Understanding the psychological mechanisms behind risk is essential to leverage this advantage in identifying potential market bottoms.

Author: Doc

Compiled by: Tim, PANews

The purpose of this article is to help you understand how I identify key signals in the market. We need to understand the psychological mechanisms behind risk to leverage this advantage in identifying potential market bottoms.

1. Projects with Lower Consensus Collapse First

When uncertainty strikes, sellers will offload their least favored assets. For example, coins with low consensus will collapse first, bleeding out earlier.

Think logically: if you urgently need money, you wouldn't sell your valuable items but rather get rid of those that are usually unnecessary and worthless.

Similarly, when traders are uncertain about market trends or wish to reduce risk, they often liquidate their least emotionally attached assets to cash out.

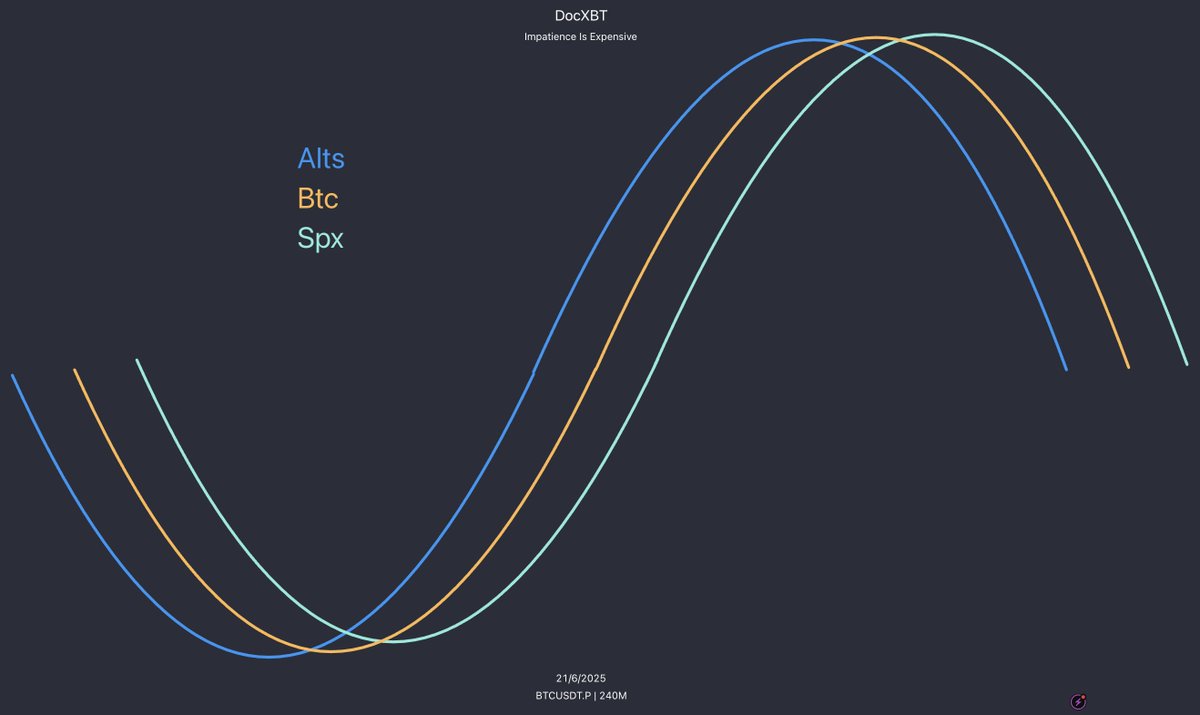

This phenomenon occurs every time Bitcoin peaks, and it is no coincidence. Altcoins do not rise after Bitcoin peaks; they rise in tandem with Bitcoin's peak. They show signs of fatigue earlier than Bitcoin, having already peaked weeks before.

This is an early warning signal. Smart traders will reduce risk before others even realize what is about to happen.

2. Risk vs. Blue-Chip Coins

Let’s return to the previous logic: people will hold onto their cherished high-quality assets for as long as possible, only parting with them when they are out of options.

The most sought-after coins usually try to hold onto their gains as much as possible. This is why Bitcoin always appears strong, and just weeks before a market crash, social media is often filled with tweets like, "Why is everyone panicking? Bitcoin is clearly very stable."

The order of sell-offs:

a) First, junk coins

b) Then, blue-chip coins

c) Finally, all coins are sold off

3. Reflexivity Effect Emerges

Weakness leads to more weakness.

When whales start selling in a depleted demand environment, it triggers market weakness. This is a typical characteristic of the chip distribution phase: lack of buying power, exhausted demand, and trends moving away.

The change in characteristics of risk assets will prompt the core decision-makers among experienced traders to reassess their strategies.

"I didn't sell at the top, but the nature of the market has changed. It's time to reduce exposure or close positions."

"If this drop is considered a nuclear-level crash, what other bombs are hidden in my account?"

Suddenly: position adjustments trigger larger sell-offs, which is reflexivity, a positive feedback loop of declining risk appetite.

4. Volatility: The Last Dance

When a significant drop in Bitcoin is imminent, the market often experiences eerie calm: volatility drops sharply, prices oscillate narrowly, and complacency peaks.

Then, bang~ it crashes.

Now, let’s focus on the nature of balanced and unbalanced markets.

Balance is achieved when market participants gradually reach a consensus on what is expensive and what is cheap. It is a dance. This is equilibrium.

Equilibrium means calm. Known information has been digested, speculative activity diminishes, and volatility narrows.

This dance will continue until one side feels weary, exhausted, or wants to go to the bar for another drink. That is, either buyers or sellers are exhausted; or supply and demand change.

Equilibrium is disrupted. Once it is broken: imbalance occurs.

Prices deviate sharply from their original positions. Value becomes unclear; volatility surges. The market craves balance and will actively seek it.

Prices often return to areas where balance was recently established: such as high volume points, order blocks, and composite value areas.

It is in these areas that you will see the most vigorous rebounds.

"Initial tests are the best timing." Subsequent tests will gradually weaken. The situation becomes structured. Prices stabilize at new levels. Volatility contracts. Balance reappears in the market.

5. Sell-Off Process and Bottom Identification

Capitulation sell-offs are not the beginning of the end, but rather the end of the mid-game.

a) Altcoins vs. Bitcoin

In this cycle, altcoins often complete their major sell-offs before Bitcoin crashes.

Recent example: Fartcoin had already dropped 88% from its peak before Bitcoin's crash at the end of February. Since this pattern holds, we can use it as a trading signal when looking for signs of market exhaustion (bottoming signals).

When Bitcoin is still experiencing significant volatility and seeking a new balance, the strongest altcoins will first show signs of relative strength exhaustion.

In simple terms, when Bitcoin enters the late stage of imbalance, one should look for quality alternative coins to establish balanced positions.

As participants, our goal is to capture these divergence phenomena.

"Is market momentum shifting?"

"Is volatility narrowing?"

"Is the speed of sell-offs slowing down?"

"When Bitcoin hits new lows, can it still hold steady?"

Second-quarter bottom signals:

Weakening momentum (e.g., Fartcoin)

SFP, divergence (e.g., Hype, Sui blockchain)

Higher lows vs. lower points in Bitcoin (e.g., Pepe coin)

Altcoins usually drop first, and their decline slows down after Bitcoin hits the bottom.

The key to identifying quality altcoins lies here.

The weak remain weak.

The strong quietly position themselves before the market trend starts.

b) Bitcoin vs. S&P 500

Now, let’s do a little exercise.

Integrating all the concepts from this article, perhaps the following phenomena will make sense:

Summer 2023: Bitcoin peaked before the S&P 500, completing its bottom formation earlier

Summer 2024: Bitcoin peaked before the S&P 500 and absorbed the S&P's macro-induced crash at lower levels

Year-to-date 2025: Bitcoin peaked before the S&P 500 and withstood a 20% drop in the S&P at lower levels

Core Conclusion

Market bottom formation is a process rather than an instantaneous event: altcoins lead → Bitcoin follows → S&P lags behind.

Operational Essence: Focus on observing the evolution of market structure rather than merely tracking emotional fluctuations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。