加密货币市场表现

当前,加密货币总市值为 4.04万亿美元,BTC占比 58.63%,为 2.36万亿美元。稳定币市值为 2734亿美元,最近7日增幅1.39%,其中USDT占比60.43%。

CoinMarketCap 前200的项目中,大部分上涨小部分下跌,其中:OKB 7日涨幅111.49%,AERO 7日涨幅63.84%,RAY 7日涨幅30.44%,SKL 7日涨幅109.68%,USELESS 7日涨幅52.53%。

本周,美国比特币现货ETF净流入:5.477亿美元;美国以太坊现货ETF净流入:28.52亿美元。

市场预测(8月18日-8月22日):

本周稳定币大额增发,美国比特币、以太坊现货ETF持续净流入,山寨币在本周有较大涨幅。RSI指数为44.15,呈现超买。恐惧贪婪指数为59(指数低于上周)。

BTC:突破$123,218后上看$125,000,若美联储有鹰派的举动,BTC可能回调,支撑位为$112,000;

ETH:在上市公司不断购买的情况下,ETH有望冲击$5,000, 支撑位$4,400;

短期交易者紧盯关键阻力/支撑,长期投资者利用回调布局,并关注9月降息决议与比特币减半周期窗口。

了解现在

回顾一周大事件

1. 8 月 12 日,据 Jupiter 数据,近 24 小时 Solana 代币发行平台市场份额排行榜中,pump.fun 以 69.7% 排名第一,Letsbonk 以 15.2% 排名第二,BAGS 以 9.14% 排名第三;

2. 8月12日,CEX内以太坊存量降至2016年7月以来的最低水平,今年Q3迄今已下降6.7%;

3. 8 月 12 日,亿万富翁 Peter Thiel 再次布局以太坊,根据美 SEC 最新文件披露,Peter Thiel 及其投资团队收购了以太坊财库储备公司 ETHZilla(原 180 Life Sciences Corp.)7.5% 的股份;

4. 8 月 13 日,据 8Marketcap 数据,随着 ETH 短时突破 4600 美元,ETH 市值暂报 5560 亿美元,超越 Netflix 位列全球资产市值第 25 名;

5. 8月13日,Bitmine Immersion(BMNR)今日宣布计划将融资规模提高 200 亿美元,用以增持 ETH;

6. 8 月 12 日,Aave 宣布活跃借款额超过 250 亿美元,创历史新高;

7. 8 月 14 日,据 rockflow 数据显示,加密交易平台 Bullish (BLSH) 美股上市首日收涨 83.78%,收盘价报 68 美元,市值 99.40 亿美元,交易额达 51.76 亿美元,换手率达 185.45%;

8. 8 月 14 日,比特币短时突破 124,000 美元,续创历史新高,最高触及 124,051 美元,现报价 123,930 美元,24 小时涨幅 3.29%;

9. 8 月 14 日,美国财政部长贝森特表示,(就加密货币储备)不会购买,将使用没收的资产。

宏观经济

1. 8 月 12 日,美国 7 月未季调核心 CPI 年率进一步走高至 3.1%,为五个月高位,高于市场预期的 3.0%,前值 2.90%;

2. 8 月 12 日,美国 7 月未季调 CPI 年率 2.7%,预期 2.80%,前值 2.70%。持平上月,略低于预期;

3. 8 月 14 日,美国 7 月 PPI 数据公布后,美联储 9 月降息 25 个基点概率小幅下降,报 92.5%,维持利率不变概率 7.5%;

4. 8 月 14 日,美国至 8 月 9 日当周初请失业金人数 22.4 万人,预期 22.8 万人,前值由 22.6 万人修正为 22.7 万人。

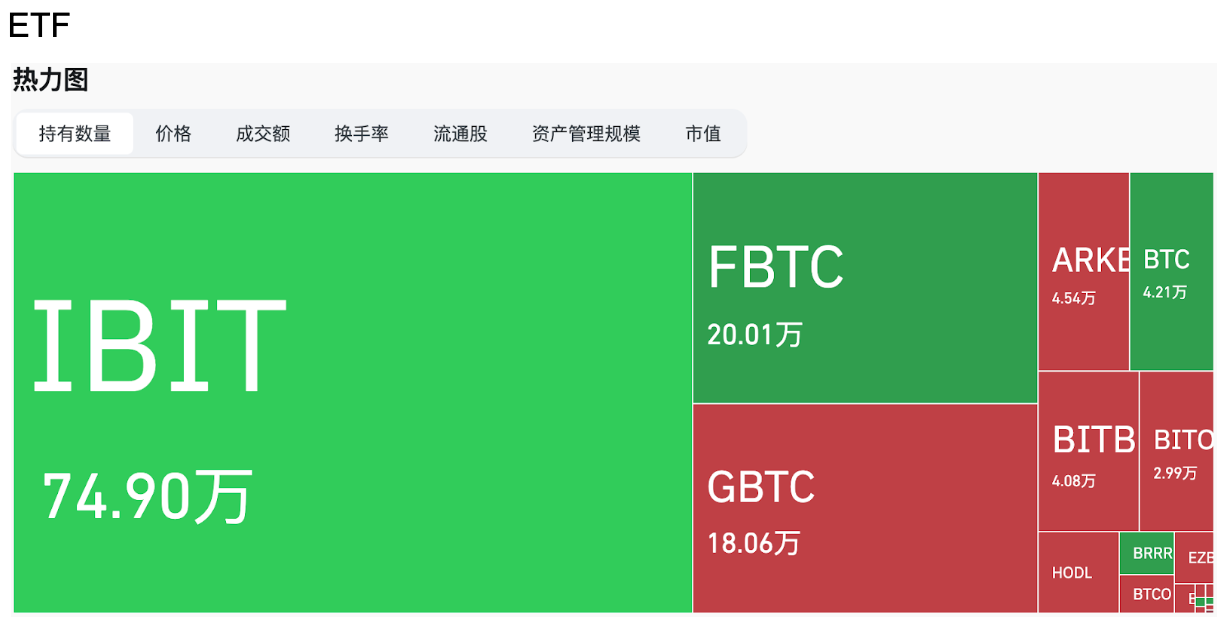

ETF

据统计,在8月11日-8月15日期间,美国比特币现货ETF净流入:5.477亿美元;截止到8月15日,GBTC(灰度)共计流出:237.58亿美元,目前持有231.51亿美元,IBIT(贝莱德)目前持有886亿美元。美国比特币现货ETF总市值为:1530.43亿美元。

美国以太坊现货ETF净流入:28.52亿美元。

预见未来

活动预告

1. Coinfest Asia 2025 将于8 月 21 日至 22 日在印度尼西亚巴厘岛举办;

2. WebX Asia 2025 将于 8 月 25 日至 26 日在日本·东京举办;

3. Bitcoin Asia 2025 将于 8 月 28 日至 29 日在香港会议展览中心举办。

重要事件

1. 8月20日10:00,新西兰联储公布利率决议;

2. 8月21日20:30,美国公布至8月16日当周初请失业金人数(万人);

3. 8月22日22:00,美联储主席鲍威尔在杰克逊霍尔全球央行年会上发表讲话。

代币解锁

1. ZKsync(ZK)将于8月17日解锁1.72亿枚代币,价值约1122万美元,占流通量的3.61%;

2. Fasttoken(FTN)将于8月18日解锁2000万枚代币,价值约9140万美元,占流通量的2.08%;

3. LayerZero(ZRO)将于8月20日解锁2572万枚代币,价值约5553万美元,占流通量的8.53%;

4. KAITO(KAITO)将于8月20日解锁2335万枚代币,价值约2522万美元,占流通量的8.82%。

关于我们

Hotcoin Research 作为 Hotcoin 交易所的核心投研机构,致力于将专业分析转化为您的实战利器。我们通过《每周洞察》与《深度研报》为您剖析市场脉络;借助独家栏目《热币严选》(AI+专家双重筛选),为您锁定潜力资产,降低试错成本。每周,我们的研究员还会通过直播与您面对面,解读热点,预判趋势。我们相信,有温度的陪伴与专业的指引,能帮助更多投资者穿越周期,把握 Web3 的价值机遇。

风险提示

加密货币市场的波动性较大,投资本身带有风险。我们强烈建议投资者在完全了解这些风险的基础上,并在严格的风险管理框架下进行投资,以确保资金安全。

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。