Key Points

The total market capitalization of cryptocurrencies globally is $4.2 trillion, up from $3.77 trillion last week, representing an increase of 11.4% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $54.43 billion, with a net inflow of $246 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $9.82 billion, with a net inflow of $326 million this week.

The total market capitalization of stablecoins is $265.9 billion, with USDT's market cap at $164.5 billion, accounting for 61.86% of the total stablecoin market cap; followed by USDC with a market cap of $65.2 billion, accounting for 24.52%; and DAI with a market cap of $5.37 billion, accounting for 2.01%.

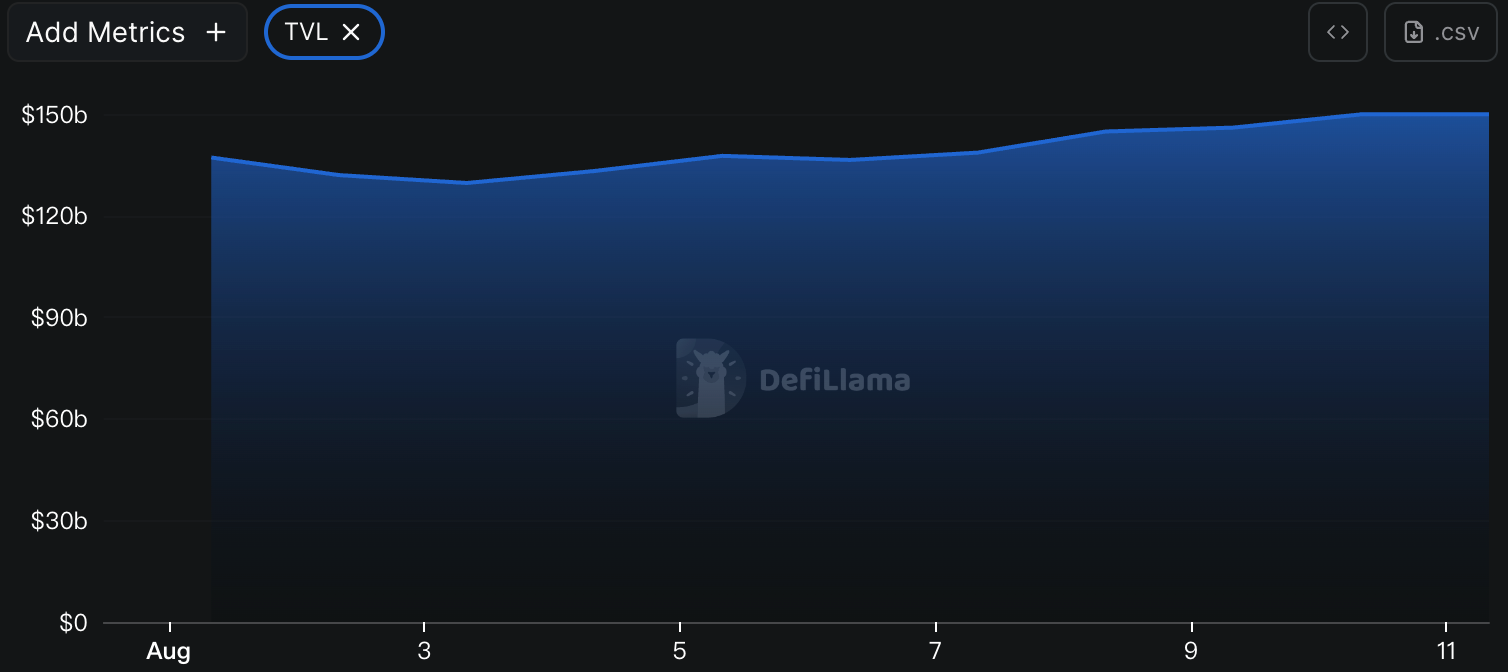

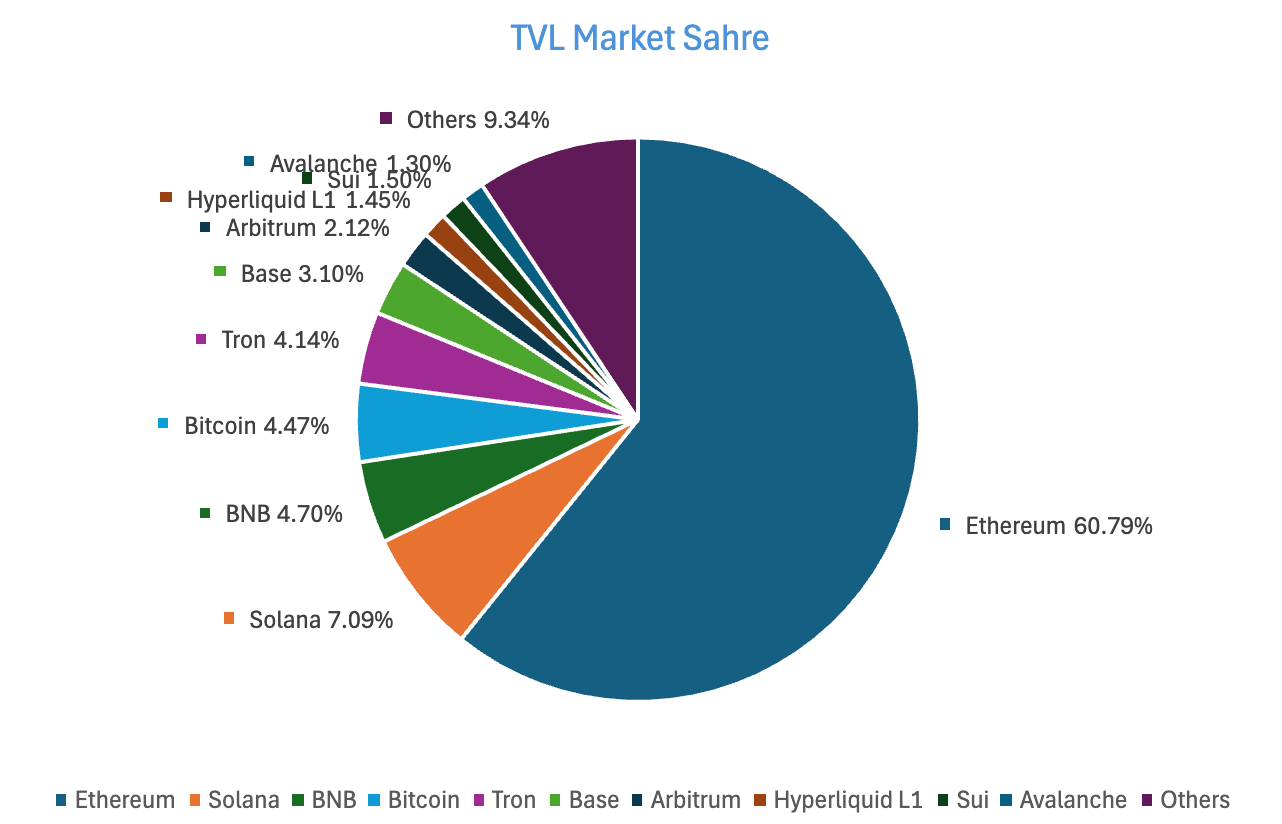

According to DeFiLlama, the total TVL of DeFi this week is $144.9 billion, up from $132.9 billion last week, an increase of approximately 9.02%. When categorized by public chains, the top three public chains by TVL are Ethereum, accounting for 60.79%; Solana, accounting for 7.09%; and BNB Chain, accounting for 4.7%.

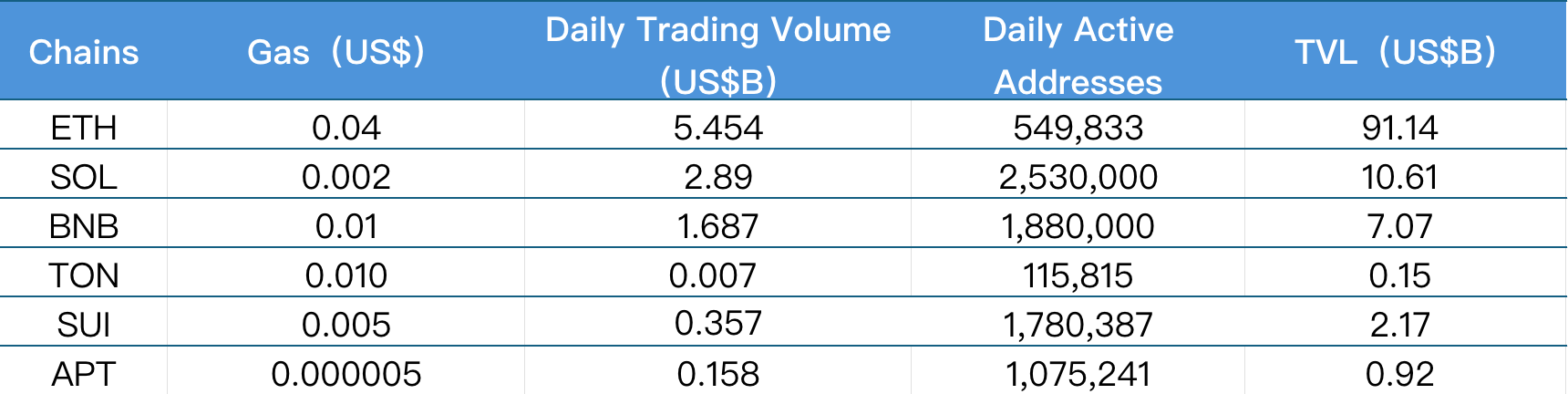

On-chain data shows that public chain data is generally positive this week: in terms of daily trading volume, all chains except TON, which fell by 92.76%, saw increases, with Solana showing the largest increase (+109.42%), followed by Sui (+55.22%), Ethereum (+32.7%), BNB Chain (+18.8%), and Aptos (+12.86%). In terms of transaction fees, BNB Chain remained flat, while Solana and Aptos decreased by 37.36% and 31.22%, respectively; Ethereum (+100%), TON (+226%), and Sui (+5.48%) saw increases. In daily active addresses, all chains except BNB Chain, which fell by 19.66%, saw growth, with Aptos (+62.3%) and Sui (+54.84%) leading, followed by Solana (+14.48%), Ethereum (+13.53%), and TON (+5.56%) with more stable increases. In terms of TVL, only TON saw a slight decline of 5.63%, while the others increased, with Ethereum (+16.03%) and Solana (+11.61%) leading, and BNB Chain (+5.84%), Sui (+9.49%), and Aptos (+3.03%) showing moderate increases.

New project highlights: Perle Labs is a Web3-based AI project focused on providing high-fidelity data pipelines for AI teams, covering secure critical areas such as code, advanced reasoning, multilingual content, and satellite imagery. TradeTide AI is a highly automated cross-chain crypto strategy platform with trend forecasting, strategy formulation, and execution capabilities, relying on intelligent automation systems and deep native integration of crypto assets to achieve an integrated operational experience from market trend identification to trade execution. Juicy.meme is a fair launch platform for memes under the Juchain ecosystem, dedicated to providing a decentralized, fair, and transparent token issuance and participation environment for community users.

Table of Contents

Market Overview

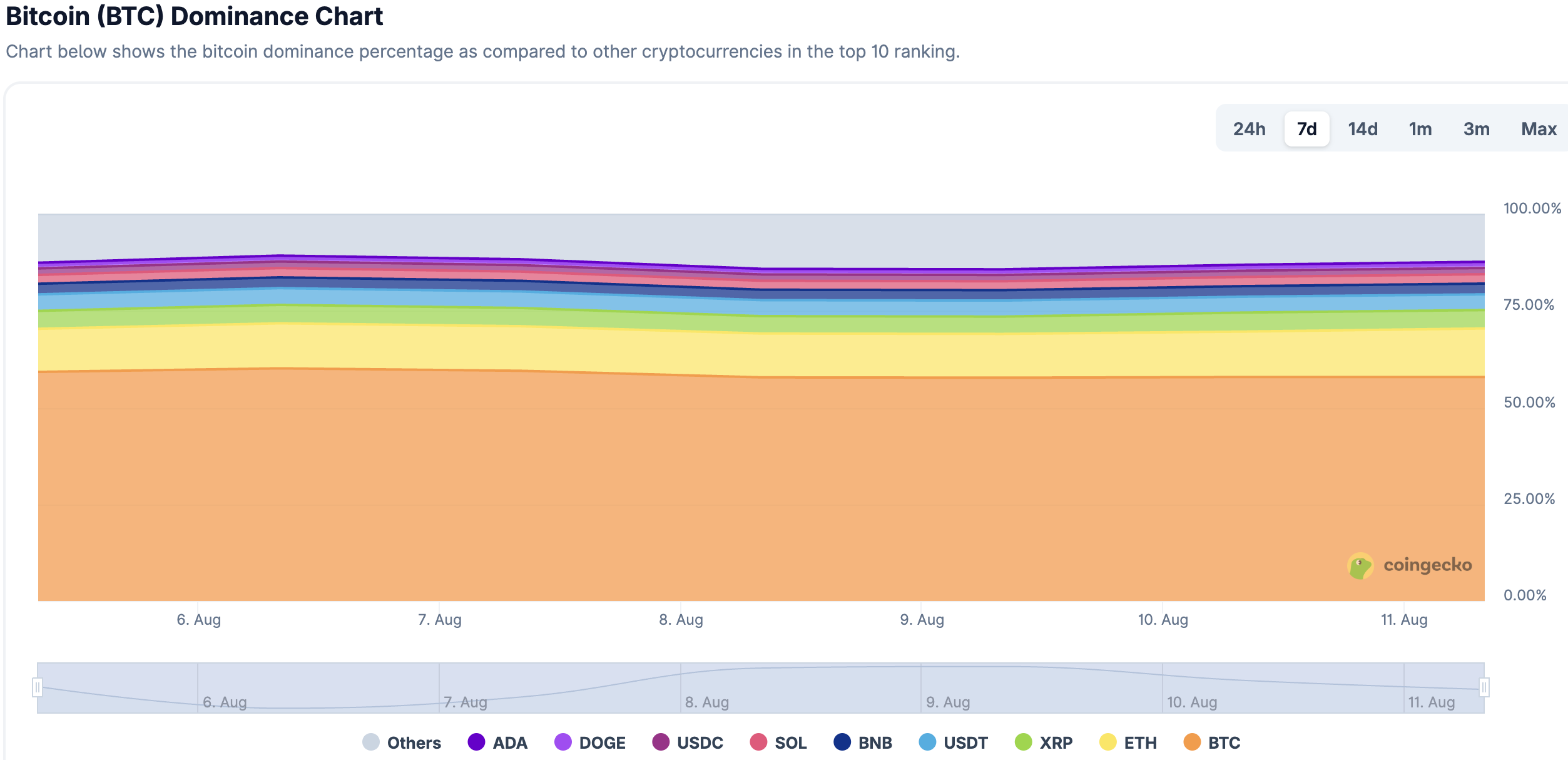

Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Proportion

The total market capitalization of cryptocurrencies globally is $4.2 trillion, up from $3.77 trillion last week, representing an increase of 11.4%.

Data Source: cryptorank

Data as of August 10, 2025

As of the time of writing, the market cap of Bitcoin is $2.37 trillion, accounting for 56.4% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $265.9 billion, accounting for 6.33% of the total cryptocurrency market cap.

Data Source: coingeck

Data as of August 10, 2025

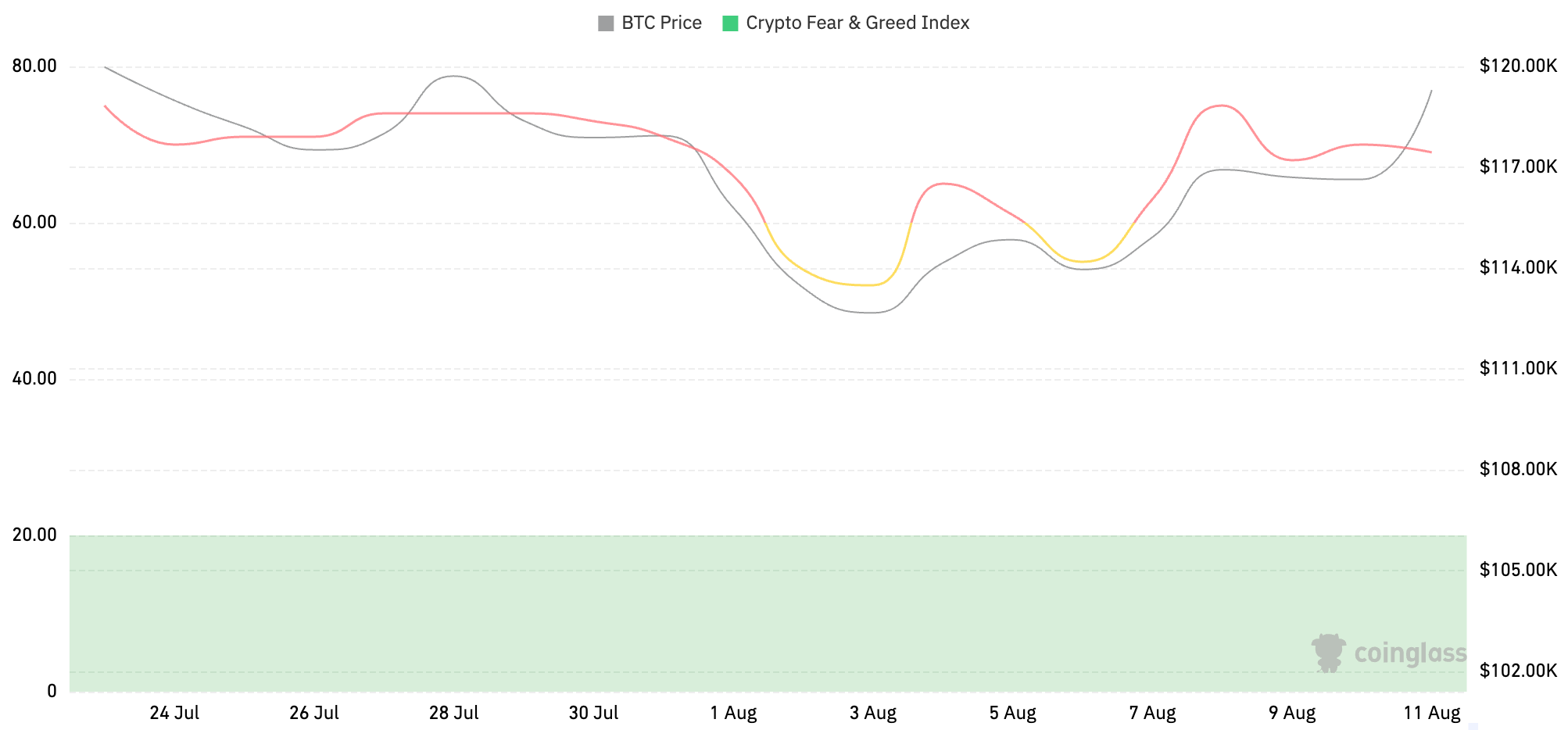

- Fear Index

The cryptocurrency fear index is at 69, indicating greed.

Data Source: coinglass

Data as of August 10, 2025

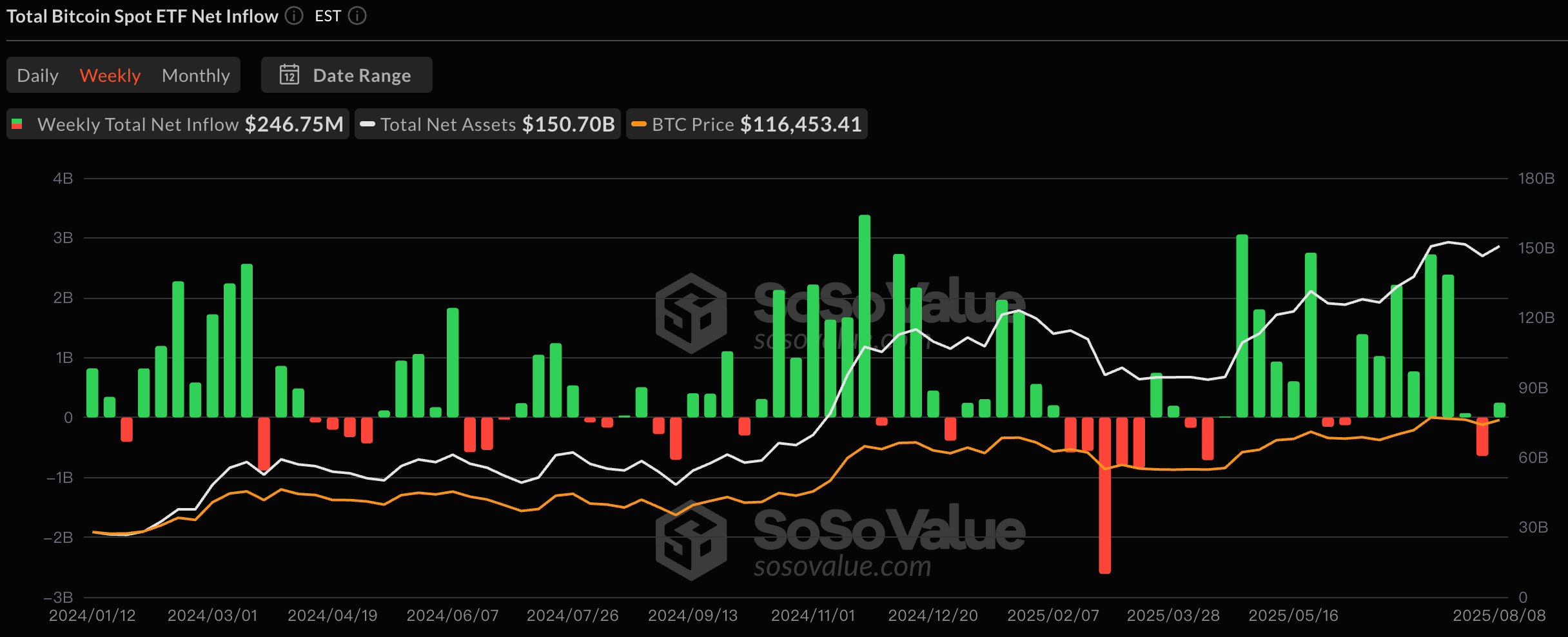

- ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $54.43 billion, with a net inflow of $246 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $9.82 billion, with a net inflow of $326 million this week.

Data Source: sosovalue

Data as of August 10, 2025

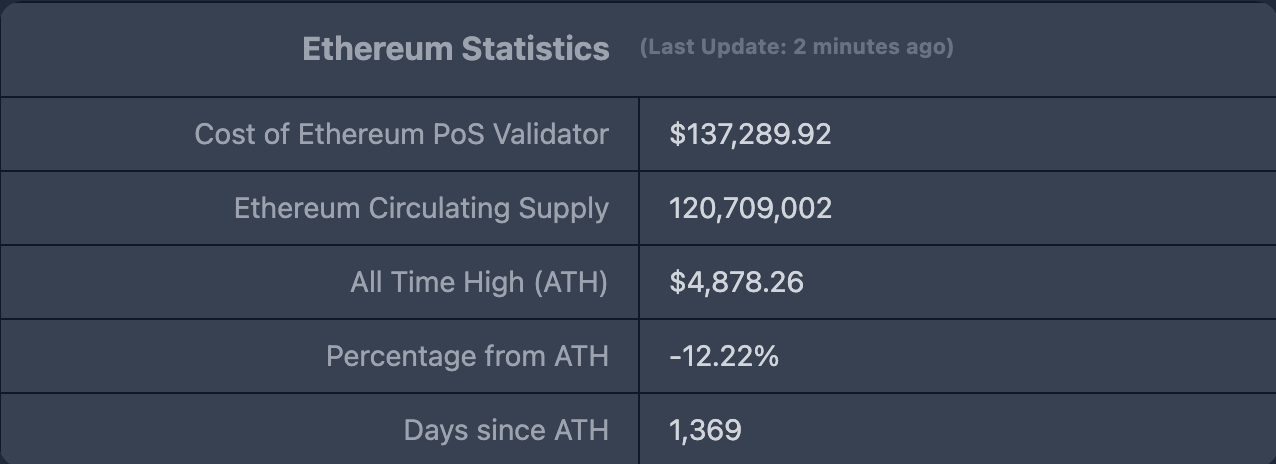

- ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $4,287.98, historical highest price $4,878.26, down approximately 12.22% from the highest price.

ETHBTC: Currently at 0.035988, historical highest at 0.1238.

Data Source: ratiogang

Data as of August 10, 2025

- Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $144.9 billion, up from $132.9 billion last week, an increase of approximately 9.02%.

Data Source: defillama

Data as of August 10, 2025

When categorized by public chains, the top three public chains by TVL are Ethereum, accounting for 60.79%; Solana, accounting for 7.09%; and BNB Chain, accounting for 4.7%.

Data Source: CoinW Research Institute, defillama

Data as of August 10, 2025

- On-chain Data

Layer 1 Related Data

Mainly analyzing daily trading volume, daily active addresses, and transaction fees for the current major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of August 10, 2025

Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. In terms of daily trading volume, this week only TON fell by 92.76%, while all other chains increased. Solana saw the largest increase at 109.42%, followed by Sui (+55.22%), Ethereum (+32.7%), BNB Chain (+18.8%), and Aptos (+12.86%). In terms of transaction fees, BNB Chain remained flat this week; Solana and Aptos decreased by 37.36% and 31.22%, respectively; while the other chains saw increases, with Ethereum (+100%), TON (+226%), and Sui (+5.48%).

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. This week, only BNB Chain saw a decline in daily active addresses by 19.66%, while all other chains experienced growth. Aptos and Sui chains increased by 62.3% and 54.84%, respectively; other chains saw increases of Solana (+14.48%), Ethereum (+13.53%), and TON (+5.56%). In terms of TVL, only TON saw a slight decline (-5.63%), while all other public chains achieved increases. Ethereum and Solana grew by 16.03% and 11.61%, respectively; BNB Chain, Sui, and Aptos had smaller increases of 5.84%, 9.49%, and 3.03%, respectively.

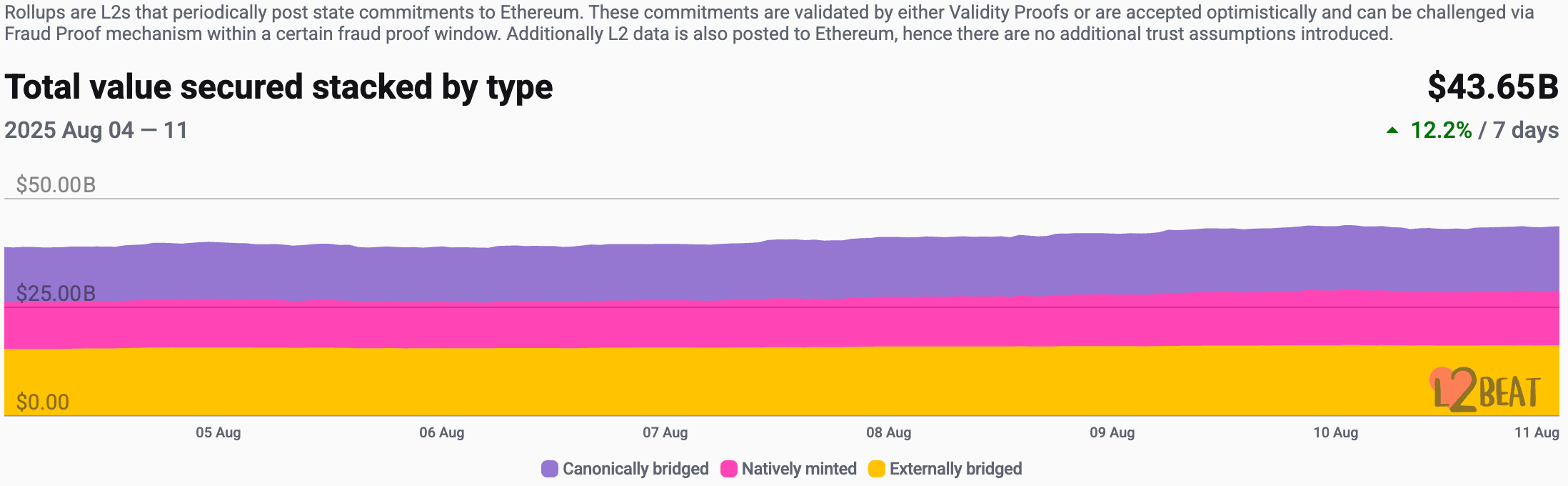

Layer 2 Related Data

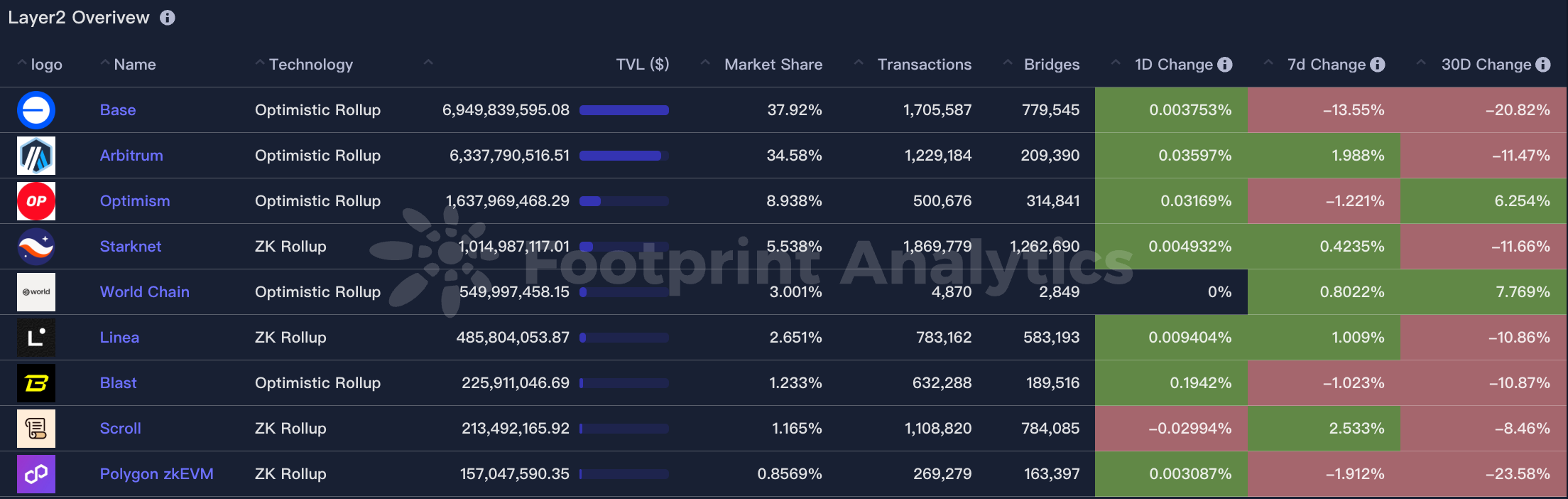

According to L2Beat, the total TVL of Ethereum Layer 2 is $43.65 billion, with an overall increase of 12.55% this week compared to last week ($38.78 billion).

Data Source: L2Beat

Data as of August 10, 2025

Base and Arbitrum occupy the top positions with market shares of 37.92% and 34.58%, respectively. Base's market share has slightly decreased over the past week, while Arbitrum has seen an increase.

Data Source: footprint

Data as of August 10, 2025

- Stablecoin Market Capitalization and Issuance

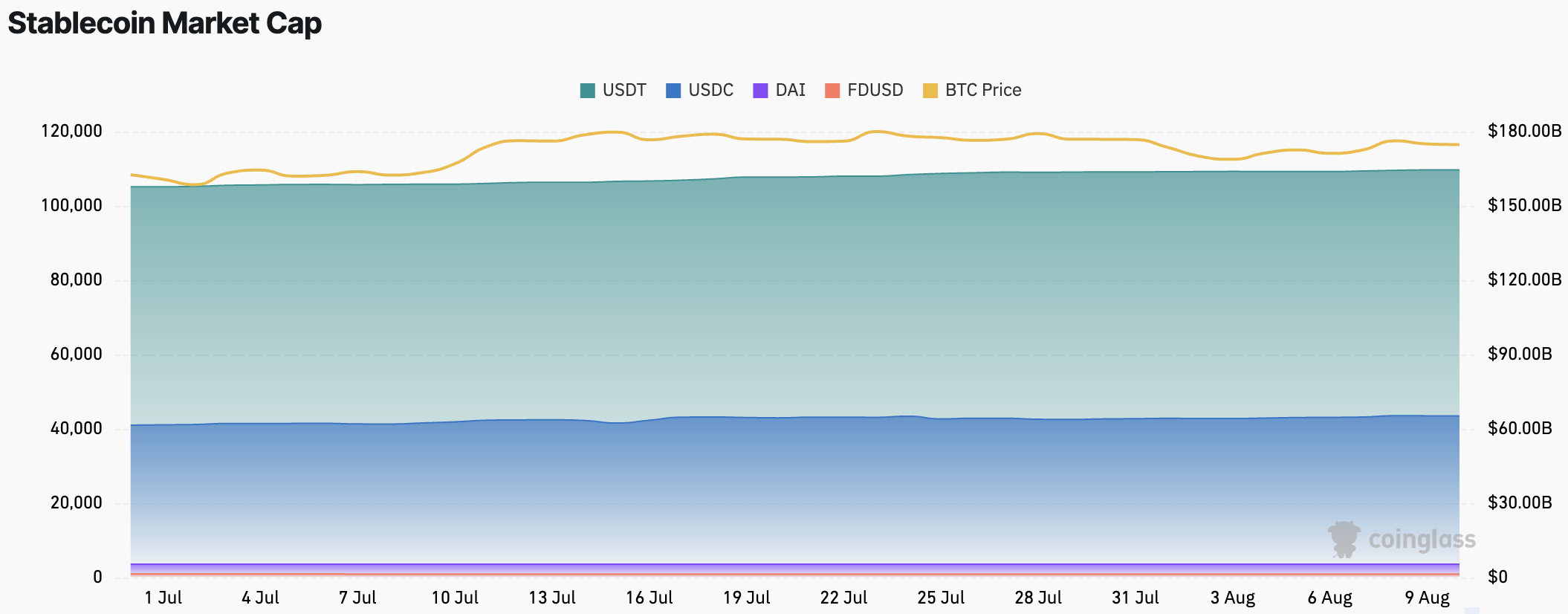

According to Coinglass data, the total market capitalization of stablecoins is $265.9 billion, with USDT's market cap at $164.5 billion, accounting for 61.86% of the total stablecoin market cap; followed by USDC with a market cap of $65.2 billion, accounting for 24.52%; and DAI with a market cap of $5.37 billion, accounting for 2.01%.

Data Source: CoinW Research Institute, Coinglass

Data as of August 10, 2025

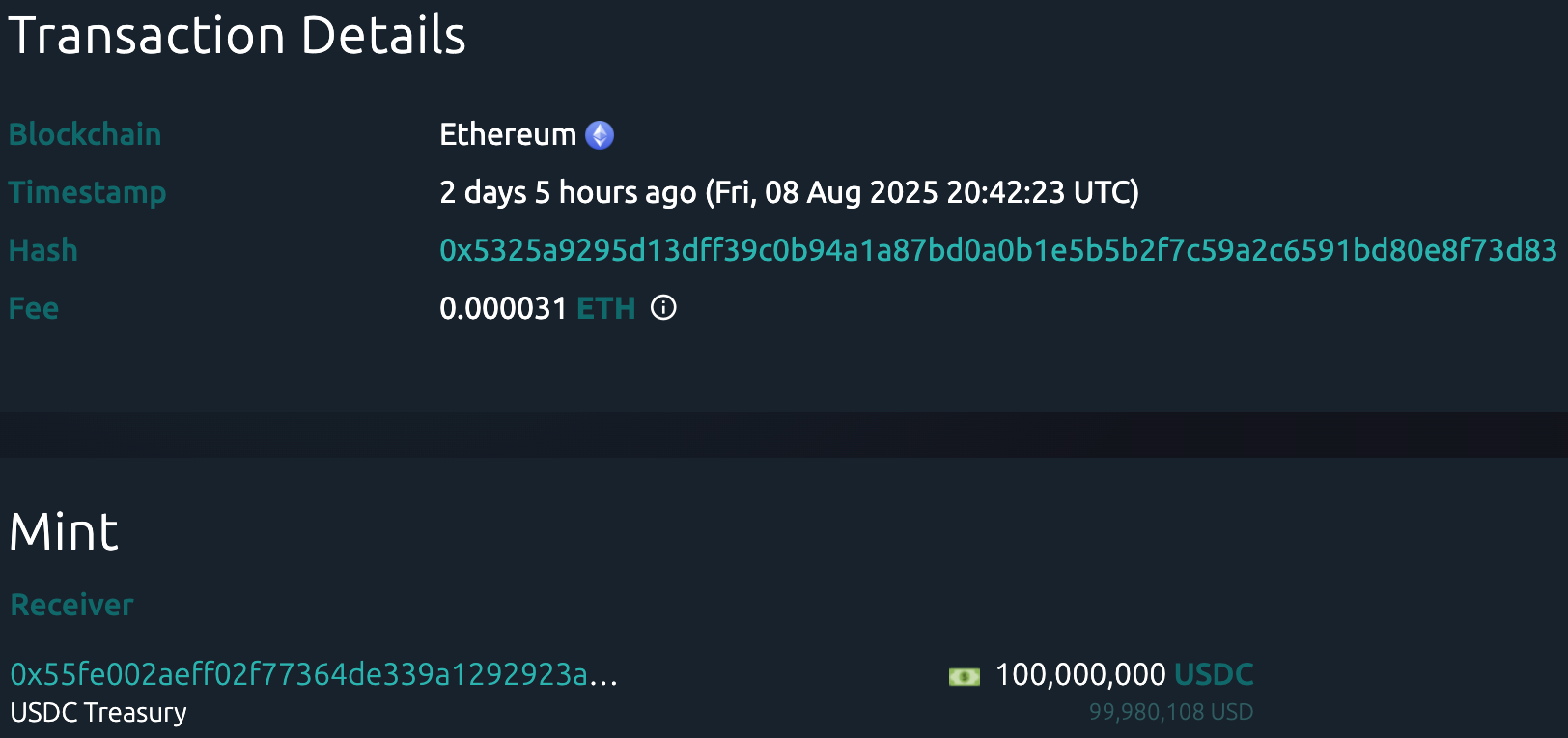

According to Whale Alert data, this week the USDC Treasury issued a total of 2.606 billion USDC, while Tether Treasury had no issuance of USDT this week. The total issuance of stablecoins this week was 2.606 billion, an increase of 6.36% compared to last week's total issuance of 2.45 billion.

Data Source: Whale Alert

Data as of August 10, 2025

II. Hot Money Trends This Week

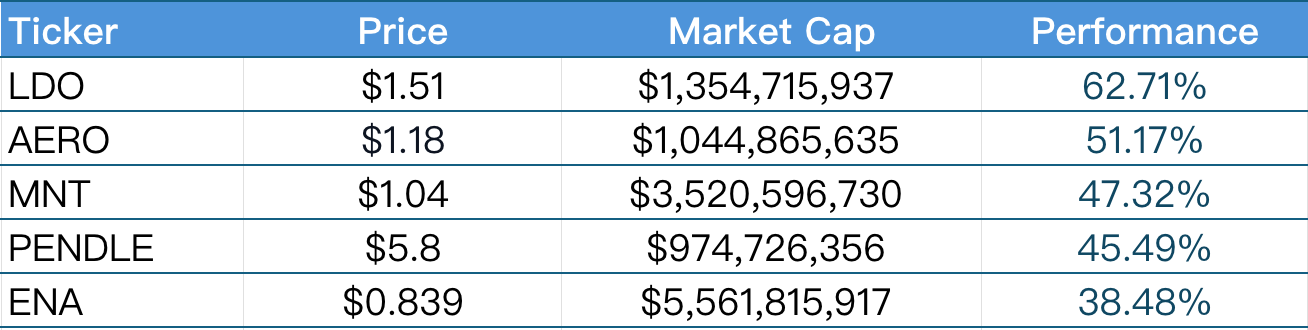

- Top Five VC Coins and Meme Coins by Growth This Week

Top five VC coins by growth in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of August 10, 2025

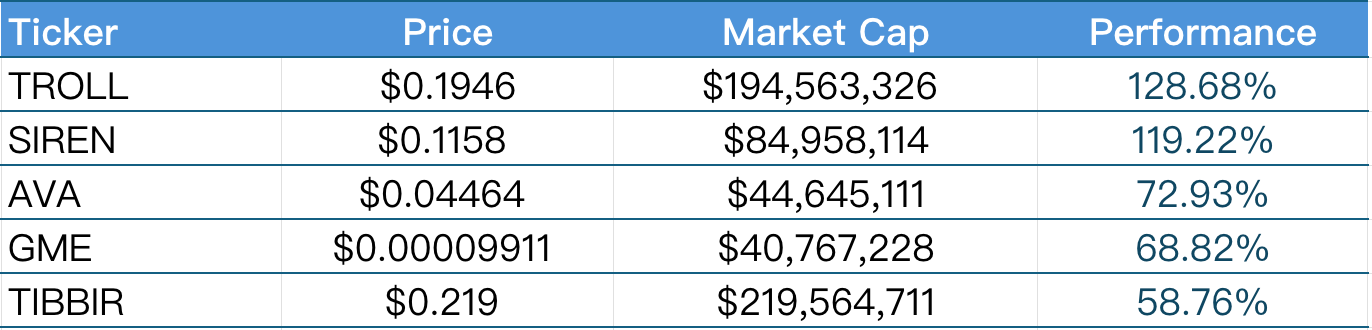

Top five Meme coins by growth in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of August 10, 2025

- New Project Insights

Perle Labs is a Web3-based AI project focused on providing high-fidelity data pipelines for AI teams, covering secure critical areas such as code, advanced reasoning, multilingual content, and satellite imagery. Unlike relying on the gig economy, Perle Labs offers labeling and evaluation services through an audited global expert network, ensuring data quality and security.

TradeTide AI is a highly automated cross-chain crypto strategy platform with trend forecasting, strategy formulation, and execution capabilities, relying on intelligent automation systems and deep native integration of crypto assets to achieve an integrated operational experience from market trend identification to trade execution.

Juicy.meme is a fair launch platform for memes under the Juchain ecosystem, dedicated to providing a decentralized, fair, and transparent token issuance and participation environment for community users. The platform encourages user participation in ecological construction and interaction through a fair distribution mechanism, promoting the development of meme culture and community engagement within the Juchain ecosystem, helping to create an innovative and inclusive on-chain community ecosystem.

III. Industry News

- Major Industry Events This Week

On August 8, the Superp Foundation officially announced that 5% of tokens will be allocated for airdrops during the Token Generation Event (TGE), with 2% of tokens already distributed, and the remaining 3% will be unlocked and distributed in one go next week. The airdrop claim page is expected to go live on August 12 (Tuesday).

On August 7, the MetaDEX project Etherex within the Linea ecosystem successfully completed the initial issuance (TGE) of the REX token. As of now, REX's market cap has reached $203 million, with a trading volume exceeding $8.7 million in 24 hours. As an upgraded version of Nile Exchange, Etherex is jointly built by Linea, Consensys, and Nile, aiming to provide users with a more efficient, secure, and smooth decentralized trading experience, promoting ecological prosperity and the widespread application of digital assets.

On August 7, Magic Eden officially announced the completion of the second quarter airdrop, distributing a total of 10 million ME tokens. This airdrop aims to thank the community for their support, expand user benefits, and further enhance the platform's ecological vitality.

On August 5, the Meme coin perpetual contract DEX Superp launched a content incentive activity, running from August 4, 18:00 to August 11, 18:00 (UTC+8). Users can participate by posting relevant content on X and tagging @Superp, then submitting the link and email. The content can cover product experiences, innovative mechanisms, and future prospects. Points will be manually assessed based on content quality and interaction volume, affecting subsequent airdrop ratios, and points will be distributed within three days after submission.

- Major Upcoming Events Next Week

The token's initial issuance for Suzaku Network (SUZ) will start from August 11 to 12, 2025, aiming to raise $150,000, with a token issuance price of $0.135, selling 1,111,111 SUZ tokens, which will be 100% unlocked at TGE. This is a re-staking infrastructure protocol designed for the Avalanche Layer-1 chain, supporting dual staking (native tokens and high-quality assets) to enhance economic security while building a validator market and censorship-resistant cross-chain communication mechanism.

AfriCred (IFT) will hold its initial token issuance from August 14 to 16, 2025, targeting to raise approximately $200,000, with an issuance price set at $0.13, selling about 1,538,462 IFT tokens, with 20% unlocked at TGE, and the remaining tokens will be released linearly over two months. AfriCred (IFT) is a blockchain-driven fintech platform that connects global capital with small and medium-sized enterprises (SMEs) in Africa through the Africred token, providing investors with high-yield opportunities of 15-20% APY while helping to fill the $330 billion credit gap for SMEs in Africa.

Emmet Finance will conduct its initial token issuance from August 18 to 20, 2025, selling a total of 7.5 million EMMET tokens at a price of $0.02, aiming to raise $150,000. The TGE (Token Generation Event) will achieve 100% unlocking, with no lock-up period or vesting period. Emmet Finance is a cross-chain decentralized finance (DeFi) platform that supports multiple blockchain networks, including Ethereum, Bitcoin, TON, and Solana, dedicated to solving inter-chain asset transfer, liquidity sharing, and interoperability issues.

- Important Financing Events Last Week

Silicon Valley smart machine infrastructure company OpenMind announced the completion of a $20 million financing round, led by Pantera Capital, with participation from well-known Web3 investment institutions such as Sequoia China, Coinbase Ventures, DCG, Lightspeed Faction, and Primitive Ventures. OpenMind is building a decentralized AI network for the robotics industry, with its core products OM1 operating system and FABRIC protocol, supporting cross-platform identity verification, secure collaboration, and data sharing for robots globally, regarded as "the Ethereum of the robotics world." (August 4, 2025)

Web3 game studio SuperGaming announced the completion of a $15 million Series B financing round. This round was led by Skycatcher and Steadview Capital, with participation from a16z Speedrun, Bandai Namco 021 Fund, Neowiz, and Polygon Ventures. SuperGaming focuses on developing cross-platform games that integrate blockchain technology, aiming to create a fair and enjoyable Web3 gaming experience. (August 6, 2025)

Tether, through its investment arm Tether Ventures, led a €30 million financing round for the Spanish crypto exchange Bit2Me, acquiring a minority stake. Bit2Me is the first Spanish-speaking fintech company to obtain the EU MiCA license and has been authorized by the Spanish securities regulator. This financing will be used to accelerate its expansion in the Latin American market, focusing on operations in Argentina. This move also marks Tether's strategic investment to promote global crypto compliance and market penetration. (August 7, 2025)

Ripple acquired the stablecoin payment platform Rail for approximately $200 million, aiming to strengthen Ripple's position in the global digital payment and stablecoin sectors. Rail is a fintech company focused on cross-border payments and settlements using stablecoins, providing efficient and secure payment infrastructure to help enterprises and financial institutions streamline fund flows and reduce transaction costs. This acquisition will help Ripple expand its payment network and promote the application of stablecoins in global payments, accelerating the construction of a more open, fast, and low-cost cross-border payment ecosystem. (August 7, 2025)

IV. Reference Links

OpenMind: https://openmind.org/

SuperGaming: https://www.supergaming.com/

Bit2Me: https://bit2me.com/

Rail: https://rail.io/

Perle Labs: https://x.com/PerleLabs

TradeTide AI: https://tradetide.cc/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。