Institutional funds continue to flow in, driving the market, but retail investors remain cautious.

Written by: White55, Mars Finance

I. Price Stalemate: A Dual Game of Technical and Sentiment Factors

(1) The "Psychological Spell" of $110,000: Misalignment of Historical Highs and Market Expectations

Since Bitcoin broke through $100,000 in April 2025, it has entered a new upward cycle, reaching a historical high of $111,957 in mid-May. However, the price has since oscillated in the $105,000-$112,000 range without forming an effective breakout. This phenomenon sharply contrasts with the rapid market surge when it broke $100,000 in December 2024, reflecting the current market's complex contradictions.

On the technical side, Bitcoin's weekly RSI indicator has entered the overbought zone, and the MACD momentum bars continue to narrow, indicating a waning short-term upward momentum. On-chain data shows that the long-term holders' (LTH) share of holdings has decreased from 76% at the beginning of the year to 72%, with some "old miners" and early investors starting to take profits, leading to an increase in net inflows to exchanges. This loosening of positions bears similarities to the characteristics seen at the end of the 2021 bull market.

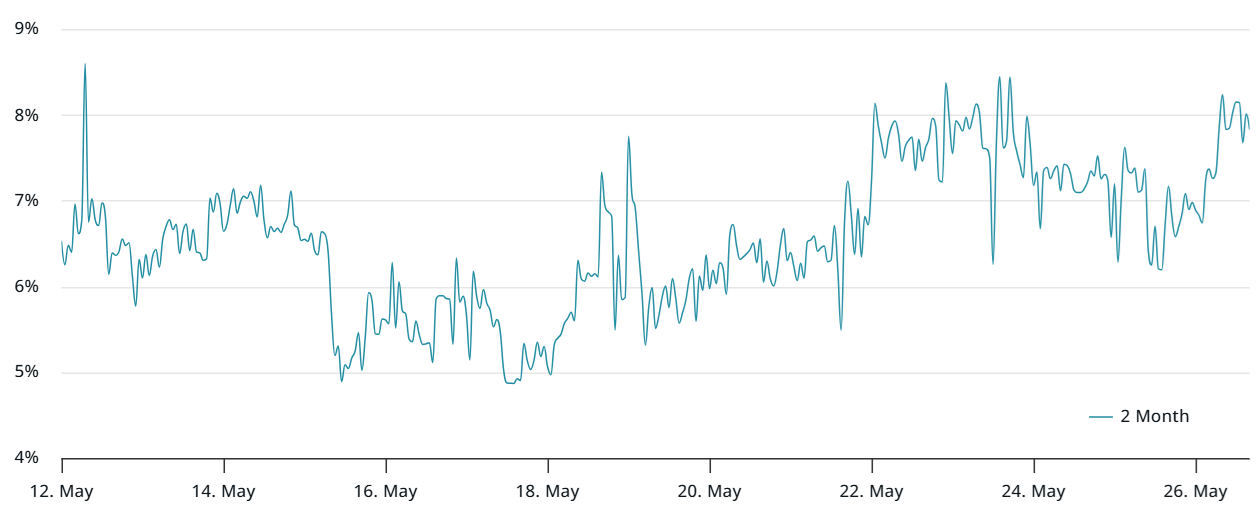

On the other hand, the derivatives market reveals a starkly different signal. As of May 26, the annualized basis rate for Bitcoin futures remains at 8%, far below the extreme level of 20% when it broke $100,000 in December 2024, indicating that leveraged long positions are not overly aggressive. Meanwhile, the Delta skew index in the options market (-6%) shows that put options are trading at a discount, a typical characteristic of a bull market, contrasting with the +15% skew during the bear market of 2024.

Image 1: Bitcoin 2-Month Futures Annualized Basis Rate.

Image 1: Bitcoin 2-Month Futures Annualized Basis Rate.

(2) The "Ice and Fire" of Market Sentiment: Institutional Influx vs. Retail Caution

Institutional funds continue to pour in, becoming the core force supporting the market. Data shows that from May 19 to 25, net inflows into U.S. spot Bitcoin ETFs reached $2.75 billion, setting a new weekly high since Trump's victory in December 2024. Among these, BlackRock's IBIT and Fidelity's FBTC account for 80% of the share, indicating that traditional asset management giants are becoming the dominant players in Bitcoin pricing.

Notably, JPMorgan announced on May 19 that it would allow clients to purchase spot Bitcoin ETFs through brokerage accounts. Although this move does not directly involve custodial services, it opens a potential entry channel for its $6 trillion in client deposits, which could trigger a "catalyst effect"—institutions like Goldman Sachs and Citigroup may be forced to follow suit to maintain competitiveness.

In contrast, retail investors exhibit a cautious attitude. The cryptocurrency fear and greed index has fallen from 78 (extreme greed) at the beginning of May to 65 (greed), while the Google search interest for the keyword "Bitcoin bubble" has increased by 320% year-on-year. This divergence reflects ordinary investors' anxiety over high-level fluctuations, contrasting sharply with institutions' "buy the dip" strategy.

II. Macroeconomic Variables: The Triple Play of Trump's Policies, Fed Shift, and Tech Stock Correlation

(1) Trump's "Tariff Game": How Geopolitics Reshapes Cryptocurrency Market Pricing Logic

On May 26, Trump announced the postponement of a 50% tariff on EU imports until July 9. This decision superficially alleviates the risk of escalating trade wars but implicitly contains political maneuvering. Historical data shows that Trump's tariff policies during his term have been highly volatile—his sudden announcement of a 25% tariff on EU cars in February 2025 led to a 12% one-day drop in Bitcoin.

The current market is more focused on the progress of his cryptocurrency strategic reserve plan. Although the March White House summit only proposed a legislative framework for stablecoins, Senator Lummis's draft of the "National Bitcoin Reserve Act" has entered the legislative process. This bill requires the U.S. Treasury to purchase 5% of the circulating supply of Bitcoin (approximately 1.05 million coins) over the next five years, which, if implemented, would directly create nearly $100 billion in demand.

(2) The Fed's "Inflation Puzzle": PCE Data as a Potential Breakthrough Catalyst

The market is highly sensitive to the PCE inflation data set to be released on May 30. Current CME interest rate futures show that traders are betting on a 68% probability that the Fed will cut rates by 25 basis points in June. However, if the core PCE year-on-year growth exceeds 2.9% (previous value 2.8%), it could reverse easing expectations. Notably, the 90-day correlation coefficient between Bitcoin and the Nasdaq index has dropped from 0.75 at the beginning of the year to 0.32, indicating that Bitcoin is moving away from the traditional risk asset framework and aligning more with the "digital gold" narrative.

(3) The "Butterfly Effect" of Nvidia's Earnings Report: The Hidden Connection Between AI Computing Revolution and the Crypto Market

Nvidia is set to release its quarterly earnings report on May 28, and its performance may impact Bitcoin through two pathways:

Computing Power Competition: If demand for the new generation of AI chips exceeds expectations, it could drive up GPU prices, indirectly increasing the cost of Bitcoin mining equipment and squeezing miners' profit margins;

Capital Diversion: If tech stocks rise due to favorable earnings reports, it may attract some capital from the crypto market to traditional stock markets, exacerbating short-term volatility in Bitcoin;

III. Institutional Underbelly: MicroStrategy's "Hoarding Economics" and the Evolution of the ETF Ecosystem

(1) MicroStrategy's "Extreme Operations": Strategic Ambitions Behind Balance Sheet Reconstruction

Michael Saylor's MicroStrategy increased its Bitcoin holdings by 4,018 coins at an average price of $106,237 from May 19 to 25, bringing its total holdings to 324,000 coins (worth approximately $34.5 billion). Notably, the coupon rate for the convertible bonds the company issued has surged from 0.625% in 2024 to 6.25%, indicating that the capital market's risk pricing of its aggressive strategy is changing.

This "debt-driven hoarding" model is creating a demonstration effect. Data shows that as of May, 17 companies in the S&P 500 have publicly held Bitcoin, totaling $48.7 billion. Companies like Tesla and Block have even begun exploring using Bitcoin to pay supply chain expenses, pushing it from a reserve asset to a medium of exchange.

(2) The "Matthew Effect" of the ETF Ecosystem: Market Reconstruction Under the BlackRock-Fidelity Duopoly

Since the approval of U.S. spot Bitcoin ETFs in January 2024, the total assets under management (AUM) have surpassed $120 billion. Among these, BlackRock's IBIT ($48.6 billion) and Fidelity's FBTC ($39.2 billion) account for 72% of the share, forming an absolute monopoly. This trend of centralization may raise regulatory concerns—the SEC is studying whether to propose new rules for ETF issuers requiring "transparency of reserve assets," mandating the disclosure of custody addresses and on-chain verification mechanisms.

The more profound impact is that ETFs are changing the volatility characteristics of Bitcoin. Through daily net inflow/outflow data calculations, ETF fund flows explain 38% of Bitcoin price changes, indicating that the traditional financial market's opening hours (Eastern Time 9:30-16:00) are becoming the main battleground for Bitcoin price fluctuations, contradicting the earlier 7×24 hour continuous trading "decentralized" feature.

Figure 3: Bitcoin Price Drops as Spot Bitcoin ETF Funds Flow Out

Figure 3: Bitcoin Price Drops as Spot Bitcoin ETF Funds Flow Out

IV. Technological Revolution: The Explosion of Layer2 Ecosystem and the Feasibility Experiment of "Bitcoin Standard"

(1) Lightning Network 2.0: The "Singularity Moment" in the Payment Track

The upgraded version of Bitcoin's Layer2 solution, Lightning Network 2.0 (LN2.0), achieved significant breakthroughs in May:

Channel capacity exceeded 8,000 BTC, a year-on-year increase of 320%;

Supports Atomic Multi-Path Payments (AMP), increasing single transaction processing capacity to 0.1 BTC;

Partnered with Visa to pilot cross-border remittances, reducing fees to below 0.3%.

These advancements are changing the utility boundaries of Bitcoin. The Salvadoran government announced that 20% of civil servant salaries will be distributed via the Lightning Network, while Amazon's Mexico site has begun accepting Bitcoin Lightning payments. If this dual function of "small, high-frequency payments + value storage" is solidified, Bitcoin may truly challenge traditional payment giants like Visa and PayPal.

(2) RGB Protocol's "Smart Contract Breakthrough": The Hidden War Challenging Ethereum

The RGB protocol, based on Bitcoin's UTXO model, completed its v0.5 version upgrade in May, achieving Turing-complete smart contract functionality for the first time. Although the current ecosystem scale is still small (total locked amount is only $120 million), its architecture, which employs client-side validation and off-chain computation, demonstrates unique advantages in privacy and scalability. Notably, Rune Christensen, the founder of MakerDAO, has announced plans to explore transferring part of DAI's reserves into the RGB protocol, which could become a landmark event for DeFi funds flowing back into the Bitcoin ecosystem.

V. Future Scenario Simulation: The Fate of Bitcoin Under Three Paths

(1) Bull Market Scenario (End of 2025 Target: $180,000 - $250,000)

Trigger Conditions:

U.S. PCE inflation data below 2.6%, Fed starts a rate-cutting cycle in June;

National Bitcoin Reserve Act passes, Treasury begins monthly purchasing plan;

Bitcoin Layer2 ecosystem locked amount exceeds $10 billion, payment scenario users exceed 50 million.

Technical Formation: Weekly level will form a "cup and handle" pattern, accelerating upward after breaking $112,000, replicating the momentum effect seen when it broke $100,000 in December 2024.

(2) Consolidation Scenario (Price Range: $100,000 - $140,000)

Core Variables:

Nvidia's earnings report shows weak demand for AI chips, and the pullback in tech stocks drags down risk assets;

Trump's tariff policy fluctuations trigger market risk aversion;

ETF fund inflows have slowed to an average of less than $1 billion per week;

Market characteristics: Increased selling pressure from miners, extended difficulty adjustment cycles, and persistently low funding rates in the derivatives market.

(3) Bear Market Scenario (Pullback Target: $74,000 - $85,000)

Risk Catalysts:

The U.S. SEC conducts a surprise investigation into ETF reserve custody, triggering a crisis of trust;

Escalation of geopolitical conflicts in the Middle East drives up oil prices, reversing global inflation expectations;

Breakthroughs in quantum computing raise concerns about the security of Bitcoin's cryptographic algorithms.

On-chain signals: Net inflows to exchanges exceed 50,000 BTC for three consecutive weeks, and the share of long-term holders falls below 70%.

Conclusion: Seeking Certainty Amid Uncertainty

The tug-of-war over Bitcoin's $110,000 mark is essentially a microcosm of the collision between old and new financial orders. From Trump's tariff games to MicroStrategy's balance sheet revolution, from the payment penetration of the Lightning Network to the institutional transformation of ETFs, multiple forces are reshaping the economic significance of this experiment. Historical experience shows that whenever Bitcoin's "death notices" flood the media, it often presents a good opportunity for long-term investors to position themselves contrarily. When the market loses its direction amid the noise, it may be more appropriate to return to the original vision of Satoshi Nakamoto's white paper—"a purely peer-to-peer electronic cash system." In this sense, the price fluctuations of 2025 are merely footnotes to this great social experiment, as the true revolution has quietly grown within the code and consensus.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。