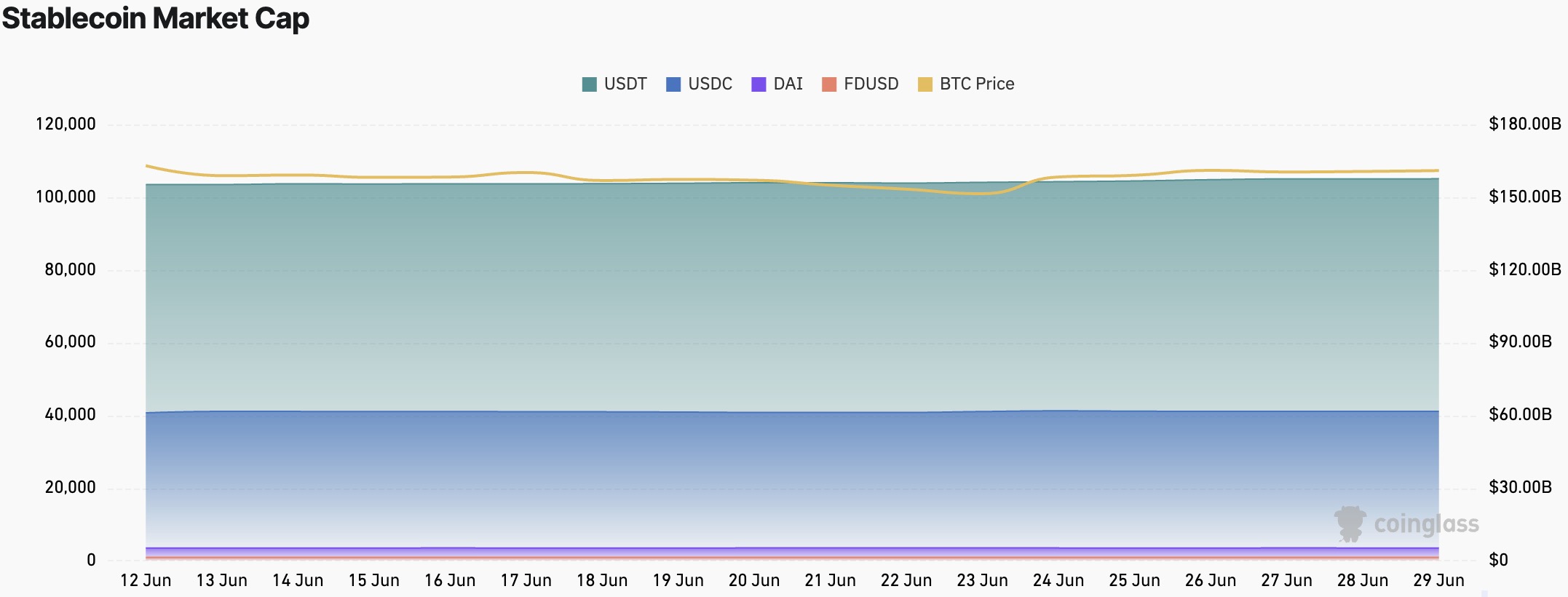

● The total market capitalization of stablecoins is $251.6 billion, with USDT's market cap at $157.6 billion, accounting for 62.64% of the total stablecoin market cap; followed by USDC with a market cap of $61.6 billion, accounting for 24.48%; and DAI with a market cap of $5.36 billion, accounting for 2.13%.

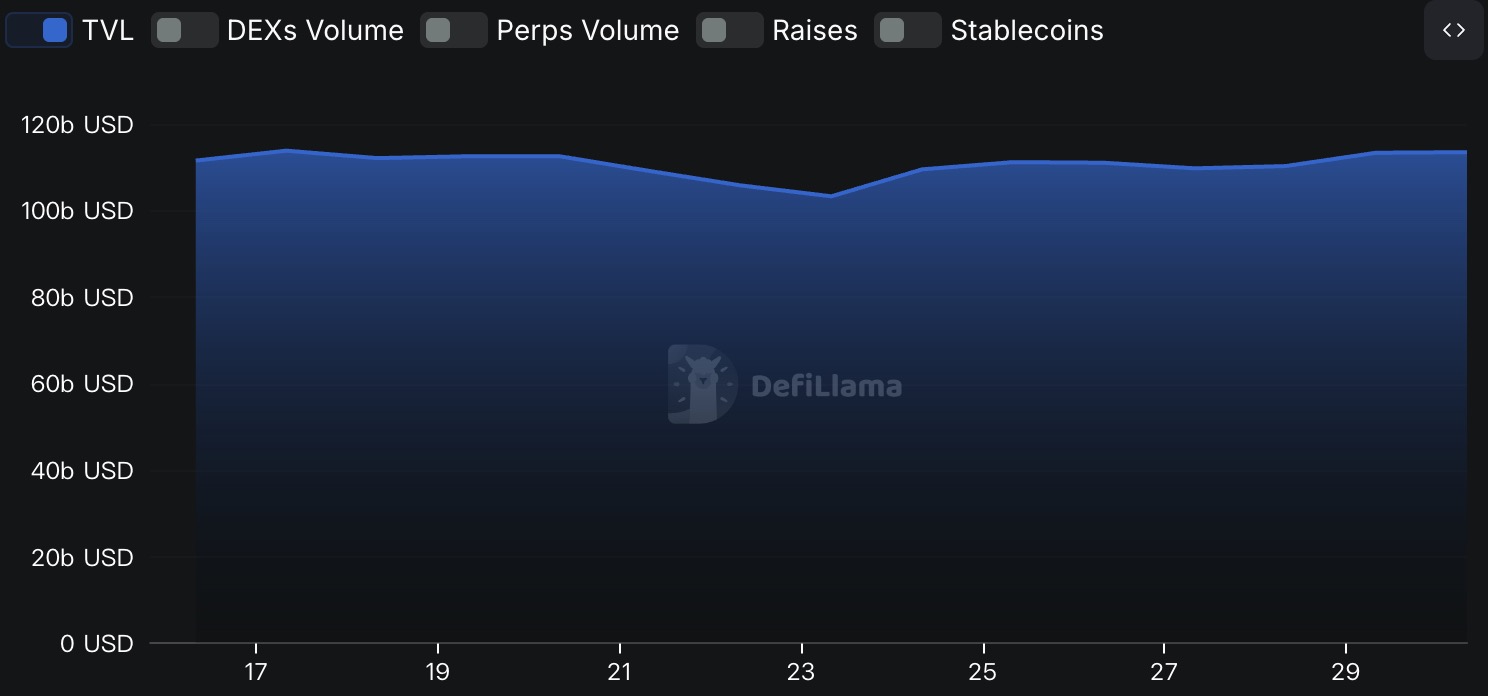

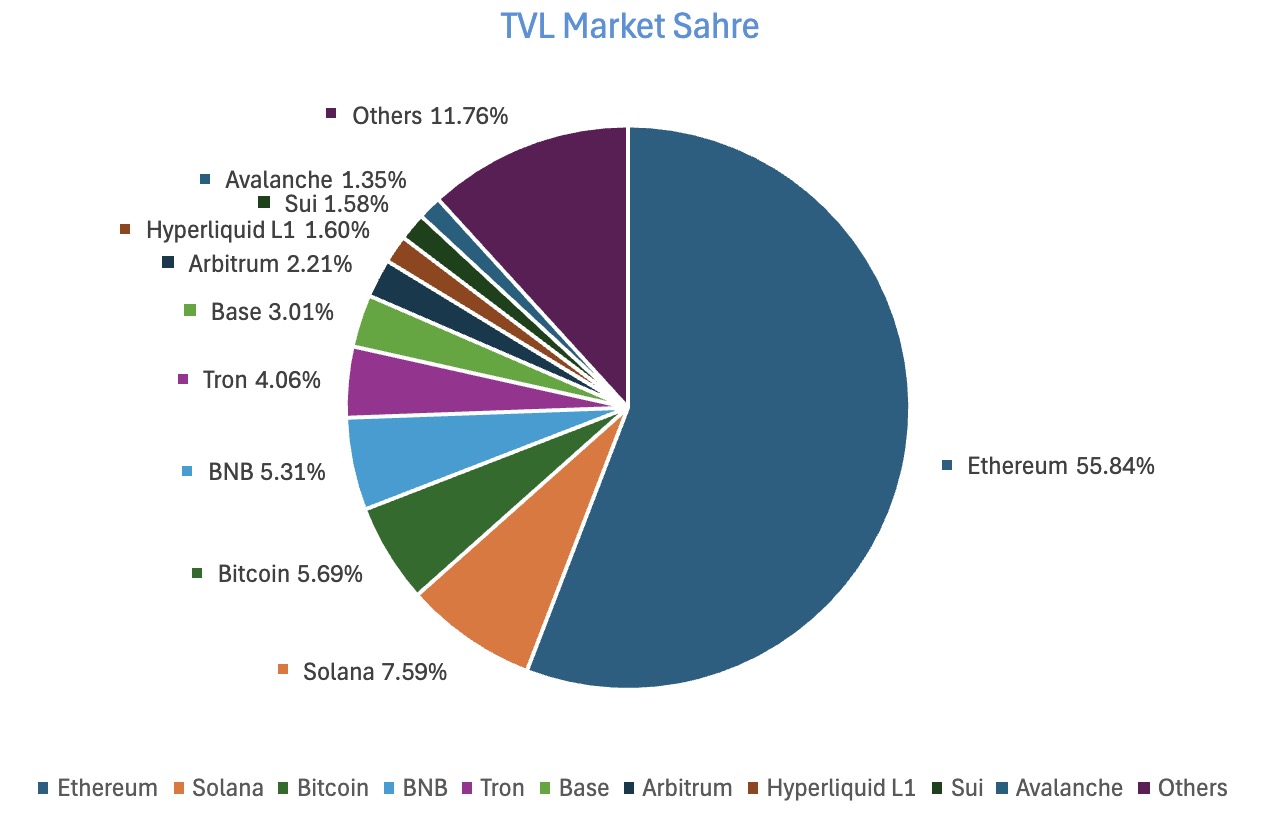

● According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $113.4 billion, up from $103.2 billion last week, an increase of approximately 9.8%. By public chain, the top three chains by TVL are Ethereum, accounting for 55.84%; Solana, accounting for 7.59%; and Bitcoin, accounting for 5.69%.

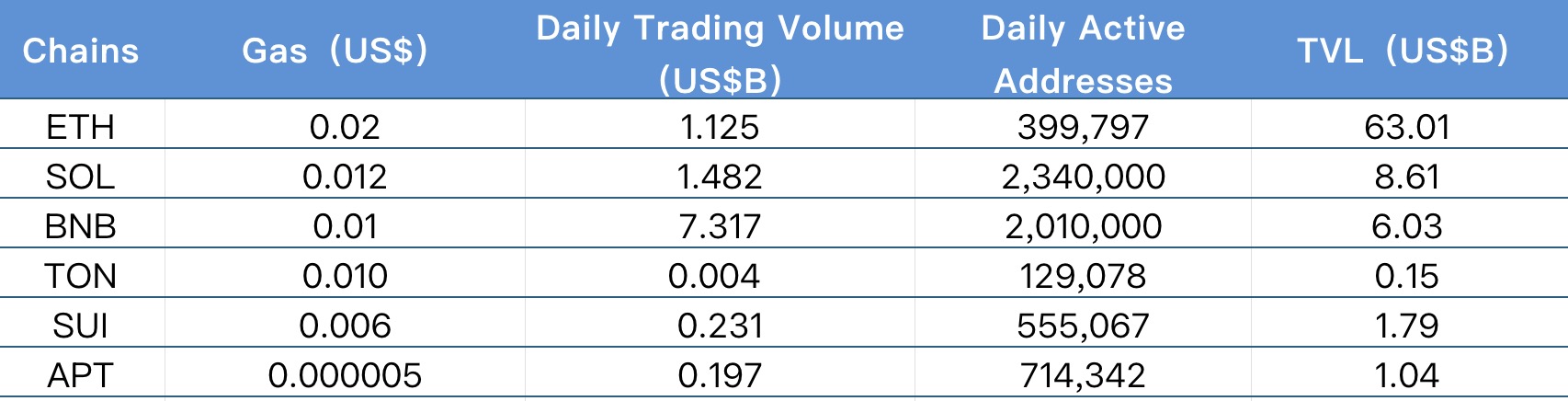

● From on-chain data, in terms of daily trading volume, BNB and Sui are the only chains with an increase this week, growing by 53% and 5% respectively, while others declined, with Aptos experiencing the largest drop of 88%. In terms of transaction fees, Solana's costs have significantly increased, soaring nearly 9.7 times; ETH fees have dropped by 60%, Aptos increased by 33%, and other changes were minor. In terms of daily active addresses, Sui, TON, and ETH saw significant growth, increasing by 40%, 27%, and 16% respectively; in terms of TVL, only Aptos saw a significant decline (-88%), while other public chains experienced slight increases, with Sui, Solana, and ETH growing by 13%, 11%, and 10% respectively.

● New project focus: Spekter Games is a blockchain game development company that emphasizes "gameplay first, Web3 as a supplement." Its first Rogue-lite game, "Spekter Agency," can be played directly on Telegram, enhancing user engagement through social incentives and passive income. OpenRouter is a platform that provides unified access to various AI language models, offering standardized APIs and deployment tools to help developers efficiently integrate and switch between mainstream models like OpenAI and Anthropic. Byzanlink focuses on the tokenization of real-world assets (RWA) through tools like account abstraction and asset settlement, helping enterprises build decentralized asset applications that connect TradFi and DeFi.

Table of Contents

1. Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD Exchange Rates

5. Decentralized Finance (DeFi)

7. Stablecoin Market Cap and Issuance

2. This Week's Hot Money Trends

1. This Week's Top Gaining VC Coins and Meme Coins

1. Major Industry Events This Week

2. Major Upcoming Events Next Week

3. Important Financing and Investment from Last Week

1. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

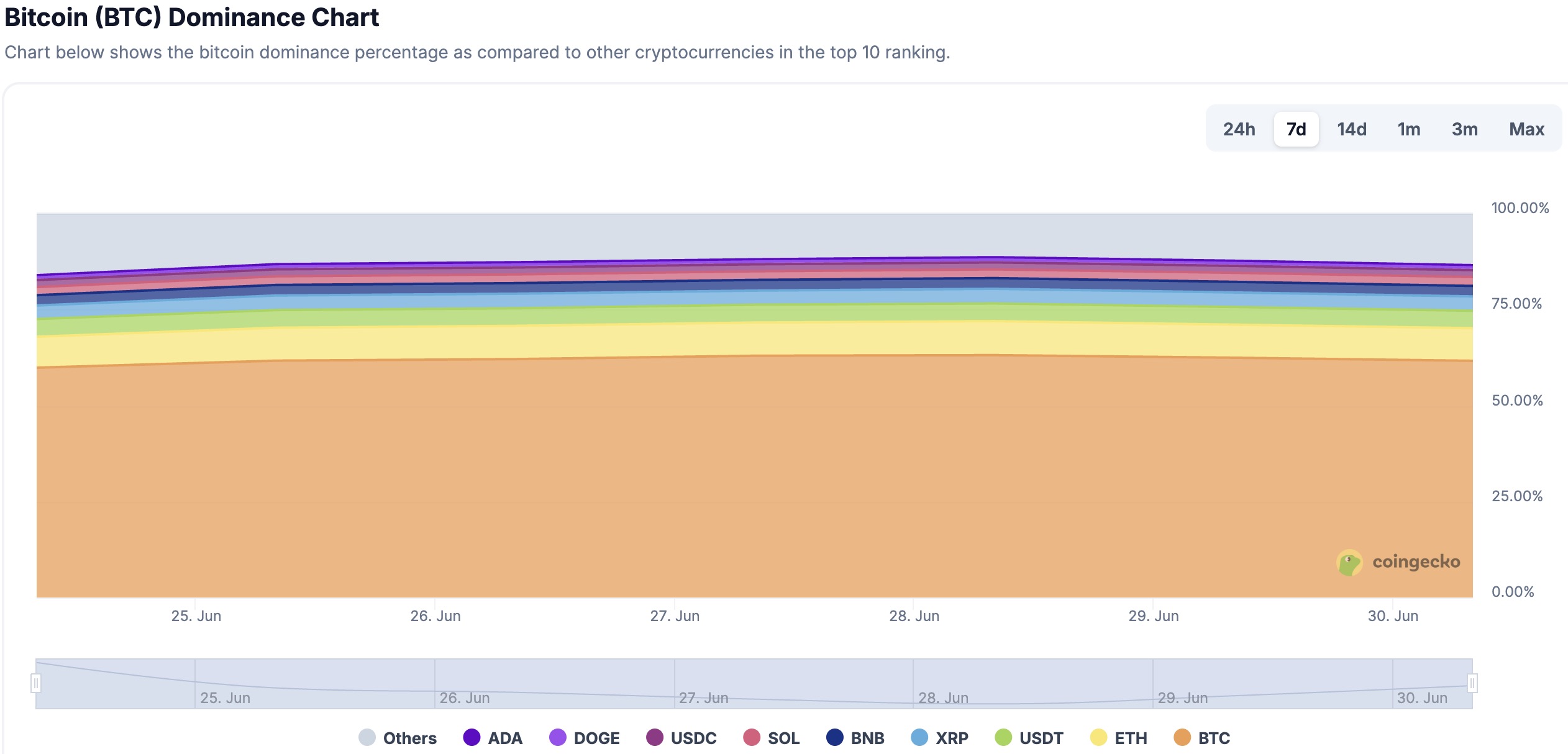

The total market capitalization of global cryptocurrencies is $3.51 trillion, up from $3.23 trillion last week, representing a 7.98% increase this week.

Data Source: cryptorank

Data as of June 29, 2025

As of the time of writing, Bitcoin's market cap is $2.16 trillion, accounting for 61.5% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $251.6 billion, accounting for 7.16% of the total cryptocurrency market cap.

Data Source: coingeck

Data as of June 29, 2025

2. Fear Index

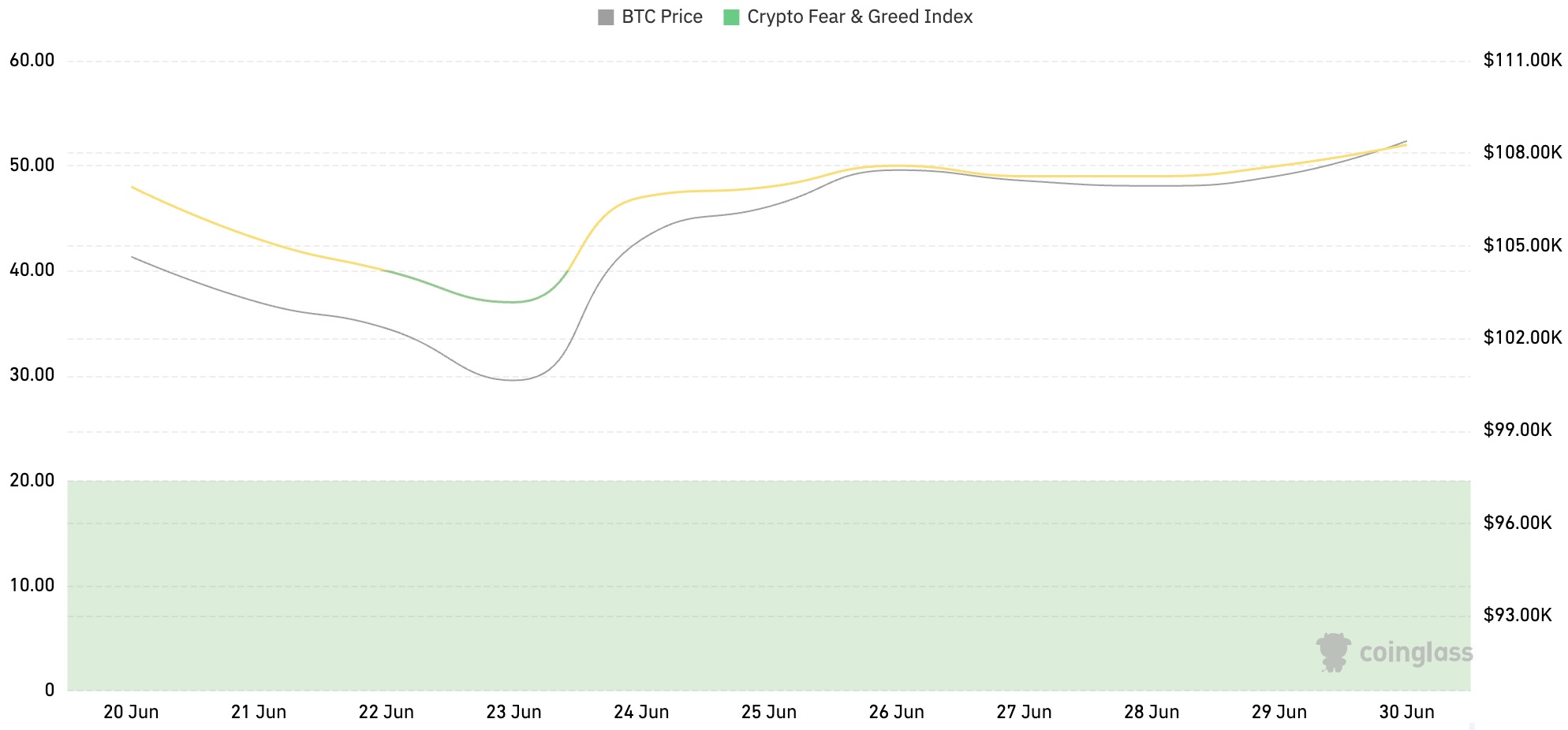

The cryptocurrency fear index is 52, indicating a neutral sentiment.

Data Source: coinglass

Data as of June 29, 2025

3. ETF Inflow and Outflow Data

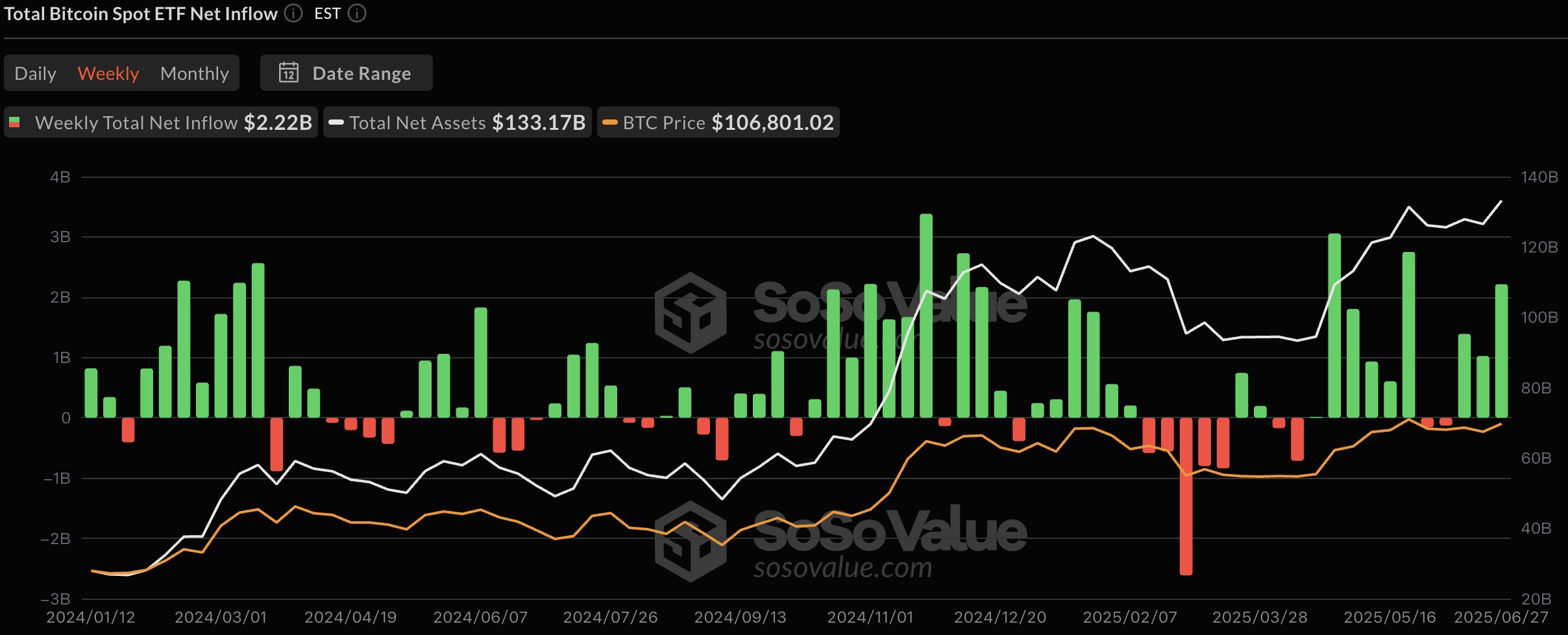

As of the time of writing, the cumulative net inflow for Bitcoin spot ETFs in the U.S. is approximately $48.87 billion, with a net inflow of $2.22 billion this week; the cumulative net inflow for Ethereum spot ETFs in the U.S. is approximately $4.18 billion, with a net inflow of $283 million this week.

Data Source: sosovalue

Data as of June 29, 2025

4. ETH/BTC and ETH/USD Exchange Rates

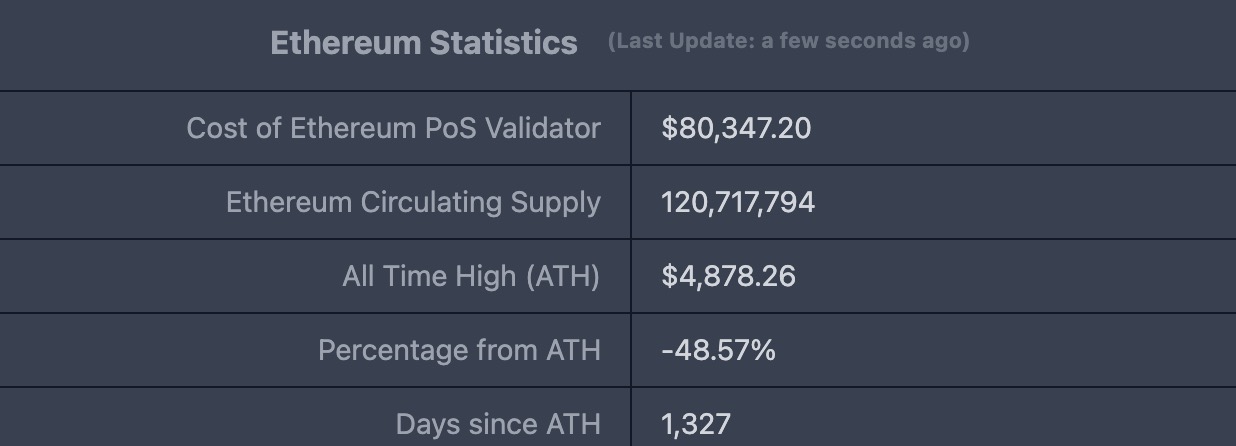

ETHUSD: Current price $2,510.85, historical highest price $4,878.26, down approximately 48.57% from the highest price.

ETHBTC: Currently at 0.023090, historical highest at 0.1238.

Data Source: ratiogang

Data as of June 29, 2025

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL in DeFi this week is $113.4 billion, up from $103.2 billion last week, an increase of approximately 9.8%.

Data Source: defillama

Data as of June 29, 2025

By public chain, the top three chains by TVL are Ethereum, accounting for 55.84%; Solana, accounting for 7.59%; and Bitcoin, accounting for 5.69%.

Data Source: CoinW Research Institute, defillama

Data as of June 29, 2025

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing daily trading volume, daily active addresses, and transaction fees for the current major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of June 29, 2025

Daily trading volume and transaction fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, only the BNB chain and Sui chain saw increases in daily trading volume, rising by 53% and 5% respectively; all other chains experienced declines, with Aptos seeing a significant drop of 88%, and TON down 45%, while ETH and Solana declined by 33% and 24% respectively. In terms of transaction fees, BNB and TON remained unchanged from last week, SUI chain saw a slight decrease of 6%, ETH fees dropped by 60%, Aptos increased by 33%, and Solana's fees surged significantly, increasing by approximately 9.7 times.

Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. This week, daily active addresses for ETH, TON, and SUI chains increased, with growth rates of 16%, 27%, and 40% respectively; the other three chains saw slight declines of 19%, 8%, and 4%. In terms of TVL, only Aptos saw a decline of 88%, while other chains experienced slight increases, with Sui chain, Solana, and ETH rising by 13%, 11%, and 10% respectively, and BNB and TON increasing by 6% and 8%.

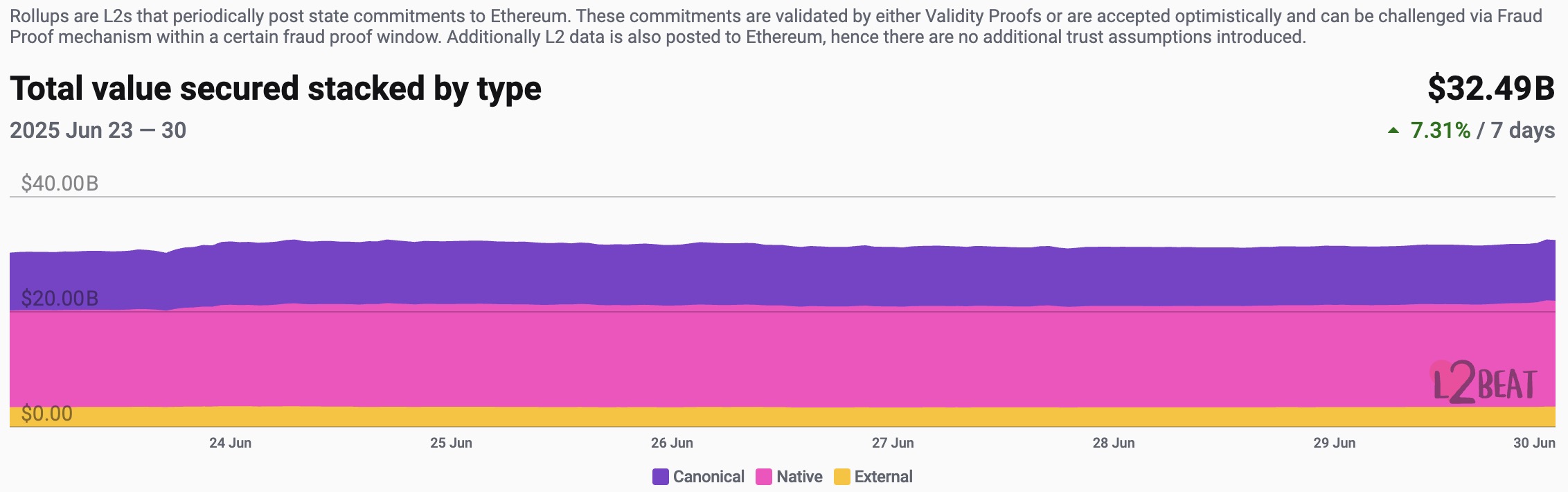

Layer 2 Related Data

According to L2Beat, the total TVL for Ethereum Layer 2 is $32.49 billion, with an overall increase of 7.16% this week compared to last week ($30.32 billion).

Data Source: L2Beat

Data as of June 29, 2025

Base and Arbitrum occupy the top positions with market shares of 36.03% and 34.08% respectively, with an overall increase in their shares.

Data Source: footprint

Data as of June 29, 2025

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $251.6 billion, with USDT's market cap at $157.6 billion, accounting for 62.64% of the total stablecoin market cap; followed by USDC with a market cap of $61.6 billion, accounting for 24.48%; and DAI with a market cap of $5.36 billion, accounting for 2.13%.

Data Source: CoinW Research Institute, Coinglass

Data as of June 29, 2025

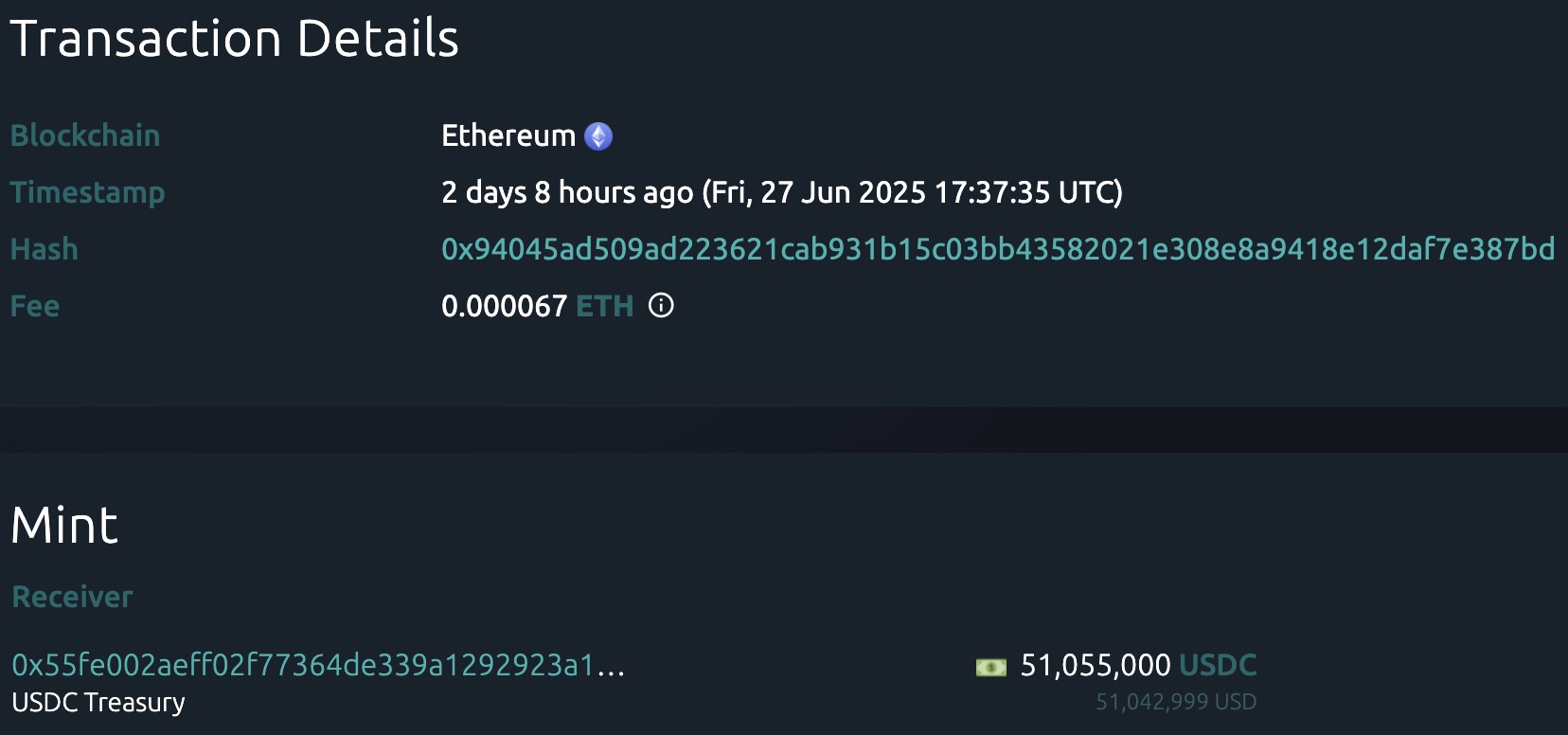

According to Whale Alert data, this week USDC Treasury issued a total of 485 million USDC, while Tether Treasury had no issuance this week. The total issuance of stablecoins this week was 485 million, a decrease of 86.68% compared to last week's total issuance of 3.64 billion stablecoins.

Data Source: Whale Alert

Data as of June 29, 2025

II. This Week's Hot Money Trends

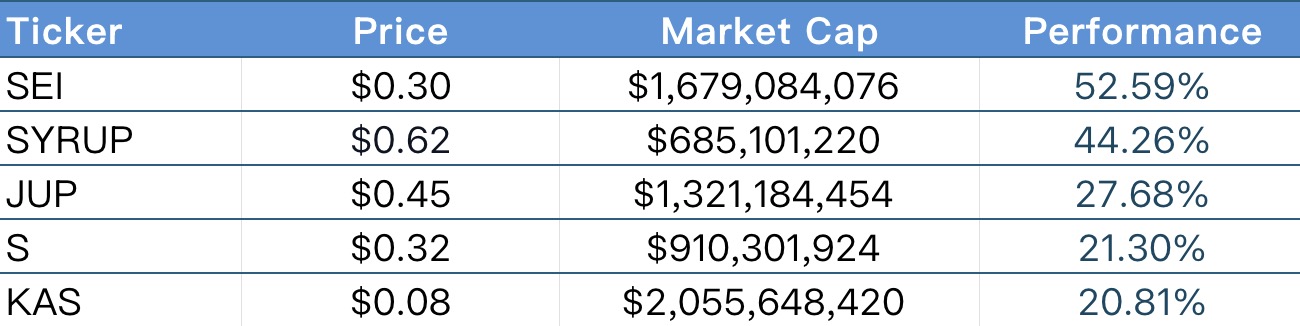

1. Top Five Gaining VC Coins and Meme Coins This Week

The top five VC coins with the highest gains in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of June 29, 2025

The top five Meme coins with the highest gains in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of June 29, 2025

2. New Project Insights

Spekter Games is a game development company focused on integrating traditional gameplay with blockchain technology, founded by veteran game developer Taehoon Kim. The company aims to create a "gameplay first, Web3 as a supplement" gaming experience. Its first game, "Spekter Agency," is a Rogue-lite action game that runs on Telegram, allowing players to experience it without downloading an app, enhancing user engagement through passive accumulation and social incentive mechanisms.

OpenRouter is a platform that provides unified access to various AI language models, aiming to simplify the process for developers and enterprises using AI technology. Through a standardized API, users can easily access and switch between multiple mainstream models, including OpenAI and Anthropic, without needing to connect with each service provider separately. OpenRouter offers a unified interface and deployment tools to help users more efficiently compare model performance and integrate them into real applications.

Byzanlink is a protocol focused on the tokenization of real-world assets (RWA), dedicated to connecting traditional finance (TradFi) with decentralized finance (DeFi). The protocol provides tools for account abstraction, asset tokenization, and settlement payments, helping enterprises conveniently build decentralized asset management and trading applications with blockchain integration capabilities, allowing users to participate and gain access to institutional-level real asset returns.

III. Industry News

1. Major Industry Events This Week

Mango Network officially launched the $MGO token airdrop and TGE on June 24. This airdrop is aimed at early participants in the testnet and community contributors, accounting for 5% of the total token supply. Users who completed relevant interaction tasks and met the conditions during the snapshot period can claim the airdrop immediately after the TGE starts and use it for various incentive activities within the ecosystem.

CESS Network officially held its token generation event (TGE) on June 26, 2025, announcing the launch of its mainnet and the issuance of its native token $CESS, which will become the core asset for network governance, storage incentives, and ecosystem participation. On the same day, the project launched the "Interstellar Expedition" airdrop activity, targeting DeShare testnet users, node operators, and community participants. Users can qualify for the airdrop by completing tasks (such as testing uploads/downloads, daily quizzes, inviting friends), with a total of over 1,000,000 points available for claiming.

Sahara AI officially launched its token generation event (TGE) on June 26, 2025, and introduced the "Knowledge Drop" airdrop plan, distributing $SAHARA tokens to users who contributed to its data platform before May 31, with a total of 28 million tokens distributed, some of which are immediately available, while the rest will be unlocked in phases. Airdrop claims began on June 29, marking Sahara's official entry into the token economic operation phase.

Moonveil officially launched its TGE on June 27 and opened airdrop claims, with approximately 6% of the total allocation designated for airdrops, released immediately to eligible closed community members, followed by governance and ecosystem usage phases. Previously, the team opened airdrop eligibility checks from June 24 to 26, allowing users to verify if they held at least 500 Moon Beams and a valid Moonveil badge to participate in the airdrop.

Blum officially launched the token generation event (TGE) for $BLUM on June 27. Airdrop recipients include early test users, community governance participants, and some partners. After the TGE, $BLUM will serve as the core equity token circulating within the platform, used for staking, governance, and various protocol interactions, further promoting community-led decentralized development.

Kittenswap is a decentralized exchange (DEX) built on HyperEVM, and the project officially opened airdrop claims on June 28, 2025, with 35% of KITTEN tokens airdropped to early users in the form of veKITTEN.

2. Major Upcoming Events Next Week

Fragmetric will open its airdrop claim window from July 1 to August 1, with all issued tokens available immediately, requiring no lock-up. Previously, the team conducted a snapshot on June 23-24 for users holding fragSOL, fragJTO, and participating in DeFi-related activities, confirming airdrop eligibility, and launched an official eligibility query tool on June 26. The project announced that 10% of the total supply (approximately 100 million $FRAG) will be used for the first round of airdrops, with 8% allocated to contributors of the Season 1 LF(ra)G activity.

NodeOps will officially launch the token generation event (TGE) for $NODE on June 30, 2025. This round of TGE will be open to eligible early supporters, marking NodeOps' entry into the formal token economic phase, establishing a long-term incentive mechanism and ecological governance foundation for its decentralized node management platform.

The Endless Clouds Foundation will officially announce the $END token economic model on June 28, 2025: the total token supply is 500 million, with an initial circulation of 155.5 million (31.1%). Of this, 17.5% is allocated for airdrop distribution, specifically incentivizing early players and community contributors; the remaining tokens will be allocated to the team (20%), ecological fund (10%), and community reward programs (32.45%), with the overall design aimed at long-term activation of the game ecosystem and community governance. Specific TGE events will be announced later.

Nemesis is conducting an airdrop event from June 20 to July 25, 2025, with the official announcement stating that each user can claim 200 NEMESIS tokens after completing social tasks and wallet verification. The total airdrop pool is 33,300,000 tokens, expected to be distributed to eligible users' wallets by July 30. The project has not yet announced its TGE plan but is actively attracting early community participants and building a decentralized ecological foundation through this airdrop.

3. Important Financing and Investment from Last Week

Niural announced the completion of a $31 million Series A financing round, led by Marathon Management Partners. Niural is a compliant crypto payroll platform that has built a low gas fee real-time payroll payment protocol based on Polygon, supporting both fiat and cryptocurrency disbursements, and equipped with a Web3 human resources system that can handle tax and employment compliance risks. This round of financing will be used to accelerate the development of an AI smart operations hub for CFOs. (June 26, 2025)

Prediction market platform Kalshi announced the completion of $185 million in financing, with a valuation of $2 billion, led by crypto venture capital Paradigm, with Sequoia Capital and others as early investors. Kalshi, founded in 2018 and incubated by Y Combinator, is a prediction market platform regulated by the U.S. federal government, allowing users to recharge using cryptocurrencies and trade contracts based on the outcomes of real events (such as sports, finance, entertainment) for profit. Kalshi operates legally and compliantly in the U.S. and provides users with rich tutorials, market data, and other tools to enhance prediction strategies and trading capabilities. (June 26, 2025)

Blockchain software and service provider Digital Asset announced the completion of $135 million in strategic financing, led by DRW Venture Capital and Tradeweb Markets, with participation from traditional finance and crypto giants including BNP Paribas, Circle Ventures, Citadel Securities, DTCC, Virtu Financial, and Paxos. Digital Asset is the developer of the privacy blockchain Canton Network, focusing on configurable privacy technology, and has attracted institutions like Goldman Sachs and BNY Mellon to test RWA (real-world asset) applications on its platform. (June 24, 2025)

The decentralized trading platform GTE announced the completion of a $15 million Series A financing round, exclusively led by the leading crypto institution Paradigm. GTE is incubated by MegaETH Labs and built on the EVM-compatible MegaETH blockchain, utilizing a central limit order book (CLOB) + AMM hybrid architecture, aiming to achieve performance and liquidity comparable to centralized exchanges like Binance and Coinbase. GTE focuses on addressing the high latency and high transaction costs faced by traditional DEXs, providing users with a more efficient, low-slippage on-chain trading experience. (June 23, 2025)

DeFi infrastructure company Veda announced the completion of an $18 million financing round, led by CoinFund. Veda is dedicated to providing native yield infrastructure for protocols and applications, allowing users to deposit assets into Veda's smart contracts, which then securely deploy funds into various DeFi protocols to generate yield. The new funding will be used to advance the development of its modular treasury framework, enabling developers to offer simplified and transparent crypto yield products without requiring users to directly engage with the complexities of DeFi. (June 23, 2025)

IV. Reference Links

Niural: https://www.niural.com/

Kalshi: https://kalshi.com/

Digital Asset: https://www.digitalasset.com/

GTE: https://www.gte.xyz/

Veda: https://veda.tech/

Spekter Games: https://www.spekter.games/

OpenRouter: https://openrouter.ai/

Byzanlink: https://www.byzanlink.com/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。