原文标题:Taking Stock of Crypto Exchanges Pursuing an IPO

原文作者:Tanay Ved 、Victor Ramirez,Coin Metrics

原文编译:AididiaoJP,Foresight News

关键要点:

· 在有利的监管环境和投资者对公开市场加密资产敞口有明显兴趣下,Kraken、Gemini 和 Bullish 正计划进行首次公开募股(IPO)。

· 2021 年 Coinbase 的 IPO 树立了行业标杆。Coinbase 上市时的估值为 650 亿美元,当时其 96% 的收入来自交易手续费,而如今订阅和服务收入在 2025 年第二季度已占 44%。

· 在 IPO 候选交易平台中,Coinbase 仍以 49% 的现货交易量领先。Bullish 和 Kraken 各占 22%,并迅速扩展新服务。

· 并非所有报告的交易量都具有同等价值。往返交易分析揭示了一些平台上的虚增活动,并强调了评估交易平台质量和透明度的必要性。

引言

在加密货币行业历史中,大多数时候美国政府对其态度冷淡,甚至充满敌意。但上周情况发生了积极的变化。

总统数字资产工作组发布了一份 166 页的报告,概述了数字资产的现状,并提出了建立全面市场结构的政策建议。与此同时美国证券交易委员会(SEC)主席保罗·阿特金斯在一次公开演讲中宣布了「加密项目」计划,旨在通过将金融市场链上化、简化加密货币业务的繁琐许可制度,以及支持创建提供多种服务的金融「超级应用」,使美国成为「全球加密之都」。

这一新监管体系的主要受益者是中心化交易平台。Kraken、Bullish 和 Gemini 等几家私营中心化交易平台正利用这一相对有利的环境寻求首次公开募股(IPO)。随着这些公司向公众开放投资,投资者有必要了解其基本面驱动因素。本文我们将深入评估这些交易平台的关键指标,并指出使用交易平台报告数据时的一些注意事项。

加密货币交易平台 IPO 热潮

自 Coinbase 于 2021 年 4 月进行 IPO 以来,过去四年中加密行业相关的 IPO 寥寥无几,主要原因是加密货币公司与前 SEC 之间的对立关系。因此私营公司无法从公开市场获得流动性,非合格投资者也无法通过投资这些公司获利。随着特朗普政府承诺推出更友好的监管制度,一批新的私营加密货币公司宣布了上市计划。

这一环境,加上投资者对公开市场加密敞口的重提兴趣,催生了一些最具爆炸性的 IPO,例如 Circle 最近的公开 IPO。Gemini、Bullish 和 Kraken 计划在美国上市,希望抓住这一机会,将自己定位为数字资产的全栈服务提供商。

Coinbase 的 2021 年 IPO

2021 年 Coinbase 的 IPO 为评估潜在交易平台 IPO 的投资前景提供了有用的基准。该公司于 2021 年 4 月 14 日通过纳斯达克的直接上市方式公开上市,参考股价为每股 250 美元,完全稀释后的估值为 650 亿美元,开盘价为 381 美元。Coinbase 的上市正值 2021 年牛市的高峰,当时比特币价格接近 6.4 万美元,交易平台交易量超过 100 亿美元。

根据其 S-1 文件,Coinbase 当时的商业模式非常简单,大部分收入来自交易手续费:

「自成立至 2020 年 12 月 31 日,我们创造了超过 34 亿美元的总收入,主要来自零售用户和机构在我们平台上基于交易量的手续费。截至 2020 年 12 月 31 日,交易收入占我们净收入的 96% 以上。我们利用交易业务的优势扩展和拓宽平台,通过投资飞轮推出新产品和服务,并扩大生态系统。」

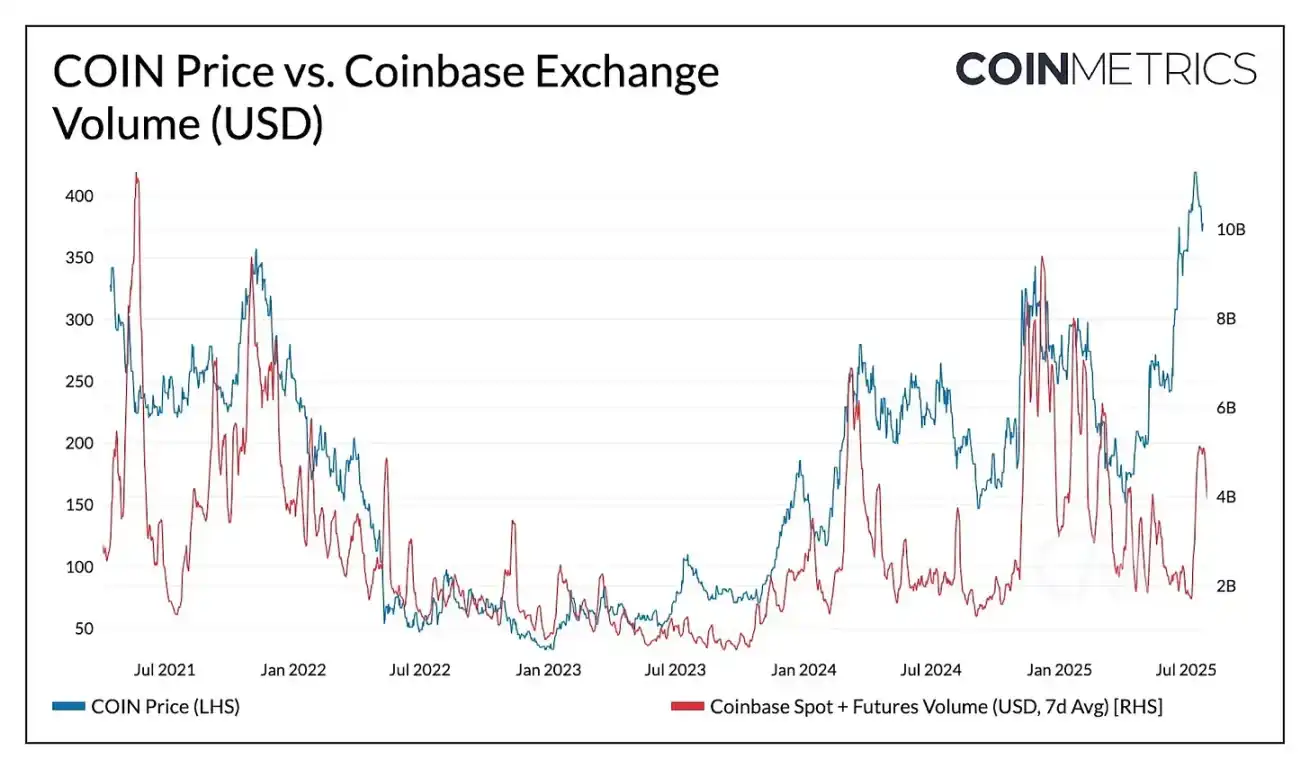

来源:Coin Metrics 市场数据专业版和谷歌财经

如今,Coinbase 更像是一个「全栈交易平台」。尽管交易仍是其核心业务,但其商业模式已显著扩展到加密货币服务的全栈领域。这一变化开始体现在 COIN 价格与交易量之间的关系上,早期两者紧密相关,但随着「订阅与服务收入」(包括稳定币收入(USDC 利息收入)、区块链奖励(质押)、托管收入等)的重要性提升,这种相关性已减弱:

Coinbase 2021 年第一季度:

· 收入 16 亿美元

· 交易收入 15.5 亿美元(96%)

· 订阅与服务收入 5600 万美元(4%)

Coinbase 2025 年第二季度:

· 收入 15 亿美元

· 交易收入 7.64 亿美元(51%)

· 订阅与服务收入 6.56 亿美元(44%)

· 企业利息收入 7700 万美元(5%)

即将 IPO 交易平台的比较分析

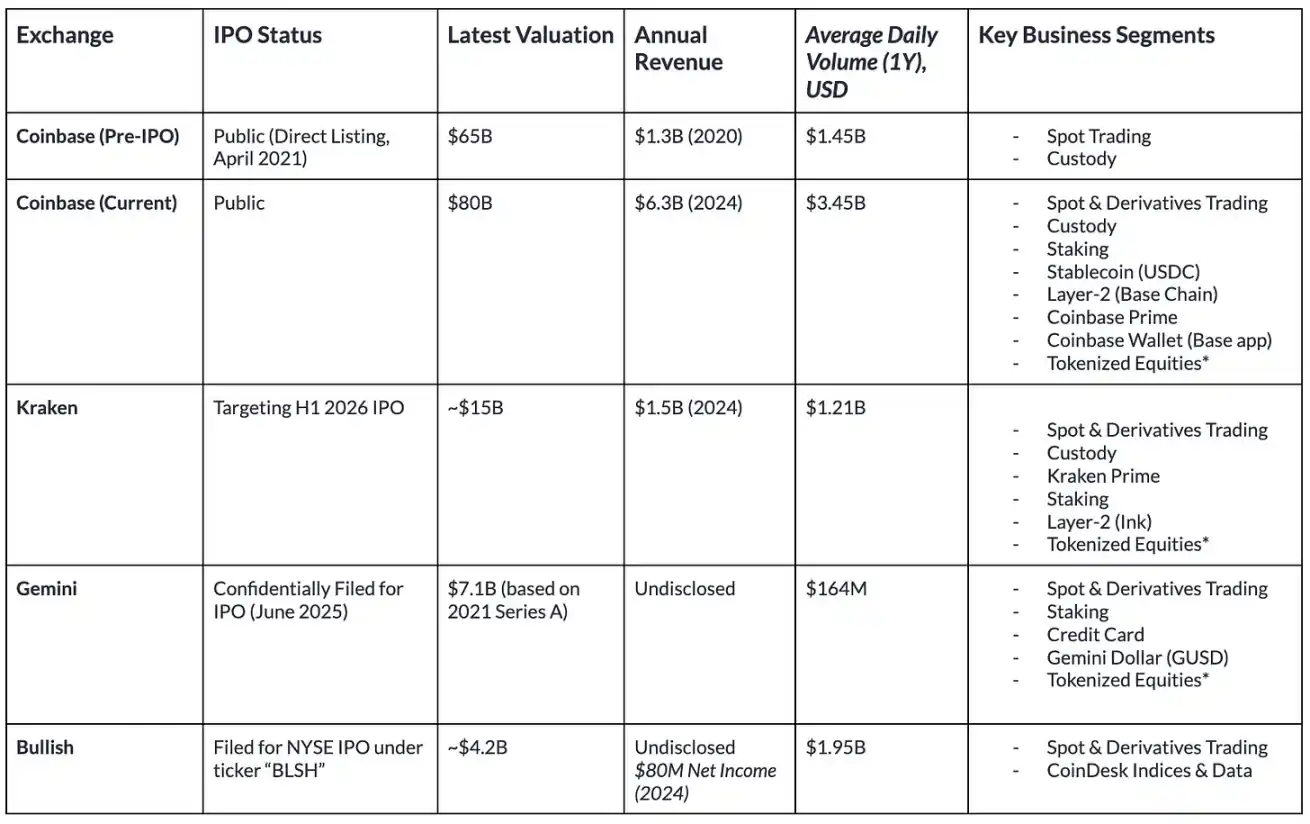

基于这一框架,我们列出了即将进行 IPO 的交易平台的估值、交易量和业务领域的估计数据。

来源:Coin Metrics 市场数据专业版及上市公司文件(截至 2025 年 8 月 1 日的数据)

尽管这些交易平台提供的服务趋于一致,但它们在市场影响力和交易活动规模上存在显著差异。

Kraken 成立于 2013 年,已达到更成熟的阶段。该公司财务增长强劲,2024 年收入为 15 亿美元(较 2023 年增长 128%),2025 年第二季度收入为 4.12 亿美元。Kraken 还通过收购 NinjaTrader、获得欧洲 MiCA 许可,并在代币化股票、支付和链上基础设施(Ink)等领域进行战略扩张。目标估值约为 150 亿美元,2024 年收入为 15 亿美元,其收入倍数为 10 倍,略低于 Coinbase 的 12.7 倍。

相比之下,Gemini 的规模较小。其过去一年的平均交易量为 1.64 亿美元,是这些交易平台中最低的。Gemini 的最新估值可追溯至 2021 年 A 轮融资的 71 亿美元,私募市场对其估值为 80 亿美元。除现货和衍生品业务外,Gemini 还提供质押和信用卡产品,为用户存款提供收益,同时也是 Gemini Dollar(GUSD)的发行方,但其流通供应量已降至 5400 万美元。

Bullish 在交易活动中名列前茅,过去一年的平均交易量为 19.5 亿美元。Bullish Exchange 是其交易和流动性基础设施的核心,该交易平台专注于机构客户,并在德国、香港和直布罗陀受到监管,同时积极寻求美国许可。此外,Bullish 还通过收购 CoinDesk 扩展至信息服务领域。根据 F-1 文件,该公司 2024 年净利润为 8000 万美元,净亏损为 3.49 亿美元。基于 2022 年取消的 SPAC 交易,其初始估值接近 90 亿美元,目前据报道寻求 42 亿美元的估值。

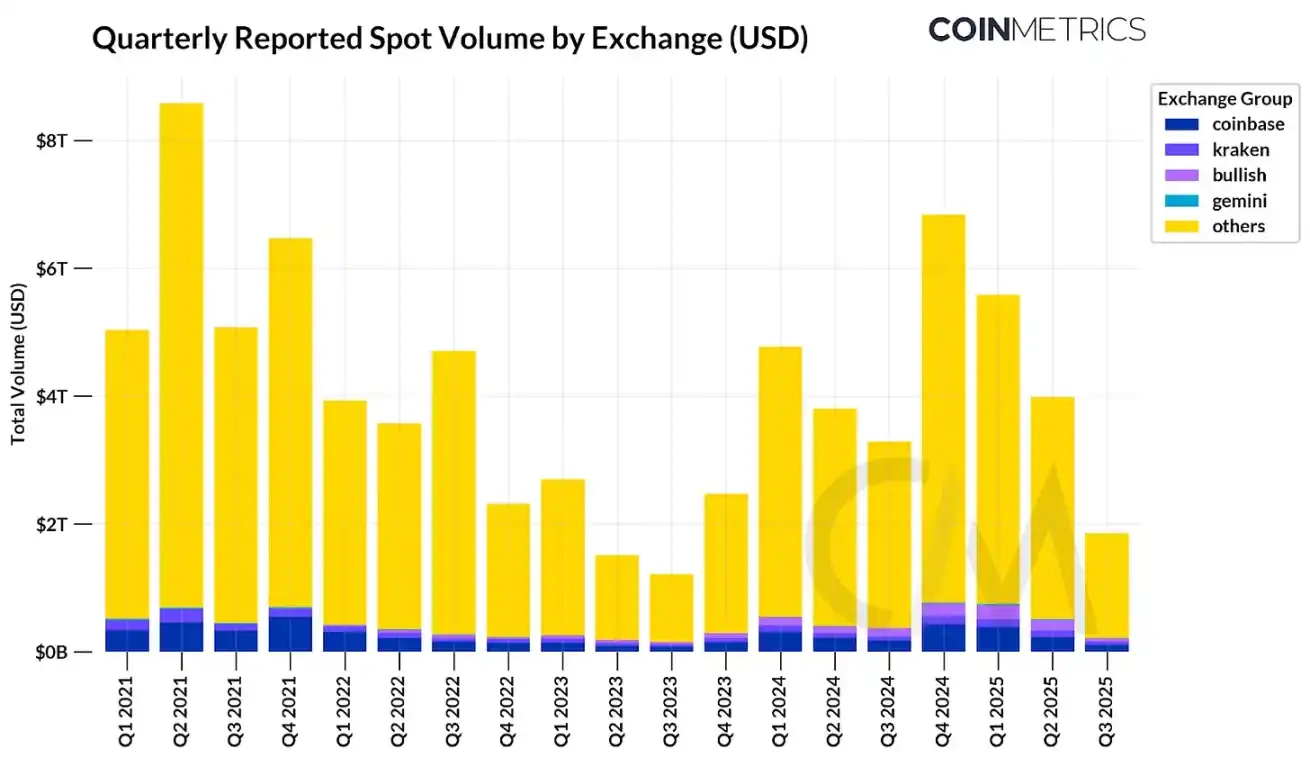

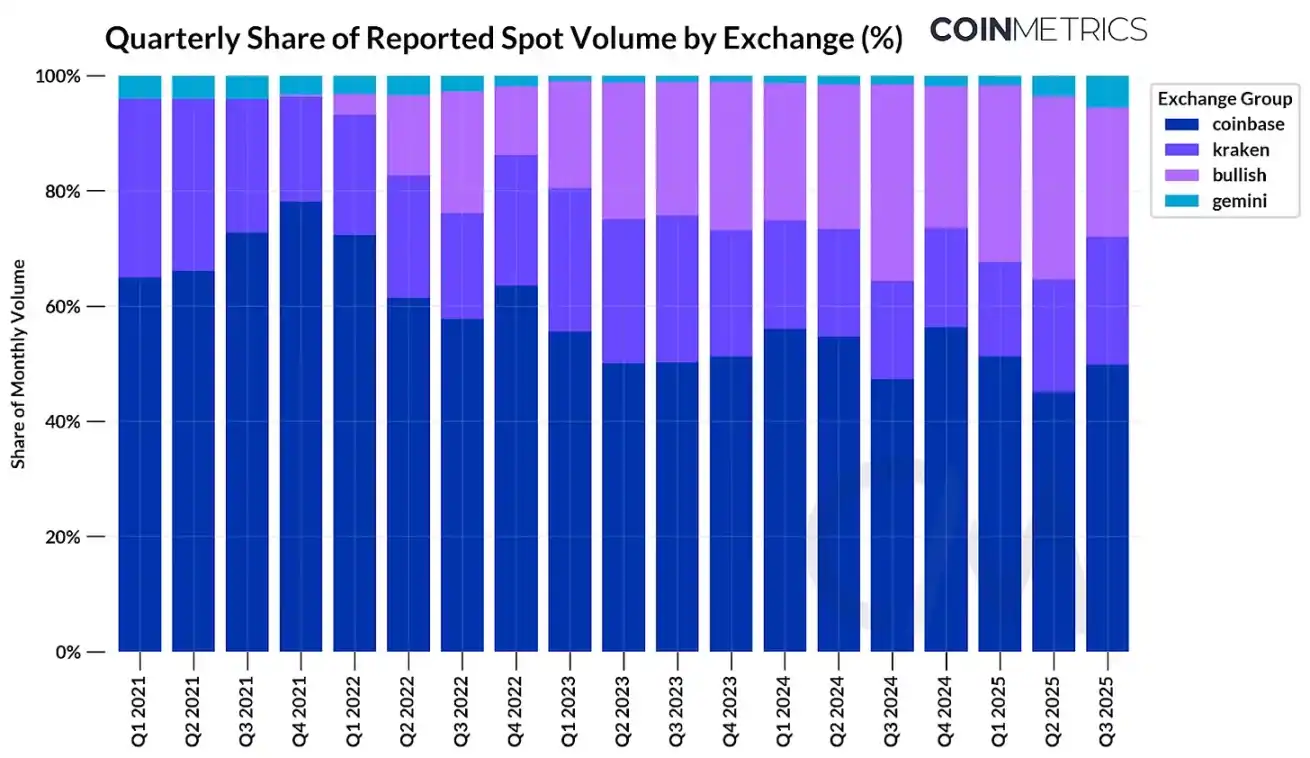

交易平台交易量趋势

来源:Coin Metrics 市场数据专业版

总体而言,Coinbase 和其他即将进行 IPO 的交易平台仅占中心化交易平台报告现货交易量的约 11.6%。仅币安就占 39%,而其他离岸交易平台也占据较大份额。在关注的交易平台中,Coinbase 占现货交易量的 49%,Bullish 和 Kraken 各占 22%。自 2022 年推出以来,Bullish 的份额稳步增长,而随着竞争加剧,Kraken 的市场份额有所缩小。

订单簿上的交易:分析交易平台的经济活动

如上所述,交易量是估算估值最具预测性的指标之一。但报告的交易量可能因交易平台而异,成为一个具有误导性的数据点。

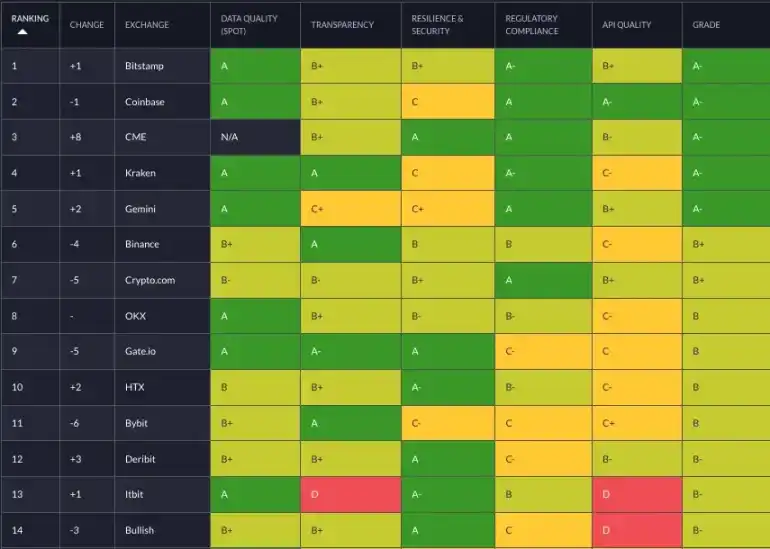

尽管大多数主要加密货币交易平台已打击洗售交易,但仍存在一些不规范行为。我们的可信交易平台框架方法详细介绍了如何检测异常交易活动,并对监管合规性等定性因素进行了评估。

来源:可信交易平台框架

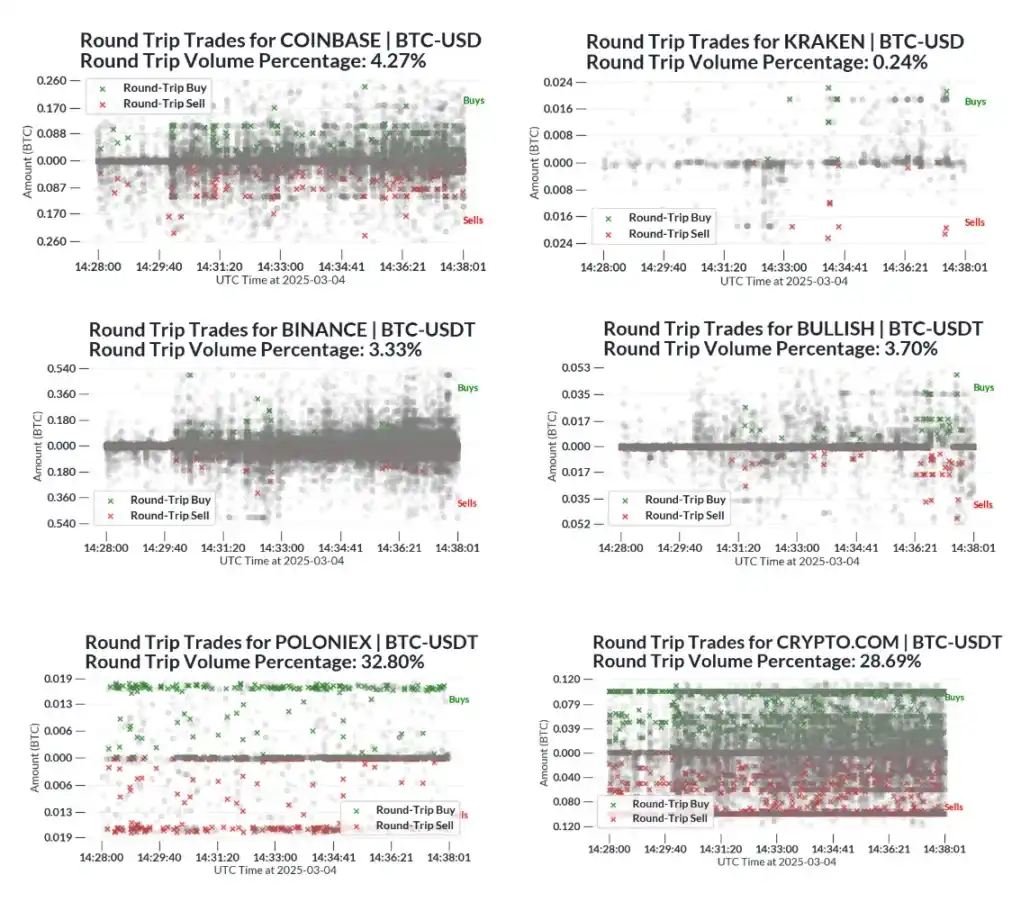

我们开发的一种更强大的检测买卖交易的信号是计算重复交易频率。我们的测试方法如下:

· 我们从 2025 年 1 月至 6 月随机抽取 144 个 5 分钟时段,共产生近 2000 万笔交易。

· 对于每个交易平台和时段,选择一笔交易。

· 如果在 10 笔交易或 5 秒内有另一笔交易,且方向相反、金额和价格几乎相同(1%),则将这两笔交易标记为重复交易。

· 对每笔交易重复此操作。如果交易已被标记为重复交易,则跳过。

· 计算标记为重复交易的交易量,并除以总量。

在下图中,我们绘制了少数交易平台在一个时段内的交易样本,并标记了疑似往返交易。每个灰点代表正常交易,绿色和红色标记代表往返交易。

来源:可信交易平台框架

由于该方法的近似性,我们预计会出现一些误报,即由正常市场活动(例如做市商通过在订单簿两侧提供流动性来促进交易)导致的重复交易。然而与 Crypto.com 和 Poloniex 等行业基线相比,重复交易比例较高,引发了对其报告交易量数据可靠性的担忧。

举例来说:在 2025 年第一季度至第二季度,我们估计 Crypto.com 的 BTC-USD(2010 亿美元)、BTC-USDT(1920 亿美元)、ETH-USD(1650 亿美元)和 ETH-USDT(1600 亿美元)的交易量约为 7200 亿美元。根据上述估计比例,这些交易对中约有 1600 亿美元的交易量来自重复交易。

结论

随着多家加密货币交易平台即将上市,投资者有必要了解这些平台的相对交易量。尽管交易量有助于估算交易收入(目前仍占收入的大部分),但业务多元化、是否存在重复交易以及监管合规性等定性因素也是评估交易平台质量的重要考量。这些信息可以帮助市场参与者判断估值是否合理。

Coinbase 在 IPO 四年后仍处于领先地位,主要得益于其在托管、稳定币和 Layer-2 费用等收入来源的多元化。然而交易平台市场的竞争正在加剧。其他交易平台要想竞争,必须将收入来源从高度依赖市场情绪的交易相关费用中多元化。随着市场结构逐渐明确,交易平台被允许从交易场所演变为全方位的超级应用。这些交易平台如何抓住这一机会,是否能够实现其愿景并复制过去突破性 IPO 的成功,将是未来一年值得关注的重要发展。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。