Original Author: BitpushNews

The U.S. Securities and Exchange Commission (SEC) has recently released key signals that may accelerate the approval process for the Solana ETF.

According to Blockworks, citing informed sources, the SEC has recently notified several asset management companies to submit updated Solana ETF registration documents (S-1 form) within 7 days. The SEC specifically requested revisions regarding "in-kind redemptions" and "staking mechanisms," and hinted that it might allow the Solana ETF to include staking yield features. This development has been interpreted by the market as a shift towards a more positive regulatory attitude, with one insider estimating that these updates could lead to the Solana ETF being approved within three to five weeks.

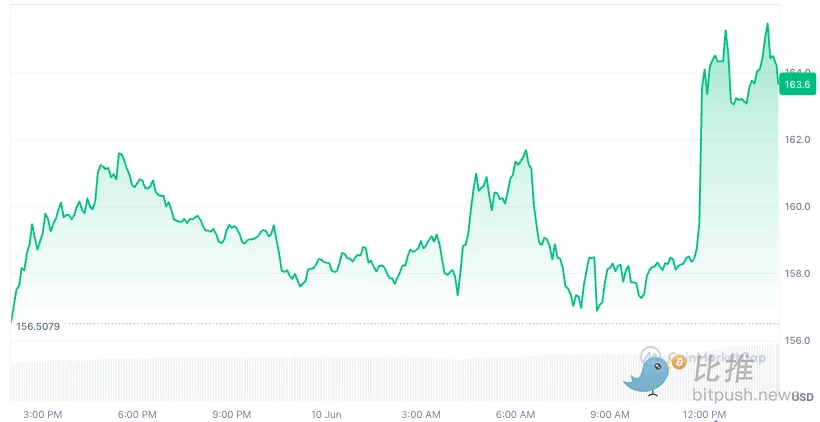

Following the news, the price of SOL surged 5% to over $165, and as of the time of writing, it has retreated to around $163.6.

The core revision requests made by the SEC focus on two main aspects: the language regarding in-kind redemptions and how the issuer will handle staking issues. For investors:

In-kind redemptions: This means that ETF shareholders, when redeeming their fund shares, can choose to receive equivalent SOL tokens instead of cash. This mechanism is generally considered to be more tax-efficient and operationally flexible than cash redemptions, making it more attractive to investors.

Staking: Solana, as a blockchain that uses a Proof of Stake (PoS) mechanism, allows its token holders to participate in network validation and earn rewards by "staking" their tokens. If the SEC allows the inclusion of staking mechanisms, it means that investors purchasing ETF shares can not only benefit from price appreciation but also indirectly enjoy staking rewards, significantly increasing the attractiveness of the SOL ETF and making it a more diversified investment product.

The lineup of institutions applying for this product is also quite impressive, including Fidelity, VanEck, and Grayscale, the original team behind Bitcoin ETFs. Notably, Grayscale plans to convert its existing SOL trust product into a spot ETF, replicating its successful path with Bitcoin and Ethereum ETFs. Market observers point out that the CME exchange is set to launch Solana futures in February 2024, a "preparatory action" that closely resembles the process before the approval of Bitcoin and Ethereum ETFs, further reinforcing expectations.

Optimistic Approval Timeline: As Early as July?

Some insiders expect that after completing these S-1 document updates, the Solana ETF could receive final approval within the next three to five weeks.

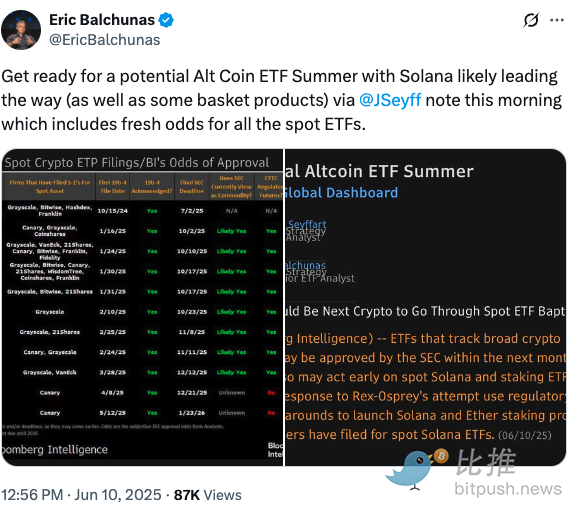

Bloomberg senior ETF analyst James Seyffart is also very optimistic about this. He stated that he expects approval could happen this year, potentially as early as July. Although the SEC's final deadline for the 19b-4 filings (application for listing rule changes) for these products is in October, Seyffart believes that the SEC may now prioritize the applications related to Solana and staking ETFs, meaning that the final decision could come sooner than originally planned, requiring issuers and industry participants to work closely with the SEC and its crypto task force to develop relevant rules.

In April of this year, Bloomberg industry research analyst Eric Balchunas raised the probability of SOL ETF approval from 70% to 90%. In his latest tweet, he stated: "Get ready for a potential altcoin ETF summer; Solana may lead the way (along with some basket products)."

Short-term Outlook for SOL

If we refer to the historical experience of Bitcoin ETFs, BTC prices rose approximately 60% within three months after the approval of the Bitcoin ETF. If Solana replicates this increase, based on the current price of $160, its price could potentially reach the $250-$300 range. However, this optimistic expectation should be viewed with caution— the case of the Ethereum ETF has proven that approval does not necessarily lead to a significant price surge.

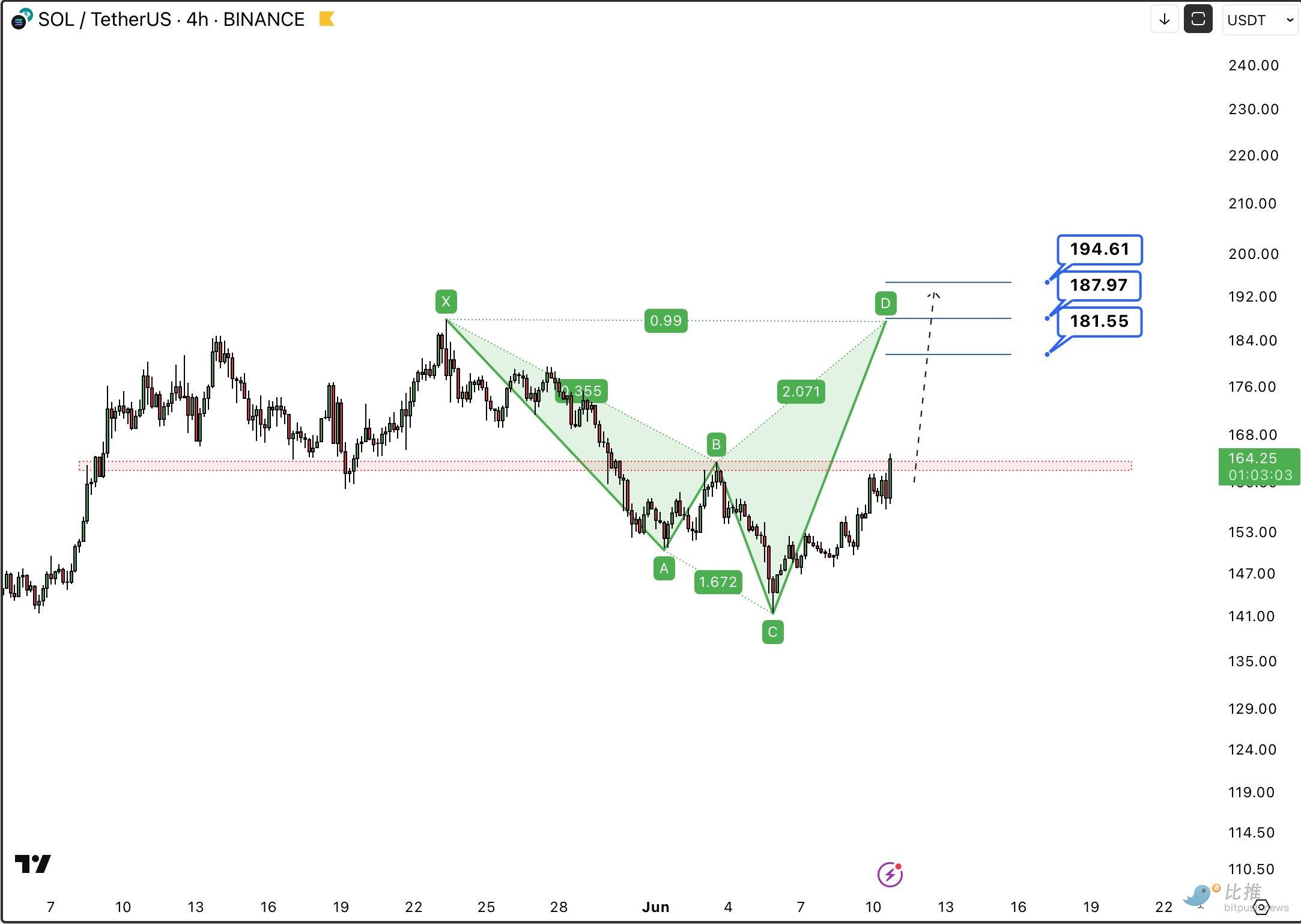

From a technical perspective, crypto analyst Grayhoood observed that SOL's technical indicators, such as RSI, Stochastic Oscillator, and Commodity Channel Index (CCI), are all sending positive signals, especially after SOL broke through the $154 resistance level, indicating that buying power is strengthening and there is still room for price increases.

From a long-term perspective, the 30-day and annual moving averages (down 5.3% and 2.9%, respectively) still show that the recent gains have not fully reversed the previous bearish structure. If it can continue to break through, the upper resistance levels are around $181/$187/$194.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。