If the Federal Housing Finance Agency (FHFA) in the United States chooses to advance this policy, it signifies that cryptocurrency is transitioning from an investment asset to a practical financial tool.

Written by: BitpushNews

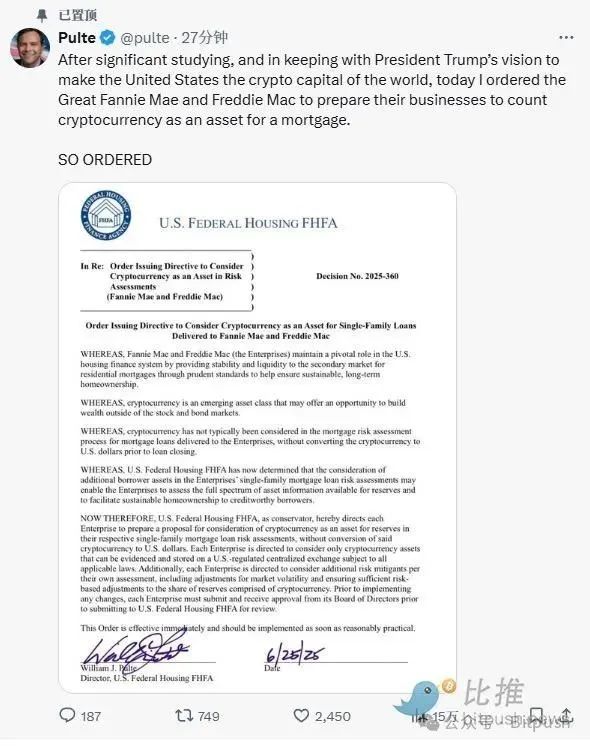

On June 25, local time, Bill Pulte, the director of the FHFA, suddenly announced that he had requested Fannie Mae and Freddie Mac—two "invisible giants" that control over half of the U.S. mortgage market—to study the inclusion of cryptocurrencies like Bitcoin into the mortgage assessment system!

Following the news, Bitcoin surged by 2.2%, reaching $107,000, with its market share skyrocketing to 66%.

It is noteworthy that Bill Pulte is the grandson of William J. Pulte, the founder of Pulte Homes, one of the largest home builders in the U.S., and he was appointed as director in March 2025 during Trump's second term.

Unlike his predecessor, Bill Pulte has publicly supported cryptocurrency since 2019 and has used his social media influence to promote the adoption of digital assets and encourage policy openness.

Financial disclosures show that he personally holds between $500,000 and $1 million in Bitcoin and a similar amount in Solana. He also holds equity in the U.S. Bitcoin mining company Marathon Digital Holdings and has invested in speculative stocks like GameStop.

What do Fannie Mae and Freddie Mac do?

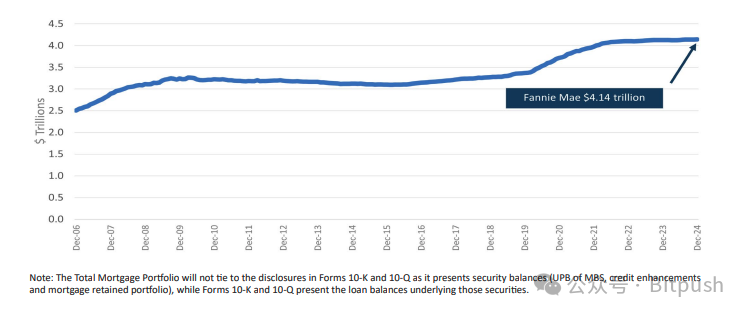

Fannie Mae (Federal National Mortgage Association, FNMA) and Freddie Mac (Federal Home Loan Mortgage Corporation, FHLMC) are two government-sponsored enterprises (GSEs) in the United States.

They do not directly provide mortgages to homebuyers but play a crucial role in the secondary mortgage market. By acting as market makers (i.e., continuous buyers), they ensure liquidity in the loan market.

This role can be roughly compared to a combination of China's "Housing Provident Fund Management Center" + "State-owned Banks" + "Secondary Market Securitization Platform," but with a more market-oriented operation model.

According to data from the National Association of Realtors, as of 2025, Fannie Mae and Freddie Mac support about 70% of the mortgage market. This means that most conventional loans provided by private lending institutions will ultimately be supported or purchased by one of these entities.

The FHFA was established after the collapse of the U.S. housing market in 2008, aiming to strengthen regulation and maintain the safety and liquidity of the mortgage finance system. Any policy changes it announces will have far-reaching effects on potential homebuyers and the entire financial industry.

Although the FHFA's review of cryptocurrency assets in mortgage underwriting is still in its early and exploratory stages, its consideration itself reflects a shift in the relevance of crypto assets and leadership priorities.

How might crypto assets be assessed?

In the U.S., borrowers wishing to use digital assets in the mortgage process must first convert them to U.S. dollars and deposit the funds into a regulated U.S. bank account. To comply with Fannie Mae and Freddie Mac's down payment or reserve guidelines, these funds must also be "seasoned," meaning they must be held in the account for at least 60 days.

The FHFA's review is expected to explore whether these regulations need updating. One possible area of focus is asset valuation. Due to the volatility of cryptocurrencies like Bitcoin, lenders may be reluctant to accept their full market value when assessing a borrower's assets. A common method in traditional finance is to apply a "haircut," which deducts a portion from the stated value to account for potential price fluctuations. Whether cryptocurrencies will adopt similar adjustments remains uncertain.

The holding history may also be scrutinized. Lenders typically prefer assets that have been held long-term rather than short-term. Assets with clear documentation, consistent custody, and minimal trading activity may carry more weight than those acquired recently or frequently transferred.

Stablecoins may be considered separately. Tokens like USD Coin (USDC) and Tether (USDT) are designed to maintain stable value relative to the U.S. dollar, which may make them more suitable for underwriting purposes. Even so, the treatment of stablecoins will depend on regulators' acceptance of their structure, custody arrangements, and transparency standards.

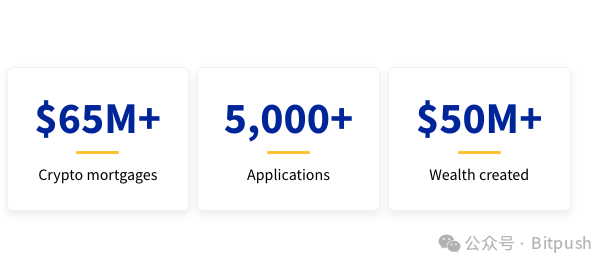

The private market has taken the lead

Milo Credit, a lender based in Florida, launched one of the first cryptocurrency mortgage products in the U.S. in 2022. It allows borrowers to pledge digital assets (such as Bitcoin, Ethereum, or certain stablecoins) as collateral without having to sell their cryptocurrencies and pay a cash down payment. This setup enables customers to obtain financing of up to 100% of the home's value without liquidating their crypto assets. As of early 2025, Milo reported that it had issued over $65 million in crypto mortgage loans.

Similarly, Figure Technologies, a fintech company led by former SoFi CEO Mike Cagney, has also explored large-scale crypto-backed mortgage programs, offering loans of up to $20 million using digital assets as collateral.

Additionally, Ledn's "Bitcoin Savings Account" can also be seen as a type of mortgage product, allowing users to obtain dollar loans at a 50% loan-to-value (LTV) ratio.

However, these private products operate outside the federal mortgage system. Their loans do not qualify for resale to Fannie Mae or Freddie Mac, meaning they do not benefit from the same level of liquidity and risk-sharing as traditional loans. As a result, interest rates tend to be higher, and lenders often retain the loans themselves or partner with alternative investors for financing.

Another limitation is risk. Crypto mortgages typically require over-collateralization—meaning borrowers must pledge digital assets worth more than the loan amount to offset volatility. But even with this buffer, price fluctuations can pose challenges.

In summary, if the FHFA chooses to advance this policy, it signifies that cryptocurrency is transitioning from an investment asset to a practical financial tool. While specific implementation will take time, it has already sent a strong signal to the market: the mainstream financial system is opening its doors to crypto assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。