After this update, the AAVE team may focus more on rebuilding the competitiveness of GHO from the practical demand scenarios of decentralized stablecoins in payment mediums, anti-censorship, and improving the capital efficiency of lending protocols.

Author: @Web3Mario

Abstract: This week, the AAVE ecosystem passed a key proposal, and the long-awaited AAVE Umbrella module has been recognized by the community, set to be executed on June 5, 2025.

Thus, the AAVE Umbrella module will officially replace the original Safety Module, carrying the bad debt guarantee function of the AAVE ecosystem.

Personally, I was very fond of the original Safety Module's stkGHO yield scenario, which provided a stablecoin-based annual yield of 13% under controllable risk, which was quite appealing.

However, the passage of this proposal will bring significant changes to the original yield paradigm of the AAVE ecosystem, so I summarize this article to introduce the specific impacts after the Aave Umbrella's implementation and share with everyone.

Overall, the launch of Aave Umbrella optimizes the pressure on the supply side of AAVE tokenomics, enhancing capital efficiency from the project perspective, but we need to observe the impact on the protocol during the transition of existing incentive scenario participants, and for stkGHO participants, they may need to seek other yield scenarios.

What Problems Does the Aave Umbrella Module Solve?

First, we need to introduce the significance of the Aave Umbrella module. We know that AAVE, as a decentralized over-collateralized lending protocol, faces core risks primarily from severe market fluctuations that can lead to a sharp decline in collateral value and liquidity, potentially triggering bad debt issues due to delayed liquidations. Before Aave Umbrella, AAVE mainly mitigated this risk through the Safety Module, which is essentially a fund pool that can be used to cover protocol losses when bad debts occur. To subsidize the providers of funds who bear the risk of protocol bad debts, AAVE allocated relatively generous incentives to them.

In the Safety Module, three types of asset categories are supported: AAVE, liquidity tokens BPT in the Balancer AAVE/wstETHPool, and GHO. Users holding these three tokens can stake them in the Safety Module to earn AAVE token rewards released by the official. The staked funds will be used to compensate for losses when AAVE faces bad debt issues, a process also known as "slashing." The maximum slashing ratio for the first two asset types is 30%, while for GHO, it is 99%. Additionally, staked funds must undergo a 20-day cooling-off period and a 2-day redemption period upon withdrawal, and any timeout will result in re-staking.

This mechanism design has two benefits: it alleviates the protocol's bad debt risk, and the yield capability provides use cases for the related tokens, thereby creating demand for AAVE tokens and GHO. As of now, the total amount of funds in the Safety Module has reached $1.14B. Among them, the staked value of AAVE is $744M, the staked value of ABPT is $222M, and the staked value of GHO is $170M.

However, this mechanism mainly has two issues:

- High maintenance costs;

- Low capital efficiency;

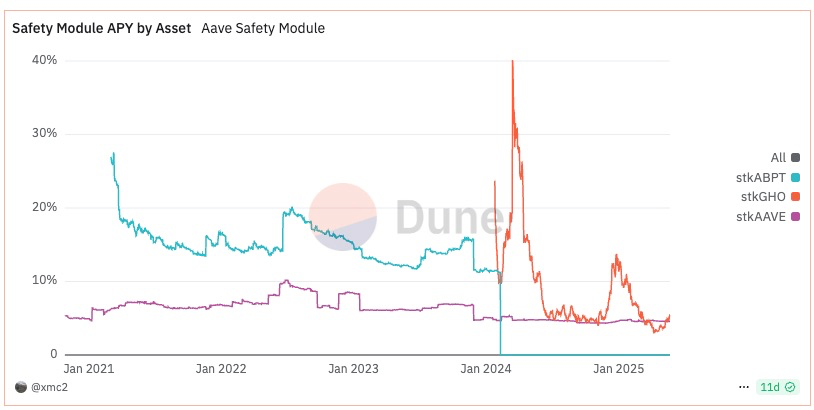

First, the cost that AAVE incurs to attract this portion of funds is astonishing. Based on the current interest rate levels, the staking APR for stkAAVE is 4.57%, for stkGHO is 5.55%, and for stkABPT is 10.18%. Roughly estimating the annual incentive expenditure based on TVL, it is around $66M, and this incentive is generated from the inflation of AAVE, which puts considerable pressure on AAVE's market value maintenance.

Secondly, since the asset categories only involve AAVE tokens and GHO-related assets, considering AAVE as a blue-chip asset lending protocol, the core category of bad debts should be blue-chip assets, such as USDT, ETH, etc. When bad debts occur, relying on the current Safety Module means having to sell AAVE-related tokens or GHO to buy back the bad debt assets to cover the shortfall, which also brings additional challenges to the liquidity of AAVE and GHO. Therefore, it can be said that the capital efficiency reflected in the risk mitigation of bad debts through a high-reward constructed fund pool is not very high.

To optimize these two issues, the AAVE team proposed Aave Umbrella to replace the original Safety Module. In simple terms, Aave Umbrella mainly has three optimizations:

In terms of asset categories, it adopts aTokens that are more closely related to protocol borrowing to attract funds, and each aToken is responsible for guaranteeing the corresponding underlying token, replacing the previous reliance on AAVE tokens and GHO-related tokens for all borrowings. In this upgrade, three new assets are mainly introduced: stkwaUSDC (staked wrapped aUSDC), stkwaUSDT, and stkwaETH.

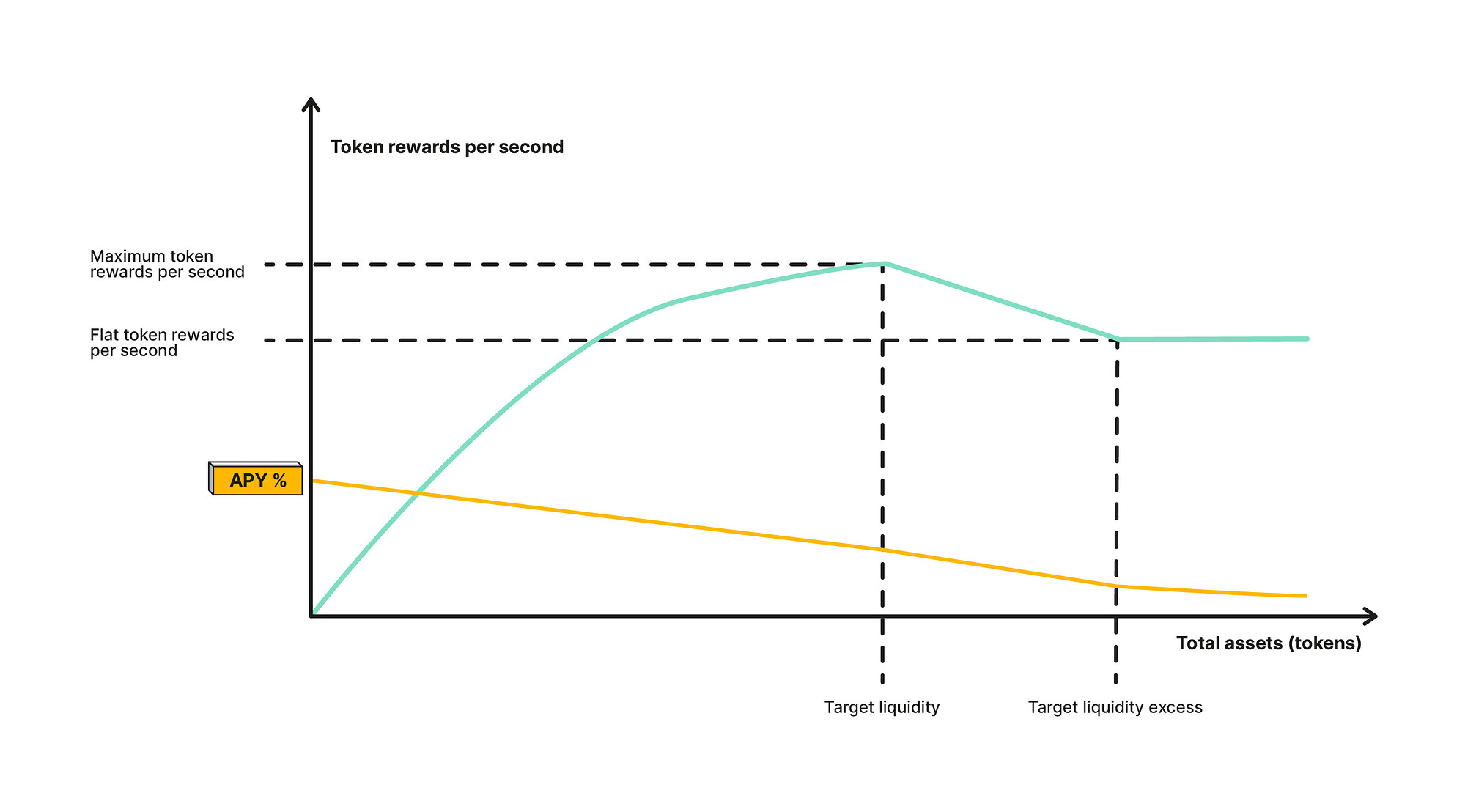

In terms of incentive distribution, a release curve model is used to determine the final staking yield for each asset, with the interest rate influenced by target liquidity, current total staked amount, and maxEmission parameters. In simple terms, the release curve is a piecewise function:

(1) When the staked amount is below the preset target liquidity, the AAVE rewards distributed per unit value of staked tokens will increase, but the growth rate will slow down as it approaches Target Liquidity until it reaches maxEmission;

(2) When the staked amount reaches Target Liquidity and is within an excess threshold (possibly 20%), the AAVE rewards distributed per unit value of staked tokens will decrease linearly;

(3) When the staked amount exceeds the threshold, the unit reward amount remains unchanged;

The overall APY changes will follow the yellow line shape, forming a piecewise function. Of course, the benefit of this approach mainly lies in capital efficiency, controlling the amount of safe funds within a reasonable range through interest rate adjustments to avoid excessive protocol subsidies. In this adjustment, the system parameters are shown in the figure, with the unit priced in base tokens.

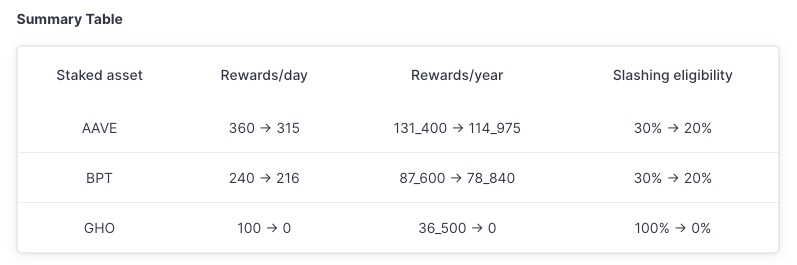

The adjustments for the release of AAVE for the original three tokens are as follows:

- In terms of the slashing mechanism, automatic execution at the smart contract level replaces the previous reliance on DAO governance for proactive triggering.

The first two points are more important for DeFi users because both the yield medium and yield rates have changed. Considering that the incentive adjustments for AAVE and ABPT adopt a gradual adjustment approach, we will mainly discuss the yield rate changes for stkGHO to illustrate the impact of AAVE Umbrella.

From 13% to 7.7%, the Risk-Return Model for GHO Stakers Undergoes a Structural Shift

Due to the transitional period provided for the reward adjustments of stkAAVE and stkABPT after this upgrade, the changes in rewards are not particularly large, which is naturally a consideration for stabilizing the demand and liquidity of AAVE. However, in the new Umbrella module, the risk compensation yield rate for GHO stakers has significantly decreased: first, we calculate based on the latest interest rate model, combined with the current preset parameters:

(1) Target Liquidity: $12M

(2) maxEmissionPerYear: $1.2M

(3) Current total staked amount of stkGHO: $170M

Assuming that current stkGHO stakers fully switch to the Umbrella module, the user's holding interest rate would only be 0.56%, which is far below the current 5.55%. Of course, considering the 7.14% yield allocated to GHO users in the Merit module, the final yield may drop from the current 13% to around 7.7%, provided that all stkGHO stakers completely switch to the Umbrella module. Given the potential outflow of funds, the actual yield rate will be higher than this value. For specific calculations, you can refer to the Desmos link for self-calculation. Of course, the decrease in yield rate also comes with a reduction in risk, as future stkGHO stakers will only need to bear the bad debt risk of GHO borrowing.

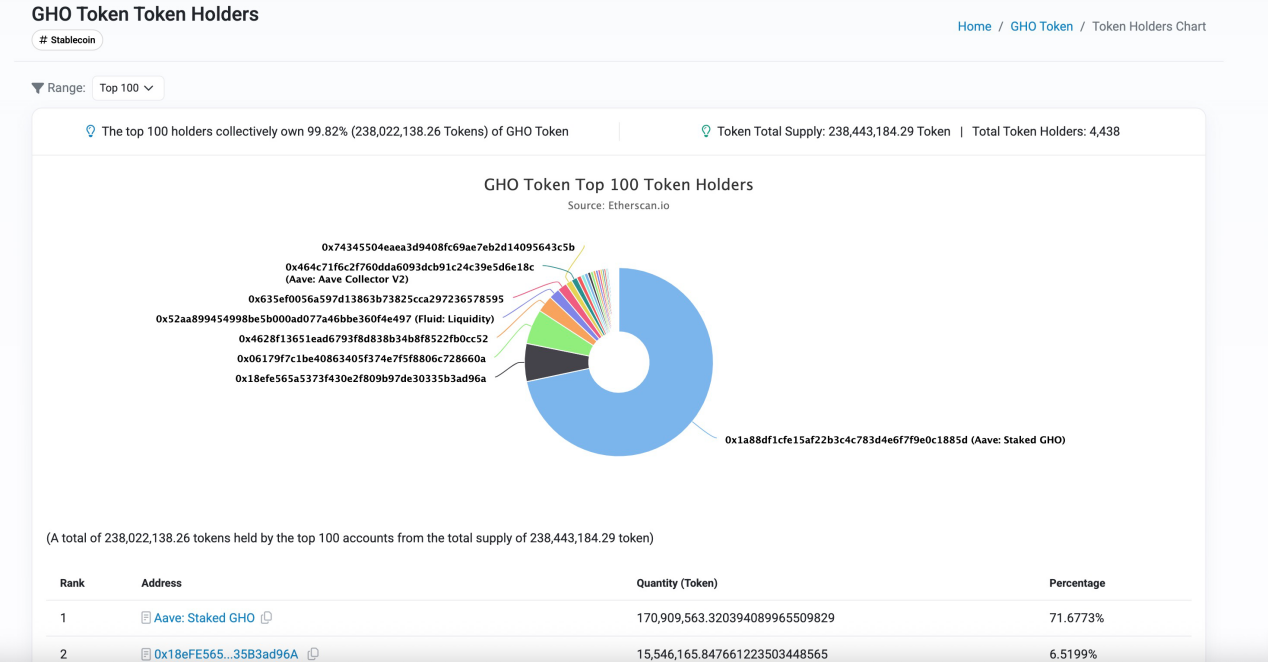

Next, let's explore what impact this will have. It is foreseeable that the issuance of GHO will see a significant shrinkage. Currently, GHO has 238M, of which the funds participating in stkGHO amount to 170M, accounting for about 71% of the total. This is a high staking volume, indicating that the current demand for GHO largely stems from the staking rewards of stkGHO in the Safety Module. The significant drop in yield rates will inevitably lead to a loss of GHO demand until a new balance of supply and demand is reached. However, the risk of a bank run during this process does not need to be overly concerned about, as the current total collateral for GHO exceeds 245%, which is at a very healthy level.

From the perspective of the AAVE protocol, this is a re-examination and adjustment of the unhealthy development model of GHO in the past phase, as the demand for GHO previously relied more on governance token subsidies without actual sustainable demand support.

After this update, the AAVE team may focus more on rebuilding the competitiveness of GHO from the practical demand scenarios of decentralized stablecoins in payment mediums, anti-censorship, and improving the capital efficiency of lending protocols. However, it is somewhat lamentable that a once-great mining opportunity may just fade away.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。