When the "iron rice bowl" is broken, CEX opens the on-chain war.

Written by: BUBBLE

Centralized exchanges are undergoing a collective directional adjustment. From Coinbase's nearly $2.9 billion acquisition of the derivatives trading platform Deribit, to its collaboration with Shopify to promote the use of USDC in physical stores. To Binance launching the Alpha program to reshape the primary market pricing mechanism. Then to Kraken acquiring NinjaTrader to expand into the options market and partnering with Backed to develop "U.S. stock" business. Bybit is also opening trading for gold, stocks, forex, and even crude oil indices on its main site.

Leading trading platforms are actively expanding their revenue sources, attempting to achieve multi-dimensional business "blood replenishment" from off-chain to on-chain, from retail to institutional, and from mainstream coins to altcoins. At the same time, these platforms are extending their reach into the on-chain ecosystem. For example, Coinbase has integrated DEX routing on the Base chain into its main site, aiming to bridge the liquidity barrier between CeFi and DeFi, and reclaim trading shares lost to on-chain protocols like Hyperliquid.

However, behind these actions is the continuous pressure on the actual revenue capabilities of trading platforms, as crypto trading platforms face unprecedented development bottlenecks. Coinbase's latest financial report shows that its trading fee revenue has halved from $4.7 billion in 2024 to $1.3 billion in Q1 2025, a quarter-on-quarter decline of 19%; among which, the trading volume of BTC and ETH has dropped from 55% in 2023 to 36%, with the revenue structure increasingly relying on the more volatile altcoin sector. Meanwhile, operating costs have not seen a decline, reaching as high as $1.3 billion in Q1 2025, nearly matching revenue. Binance is also facing challenges with declining trading fees; according to a TokenInsight report, its average trading fee revenue from the end of 2024 to now has hit a three-year low, although it still leads in market share.

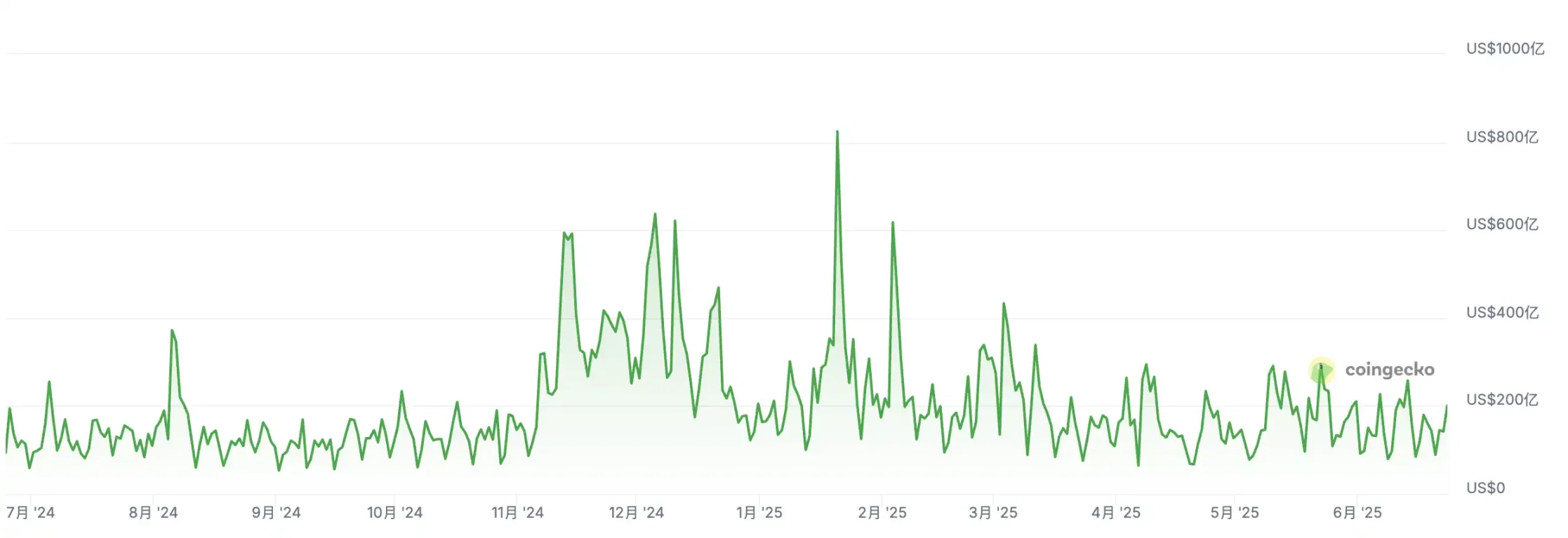

Binance's trading volume has been mostly sluggish over the past year, source: coingecko

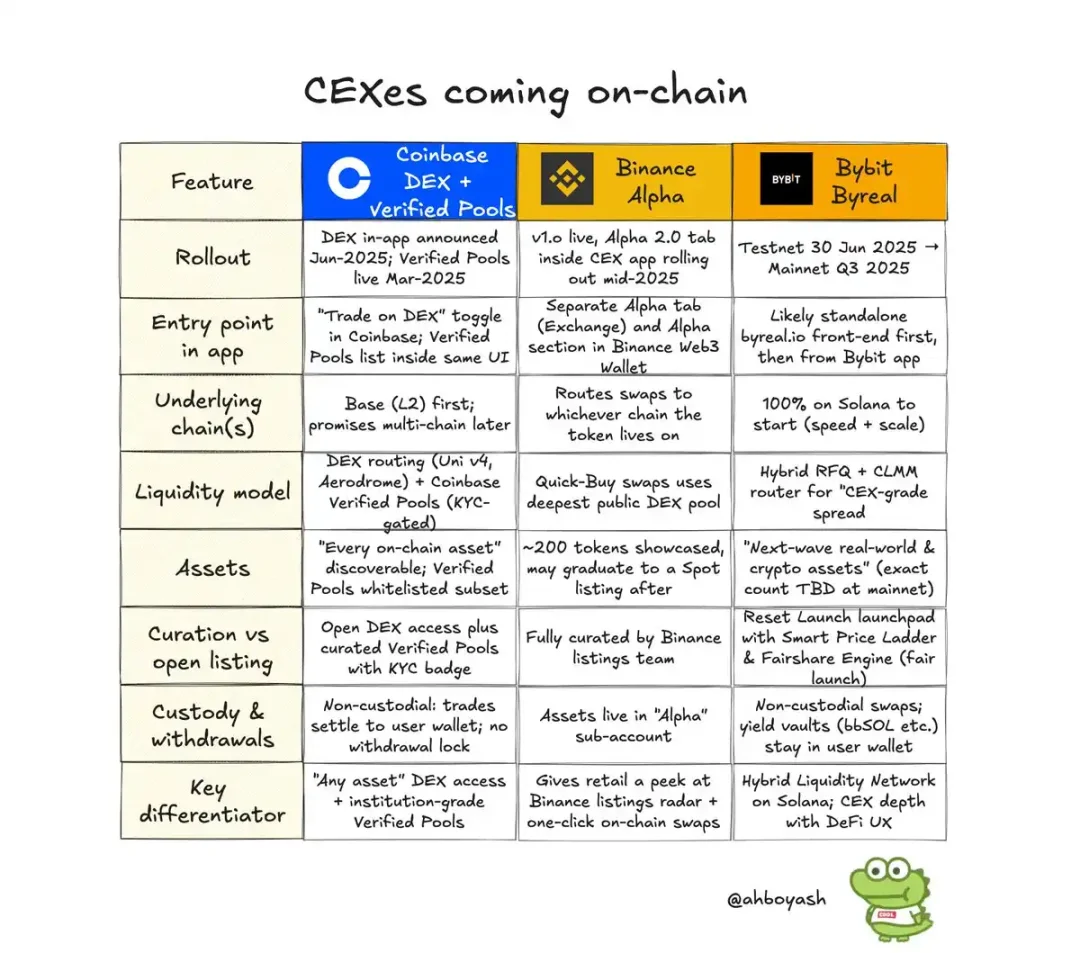

The compression of trading fee space, continuous diversion of on-chain liquidity, and traditional brokerages reshaping compliance to enter the market. These intertwined forces are compelling CEX to transform into "on-chain platforms." Well-known KOL ASH analyzed on X that as more DEXs improve their trading mechanisms, creating products with user experiences that can almost rival CEXs, but with more transparent trading processes, CEXs have finally begun to notice this and shift their strategic focus to permissionless models, with several CEXs starting a "on-chain CEX" market competition.

OKX, focusing on infrastructure development

In the annual letter dated December 30, 2024, OKX founder Star Xu expressed his firm belief that "true decentralization will lead to the large-scale adoption of Web3," and is committed to building a bridge connecting traditional finance and decentralized finance.

This statement is not unfounded; OKX is currently one of the earliest and most systematically laid out centralized trading platforms for on-chain infrastructure, aside from Binance. It is not merely launching a wallet or feature sporadically, but is building a full-stack solution to create a Web3 operating system that can replace centralized scenarios, forming a closed loop with CEX user assets.

Over the past two years, OKX has continuously advanced its strategic construction of on-chain infrastructure, attempting to transform from a centralized trading platform into a core participant in the Web3 operating system. One of its key focuses is the OKX Wallet (a non-custodial wallet supporting over 70 public chains), which integrates functions such as Swap, NFT, DApp browser, inscription tools, cross-chain bridges, and yield vaults in the Web3 sector.

The OKX Wallet is not a standalone product but the core hub of OKX's Web3 strategy, connecting users with on-chain assets and bridging centralized accounts with on-chain identities. Its comprehensive components mean that many newcomers to the crypto space around 2023 first encountered on-chain usage through the OKX Wallet.

On the other hand, OKX is also continuously investing in underlying networks and developer ecosystems. It launched OKExChain (later renamed OKTC), an EVM-compatible L1 public chain, as early as 2020, but this chain has not received strong market acclaim. However, to support the chain's development, OKX simultaneously launched basic components such as a block explorer, developer portal, contract deployment tools, and faucet services, encouraging developers to build DeFi, GameFi, and NFT applications within its ecosystem.

In addition to continuously hosting hackathons and launching ecosystem support funds, OKX is forming a complete closed-loop on-chain ecosystem. Although OKX has never publicly disclosed the total investment amount, the scale of its wallet, chain, bridge, tools, and incentive system construction has led the market to generally estimate that its investment in on-chain infrastructure has exceeded $100 million.

Binance Alpha, monetizing reputation and liquidity

In 2024, the crypto market experienced a bull market boom driven by the approval of Bitcoin spot ETFs and the meme frenzy. Although liquidity has significantly rebounded on the surface, hidden behind the prosperity is the gradual failure of the pricing mechanism between the primary and secondary markets. Project valuations are continuously inflated during the VC stage, the token issuance cycle is repeatedly extended, and the participation threshold for ordinary users continues to rise. When tokens finally go live on trading platforms, they often serve merely as an exit for project parties and early investors, leaving retail investors with price collapses after "peak at opening" and high-level buy-ins.

In such a market environment, Binance launched Binance Alpha on December 17, 2024. Originally just an experimental feature in the Binance Web3 wallet for exploring quality early projects, it quickly evolved into a key tool for Binance to reshape the primary market pricing mechanism on-chain.

Binance co-founder He Yi publicly acknowledged in a Twitter Space responding to community controversies that there is a structural issue of "peak at opening" for new tokens on Binance, admitting that the traditional token listing mechanism is difficult to sustain under the current trading volume and regulatory framework. In the past, Binance attempted to correct the pricing imbalance after new tokens go live through voting listings, Dutch auctions, and other methods, but the results were always unsatisfactory.

The launch of Binance Alpha has, to some extent, become a strategic alternative to the original token listing system within a controllable range. Since its launch, Alpha has introduced over 190 projects from multiple chain ecosystems including BNB Chain, Solana, Base, Sonic, and Sui, gradually forming a Binance-led platform for discovering and preheating early on-chain projects, providing an experimental path for trading platforms to regain primary pricing power.

With the launch of the Alpha Points mechanism, it has become a hotspot for retail investors to "farm," attracting not only players within the field but even reaching out to a broader Web2 audience, with decent returns prompting many to mobilize their families, companies, and even entire villages to participate.

Although it has become increasingly competitive, there have been instances of tokens like ZKJ plummeting after going live on Alpha, raising concerns about its "compliance." The community has mixed opinions; well-known KOL thecryptoskanda has praised Alpha, considering it Binance's second great innovation after Binance IEO, and analyzing its role in the ecosystem, stating, "The historical mission of Binance Alpha is to dismantle the primary pricing power of North American VCs like A16Z and Paradigm, which can raise funds from tradfi at almost no cost, and reclaim it for the Binance system. It aims to crush the altcoin market of other trading platforms to prevent similar situations like Grass from appearing on Bybit, which could lead to a loss of interest, while converting all chain assets into Binance's assets through BSC. Alpha has successfully accomplished these three goals."

Coinbase connects to DEX, benefiting from Base

Following in the footsteps of Binance and OKX, Coinbase has also begun its integration into the on-chain ecosystem, with their initial strategy being to connect to DEX trading and verified liquidity pools. At the recent 2025 Cryptocurrency Summit, Coinbase's Vice President of Product Management Max Branzburg announced that they will integrate DEX trading on the Base chain into the main Coinbase application, with future applications embedding DEX trading.

By routing transactions for any on-chain token through Base and packaging them into KYC-verified liquidity pools, institutions can also participate. Coinbase now has over 100 million registered users, with 8 million active trading users monthly, and according to Coinbase's investor report, the value of customer assets on its platform is $328 billion.

Retail trading accounts for only about 18% of Coinbase's transactions; starting in 2024, the trading volume of Coinbase's institutional clients has been steadily increasing (with Q1 2024 trading volume at $256 billion, accounting for 82.05% of total trading volume). As Coinbase integrates DEX on Base, the breadth of DeFi combined with TradFi's compliance standards should be able to introduce significant liquidity for tens of thousands of tokens on the Base chain. More importantly, many products in the Base ecosystem will have the potential for compliance pathways with the real world through Coinbase.

The largest native DEX on Base, Aerodrome, has also become a hot topic of discussion recently, as one of the first trading routes embedded in the main Coinbase site, it has risen 80% in the past week, with a market cap increase of nearly $400 million.

The community's attitude towards this is divided into two parts. Well-known KOL thecryptoskanda is not optimistic about Coinbase's strategy, stating during a discussion about Binance Alpha that Coinbase's imitation of Binance Alpha and the opening of the app to buy assets on the Base chain is merely scratching the surface. However, KOL deconstructor 0xBeyondLee believes that this is not the same concept as Binance Alpha, stating, "Alpha has an access mechanism, not just any token can be listed, while Coinbase's rhetoric suggests that all Base assets can appear. It's as absurd as being able to trade the equity of a fruit stand downstairs directly on a stock trading platform. In terms of liquidity and attention, the benefits for the Base chain are unprecedented."

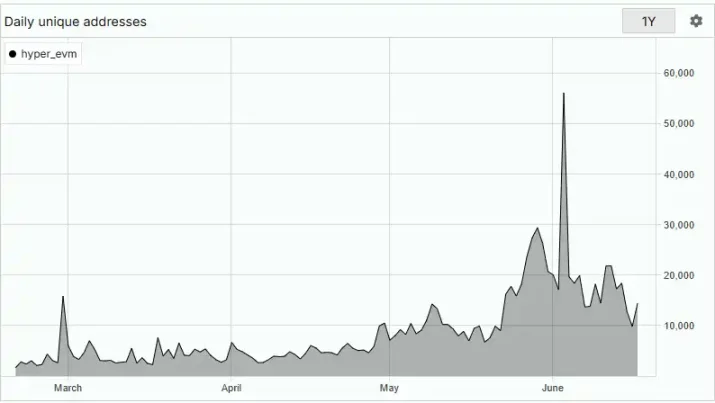

Coinbase's offensive on on-chain liquidity does not stop there. Well-known KOL TheSmartApe "thesmartape" stated on social media that due to Coinbase's actions, he will begin selling the $Hype he has held since TGE. He further explained that Hyperliquid currently has about 10,000 to 20,000 active users daily, with a total user base of around 600,000. Among them, 20,000 to 30,000 core users contribute nearly $1 billion in revenue, a significant portion of which comes from the United States.

However, most American traders use Hyperliquid because they have no better options. They are excluded from Binance and other major CEXs and cannot trade perpetual contracts. But with both Coinbase and Robinhood announcing the launch of perpetual futures products in the U.S., this will be a huge blow to Hyperliquid, as a large portion of its core users may turn to Coinbase or Robinhood. Coinbase, with its safer and more convenient access, no need for self-custody, no complex DeFi UX, and full support from regulatory bodies like the SEC, can attract most traders who do not care about decentralization as long as it is safe and easy to use.

Byreal, Bybit's on-chain doppelgänger

Bybit's actions in the on-chain war are more "restrained" compared to Binance and OKX, not creating its own chain or building Rollups. It is advancing lightly around three directions: "user entry," "on-chain trading," and "fair issuance."

First, starting in 2023, Bybit has promoted the independence of its Web3 brand by launching the Bybit Web3 wallet, embedding core on-chain functions (Swap, NFT, inscriptions, GameFi) within it. The wallet integrates capabilities such as a DApp browser, airdrop activity pages, and cross-chain aggregated trading, while supporting EVM chains and Solana, aiming to become a lightweight bridge for CeFi users to migrate to the on-chain world. However, as competition in the wallet market intensifies, this project has not sparked a significant trend.

Bybit then shifted its focus to on-chain trading and issuance platforms, launching Byreal, which is deployed on Solana. The core design concept of Byreal is to replicate the "matching experience" of centralized trading platforms, achieving low-slippage trading through a hybrid model of RFQ (Request for Quote) + CLMM (Concentrated Liquidity Market Making), and embedding mechanisms such as fair issuance (Reset Launch) and yield vaults (Revive Vault). The testnet is reportedly set to launch on June 30, with the mainnet expected to be released in Q3 2025.

Additionally, Bybit has launched Mega Drop on its main site, which has already gone through four phases, adopting a model where users stake to automatically receive project token airdrops. Current yield estimates suggest that staking $5,000 can yield about $50 per phase, though this varies depending on the quality of the projects.

Overall, Bybit's strategy in the on-chain war is to "use lower development costs and leverage existing public chain infrastructure" to build a bridge connecting CeFi users with DeFi scenarios, and to expand its on-chain discovery and issuance capabilities through components like Byreal.

This wave of decentralized derivatives ignited by Hyperliquid has evolved from a breakthrough in technical paradigms into a reshaping of the competitive landscape among trading platforms. The boundaries between CEX and DEX are being broken down, with centralized platforms actively "going on-chain," while on-chain protocols continuously simulate the centralized matching experience. From Binance Alpha's reclamation of primary pricing power to OKX's construction of a full-stack Web3 infrastructure, and Coinbase leveraging compliance to access the Base ecosystem, even Bybit is establishing its own on-chain doppelgänger through Byreal. This "on-chain war" is far more than a technical competition; it is a struggle for user sovereignty and liquidity dominance.

Ultimately, who can occupy the high ground of future on-chain finance will depend not only on performance, experience, and model innovation but also on who can build the strongest capital flow network and the deepest channels of user trust. We may be standing at the critical point of deep integration between CeFi and DeFi, and the winner of the next cycle may not necessarily be the most "decentralized" one, but rather the one that understands on-chain users the best.

Hype! Hype! Hype!

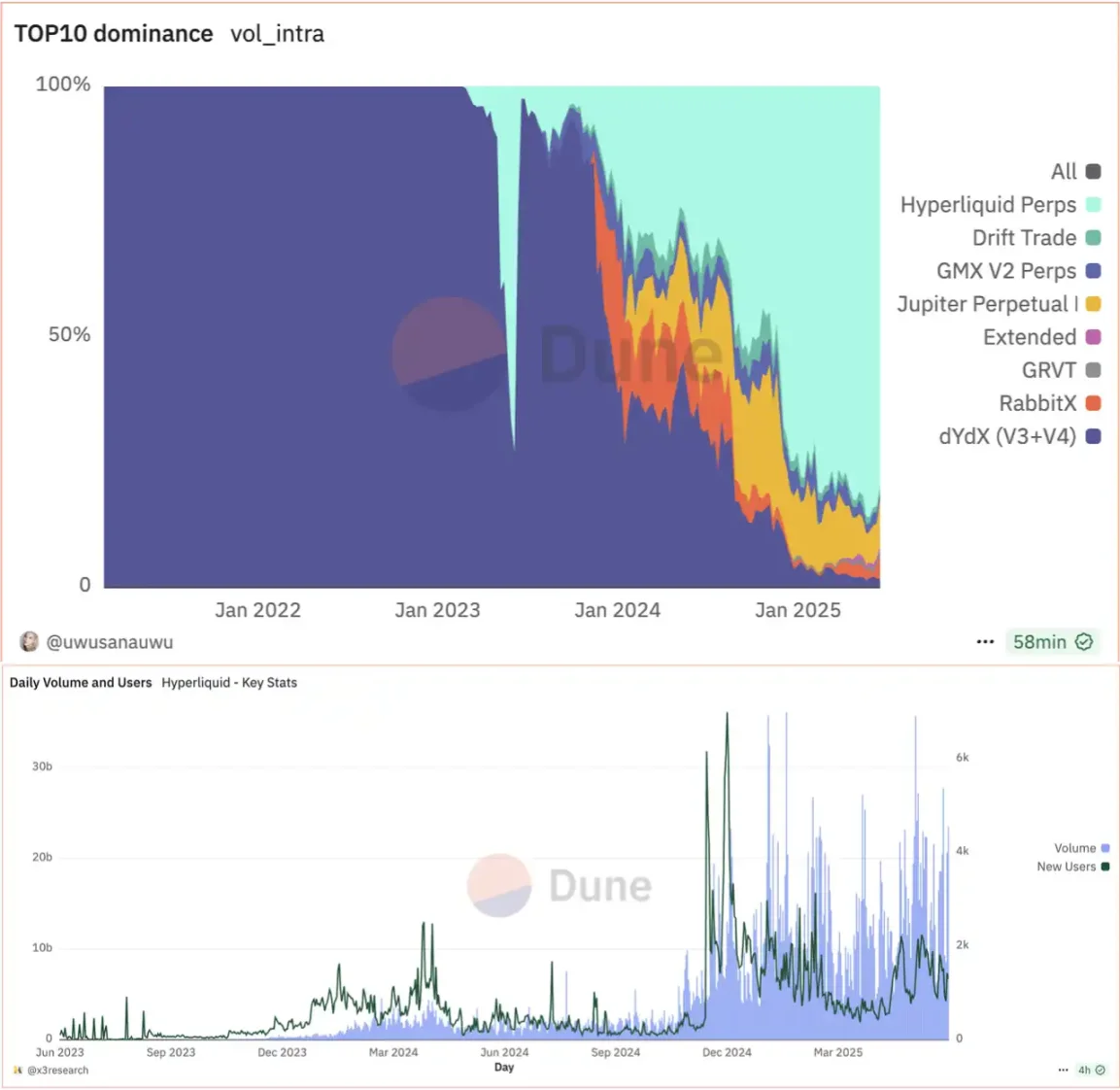

In April 2020, dYdX first launched decentralized perpetual contract trading for BTC-USDC, thus opening the path for derivatives on decentralized trading platforms. After five years of market development, the emergence of Hyperliquid has liberated the potential in this field, accumulating over $30 trillion in trading volume to date, with an average daily trading volume approaching $7 billion.

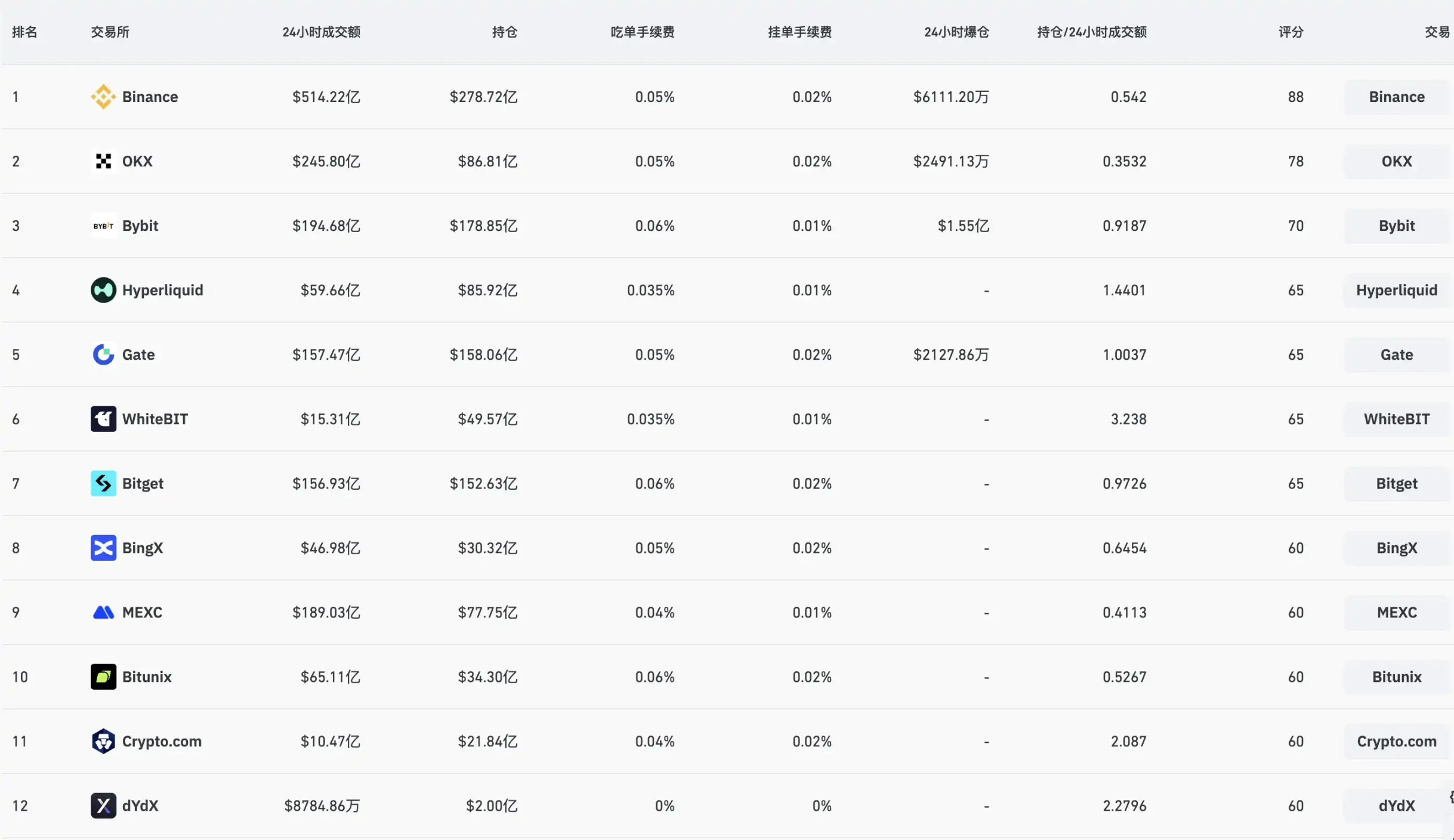

With Hyperliquid breaking into the mainstream, decentralized trading platforms have become a force that centralized trading platforms can no longer ignore. The gradually stagnating growth of trading players, combined with the diversion caused by decentralized trading platforms led by Hyperliquid, has prompted centralized trading platforms to urgently seek the next "growth anchor." In addition to expanding stablecoin or payment-related "open-source" strategies, the primary focus is on reclaiming the "throttling" strategy for contract players flowing onto the chain. From Binance to Coinbase, major centralized trading platforms are integrating their on-chain resources. Meanwhile, community players' attitudes towards blockchain have shifted from being entangled in "decentralization" to a greater concern for "permissionless" and "fund security," blurring the boundaries between decentralized and centralized trading platforms.

In recent years, the idea represented by DEX has been a symbol of resistance against CEX's power monopoly. However, over time, DEX has gradually begun to borrow from and even replicate the core skills of the once "dragons." From trading interfaces to matching methods, liquidity design, and pricing mechanisms, DEX is reshaping itself step by step, learning from CEX, and even going further.

Now that DEX has grown to the point where it can perform various functions of CEX, even facing suppression from CEX, it cannot erase the market's enthusiasm for its future development. It carries not only "decentralization" but also a transformation of financial models and the changes in the "asset issuance" model it supports.

CEX seems to be launching a counterattack, not only developing more business channels but also attempting to bind the liquidity that originally belonged to the chain with its own system to compensate for the decreasing trading volume and user numbers "stolen" by DEX.

When the market is filled with diverse competition, it is the most creative and vibrant. The competition between DEX and CEX is the result of continuous compromise between the market and "reality." This "on-chain war" over liquidity dominance and user attention has far exceeded the technology itself. It concerns how trading platforms can reconstruct their roles, capture the needs of a new generation of users, and find a new balance between decentralization and compliance. The boundaries between CEX and DEX are increasingly blurred, and the future winners will be those builders who can find the optimal path among "experience, security, and permissionless."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。