The key to the future lies in community consensus.

Written by: Deep Tide TechFlow

As of mid-2025, Bitcoin has already surpassed new highs.

Traditional financial giants like BlackRock and the National Strategic Reserve Fund have entered the market, viewing Bitcoin as a safe-haven asset; large companies are also following MicroStrategy's lead in making Bitcoin a strategic reserve.

However, the embrace of traditional finance has not fully benefited the BTC network itself.

A ghost story is that, although there is a lot of excitement outside, the Bitcoin network's transactions have entered an ice age.

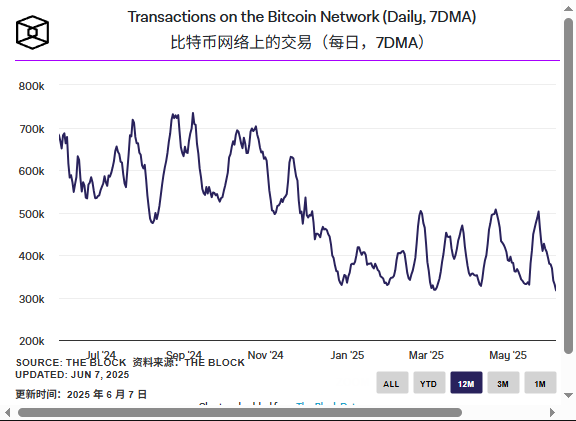

According to the latest data from The Block, the 7-day moving average transaction volume on the Bitcoin network has dropped to $317,000, marking a 19-month low since October 2023. In October 2023, Bitcoin's price was around $27,000, and only 270,000 transactions were packed into Bitcoin blocks in a week; now, with Bitcoin's price reaching $100,000, only 250,000 transactions are being packed into blocks each week.

In simple terms, the price has indeed risen significantly, but the Bitcoin chain is not active. This figure is far below the peak during the spring of 2023 when Bitcoin inscriptions surged.

You could say it is increasingly resembling digital gold, with infrequent transactions. But don't forget that Bitcoin miners rely on transaction fees for their livelihood.

The third halving in 2024 will reduce the block reward to 3.125 BTC, making transaction fees a lifeline for their income. However, the current inactivity on the chain forces some miners to accept transactions below 1 sat/vB to maintain operations.

Looking back at the spring of 2023, the inscription craze triggered by the Ordinals protocol once ignited ecological vitality, with BRC-20 tokens like $Ordi driving a surge in transaction volume, contrasting sharply with the current slump.

The frozen BTC network urgently needs rejuvenation.

In recent days, a transaction proposal from Bitcoin Core has hinted at a thaw --- it aims to adjust the transaction rules of the Bitcoin network to allow more data on-chain, potentially bringing new life to struggling miners and the cooling inscription ecosystem.

This proposal has sparked intense discussion online, with 700,000 views and hundreds of comments by the time of publication, but there has been little media coverage domestically.

We have organized the key content as follows.

Bitcoin Core's New Proposal: No Limits on Transactions

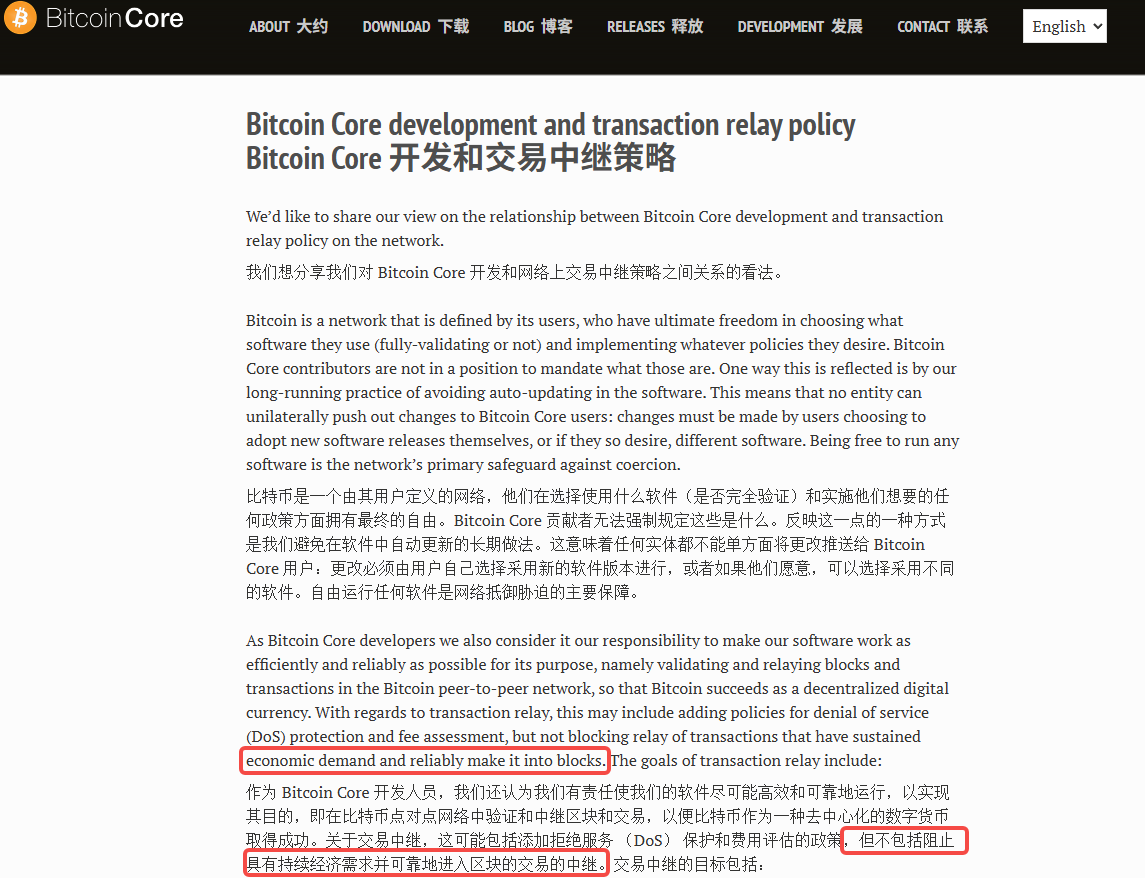

This proposal from Bitcoin Core is a statement regarding transaction relay policy, co-signed by 31 relevant developers.

Its core idea is: the node software of the Bitcoin network should minimize interference with transactions, allowing more economically viable transactions to be relayed and packed into blocks.

The reason this proposal has sparked widespread discussion is that it sounds like a technical adjustment, but it could have far-reaching impacts on the activity level of the Bitcoin chain, miner income, and the inscription ecosystem.

First, you need to understand what transaction relay means.

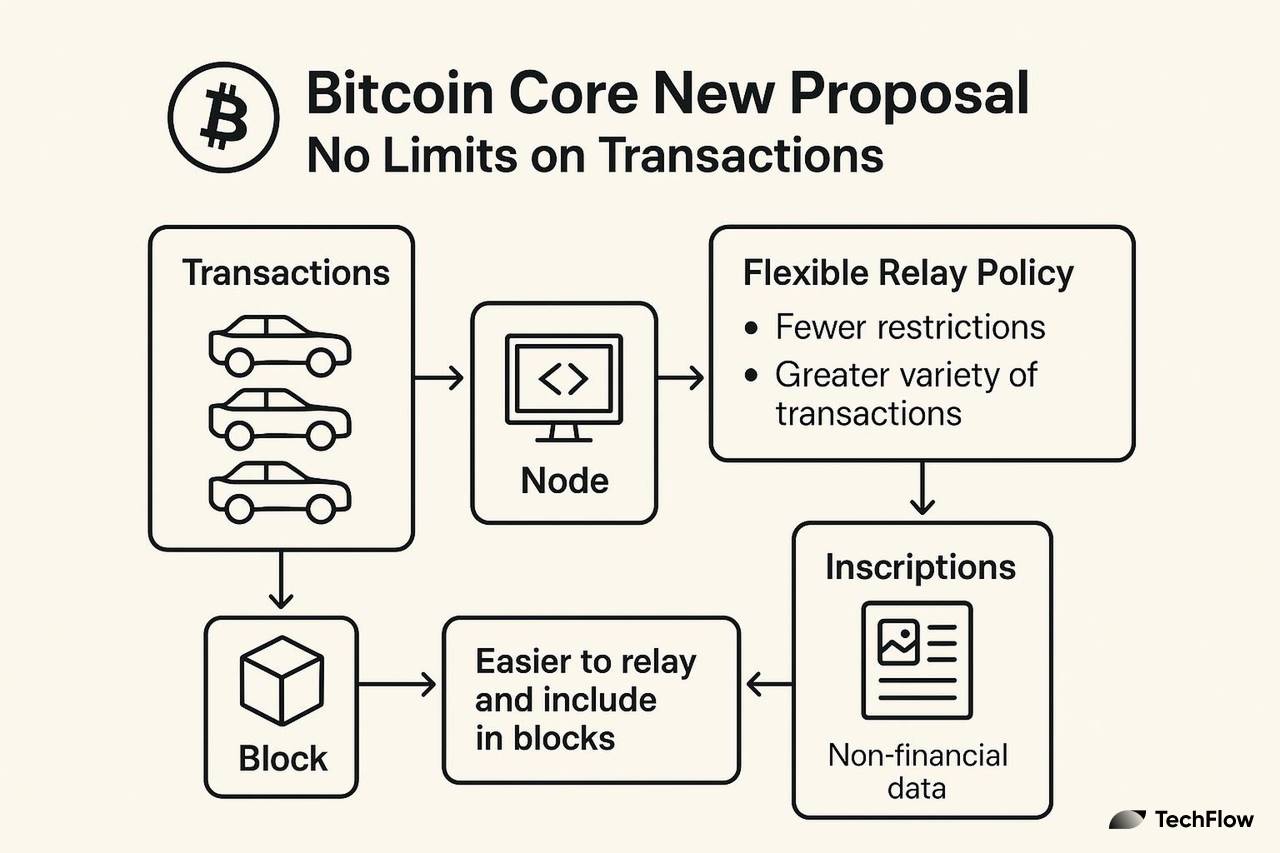

In simple terms, transaction relay is the process by which nodes in the Bitcoin network propagate transactions.

You can think of it as a dispatcher on a highway, responsible for directing vehicles (transactions) to ensure they reach the miners' "worksite" (block packing) smoothly.

In this process, nodes determine which transactions can be propagated and which need to be filtered based on certain rules.

In the past, the relay rules for Bitcoin nodes were relatively strict, especially for transactions containing a lot of data (like inscription transactions), which could be rejected for occupying block space or having too low fees.

The Bitcoin Core proposal introduces an important principle: as long as a transaction has economic demand and can be accepted by miners, nodes should not obstruct its propagation.

This idea of "flexible relay" allows for a freer flow of "traffic" on the Bitcoin network. Specifically, nodes will reduce restrictions on transaction size, fees, etc., allowing more transactions to be smoothly relayed to miners.

The diversity of transactions will be enhanced, especially those containing non-financial data (like inscriptions, BRC-20 tokens), which may be more easily propagated and packed.

What Does This Have to Do with Inscriptions and Miners?

Clearly, this policy adjustment of "flexible relay" also evokes thoughts of a key function in Bitcoin scripts: OP_RETURN. This function is directly related to the rise of inscriptions.

OP_RETURN is an opcode in Bitcoin scripts that allows users to attach a small amount of data to transactions.

Currently, the limit for this opcode is 80 bytes, and this data is not considered a valid Bitcoin output and cannot be spent. You can think of it as a "small package" on a truck; while it does not directly participate in the transaction, it can store information, such as:

File hashes (proof of existence)

NFT metadata

BRC-20 token information

Originally, OP_RETURN was designed to record simple information, like messages on the chain. However, 80 bytes is too small to accommodate complex content, yet developers have managed to achieve significant results with it.

In the spring of 2023, the Ordinals protocol utilized Bitcoin's Taproot feature and OP_RETURN to allow users to mint inscriptions and tokens on the blockchain. Inscriptions achieved NFT-like functionality by embedding data into Bitcoin transactions, while BRC-20 further expanded the application scenarios for tokens.

This innovation ignited activity on the Bitcoin chain at the time, even leading to transaction congestion and soaring miner fees, creating a wave of inscription spring.

However, the 80-byte limit greatly restricts the development potential of OP_RETURN, as users cannot upload more complex content (like larger images or videos), limiting Bitcoin's potential as a decentralized data storage platform.

Although the aforementioned proposal does not directly mention OPRETURN, its principle of "flexible relay" may indirectly loosen the restrictions on the use of OPRETURN:

Reduce node interference with transactions: The proposal advocates that nodes should not refuse to propagate transactions with economic demand. If this principle is adopted, nodes will be more inclined to relay transactions containing OP_RETURN data rather than rejecting them due to data size or type.

Promote relaxation of data restrictions: The spirit of the proposal may lay the groundwork for future relaxation of the 80-byte limit on OPRETURN. With the adjustment of relay policies, the community may further explore the feasibility of expanding OPRETURN data capacity.

Enhance transaction propagation efficiency: Even if the data limit for OPRETURN remains unchanged, the proposal can significantly improve the propagation efficiency of transactions containing OPRETURN data, avoiding transaction failures due to node filtering.

The prosperity of inscriptions and BRC-20 once led to record-high fee income for Bitcoin miners. If the restrictions on OP_RETURN are relaxed, more users will be willing to pay higher fees to upload complex data. This could not only alleviate the income pressure miners face after the halving but also incentivize them to support the new relay policy.

It is also worth mentioning that this proposal is relatively easier to accept from a technical standpoint.

The adjustments in the proposal only involve transaction relay policy, rather than Bitcoin's consensus rules.

Relay policy only determines whether nodes propagate certain transactions, affecting the efficiency of transaction propagation without changing the legality of transactions. Therefore, the implementation of the proposal is relatively simple; Bitcoin Core just needs to release a new version, and users and miners can choose whether to upgrade.

Having understood this, let's look at a practical example to clarify its potential real-world impact.

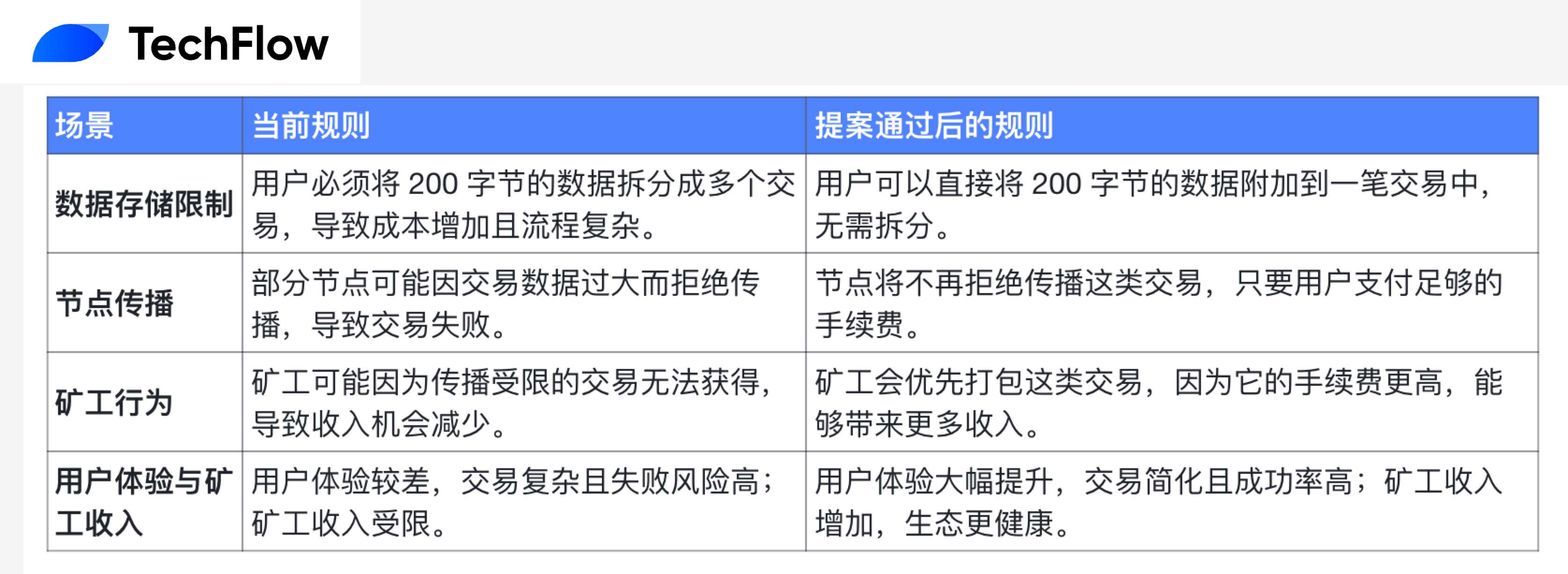

Suppose a user wants to mint a high-resolution NFT image on the Bitcoin chain, but the image's metadata requires 200 bytes of storage space. Under the current rules and the rules after the Bitcoin Core proposal, you can intuitively see the comparison:

Ultimately, user experience will be greatly improved, and miner income will also increase.

Bitcoin Core's proposal may seem like a small adjustment to the transaction relay policy, but it could be a key step towards "thawing" the Bitcoin network.

More importantly, this proposal provides the possibility of relaxing the restrictions on OP_RETURN, while also allowing businesses to use Bitcoin transactions to store hashes of important files, ensuring data immutability, and expanding the non-financial use cases of Bitcoin.

Community Voices

The new proposal from Bitcoin Core is like a stone thrown into a pond, creating ripples. Currently, there are clear voices of both support and opposition in the community.

For example, crypto KOL 0xTodd believes that flexible relay returns to Satoshi's spirit of no restrictions, allowing miners to earn more income; he also does not consider them to be spam transactions, as inscriptions pay fees based on their size.

Bitcoin will never become a storage chain, but it is not a big deal to store some data as a side job without cutting into the underlying structure.

Real physical gold can be carved to leave a record, and the BTC that everyone calls electronic gold should also allow for this.

However, opponents are more concerned that the surge in on-chain data will lead to more problems.

Under the original post from Bitcoin Core, some have criticized the proposal, claiming that Bitcoin Core "ignores the purity of Bitcoin," turning the network into a "universal Swiss Army knife," sacrificing the interests of volunteer nodes and users.

Many others worry that flexible relay will lead to an overflow of "spam transactions," occupying block space.

For example, Luke Dashjr, a "hardcore" member among the core developers, directly replied "NACK" (negative acknowledgment) to the statement, believing that the proposal is misguided and predicting that mined transactions would be equivalent to censorship, violating the anti-censorship principle.

According to Glassnode, the current blockchain has reached 500GB, and if data surges, the costs for full nodes will skyrocket, potentially reducing the number of decentralized nodes and pushing the network towards a centralized abyss.

Opponents argue that Bitcoin should focus on its monetary function rather than becoming a storage chain.

The division within the community is also reflected in the distribution of nodes. CoinDance data shows that 93% of nodes run Bitcoin Core, while 7% use alternative clients (like Bitcoin Knots).

Knots, which rejects inscription transactions due to its "spam filter," has become a stronghold for the opposition. If the proposal passes, Knots users may continue to resist, and the potential risk of a split in Bitcoin client usage has already surfaced.

Historical lessons are present; the SegWit2x controversy in 2017 nearly split the network. Will this debate replay a similar scenario?

The key to the future lies in community consensus.

This debate is far from over. Supporters see hope for miner income and ecological innovation, while opponents guard decentralization and monetary purity.

The fate of the proposal depends on code reviews on GitHub and the willingness of nodes to upgrade. If the community reaches a consensus, flexible relay may be implemented within months, and the spring of inscriptions could reappear; if divisions deepen, Bitcoin's ice age may continue, potentially leading to client forks.

This is a debate that does not belong to Bitcoin's price; the thawing within the Bitcoin ecosystem still awaits spring.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。