This article will introduce three new stablecoin protocols that compete for a trillion-dollar monopoly market with yields ranging from 4% to 16%.

Written by: Duo Nine

Translated by: Tim, PANews

The stablecoin market is undergoing changes, as USDT and USDC do not return the profits they generate to users, but instead keep them for themselves.

This has provided opportunities for other stablecoin competitors.

Now, let's take a look at the three project cases below, with more cases in preparation.

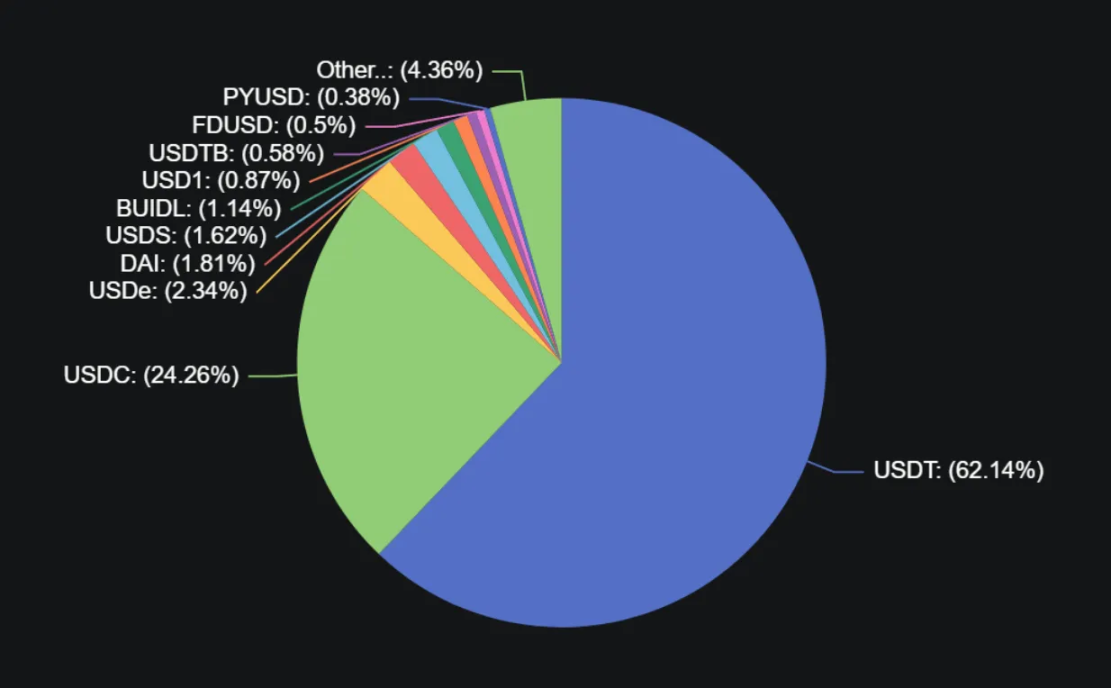

Currently, the stablecoin market has a market share of about $250 billion, with USDT accounting for 62% and USDC for 24%. Together, they occupy 86% of the total market value of stablecoins.

What problems do they have?

Both USDT and USDC do not pay any yield to their holders; all dollar assets used as collateral are invested in U.S. Treasury bonds, which can generate about 4% annualized yield, and all these profits belong to Tether and Circle, not the users.

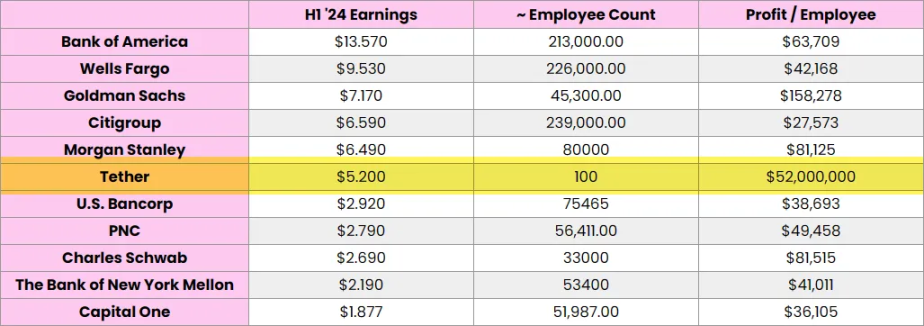

You can imagine that in 2024, Tether became the most profitable company in the world, generating over $50 million in profit per employee, and by 2025, this number was close to $60 million. This makes Tether the most profitable bank that actually exists.

However, this is also a clear weakness.

Token holders do not receive any yield, and they will inevitably demand control over this yield. This presents an excellent entry point for other stablecoins that aim to share profits with users. The following three cases support this view.

1. Resolv, USR—8.6% Annual Yield

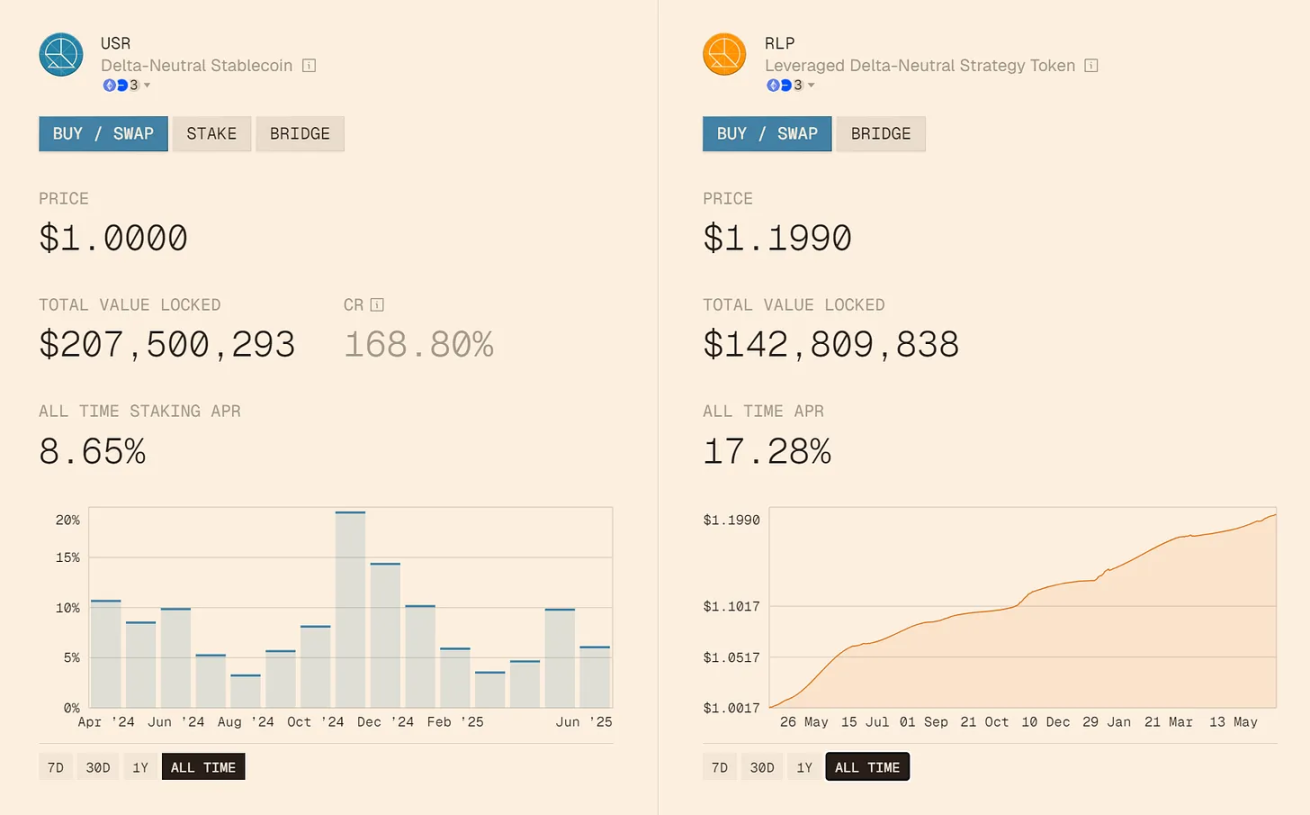

Resolv has two key products.

USR: A stablecoin fully backed 1:1 by Bitcoin and Ethereum

RLP: Resolve liquidity pool token

Annual yields can be generated through the hedging positions of Bitcoin and Ethereum as shown below.

USR has 168% collateral assets as backing, making it very low risk. Its biggest risk lies in potentially losing its peg to the dollar, but this has never happened so far. An average annual yield of 8.65% is double that of the AAVE platform, making it noteworthy.

RLP is a token that accumulates value through yield, driving price increases over time. Its yield comes from excess collateral being leveraged into the same market-neutral strategy. RLP has higher risk attributes; if market conditions are unfavorable, the token price may also decline.

RLP acts as a buffer and protection layer for USR, where RLP depositors take on higher risks for higher returns, while USR users are protected, making this design mechanism quite fair.

Advantages of USR

Yield superior to AAVE

Fully backed by BTC and ETH

High transparency

Protected by the RLP mechanism in unfavorable market conditions

Zero minting and redemption fees

Supports instant staking and unstaking with no lock-up period

Disadvantages of USR

The service is only available on the Ethereum network, which may lead to higher fees.

Users must stake USR tokens to earn yields

2. Noble Dollar, USDN—4.1% Annual Yield

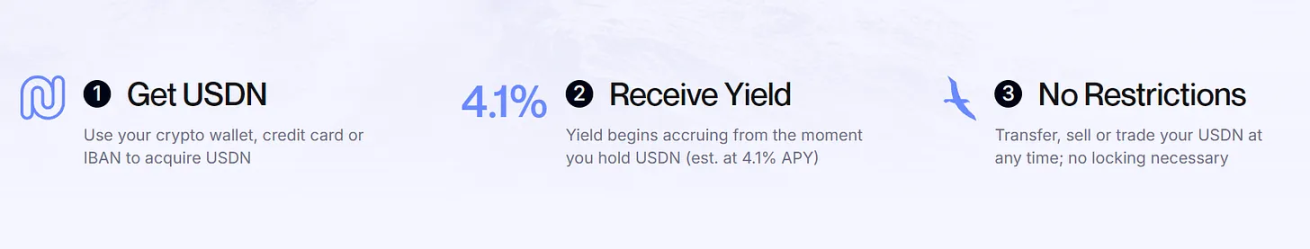

Noble Dollar is a product launched by m0, with the core feature that users can earn 4.1% yield from U.S. Treasury bonds based on the USDN stablecoin they hold, without the need for lock-up or staking. In short, users' wallets automatically receive additional USDN daily, equivalent to a free airdrop.

Although the current use cases for USDN are limited, it is about to gain support in multi-chain ecosystems such as Ethereum and its layer two networks. Imagine the scenario of staking USDN in AAVE: users can not only earn the default 4% base yield but also earn an additional 4% to 5% in AAVE incentive rewards.

The potential application scenarios for this digital dollar are endless. If this dollar is successfully promoted in the future, USDT and USDC may be affected.

Advantages of USDN

Considerable yield backed by U.S. Treasury bonds

High transparency

No need for staking

Daily yield settlement

Can be purchased with fiat currency on their website

Native cross-chain bridge for easy transfer of USDC

Disadvantages of USDN

Current use cases are limited (to be improved later)

Yield lower than competitors like Resolv

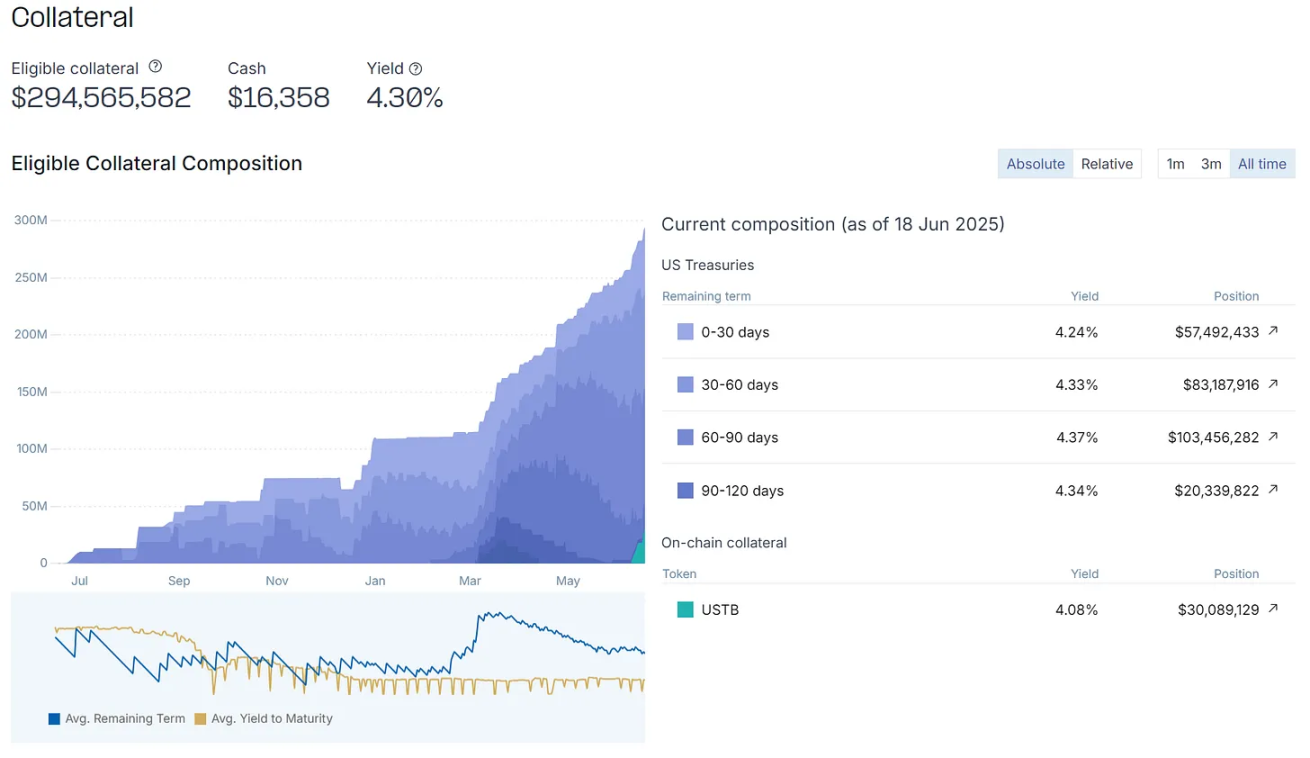

3. infiniFi, iUSD—8.5% to 16% Annual Yield

InfiniFi belongs to a new generation of "stablecoins" that can provide different yields based on user interests and risk preferences. To obtain 1 iUSD, 1 USDC must be deposited, which will be used to invest in diversified yield strategies.

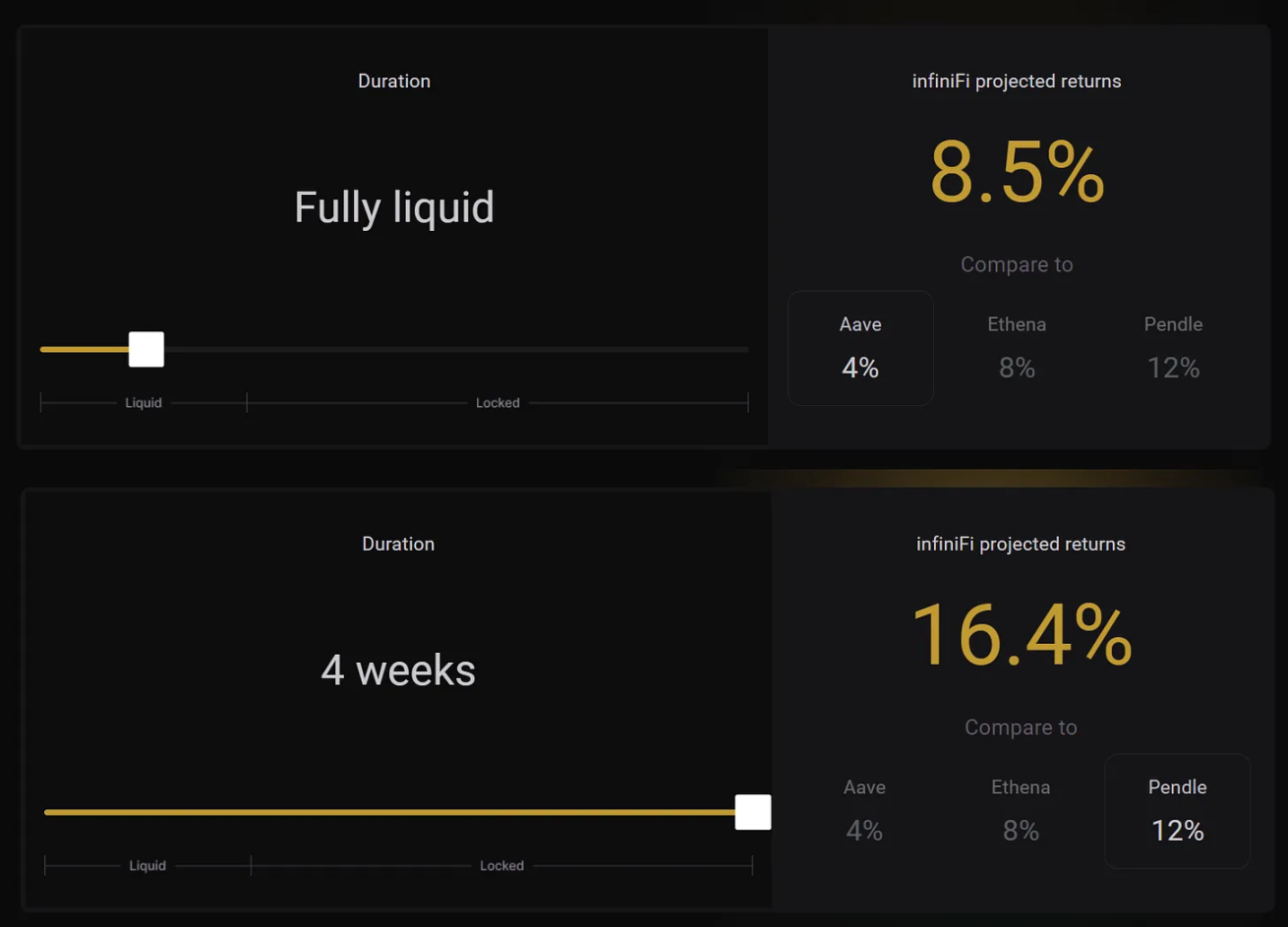

If users want to withdraw USDC at any time for instant liquidity, the yield will be lower. However, if the iUSD lock-up period is extended, the protocol can adopt more advanced USDC strategies to achieve higher yields. Although the risk increases, the higher yield may compensate for this.

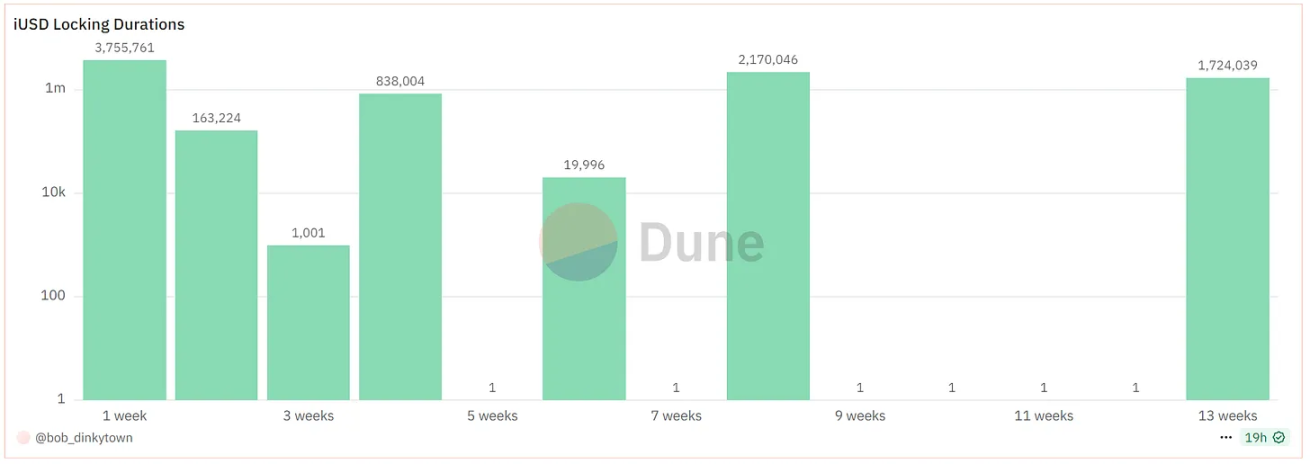

The current no-lock-up rate is about 8.5%. However, if users are willing to lock iUSD for 4 weeks or longer, the yield can reach up to 16.4%.

Overall, I do not recommend locking funds for several weeks. This is because if problems arise, you will be in a passive position. However, this approach is reasonable for stablecoin investments. To some extent, it resembles the model of short-term bank deposits.

The operational mechanism of iUSD is that after users lock iUSD for one to several weeks, it can provide protection for users who keep iUSD liquid (not locked). If the system encounters issues, the users with the highest yields will bear the losses first. This is similar to how Resolv RLP users provide protection for USR holders. Why is this mechanism crucial?

Imagine a scenario where everyone holding iUSD wants to withdraw and get back their USDC. But only when liquidity is sufficient can those holding liquid iUSD exit first.

If liquidity is insufficient (due to a large amount of USDC being locked in various long-term strategies), then iUSD may lose its 1:1 peg to USDC or incur losses. This is because exiting a locked USDC strategy for up to 8 weeks may incur additional costs.

These losses will be borne first by the users with the longest lock-up periods. In principle, this mechanism can maintain the pegged exchange rate of iUSD and protect liquid iUSD holders. However, if the liquidation speed is insufficient, black swan events may still cause iUSD to decouple and fluctuate.

Generally, as long as InfiniFi does not hold a large amount of USDC or suffer significant losses in its strategies, this risk is low. However, if the DeFi protocol used in its long-term strategies (such as Ethena) is hacked or drained of funds, the risk will explode. At that time, users of iUSD who adopted the lock-up mechanism will suffer heavy losses, potentially even losing their principal.

Advantages of iUSD

Extremely high yield

High transparency

The lowest yield tier can also have instant liquidity

High yield tier provides a safety net for low yield

Suitable for different risk preference groups

Disadvantages of iUSD

This is not a true stablecoin, but a receipt for USDC deposits

Risk of insufficient liquidity, meaning not enough USDC to meet redemption requests

If liquidity runs dry, iUSD may "decouple"

High-risk strategies may lead to yields falling short of expectations or even principal losses

The product is linked to the potential risks of all DeFi platforms used to generate yields

When investing in such new protocols, I recommend testing with small amounts first and waiting until the bear market is over before investing large sums. These new protocols must undergo stress testing to complete market validation. Taking InfiniFi as an example, their protocol operation model is more akin to a hedge fund that absorbs user funds for investment.

On the other hand, it is crucial to pay attention to the development of these new tracks. Various protocol combinations can not only provide diverse choices but also allow users with different risk tolerances to achieve specified yield targets through a platter strategy at their comfortable risk levels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。