The probability of mining a block is over 100 times higher than winning the lottery.

Written by: Liu Jiao Lian

Solo mining, as the name suggests, refers to individual miners. Although most of the current BTC mining power is concentrated in mining pools, with a few large pools distributing rewards based on so-called power contributions, there are still many people who choose to mine solo using their own computing power.

Compared to steadily receiving "work points" from a mining pool, solo mining is akin to a gamble of "either hit a block or waste effort." For today's BTC block rewards, hitting a block means the solo miner exclusively receives 3.125 BTC, equivalent to over $300,000. However, the probability of hitting a block is incredibly low, making hope seem distant.

How low is the probability of solo mining a block?

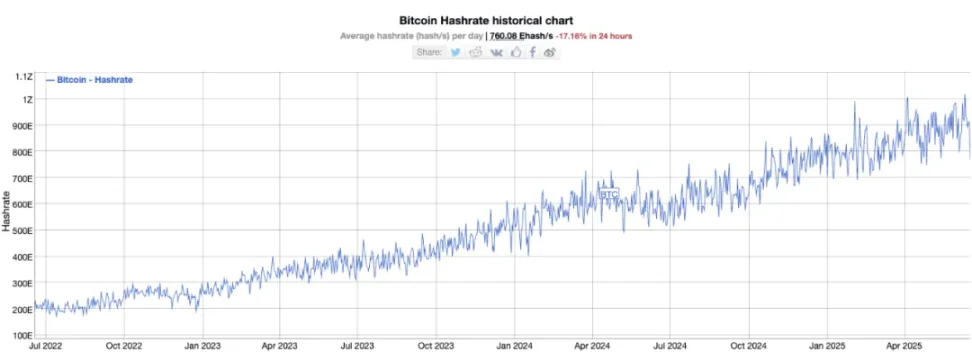

According to estimates of the total BTC network hash rate, the current total hash rate is around 900E (900EH/s). For simplicity, we take 900E. This number means that the BTC network can compute approximately 900E hashes per second. An astonishing astronomical figure.

According to estimates by netizen Matt Cutler, if using a desktop miner with a hash rate of 1T (1TH/s), then based on the assumption of independent and identically distributed variables, the probability of hitting a block is 1T/900E = 1/900M, or one in 900 million.

How low is this probability? Based on the average of one block being mined every 10 minutes across the BTC network, it would take an average of 9 billion minutes, or about 17,000 years, to hit a block once.

For comparison, he listed the winning probabilities of two typical lottery products:

Powerball Jackpot: 1/292M, or one in 292 million.

Mega Millions: 1/303M, or one in 303 million.

Clearly, on the surface, the probability of hitting a block is much lower than the winning probabilities of these two lotteries.

But wait. We are ignoring time. The draw times for the two lottery comparisons are three times a week and twice a week, far less frequent than BTC's once every 10 minutes.

If we calculate the winning probability as one in 300 million, then for three draws a week, it would take an average of 100 million weeks, or 1.92 million years, to win a jackpot.

Clearly, it seems that solo mining has a higher probability than winning the lottery.

Let’s consider time and align the comparisons:

Weekly:

Powerball (3 draws): Winning probability: 1/97M, or one in 97 million.

Mega Millions (2 draws): Winning probability: 1/151M, or one in 151 million.

Solo mining (1T hash rate) (1,008 draws): Winning probability: 1/892K, or one in 892 thousand.

Monthly:

Powerball (12 draws): Winning probability: 1/22M, or one in 22 million.

Mega Millions (8 draws): Winning probability: 1/35M, or one in 35 million.

Solo mining (1T hash rate) (4,320 draws): Winning probability: 1/208K, or one in 208 thousand.

Yearly:

Powerball (156 draws): Winning probability: 1/1.87M, or one in 1.87 million.

Mega Millions (104 draws): Winning probability: 1/2.9M, or one in 2.9 million.

Solo mining (1T hash rate) (over 52,000 draws): Winning probability: 1/17K, or one in 17 thousand.

The probability of mining a block is over 100 times higher than the probability of winning the lottery.

Of course, probability calculations tell us that even with a probability over 100 times higher, for the vast majority of people, the contribution is greater than the return, and the cost outweighs the benefit—in short, mining is a loss.

Because most people's lifespans are less than 100 years, which is nearly one two-hundredth of 17,000.

This is precisely the clever design of BTC's underlying structure.

Is there any investment (or speculative) product in this world where the number of participants is particularly large, most of whom lose money, yet everyone is still happily engaged?

Some friends who enjoy joking might answer. Wrong.

The correct answer is: the lottery.

BTC's PoW mining incentive mechanism is very similar to a lottery.

Miners may not make money, but their tireless calculations contribute remarkably to the world's largest "public welfare project"—maintaining the BTC public ledger, voluntarily and selflessly.

In a daze, there seems to be a spirit of a public welfare lottery within it.

Since BTC's inception 16 years ago, there have been annual doubts about how the BTC network will sustain itself as rewards decrease with halving.

This reflects a dogmatic error of viewing problems with a static perspective rather than a developmental one.

It is only because, at this stage, BTC is primarily powered by mining pools and mining companies that people question these enterprises' need for profit; otherwise, they would not continue mining or providing hash power.

Perhaps this is precisely what the design intended!

As miners and mining companies that mine for profit gradually exit due to reduced profits, solo miners and home miners who mine for fun, not fearing losses, will gradually take their historical place.

By that stage, BTC will have entered a relatively mature phase.

The current situation is merely a phase of BTC still growing rapidly (reflected in the rapidly rising price).

From a financial perspective, BTC is a non-interest-bearing, non-exploitative currency. The BTC chain does not allow for certain reserve requirements and credit expansion found in traditional financial systems. Therefore, based on financial theories understood since the last century, a financial institution that offers such currency deposits without allowing loans cannot only not pay interest to depositors but must also charge them management fees; otherwise, it becomes economically unsustainable.

The BTC network is akin to such an institution that provides BTC deposits but does not allow loans. It is a distributed virtual institution operated collectively by hundreds of thousands of miners around the world.

Thus, the costs incurred by individual miners, such as electricity fees, are essentially what economists refer to as management fees paid to this deposit institution.

Unlike today's miners whose motivation for mining comes from earning block rewards (which essentially dilute the value for all holders) and transaction fees (the fees traders are willing to pay), future individual miners will be personal or business users who hoard BTC and treat BTC as savings. Their motivation to cover the costs of running such a mining node will be to ensure the safety of their deposits.

Currently, the total hash power of several major mining pools in the network is about 900E. If we break it down to 9 million users, then each user would need to provide an average of 100T of hash power.

In the future, as hash power efficiency improves, energy consumption decreases, noise reduction technology advances, and electricity costs drop (such as through nuclear fusion power generation), it may even be possible to reuse by-products (like using chip heat for heating), making it feasible for each user to provide 100T or more hash power.

We should start considering the future now, ensuring the BTC ledger's size is streamlined, strictly controlling junk data and abuse, to avoid future issues that could hinder a return to greater decentralization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。