Author: Sumanth Neppalli and Nishil Jain, Decentralised.co

Translated by: Felix, PANews (This article has been edited)

The business model of the internet is disconnected from how the public uses it. In 2009, Americans visited over 100 websites per month on average. Today, the average user opens fewer than 30 applications per month, but spends much more time on them. Back then, users spent about half an hour daily; now, it's close to five hours.

Amazon, Spotify, Netflix, Google, and Meta have become aggregation platforms that gather consumer demand and turn casual browsing into habits. They price these habits as subscription services.

This model is effective because human attention follows certain patterns. Most people watch Netflix in the evenings. They order products from Amazon weekly. Amazon's Prime membership includes shipping, return services, and streaming services for just $139 a year. Subscription services eliminate many hassles. Nowadays, Amazon has started pushing ads to subscription users to increase profit margins, forcing users to either watch ads or pay more. When aggregators cannot justify the rationale for subscription services, they rely on ads for profit, attracting attention rather than stimulating purchase intent.

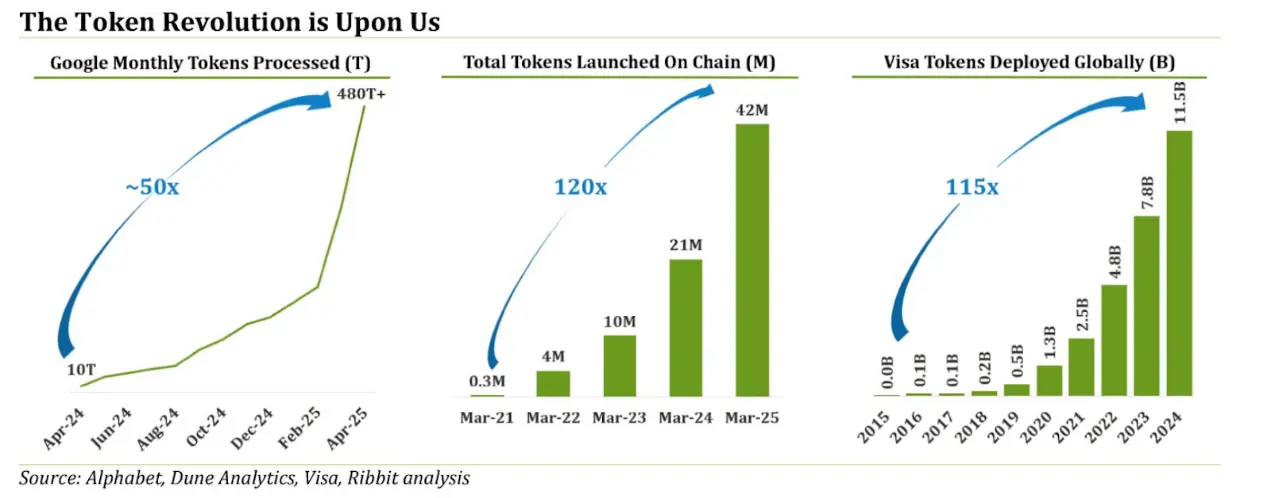

Today, bots and automated programs account for nearly half of all web traffic. This is mainly due to the proliferation of artificial intelligence and large language models (LLMs), making it easier and more scalable to create bot programs.

API requests account for 60% of the dynamic HTTP requests handled by Cloudflare. In other words, machine-to-machine communication has taken up most of the traffic.

The current pricing model is based on purely human internet usage, but today's traffic is machine-to-machine and sporadic. The subscription model is based on user habits, but machines have neither habits nor eyeballs; they only have triggers and tasks.

Content pricing depends not only on market constraints but also on the distribution channels behind it. Music has existed in album form for decades because physical media needed to be bundled. Later, the splitting of albums increased song exposure but also reduced revenue. Most fans only buy popular songs and do not purchase niche songs, which compresses the income of many artists.

The advent of the iPhone changed the landscape again. Affordable cloud storage, 4G networks, and global content delivery networks (CDNs) made accessing any song instant and seamless. Today, music subscription revenue accounts for over 85% of total music revenue.

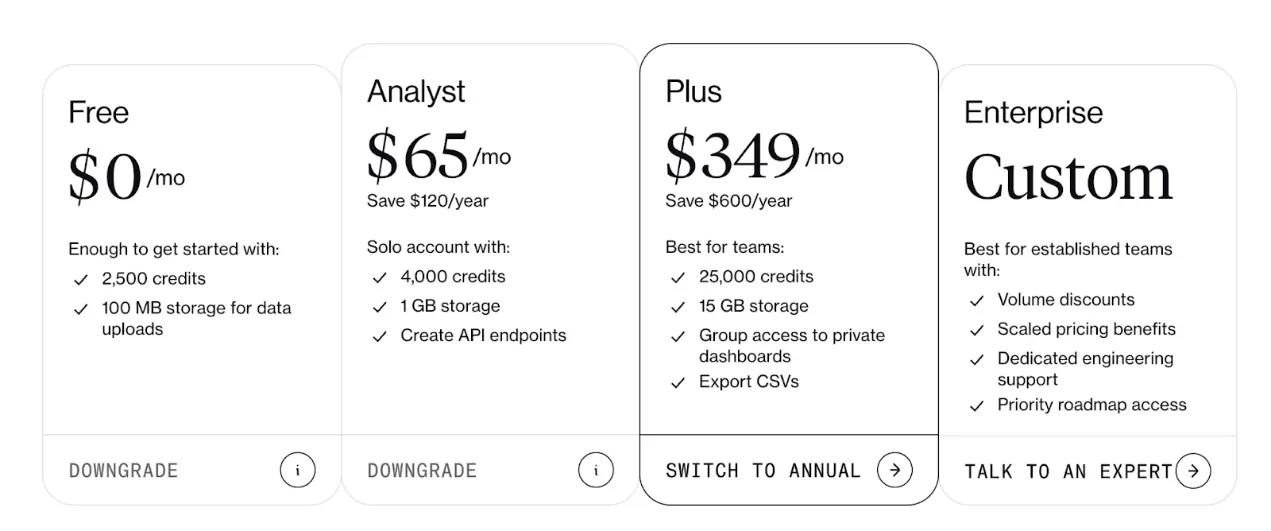

Enterprise software follows the same logic. Since products are digital, vendors can charge based on the actual resources used. B2B SaaS vendors typically offer predictable service access on a "per user" basis, charging monthly or annually, usually around $50/user/month, plus $0.001 per API call, with different feature tiers.

Subscriptions cover predictable human usage, while metering handles the sporadic traffic of machines. Last year, B2B SaaS revenue reached $500 billion, which is 20 times the revenue of the music streaming industry.

Today, most consumption is driven by machines and is explosively growing, so why does the pricing model still linger in 2013? The subscription model has become the default because making a decision once a month is better than frequently making small payments.

This is not to say that cryptocurrencies created the infrastructure that supports small payments today. That is somewhat true, but the internet itself has grown so large that new ways are needed to price usage.

Why Have Micropayments Failed?

The dream of purchasing content at extremely low prices is as old as the internet itself. Every few years, someone wonders: what if each article cost only $0.002, and each song cost $0.01, which is the actual price of the goods? But they ultimately fail in the same way: people hate quantifying their consumption.

AOL paid a painful price for this in 1995. They charged dial-up internet fees by the hour. For most users, this was objectively cheaper than a monthly subscription. However, customers hated this practice because it created a mental burden. After AOL switched to an unlimited plan in 1996, usage doubled overnight.

People are willing to spend more money to think less. "Pay-per-use" sounds efficient, but for humans, it often feels like spending money to buy anxiety.

The "Subscription Hell"

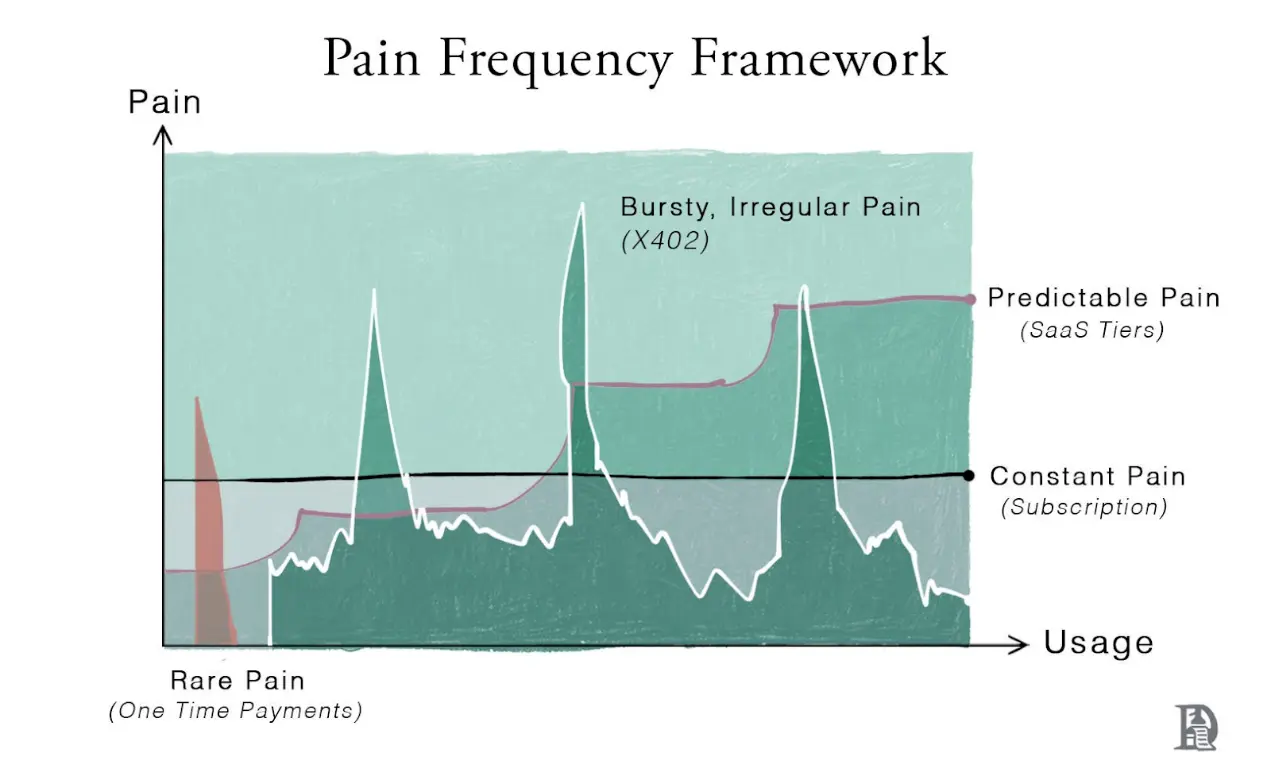

If there is a desire for the simplicity and convenience of subscription models, why are people now complaining about the various downsides of subscriptions? A simple pricing logic is: how many pain points can this product help you solve?

The demand for entertainment is endless. The black line in the chart represents this persistent pain point, a shared dream between users and businesses for a smooth, predictable, and constant pain point curve. This is why Netflix evolved from a quirky DVD rental service into a member of the elite FAANG club. It offers endless content and eliminates billing fatigue.

The convenience of the subscription model has reshaped the entertainment industry. When Hollywood studios saw Netflix's stock price soar, they also began to reclaim their libraries to create their own subscription platforms: Disney+, HBO Max, etc.

The fragmentation of content libraries forces users to purchase more subscription services. For users, watching content has become a matter of combining subscriptions.

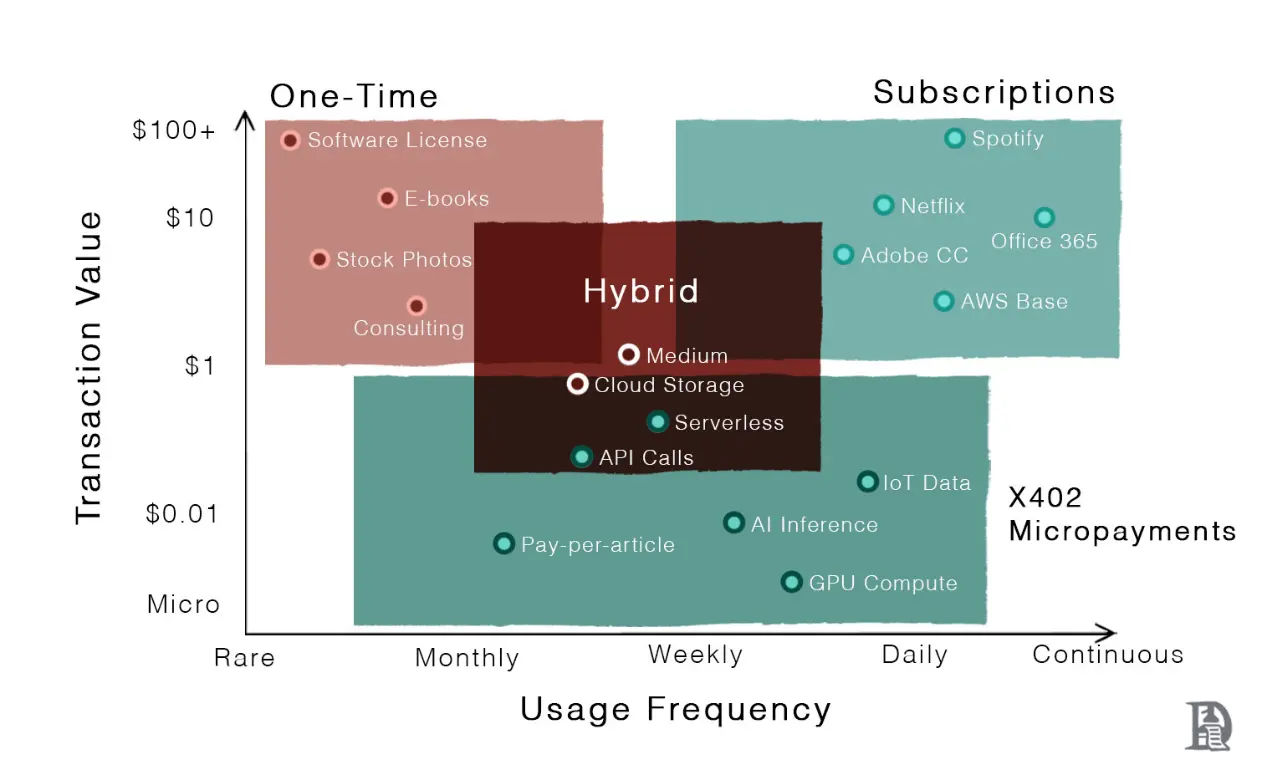

Pricing depends on two factors: how accurately the underlying infrastructure can measure and settle usage, and who decides the value consumed each time.

One-time payments work great for rare and sporadic events, such as buying books, renting movies, or paying for one-time consulting fees. This model works well when tasks are infrequent and the value is obvious. Accurate measurement of usage means fees are charged based on actual workload.

Metering is different: the cloud can monitor usage down to the millisecond. Once Amazon Web Services (AWS) can measure with this level of precision, renting an entire server becomes meaningless. Servers only start when needed, and charges apply only during operation.

Ironically, even though precise measurement is possible today, the charging methods still resemble cable television. Usage is measured down to the millisecond, but fees are settled through monthly credit card subscriptions.

The Confusing Middle Ground

A simple way to categorize pricing models is to use a two-dimensional coordinate system, where the x-axis represents usage frequency and the y-axis represents usage volatility. Here, volatility refers to the sporadic nature—how irregular a single user's usage pattern is over a period. Watching Netflix for two hours most nights is low volatility; an AI agent making 800 API calls in ten seconds and then going quiet is high volatility.

In the lower left corner is one-time purchases. When tasks are rare and predictable, a simple "buyout" pricing model is effective because users only need to pay once to continue with other activities.

The upper left corner represents the chaotic browsing mode, where news browsing is irregular, links are clicked randomly, and the willingness to pay is low. Subscription services seem redundant, while pay-per-click micropayment methods struggle to be implemented due to decision-making and transaction friction. Advertising has become the primary profit model, aggregating millions of fragmented, unstable views. Global advertising revenue has surpassed $1 trillion, with digital advertising accounting for 70% of that, indicating that a large portion of internet users are in this low-investment consumption mode.

The lower right corner is where subscription models truly shine. Services like Slack, Netflix, and Spotify align with users' daily habits. Most SaaS products are located in this area, distinguishing heavy users from light users through different payment tiers. Most products offer a freemium model, encouraging users to start using them, and gradually shifting their usage from the upper left corner to the lower right corner through stable daily habits. Subscription services generate about $500 billion in revenue globally each year.

The upper right corner is the core of the modern internet, encompassing LLM queries, agent operations, serverless burst traffic, API calls, cross-chain transactions, batch jobs, and IoT device communication. Usage is both stable and volatile. Fixed charging models lower the psychological barrier to payment but fail to accurately reflect this reality. Light users pay too much, while heavy users enjoy subsidies, leading to a disconnect between revenue and actual usage.

As a result, products based on seat-based charging are gradually shifting towards metered charging models. Basic packages are retained for collaboration and support, but high-load applications are charged. For example, Dune offers a limited monthly quota. Small, simple queries are inexpensive, while larger queries that run longer require more fees.

Stablecoins can provide programmable, globally accepted, and finely-tuned payments down to the cent. They can settle transactions in seconds, operate around the clock, and can be held directly by users without going through a banking interface. If usage trends are event-driven, settlements should be as well, and cryptocurrencies are the first to effectively keep up with this settlement track.

Stablecoins can provide programmable, globally accepted, and finely-tuned payments down to the cent. They can settle transactions in seconds, operate around the clock, and can be held directly by users without going through a banking interface. If usage trends are event-driven, settlements should be as well, and cryptocurrencies are the first to effectively keep up with this settlement track.

The Nature of X402

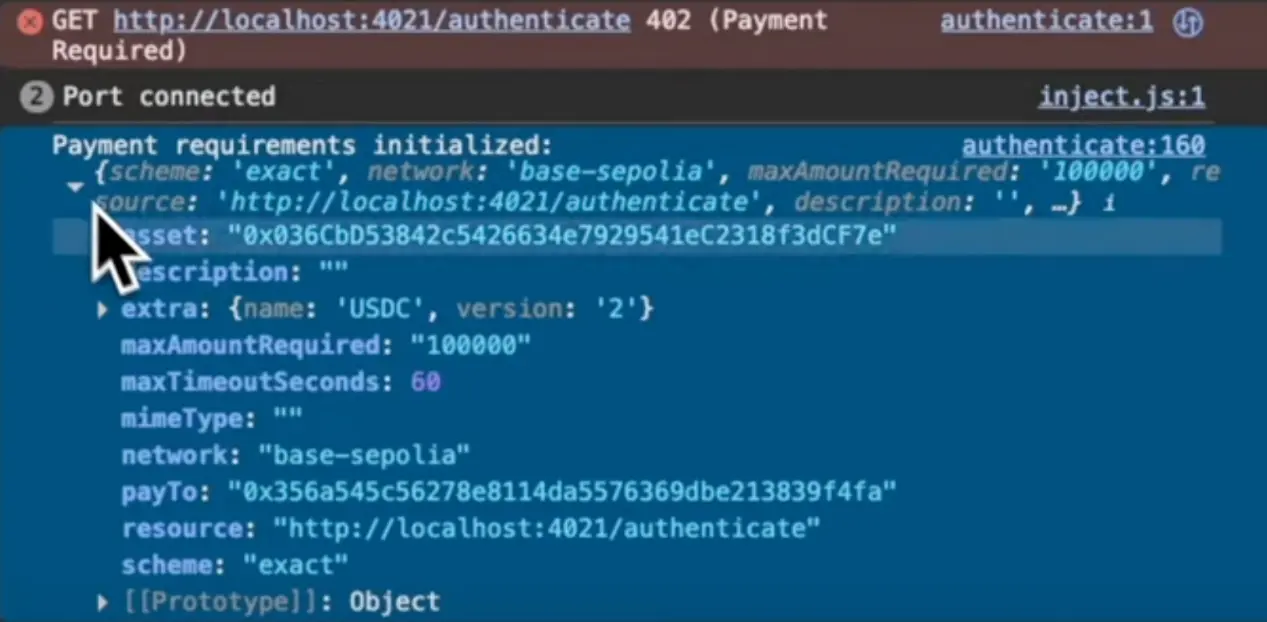

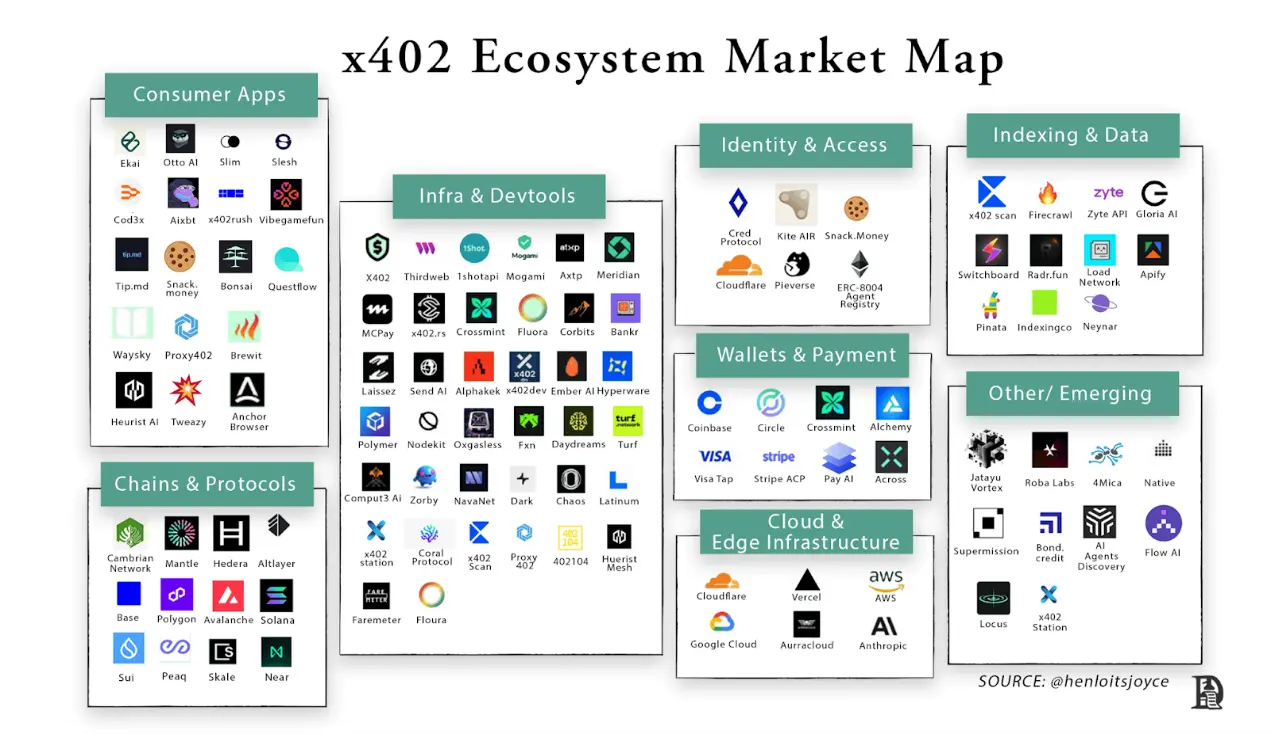

X402 is a payment standard that works in conjunction with HTTP, using the 402 status code reserved decades ago, originally intended for micropayments.

x402 is merely a way for sellers to verify whether a transaction is complete. Sellers wishing to accept on-chain, fee-free payments via x402 must connect to intermediary platforms like Coinbase and Thirdweb.

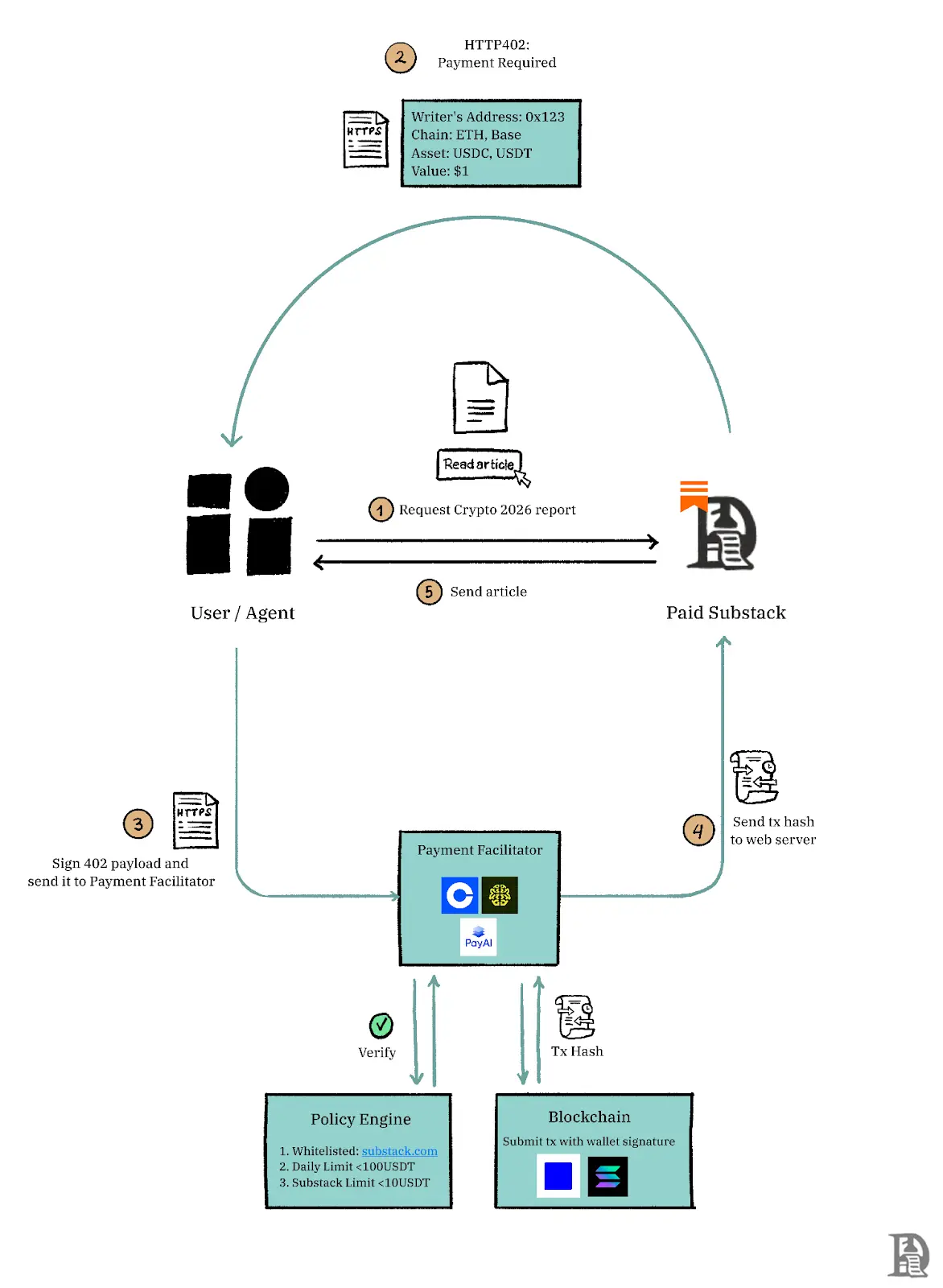

Imagine Substack charging $0.50 for a high-quality article. When you click the "pay to read" button, Substack returns a 402 code containing the price, accepted assets (like USDC), network (like Base or Solana), and policies. The content would look something like this:

Your MetaMask wallet authorizes $0.50 by signing the message and passes it to the settlement party. The settlement party puts the text on-chain and notifies Substack to unlock the article.

Stablecoins make accounting easy. They settle at network speed, with very small units, and there’s no need to open accounts with every vendor. With x402, you don’t need to pre-load five credit limits, rotate API keys across different environments, or discover at 4 AM that your quota has been exhausted, causing tasks to stop. Manual billing can continue to operate through the most efficient link, such as credit cards, while all the volatile machine-to-machine communication paths run automatically and at low cost in the background.

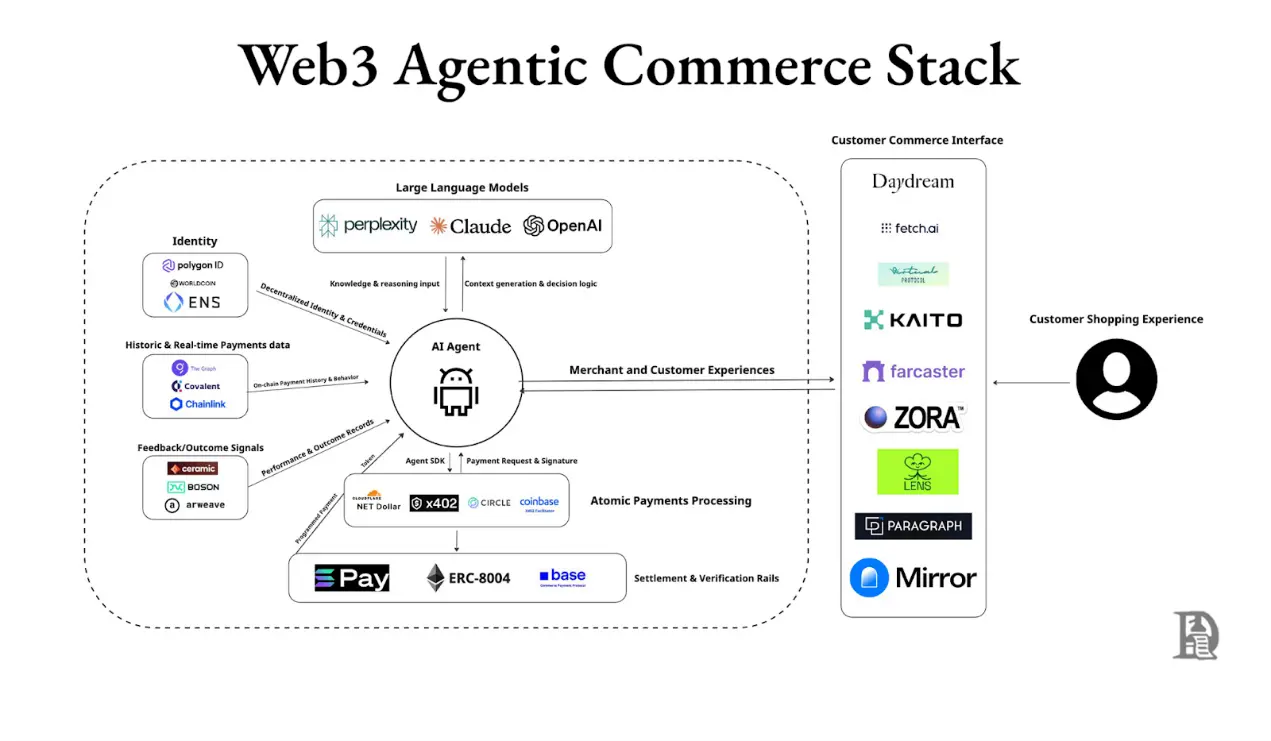

In agent-based checkout, you can feel the difference. Suppose you are using the AI chatbot Daydream; the traditional shopping process would redirect you to Amazon to pay using your saved card information. In the x402 world, the agent understands the context, retrieves the merchant's address, and pays from your MetaMask wallet without leaving the conversation thread.

The interesting thing about x402 is that it is not a single entity but consists of various layers similar to those in real payment systems (Rail). Anyone building AI agents with the Cloudflare Agent Kit can create bots that charge per operation.

Integrating x402

Once the network supports native payments, where will it first emerge? The answer lies in high-frequency usage areas, specifically where transaction amounts are below $1. As long as blockchain fees remain reasonable, x402 can settle each request at machine speed, with a minimum granularity of $0.01.

Two factors make this transition urgent. On the supply side, every meaningful operation on the modern web comes with a tiny, machine-readable unit. On the demand side, SaaS pricing leads to significant waste. About 40% of licenses are idle.

Event-based native billing with caps is a way to coordinate different domains without causing buyer panic. Soft caps can be set to achieve optimal pricing. News websites or developer APIs can charge based on the number of requests throughout the day and automatically refund before reaching the daily cap amount.

If The Economist publishes "0.02 dollars per article, capped at 2 dollars per day," curious readers can browse 180 links without mental calculations.

At midnight, the protocol reduces all fees to 2 dollars. The same model applies to developer platforms. News organizations can charge for each LLM crawl to sustain future AI browser revenues.

What is currently lacking is a programmable process that allows customer service personnel to automatically make a second choice based on user requests without popping up user interface prompts or manual upgrades.

For most B2B tools, the actual end state looks like "subscription base package + x402 burst usage." Teams will retain a base package for collaboration, support, and backend use. Occasional high computational costs (like vector searches or image generation) will be charged through x402 without needing to upgrade to a higher tier.

Higher-quality networks can also be accessed. Double Zero aims to sell faster, more stable internet services through dedicated fiber optics. Routing agent traffic to these dedicated fibers allows for billing by GB using the x402 protocol, with clear SLAs and traffic caps. For agents needing low latency for transactions, rendering, or model jumps, they can temporarily enter a fast lane, paying for specific traffic peaks before exiting.

SaaS will accelerate the shift to usage-based pricing models but will set some limitations:

- Customer acquisition and activation costs will decrease. Profitability can be achieved from the first call. Even "passing" developers who have never filled out OAuth or credit card forms can pay $0.03. Agents prefer vendors that can accept instant payments.

- Revenue will be tied to actual usage rather than user seat inflation. This can address the 30-50% seat waste issue in most organizations.

- Pricing becomes an intuitive reflection of the product. Features like "fast lane, pay an extra $0.002 per request" or "bulk mode at half price" allow startups to experiment with adjustments to increase revenue.

- Lock-in effects weaken. Since there’s no need to invest effort and time in integration to try out vendors, switching costs decrease.

A World Without Ads

Micropayments won’t eliminate ads; they still perform well in casual browsing areas. x402 prices pages that ads cannot reach, and occasionally someone might choose to pay for a high-quality article instead of subscribing to a monthly service.

x402 reduces payment friction; once it reaches a certain scale, it may change the future.

Substack has 50 million users, with a 10% paid conversion rate, meaning there are 5 million paying subscribers who pay about $7 on average per month. When the number of paying subscribers doubles to 10 million, Substack is likely to gain more revenue from micropayments. With the lowered payment threshold, more casual readers may turn to paying for each article, accelerating revenue growth.

The same logic applies to any seller with high volatility and low frequency: when people use products occasionally rather than habitually, pay-per-use feels more natural than long-term subscriptions.

Through x402, personalization can also be reflected at the digital level. Users can set their payment preferences through policies, while businesses can adopt flexible pricing models to accommodate everyone’s habits and choices.

The real advantage of x402 lies in agent workflows. If the past decade was about transforming humans into logged-in users, the next decade will be about transforming agents into paying customers.

We are already halfway there. AI routers like Huggingface allow users to choose among multiple LLMs. OpenAI's Atlas is an AI browser that uses LLMs to run tasks for you. x402 perfectly fills this gap, becoming the missing payment channel. It enables software to settle micropayments with other software at the moment work is completed.

But having only a payment channel does not create a market. Web2 has built a whole supporting system around credit card networks. KYC on the bank side, PCI (Payment Card Industry Data Security Standard) on the merchant side, PayPal's dispute resolution mechanisms, card blocking measures against fraud, and refund mechanisms when issues arise. Agent-based commerce currently lacks all of these. Stablecoins combined with HTTP 402 provide agents with payment means but simultaneously strip away the built-in recourse paths that people have come to expect.

Related reading: x402 Protocol: Deconstructing the On-Chain Payment Revolution of the AI Agent Economy

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。