This article analyzes the core framework of two major bills, combined with quantitative forecasts, to systematically project the ten-year growth trajectory of compliant US dollar stablecoins and their reconstructive effects on the public chain ecosystem.

Written by: Jeffrey Ding, Chief Analyst at HashKey Group

First published in Wen Wei Po

With the recent stablecoin-related legislation in the United States and Hong Kong, the global digital asset market has officially entered a new growth cycle driven by regulation. The implementation of these regulations not only fills and improves the regulatory gaps for stablecoins pegged to fiat assets but also provides the market with a clear compliance framework, including reserve asset isolation, redemption guarantees, and anti-money laundering compliance requirements, effectively reducing systemic risks (such as bank runs or fraud).

This article analyzes the core framework of two major bills, combined with quantitative forecasts, to systematically project the ten-year growth trajectory of compliant US dollar stablecoins and their reconstructive effects on the public chain ecosystem.

I. Growth Momentum and Quantitative Projection of US Dollar Stablecoins under the GENIUS Act

The US "GENIUS Act" (Guiding and Establishing National Innovation for U.S. Stablecoins Act) was passed in the Senate in May 2025, marking a key step in US stablecoin regulation. This act establishes a detailed regulatory framework for stablecoin issuers, requiring them to hold reserves backed at least 1:1 by highly liquid assets such as US dollar cash, short-term US Treasury bonds, or government money market funds, and to undergo regular audits while complying with anti-money laundering (AML) and know your customer (KYC) requirements. Additionally, the act prohibits stablecoins from offering interest yields, restricts foreign issuers from entering the US market, and clarifies that stablecoins are neither securities nor commodities, thus providing a clear legal positioning for digital assets. This legislation aims to enhance consumer protection, mitigate financial risks, and provide a stable regulatory environment for fintech innovation.

The implementation of the GENIUS Act is expected to have a profound impact on the global cryptocurrency market landscape. First, investing in highly liquid US dollar assets that are not allowed to earn interest will directly benefit the issuance of US Treasury bonds, making stablecoins an important distribution channel for US Treasury bonds. This mechanism not only alleviates the financing pressure of the US fiscal deficit but also strengthens the international settlement position of the dollar through digital currency channels. Second, the clear regulatory framework may attract more financial institutions and tech companies to enter the stablecoin space, promoting innovation and efficiency in payment systems. However, the act has also sparked some controversies, such as potential conflicts of interest arising from former President Trump's family's involvement in the cryptocurrency industry and the international regulatory coordination issues that may arise from restrictions on foreign issuers. Nevertheless, the GENIUS Act provides institutional guarantees for the development of stablecoins, marking an important step for the US in the global digital asset regulatory competition.

According to Citigroup's forecast, under a scenario of clarified regulatory pathways, the global market value of stablecoins is expected to grow from $230 billion in 2025 to $1.6 trillion by 2030. Notably, this forecast implies two key assumptions: first, compliant stablecoins will accelerate the replacement of traditional cross-border payment channels, saving approximately $40 billion in international remittance costs annually; second, the locked amount of stablecoins in DeFi protocols will exceed $500 billion, becoming the foundational liquidity layer of decentralized finance.

II. Differentiated Positioning of Hong Kong's Stablecoin Regulatory Framework

The Hong Kong Special Administrative Region government recently released the "Stablecoin Ordinance," marking significant progress in its systematic layout in the Web 3.0 field. This ordinance establishes a licensing system for stablecoin issuance, requiring issuers to obtain permission from the Hong Kong Monetary Authority (HKMA) and meet strict requirements regarding reserve asset management, redemption mechanisms, and risk control. Additionally, Hong Kong plans to introduce a dual licensing system for over-the-counter (OTC) and custody services within the next two years, further improving the full-chain regulatory system for virtual assets. These measures aim to enhance investor protection, increase market transparency, and solidify Hong Kong's position as a global digital asset center.

The HKMA plans to release operational guidelines on the tokenization of real-world assets (RWA) in 2025, promoting the on-chain tokenization of traditional assets such as bonds, real estate, and commodities. By utilizing smart contract technology to achieve automatic dividends and interest distribution, Hong Kong aims to build an innovative ecosystem that integrates traditional finance with blockchain technology, opening up broader application spaces for the development of Web 3.0. Under Hong Kong's regulatory framework, the issuance of stablecoins is expected to flourish in a multi-currency and multi-scenario environment, further consolidating Hong Kong's position as a technology and finance hub.

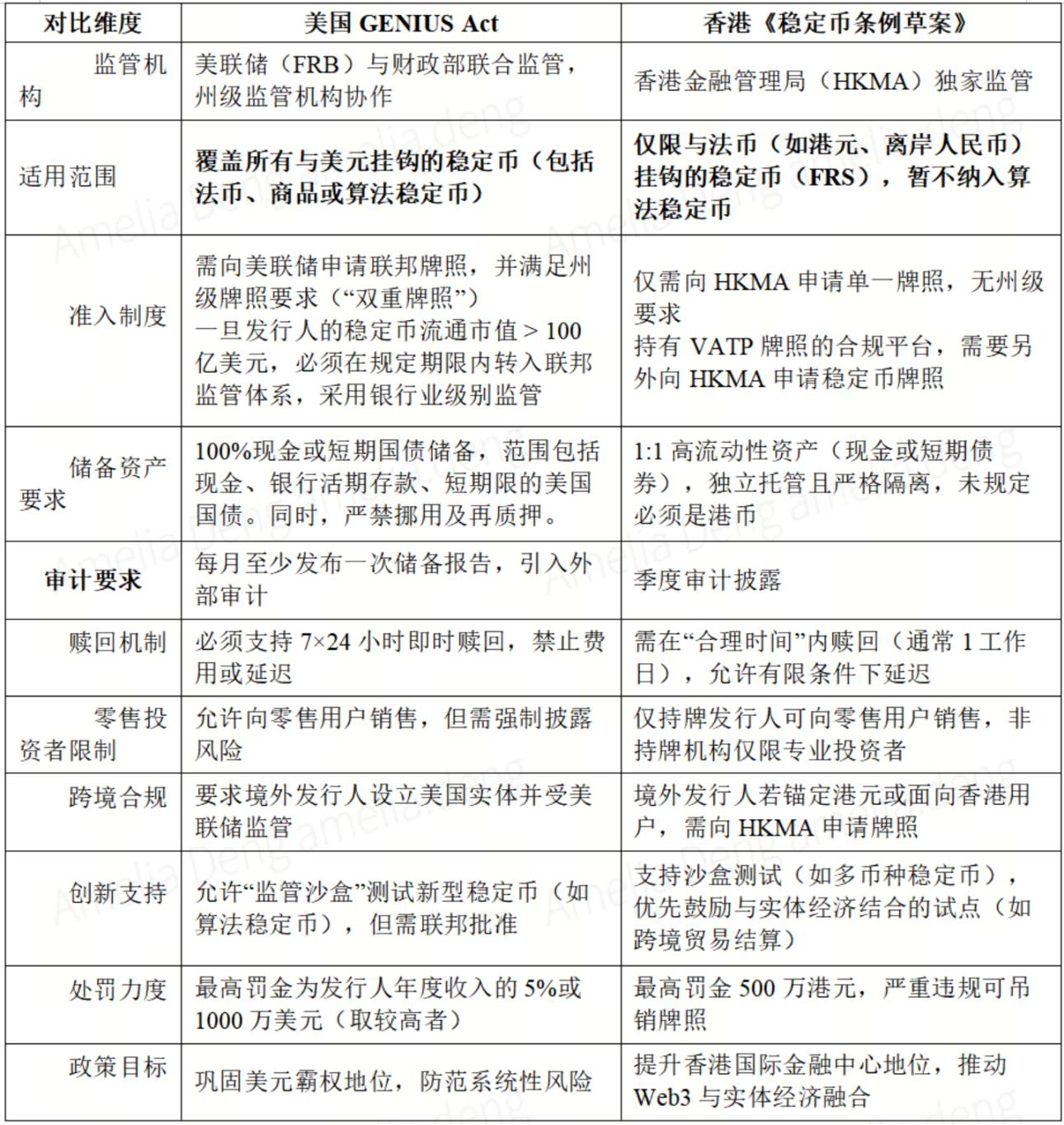

Although the Hong Kong "Stablecoin Ordinance Draft" draws on US regulatory logic, it presents significant differences in implementation details (see Table 1):

Table 1: Comparison of Stablecoin Regulatory Frameworks between the US and Hong Kong

III. Evolution of the Global Stablecoin Landscape under Regulatory Competition

(1) Strengthening Effect of US Dollar Stablecoins as a Global Reserve Currency

Under the regulatory framework established by the GENIUS Act, payment stablecoins must use US Treasury bonds as reserve assets, which endows US dollar stablecoins with strategic significance beyond the realm of digital currencies. Essentially, these stablecoins have become a new distribution channel for US Treasury bonds, creating a unique funding circulation system globally: when global users purchase stablecoins denominated in US dollars, the issuing institutions must allocate the corresponding funds to US Treasury assets, which not only facilitates the return of funds to the US Treasury but also invisibly strengthens the global usage breadth of the dollar. This mechanism can be seen as a globalization extension of the dollar's financial infrastructure.

From the perspective of international settlement, the emergence of stablecoins signifies a paradigm shift in the US dollar clearing system. In the traditional model, the cross-border flow of dollars heavily relies on interbank settlement networks like SWIFT, while blockchain-based stablecoins embed "on-chain dollars" directly into various compatible distributed payment systems. This technological breakthrough allows dollar settlement capabilities to extend beyond traditional financial institutions. This not only expands the international usage scenarios of the dollar but also represents a modernization upgrade of dollar settlement sovereignty in the digital age, further consolidating its core position in the global monetary system.

(2) Regulatory Coordination Challenges between Hong Kong and Singapore

Although Hong Kong has taken the lead in establishing a stablecoin licensing system, the Monetary Authority of Singapore (MAS) has concurrently launched a "stablecoin sandbox" that allows experimental issuance of tokens pegged to existing fiat currencies. Regulatory arbitrage between the two regions may lead issuers to engage in "regulatory site selection," necessitating the establishment of unified reserve audit standards and anti-money laundering information-sharing mechanisms through the ASEAN Financial Regulatory Forum.

While Hong Kong and Singapore share similar goals in stablecoin regulatory policies, their implementation paths exhibit significant differences. Hong Kong adopts a prudently tightening regulatory approach, with the HKMA planning to establish a statutory stablecoin licensing system, positioning stablecoins as "virtual bank alternatives" and strictly adhering to traditional financial regulatory frameworks. In contrast, Singapore maintains an experimental regulatory philosophy, allowing innovative pilot projects that link digital tokens to fiat currencies, preserving flexibility for technological and business model innovation, and generally adopting a trial-and-error regulatory attitude.

These regulatory differences may lead issuing institutions to selectively register to evade strict scrutiny or exploit regulatory standard discrepancies for arbitrage, thereby undermining the effectiveness of the fiat-pegged mechanism's review. In the long run, if coordination is lacking, this divergence may compromise regulatory fairness and policy consistency, potentially triggering regional regulatory competition risks and leading to internal competition between the two regions. Furthermore, the lack of unified regulatory standards may weaken Asia's voice in the global stablecoin system, thereby affecting the competitiveness of Hong Kong and Singapore as international financial centers.

Regulatory authorities in both regions need to strengthen policy coordination, seeking a better balance between preventing systemic risks and encouraging financial innovation to enhance Asia's overall influence in global digital financial governance.

Conclusion: Regulatory Clarity Opens a Golden Decade for Stablecoins

The joint implementation of the US GENIUS Act and the Hong Kong Ordinance Draft marks a transition from fragmented to systematic digital asset regulation. Compliant US dollar stablecoins are expected to achieve exponential growth over the next decade, becoming a core bridge connecting traditional finance and the crypto ecosystem. The technological evolution of public chain infrastructure will determine whether it can capture maximized value dividends within the regulatory framework. For issuers, building a stablecoin system that is multi-chain, multi-currency, and multi-regulatory compliant will be a key strategy to win the competition in the next decade.

(Note: The data model in this article is based on Citigroup's April 2025 report, US Senate Banking Committee hearing records, and publicly available documents from the Hong Kong Monetary Authority, with growth forecasts considering macroeconomic volatility and technological risk factors.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。