This article will take you through a series of topics, starting with an understanding of the existing financial system. This lays the groundwork for understanding how to integrate "agents" into the system for autonomous commerce (i.e., agents paying for you). Finally, we will provide a comprehensive overview of companies building autonomous capital infrastructure for autonomous commerce.

Author: cookies

Compiled by: Shenchao TechFlow

Hey, welcome back! This is the second part of the series. If you're wondering where the first part is, you can click here. I strongly recommend reading the first part first to understand the necessity of blockchain in autonomous capital before diving deeper into the companies dedicated to autonomous capital infrastructure.

The Age of Agentic Capital | Part One So… have you watched the first part? If not, go check it out—just kidding. If you haven't seen the first part, there's one thing you must know before reading this article:

Autonomous Capital: Refers to AI systems that have the ability to independently hold, manage, and deploy financial resources, capable of achieving specific goals without human intervention. In this context, "agents" refer to autonomous economic entities with their own economic behavior capabilities.

Introduction

This article will take you through a series of topics, starting with an understanding of the existing financial system. This lays the groundwork for understanding how to integrate "agents" into the system for autonomous commerce (i.e., agents paying for you). Finally, we will provide a comprehensive overview of companies building autonomous capital infrastructure for autonomous commerce.

Traditional Financial System

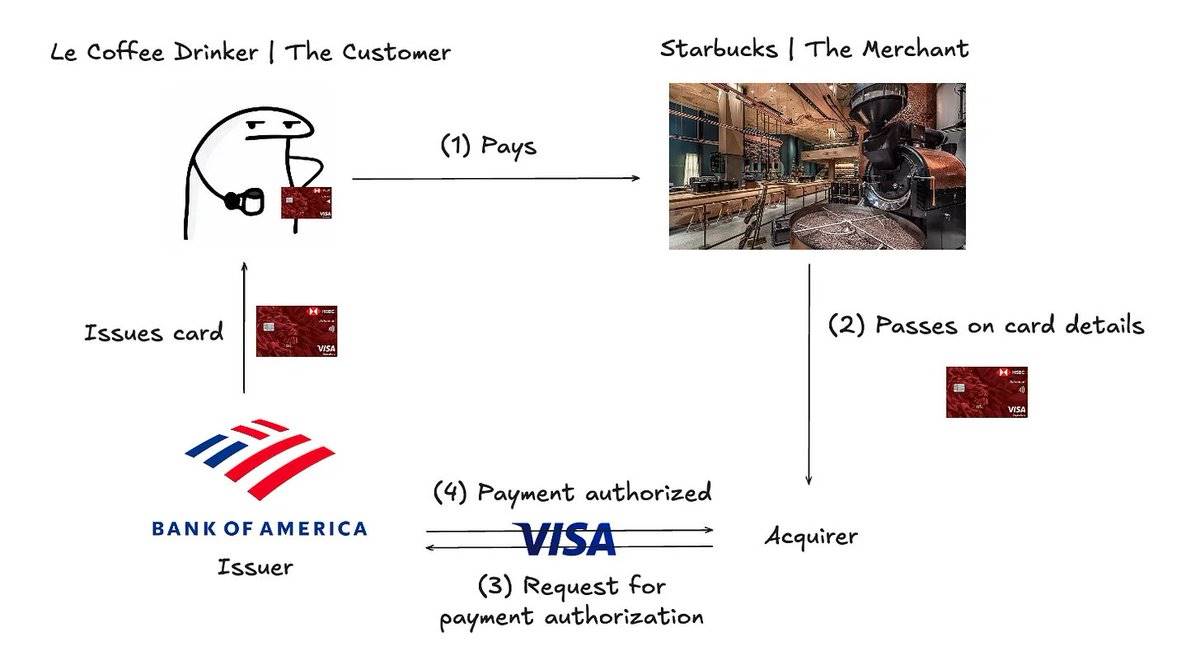

Commonly referred to as the "four-party model," this is a typical way of processing payments:

The Four-Party Model of Payment Processing

The user makes a payment using a credit card.

The card information is passed to the acquirer.

The acquirer forwards the card information to the payment network.

The payment network requests authorization from the issuer— the issuer verifies the card information and checks if funds are sufficient.

To learn more about how payment settlements are implemented, you can refer to this article.

Further Analysis:

Issuer: The issuer is the financial institution that issues credit cards to customers. Issuers can be banks, credit unions, or other financial institutions that choose to provide credit limits to customers. When a customer disputes a transaction on their credit card, the issuer is responsible for deciding whether to support a chargeback. Some of the largest issuers include Chase and Bank of America.

Acquirer: The acquirer is the bank or financial institution that collects payments on behalf of merchants from the issuer. The acquirer ensures that customer payments are processed smoothly by passing information to the payment network. When a chargeback occurs, the acquirer is responsible for returning the customer's funds (ultimately deducted from the merchant).

Payment Network: The payment network processes card transactions by connecting customers, merchants, acquirers, and issuers. Common payment networks include Visa and Mastercard.

To gain a deeper understanding of the roles of various parties involved in the payment process, you can refer to this article.

The Rise of Autonomous Commerce

Now, we pass the baton to "agents"—they will become the new shopping enthusiasts.

Agentic Commerce: A payment process dominated by agents that simplifies the shopping experience, including search and recommendation features.

Agentic commerce is not the only form of autonomous capital, but in this article, we will use it as an example to illustrate why agents need the ability to autonomously access funds.

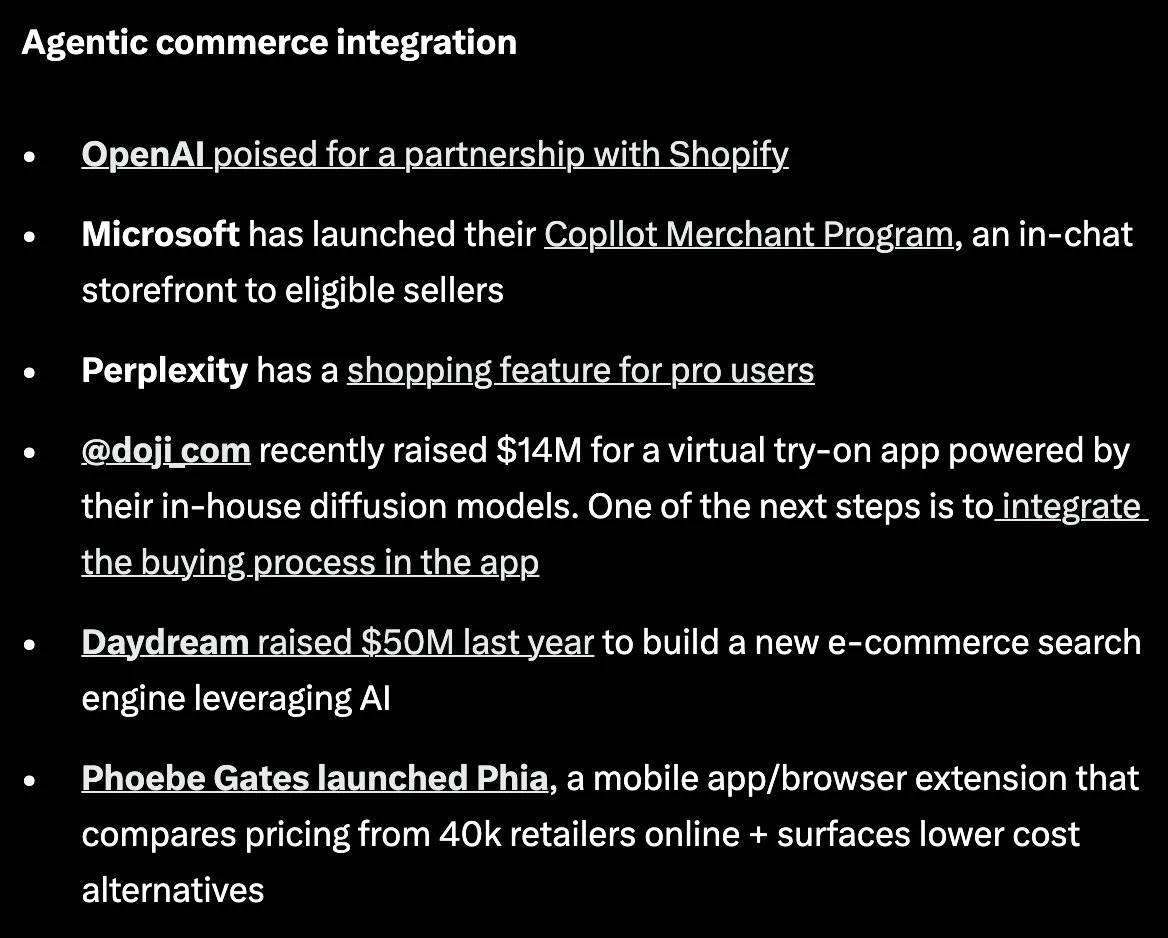

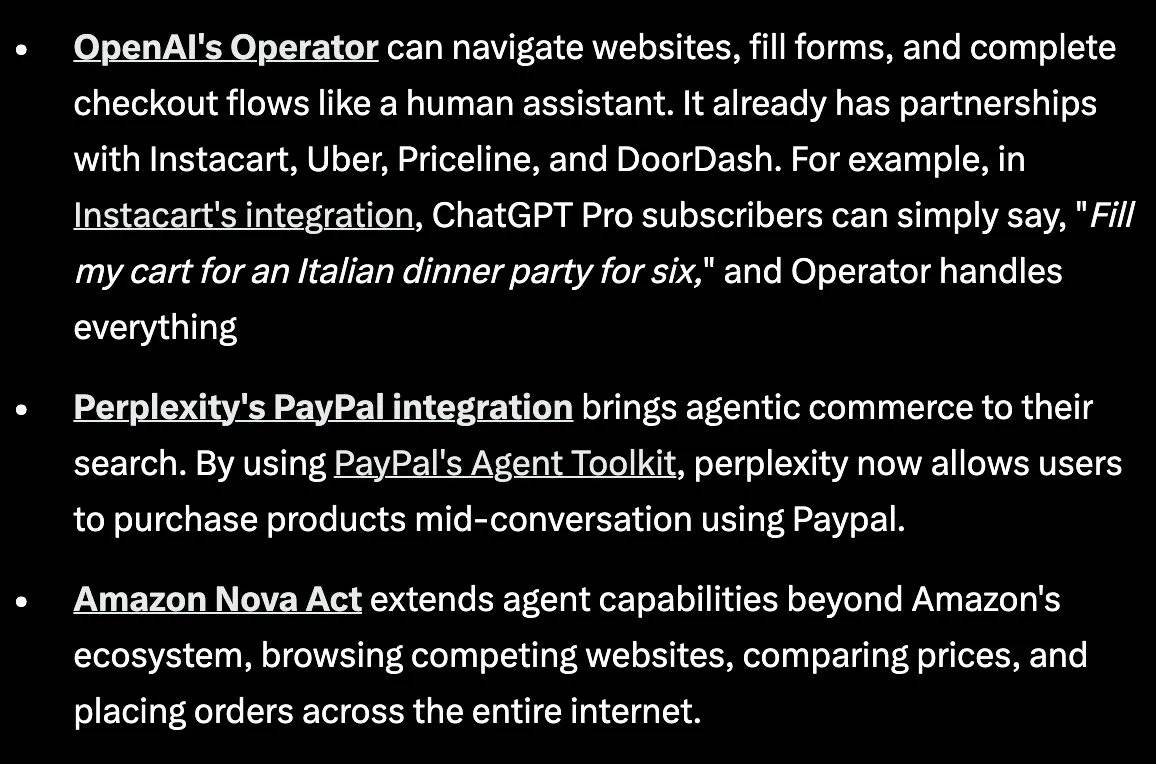

The popularity of agentic commerce is evident:

Source The purpose of this article is not to delve into why these tech giants are trying to establish a foothold in the field of agentic commerce. From a macro perspective, here are some advantages that companies can gain by becoming the consumer interface layer of agentic commerce:

Economic Benefits: Every time a user completes a payment on the platform, the platform earns a fee.

Data Flywheel Effect: The platform can gain valuable insights from the purchasing patterns of agents and recommend complementary products to users by analyzing this data—imagine YouTube's algorithm always suggesting videos you want to watch.

Network Effects: When a platform becomes a source for product discovery, it attracts more merchants to list their products on the platform.

You can read this excellent article by my team member Evan, which details how business models and advertising models will evolve as the commercial paradigm shifts. I personally believe that the topic of agents monetizing through advertising is an undervalued area, and this article articulates the nuances of this digital new era well.

Traditional Companies' Autonomous Capital Infrastructure

You have seen large tech companies trying to gain an advantage in the field of agentic commerce. So, how are they achieving this?

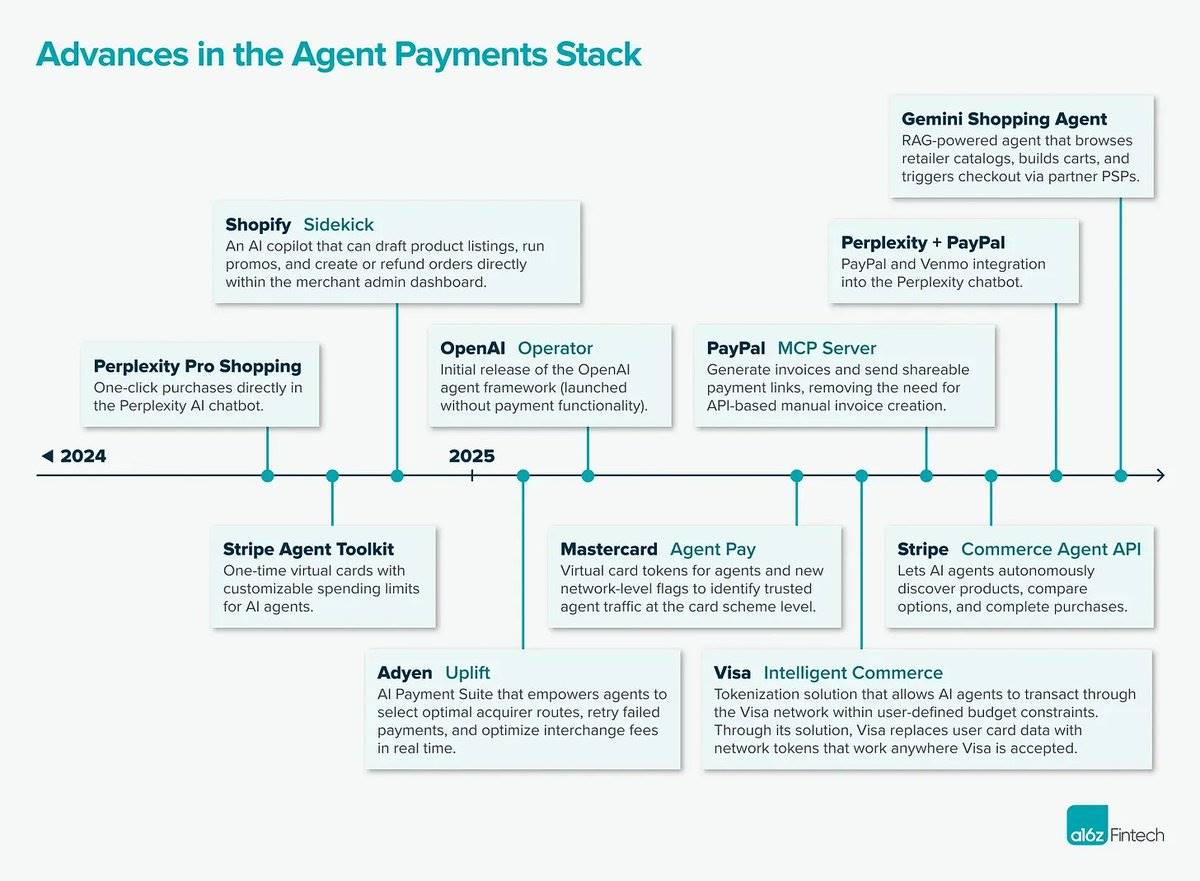

This section will detail the autonomous capital infrastructure built by several traditional financial institutions, including Visa, Stripe, PayPal, Coinbase, and Mastercard (Senchao TechFlow note: more colloquially, this stage is AI payment infrastructure).

Visa | @Visa

On April 30, 2025, Visa announced the launch of the "Visa Intelligent Commerce" framework, aimed at enabling AI to autonomously shop and pay. The framework is designed to view agents as the ultimate consumers.

Architecture and Feature Highlights:

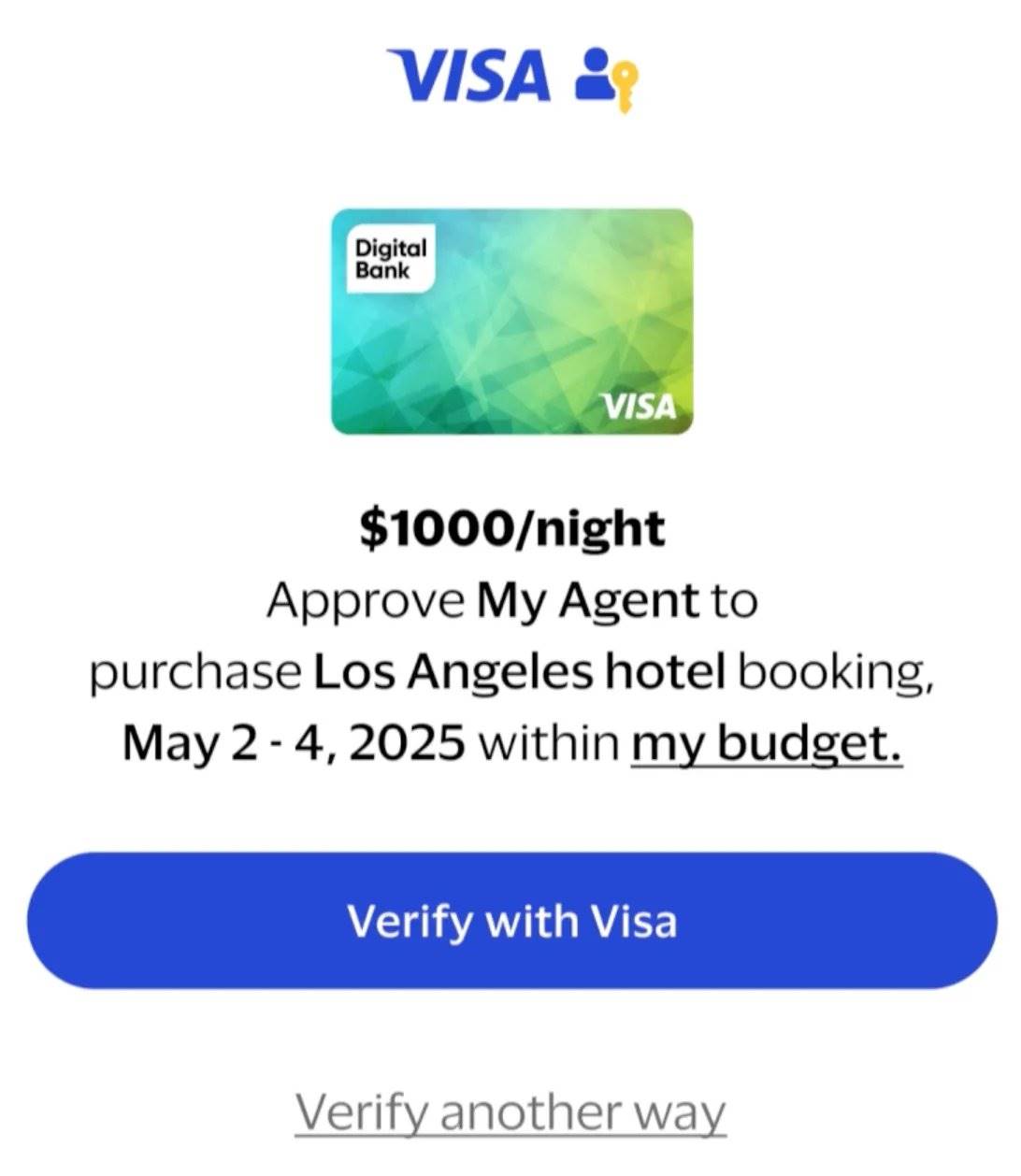

Payment Passkeys: Used for authentication when agents check out. This authentication enhances merchants' confidence in accepting payments, promoting the adoption of agentic commerce.

Access Controls: Payment passkeys allow users (agent owners) to specify parameters, including spending limits, approved merchant categories, etc. These features are implemented through APIs and SDKs designed by Visa.

Dispute Resolution: Specifically designed to handle issues that may arise during the agent payment process.

Workflow:

The user inputs a request for a product in the Visa Agentic Wallet.

The agent begins searching for the product.

Upon receiving search results, the user authorizes the agent to complete the payment using the payment passkey.

User Authorization

You can view the demo video.

Advantages:

Trust: By authorizing transactions, users can be assured that agents will not go rogue and make inappropriate purchases.

Network Effects: 99.9% of merchants already accept Visa, meaning users can purchase almost any product.

Personalization: By studying users' transaction patterns, agents can understand user preferences and make better decisions over time, such as choosing hotels that fit the budget.

Strong Partner Ecosystem: Includes leading language model users such as OpenAI, Perplexity, Microsoft, Anthropic, and Mistral AI.

For more information about Visa's autonomous payment architecture, please check out this article.

Stripe | @stripe

As early as November 2024, Stripe launched the Stripe Agent Toolkit, allowing businesses to integrate payment functionality into their autonomous workflows.

Architecture and Feature Highlights:

One-Time Virtual Cards: Designed for agent consumption, implemented through simple language model function calls.

Access Controls: Parameters for agent consumption can be defined through the order intent API, such as budget and merchant selection.

Native Billing Support: Stripe monitors payments and charges businesses based on usage.

Workflow: Here is an example of an agent helping a user book a flight:

The agent builder performs Know Your Business (KYB) through Stripe to obtain an API key, granting the agent autonomous fund management capabilities.

The user prompts the agent, "Help me find a flight to Rome for under $1000."

The agent searches and finds a flight for $800.

Using Stripe Issuing, a one-time virtual card limited to $800 is generated.

The agent generates a payment link, which is authorized by the user.

After the payment is completed, Stripe notifies the agent and updates the status, closing the card.

To see a visual representation of the workflow, please check this video. For more detailed information about the architecture, please refer to Stripe's developer documentation.

Advantages:

Convenient Access: Agents can complete payments through traditional financial payment methods, including credit cards, bank transfers, Apple Pay, etc.

Wide Integration: The toolkit has been integrated with widely used platforms, including OpenAI's Agent SDK, CrewAI, LangChain, and Vercel's AI SDK.

PayPal | @PayPal

On April 14, 2025, PayPal launched the PayPal Agent Toolkit, supporting the construction of autonomous workflows capable of handling financial operations.

Architecture and Feature Highlights:

End-to-End Support: Achieved through PayPal's account linking, encrypted wallets, and emerging payment key checkout processes.

Core Business Functions: Agents can access various functions such as payments, invoicing, dispute resolution, shipping tracking, product catalogs, subscriptions, reporting, and more.

Workflow:

The user searches for products through Perplexity.

After finding a product, the user can quickly check out via PayPal or Venmo (identity verification required).

For more information about the Agent-to-Agent (A2A) protocol from Google Cloud, please check this page.

Merchant Application Scenarios:

Order Management and Shipping Tracking: Agents can intelligently handle order statuses and shipping information.

Smart Invoice Processing: Agents can generate invoices based on predefined templates or dynamic parameters, send them to customers, track payment statuses, and remind overdue payments.

Simplified Subscription Management: AI agents can manage the entire subscription lifecycle, including creating new products, subscription plans, and processing recurring payments through PayPal-supported payment methods.

Disadvantages:

- Network Effects: Only about 72.5% of retail websites accept PayPal, which is slightly lower than the 99.9% acceptance rate of other payment networks.

Coinbase | @coinbase

On May 7, 2025, Coinbase announced the launch of the x402 protocol, a payment protocol that allows stablecoin payments directly via HTTP.

Architecture and Feature Highlights:

Utilizes the original HTTP status code "402 Payment Required" to embed stablecoin payments into web interactions.

x402 allows developers and AI agents to directly pay for APIs, services, and software fees using stablecoins via HTTP.

Workflow:

The agent requests the required resources (e.g., GET /api) from an x402-supported HTTP server.

The server replies with a "402 Payment Required" status code and provides payment details (e.g., price, acceptable tokens).

The client sends a signed payment data packet using supported tokens (e.g., USDC) through standard HTTP headers.

The client resends the request, including the encoded payment data packet in the X-PAYMENT header.

The payment service provider (e.g., Coinbase x402 Facilitator service) verifies and completes the on-chain payment while fulfilling the request.

The server returns the requested data to the client and confirms the transaction success in the X-PAYMENT-RESPONSE header.

Advantages:

Metered Services: Users can make small payments without having to pay a one-time high fee.

Mastercard | @Mastercard

Mastercard has launched Agent Pay, a program that seamlessly integrates payment functionality into conversational AI platforms.

Architecture and Features

Agentic Tokens:

A system for registering and verifying agents, equivalent to a KYC (Know Your Customer) system for authenticating agent identities.

Tokenization: Protects information security by replacing card numbers with "substitute numbers."

A one-time code (encrypted information) is generated to authenticate transactions when using the card.

Learn more about tokenization in this detailed explanation.

Payment Passkeys:

- Identity confirmation through devices (e.g., biometrics).

Access Controls:

- Consumers can define what purchases agents are allowed to make.

Advantages

Transparency: Agentic tokens make it possible to identify and track transactions executed by agents.

Partners: Collaborates with acquirers and checkout service providers (e.g., Braintree and checkout.com).

To learn more about Mastercard's partners, you can check this article.

Blockchain Autonomous Capital Infrastructure

The next section will delve into companies focused on building autonomous payments using stablecoins. Before that, let's understand the two key roles in autonomous payments:

Agent Builder: Developers who create agents that provide specific services, which in turn receive payments.

Agent User: Users who deposit a certain amount of funds for the agent to use, after which the agent will make payments.

Skyfire | @trySkyfire

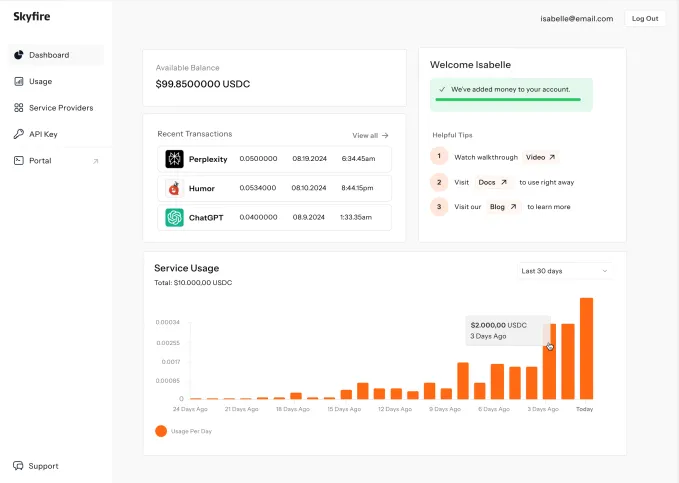

Skyfire aims to become a payment network similar to Visa, creating a global, instant, and secure payment network specifically for AI agents, enabling agents to autonomously make payments and receive funds. This will allow agents to access resources such as MCP servers, APIs, large language models (LLMs), and datasets.

Architecture Highlights:

Stablecoins: Supports programmable payments.

Unique Identifiers: Creates verified identities for agents to start receiving and initiating payments after account setup.

Trust Badges: Various vendors provide agents with "blue check certification" (similar to a blue check mark), allowing businesses on the Skyfire platform to trust and interact with agents (whether buying or selling).

Feature Highlights:

Agent-to-Agent Payments: Supports instant payments between agents.

Autonomous Payments: Agents can complete payments without human involvement and can also receive payments without a bank account.

Agent Funding: Agents can obtain funds through various means, including debit cards, credit cards, wire transfers, and stablecoins.

Access Control: Spending limits can be set for each agent.

Agent History: Provides verifiable records of agent activities, allowing agent builders to track the demand for their agent services.

Skyfire's agent tracking interface

Workflow Here is an example of an agent attempting to purchase data access:

The agent initiates a service request by calling the data provider's API.

The service verifies the agent's identity.

Once verified, the agent receives the requested data.

After the transaction is completed, payment will be released to the data provider.

Advantages

Market Expansion: Businesses can not only sell services to human users but also to agents (a market that has not been fully developed yet).

This model is particularly striking in the long-tail market.

Traditionally, selling long-tail services to businesses has been challenging due to the small number of customers, making it difficult to justify the cost of setting up a business for selling a small number of products, including business development (BD) and user acquisition costs.

With a universal marketplace, you can simply upload long-tail datasets and other content, allowing agents to discover these resources based on metadata, thus eliminating business development and advertising costs.

Industry Applications and Impact

Pricing Culture: Real-time contextual data intelligence from proprietary datasets is being purchased and utilized by agents.

Denso: Supports agents in finding the materials needed in the global automotive parts manufacturing industry.

Financing Dynamics

- Skyfire has secured $9.5 million in funding supported by Coinbase Ventures, a16z CSX, Circle, and others.

Payman | @PaymanAI

Payman is a platform where AI agents can pay for professional tasks completed by humans (understood as AI outsourcing tasks to freelancers).

Architecture

Human Marketplace:

- Payman is developing a vetted database of skilled workers to ensure high-quality task completion. This marketplace provides resources for AI agents to have tasks completed by humans.

Verification Agents:

- A set of specialized agents to verify whether the work completed by humans meets the task requirements.

KYC Verification:

- Individuals wishing to join the Payman worker database must pass KYC (Know Your Customer) verification to ensure that agents are paying for legitimate services.

Wallet System:

USD Wallets: Stored in Stripe.

USDC Wallets: Custodied by Bridge.

Payment Network:

- Payman uses Skyfire to facilitate payments from agents to humans.

Feature Highlights

Payment Methods: Agents can pay through various means, including fiat currency and cryptocurrency.

Programmable Policy Enforcement: Each transaction is governed by user-defined rules, such as the specific amount to be paid for a task.

Payment Tracking: Each transaction has a reference ID and real-time status for seamless tracking.

SOC2 Compliance: A framework for assessing and verifying customer data security practices, Payman uses data masking and encryption to protect sensitive information.

Workflow

Think from the perspective of someone wanting to establish an agent that will ultimately be responsible for sourcing resources for task completion.

For users wishing to set up an agent:

Wallet Setup: Users set up a wallet for the agent and add funds.

Task Creation: The agent creates tasks based on user prompts and publishes them to the task marketplace for human workers to discover.

Policy Setting: Set spending limits, approval rules, etc.

Task Approval: Users receive notifications on the dashboard and can approve or reject agent requests.

For human workers:

- Add a wallet on the platform (crypto wallet or bank account).

- View the Payman platform demo.

Application Scenarios

Product Management: Collect user feedback to improve product development.

Human Resources: Pay candidates for task completion.

Software Engineering: Pay experts for code reviews.

Financing Situation

- Pre-seed funding of $3 million, supported by Visa, Coinbase Ventures, and others.

My Thoughts

How detailed is the verification of agents? For tasks with clear outcomes, it is relatively easy to verify whether the work was completed excellently. However, what kind of agents will be used to verify tasks with less clear outcomes?

Currently, Payman requires users to manually create tasks. In the future, could it be possible for agents to have autonomy based on general prompts to determine which services need to be procured? This could potentially be achieved through small language models (SLMs) focused on specific domains, such as the automotive or food service industries.

Overall, this idea is very interesting. It injects some human qualities into algorithmically programmed agents. In the age of AI, this approach helps retain human aesthetics and diverse perceptual abilities. For example, a designer's evaluation of an agent's completion of a task could add more value and depth to the outcome.

Catena Labs | @catena_labs

Catena Labs is building the first AI-native financial institution, a regulated entity designed to facilitate collaboration between agents and humans. The design vision of Catena Labs is for agents to become powerful economic participants, building infrastructure that includes agent identification and AI-specific risk management frameworks.

Architecture - Agent Commerce Kit (ACK)

ACK aims to enable interoperable financial interactions involving agents, consisting of two complementary protocols:

ACK-ID: Verifiable Agent Identity

Verifiable Agent Ownership: Agents are cryptographically linked to their organizational owners (humans).

Secure Authentication: Agents use this to prove their identity to counterparties and systems they interact with.

Privacy-Preserving Verification: Only necessary identity information is disclosed.

Built on decentralized identifiers (DIDs) and verifiable credentials (VCs).

Learn more about ACK-ID.

ACK-PAY: Agent-Native Payments

To learn more about ACK-PAY, please check this page.

Provides infrastructure for agents to initiate payments and conduct financial transactions.

Standardized Payment Processes: Communicates payment requirements from service providers to agents.

Flexible Settlement: Agents can settle transactions through various payment channels, including traditional finance and cryptocurrency.

Verifiable Receipts: Provides cryptographic proof of payment through secure credentials.

Human Oversight: Certain areas of the workflow still require human approval.

Workflow Here is an example of an agent attempting to purchase proprietary financial data:

Request: The agent sends a request to Organization M (M stands for Money) to purchase financial data.

Authentication: Organization M uses ACK-ID to verify the agent's identity (ensuring it is not malicious) and its access rights (whether it is authorized to access that data).

Payment:

Organization M sends a standardized ACK-Pay payment request payload to the agent.

The agent selects a payment method based on its preferences (fiat/cryptocurrency).

This process may require human approval.

Receipt:

After payment confirmation, a verifiable ACK receipt (as a verifiable credential) is generated.

The receipt is delivered to the agent, allowing it to access the required data.

For a more detailed workflow.

Financing Dynamics

- Catena Labs has secured $18 million in funding supported by a16z Crypto, Circle Ventures, Coinbase Ventures, and others.

My Thoughts Catena Labs seems to be building a comprehensive infrastructure solution for "agent capital." Its development plan includes enhancing agent identity mechanisms, protocol interoperability, compliance and risk monitoring tools, and establishing an agent reputation system.

Nevermined | @Nevermined_io

Nevermined is building a payment platform specifically designed for AI agents, aimed at enabling agents to initiate and receive payments.

Workflow

Agent Setup Phase

Agent Registration: AI developers register their agents and payment plans through the Nevermined app.

Payment Plan: A program that records the fees developers wish to charge for their agents—Nevermined charges a 1% fee when the plan is sold.

Plan Creation: Nevermined associates a decentralized identifier (DID) with the developer's wallet.

Discovery Setup: Nevermined creates a widget containing plan information for display on its marketplace.

User Access Workflow

Purchase: Users order payment plans through the Nevermined marketplace.

- If users choose to pay agents with stablecoins, the funds will be locked in a smart contract until the user receives their credits.

Distribution: Users receive credits corresponding to their purchased plans.

Consumption: Users make requests to AI agents through the Nevermined app.

Access Control: There are two types of credits that determine how agents can be used:

Time-Based: Users gain access for a fixed period (e.g., 1 day or 1 month).

Request-Based: Users redeem credits per request, divided into:

Fixed: A fixed number of credits is consumed for each request.

Dynamic: The number of credits consumed varies dynamically based on the complexity of the request.

To learn more about payment types, check out the detailed article related to Nevermined payments.

Advantages

Discovery Engine: Nevermined becomes a platform for agent discovery by storing the metadata provided during agent registration.

Fewsats | @fewsats

Fewsats enables agents to pay service fees without relying on external payment services.

Architecture and Features

L402: When a server responds with HTTP 402 "Payment Required" status, it includes machine-readable payment terms for agents to complete the payment.

Authentication: Agents are authenticated through a cryptographic proof protocol.

Access Control: Defines transaction limits and approval workflows.

Check out the demo.

Currently, there is limited information about Fewsats, but reports suggest it may integrate with the Bitcoin Lightning Network to support agents in achieving low-cost, near-instant payments.

Conclusion

In this article, I introduced the following companies active in the AI payment infrastructure space: Visa, Stripe, PayPal, Coinbase, Mastercard, Skyfire, Payman, Catena Labs, Nevermined, and Fewsats (with future updates on Nekuda, Protegee, and Brahma Finance). Undoubtedly, this is a rapidly evolving emerging field, as evidenced by the innovations of traditional payment companies and their investments in payment networks.

In the coming years, key infrastructure questions need to be addressed, including:

Agent Authentication: How will large-scale KYA (Know Your Agent) be achieved?

Access Control: What will be the level of granularity? How much autonomy can be delegated to agents? Will this autonomy increase with "good behavior"?

Nevertheless, there are still some uncertainties:

- Source of Funds: Currently, most infrastructures are focused on verifying agents' identities to ensure they are not malicious and have funding. Once agents begin engaging in larger transactions, will this raise concerns about money laundering?

By reviewing the architectures and products of various companies, I believe that the companies that will dominate this field will be those that can develop applications allowing retail and enterprise customers to seamlessly access the services they need through agents. Will this become a business development game to see which platform can attract the most partners/providers? Perhaps.

In my view, the data generated from these agent transactions will be extremely valuable and capable of creating a data flywheel. For instance, in the case of purchasing agents, their transactions and interactions with other agents can be learned to optimize their purchases. For agents providing specific services, they can observe the purchasing behaviors of other agents and potentially create new services to capture a larger market.

This is the second part of the Agent Capital series. In the third part, we will continue to explore its practical application scenarios.

Disclaimer This article is based on company documents and articles. If there are any inaccuracies or aspects you disagree with, please comment, and I would be happy to discuss further.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。