撰文:深潮 TechFlow

8月4日,去中心化质押平台Lido联合创始人Vasiliy Shapovalov发文宣布将裁员15%,

在当前几乎所有人都认为即将迎来机构推动的ETH牛市,以及SEC已经有迹象表明会通过ETH现货ETF质押申请的情况下,这条消息显然违背了大家的预期。

作为ETH质押赛道的龙头项目之一,Lido在大多数人心中可能会是SEC批准ETH质押ETF消息的最大受益者,但事实真的如此么?

Lido此次的裁员不仅仅是一次简单的组织调整,更像是整个去中心化质押赛道面临转折的一个缩影。

官方给出的解释是“为了长期可持续性和成本控制”,但背后折射出的,是一个更深层的行业变化:

当ETH不断从散户流向机构手中,去中心化质押平台的生存空间正在不断被压缩。

让我们把时间拉回2020年,彼时Lido刚刚上线,ETH2.0质押也才刚刚开始,32个ETH的质押门槛让大多数散户望而却步,但Lido通过流动性质押代币(stETH)的创新,让任何人都可以参与质押并保持资金流动性。这个简单而优雅的解决方案,让Lido在短短几年内成长为TVL超过320亿美元的质押赛道巨头。

然而,近两年加密市场的变化打破了Lido的增长神话。随着贝莱德等传统金融巨头开始布局ETH质押,机构投资者们正在用他们所熟悉的一套方式重塑这个市场。这一轮由机构推动的ETH牛市中的几位主角都给出了各自的方案:BMNR选择Anchorage,SBET选择Coinbase Custody,贝莱德等ETF则全部采用离线质押。

无一例外,相比于去中心化质押平台,他们更倾向中心化的质押方案。这种选择的背后,即有合规考虑,也有风险偏好,但最终结果都指向一个:去中心化质押平台的增长引擎正在“熄火”。

机构向左,去中心化质押向右

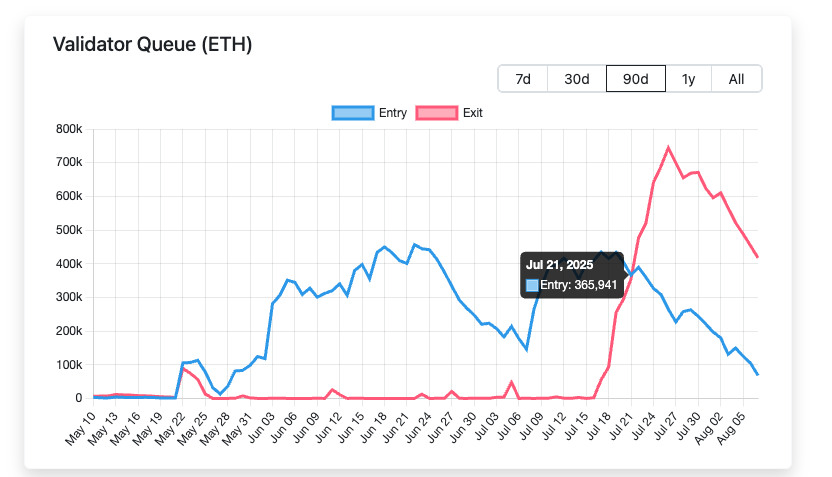

要理解机构的选择逻辑,我们需要先看一组数据:2025年7月21日起,ETH排队解除质押的数量开始明显高于进入质押数量,其中最大差值高达50万枚ETH。

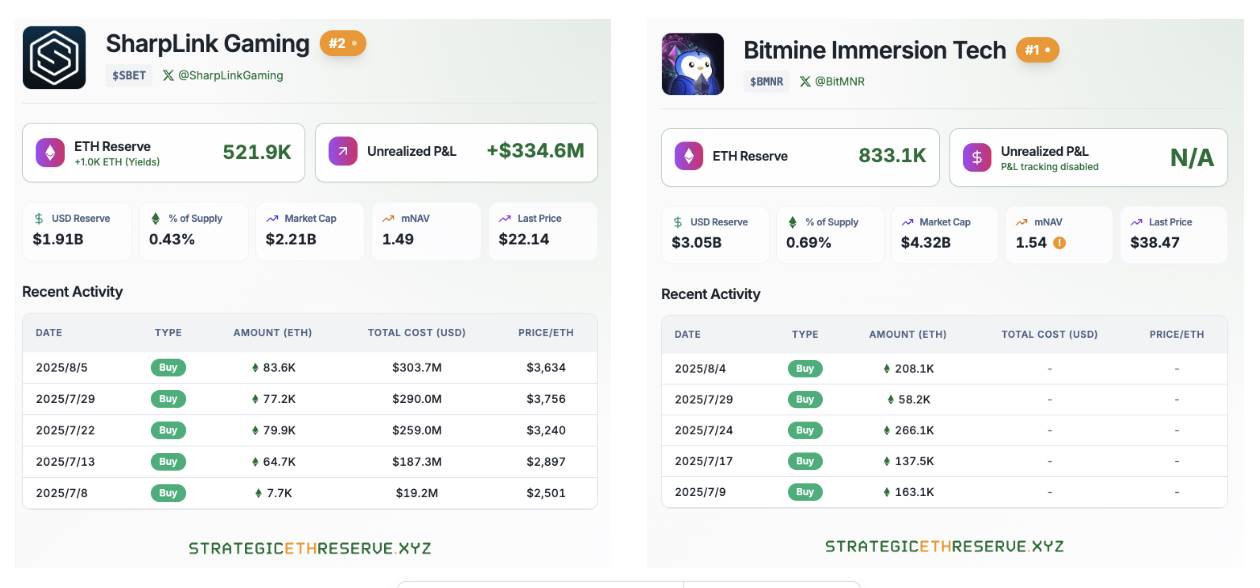

于此同时,以BitMine和SharpLink为首的ETH战略储备公司正在持续大批量购入ETH,当前仅这两家公司持有的ETH数量总和超过135万枚ETH。

贝莱德等华尔街机构也在SEC批准通过ETH现货ETF后不断购入。

根据以上数据,毫无疑问可以得出一个结论:ETH正在从散户手中不断流向机构手中。这种持有结构的剧烈变化,正在重新定义整个质押市场的游戏规则。

对于管理着数十亿美元资产的机构来说,合规永远是要放在优先级第一位的。SEC在审查贝莱德提供的ETH质押ETF申请时,也明确要求申请方必须能够证明其质押服务提供商的合规性、透明度和可审计性。

而这恰恰击中了去中心化质押平台的软肋,类似Lido的去中心化质押平台节点运营商分布在全球各地,这种去中心化的结构虽然增强了网络的抗审查性,但也让合规审查变得极其复杂。试想一下,当监管机构要求提供每个验证节点KYC信息时,去中心化协议将如何应对?

相比之下,Coinbase Custody这样的中心化方案就简单的多。他们有明确的法律实体、完善的合规流程、可溯源的资金流向,甚至还有保险覆盖。对于需要向LP交代的机构投资者来说,选择是显而易见的。

机构的风控部门在评估质押方案时,会关注一个核心问题:出了问题找谁负责?

在Lido的模式中,如果因为节点运营商的失误导致的损失将由所有stETH持有者共同承担,而具体的责任人可能难以追究。但在中心化质押中,服务提供商会承担明确的赔偿责任,甚至提供额外的保险保障。

更重要的是,机构需要的不仅仅是技术上的安全,还包括运营的稳定性。当Lido通过DAO投票更换节点运营商时,这种“人民投票”在机构眼中反而成了不确定性的来源。他们更愿意选择一个可预测、可控制的合作伙伴。

监管松绑,但并非完全利好

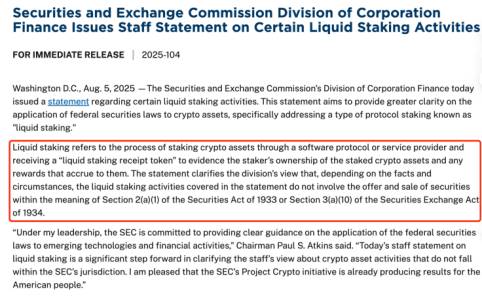

7月30日,SEC宣布收到贝莱德提交的ETH质押ETF申请。就在8月5日,SEC再次发布最新指引:特定的流动性质押不属于证券法管辖范围。

似乎一切都在向好的一面发展,表面上这是去中心化质押平台期待已久的利好消息,但深入分析后会发现,这也可能是悬在所有去中心化质押平台头上的达摩克利斯之剑。

监管放松带来的短期利好是显而易见的,Lido、ETHFI等主流去中心化质押平台代币在消息公布后瞬间价格上涨超3%,截止至8月7日,24小时内流动性质押标的PRL涨幅19.2%,SWELL涨幅18.5%。价格的上涨在一定程度上反映了市场对LSD赛道的乐观预期,更重要的是SEC这一表态为机构投资者扫清了合规障碍。

长期以来传统金融机构对参与质押业务的主要担心就在于潜在的证券法风险。现在,这层阴霾被驱散了大半,似乎SEC通过ETH质押ETF只是时间问题了。

然而,正是这片欣欣向荣的景象背后,隐藏着更深层的赛道危机。

SEC的监管松绑不仅为去中心化平台打开了大门,更为传统金融巨头铺平了道路。当贝莱德这样的资产管理巨头开始推出自己的质押ETF产品时,去中心化平台将面临前所未有的竞争压力。

这种竞争的不对称性在于资源和渠道的差距。传统金融机构拥有成熟的销售网络、品牌信任度和合规经验,这些都是去中心化平台在短期内难以匹敌的。

更关键的是,ETF产品的标准化和便利性对普通投资者具有天然的吸引力。当投资者可以通过熟悉的券商账户一键购买质押ETF时,为什么还要费力地学习如何使用去中心化协议?

去中心化质押平台的核心价值主张——去中心化和抗审查性——在机构化浪潮面前显得苍白无力。对于追求收益最大化的机构投资者来说,去中心化更多是一种成本而非优势。他们更关心的是收益率、流动性和操作便利性,而这恰恰是中心化解决方案的强项。

长期来看,监管松绑可能加速质押市场的"马太效应"。 资金将越来越集中到少数几个大型平台,而小型的去中心化项目将面临生存危机。

更深层的威胁在于商业模式的颠覆。传统金融机构可以通过交叉销售、规模经济等方式压低费率,甚至提供零费率的质押服务。而去中心化平台依赖协议费用维持运营,在价格战中处于天然劣势。当竞争对手可以通过其他业务线补贴质押服务时,单一业务模式的去中心化平台将如何应对?

因此,SEC的监管松绑虽然在短期内为去中心化质押平台带来了市场扩容的机遇,但长期而言,它更像是打开了潘多拉的盒子。

传统金融势力的进入将彻底改变游戏规则,去中心化平台必须在被边缘化之前找到新的生存之道。这可能意味着更激进的创新、更深度的DeFi整合,或者——讽刺的是——某种程度的中心化妥协。

在这个监管春天到来的时刻,去中心化质押平台面临的或许不是庆祝的时刻,而是生死存亡的转折点。

以太坊质押生态的危与机

站在2025年的关键节点,以太坊质押生态正经历着前所未有的变革。Vitalik的担忧、监管的转向、机构的进场——这些看似矛盾的力量正在重塑整个行业格局。

诚然,挑战是真实存在的。中心化的阴影、竞争的加剧、商业模式的冲击,每一个都可能成为压垮去中心化理想的最后一根稻草。但历史告诉我们,真正的创新往往诞生于危机之中。

对于去中心化质押平台而言,机构化浪潮既是威胁,也是倒逼创新的动力。当传统金融巨头带来标准化产品时,去中心化平台可以专注于DeFi生态的深度整合;当价格战不可避免时,差异化的服务和社区治理将成为新的护城河;当监管为所有人打开大门时,技术创新和用户体验的重要性将更加凸显。

更重要的是,市场的扩大意味着蛋糕在变大。当质押成为主流投资选择时,即使是细分市场也足够支撑多个平台的繁荣发展。去中心化与中心化不必是零和游戏,它们可以服务不同的用户群体,满足不同的需求。

以太坊的未来不会由单一力量决定,而是由所有参与者共同塑造。

潮起潮落,唯有适者生存。在加密行业,"适者"的定义远比传统市场更加多元,这或许正是我们应该保持乐观的理由。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。