Bitcoin breaks out of the "death cross" zone, with continuous positive news ahead.

Written by: Bright, Foresight News

On the morning of June 10, as positive news from the China-U.S. talks was released, the secondary cryptocurrency market warmed up. BTC rebounded and broke through the 110,000 mark, just 1,400 dollars away from its historical high, with many altcoins also experiencing significant rebounds. After reaching a new high on May 22, BTC has been in a continuous correction for two weeks, hitting a low of 100,355 dollars, and has steadily risen to 110,000 dollars this week, with an increase of over 10.26%. As of the time of writing, Bitcoin is reported at 109,632 dollars.

ETH performed relatively strongly. After a brief consolidation, it continued its good upward trend, rebounding from a low of 2,379 dollars to break through to 2,726 dollars, just 62 dollars away from the new high of this round of increases, with a rise of over 12.2%. SOL may have been sold off by large holders due to a cooling on-chain market, rebounding slightly from a low of 141 dollars to 161 dollars, an increase of 14.18%, but still has a significant gap to the recent high of 187.71 dollars.

The total market capitalization of cryptocurrencies has rebounded by over 2%, approaching 3.5 trillion dollars. With altcoins collectively rising, Bitcoin's market share has slightly decreased to 62.42%, and the altcoin season index has risen to 20, while the fear and greed index has climbed to 64, indicating greed. During the same period, U.S. stocks rose slightly overall. The S&P 500 index closed up 5.52 points, an increase of 0.09%, just 2.3% away from the closing high on February 19. The Dow Jones Industrial Average closed down 1.11 points, a decrease of 0.00%, at 42,761.76 points. The Nasdaq closed up 61.28 points, an increase of 0.31%. Among U.S. cryptocurrency stocks, Circle continues to perform well, breaking through 138 dollars during trading, having risen over 4.45 times from its issue price of 31 dollars. Coinbase rose 2.13%, with its stock price rebounding to 256.63 dollars. Meanwhile, MicroStrategy rose over 4.71%, closing at 392.12 dollars, quickly returning to the 400 dollar mark.

In terms of liquidation data, according to Coinglass, over 106,600 people were liquidated in the last 24 hours, with a total liquidation amount of 436 million dollars, including 381 million dollars in short liquidations and 54.626 million dollars in long liquidations, primarily short liquidations. The largest single liquidation on CEX was ETH-USDT, occurring on Huobi, valued at 4.0596 million dollars.

It can be said that the medium to long-term fundamentals of BTC remain unchanged, with continuous buying from asset management institutions and listed companies being the main buying force for BTC's continued upward trend. After two weeks of wide-ranging corrections, BTC has risen healthily, and the positive news from the new round of trade negotiations between China and the U.S. has further stimulated the overall warming of risk assets. BTC's push towards 120,000 dollars may not be difficult in June.

Trump Administration Praises "Good"

On June 9, the first meeting of the China-U.S. economic and trade consultation mechanism was held in London, UK, discussing issues related to China's rare earth imports and exports and the U.S. imports and exports of various technology products. Chinese Vice Premier He Lifeng, U.S. Treasury Secretary Janet Yellen, and U.S. Secretary of Commerce Gina Raimondo attended the meeting. Among them, U.S. Secretary of Commerce Raimondo was absent from the Geneva talks in May and is considered a senior U.S. official with a very strict stance on China's technology export controls.

On June 10, the Trump administration expressed satisfaction with the consultation meeting. U.S. Treasury Secretary Yellen remarked on the China-U.S. talks, stating, "It was a good meeting." U.S. Secretary of Commerce Raimondo described the talks as "productive." Subsequently, U.S. President Trump stated, "We are making good progress with China, receiving good news from London. We will consider lifting export controls, and the China-U.S. negotiations are still ongoing." Immediately, U.S. semiconductor stocks led the gains, with Nvidia rising over 2.2%.

Public opinion generally believes that the positive attitude of both sides' officials in this dialogue clearly hopes to extend the truce period recognized by both sides after earlier trade frictions. The Trump administration's satisfied remarks after the talks have further driven the rise of global risk assets.

Macroeconomic Data Boosts Confidence

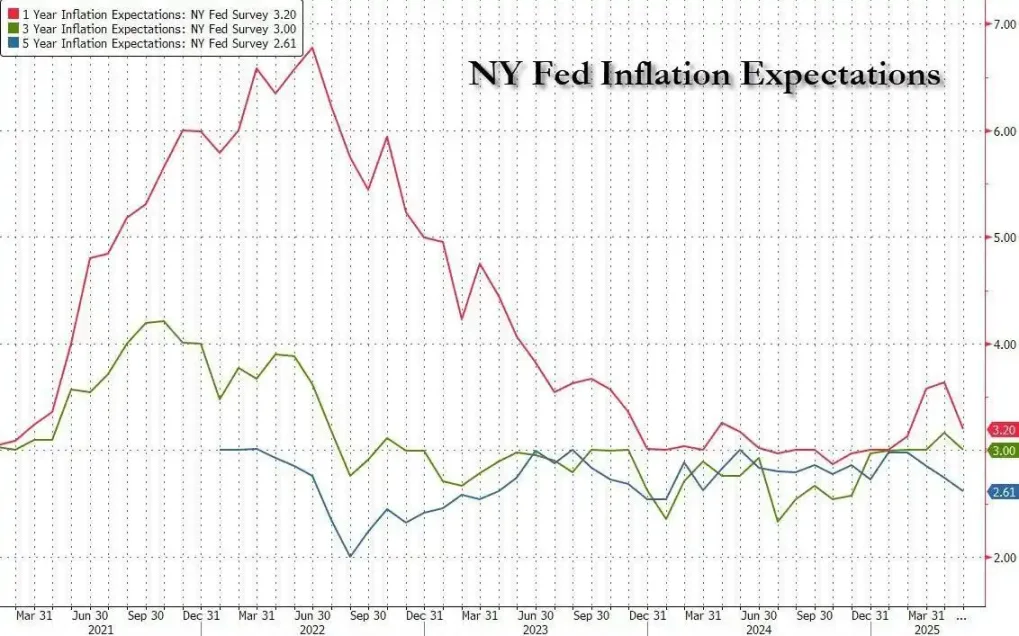

In May, U.S. consumers' expectations for future inflation fell across the board, marking the first decline since 2024, with the largest drop in short-term inflation expectations. The latest survey results released by the New York Fed in May showed that one-year inflation expectations dropped from 3.6% in April to 3.2%, the largest decline. Three-year inflation expectations fell from 3.2% to 3%. Five-year inflation expectations decreased from 2.7% to 2.6%.

Analysts point out that although inflation expectations are still above the Federal Reserve's target of 2%, they have clearly retreated, indicating an improvement in consumer confidence, primarily due to the temporary easing of the China-U.S. trade situation. Following the announcement of tariff relief, multiple surveys (including the New York Fed's survey) have shown a rebound in consumer sentiment.

Kevin Hassett, Director of the White House National Economic Council, stated, "From various inflation indicators, the current decline in inflation is the largest in the past four years. While tariff revenues are rising, inflation is falling, which contradicts what many people say (that tariffs will push up inflation), but aligns with our long-standing judgment."

April inflation data also showed that the Fed's preferred inflation indicator—the Personal Consumption Expenditures Price Index (PCE)—was at 2.1% in April, the lowest level since February 2021. The core PCE, excluding food and energy, was at 2.5%. Federal Reserve officials are closely monitoring consumer inflation expectations to assess whether tariffs could lead to sustained inflation increases. The market generally expects the Fed to maintain interest rates at the meeting on June 17-18.

However, "Fed mouthpiece" Nick Timiraos indicated that uncertainty regarding U.S. medium-term inflation expectations remains high (three-year inflation expectations at 3%, down from 3.2%; five-year inflation expectations at 2.6%, down from 2.7%). The market may be "overly optimistic" in interpreting short-term data.

Bitcoin Momentum Strong

An increasing number of listed companies are entering the game of strategically holding Bitcoin.

On June 9, U.S. listed company KULR is seeking to raise up to 300 million dollars by issuing common stock in the market. The company currently holds 800 Bitcoins and plans to use the raised funds for general corporate purposes, including purchasing more Bitcoins. It is reported that KULR has also leased 5,500 S-19 Bitcoin mining machines through two agreements for mining, totaling over 4 million dollars.

On June 9, cryptocurrency mining company BitMine Immersion Technologies announced that it had purchased 100 Bitcoins in the open market using funds from a recent stock issuance, officially launching its Bitcoin reserve strategy. The company stated that it will continue to increase its Bitcoin holdings as a long-term investment and core business pillar.

On the same day, the board of directors of the UK-listed company Anemoi International announced that based on the announcement released on June 6, 2025, the company has invested approximately 30% of its cash reserves in Bitcoin. The board believes that the revised financial management strategy is fully complementary to the current core business and expects to release further announcements regarding the company's business and financial management strategy soon. Anemoi International Ltd. is a holding company based in the British Virgin Islands. The company operates through its subsidiary id4 AG, a regulatory technology company providing digital solutions for small and medium-sized financial institutions.

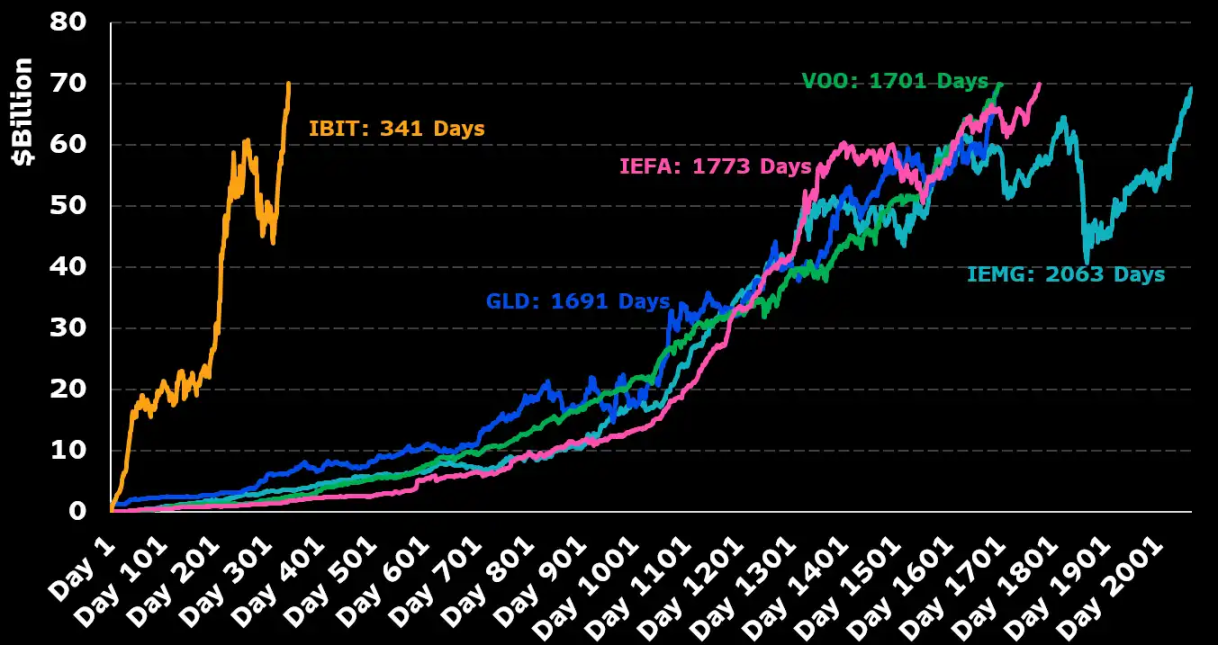

In addition, the continuous influx of institutional funds has become one of the main drivers of Bitcoin's rise. According to Bloomberg senior ETF analyst Eric Balchunas, BlackRock's IBIT holdings have surpassed 70 billion dollars, becoming the fastest ETF to reach this milestone in just 341 days, five times faster than the previous record of 1,691 days held by GLD.

Decrypt analyst Jose Antonio Lanz stated that the gap between Bitcoin's 50-day exponential moving average (EMA) and the 200-day EMA is widening, which is usually a signal of strengthening bullish momentum in the market. This trend confirms a bullish outlook in the medium term while successfully avoiding a potential "death cross," making the short-term moving average range easier to be viewed as a good price support area. Even if the price corrects, it is difficult to fall below the key support level of 100,000 dollars—currently, the EMA line is right at this position.

Currently, the dialogue between government officials from China and the U.S. in London is still ongoing. Given the strategic development considerations of both countries, whether this dialogue can achieve the expected results still has certain uncertainties. Any rise based on policy compromise should be cautious of the black swan of a potential breakdown in agreements. The impact of the July tariff data still requires the market to explore and "clear the mines."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。