作者:Honeypot

导语(Lede)

过去十年,全球加密市场的绝大多数交易依然掌握在中心化交易所手中:用户资金被托管;撮合与清算逻辑不可见;波动时强平机制无从理解;黑天鹅永远在下一次出现(Mt.Gox、FTX、Bitzlato…)。CEX 的黄金时代塑造了市场规模,也塑造了单点信任的最大风险。

越来越多专业交易者与资本意识到:透明性不是可选项,是金融的根本权利,而实现这一点的唯一方式,就是把衍生品交易,真正搬到链上。于是我们见到了一批优秀的链上 perp dex - dydx, Hyperliquid, Aster, GMX。

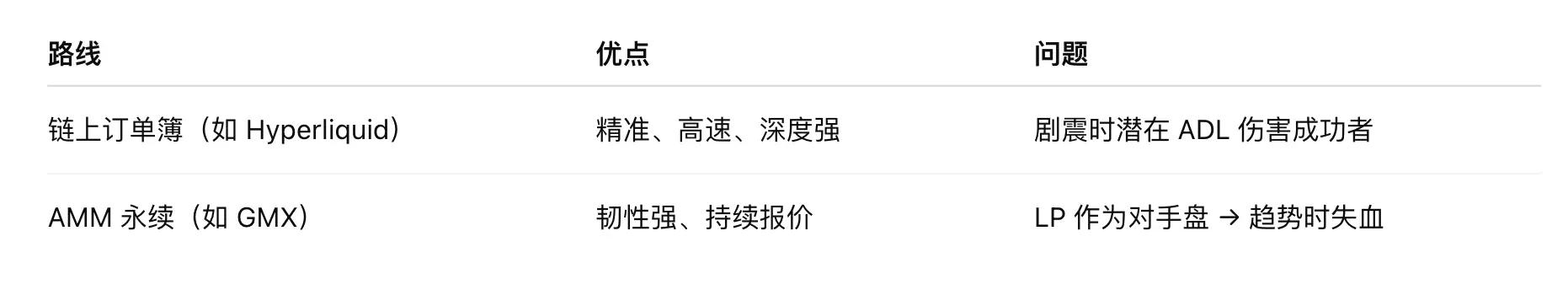

大体上,这些链上 perp dex 分为 2 种主流解决方案,Orderbook Perp Dex 和 AMM Perp Dex。目前 orderbook perp dex 占据市场解决方案的主流。在我们看来,两种解决方案各有优劣。

两条路线,在未来交汇 链上永续市场正处于两条技术路线的博弈:

它们代表的是:“性能与精度” vs “韧性与可持续”。未来的终局,是两者结合后的市场秩序,而最近以 3500 万估值拿下 Mask Network 等著名投资机构的集成式全能流动性枢纽 Honeypot Finance 正在补上市场孔缺的一环。

Honeypot 想做的事很简单:不追花俏的衍生设计,只用三个模块,补上 AMM 永续缺失的那块拼图——一个可控、可预期、能在风暴里成交的市场。

一、订单簿的根本问题:在最重要的时刻最脆弱

The Fragility of Order Books: When You Need Them Most, They Vanish

关键时刻最容易掉链子

订单簿(LOB)流动性的核心并非算法保证,而是做市商意愿。在行情平稳时——做市商风险可控、点差极窄、深度充足,看似完美。但一旦市场进入高波动区间:

1️⃣ 意愿性流动性崩塌

波动放大 → 风险非线性上升

做市商集体撤单或大幅拉宽点差,导致:带宽范围之外完全没有真实挂单,出现「流动性断层(Liquidity Void)」。📌 价格不是滑动,而是跳空。📌 清算单在真空中成交。📌 交易与风险参考价格被严重扭曲。

2️⃣ 链上延迟与排序权 → “可剥削市场”

做市挂单暴露于:区块延迟、MEV 抢跑、Latency arbitrage。结果是挂单被系统性捕食:每次被狙击 → 下次报得更浅、更少、更宽,持续削弱有效深度,深度质量呈反身性衰退。有效深度呈结构性恶化。

3️⃣ 库存风险无法及时对冲

剧震期间:外部对冲成本陡升、成交路径受阻、做市仓位偏斜加剧。风险外溢模式:做市商生存 → 成本向交易者与清算者转嫁,导致清算时点冲击最大化。

而 AMM 的存在意义就在此刻:📌 当订单簿失灵,AMM 仍在履行,持续报单 + 最小成交保证,确保市场能够正常运行。

二、AMM 永续为何仍未壮大?

Why AMM Perpetuals Still Lag Behind

AMM 应该是「永远开着的摊位」,理论上能抗波动,但实际上有三个结构性问题:

1️⃣ LP 与交易者零和对打:LP 是对手盘,行情一旦单边,池子被榨干。

2️⃣ 报价滞后 → 套利者盛宴:AMM 价格取决于池内资产比例。当外部市场变动时,AMM 不知道,直到交易发生。套利者发现价差,立即行动,在帮 AMM「修正价格」的同时,把 LP 的价值搬走。

3️⃣ 资本层次混淆:保守 LP 和追收益 LP 在同一池,谁先扛亏损没写清楚。结果是保守资金不敢久留,TVL 失血。

三、行业两大王者模型:Hyperliquid 与 GMX

The Two Kings: Hyperliquid and GMX

Hyperliquid:速度的极限与 ADL 的代价

Hyperliquid 是目前链上订单簿的标杆。它构建自有 Layer1「HyperCore」,实现高频撮合与低延迟。交易体验近乎中心化,深度充足、速度极快。但速度不是免费的。它的清算机制分为三层:市场清算(Market Liquidation):在订单簿上强平亏损仓位;Vault 承接(HLP Intervention):流动性不足时,金库接手仓位;ADL(Auto-Deleveraging):当 Vault 也扛不住时,系统强制盈利方仓位减杠杆。这让 Hyperliquid 几乎不可能破产,但代价是:即使你是赢家,也可能被动减仓。最新的“1011”事件 hyperliquid 充分暴露了其为了保证系统公平而失去个体公平的设计缺点。

GMX:AMM 永续的稳健派

GMX 是 AMM 永续领域的先驱。也是目前 AMM Perp Dex 的王者。AMM 永续真正的时代,是从 GMX 才正式开始。它不是跟随者,而是开路者,是这个赛道的 GOAT 🐐。

GMX V2 带来了决定性的结构创新:市场隔离池(Isolated GM Pools):BTC 的风险只属于 BTC,ETH 的风险只属于 ETH,Meme 波动不会拖垮主流市场 → AMM 永续告别“一损俱损”的过去;

Oracle-Mark 定价机制:不再盲信池内价格,直接贴近外部真实市场 → 套利者不再能免费掠夺 LP;

持续在线流动性:订单簿熄火时,AMM 成为“最后的成交保底层”。GMX 给了 AMM 永续存在的价值与位置,并证明它可以成为真正的市场基础设施,不是备胎,而是正室。

但目前 GMX 设计中仍面临我们认为需要解决的两个结构性挑战:

1️⃣ LP = 市场对手盘,趋势行情 → LP 持续出血,TVL 在市场最需要它时反而萎缩,市场不能依赖“运气”去穿越周期。

2️⃣ 风险未分层,保守资金与高风险资金扛相同的亏损优先级,机构只会问一句:“为什么我必须承担所有市场行为的风险?”→ 无法说服监管资金与大规模流动性入场 → AMM 永续难以真正扩张盘面。接下来,是结构升级的时代,这是 Honeypot Finance 所在的位置,也是我们坚信解决方案下一次跃迁到来的原因。

四、Honeypot 的创新:从结构上修复 AMM 永续的脆弱性

我们在设计和突破现有的 AMM 模型时聚焦三件事:风险必须被层级化;交易与清算必须可预期;冲击必须被隔离。为此,我们引入了完整的结构升级:

1: LP 不直接面对 AMM。LP 把资金存入自己选择不同风险层级(junior, senior) 的 ERC-4626 金库:Senior 金库:费用优先、最后承担亏损(机构/保守资金)。Junior 金库:先亏损、换更高收益(加密原生风格)。

2: 金库为 AMM 的「预言机锚定报价带」提供流动性(Senior 侧重近端带、Junior 侧重远端带)。

3: 交易者与金库流动性成交;大单跨越更多带 → 滑点与订单大小线性可预期,且以预言机标记价为中心。

4: 资金费与利用率按分钟微调,让拥挤一侧付更多费用,持仓自我再平衡。

5: 按市场隔离:每个交易对都有独立 AMM、金库、限额与清算逻辑,杜绝跨资产连锁反应。

我们也同时解决了 Hyperliquid 清算时候所存在的公平性问题。当像 1011 这样的事件来临时,大波动 + 爆仓密集 + 流动性吃紧时,Hyperliquid 的清算设计路径保证了系统的安全,盈利者在最成功时却被削减头寸,牺牲了个人的公平和盈利。

我们的清算顺序:Honeypot 清算顺序(Process Fairness)

1️⃣ 部分减仓 → 降杠杆而非直接清仓

2️⃣ 小型拍卖 → 风险市场化转移

3️⃣ Junior 金库先亏 → 风险自愿承接

4️⃣ 保险池兜底 → 避免系统性冲击

5️⃣ ADL 小批次执行 → 真正最后手段

我们先保护系统,同时保护成功的个体。这是系统公平 + 过程公平的结合。在 Honeypot 的系统里:风险是自愿的,胜利也是可以保有的。我们的设计,先用结构守住系统,再保护成功的个体。

五、三大体系横向对比:速度、韧性、信任

六:Honeypot Finance 让每个市场参与者都能完美平衡收益风险

在 Honeypot Finance 的设计中,每一个角色都真正有了自己的位置。

Crypto 原生收益玩家:Junior Vault = 以波动为收益来源,风险不再隐藏。

机构与合规资本:清晰的回撤边界、可审计的 ERC-4626 资产,可以安心参与。

交易者:平稳行情 → CEX 级别体验;波动行情 → 可预期的滑点与爆仓逻辑,盈利不会被突然剥夺。

七、结语:速度代表性能,可预期代表信任

Hyperliquid → 性能极限

GMX → 结构先驱

Honeypot → 韧性与信任的新基线

我们不追求更快,我们追求不崩。当市场真正关心的,不再是谁拥有最低点差,而是:当一切都在下跌时,你还能成交吗?那一天,AMM 永续的新基线将以 Honeypot 的方式被重写。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。