Stablecoins, with their advantages of payment and settlement as well as a lightweight account system, not only demonstrate disruptive potential in traditional payment fields but also become a key driving force in the tokenization of U.S. stocks (RWA) and AI Agent payment scenarios.

Written by: Li Xiaoyin, Wall Street Insights

A new track for stablecoins is emerging, with the tokenization of U.S. stocks and AI Agents expected to siphon global liquidity.

Driven by accelerated legislation, active corporate participation, and rapid growth in trading volume, stablecoins are transitioning from a marginal role in cryptocurrency to the core of financial innovation, attracting global market attention.

According to news from the Chase Wind Trading Desk, analysts Song Jiajie and Ren Heyi from Guosheng Securities stated in their latest research report that stablecoins, leveraging their advantages of payment and settlement as well as a lightweight account system, not only show disruptive potential in traditional payment fields but also become a key driving force in the tokenization of U.S. stocks (RWA) and AI Agent payment scenarios.

The report indicates that the tokenization of U.S. stocks provides cryptocurrency investors with more asset allocation options while also likely driving rapid expansion of stablecoin scale. Meanwhile, AI Agent payments may relieve users of operational burdens, giving rise to entirely new payment models. The integration and innovation of these two new tracks are expected to become a new catalyst worth looking forward to in the second half of the year.

Tokenization of U.S. Stocks Reignites RWA Boom

As an important branch of Real World Asset (RWA) tokenization, the tokenization of U.S. stocks is entering a critical period of accelerated implementation.

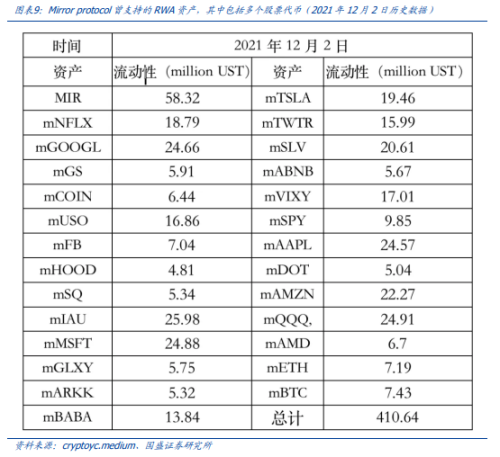

In the past, stock tokenization briefly emerged on platforms like Mirror Protocol, supporting synthetic tokenization of U.S. stock assets such as Tesla and Google, but fell silent due to regulatory issues and market volatility. Now, with the advancement of RWA regulatory frameworks, interest in stock tokenization is heating up again.

In the context of a gradually clarifying regulatory environment, traditional financial institutions represented by BlackRock and cryptocurrency institutions are actively lobbying regulators to restart stock tokenization.

The report shows that cryptocurrency exchange Coinbase is seeking approval from the U.S. Securities and Exchange Commission to offer "tokenized stock" trading services to users; established exchange Kraken has taken the lead, announcing a partnership with Backed Finance to launch the "xStocks" service, initially covering over 50 U.S. listed stocks and ETFs, including Apple, Tesla, and Nvidia.

The report analyzes that this service not only provides cryptocurrency investors with a channel for allocating traditional financial assets but may also significantly enhance the circulation scale of stablecoins by expanding their use cases.

The report anticipates that the enormous scale of the U.S. stock market is sufficient to drive rapid expansion of stablecoin demand. As an on-chain "fiat currency," stablecoins play an infrastructural role in U.S. stock tokenization trading and are expected to become the next important application scenario for stablecoins.

AI Agent Opens a New Era of Intelligent Payments

The deep integration of stablecoins and AI Agents is also seen as another potential market. Especially in future AGI (Artificial General Intelligence) scenarios, AI Agents may replace humans in completing a large number of payment operations.

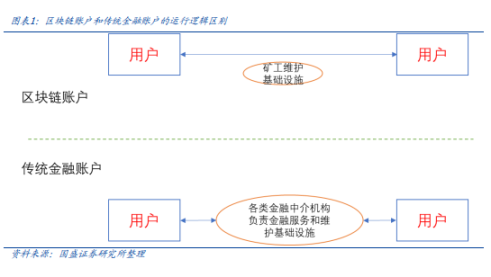

The report points out that the complex authorization processes of traditional financial accounts are not friendly to AI, often requiring user authorization and financial institution review among multiple steps, while the lightweight account system of stablecoins based on blockchain is naturally suitable for AI Agent manipulation.

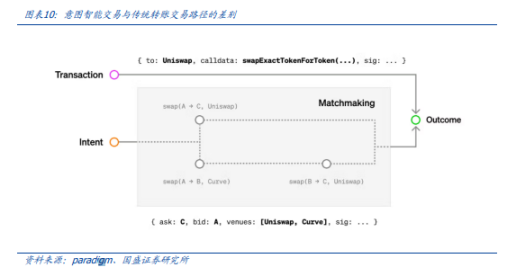

The introduction of blockchain smart contracts further strengthens the integration of AI decision-making and payments, allowing AI Agents not only to provide analytical recommendations but also to directly operate user accounts, achieving truly intelligent payments.

Moreover, blockchain accounts are essentially smart contracts, inherently possessing AI characteristics, as seen in features like flash loans and automated market maker (AMM) protocols.

The report mentions that in intent-centric applications, users only need to authorize with "one click," and AI can optimize the trading path through algorithms, achieving efficient exchanges from token A to token B without manual intervention from users. This high degree of integration between AI and blockchain accounts provides vast imaginative space for stablecoin payment scenarios, especially in automated trading and intelligent payment fields.

However, the report also adds that AI Agent payments are still in the early stages, and the decentralized architecture of blockchain networks leads to significant efficiency bottlenecks.

For example, the Ethereum mainnet can only process a double-digit number of transactions per second, far below the efficiency of traditional payment systems (such as Alipay's peak of 256,000 transactions per second during the Double 11 shopping festival in 2017). Technical scaling and network congestion issues need urgent resolution; otherwise, it will be difficult to accommodate large-scale user demand.

Competition in Payment Scenarios Becomes Fiercer, Stablecoin Potential is Huge

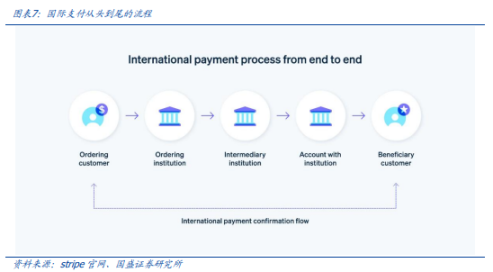

The application potential of stablecoins in international payments is also significant, with their peer-to-peer and payment-as-settlement characteristics clearly outperforming the high costs and low efficiency of traditional financial systems.

The report points out that in underdeveloped regions, stablecoins have even achieved "leapfrog" development, allowing users to complete dollar payments simply by registering a blockchain account via mobile phones, solving the problem of lack of banking services. Additionally, payment giant Stripe's acquisition of Bridge for $1.1 billion has launched stablecoin financial account services covering 101 countries, further bridging stablecoins with fiat payment systems.

The report also mentions that there are "non-homogeneous" characteristics among different types of stablecoins, making market competition exceptionally fierce.

Even Coinbase's USDC has a trading volume that is only one-eighth that of USDT; the scale of the PYUSD stablecoin launched by payment giant PayPal is only about $950 million, far below market expectations.

The report adds that for stablecoins to be widely used in the payment field, it is necessary to address the efficiency bottlenecks caused by the "impossible trinity" limitations of blockchain. Traditional payment systems like Alipay reached a peak of 256,000 transactions per second during the 2017 Double 11 shopping festival, while the Ethereum mainnet can only handle a double-digit transaction volume per second.

The main viewpoints of this article are derived from the research report "The Next Stop for Stablecoins: International Payments, U.S. Stock Tokenization, and AI Agents" published by Guosheng Securities analysts Song Jiajie and Ren Heyi on June 24.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。