Saylor Signal Another Bitcoin Purchase Fuels Strategy’s BTC Expansion

Michael Saylor, the co-founder of Strategy (formerly MicroStrategy), has once again hinted at a new Bitcoin purchase. On Sunday, he shared the company’s Bitcoin portfolio tracker on social media platform X, marking the tenth week in a row he's done so. These tracker posts often come just before a new buy. Many now see them as clear signals that a purchase is about to happen.

Source: Michael Saylor X Handle

Aiming for 600,000 BTC

According to the latest data, Strategy currently holds 582,000 BTC on its balance sheet. At current prices, that’s worth over $61 billion. The company is slowly inching toward the 600,000 BTC milestone, a massive amount even compared to leading Bitcoin ETFs like BlackRock’s IBIT.

What makes the approach by Saylor unique is that they follows a dollar-cost averaging (DCA) method. Instead of buying a huge amount in one go, the company has been purchasing this currency in smaller chunks over time. This helps reduce the risk of market swings. During the early years of strategy’s operations, it purchased approximately 226,000 BTC. Although in the past few years, the organisation has taken pace.

Breaking Their Own Record

In the last week, Saylor purchased 1,045 BTC for about $110 million. With this momentum, the organisation is now on track to break its previous record of 12 straight weeks of buying. That record was set between November 2024 and February 2025.

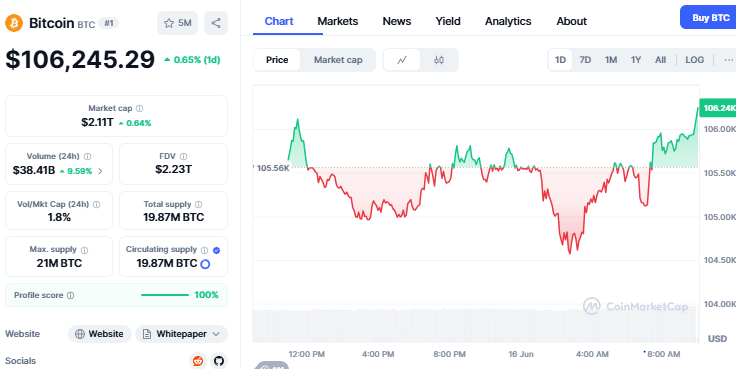

This steady accumulation has become a key part of Strategy’s business model. The firm is using new financial tools, like its preferred stock STRD listed on Nasdaq, to raise funds and continue buying. Earlier, it also launched STRF and STRK, raising over $3 billion for BTC purchases. The coin is currently trading at $106,245.29 with an increase of 0.66% within the last 24 hours, and the trading volume has also increased by 9.59% as per the CoinMarketCap.

Source: CoinMarketCap

Investor Concerns and Criticism

Even with the strong belief in Bitcoin of the company, some investors are concerned. A few insiders, including member of the top management Carl Rickertsen, have sold all their MSTR shares . Experts like Peter Schiff have also warned that investing so much into BTC might not be a smart move. He believes a reduction in the price of Bitcoin could hit the organisation hard and hurt the shareholders.

Still, Strategy’s stock has done surprisingly well. Over the past year, MSTR has outperformed big tech stocks like Apple, Tesla, and Amazon. That depicts some investors still believe in the long-term plan of the company.

Bitcoin Holds Steady Amid Global Tensions

Interestingly, all this is happening during growing tension in the Middle East. Israel recently carried out airstrikes in Tehran, Iran . But even with this conflict, BTC only dropped around 3% and quickly returned to about $105,000. This depicts how strong this digital asset is, even during global crises.

The Crypto Fear and Greed Index is at 60, depicts investors are being bullish when it comes to cryptocurrency. Saylor has also tweeted a post saying "bitcoin is hope", amid this global tension.

Final Thoughts

The tracker posts by Michael Saylor are not just to be considered as updates, they’re signals. As the Strategy already controls more than half a million BTC and does not stop its steps, everyone is eager to see what can possibly be their next move. The confident Bitcoin bet by Strategy is becoming the topic of the discussion in crypto and even in conventional finance as the global uncertainty has raised.

Also read: Ethereum Whale Wallet Moves After 10 Years, Market Eyes $2950免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。