Table of Contents

Background: Zora Drives the "Coin Creation Craze" on Base Chain

Zora: The Automatic Tokenization Protocol for Social Content

Coinbase: The Key Driver Behind Zora's Explosion

Coinbase's Strategic Layout: Building a Super Entry Point for On-chain Life

Strategic Significance Analysis: Transitioning from Exchange to Web3 Platform Provider

Potential Risks and Future Outlook

References

1. Background: Zora Drives the "Coin Creation Craze" on Base Chain

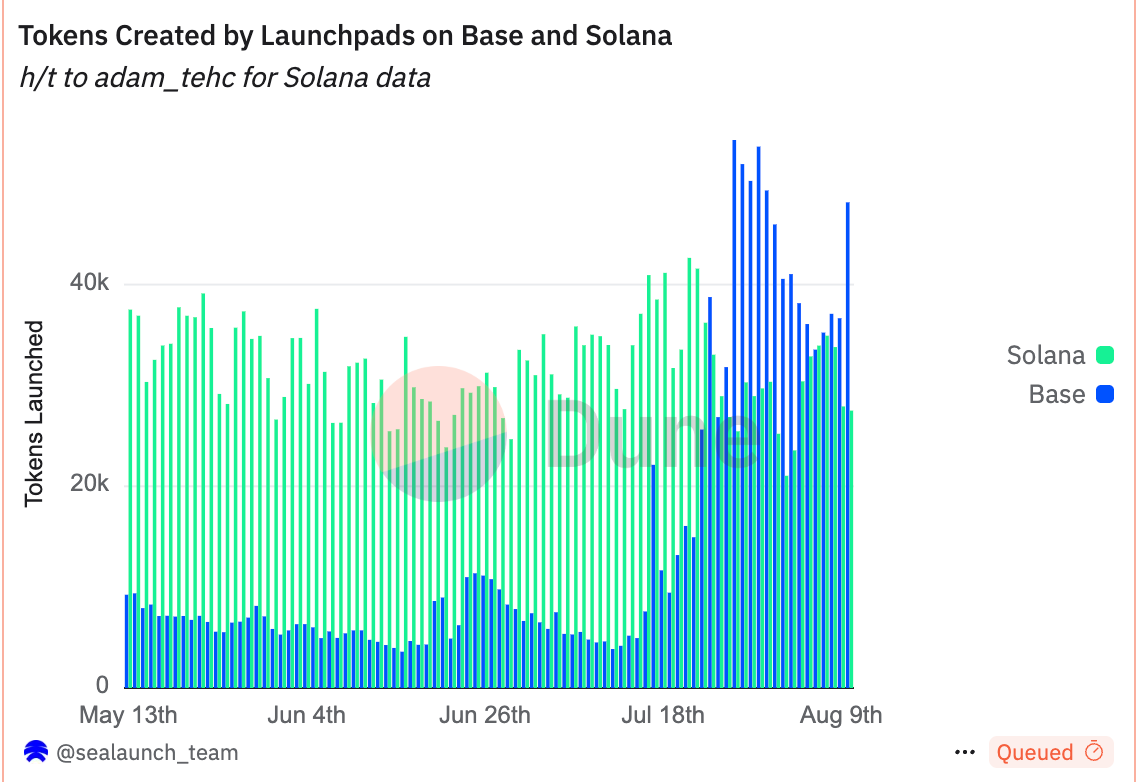

At the end of July, a wave of "coin creation" on the Base network attracted widespread attention from the crypto community. According to Dune data, since July 26, the number of tokens issued daily on the Base chain has exceeded that of Solana for 10 consecutive days, achieving a historic first. On July 27, the number of new tokens on Base reached 54,341, setting a new record, far surpassing Solana's 25,460 during the same period.

Figure 1. Tokens Created by Launchpads on Base and Solana. Source: https://dune.com/sealaunch/zora-coins-analysis

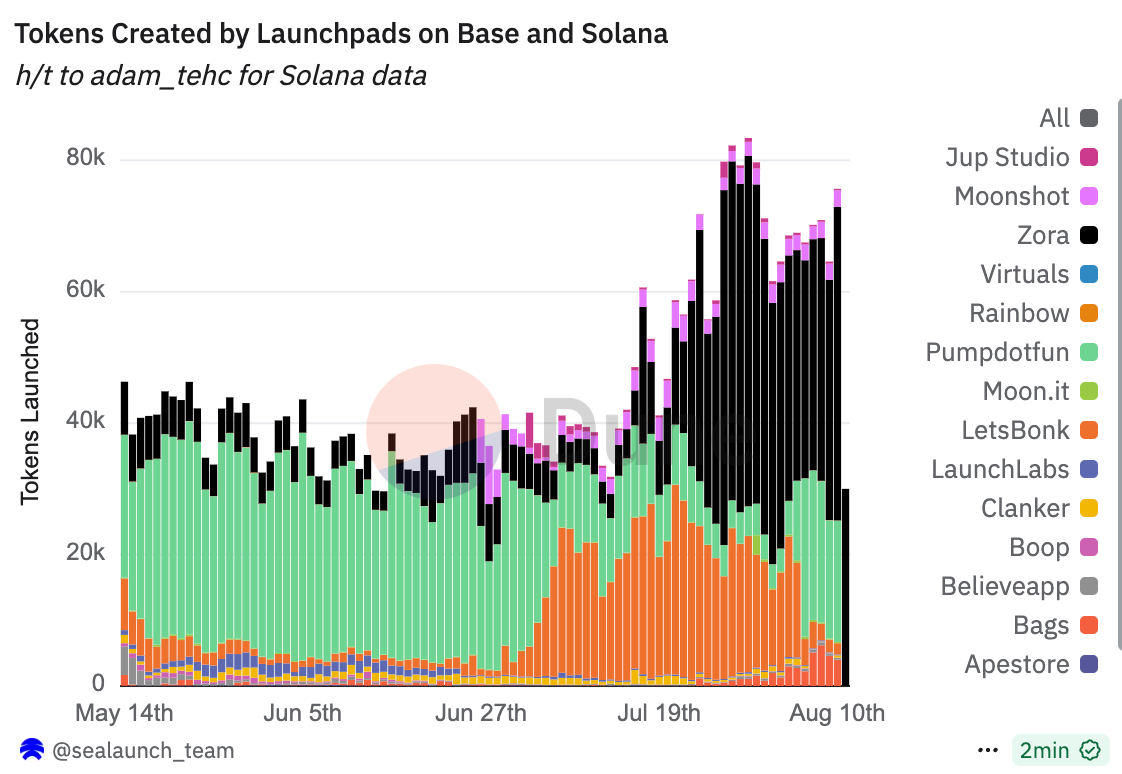

In terms of market share for token issuance on Base and Solana, Zora has maintained the top position since July 23. On July 27 alone, the number of tokens minted on the Zora platform reached 54,009, capturing a market share of 67.67%, surpassing the combined total of Letsbonk (15,626) and pump.fun (4,722) for that day. As of August 11, the number of tokens issued daily on the Zora platform was 20,570, although it has decreased, it still ranks first in market share for token issuance on both Base and Solana chains.

Figure 2. Tokens Created by Launchpads on Base and Solana. Source: https://dune.com/sealaunch/zora-coins-analysis

It is evident that Zora is the main driving force behind this round of coin creation craze on the Base chain. Unlike past meme coin trends dominated by speculation, Zora's explosion has ignited narratives around "content assets," leading people to transform social content (including text, images, and the act of creation itself) into tradable assets on-chain.

In this trend, Zora has quickly gained popularity with its "one-click tokenization of content" mechanism, becoming the most vibrant content assetization protocol currently. Users only need to publish a piece of content, and the platform automatically generates a corresponding token and injects initial liquidity; once a transaction occurs, creators can earn a share of the fees. This seemingly lightweight operational logic actually carries a deeper strategic narrative that Coinbase is promoting.

Zora's explosion is not a random market sentiment but a crucial part of Coinbase's strategic push for building on-chain cultural infrastructure through the Base network. In fact, Coinbase is not only an early investor in Zora but also views it as a key content protocol to support within the Base network.

This article will detail Zora's operational mechanism and the key role Coinbase plays behind the scenes, exploring Coinbase's strategic ambitions.

2. Zora: The Automatic Tokenization Protocol for Social Content

2.1 Origins and Evolution: From NFT Market to Content Asset Protocol

Zora was developed by the Zora Labs team and launched in 2020, initially positioned as a decentralized NFT trading market aimed at addressing issues such as severe centralization on traditional platforms and creators' income being siphoned off by platforms. It emphasizes openness and modular design, allowing anyone to freely mint, display, and trade NFTs, while creators can sustainably earn from both primary and secondary transactions. This mechanism allowed Zora to be widely used in digital creation scenarios such as crypto art, music, and photography, attracting a large number of independent creators and Web3-native artists.

As the NFT craze gradually cooled, Zora began to look in a broader direction: could content itself be transformed into an asset, not just limited to images or artworks? In 2023, Zora officially proposed the narrative of "content as an asset" and initiated the transition from an NFT market to an on-chain content asset protocol.

At this stage, Zora is no longer limited to the display and trading of static NFTs but emphasizes that "any form of content can be monetized," whether it is text, images, links, or social dynamics. Each piece of content can be viewed as a tradable asset, with corresponding tokens automatically generated on-chain to facilitate circulation and value exchange.

Zora's protocol has gradually embedded itself into social networks, such as deep integration with Farcaster, and has launched the Ethereum Layer 2 network—Zora Network—built on OP Stack, further reducing transaction costs and enhancing the protocol's scalability and composability. Through this path, Zora has evolved from a functional NFT tool platform into a foundational content finance protocol, becoming an important part of on-chain cultural infrastructure.

2.2 Product Mechanism and Workflow: Post a Piece of Content = Mint a Token

Zora's core concept is very simple: every piece of content is a token. This is precisely what distinguishes it from other content platforms; it has built a streamlined yet complete assetization process, allowing creators to achieve "content as a token, creation as on-chain" without technical barriers.

One-click Generation: Content Automatically Minted as Tokens

Users only need to publish a piece of content on a Zora-supported frontend (such as the Zora website), whether it is an image, video, or AI-generated content, and the system will automatically execute the following processes:

- Minting Tokens: The system generates an independent ERC-20 token for each piece of content, with a default total issuance of 10 million tokens.

- Injecting Liquidity: The Zora protocol automatically creates a corresponding Uniswap V4 trading pool for each minted token in the background through the ZoraFactory contract and injects preset initial liquidity (e.g., 0.003 ETH and an equivalent token).

- Trading Pairing: These tokens form trading pairs with their "backing currency" (such as ZORA, CreatorCoin, or ContentCoin), and the protocol's smart contract automatically collects and distributes fees during transactions. By default, the mainnet pairs with ZORA tokens.

- Open Trading: Minting completes the market creation, allowing any user to participate in buying and selling instantly through the Zora platform.

- Creator Revenue Sharing: When a transaction occurs, the system automatically deducts fees, allocating a certain percentage to creators, referrers, and the protocol, while locking 33% of the fees as permanent liquidity, with all earnings paid in ZORA tokens, enabling passive income for creators during the content dissemination process.

The entire process requires no development skills, complex setups, or even manual contract deployment by users; the "monetization" path for a piece of content is highly automated and modular.

Creator Incentive Mechanism: No Community Needed, No Funding Needed, One Post Equals an Asset

Zora's innovation lies in its ability to free content creation from the dependency on "building a community first, then issuing tokens." Compared to the traditional model where creators need to build influence, seek funding, arrange initial liquidity, and organize token holder communities as prerequisites, Zora offers a "reverse-driven" asset path: creation comes first, the system automatically generates assets, and the community and trading arise spontaneously with the content, with value flowing back to the creators.

In Zora's mechanism, every piece of content can be packaged into a tradable token and launched on the market. As long as the content has certain viral potential, meme characteristics, or social topicality, it can attract others to purchase and share, thereby driving the trading volume of tokens and increasing creator earnings.

More importantly, what Zora stimulates is not only the act of creation itself but also the proactive dissemination behavior of token-holding users. Since token buyers are bound by the interests formed with the content's value, they often actively participate in the re-dissemination and re-creation of content, hoping to expand their influence and drive up token prices. This "holding tokens means participation" structure not only strengthens the breadth of content circulation but also enhances user stickiness and re-creation activity within the ecosystem.

The standardized creation and revenue-sharing mechanism built by Zora opens up a monetization path for creators that requires no technical background or financial barriers. Whether it is an artwork, AI image, humorous meme, or emotional expression, as long as it can stimulate social interaction, it has the potential to translate into real economic behavior on Zora. This is Zora's unique value in the direction of "content as an asset."

3. Coinbase: The Key Driver Behind Zora's Explosion

Zora's explosive growth in on-chain content assetization by 2025 is inseparable from Coinbase's continuous support over the years in terms of funding, technology, ecosystem, and traffic. From early investment layouts to deep integration with Base, and providing exposure at the product entry level, Zora has become one of the core examples of Coinbase reshaping the on-chain cultural ecosystem.

Early Investment Layout

Zora was co-founded by former Coinbase product manager Jacob Horne and received $2 million in seed funding in October 2020, including investment from Coinbase Ventures. At that time, Zora was still positioned as an open NFT market protocol, focusing on "decentralized, composable" creator tools, which aligned closely with the open financial culture advocated by Coinbase. In May 2022, Zora completed a new round of funding of $50 million at a valuation of $600 million, with Coinbase Ventures continuing to invest, laying a capital foundation for its subsequent development.

Technical Ecosystem Integration: One of the First Content Native Protocols on Base

In June 2023, the Zora Network mainnet was launched, integrating into the Base technology system. Following Coinbase's launch of the Base network, Zora quickly launched its self-built OP Stack L2 network, Zora Network, in June 2023. This network is fully compatible with Base and rapidly completed technical integration with it. Zora became one of the first content protocols deployed on Base, receiving comprehensive support in terms of technology, users, and resources.

Standardized Collaboration Implementation: Deep Integration with Farcaster to Achieve "Post to Mint"

By mid-2025, Zora achieved deep integration with the decentralized social platform Farcaster. By accessing Farcaster's Frame feature, users can directly mint tokens when posting on the social platform, achieving a convenient "post to mint" experience without needing to navigate away from the page to interact.

Like Zora, Farcaster is one of the early core applications in the Base ecosystem, and both are deployed and operated on the Base mainnet. The Base team has mentioned multiple times in official articles and interviews: "Farcaster + Zora is the most promising on-chain growth engine in our eyes."

It is evident that this collaborative model is driven by Coinbase, with the Base team promoting this joint path and user value through official channels, creating a positive interaction. As a result, the "post to mint" experience became widely popular, paving the way for a surge in Zora users.

Product Entry-Level Support: Embedded in Base App, Triggering Exponential Growth

In July 2025, Coinbase announced that it would rename its official wallet product to Base App, transforming it into a social-first crypto super app. In this upgrade, Zora's token minting system will be directly embedded on the product's homepage, allowing users to publish content, generate tokens, and complete trading processes within the app without navigating to external DApps, significantly enhancing visibility and conversion efficiency.

At the same time, the official Base App also provides a "Sign In with Farcaster" login path, allowing users to log in using their Farcaster identity within the Base App, achieving one-click identity access. After logging in, when users post on Farcaster, they can directly embed links provided by Zora in their posts, allowing others to mint content or participate in token trading with a single click without navigating away from the page. The entire process requires no platform switching or multiple authorizations, greatly reducing the participation threshold for users. The effects quickly became apparent:

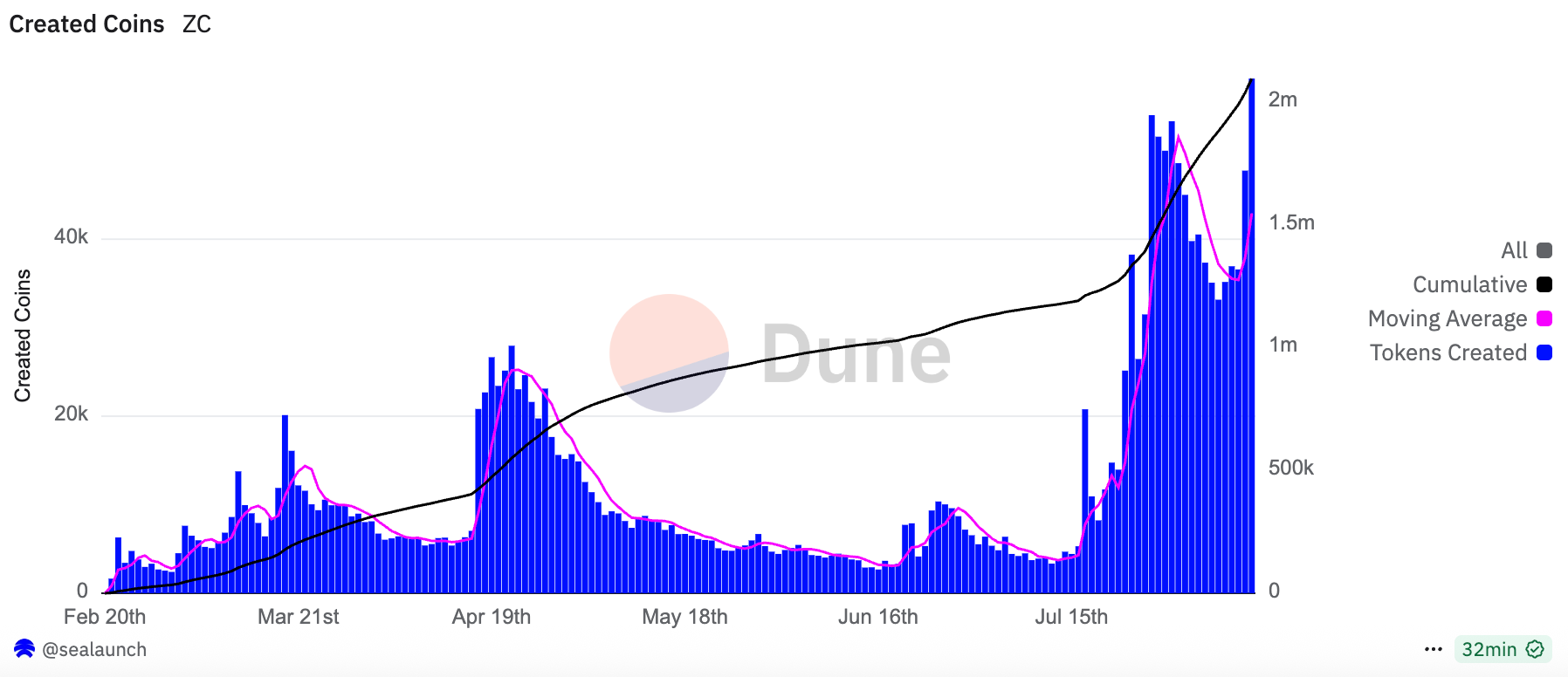

The number of tokens minted on the Zora platform surged from 4,000 to over 38,000, reaching a historic high of 54,341 on July 27. As of August 11, Zora had created a total of 2,095,773 content tokens. During the same period, the price of the native ZORA token rose over 440% within a week, with platform trading volume and the number of creators also skyrocketing.

Figure 3. Created Coins in Zora. Source: https://dune.com/queries/4769188/7913018

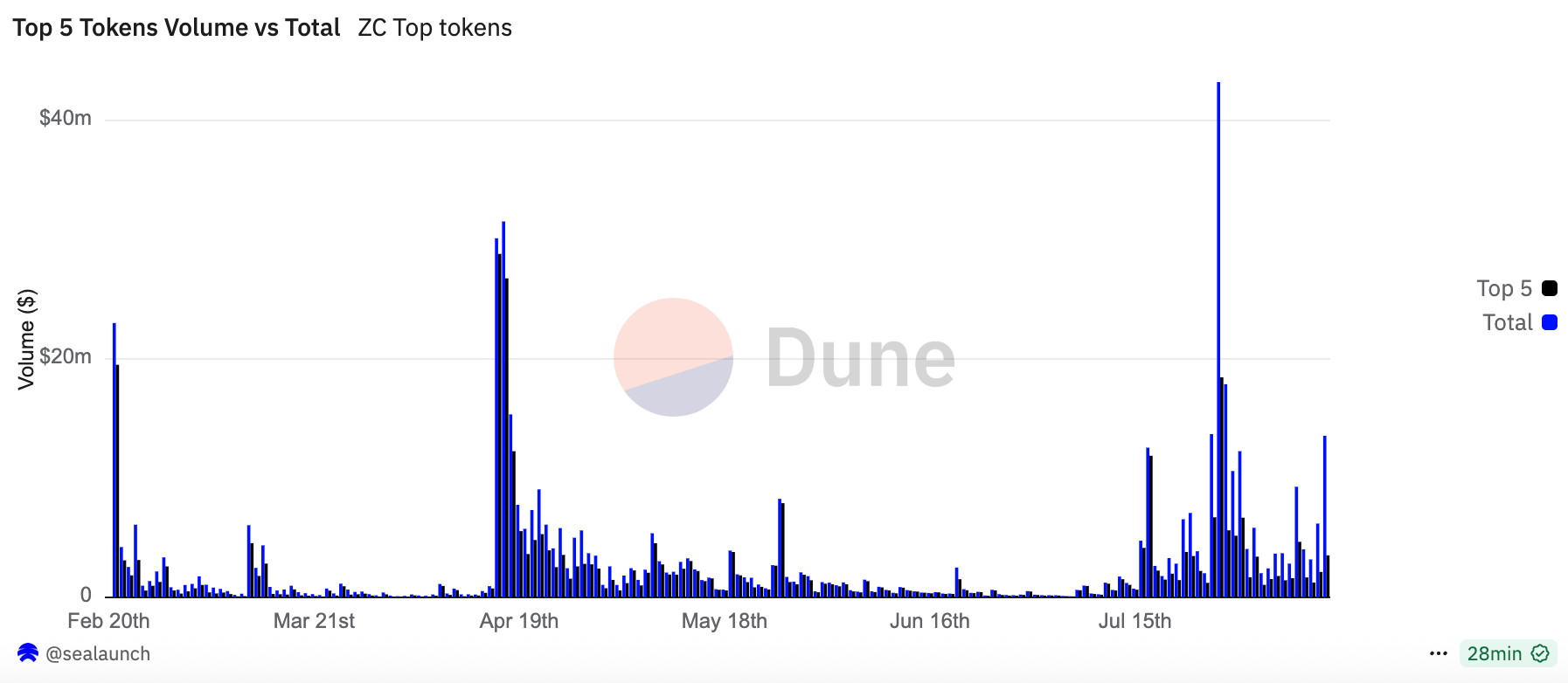

In terms of trading volume, the total trading volume of tokens on Zora on July 27 was $43 million, with the top five tokens accounting for $18 million, approximately 41.86% of the total. Subsequently, it returned to a normal state, with daily total trading volumes ranging from $2 million to $20 million. It can be seen that although the enthusiasm for coin creation remains high, the platform's trading volume mainly comes from influential KOLs.

Figure 4. Top 5 Tokens Volume vs TotalZC Top tokens on Zora. Source: https://dune.com/queries/4770031/7914239

Coinbase and the Base team have cited Zora data across multiple social channels and frequently output content asset narratives, promoting it as a key project for cultural infrastructure development. It is clear that every product evolution and explosion of Zora is almost accompanied by Coinbase's push in investment, technology, standards, and traffic. It is not just an ecological project on Base but an important execution vehicle for Coinbase to build an on-chain cultural ecosystem centered around "content as an asset."

4. Coinbase's Strategic Layout: Building a Super Entry Point for On-chain Life

Behind Zora's explosive growth, in addition to its automated and modular minting experience and user incentive design, it is worth noting the support behind it - Coinbase. In the previous section, we mentioned that Zora is an early investment project of Coinbase Ventures, and its mainnet is deployed on the Base network launched by Coinbase. In fact, Coinbase's ambition to build on-chain cultural infrastructure has long been evident, and Zora is undoubtedly an important part of it.

Coinbase's Strategic Layout: Expanding from Finance to Cultural Infrastructure

Although Coinbase's current core business still primarily revolves around centralized exchanges (CEX), including fiat deposits, crypto asset trading, custody, and compliance services, its recent strategic direction indicates that it is no longer satisfied with being a single trading platform. Instead, it is gradually expanding to become a leader in "on-chain life," actively embracing the comprehensive on-chaining of crypto users' daily behaviors.

"On-chain life" refers to a lifestyle where various activities such as identity construction, social interaction, content creation, asset management, and even consumption behaviors gradually migrate to be completed on blockchain networks. In this process, users no longer rely on traditional platforms but instead use on-chain applications to independently establish and manage identities, accumulate social relationships, create content, and realize value circulation.

Coinbase recognizes that achieving mass adoption in the crypto industry requires a foundation built on users' real daily behaviors being on-chain and a structural transformation of their lifestyles. This life-centered transformation will further drive the crypto world from niche circles to mainstream society.

Building On-chain Cultural Infrastructure: Base is No Longer Just an L2

Through Base, Coinbase is positioning itself from a "crypto financial service provider" to a "builder of on-chain cultural infrastructure." This is not only an expansion of its business landscape but also reflects its forward-looking judgment on the future trends of the crypto industry.

In 2023, Coinbase launched its own Layer 2 network - Base. Unlike other Layer 2 solutions that focus primarily on DeFi, Base explicitly proposes the vision that "Onchain is the new online," meaning that just as the internet changed traditional lifestyles, on-chain life will also reconstruct the ways users interact with content, assets, and social interactions. It aims to promote on-chain as a new venue for users' daily activities, including creation, socializing, identity, and content consumption. Unlike many Layer 2 solutions that focus on enhancing financial transaction efficiency, Base is not merely a technical L2 network focused on DeFi and on-chain trading; its strategic focus has been clearly positioned from the beginning as building "on-chain cultural infrastructure."

To achieve this goal, the Base mainnet integrated several key applications early on, including the social protocol Farcaster, the content asset minting platform Zora, and the creator economy platform friend.tech.

Farcaster is an "on-chain social protocol." It is not a single social software but a foundation that allows developers to freely build various social applications. The identities and social relationships established by users on Farcaster are no longer tied to a specific platform but belong to the users themselves. For example, even if you switch to a different social application today, your account, following list, and published content can be seamlessly transferred. This approach breaks the phenomenon in Web2 where social relationships are "captured" by platforms, allowing users to truly own their social data.

The core of friend.tech is "social + assetization," initially launched on the Base chain and gaining popularity with its novel mechanism of "user shares." Users can tokenize their social identities on the platform, and others can purchase their "shares" to enter exclusive communities or gain certain privileges, forming a revenue distribution mechanism based on social influence. This means users can turn their interactions with friends into tradable social assets. You can think of a person's "personal space" on friend.tech as a kind of "social stock," where others can purchase this "stock" to gain the right to privately interact with that user. Users can also earn income from these transactions, creating a closed loop of "social monetization." It is an experimental implementation of the creator economy on-chain.

These protocols provide non-financial on-chain interaction scenarios: users can establish social relationships through Farcaster, mint creative content into tradable digital assets with Zora, and realize the distribution of creative earnings on platforms like friend.tech.

Coinbase's strategy is undergoing a fundamental expansion: it is not just providing financial infrastructure but is also focused on building the infrastructure of on-chain culture, connecting users' on-chain lives.

Base Wallet Upgraded to Base App, Creating a Web3 Super App and Building Users' On-chain Lifestyle

In July 2025, Coinbase announced that it would upgrade Base Wallet to the Web3 super app Base App, which is not only a change in product name but also reflects a profound adjustment in strategic positioning.

Unlike traditional crypto wallets, the Base App is no longer just a tool for storing and managing digital assets; it is an "on-chain life entry point" that integrates multiple functions such as social interaction, content, payments, and trading. Its core positioning is to become a super app for users in the Web3 world, allowing them to complete almost all on-chain activities within a single application.

On the social level, the Base App introduces a "community dynamic wall" built with the decentralized social protocol Farcaster, similar to a Web2 friend circle or Twitter timeline, where users can view their friends' posts, NFT minting activities, and on-chain interactions in real-time, enhancing the visualization and immersion of on-chain social interactions. Furthermore, in conjunction with the Zora protocol, the content published by users can be minted into tradable digital assets, allowing creators to earn income not only through content sales or tips but also to receive weekly rewards based on interaction levels, incentivizing the production and dissemination of high-quality content.

In terms of functional expansion, the Base App integrates hundreds of mini-apps covering various vertical application scenarios such as gaming, prediction markets, and NFT tools, enabling users to explore and enjoy diverse on-chain experiences without switching platforms. This "mini-program" structure not only enhances playability but also increases user stickiness.

In payment experience, the Base App supports one-click USDC payments via NFC, significantly simplifying the on-chain payment process, making it suitable for offline payment scenarios in real life, thus bridging the gap between on-chain assets and the real world.

Additionally, the Base App provides native encrypted chat functionality through the integration of the XMTP protocol, allowing users to engage in peer-to-peer private chats (like a Web3 version of Telegram) and initiate asset transfers directly within the chat interface, such as sending USDC in the chat window. This "chat and transfer" experience further lowers the threshold for transfers and enhances interaction efficiency.

Overall, the upgrade of the Base App not only enhances functional diversity and user experience but, more importantly, reconstructs the way users interact with the Web3 world. It is no longer just a tool but a rich, coherent on-chain life platform. This integration model of "social + content + payments + application ecosystem" is expected to become the development paradigm for future Web3 super apps.

Coinbase currently still relies on centralized exchanges (CEX) as its main revenue source, but its continued investment in Base and support for on-chain native projects clearly demonstrates that its strategic focus has begun to shift towards "on-chain cultural infrastructure." Coinbase is evolving from a "financial tool platform" to a "builder and guide of on-chain lifestyles," aiming to carry the true driving force behind the next wave of crypto user growth—decentralized identity, social interaction, and creative experiences.

5. Strategic Significance Analysis: Transitioning from Exchange to Web3 Platform Provider

Coinbase's strategic focus is fully transforming from "crypto exchange" to "Web3 platform provider."

While centralized exchange (CEX) business remains an important entry point for users into the crypto world, Coinbase is no longer satisfied with merely providing asset trading and custody services. Instead, it is leveraging the Base chain (its self-built Layer 2 network) and the Base App (upgraded wallet) to construct a broader Web3 ecological platform. This transformation signifies an upgrade in its role from "a platform for facilitating transactions" to a three-in-one strategic hub of "Web3 entry + application platform + user ecosystem."

The Base chain serves as the underlying network, bearing the infrastructure roles of social interaction, content, payments, and identity.

With the Base App, users can not only access assets but also use NFC to pay USDC, participate in on-chain social interactions, and engage in activities such as gaming, creation, and tipping through mini-apps. All these interactions operate on the Base chain, making it the core execution layer for users' on-chain behaviors and value circulation. Mini-apps provide developers with an open field, helping Coinbase attract more use case scenarios and expand the application ecosystem's reach.

This layout is essentially a competition for "entry rights" in Web3.

By integrating trading, social interaction, payments, content, and AI applications, Coinbase aims to encapsulate users' on-chain lives entirely within the Base App, achieving a full-chain binding of user behaviors. This not only enhances user stickiness but also brings sustainable trading flow and content value accumulation to the Base chain, further strengthening its ecological moat.

Coinbase's layout of on-chain social protocols aims to master the Web3 social entry point.

Coinbase's establishment of on-chain social protocols is intended to grasp the Web3 social entry point and activate the full-stack scenarios of on-chain life.

In the narrative of Web3, social interaction is not only the starting point for traffic and user relationships but also a key entry point for user identity, content creation, and asset monetization. Its strategic focus is not just on content or social interaction itself but on using "social" as the starting point to activate users' on-chain behaviors. Once users have established identity and content through social relationships, transaction demands (such as purchasing NFTs or tipping creators) and payment behaviors (such as USDC transfers) will naturally emerge, further promoting asset circulation and protocol activity within the Base ecosystem. Through deep integration of the Base chain and social protocols, the user entry and behavior pathways of Web3 are being reshaped, making "social as an asset" a new pivot in the on-chain economy.

It is evident that Coinbase is transitioning from a single-function exchange to a multi-dimensional platform encompassing "chain + applications + users." This transformation means it will no longer merely be an intermediary in the crypto market but will become a provider of infrastructure for productivity, creativity, and everyday consumption in the crypto world, taking a crucial step towards "on-chain life" and "consumer-grade Web3 applications."

6. Potential Risks and Future Outlook

Potential Risks

Although Zora has significantly lowered the barriers to content assetization and sparked enthusiasm among many creators, it has also raised concerns about "token proliferation." A large amount of content lacking creative value is quickly minted into NFTs and used for speculation, which may attract liquidity in the short term but is prone to a cycle of "minting—speculation—zeroing out." If the quality of platform content cannot be maintained, users may lose trust, affecting the healthy development of the entire ecosystem.

At the same time, the current wave of content assetization is largely built on early participation dividends and topic speculation. Whether Zora and its "content as an asset" ecosystem can form a closed loop of sustained creation and consumption remains unverified. Once the short-term hype fades, content platforms lacking real users may face risks of sudden liquidity reduction and ecological hollowing.

Finally, the Base App integrates multiple core functions such as identity, assets, payments, social interaction, chat, and trading, making it an important carrier of users' "on-chain life." However, this high level of integration also brings centralization risks: if security vulnerabilities or privacy breaches occur, it could result in damage to users' assets and information across multiple levels, affecting a range far beyond traditional wallet applications, posing a serious threat to user trust and ecological stability.

Outlook

Coinbase's series of strategic layouts are profoundly reshaping the user experience and industry development direction in Web3. For ordinary users, the integration of the Base chain, Base App, and social protocols significantly lowers the barriers to using Web3. From wallet usage to social interaction, content creation, and payment transactions, users can complete on-chain operations within a unified interface without switching between multiple platforms. Content creators can also quickly assetize their content through protocols like Zora without relying on traditional centralized platforms or intermediaries, independently issuing and earning revenue, truly realizing "creation as economy."

Moreover, Coinbase is building an integrated user sovereignty platform of "social + finance + assets." Leveraging the identity and relationship network provided by Farcaster, users can interact in real-time and browse updates; through the Base App combined with USDC payments, NFT minting, and other functions, it forms an on-chain version of "friend circle + Alipay + NFT community." This highly integrated design of social and financial elements marks the transition of on-chain lifestyles from concept to reality, bringing users unprecedented sovereignty and freedom.

From an industry perspective, Coinbase is driving the narrative of Web3 from finance to culture and identity. In recent years, the main narrative of Web3 has focused on financial tools like DeFi, but Coinbase's strategic layout indicates that future growth engines may come from culture, identity, and creation. With the rise of content assetization, the creator economy, and on-chain social interaction, a new cycle of Web3 with a more humanistic attribute is beginning.

This not only broadens the user boundaries of Web3 but also injects new imagination into the crypto industry. With Coinbase leading the way, on-chain lifestyles are expected to gradually move from niche exploration into mainstream visibility, attracting a broader user base. At the same time, new economic models surrounding content assets and social protocols are likely to emerge rapidly, further stimulating the diversity and innovative vitality of the Web3 ecosystem.

References

Zora docs. Link: https://docs.zora.co/coins/contracts/creating-a-coin

Base docs. Link: https://docs.base.org/get-started/launch-token

Farcaster docs. Link: https://docs.farcaster.xyz/developers/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。