Using US Stock Contracts to Hedge BTC and Bet on Earnings Season, Including Three Advanced Strategies.

Written by: US Stock OK Brother

In 2025, cryptocurrencies are gradually being accepted in compliance, and RWA is steadily advancing. In the third quarter of 2025, Bitget launched US stock contract products, including over 30 popular stocks with a maximum leverage of 25 times.

Bitget positions itself in UEX, offering trading opportunities for everything from trillion-dollar market cap companies like Apple and Nvidia to meme coins worth a few million dollars. It aims to become the most retail-friendly exchange in the future.

1. Why Trade US Stock Contracts

- Broader Market Opportunities:

Don't put all your eggs in one basket. Since October 11, BTC prices have fallen by over 20%, while the S&P 500 has risen by 1.5%. As BTC prices drop, altcoins suffer even more, leading to a poor wealth effect. However, as the only exchange in the market supporting US stock contracts, Bitget expands the entry point for US stock trading, giving users more options to seize opportunities in major asset classes during the crypto market pullback.

- Two-Way Profit Opportunities:

The US stock market has been steadily rising over the past 30 years, making it more friendly for retail investors. The overall volatility of the US stock market is lower than that of the crypto market, but Bitget's US stock trading offers up to 25 times leverage, similar to crypto contract trading, allowing users to easily go long or short on US stock targets and seize two-way profit opportunities.

- More Strategy Choices:

Cryptocurrency assets and stock contracts are not mutually exclusive. Users can choose from more asset types with Bitget's joint margin for contracts, allowing simultaneous trading of crypto assets and US stock contracts. If AI + crypto assets become the mainstream of investment in the future, Bitget contracts support going long on both BTC and NVDA at the same time. One platform, Bitget, is enough for investment.

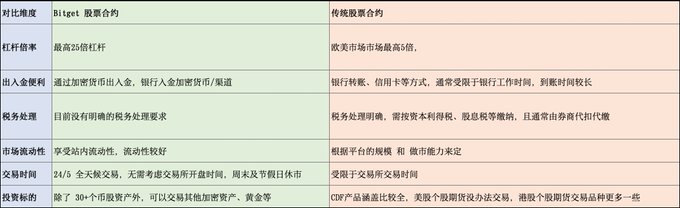

2. Advantages of Bitget US Stock Contracts

- Trading Fee Advantages

Bitget stock contracts charge 0.0065% of the trading volume, which means for a trading volume of 100,000, only $6.5 is charged as a platform fee! Three important advantages:

• Trading fees are significantly lower than CFD platform charges;

• Bitget's stock contracts have a different charging logic than traditional CFD platforms: CFD platforms charge fees based on the number of shares, meaning that stocks with lower face prices are more cost-effective to trade on Bitget;

• Bitget has no minimum fee standard, making it more friendly for retail investors.

- Spread and Liquidity Advantages

For top star assets on Bitget, user trading friction is similar to that of CFD platforms, especially with a trading volume of $10,000, where Bitget can provide users with the lowest trading friction and the best trading experience.

- Product Advantages

3. Strategies Related to US Stock Contracts

- Hedging Strategy: Under joint margin, users can trade the correlation between BTC and traditional stock assets, hedging risks while increasing potential returns;

Example Strategy: Trader A realizes on October 10 that the crypto market may face pullback pressure but wants to hedge risks through tech stocks. The strategy could be: short BTC 10 times and long APPL 10 times (the correlation between crypto assets and tech stocks is positive).

Assuming Trader A opens a position on October 13 with a capital of $1,000, the current profit is:

• BTC short at 115,000, currently at 92,000, floating profit of $2,000;

• APPL long at 247, currently at 270, floating profit of $931;

Trader A uses Bitget US stock contracts, leveraging $1,000 to achieve a floating profit of $2,931, with a return rate close to 300%!

- Earnings Report Betting Strategy: Bitget US stock contracts offer up to 25 times leverage and provide 5*24 hours of trading. If users have knowledge about US companies, they can use Bitget US stock contracts to bet on earnings reports; before the earnings report is released, they can choose to "bet on an increase" or "bet on a decrease" based on market conditions and set corresponding take-profit and stop-loss orders to maximize profit potential while keeping risks under control;

Example Strategy: Trader B understands Nvidia's financial situation and expects that on October 19 at 5 PM New York time, Nvidia's earnings report will exceed expectations. The trading strategy could be: open a position at 4 PM on October 19, going long on Nvidia stock with 25 times leverage, with a capital of $1,000, and set a 2% stop-loss and a 6% take-profit point. The strategy's result is:

• Trading Strategy: At 4 PM on October 19, NVDA at $185, going long with 25 times leverage, setting a stop-loss at $181.5 and a take-profit at $196.1.

• Strategy Result: After the earnings report is released, 5 hours after opening the position, take-profit and exit, cashing out $1,500.

Trader B uses his understanding of Nvidia's earnings report to leverage $1,000 and makes $1,500 in just 5 hours!

- Individual Stock Strategy: By understanding crypto-listed companies, more joint strategies can be developed.

Example Strategy: Trader C believes that MSTR's mNAV will recover to above 1 and reach a level of 1.05. Currently, MSTR's mNAV is 0.99; the strategy he could take is to short BTC 25 times and long MSTR 25 times.

If the crypto market stabilizes and BTC starts to rebound, Trader C's strategy is likely to start working, and he could achieve a return of 150%!

4. Bitget's High-Profile US Stock Contract Promotional Activities

Bitget US stock contracts currently have many promotional activities, and both new and old users have the opportunity to participate:

- Stock Contract First Trade Liquidation Compensation Activity:

Activity Details: After completing registration, users can enjoy liquidation compensation services for their first stock contract trade within 7 days of opening a position; new users participating in stock contract trading for the first time can enjoy liquidation compensation for their first trade, with ordinary users receiving up to $50 USDT in contract experience; VIP users can receive up to $200 USDT in contract experience.

- Weekly Stock Contract Sprint Competition:

NVDAon, TSLAon, weekly rewards galore.

Stock Contract Sprint Competition (Phase 7) total prize pool of 280,000 USDT in equivalent popular US stock tokens

Points Prize Pool: Daily trading check-ins to share 40,000 USDT in equivalent popular US stock tokens

Leaderboard Prize Pool: Trading volume rankings share 40,000 USDT in equivalent popular US stock tokens

Blind Box Prize Pool: New users of US stock contracts making their first trade of $100 can receive 5 blind boxes, with prizes every time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。