Recently, the Bitcoin community has been embroiled in intense debates surrounding "Inscriptions" and the Ordinals theory. Supporters believe it brings innovation and wealth effects to the Bitcoin ecosystem, while opponents worry it undermines decentralization and the purity of the network.

Written by: Luke, Mars Finance

In the cacophony of the crypto world, market attention is often drawn to the fleeting changes in price. However, recently, a joint letter quietly circulated on the Bitcoin Core forum, like a stone thrown into a deep lake. While it may not have immediately stirred up a massive wave, it could profoundly change the direction of the entire Bitcoin ecosystem. This letter does not directly discuss wealth, but it may determine where future wealth is born. It resembles a "ceasefire agreement," attempting to put an end to a protracted "civil war" concerning the soul of Bitcoin.

At the heart of this "war" are the "Inscriptions" that have ignited the Bitcoin network in recent years and the Ordinals theory behind them. When developer Casey Rodarmor cleverly utilized a long-overlooked corner of Bitcoin transactions—witness data—in early 2023 to permanently engrave non-financial data such as images and text onto the smallest unit of Bitcoin, the "Satoshi," he may not have anticipated that he had unleashed a Pandora's box filled with opportunities and controversies.

"Spam" or "Renaissance"? A divisive debate within the community

Inscriptions have ignited the Bitcoin ecosystem in unprecedented ways. In a short time, a large number of "BRC-20" tokens and NFTs have surged onto this public chain, known for its "purity," creating astonishing wealth effects and bringing a much-needed boon to the dwindling income of miners—transaction fees once soared, even surpassing fixed block rewards. Supporters hailed this as a "Renaissance of Bitcoin," believing it proves that the Bitcoin network can build a rich application ecosystem without relying on complex smart contract virtual machines, thus attracting massive users and funds.

However, on the flip side, there is the anger and concern of Bitcoin purists and some core developers. In their eyes, these inscriptions, seen as "financial graffiti," are a serious abuse of the precious space resources of the Bitcoin blockchain. Among the most notable opponents is veteran Bitcoin core developer Luke Dashjr, who denounced inscriptions as a "spam attack" exploiting a "vulnerability" in the Bitcoin Core client.

His logic is solid and clear: Bitcoin was originally designed as a peer-to-peer electronic cash system, and every byte of its blockchain should serve this core goal. Inscriptions permanently engrave a large amount of irrelevant data onto the ledger, causing the blockchain to expand at an unprecedented rate, which not only raises the hardware threshold for ordinary users to run full nodes but, in the long run, will undermine the decentralized foundation on which Bitcoin relies. He believes this behavior seriously deviates from Bitcoin's ultimate vision as a robust currency. Thus, Luke and developers with similar views began to explore how to "fix" this vulnerability through software upgrades, known as "soft forks," to fundamentally prevent the generation of inscriptions. For a time, a storm was brewing, and the entire emerging inscription ecosystem was shrouded in the shadow of potentially being "one-click cleared."

This debate quickly evolved into a profound philosophical and ideological struggle, splitting the Bitcoin community into two camps. One side consists of "minimalists," who firmly believe that Bitcoin should maintain its simplest and purest form, focusing on being digital gold and the ultimate store of value, with any "impurities" that might interfere with this goal being eliminated. The other side comprises "expansionists," who argue that Bitcoin is the most secure computing and consensus platform in human history, and its vast security budget should not only be used to protect simple transfer transactions. Using Bitcoin as a settlement layer for broader applications can not only increase its application value but also create sustainable income for miners through a thriving on-chain economy, thereby ensuring the long-term security of the Bitcoin network in a future of continuously halving block rewards.

A "conspiracy" behind a joint letter

Just as the contradictions between the two sides seemed irreconcilable, the emergence of this joint letter brought a turning point to the tense situation. The list of signatories is itself highly persuasive, including not only Casey Rodarmor, the founder of the Ordinals theory, but also core developers like b10c and influential project parties in the inscription ecosystem such as Taproot Wizards. This marks that those once seen as "heretics" are now presenting their ideas to the entire community, especially miners and developers, in a more mature and constructive manner.

The core argument of the letter cleverly sidesteps the subjective value judgment of "whether inscriptions are useful" and instead strikes at the most core and indisputable principle of Bitcoin—censorship resistance. The letter emphasizes that Bitcoin is great precisely because it is a permissionless, neutral platform. As long as a transaction complies with the network's consensus rules (format valid, spender owns the corresponding UTXO, and pays sufficient fees), it should be packaged and should not be censored by any developer, miner, or group based on its "intent" or content. Today, one can refuse to package inscription transactions because they "dislike JPEGs," and tomorrow, they might refuse to package any "unpopular" transactions for other reasons, opening a dangerous Pandora's box that fundamentally erodes Bitcoin's value proposition.

Rather than a defense, this is more of a higher-dimensional "generalship." It passes the ball to those developers attempting to "fix" the vulnerability: are you willing to sacrifice the fundamental principle of censorship resistance to maintain your vision of a "pure" Bitcoin?

Furthermore, the letter does not shy away from pointing out a reality that everyone cannot ignore: Bitcoin's economic security model. With the block reward halving every four years, miners' income will increasingly rely on transaction fees. A quiet Bitcoin network with only a few transfer transactions will not be able to support a security budget worth trillions of dollars, sufficient to withstand nation-state attacks. Inscriptions and various potential non-financial applications are precisely the most powerful engines of the Bitcoin fee market. The letter clearly states that helping miners earn rewards is helping the Bitcoin network remain vibrant and secure. This undoubtedly represents a "conspiracy" aimed directly at the core interests of the miner community, forcing them to choose between "philosophical ideals" and "economic realities."

From "blocking" to "guiding": The three-act evolution of Bitcoin's metaprotocol

The far-reaching significance of this joint letter lies in its indication that the internal contradictions of the Bitcoin community are shifting from "confrontation" to "integration," from simple "blocking" to more intelligent "guiding." It does not end the debate but sets a healthy baseline for it. When the question of "whether to build" is no longer an issue, the community's creativity can focus on "how to build better" in unprecedented ways. History is proving this point; when the option of "blocking" is set aside, the path of "guiding" becomes clear.

The wave of innovation surges along the ancient river of Bitcoin, and the evolution of metaprotocols has become the most noteworthy three-act play in this wave.

Act One: Genesis - The groundbreaking Ordinals The Ordinals theory and inscriptions are the starting point of this evolution, serving as a great "proof of concept," roughly yet powerfully demonstrating to the world that issuing non-fungible tokens (NFTs) and fungible tokens (BRC-20) on Bitcoin is entirely feasible. Although it brought issues such as UTXO set expansion, it ignited the first spark, revealing another side of Bitcoin that had long been dormant. However, its limitations are equally apparent: its functionality mainly revolves around token issuance and simple peer-to-peer transfers, lacking broader programmability. This led to a bottleneck in further innovation in the ecosystem after the initial hype.

Act Two: Improvement - The clever turn of Runes Against this backdrop, the Runes protocol, personally crafted by Ordinals founder Casey Rodarmor, emerged. It acts like a meticulous engineer, precisely optimizing the drawbacks of BRC-20 that generate a large amount of "garbage" UTXOs during transactions. Through a more efficient and "Bitcoin-native" UTXO model, Runes provides an elegant solution for issuing fungible tokens. The emergence of Runes is a logical necessity in the evolution of metaprotocols, moving from "feasible" to "better." It makes asset issuance cleaner and more efficient, but ultimately, it still operates within the framework of "asset issuance" and does not touch upon deeper transformations.

Act Three: Paradigm Revolution - The astonishing leap of Alkanes However, whether it is Ordinals or Runes, they still answer the question of "how to issue assets on Bitcoin." The real breakthrough lies in answering a more fundamental question: "Can Bitcoin become a decentralized computer capable of supporting complex applications?" The latest "Alkanes protocol" is attempting to achieve this astonishing leap, pushing the entire narrative to new heights.

Alkanes is no longer satisfied with patching existing protocols; it ambitiously introduces a complete, WASM (WebAssembly)-based smart contract environment on the foundation of Bitcoin. WASM is an efficient binary instruction format that allows developers to write complex applications using various high-level languages (such as Rust, C++) and execute them securely on the Bitcoin network. Theoretically, this is equivalent to embedding an "operating system" directly into Bitcoin's underlying layer.

This leap is disruptive. It means developers can finally build truly autonomous decentralized applications (DApps) on the Bitcoin main chain, such as automated market maker (AMM) decentralized exchanges, trustless lending protocols, on-chain derivatives, and even complex yield aggregators. This is no longer about simply issuing a "small image" or a "meme coin," but about constructing a complete, composable DeFi Lego world.

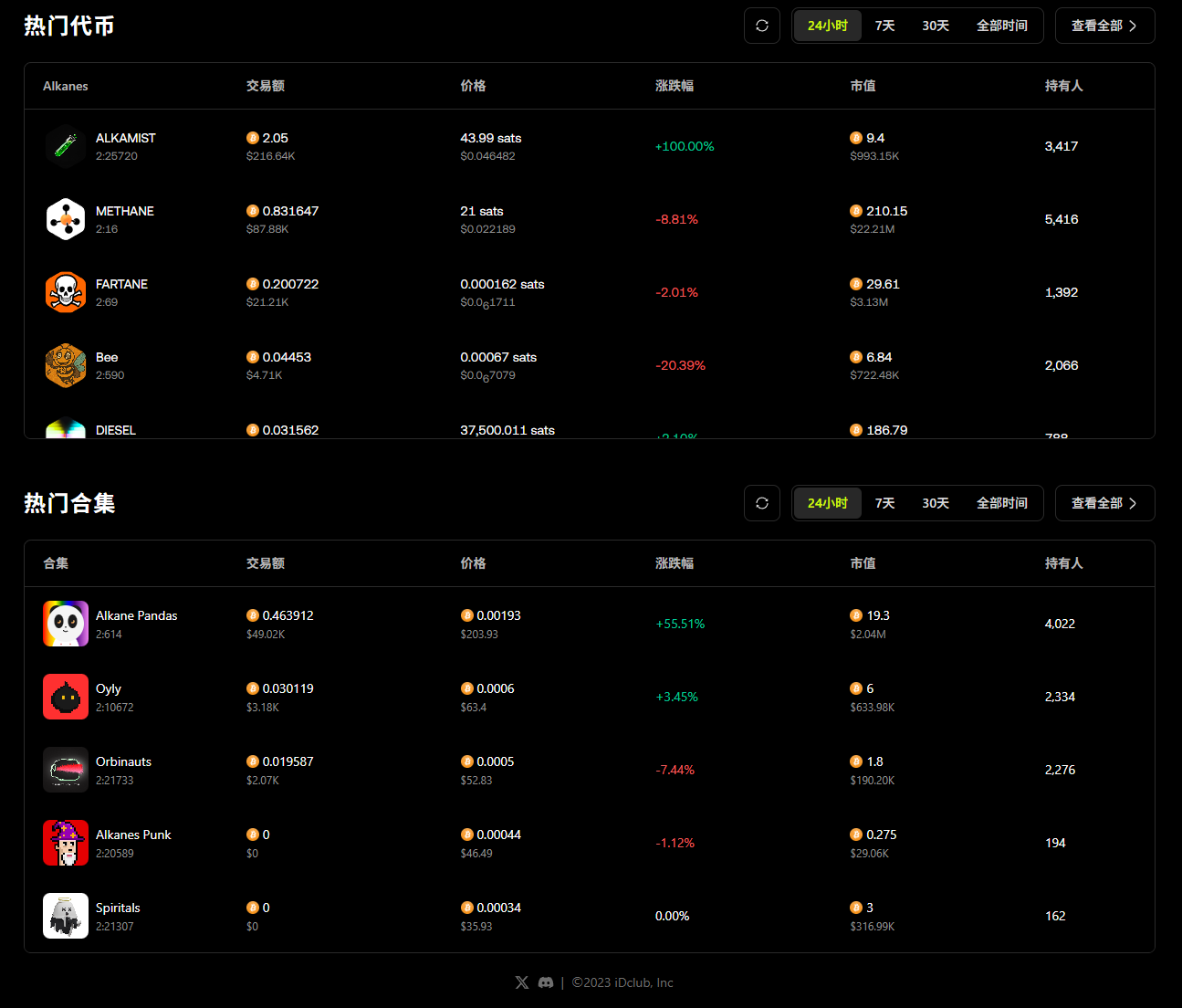

Since its launch in January 2025, Alkanes has begun to gain momentum after several months of silence. Data shows that in just three months from March to May, the transaction fees generated from exchanges interacting with the Alkanes protocol reached 11.5 BTC. Although this figure is still less than Runes (41.7 BTC) and BRC-20 (35.2 BTC), it has significantly surpassed the same period's Ordinals NFT (6.2 BTC), demonstrating strong growth momentum.

Alkanes' true killer feature lies in its upcoming native AMM DEX. Once launched, it will completely transform the trading experience of Bitcoin-native assets. Users will no longer need to go through the cumbersome process of manually placing orders and waiting for counterparties to match; instead, they can interact directly with liquidity pools driven by smart contracts, achieving instant and smooth transactions. This is not only a significant leap in user experience but also an essential breakthrough in functionality. It means that the Bitcoin ecosystem can finally bridge the gap with modern smart contract platforms like Ethereum, laying the foundation for more expressive and native DeFi activities. The emergence of Alkanes represents the next evolution of Bitcoin's metaprotocol, shifting the narrative from static "asset issuance" to dynamic "application deployment." Behind this door it opens is a world full of imagination.

Evolution, never-ending

The story of Bitcoin, from the moment of its birth, has not been a perfect script written by a single "deity," but rather an epic of evolution co-authored by countless developers, miners, and users through debate, compromise, and consensus. From the early "block size wars" to today's "inscription disputes," every significant divergence has ultimately become a catalyst for Bitcoin's forward evolution. This seemingly inconspicuous joint letter is yet another key chapter in this epic.

It reminds us that Bitcoin's greatest strength is not the rigidity of its code, but the powerful resilience and self-correcting ability of its consensus mechanism. A truly decentralized system will eventually find a path that is inclusive and ever-evolving. From the groundbreaking achievements of Ordinals to the meticulous improvements of Runes, and now to the revolutionary leap of Alkanes ushering in the era of smart contracts, we are witnessing the acceleration of this evolution.

For those paying attention to this field, it may be time to shift some focus away from the K-line and spend more time gazing at this ancient yet youthful public chain. Because within those seemingly dull codes and forum debates, in new protocols like Alkanes, the seeds of the next paradigm shift are brewing. The future of Bitcoin may be broader than we imagine.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。